Market

3 New Cryptos Launched This Week to Keep an Eye On

BROCCOLI, FULLSEND, and B3 are among the top-performing new cryptos this week. BROCCOLI, a meme coin on BNB Chain, has skyrocketed to a $151 million market cap in just a day, fueled by hype around Binance founder CZ’s dog.

On Solana, FULLSEND has surged over 260% in 24 hours, reaching a $54 million market cap with more than 164,000 transactions. Meanwhile, B3, a gaming-focused project on Base, now holds a $203 million market cap, ranking as the eighth-largest token on the chain despite recent price fluctuations.

CZ’s Dog (BROCCOLI)

The crypto market has been flooded with various “BROCCOLI” tokens after Binance founder Changpeng Zhao revealed his dog’s name, sparking mixed reactions from the community.

For this analysis, the focus is on the BROCCOLI token with the address 0x6d5AD1592ed9D6D1dF9b93c793AB759573Ed6714, which is built on the BNB Chain. Among the many meme coins emerging from this trend, this version has gained the most traction.

Launched just a day ago, BROCCOLI has already attracted over 35,000 holders, making it the biggest new crypto on BNB Chain this week and one of the biggest new cryptos among all chains.

With a market cap of $151 million and more than 155,000 transactions in the last 24 hours, its explosive growth suggests it could become one of the next major meme coins.

BROCCOLI’s RSI is currently at 48, signaling neutral momentum with no immediate overbought or oversold conditions.

This means that BROCCOLI could still gain momentum if demand continues, but if enthusiasm fades, it may consolidate or face a potential pullback.

Fullsend Community Coin (FULLSEND)

FULLSEND launched just four days ago on Pumpfun and has quickly gained massive traction, reaching a market cap of $54 million. In the last 24 hours alone, it recorded over 164,000 transactions and attracted more than 20,000 holders. That makes it one of the most actively traded new cryptos on Solana.

Rising over 260% in the past day, FULLSEND has established itself as one of the biggest new cryptos launched on Solana this week, hitting the $50 million market cap milestone within just three days. With an RSI of 57.9, FULLSEND still has room for further upside if buying pressure continues.

As momentum builds, FULLSEND’s next moves will depend on whether it can sustain its strong trading volume and holder growth. If demand remains high, it could push toward new highs. It could reach $100 million in market cap in the next few days.

B3

B3 has been trending in the last few days, making it one of the fastest-growing new cryptos on Base in recent months. Founded by former Base team members, it is a gaming-focused project that has quickly gained attention. It quickly became one of the most discussed gaming coins of this cycle.

Launched almost five days ago, B3 has already climbed to become the eighth-largest coin on Base. Despite a 30% decline in the last 24 hours, the project continues to attract investors. It has over 105,000 holders and a market cap exceeding $203 million.

B3’s RSI currently sits at 36.6, indicating that it is approaching oversold territory. Typically, an RSI below 30 suggests an asset is oversold and could be due for a rebound, while an RSI above 70 signals overbought conditions.

The post 3 New Cryptos Launched This Week to Keep an Eye On appeared first on BeInCrypto.

Market

How It’s Impacting the Network

At the beginning of 2025, Layer-1 (L1) blockchain network Solana found itself in the spotlight, thanks to meme coins.

Donald Trump’s Official Trump (TRUMP) meme coin launch on January 17 ignited a flurry of activity across the network, driving demand to levels unseen since the 2021 bull cycle.

While these volatile assets boosted Solana’s network activity and pushed up SOL’s price, they also present a paradox. They have brought in liquidity, users, and attention—but at what cost?

Presidential Memes Pump Solana Into Overdrive

Solana’s cheap, lightning-fast transactions and highly composable DeFi infrastructure make it one of the most preferred blockchains for launching meme coins. So when newly elected Donald Trump launched his TRUMP meme coin on the network in January, it came as no surprise to many.

Following TRUMP’s launch on January 17, demand for Solana skyrocketed, driven on the one hand by developers eager to launch their own meme coins and on the other by the frenzy of trading activity surrounding them.

Melania Trump followed her husband’s lead by launching her MELANIA meme coin on the same chain two days later. This move exacerbated the meme hype and drove significant trade volumes across multiple meme coins, both existing and newly created.

For example, within a day of launch, MELANIA’s trading volume soared 396%, jumping from $1.33 billion to $6.6 billion, according to CoinGecko data.

Solana Memes Took It to the Moon, Then Back Down

This development drove significant user engagement on Solana. According to Glassnode, by January 24, the network was processing 832,000 active addresses per hour, over 26 times more than Ethereum, which recorded just 31,000 per hour.

Due to the huge influx of new users on the network, transaction fees rocketed. Per Glassnode, Solana’s total transaction fees climbed to an all-time high of $32.43 million on January 19 after MELANIA launched. On the same day, SOL climbed to an all-time high of $293.

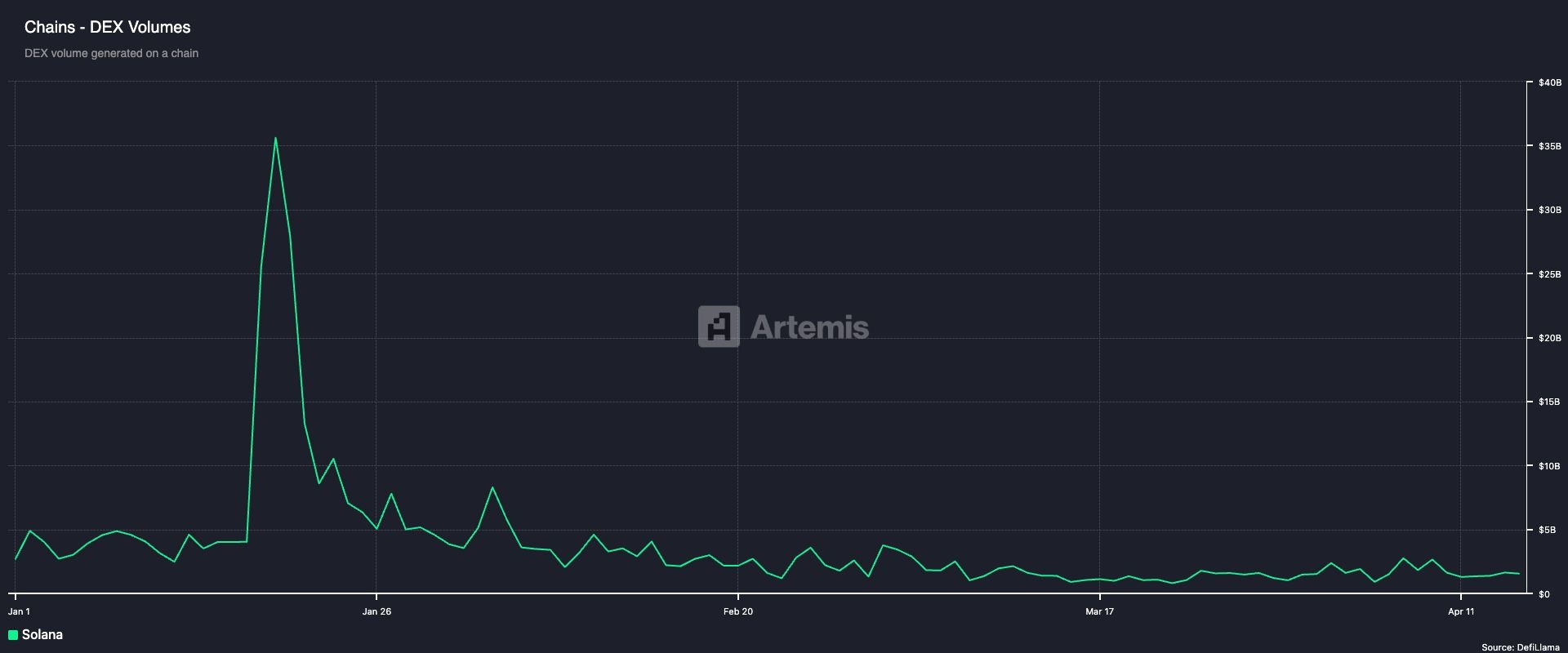

However, market exhaustion set in shortly after this price peak was reached. The meme coin mania began to fade, taking Solana users with it. Daily active addresses and new demand for the L1 plunged, dragging down DEX volume, SOL’s price, and DeFi TVL.

For example, SOL’s DEX volume hit an all-time high of $36 billion on January 19. But as the meme coin hype cooled off, by January 31, it had plummeted to just $3.8 billion, dropping nearly 90%. As of April 15, this totaled $1.5 billion.

Solana’s network revenue was not spared. Daily revenue, which rose to an all-time high of $16 million on January 19, plummeted to under $5 million by the end of January. Yesterday, the network’s total revenue from all transactions completed was under $115,000.

Solana Has Bigger Plans, Analyst Says

While TRUMP, MELANIA, and the slew of other meme coins that launched on Solana in the first few weeks of the year drove unprecedented network activity and boosted SOL’s value, the drop in their values and overall trading volumes has impacted the network’s performance.

It then raises the question of whether Solana’s actual value is now tied to this highly volatile, borderline chaotic asset class.

In an exclusive interview with BeInCrypto, Binance Research spokesperson Marina Zibareva noted that while these meme assets contributed to the network’s growth at the beginning of the year, Solana’s performance remains “increasingly driven by broader ecosystem fundamentals.”

According to Zibareva:

“We’ve seen DeFi TVL grow nearly 4x in SOL terms since January, and stablecoin supply has increased over 6x – pointing to lasting interest in real utility. Developer activity is also accelerating, with smart contract deployments rising almost 6x, suggesting strong long-term potential beyond the speculative wave.”

Although Solana’s inherent features make it a go-to destination for launching meme coins via platforms like Pump.fun, Jupiter, and Meteora, Zibareva sees a future for the network that stretches beyond meme coins.

“Meme coins have brought attention and users, but the long-term trajectory likely points toward use cases like DeFi, DePIN, Gaming, and SocialFi. Solana’s daily active addresses have increased nearly 6x year-to-date, and with its infrastructure battle-tested, we expect to see more developer activity focused on sustainable value creation,” she added.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

DWF Invests $25 Million in Trump’s World Liberty Financial

DWF Labs announced today that it invested $25 million into Trump Family-backed World Liberty Financial and is planning to open an office in New York City. It hopes to use this office to drive new relationships with regulators, financial institutions, and more.

Although this partnership would potentially create more liquidity opportunities for the US crypto market, previous allegations against DWF have raised some concerns about political misconduct.

Understanding DWF Labs’ Investment in WLFI

World Liberty Financial (WLFI), one of the Trump family’s major crypto ventures, has been making some big moves since the President’s inauguration in January.

The DeFi project allegedly entered talks with Binance to launch a new stablecoin, and it officially announced USD1 shortly after. Today, WLFI has entered a new partnership with Dubai-based Web3 investment firm DWF Labs.

“The US is the world’s largest single market for digital asset innovation. Our physical presence reflects our confidence in America’s role as the next growth region for institutional crypto adoption. Moreover, the USD1 stablecoin and forthcoming global DeFi solutions align with our broader mission to improve financial services,” claimed Managing Partner Andrei Grachev.

DWF’s statement includes a few key details about its new relationship with WLFI. It essentially boils down to two key points: the firm has already purchased $25 million in WLFI tokens, and it plans to open a physical office in New York City.

On a positive note, this partnership could be significant for the overall US crypto market. DWF Labs has a portfolio of over 700 crypto projects.

So, physically setting up a hub in New York will give me regulatory freedom and the opportunity to invest directly in the local crypto market. This would potentially open up more liquidity for upcoming Web3 projects and startups in the US

Concerns of Financial Misconduct

Although DWF Labs is a popular market maker, it has been at the center of major controversies. Last year, it was accused of wash trading and market manipulation, and Binance allegedly shut down its internal investigation due to financial incentives.

Also, one of its partners was dismissed back in October over allegations of drugging a job applicant. So, the firm’s credibility and reputation have been shaky in recent times.

This is to say that the crypto community has reasons to worry about a deal between DWF and World Liberty Financial. A report from late March determined that most WLFI revenues go directly to Trump’s family.

WLFI owners are unable to actually trade their tokens, and the stated governance use of the assets seems unclear. In other words, there isn’t a clear reason why anyone would invest.

The growing concern is that firms like DWF would invest in WLFI as an easy tool for political corruption. Shortly after the election, Tron founder Justin Sun invested $30 million into World Liberty. Trump’s family apparently got most of this money, and the SEC settled a fraud case against Tron in February.

If DWF Labs invested a similar amount in WLFI, could this give it some legal protection? The Department of Justice already gutted its Crypto Enforcement Team, and New York’s US Attorney also signaled its intent to stop crypto prosecutions.

As this deal goes forward, it will be important to look for signs of any possible financial misconduct.

BeInCrypto has contacted DWF Labs about the 2024 market manipulation claims but has yet to receive a reply.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Are TRUMP Meme Coin Investors Selling Before Friday’s Unlock?

The TRUMP meme coin has lost 29% of its value over the past month and is now down more than 90% from its all-time high. The sharp decline has been accompanied by weakening momentum across multiple indicators.

Both suggest that bullish strength has faded and downside risks are growing. Adding to the pressure, a large wallet just withdrew millions in USDC ahead of a $317 million token unlock next week, raising concerns about possible selling activity.

Indicators Suggest Weak Momentum for TRUMP Meme Coin

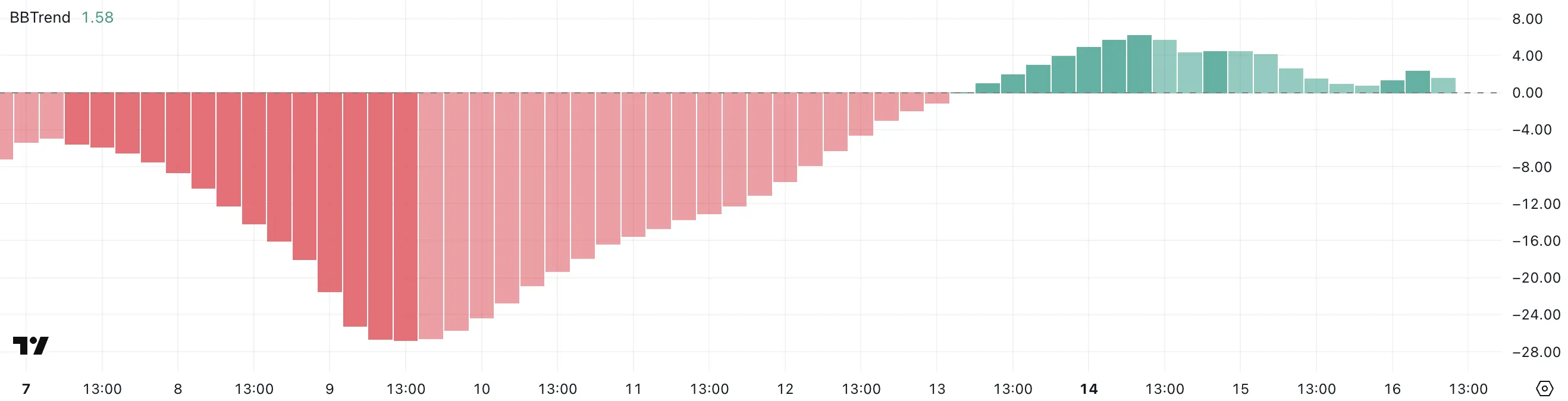

TRUMP’s BBTrend indicator has sharply dropped to 1.58, down from 6.23 just two days ago. This sudden decline suggests that the strength of the previous trend has significantly weakened.

After showing strong momentum earlier in the week, the current BBTrend reading points to a possible shift toward consolidation or even a reversal if buying interest continues to fade.

BBTrend, short for Bollinger Band Trend, is a technical indicator that measures the strength of a price trend based on the width of Bollinger Bands.

Higher values typically indicate a strong directional move, while lower values suggest that the market is entering a less volatile phase.

With TRUMP’s BBTrend now at 1.58—close to the neutral zone—it could signal that the strong bullish phase is cooling off. If the indicator continues to fall and the price loses support, it may point to a period of sideways movement or the beginning of a downtrend.

TRUMP’s Ichimoku Cloud chart shows a clear bearish setup. The price is currently trading below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (baseline).

This positioning suggests that short-term momentum remains weak, and buyers have yet to regain control.

The fact that price candles are still beneath the cloud reinforces the ongoing bearish sentiment, as the cloud often acts as resistance when prices are below it.

Looking ahead, the cloud (Kumo) is transitioning from red to green but remains flat and narrow, signaling limited upside strength. The green Senkou Span A is only slightly above the red Senkou Span B, meaning the future trend outlook is still uncertain and lacks conviction.

For any bullish reversal to gain traction, TRUMP meme coin would need to break above the cloud with strong volume. Until that happens, the chart points to continued caution, with the potential for more sideways or downward price action.

Whale Withdrawal Raises Concerns Ahead of $317 Million TRUMP Unlock

A wallet linked to Donald Trump’s memecoin withdrew $4.6 million in USDC from the Solana DEX Meteora on Tuesday.

These funds were previously used to provide liquidity for the TRUMP-USDC trading pair. They helped ensure smoother trading and price stability. This wallet has made a withdrawal for the first time, and the size and timing of the move make it noteworthy.

Even after the withdrawal, the pool still holds around $205 million in USDC and $122 million in TRUMP tokens.

This activity comes just days before a major unlock event set for next Friday. Around $317 million worth of TRUMP meme coin tokens will become available.

Unlocks often worry investors as they increase token supply. If a large portion is sold, it can push prices down. The $4.6 million withdrawal has raised speculation about insider moves. Some believe funds are being repositioned ahead of the unlock.

While it’s not clear if a selloff is coming, the timing suggests caution. In the days ahead, on-chain activity should be closely watched.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Metrics Reveal Critical Support Level – Can Buyers Step In?

-

Market18 hours ago

Market18 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Market17 hours ago

Market17 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Adoption Grows As Public Firms Raise Holdings In Q1

-

Market16 hours ago

Market16 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market15 hours ago

Market15 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

-

Market23 hours ago

Market23 hours agoAxiom Leads Solana Trading Bots