Market

Argentina’s President Milei Denies Ties to LIBRA Meme Coin

Argentina’s President Javier Milei has distanced himself from the LIBRA meme coin after promoting it in a now-deleted tweet.

His clarification follows accusations that the project’s developers drained approximately $107 million in what appears to be a pump-and-dump scheme.

LIBRA Meme Coin Controversy

On February 14, Milei’s X account endorsed LIBRA, a Solana-based meme coin, which triggered a surge in trading activity. The token’s market cap briefly hit $4.5 billion as investors rushed in.

The project claimed its goal was to support Argentina’s economy by funding small businesses and local ventures. Julian Peh, co-founder of KIP Protocol, confirmed the platform’s involvement, stating that its role was to manage fund distribution rather than oversee the token itself.

“Our primary role is to help run the fund allocation to the Argentinian companies, and less on the token side. We are not the [Market maker]…We will put together the plan to run the Project Libertad as per the original objective. We would not have gotten the help we did to launch it if we were not serious. Not a single SOL will be used outside of the purpose of running Project Viva La Libertad,” Peh said.

However, doubts quickly emerged regarding the legitimacy of the launch. Crypto analyst Conor Grogan pointed out that the wallet deploying LIBRA had received funds from an exchange that does not require Know Your Customer (KYC) verification.

As concerns mounted, Milei addressed the issue, stating that he had initially shared the project to support a private initiative, something he does regularly.

Upon further review, he retracted his endorsement and deleted the post. Following his statement, LIBRA’s price plummeted by around 90%.

“I was not aware of the details of the project and after having become aware of it I decided not to continue spreading the word (that is why I deleted the tweet). To the filthy rats of the political caste who want to take advantage of this situation to do harm, I want to say that every day they confirm how vile politicians are, and they increase our conviction to kick them in the ass,” Milei said.

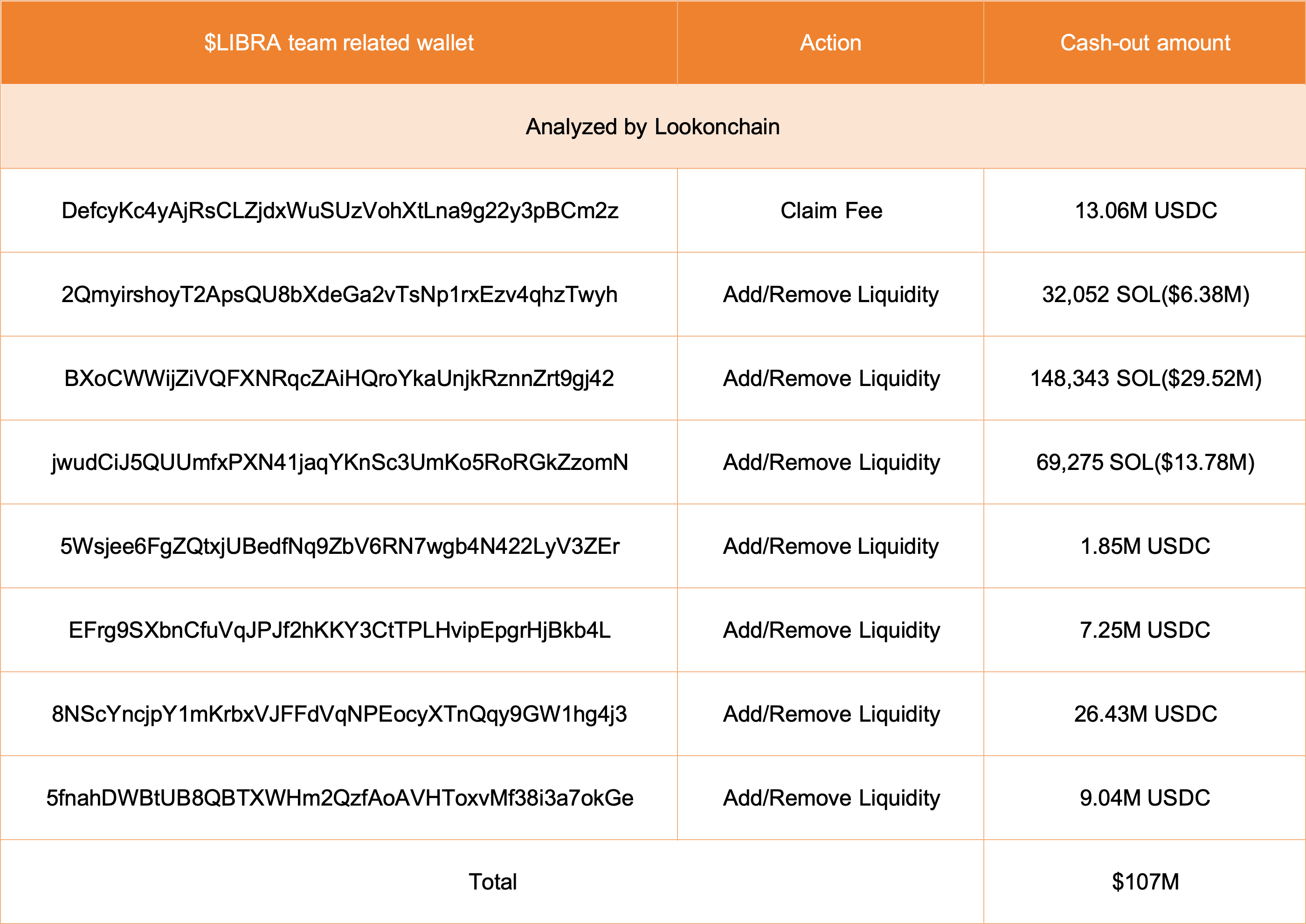

Meanwhile, blockchain analysis from Lookonchain revealed that insiders had withdrawn approximately $107 million. Eight wallets linked to the project moved $57.6 million in USDC and 249,671 SOL, worth nearly $50 million. Analysts suggested these withdrawals were tied to liquidity manipulation and accumulated fees.

Additionally, crypto analyst EmberCN reported that insiders made at least $20.18 million by front-running the promotional tweet, buying seconds after it was posted, and selling after the price spike.

Political Meme Coins and Industry Reactions

The LIBRA fallout highlights concerns surrounding politically affiliated meme coins. Similar speculation surrounded the launch of the TRUMP token in January and the Central African Republic’s CAR meme coin.

In both cases, traders rushed to buy in before questioning their legitimacy. While those tokens turned out to be authentic, LIBRA’s rapid collapse has raised alarms within the crypto community.

Industry figures have condemned the situation. Sonic Labs co-founder Andre Cronje criticized the trend, suggesting that meme coin traders do not engage with decentralized finance or blockchain technology.

“[Meme coin traders are] a demographic that doesnt care about decentralized finance or even blockchains. So memes arent stealing any attention, since the participants werent our participants in the first place,” Cronje stated.

On the other hand, SlowMist founder Yu Xian called for accountability, stating that those responsible should face legal consequences.

“Support everyone in defending your rights; the instigator must be punished by law, and hopefully, they will also face the President’s wrath,” Xian added.

The LIBRA controversy reflects the risks of speculative meme coins, particularly when linked to political figures. The incident has further fueled discussions about regulatory oversight and investor protection in the crypto space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Galaxy Executive Denies SPX Token’s Alleged Sale by Murad

Galaxy’s Head of Research, Alex Thorn, has refuted claims that Murad Mahmudov, a meme coin analyst, sold his SPX6900 (SPX) tokens to them.

Reports alleged that Murad conducted the sale through over-the-counter (OTC) transactions to bypass on-chain activity.

Did Murad Really Sell His SPX Tokens?

According to the rumors circulating on social media platform X (formerly Twitter), Murad offloaded $20 million worth of SPX tokens for $13 million. He bypassed on-chain transactions to avoid public scrutiny.

Moreover, users noted that the situation extends beyond a simple token sale. The claims suggested that Galaxy acquired Murad’s seed phrase, granting them control over his wallets.

“This isn’t just an OTC sale—it’s a full-scale, hidden liquidation,” one user wrote on X.

The rumors went further, alleging that Galaxy was liquidating Murad’s assets through private OTC deals while simultaneously hedging its position with short trades. These speculations were supposedly backed by leaked internal memos and chat logs from a Galaxy employee, purportedly confirming the private sale strategy.

However, Thorn was quick to shut down the rumors.

“This is fake,” Thorn stated.

In a statement on X, Thorn addressed the circulating photos, confirming they were forgeries. He pointed out that the ID badge featured in the images did not belong to him or his team and that the email groups shown were not legitimate distribution lists.

Thorn emphasized that the entire situation was a fabrication designed to mislead the public.

“This is truly false — you are being played by random meme coin scammers,” he added.

It’s important to note that Murad has been a vocal supporter of SPX, endorsing the meme coin multiple times in the past. His strong backing of the project made the recent claims all the more surprising.

“SPX6900 will become the Biggest meme coin in World History,” Murad wrote in January.

However, his endorsements have also raised some eyebrows. Previously, Crypto sleuth ZachXBT’s investigation revealed that Murad used 11 separate wallets for his $24 million holdings, including SPX. His public promotions of the coin contributed to SPX’s value soaring and raised concerns about potential market manipulation.

Meanwhile, the rumors of Murad selling SPX had little impact on the token’s price. On the price front, SPX had already been struggling.

After a brief recovery last week, the token continued to depreciate. At the time of writing, it was trading at $0.61, down 8.1% over the past day. The token’s monthly losses stood at 56.1%, reflecting a bearish sentiment in the market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Stuck In Limbo—What’s Holding Back The Recovery?

Dogecoin started a fresh decline below the $0.270 zone against the US Dollar. DOGE is now consolidating and might face hurdles near $0.2550.

- DOGE price started a fresh decline below the $0.270 and $0.260 levels.

- The price is trading below the $0.260 level and the 100-hourly simple moving average.

- There is a connecting bearish trend line forming with resistance at $0.2560 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could start another increase if it clears the $0.2560 and $0.2600 resistance levels.

Dogecoin Price Faces Resistance

Dogecoin price started a fresh decline from the $0.2840 resistance zone, like Bitcoin and Ethereum. DOGE dipped below the $0.270 and $0.260 support levels. It even spiked below $0.250.

A low was formed at $0.2420 and the price is now attempting to recover. There was a move above the 23.6% Fib retracement level of the downward wave from the $0.2830 swing high to the $0.2420 low. The price even cleared the $0.2500 resistance level.

Dogecoin price is now trading below the $0.260 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.2550 level. There is also a connecting bearish trend line forming with resistance at $0.2560 on the hourly chart of the DOGE/USD pair.

The first major resistance for the bulls could be near the $0.2620 level or the 50% Fib retracement level of the downward wave from the $0.2830 swing high to the $0.2420 low. The next major resistance is near the $0.2670 level.

A close above the $0.2670 resistance might send the price toward the $0.300 resistance. Any more gains might send the price toward the $0.320 level. The next major stop for the bulls might be $0.3420.

Another Decline In DOGE?

If DOGE’s price fails to climb above the $0.260 level, it could start another decline. Initial support on the downside is near the $0.2480 level. The next major support is near the $0.2420 level.

The main support sits at $0.2350. If there is a downside break below the $0.2350 support, the price could decline further. In the stated case, the price might decline toward the $0.2220 level or even $0.2150 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now below the 50 level.

Major Support Levels – $0.2480 and $0.2420.

Major Resistance Levels – $0.2600 and $0.2620.

Market

Analyst Highlights Top Challenges Confronting IBIT Bitcoin ETF

Bloomberg’s senior ETF analyst Eric Balchunas has stated that while BlackRock’s iShares Bitcoin Trust ETF (IBIT) has done well since its launch last year, it faces several challenges going forward.

This assessment comes amid recent signs of turbulence in the broader Bitcoin (BTC) exchange-traded fund (ETF) market.

Upcoming Challenges for IBIT Bitcoin ETF

Balchunas pointed to a crucial factor that could hinder IBIT’s continued growth: Bitcoin’s tendency to decline when stocks fall. This correlation presents a unique challenge for the Bitcoin ETF, as it could struggle to gain significant adoption compared to more traditional ETFs.

“IBIT did reach $50 billion in first year (it took VOO six years to hit that mark) so definitely one to watch but it would take a ton more adoption (flows), and you probably need a break in correlation with stocks,” Balchunas added.

Despite concerns about Bitcoin’s market volatility, recent 13F filings reveal a growing interest in IBIT. A 13F filing is a quarterly report mandated by the US Securities and Exchange Commission (SEC) for institutional investment managers overseeing more than $100 million in assets.

It offers transparency into major players’ investment activities. All filings must be made public within 45 days of the quarter’s end. Therefore, the deadline for Q4 2024 was February 14, 2025.

Balchunas mentioned that IBIT had attracted 1,100 holders through 13F filings. The previous record for a first-year ETF was around 350 holders.

“For context, NUKZ, a pretty successful nuclear theme ETF launched same day as IBIT has 29 holders. Most newbies have under 10,” he said.

Notably, IBIT remains the largest Bitcoin ETF, holding 2.98% of the total supply. It has continued to attract substantial investments from major players, with the latest being Abu Dhabi’s Mubadala Sovereign Wealth Fund. Last week, Mubadala invested $436 million into BlackRock’s ETF, becoming the seventh-largest holder.

From a broader perspective, institutional adoption of Bitcoin ETFs has seen a remarkable growth. The assets under management tripled in Q4, reaching $38 billion.

Yet, recent data shows that the momentum has slowed in 2025. Bitcoin ETFs saw their first week of net outflows last week. The weekly total net outflow reached over $585 million. Furthermore, the trend seems to be continuing.

On February 18, Bitcoin ETFs experienced $129 million in outflows. As BeInCrypto highlighted earlier, this could be due to investor caution following Jerome Powell’s rejection of rate cuts and ongoing concerns over high inflation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoThe Fed is expected to cut interest rates twice in 2025, what might this mean for the Bitcoin price?

-

Market24 hours ago

Market24 hours agoMeteora Cofounder Ben Chow Resigns Amid Libra Fallout

-

Blockchain20 hours ago

Blockchain20 hours agoBlockchain Forum 2025: Global crypto leaders to meet in Moscow

-

Ethereum22 hours ago

Ethereum22 hours agoHyperliquid launches its general-purpose EVM and unveils bug bounty program

-

Market17 hours ago

Market17 hours ago2-Month High Inflows And HODLing To Drive Cardano Price Rally

-

Altcoin21 hours ago

Altcoin21 hours agoNew Crypto Users Can Benefit from Best Wallet Token Presale

-

Market20 hours ago

Market20 hours agoPi Network’s 5-Second Block Speed Stirs Excitement

-

Market19 hours ago

Market19 hours agoGrayscale Pyth Trust Opens for Subscription