Market

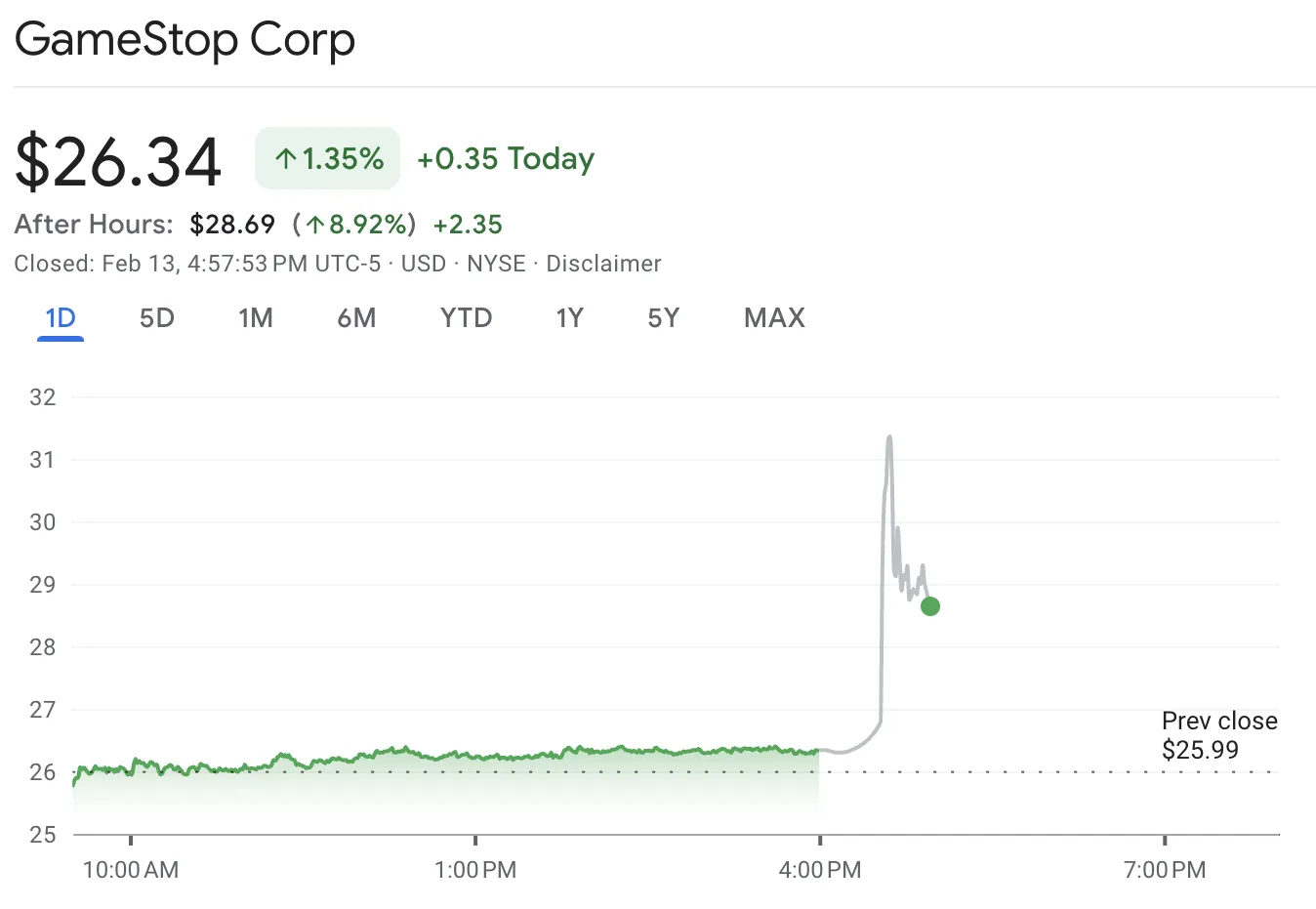

GameStop May Buy Bitcoin, Stock Price Bounces Dramatically

GameStop is considering investing in Bitcoin, and the news already started impacting its stock price. CEO Ryan Cohen recently posted a photo with MicroStrategy’s Michael Saylor, and his firm may serve as a blueprint.

GameStop previously tried to enter the Web3 market with its NFT marketplace, but this proved unsuccessful. Bitcoin is completely unrelated to its core business model and may dramatically change the company, but its revenues would keep it afloat.

GameStop, ostensibly a gaming and electronics retailer, has changed a lot in the last few years. After steadily declining revenues, a Reddit-driven stock squeeze in 2021 brought about a legendary stock pump. This event rejuvenated company leadership, prompting new Web3-oriented business solutions like an NFT marketplace.

However, GameStop’s momentum couldn’t last forever; the firm fired CEO Matthew Furlong in 2023 and shuttered its NFT marketplace the following January.

Today, however, GameStop is preparing to take a truly radical step: investing in Bitcoin. According to published rumors, the firm may invest in it and other cryptoassets soon. The news quickly had a notable impact on its stock price.

The price of Bitcoin has been extremely bullish in recent months, but that doesn’t fully explain GameStop’s decision. Despite the recent liquidations triggered by Trump’s geopolitical decisions, Bitcoin is starting to stabilize.

Given BTC is still below $100,000 and analysts predict much higher prices by the end of the year, it would be an optimal time for GameStop to add Bitcoin to its portfolio. The decision seems to be somewhat inspired by MicroStrategy’s Michael Saylor.

Before buying Bitcoin, MicroStrategy was in a very similar position to GameStop. Saylor saw revenues from its traditional business model drying up and made a dramatic gamble on BTC.

This bet has paid off extraordinarily well, and Saylor recently rebranded the company to prominently feature the Bitcoin logo.

“GameStop, a company with no viable business plan, has thrown another Hail Mary by announcing that it might use its cash to buy Bitcoin. The irony is that Bitcoin is even more overpriced than GME. No matter; speculators are buying the stock anyway, hoping it becomes another MSTR,” wrote anti-crypto advocate Peter Schiff.

In other words, Saylor’s Bitcoin rebrand could serve as a blueprint for GameStop. The company tried to adapt to meet Web3 market opportunities when it entered the NFT market, but this wasn’t enough. Many of its NFTs were gaming-themed, and this proved a niche market. Bitcoin, however, has nothing to do with its old business model.

Committing to a Bitcoin-first strategy could completely change GameStop’s revenue model. MicroStrategy was totally transformed by its pivot to BTC. Even Tesla, one of the world’s largest tech firms, has noticeably changed due to its crypto purchases.

However, no further updates regarding any accumulation plans have been revealed yet.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Sam Bankman-Fried Requests Pardon From Trump

Sam Bankman-Fried, the imprisoned former CEO of FTX, is hoping that President Trump will pardon him. In a recent interview, he portrayed his own conviction as part of the anti-crypto overreach of Biden’s Presidency.

However, while Bankman-Fried was a free man and a billionaire, he donated millions against Trump in the 2020 election. Securing a pardon under these circumstances may be a long shot.

Will Trump Pardon Sam Bankman-Fried?

Sam Bankman-Fried, one of the biggest criminals in crypto history, is trying to get out of federal prison. He has consistently petitioned for his release since the legal battle begun in 2022, but with little success.

Now, however, Bankman-Fried is looking for a new strategy, hoping that President Trump will pardon him.

“My judge, Judge Kaplan, is one of Trump’s judges in New York, which is sort of part of a larger fight going on between the incoming Trump DOJ and what they see from Biden’s DOJ. I know there have been discussions of a pardon… Given what President Trump has seen of the DOJ and its politicization, I think there is a real conversation happening around that.” says Bankman-Fried.

Before FTX came crashing down in 2022, Bankman-Fried was one of the biggest figures in the international crypto space. He was a major Democratic donor, contributing to Joe Biden’s 2020 victory over Donald Trump, but all his political capital disappeared with his empire.

Recently, prosecutors made an exception for him when announcing an end to crypto crackdowns.

However, now that Trump is in charge, this may present a new opportunity. He pardoned Silk Road founder Ross Ulbricht, whose decade-long imprisonment was a cause célèbre in the crypto community after petitions from Ulbricht’s mother. Bankman-Fried’s own parents noticed this and began asking President Trump to pardon their son last month.

In his first interview from prison with The New York Sun, Bankman-Fried was very light on directly praising Trump in his pardon requests.

Instead, he acknowledged his past ties with the Biden administration and claimed that he became dissatisfied with its crypto policies. He alleged that his own conviction was a casualty of this government overreach, which Trump can correct:

“I viewed myself at the time as sort of center-left, and that’s not how I view myself anymore. By 2022, I had spent a bunch of time in Washington, D.C., working with legislators, regulators, and the executive branch, and I became really frustrated and disappointed with what I saw of the Biden administration and the Democratic Party. Particularly on crypto policy, the Biden administration was just incredibly destructive and difficult to work with. I think my case fits into that broader context,” Bankman-Fried claimed.

It’s presently unclear whether this framing will do much to move President Trump. Although Bankman-Fried claimed that he also donated to Republicans, he nonetheless directly backed Trump’s opponent with millions of dollars.

In other words, although Bankman-Fried maintains his innocence, a pardon seems like a real long shot.

Bankman-Fried Still Claims to be Innocent

Sam Bankman-Fried says that the prosecutors pushed some “very big misinformation during his trial.” They also provided misleading information about his luxury apartment complexes, according to the FTX founder.

He also firmly denies that FTX and Alameda Research were bankrupt or insolvent.

“Both companies had enough to make good on all their liabilities. What happened was a liquidity crisis, a run on the bank. We had more in assets than in debt, but all of a sudden there was a big demand on cash delivery immediately,” he claims.

Regardless of his claims, Bankman-Fried’s colleagues, Gary Wang and Nishad Singh, as well as Caroline Ellison, testified against him during the trial. All of them received much lighter sentences due to their cooperation.

Although the founder made some remarks about his mistakes, he claimed his sentencing was exaggerated. However, the crypto community might not agree.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Altcoins Trending Today — OM, PAIN and SHADOW

After a few days of broad decline, the crypto market is showing signs of recovery, with the total market cap rising by $58 billion in the past 24 hours.

Amid this rebound, a number of altcoins are drawing significant attention due to ecosystem updates and notable price movements. Here is a closer look at today’s trending tokens.

MANTRA (OM)

OM, the native coin of the real-world asset (RWA) Layer-1 (L1) blockchain Mantra, is one of the trending altcoins today. It has grabbed investors’ attention because of Mantra’s newly launched RWAccelerator, a startup accelerator program backed by Google Cloud that drives the tokenization of real-world assets (RWAs).

The program, announced at Consensus Hong Kong, will provide funding, mentorship, AI-driven resources, and technical support for real estate and finance startups.

However, its price performance has remained muted to this development. The coin trades at $7.37 at press time, noting a 3.2% decline over the past day. During that period, its trading volume totaled $219 million, falling 43%.

A decline in an asset’s price and trading volume signals weakening market interest and reduced liquidity. Therefore, OM risks plummeting to $5.41 if this trend persists.

On the other hand, a surge in the demand for the altcoin could trigger a rally toward its all-time high of $8.12.

PAIN (PAIN)

The newly launched Solana-meme coin PAIN is another trending altcoin today. PAIN has made a strong debut, reaching a market capitalization of $168 million within 17 hours of its launch, with a trading volume of $93 million.

As of this writing, the meme coin trades at $16.99, having declined 10% in price in the past 24 hours. Its falling Relative Strength Index (RSI) on the hourly chart confirms the dropping demand for PAIN. It is in a downward trend at 56.87

An RSI reading of 56 indicates moderate bullish momentum, but its decline suggests weakening buying pressure. If the downtrend continues, it could signal a shift toward neutral or bearish territory.

If this decline continues, PAIN’s price could drop to $5.74.

On the other hand, if demand climbs, its price could touch $57.13

Shadow (SHADOW)

SHADOW is another trending altcoin today because its value has rocketed over 50% in the past 24 hours. It currently trades at $168.27, with sustained demand among market participants.

This is reflected by its positive Balance of Power (BoP), which is at 0.77 at press time. The indicator measures the strength of buyers versus sellers in a market. A positive BoP indicates buyers have greater control, signaling bullish momentum.

If buying pressure remains strong, SHADOW could reclaim its all-time high of $199.68.

Conversely, a spike in selloffs could cause a price decline to $154.13.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bybit CEO Calls Pi Network a Scam, Denies Listing Plans

Bybit CEO Ben Zhou shared a 2023 warning from China’s law enforcement officials, calling Pi Network a scam. Pi made the largest airdrop in crypto history today, but despite the hype, it still has bitter opponents.

The warning described Pi using very harsh language, calling it a “pyramid scheme” that uses the elderly as “hunting targets.” If the project collapses in the future, it could have repercussions for China’s crypto policy.

Bybit Remains Firm Against Listing Pi

Pi Network, one of the most ambitious blockchain projects, had its long-awaited mainnet launch today. It quickly became the most valuable airdrop in crypto history, with a staggering $12.6 billion in airdropped tokens.

However, the project still has significant critics, as Bybit CEO Ben Zhou shared a 2023 warning against Pi from law enforcement in China:

“Many criminals use Pi to claim that they can mine for free by simply downloading an app on their mobile phones. They also give lectures to the elderly, expand the victim group by claiming that they can ‘recommend rebates’ by developing downlines, resell user personal information, and defraud the elderly of their pensions,” the statement claimed.

Zhou relayed this warning to show that China has long-held suspicions regarding Pi Network. Bybit is one of the world’s major crypto exchanges, and Zhou wished to justify why his company has zero interest in listing Pi.

He also shared it in response to Pi enthusiasts mocking him, strongly stating his personal belief that Pi is a scam.

Bybit is not the only exchange involved in this controversy. When OKX claimed it might list Pi, users strenuously reminded it that China might take offense.

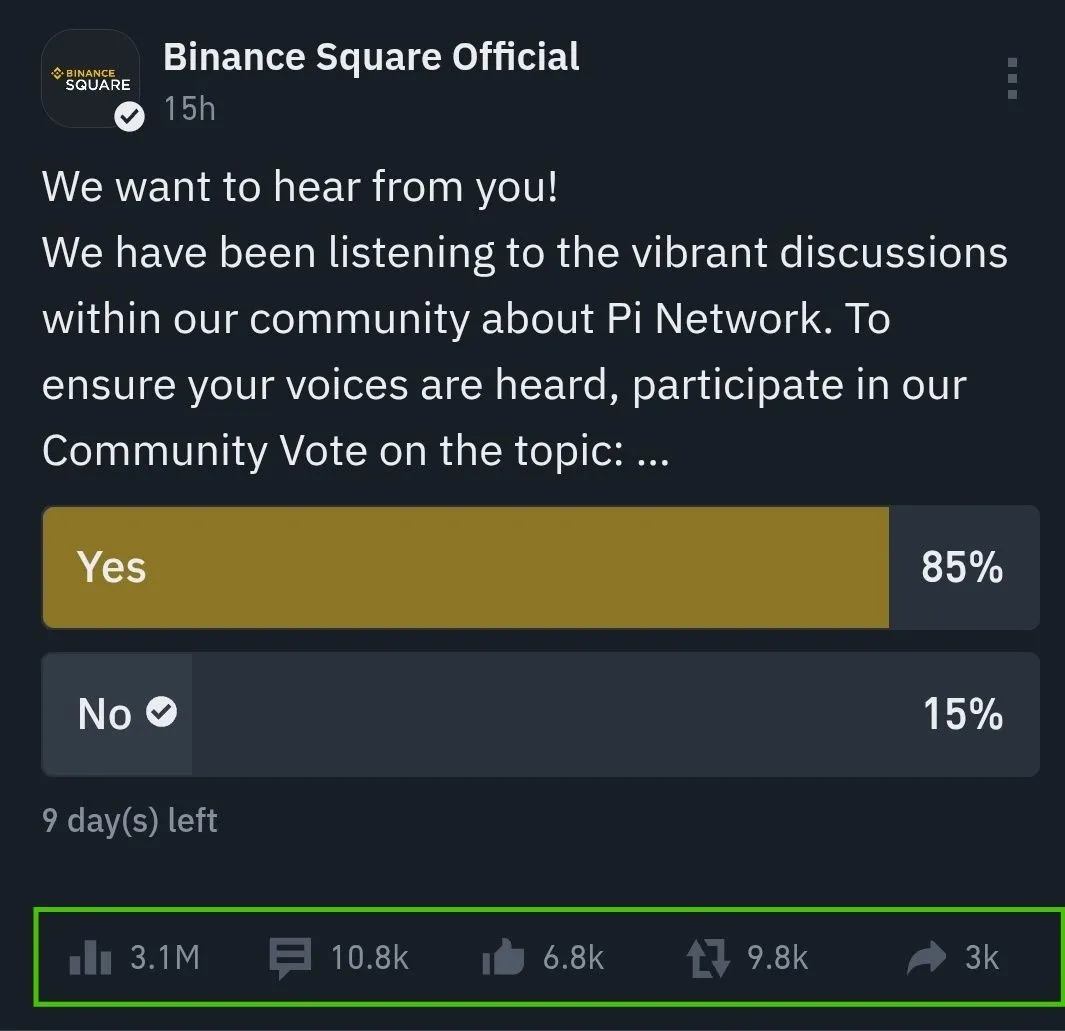

These criticisms also surfaced when Binance launched a community vote to decide on the token’s listing. Currently, the Binance community is largely in favor of listing the token, but many are against it.

despite the overwhelming vote in favor. In short, Pi Network may have strong momentum, but it also has dedicated antagonists.

One of the key criticisms against Pi Network is how it might impact China’s stance on the crypto industry. The 2023 warning characterized the project as a pyramid scheme that targets the elderly, repeatedly using very harsh language to describe the token’s promoters.

China has shown a few signs of warming to crypto, but a major scandal could seriously harm progress.

Despite intense criticism from China, Pi Network still has fervent defenders. Bybit may have zero interest in listing it, but there are plenty of opportunities to buy it elsewhere.

Pi launched earlier today at a price of around $1.24, and it’s currently down nearly 50%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market18 hours ago

Market18 hours agoNigeria Sues Binance for $81.5 Billion

-

Market16 hours ago

Market16 hours agoSolana’s Price Recovery From $170 Faces Investors’ Defiance

-

Market24 hours ago

Market24 hours agoCoinbase Listing Drives Bittensor (TAO) 17% On the Day

-

Regulation23 hours ago

Regulation23 hours agoUS SEC Withdraws Dealer Rule Appeal After Court Rejects Overreach

-

Market23 hours ago

Market23 hours agoCardano Traders on Edge as Technical Signals Clash

-

Market21 hours ago

Market21 hours agoCrypto Exchanges Launch Pi Network Airdrop

-

Market20 hours ago

Market20 hours agoEthereum Struggles Below $3,000 Amid Weak Buying Pressure

-

Market19 hours ago

Market19 hours agoHedera Slumps After 40% Drop – Can HBAR Recover?