Bitcoin

Bitcoin Boom In El Salvador? Saylor And Bukele Share Plans

Michael Saylor, the co-founder of MicroStrategy (now rebranded to Strategy) and a Bitcoin advocate, recently convened a meeting with President Nayib Bukele of El Salvador to deliberate on strategies for promoting the adoption of Bitcoin in the Central American country.

The meeting indicates an ongoing dedication to the integration of Bitcoin into the country’s economy, in light of El Salvador’s pioneering posture on the cryptocurrency.

Saylor tweeted over the weekend about their discussion. He brought attention to the fact that El Salvador can take advantage of Bitcoin’s expansion in other ways.

New Phase In El Salvador’s Bitcoin Experiment

In September 2021, El Salvador became the first country to legalize Bitcoin. Over that period, the country has issued Bitcoin-backed bonds, attracted crypto entrepreneurs, and worked hard to develop Bitcoin City, a tech-based economic hub. Over the years, Bukele has announced various government Bitcoin acquisitions for national savings.

Yesterday, @NayibBukele and I had a great discussion about the opportunities for El Salvador🇸🇻 to benefit from and accelerate global Bitcoin adoption. pic.twitter.com/BerAmVWGdn

— Michael Saylor⚡️ (@saylor) February 14, 2025

El Salvador has acquired 6,077 Bitcoin, which is equivalent to over $600 million. Since Bukele’s statement in November 2022, the nation has been true to its commitment to buy one Bitcoin every day.

Saylor’s visit suggests development. He lauded Bukele’s leadership and El Salvador’s Bitcoin integration without providing details. The meeting is another indication of continued institutional interest in the country’s bold crypto experiment.

Challenges And Modifications In Bitcoin Policy

El Salvador has had to make some adjustments even if it is quite passionate about Bitcoin. The government has modified its laws to guarantee an International Monetary Fund (IMF) loan of $1.4 billion. These included scaling back mandatory Bitcoin acceptance for businesses and limiting the public sector’s involvement in Bitcoin-related activities.

Bitcoin market cap currently at $1.93 trillion. Chart: TradingView.com

The Economic Implications Of Bitcoin In El Salvador

The introduction of Bitcoin has sparked debate about its actual economic benefits. Even though El Salvador has gained global attention and is known as a crypto-friendly country, the projected increase in financial inclusion and foreign investment has not yet occurred to the extent that some had hoped.

Still, Bitcoin remittances remain a major influence since the nation has gotten millions of dollars via the Bitcoin network, which lowers transaction fees when compared to more conventional remittance companies. The government still believes that the acceptance of Bitcoin would have long-term and significant advantages.

What’s The Future Of Bitcoin In El Salvador?

Saylor’s visit could be a sign of things to come, like the possibility of more Bitcoin-backed projects or relationships. As the use of Bitcoin grows around the world, El Salvador stays at the forefront of incorporating cryptocurrency into a national economy.

Even though problems still exist, the fact that Bukele and well-known Bitcoin supporters like Saylor are working together shows that the country is not going to give up on its Bitcoin project any time soon.

Featured image from Gemini Imagen, chart from TradingView

Bitcoin

Strategy’s Bitcoin Play Inspires Risky Copycats in Business

As companies face stagnation and declining revenues, some turn to an unconventional strategy to regain investor interest—buying Bitcoin (BTC).

Firms are now trying to emulate MicroStrategy (now Strategy), whose Bitcoin accumulation commitment continues to place it on the leaderboard.

Bitcoin Becomes A Quick Fix for Fading Businesses

Rather than reinvesting in their core operations, firms like Goodfood Market Corp are using Bitcoin as a financial maneuver to create buzz around their stocks.

According to Bloomberg, Goodfood CEO Jonathan Ferrari once led a promising meal-delivery startup. However, the company’s stock plummeted 98% from its pandemic-era highs. Ferrari then sought a drastic measure, investing corporate funds in Bitcoin, to reinvigorate investor interest.

“We have a nice core business, but it’s too small to be relevant to the capital markets. I think as we start investing more into our Bitcoin treasury strategy, we’ll be able to create more liquidity in our stock and attract investors,” Bloomberg reported, citing Ferrari.

According to Bloomberg, this tactic centers on the hope that these firms will replicate the success of Michael Saylor’s Strategy. Meanwhile, Goodfood is not alone; dozens of public companies are following in Saylor’s footsteps with their Bitcoin strategies.

The report cites firms in social media, video gaming, and even coal mining that divert corporate cash to invest in Bitcoin. Further, some firms, like Semler Scientific, borrowed funds to invest in the pioneer crypto.

Recently, BeInCrypto reported that GameStop is mulling a Bitcoin investment. The American video game retailer’s pivot to BTC is motivated by the need for financial stability.

“GameStop, a company with no viable business plan, has thrown another Hail Mary by announcing that it might use its cash to buy Bitcoin. The irony is that Bitcoin is even more overpriced than GME. No matter; speculators are buying the stock anyway, hoping it becomes another MSTR,” Bitcoin critic Peter Schiff wrote.

This suggests that firms beyond retail are also banking on Bitcoin’s volatile yet historically upward-trending value to boost their stock appeal. However, the speculative strategy carries significant risks, raising concerns.

As BeInCrypto reported, MicroStrategy faces a billion-dollar tax dilemma over Bitcoin gains. Specifically, the firm may owe billions under the US corporate alternative minimum tax (CAMT) for its $47 billion Bitcoin holdings. This includes $18 billion in unrealized gains.

New Financial Accounting Standards Board (FASB) rules compound the issue. Starting this year, companies must report the fair value of cryptocurrencies on their balance sheets. MicroStrategy disclosed that this change would add up to $12.8 billion to its retained earnings and potentially $4 billion to its deferred tax liabilities.

This means that companies’ Bitcoin holdings could directly affect their financial statements. Such an outcome would make them more susceptible to regulatory scrutiny and market volatility. Similarly, the IRS is set to begin tracking cryptocurrency transactions on centralized exchanges in 2025, signaling a broader regulatory crackdown.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Montana Pushes Forward with Bitcoin Reserve Bill

The State of Montana has passed a bill that would allow the creation of a state special revenue account for investments in precious metals and digital assets, including Bitcoin (BTC).

The bill now moves to the full House for a vote. If approved, it will move to the Senate and then to the governor. If signed, it will become law on July 1, 2025.

Montana Advances Strategic Bitcoin Reserve Bill

Representative Curtis Schomer introduced House Bill 429. It is titled “An Act Creating a State Special Revenue Account for Investment in Precious Metals and Digital Assets as Determined by the Board of Investments; Providing Definitions; Providing for a Transfer; and Providing an Effective Date.”

“HB 429 passed the House Business and Labor Committee by a vote of 12-8,” Bitcoin Laws posted on X.

The bill is designed to create an investment strategy for Montana’s state funds by using a mix of assets as a hedge against inflation. HB429 defines a digital asset as virtual currencies, cryptocurrencies, stablecoins, non-fungible tokens (NFTs), and other digital assets offering economic or access rights.

According to the bill, exchange-traded products, such as those linked to commodities or stocks, will be permissible investments. Additionally, precious metals, such as gold, silver, and platinum, in any form—whether coins or bullion—are included.

“The board of investments is authorized to invest the funds in the account provided for in [section 3] in precious metals, digital assets with a market cap of over $750 billion averaged over the previous calendar year, and stablecoins,” the bill specifies.

It is worth noting that only Bitcoin (BTC) fulfills the market cap threshold criteria. Its market capitalization stands at $1.92 trillion.

Meanwhile, Montana is one of the many US states in the race to establish a strategic Bitcoin reserve. According to Bitcoin Laws, as of February, at least 20 states have introduced similar legislation.

“Montana becomes the 4th state to pass SBR out of committee. Utah, Oklahoma, Arizona, and Montana,” Satoshi Action Fund’s CEO, Dennis Porter, wrote on X.

In Utah, HB 230 has moved to the Senate Revenue and Taxation Committee. Furthermore, Utah is currently leading the state reserve race. In Arizona, SB 1373 passed the Senate Finance Committee with a 5-2 vote.

It now goes to the Rules Committee before a full Senate vote. SB 1373 is the second Bitcoin Reserve bill in Arizona, after SB 1025. This bill is also set for a full Senate vote.

The growing momentum behind state-level Bitcoin reserves reflects a broader belief in the value of digital assets. Notably, industry figures like Changpeng Zhao (CZ), former CEO of Binance, have underlined the inevitability of Bitcoin’s role in the global economy.

“You can buy bitcoins after the US government is done buying, or before. There is no other choice, btw,” he remarked.

CZ emphasized that avoiding the use of Bitcoin is as impossible as avoiding the internet or money.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

MicroStrategy to Sell $2 Billion in Stock to Buy More Bitcoin

Strategy (formerly MicroStrategy) is conducting a private offering of convertible senior notes. The firm will offer $2 billion of these assets and use the proceeds to buy more Bitcoin.

Saylor announced that his firm had not bought any Bitcoin in the last week, further interrupting his purchasing trend. Still, other than this detail, everything else seems to fit within his standard acquisition playbook.

Strategy Keeps Buying Bitcoin

Since MicroStrategy (recently rebranded to Strategy) began acquiring Bitcoin, it’s become one of the world’s largest BTC holders. Earlier this month, the firm broke its 12-week streak of consecutive purchases, quickly resuming it shortly afterward.

Today, Michael Saylor acknowledged that the company paused its purchases again, but not for long:

“Last week, Strategy did not sell any shares of class A common stock under its at-the-market equity offering program, and did not purchase any bitcoin. As of 2/17/2025, we hold 478,740 BTC acquired for ~$31.1 billion at ~$65,033 per bitcoin,” Saylor claimed.

Specifically, a few hours after Saylor made this first post, he followed it up with another announcement. The company is planning to privately offer $2 billion worth of convertible senior notes.

These stock offerings, of course, will help Strategy fund more Bitcoin purchases. This is an established technique for the company, making a similar offering last month.

Strategy has employed a few different tactics to continue these major Bitcoin acquisitions. It sold enough stock that BlackRock now owns 5% of the company, and its Strike Preferred Stock (STRK) has been a strong performer. The company’s formidable BTC stockpile has significantly appreciated in value, but the company is strictly holding these assets.

The price of Bitcoin has been somewhat wobbly over the past few weeks, which may present an opportunity for Strategy. After striking ups and downs, its price is consolidating just under the $100,000 mark. This isn’t much of a price decline in the grand scheme, but it will still help Strategy get more assets for the same investment.

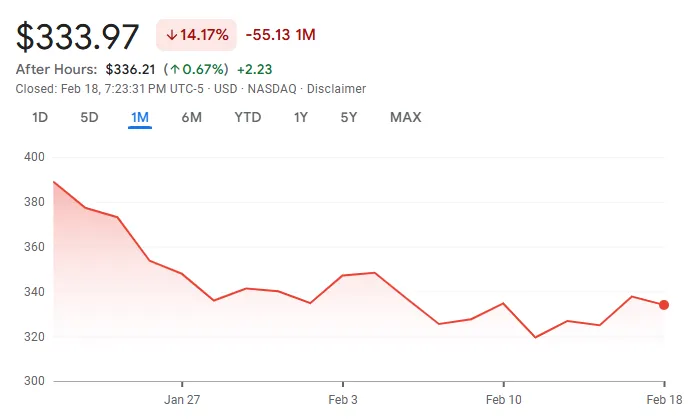

Meanwhile, MSTR’s stock price has also underperformed recently. It remains down by nearly 15% in the past month.

Ultimately, this whole operation seems pretty by the book. Strategy has clearly telegraphed its intentions to buy more Bitcoin with this stock sale, just like several other recent offerings.

Although there have been rumors that the firm may face difficulties fulfilling this strategy, they haven’t surfaced yet. For now, Saylor seems content with the same outlook – maximalist bullishness.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoNigeria Sues Binance for $81.5 Billion

-

Market20 hours ago

Market20 hours agoSolana’s Price Recovery From $170 Faces Investors’ Defiance

-

Regulation23 hours ago

Regulation23 hours agoTether Excluded as MiCA Clears 10 Stablecoin Issuers In Europe

-

Market21 hours ago

Market21 hours agoBitcoin Price Edges Higher But Remains Stuck In a Tight Zone

-

Altcoin19 hours ago

Altcoin19 hours agoBTC Reclaims $97K, Altcoins Jump In Sync

-

Market17 hours ago

Market17 hours agoBNB Price Approaches a Key Level—Can It Clear the Hurdle?

-

Market16 hours ago

Market16 hours agoPi Network (PI) Lists on OKX, Drops 21% After Initial Surge

-

Altcoin16 hours ago

Altcoin16 hours agoBinance To Delist These Token Pairs Soon, Prices At Risk?