Bitcoin

Bitcoin And Gold In One Index? Bloomberg’s Latest Move Shakes Up Finance

Bloomberg recently launched multiple asset indices to help investors diversify their traditional portfolios, a pioneering work that combines bitcoin and commodities.

Bloomberg – a global financial media, data, and technology company – introduced its Bitcoin & Gold Blend Indices which include the Bloomberg Bitcoin and Gold Equal-Weighted Index, and the Bloomberg Dollar, Bitcoin and Gold Equal-Weighted Index, aiming to help institutional and retail investors to expand their portfolios.

A Remarkable Year

In a press statement, Bloomberg disclosed that 2024 was a landmark year for cryptocurrencies, saying that favorable regulations and sentiment brought more than $220 billion in crypto investments.

“These assets were across 250+ ETFs, including those linked to spot Bitcoin and spot Ethereum which expanded access to crypto markets using a familiar wrapper,” Bloomberg added.

Bloomberg launches Gold and #BTC composite index. https://t.co/vppRXQc5FR

— Cryptocurrency (@cryptocurrency) February 14, 2025

According to the financial giant, gold and Bitcoin reached their peaks last year, which they believed further bonds the “relationship between digital and physical assets.”

As a result, many investors began to explore their competing and complementary attributes in diversified portfolios.

Blending Bitcoin And Gold

Bloomberg explained that Bitcoin & Gold Blend Indices are the first in this set of indices, saying they created this with a unit-based framework to allow modifications in the future and “customization of building blocks and weight based on client interest.”

BTCUSD trading at $97,581 on the daily chart: TradingView.com

According to the financial giant, the goal of the new indices is to capture Bitcoin’s growth and couple it with gold’s historic stability.

“We expect the Bloomberg Bitcoin and Gold basket to be the first of many commodities and digital asset blends as we see an increasing investor appetite for tailored indices that can target specific investment objectives and return profiles,” Bloomberg Index Services Limited Head of Commodities & Crypto Index Products Jigna Gibb said.

Bloomberg said that the Bloomberg Dollar, Bitcoin and Gold Equal-Weighted Index merges the US dollar’s defensive attributes with Bitcoin and gold’s “potential, long-term uncorrelated characteristics.”

Historically, Bitcoin and gold have a nearly zero correlation with each other, noting that both have maintained positive long-term returns making their basket an excellent diversifier for traditional multi-asset portfolios.

“With Bloomberg Indices’ capabilities, we’re able to continuously customize index offerings as the industry evolves. As a key investment hurdle in Bitcoin is elevated volatility, we see a fundamental case for using Bitcoin and Gold, not Bitcoin versus Gold,” Gibb said.

Key Notes

– Gold making new ATHs forming HHs and HLs

– $BTC range bounding between 91k – 105kEach time Gold displaces away from BTC, BTC plays catch up as highlighted in black circles pic.twitter.com/IcrxJINCIf

— Daink (@TraderDaink) February 10, 2025

Bitcoin Follows Gold

Meanwhile, a crypto analyst disagrees that Bitcoin and gold have zero correlation.

Daink said in a post that Bitcoin is inclined to follow gold’s movements after periods when they have been decoupled or moved in different directions.

“Each time Gold displaces away from BTC, BTC plays catch up as highlighted in black circles,” Daink explained on the X platform.

Throughout the majority of Bitcoin’s existence, the correlation between Bitcoin and gold has been subject to fluctuations. Initially, the prices of these two assets fluctuated in a largely independent manner. This meant that when the price of one asset increased, the other did not necessarily follow suit.

Although there is no immediate relationship between Bitcoin and gold, the crypto tends to align its movement with that of the precious metal after a certain period.

Featured image from Gemini Imagen, chart from TradingView

Bitcoin

VanEck Tool Shows Strategic Bitcoin Reserve Can Trim US Debt

Asset manager VanEck has stated that a Strategic Bitcoin Reserve could help mitigate the US’ growing debt, which currently stands at $36 trillion.

To explore the potential effects of this idea, the firm has developed an interactive tool inspired by the BITCOIN Act.

How Will a Strategic Bitcoin Reserve Reduce US Debt?

The BITCOIN Act, introduced by Senator Cynthia Lummis, outlines a plan for the US government to acquire up to 1 million Bitcoins (BTC) over five years, purchasing no more than 200,000 BTC per year.

These assets would be held in a dedicated reserve for at least 20 years. Lummis believes such a reserve could substantially reduce the nation’s debt.

Notably, VanEck’s new calculator lets users know the impact of such a reserve. The tool allows the simulation of a variety of hypothetical scenarios by adjusting different variables.

These include the debt and BTC’s growth rates, the average purchase price of Bitcoin, and the total quantity of Bitcoin held in reserve. Meanwhile, VanEck has also included their own “optimistic projection.”

“If the US government follows the BITCOIN Act’s proposed path – accumulating 1 million BTC by 2029 – our analysis suggests this reserve could offset around $21 trillion of national debt by 2049. That would amount to 18% of total US debt at that time,” VanEck noted.

The analysis is based on assumptions regarding the future growth rates of both US debt and Bitcoin. VanEck has supposed a 5% annual growth rate for the national debt. This would see it rise from $36 trillion in 2025 to around $116 trillion by 2049.

Similarly, Bitcoin is presumed to appreciate at a compounded rate of 25% per year. Its acquisition price is predicted to start at $100,000 per Bitcoin in 2025. Thus, by 2049, the price could potentially be $21 million per Bitcoin.

While the federal government considers the potential of a Strategic Bitcoin Reserve, interest is also rising at the state level. At least 20 US states have introduced bills to create digital asset reserves.

According to Matthew Sigel, Head of Digital Assets Research at VanEck, state-level bills could collectively drive as much as $23 billion in Bitcoin purchases.

President Trump’s Crypto Promise

VanEck’s move comes as Bitcoin is receiving increasing political support. US President Donald Trump has reiterated his commitment to positioning the US as a global leader in cryptocurrency.

Speaking at the Future Investment Initiative Institute summit in Miami, Trump emphasized the economic growth driven by crypto-friendly policies.

“Bitcoin has set multiple all-time record highs because everyone knows that I’m committed to making America the crypto capital,” Trump said.

Since returning to office, Trump has signed an executive order to establish a national “digital asset stockpile.” He has also nominated pro-crypto leaders to head major regulatory bodies. However, whether a Bitcoin reserve will actually be established remains to be seen.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

$2 Billion Bitcoin, Ethereum Options Expiry Signals Market Volatility

Today, approximately $2.04 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire, creating significant anticipation in the crypto market.

Expiring crypto options often leads to notable price volatility. Therefore, traders and investors closely monitor the developments of today’s expiration.

Options Expiry: $2.04 Billion BTC and ETH Contracts Expire

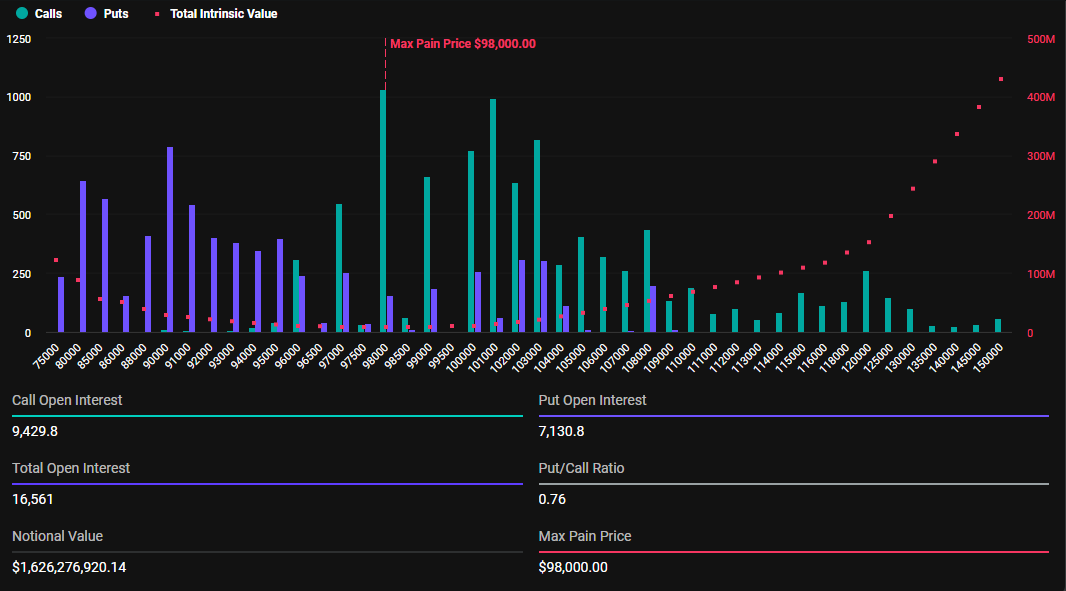

Today’s expiring Bitcoin options have a notional value of $1.62 billion. These 16,561 expiring contracts have a put-to-call ratio of 0.76 and a maximum pain point of $98,000.

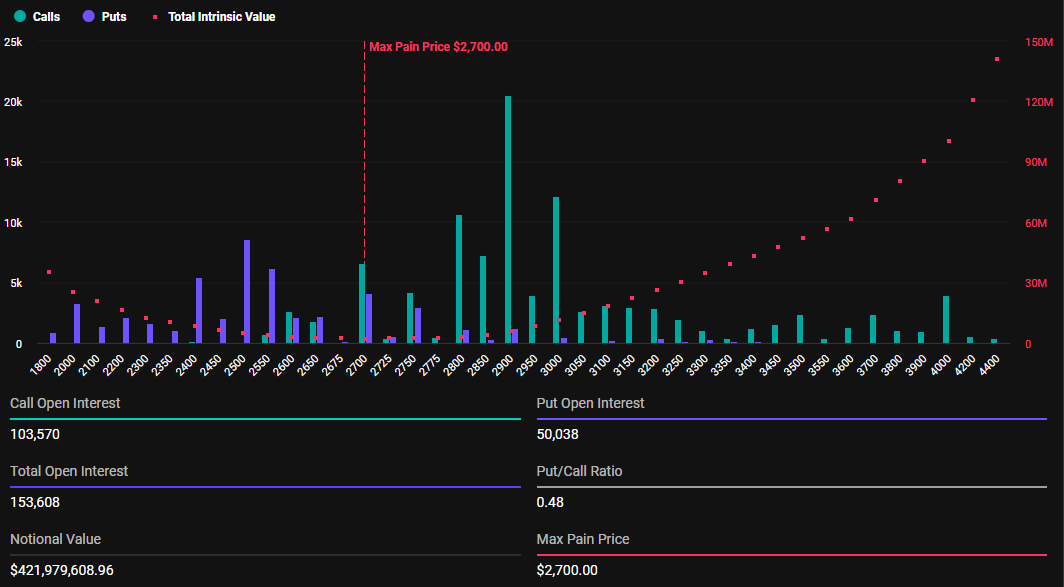

On the other hand, Ethereum has 153,608 contracts with a notional value of $421.97 million. These expiring contracts have a put-to-call ratio of 0.48 and a max pain point of $2,700.

At the time of writing, Bitcoin trades at $98,215, a 1.12% increase since Friday’s session opened. Ethereum trades at $2,746, marking a 0.20% decrease. In the context of options trading, the put-to-call ratio below 1 for BTC and ETH suggests a prevalence of purchase options (calls) over sales options (puts).

However, according to the max pain theory, Bitcoin and Ethereum prices could gravitate toward their respective strike prices as the expiration time nears. Doing so would cause most of the options to expire worthless and thus inflict “max pain”. This means that BTC and ETH prices could register a minor correction as the options near expiration at 8:00 AM UTC on Deribit.

It explains why analysts at Greeks.live noted a cautiously bearish sentiment in the market, with low volatility frustrating traders. They suggest ongoing concern among traders and investors, particularly around Bitcoin, with traders closely monitoring key price points.

“The group sentiment is cautiously bearish with low volatility frustrating traders. Participants are watching $96,500 level with skepticism about upward momentum, while discussing possibilities of volatility clustering at low levels around 40%,” the analysts wrote.

Elsewhere, Deribit warns that while low volatility feels safe, this sense of safety is only momentary, as markets tend not to wait long.

Bitcoin Price Outlook: Key Levels and Market Outlook

Bitcoin trades around $98,243, hovering above a critical demand zone between $93,700 and $91,000. This area has previously acted as strong support, indicating buyers may step in to defend these levels.

On the other hand, a key supply zone is positioned at around $103,991, where selling pressure has historically been significant. BTC has struggled to break past this level, making it a major resistance to watch.

From a price action perspective, BTC has been forming lower highs and lower lows, suggesting a short-term bearish trend. However, the recent price movement hints at a possible reversal, as BTC is attempting to bounce off its demand zone.

The volume profile also shows significant trading activity near $103,991, reinforcing the resistance level. Meanwhile, a noticeable low volume area near $91,000 suggests that if BTC breaks below this level, a sharp drop could follow due to the lack of strong support.

Meanwhile, the Relative Strength Index (RSI) is currently at 50.84, indicating neutral momentum. While BTC is not overbought or oversold, the RSI’s slight upward trend could signal growing buying interest.

If Bitcoin holds above the $93,700 support zone, it may attempt a push towards the $100,000 milestone. However, a breakdown below $91,000 could trigger a move lower, potentially testing the $88,000 to $85,000 range.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin ETFs See Institutional Ownership Multiply 55x In Less Than A Year

The institutional adoption of Bitcoin exchange-traded funds (ETFs) has experienced an unprecedented surge in the past 11 months, underscoring a tectonic shift in the way traditional investors interact with digital assets.

Bitwise data indicates that the number of institutional holders of US spot Bitcoin ETFs has increased by nearly 55 times – from 61 in March 2024 to 3,323 by mid-February 2025. This rapid ascent indicates a heightened desire for Bitcoin exposure through regulated financial instruments.

BREAKING: Institutional investors holding #Bitcoin ETFs have increased a remarkable 54.5x in the past 11 months.

Don’t panic. HODL. pic.twitter.com/roidg4QMXJ

— Carl ₿ MENGER ⚡️🇸🇻 (@CarlBMenger) February 18, 2025

An Immense Rise In Institutional Involvement

This demonstrates a high level of confidence in the asset class, as Wall Street titans and global financial entities have substantially increased their Bitcoin ETF holdings.

Goldman Sachs has nearly doubled its investment, now possessing over 24 million shares valued at approximately $1.35 billion—a 89% increase from previous figures.

Millennium Management was not far behind, increasing its holdings by 116% to over 23 million shares, which are valued at approximately $1.32 billion.

Additionally, sovereign wealth funds have entered the market. Abu Dhabi Sovereign Wealth Fund acquired over 8 million shares, which equates to a $461 million investment in Bitcoin ETFs.

Major financial institutions’ actions suggest that they regard Bitcoin as a legitimate asset for long-term investment strategies.

Bitcoin ETF Market Surpasses $56 Billion

The total assets under management (AUM) for US-traded spot Bitcoin ETFs have increased significantly as institutional demand continues to rise. These ETFs collectively oversee nearly $57 billion in assets. BlackRock’s Bitcoin ETF is the leading player in this sector, with a total AUM of over $56 billion. This establishes it as the dominant force in the industry.

Bitcoin ETFs currently have in their disposal around 1.35 million BTCs, which further solidifies their market influence. The rapid accumulation of Bitcoin by these funds indicates that digital assets are becoming more widely accepted and adopted within traditional financial systems.

Image: Global Finance Magazine

Implications For The Crypto Market

The rapid rise in Bitcoin ETFs highlights a larger institutional trend towards digital assets. With wider exposure through regulated products, Bitcoin may gain stability and reputation, which would entice hedge funds, pension funds, and even individual investors to make additional investments.

Additionally, market liquidity increases and may lessen volatility as institutions amass more Bitcoin through ETFs. The long-term prospects for Bitcoin’s price and uptake are getting better as demand rises.

The Road Ahead For Bitcoin ETFs

As the institutional embrace of Bitcoin accelerates, the next phase will likely see continued expansion and regulatory developments. More institutional financial firms could follow suit, further legitimizing the crypto’s role in diversified investment portfolios.

Featured image from Reuters, chart from TradingView

-

Regulation7 hours ago

Regulation7 hours agoCoinbase scores major win as SEC set to drop lawsuit

-

Market22 hours ago

Market22 hours agoAnalyst Says PEPE Price Must Break This Resistance Level For 150% Surge Toward ATHs

-

Ethereum22 hours ago

Ethereum22 hours agoBig Players Keep Buying Ethereum – Whales Accumulate 430,000 ETH In 72 Hours

-

Market21 hours ago

Market21 hours agoKAITO Price Attempts Recovery as Top Holders Exit Post-Airdrop

-

Altcoin21 hours ago

Altcoin21 hours agoCan Shiba Inu Price Surge 422%? This Pattern Signal SHIB New All-Time High

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Could Target $3,000 Once It Breaks Current Supply Levels – Analyst

-

Bitcoin14 hours ago

Bitcoin14 hours ago$2 Billion Bitcoin, Ethereum Options Expiry Signals Market Volatility

-

Market20 hours ago

Market20 hours agoButerin Wants Devconnect in Argentina After the LIBRA Scandal