Market

Chainlink Struggles to Break $19 Barrier Amid Market Uncertainty

Chainlink (LINK) has struggled to maintain momentum after a failed attempt to breach the $26 resistance level towards the end of January. This setback triggered a decline, causing LINK to fall below the $20 mark.

For a meaningful recovery, Chainlink now relies on the actions of its investors to make the right moves.

Chainlink Investors Have An Opportunity

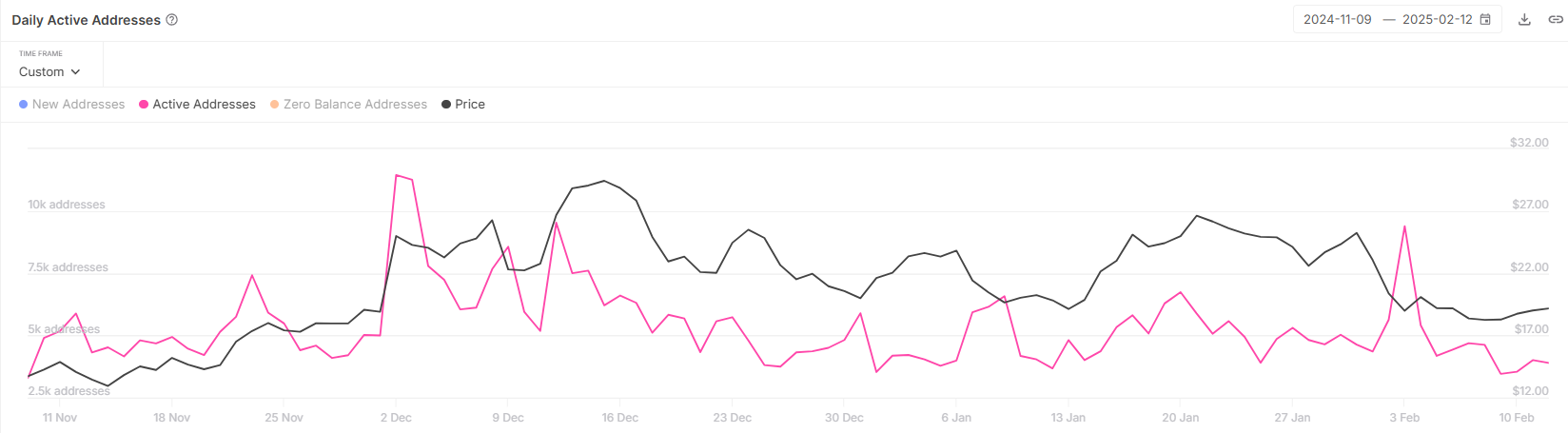

Currently, Chainlink’s active addresses have dropped to a two-month low of 3,400, a figure not seen since November 2024. This decline in active users indicates a waning interest from investors, as fewer participants are conducting transactions on the network. This suggests that the sentiment among LINK holders is largely skeptical.

The reduction in active addresses signals that many investors are adopting a wait-and-see approach, likely due to the recent price struggles. This lack of engagement and hesitance could further weigh on Chainlink’s price, as diminished transaction activity tends to correlate with limited upward momentum in the market.

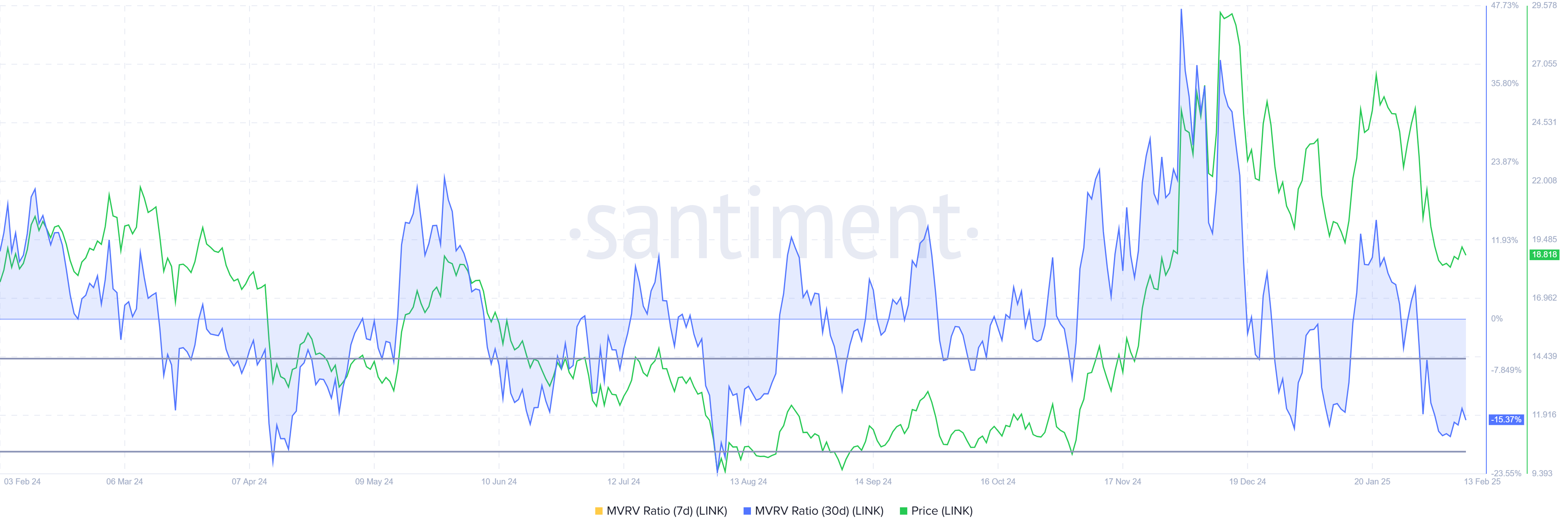

Chainlink’s broader momentum is also under pressure, as reflected by the Market Value to Realized Value (MVRV) ratio, which is currently at -15%. This means that those who bought LINK in the last month are facing losses of 15% on average. The MVRV ratio is now in the opportunity zone, between -8% and -19%, signaling potential for a reversal.

Historically, when the MVRV ratio dips into this range, it suggests that investors are halting sales and instead choosing to accumulate at lower prices. If this pattern continues, it could mark a turning point for Chainlink’s price, as long-term holders may step in to provide support and drive price recovery.

LINK Price Prediction: Bouncing Back

Chainlink’s price has fallen by 25% since the beginning of the month, currently trading at $18.84. The altcoin has been struggling to break above the resistance at $19.23 for the past week, which indicates a crucial level that must be breached for a potential recovery.

If investors begin to accumulate LINK at these lower prices, there is a strong possibility that the $19.23 resistance will be flipped into support. This could push Chainlink toward the next barrier at $22.03, providing the momentum needed for further price gains.

However, if the breach of $19.23 fails, Chainlink could fall through its downtrend support line, hitting $17.31. A drop below this level would invalidate the current bullish outlook, signaling a continued bearish trend for LINK and possibly triggering further declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

GameStop May Buy Bitcoin, Stock Price Bounces Dramatically

GameStop is considering investing in Bitcoin, and the news already started impacting its stock price. CEO Ryan Cohen recently posted a photo with MicroStrategy’s Michael Saylor, and his firm may serve as a blueprint.

GameStop previously tried to enter the Web3 market with its NFT marketplace, but this proved unsuccessful. Bitcoin is completely unrelated to its core business model and may dramatically change the company, but its revenues would keep it afloat.

GameStop, ostensibly a gaming and electronics retailer, has changed a lot in the last few years. After steadily declining revenues, a Reddit-driven stock squeeze in 2021 brought about a legendary stock pump. This event rejuvenated company leadership, prompting new Web3-oriented business solutions like an NFT marketplace.

However, GameStop’s momentum couldn’t last forever; the firm fired CEO Matthew Furlong in 2023 and shuttered its NFT marketplace the following January.

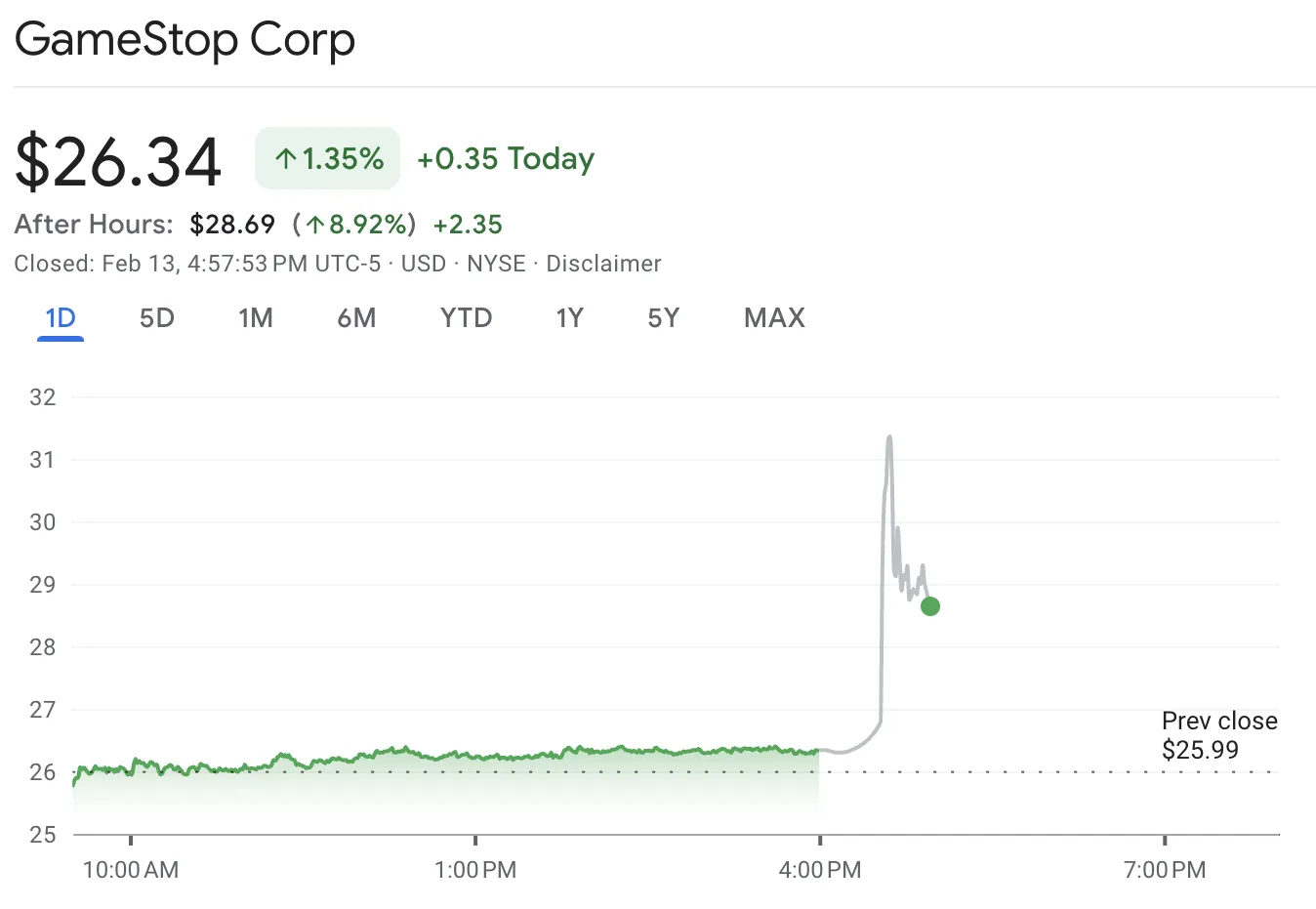

Today, however, GameStop is preparing to take a truly radical step: investing in Bitcoin. According to published rumors, the firm may invest in it and other cryptoassets soon. The news quickly had a notable impact on its stock price.

The price of Bitcoin has been extremely bullish in recent months, but that doesn’t fully explain GameStop’s decision. Despite the recent liquidations triggered by Trump’s geopolitical decisions, Bitcoin is starting to stabilize.

Given BTC is still below $100,000 and analysts predict much higher prices by the end of the year, it would be an optimal time for GameStop to add Bitcoin to its portfolio. The decision seems to be somewhat inspired by MicroStrategy’s Michael Saylor.

Before buying Bitcoin, MicroStrategy was in a very similar position to GameStop. Saylor saw revenues from its traditional business model drying up and made a dramatic gamble on BTC.

This bet has paid off extraordinarily well, and Saylor recently rebranded the company to prominently feature the Bitcoin logo.

“GameStop, a company with no viable business plan, has thrown another Hail Mary by announcing that it might use its cash to buy Bitcoin. The irony is that Bitcoin is even more overpriced than GME. No matter; speculators are buying the stock anyway, hoping it becomes another MSTR,” wrote anti-crypto advocate Peter Schiff.

In other words, Saylor’s Bitcoin rebrand could serve as a blueprint for GameStop. The company tried to adapt to meet Web3 market opportunities when it entered the NFT market, but this wasn’t enough. Many of its NFTs were gaming-themed, and this proved a niche market. Bitcoin, however, has nothing to do with its old business model.

Committing to a Bitcoin-first strategy could completely change GameStop’s revenue model. MicroStrategy was totally transformed by its pivot to BTC. Even Tesla, one of the world’s largest tech firms, has noticeably changed due to its crypto purchases.

However, no further updates regarding any accumulation plans have been revealed yet.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto AI Agents Market Cap Drops 65% in a Month

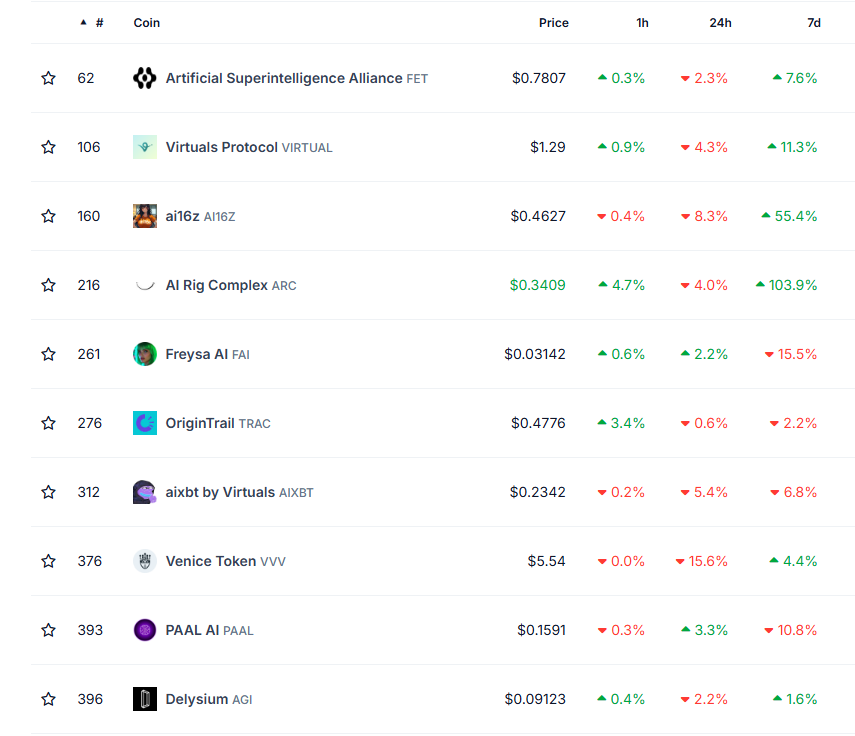

Crypto AI Agents’ total market cap has sharply declined, now sitting around $7 billion after dropping from $20 billion just a month ago. While some leading tokens continue to struggle, others have shown resilience, with AI16Z and ARC posting significant gains in the last seven days.

Whale engagement and smart account activity have been declining but at a slower pace, suggesting potential stabilization. If interest in AI-driven narratives returns, the top-performing Crypto AI Agents could be primed for another breakout, with projects like VIRTUAL, AI16Z, and ARC positioned to benefit the most.

Some Crypto AI Agents Leaders Are Struggling, But Others Are Rising

The top 10 biggest Crypto AI Agents coins show a mixed performance, with one recently launched, three declining over the last seven days, and six posting gains. AI16Z and ARC have led the recent upside, highlighting strong momentum within certain coins.

VIRTUAL, the largest Crypto AI Agent coin, is up around 10% this week but is still struggling to regain the momentum that once made it the biggest artificial intelligence token in the market. Its dominance in the sector is reflected in the top 10, as three of the biggest AI Agent coins are directly linked to its ecosystem.

Blockchain distribution also plays a key role. Four of these tokens launched on Base and another four on Solana, with only one on Ethereum and one on BNB. With Virtuals Protocol now live on Solana, the network’s presence in the crypto AI agents ecosystem space could become even stronger.

ARC and AI16Z

ARC has been the biggest winner among the top 10 Crypto AI Agents coins in the past seven days, surging nearly 96%. This impressive rally has pushed ARC to the fifth spot in the rankings, with a market cap of approximately $320 million.

Despite a slight pullback in the last few hours, ARC is still trading at its highest levels since late January.

AI16Z follows as the second-best performer, climbing over 50% in the past week as AI-powered market analysis bots regain momentum.

With this surge, AI16Z has now become the second-largest Crypto AI Agent coin and the biggest one built on Solana, reaching a $513 million market cap.

However, it still trails VIRTUAL by 61%, showing that while AI16Z is gaining traction, VIRTUAL remains the dominant force in this sector.

Are Crypto AI Agents Ready for a Rebound?

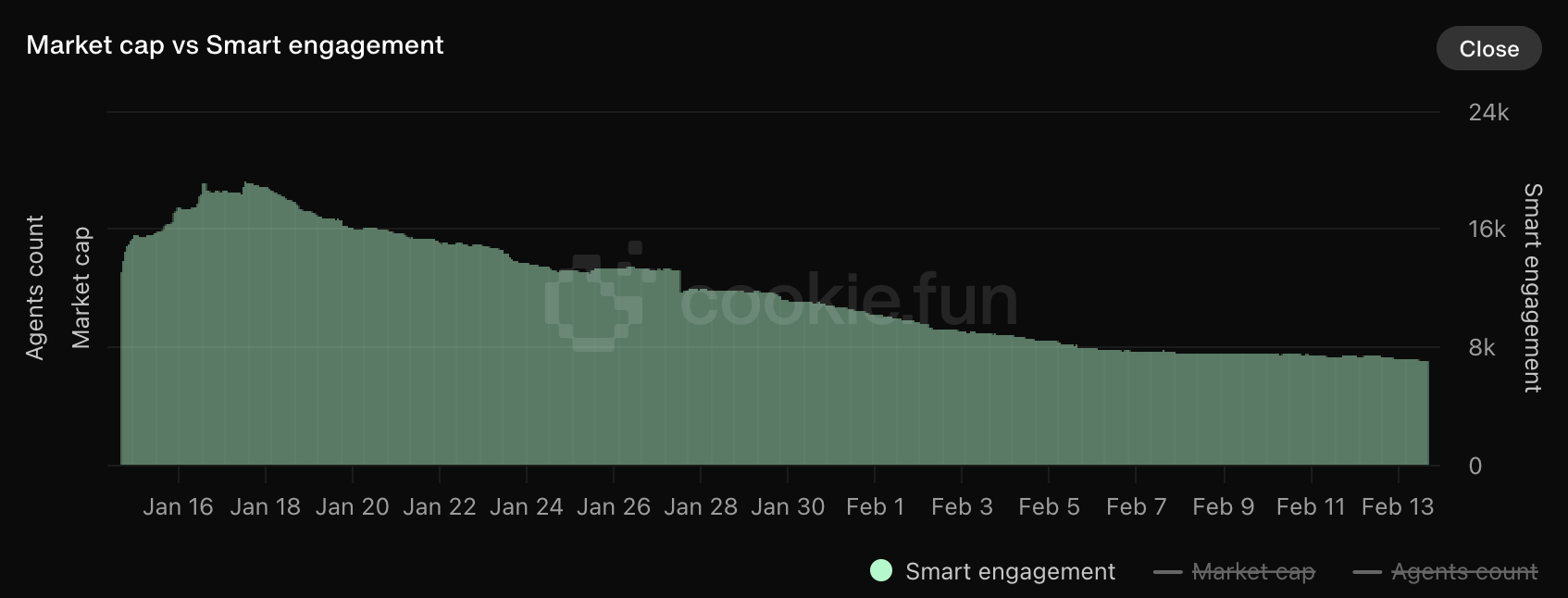

The engagement of smart accounts on Crypto AI Agents – wallets linked to KOLs or smart traders – has been steadily declining since January 27. These accounts play a crucial role in the market, as they often indicate where experienced investors are focusing their attention.

A sustained drop in engagement suggests that interest in AI-driven crypto narratives has cooled off, leading to reduced activity in key tokens. However, while engagement is still trending downward, the rate of decline has begun to slow.

If smart account activity stabilizes and eventually starts to rise again, it could signal renewed confidence in the sector.

A resurgence in AI-related hype, similar to the levels seen in previous months, would likely benefit major crypto AI Agent tokens like VIRTUAL, AI16Z, and ARC.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Foundation Will Start Earning from DeFi Lending

The Ethereum Foundation (EF) today allocated $120 million in ETH tokens to DeFi lending protocols: Aave, Spark, and Compound.

The Foundation has been in a sustained leadership crisis caused by token sales to pay overhead costs. The EF has shown a willingness to respond to the community, but it still faces tough challenges ahead.

Ethereum Foundation Banks on DeFi Lending

The Ethereum Foundation (EF) has been going through a leadership crisis lately. Specifically, it has been selling ETH tokens to pay overhead costs, and an outraged user base has demanded alternate solutions.

Today, the EF found one, transferring tokens worth $120 million into a few DeFi lending protocols.

“We’re grateful for the entire Ethereum security community that has worked diligently to make Ethereum DeFi secure and usable! More to come, including exploring staking. If you have suggestions or ideas for future deployments, reply in the comments below and let us know!” the Ethereum Foundation claimed on social media.

The EF picked three DeFi lending protocols for this allocation, putting 10,000 ETH into Spark and 4,200 into Compound. The rest went to Aave: 10,000 to Aave Prime and 20,800 to Aave Core.

Aave is a popular lending protocol that has been particularly entangled with Ethereum. In the past, it has surged dramatically in response to ETH price moves.

By using these DeFi lending protocols, the EF will be able to reap substantial rewards passively. Based on a 1.5% supply rate, these tokens will earn around $1.5 million annually. The community has responded positively to these changes, and Vitalik Buterin warmly welcomed them on social media.

In some ways, this turn to DeFi is a prime example of the EF actually responding to community pressure. However, the Foundation is still facing a lot of other challenges that will truly put it to the test.

When it comes to specific demands, Buterin has been willing to adapt to community pressure, but he has resolutely refused challenges to his leadership.

Meanwhile, Ethereum’s price has seen a continued decline lately. The market still shows a strong confidence that it will return: ETH ETFs are soaring because traders are buying the dip. Nonetheless, this won’t be enough to create bullish new momentum by itself.

Ultimately, these DeFi lending protocols might make a real difference in changing the EF’s fortunes. By changing tactics here, Ethereum’s leadership has demonstrated a willingness to respond to the community.

Between a show of good faith and strong investor confidence, another small push might start to turn things around for ETH’s market performance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoB3 Price Soars, Becoming a Top Coin on the Base Chain

-

Altcoin18 hours ago

Altcoin18 hours agoAnalyst Says It’s Time To Buy Bitcoin Again After Cup And Handle Pattern, Reveals New ATH Target

-

Altcoin23 hours ago

Altcoin23 hours agoUS CPI Rises To 3% Sparking Crypto Market Crash Speculations

-

Altcoin19 hours ago

Altcoin19 hours agoBTC Jumps To $97K, ETH Gains 6%, & CAKE Soars 59%

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Whales Have Bought Over 600,000 ETH In The Past Week – Time For A Price Upswing?

-

Market18 hours ago

Market18 hours agoSolana (SOL) Inches Toward $200—Breakout Confirmation Needed

-

Market11 hours ago

Market11 hours agoBNB Price Climbs, Can It Break Its All-Time High?

-

Market17 hours ago

Market17 hours agoBNB Soars to New Heights – Outpaces Solana in Market Cap