Market

BNB Price Climbs, Can It Break Its All-Time High?

BNB has staged an impressive comeback, surging 40% after hitting a five-month low on February 3. The coin now trades at $698.40, adding 10% to its value over the past day.

Despite broader market consolidation, BNB has defied the trend, maintaining strong upward momentum as accumulation rises.

BNB Defies Market Headwinds

BNB plunged to a five-month low of $500 on February 3. However, despite recent market headwinds, the fifth crypto asset by market capitalization bucked the general trend and recorded an uptrend. It currently trades at $698.40, climbing by 40% in the past ten days.

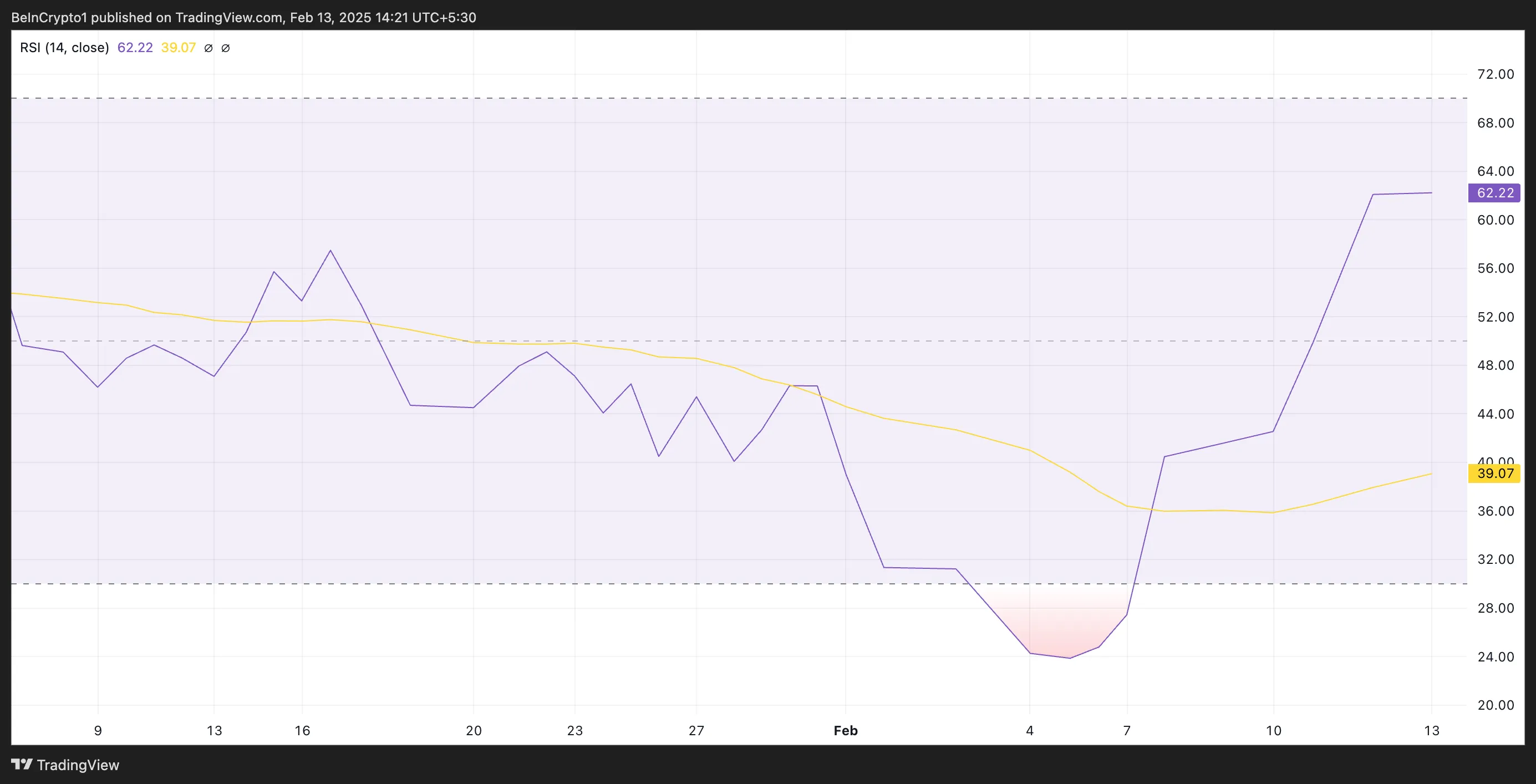

An assessment of the BNB/USD one-day chart reveals that this price hike is backed by actual coin demand and not by speculative trades. For example, its Relative Strength Index (RSI) is in an upward trend above the 50-neutral line at 62.22, reflecting the buying pressure in the market.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. On the other hand, values below 30 indicate that the asset is oversold and may witness a rebound.

At 62.22, BNB’s RSI indicates it is in bullish territory but not yet overbought. This suggests strong buying momentum with room for further upside.

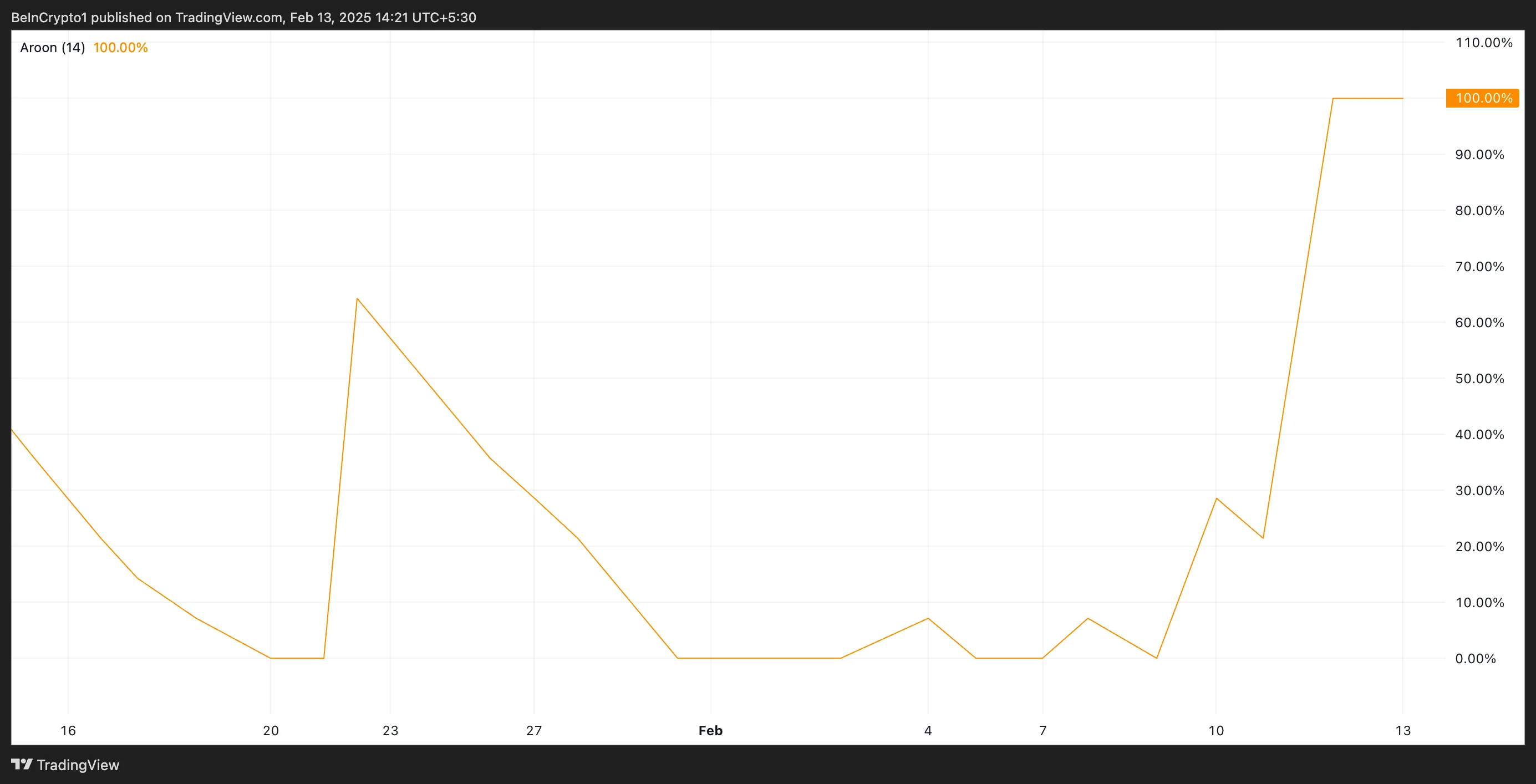

Moreover, the coin’s Aroon Up Line is at 100%, highlighting the strength of the current uptrend.

The Aroon Indicator measures an asset’s trend strength. It identifies potential reversals by tracking the time elapsed since the highest high (Aroon Up) and lowest low (Aroon Down) over a set period. When the Aroon Up line is at 100%, it signals a strong uptrend, indicating that a new high was recently reached and bullish momentum is dominant.

BNB Price Prediction: All-Time High Next?

According to readings from BNB’s Fibonacci Retracement tool, if the demand for BNB strengthens, its next price target is its all-time high of $793.86, last reached on December 4.

However, a reversal in the current trend will invalidate this bullish prediction. In that scenario, BNB could shed recent gains and fall to $685.55. If the bulls fail to defend this support level, its price could drop to $610.98.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Pepe, BTC, and Solana

Crypto majors including Bitcoin remain under pressure amid a neutral market sentiment. However, revolutionary projects within the sector are thriving as savvy investors look for cheaper alternatives with great growth potential.

Bitcoin Pepe, the first meme ICO on the Bitcoin network has captured the attention of crypto enthusiasts, surpassing $1 million within the first 6 hours of its presale. Its early adopters acknowledge that its unique approach of merging the meme culture with Solana’s speed and Bitcoin’s security will yield hefty returns ahead of its launch in Q2’25.

Bitcoin price to remain range-bound amid a neutral market sentiment

Bitcoin price has remained in consolidation; trading in the red for the third consecutive week. At a fear & greed index of 47, which points to a neutral market sentiment, the crypto major may remain range-bound in the absence of a key near-term catalyst.

In the short term, the range between the support level of $93,500 and the resistance zone of $100,898.95 remains worth watching. Indeed, below this range, this thesis will be invalid. If successful at breaking the current resistance, bitcoin bulls will have their eyes on the next target at $102,954.12.

Bitcoin Pepe’s unique trifactor positions it for fastest-growing ICO of 2025

Bitcoin Pepe, the first meme ICO on the Bitcoin network, has already raised over $1.7 million within the first 48 hours of its presale. Indeed, this is the playing field that meme coin enthusiasts have hungered for.

On the one hand, Bitcoin is highly valued as the main alternative to fiat currency. Besides, it is considered as a safe haven and hedge against inflation.

While its Proof-of-Work (PoW) system assures Bitcoin’s unmatched security, it results in slower transaction speed of up to 60 minutes. In comparison, it takes about 0.5 seconds for a transaction to be completed on Solana with up to 65,000 transactions processed in a second.

Bitcoin Pepe has merged the two while propelling the meme culture; a trifactor that has captured the attention of crypto enthusiasts. The project leverages on Bitcoin’s security and Solana’s super speed while integrating the ultra-popular meme culture.

It is this ideal setup that has sparked immense interest among crypto enthusiasts. Amid the heightened FOMO, savvy investors understand that the current price of $0.0232 may be the lowest for the BPEP token moving forward.

It is currently at stage 3 of the total 30 stages on its 2025 roadmap, which also includes launching a decentralized exchange (DEX) and L2 Bridge. As it achieves these developments, its value is set to skyrocket. As such, this is the best opportunity for cryptocurrency enthusiasts to amass some BPEP tokens. Buy the Bitcoin Pepe here.

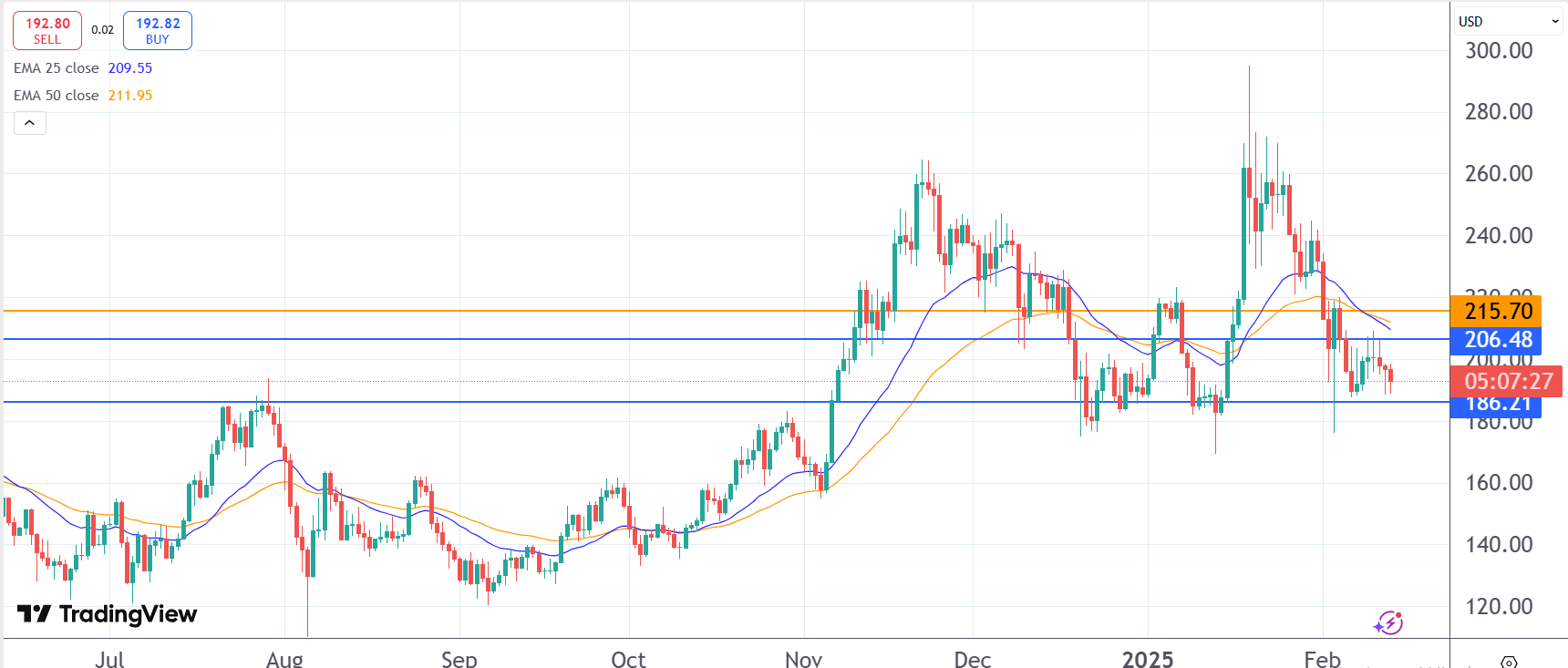

Solana price will need steady rebounding to ratify trend reversal

Solana price is set for its fourth week of losses despite the recent rebounding that cut across crypto majors. While the selling pressure may remain a headwind in the near term, improvement of the market sentiment may flip its plight as it leverages on its super speed and low transaction fees.

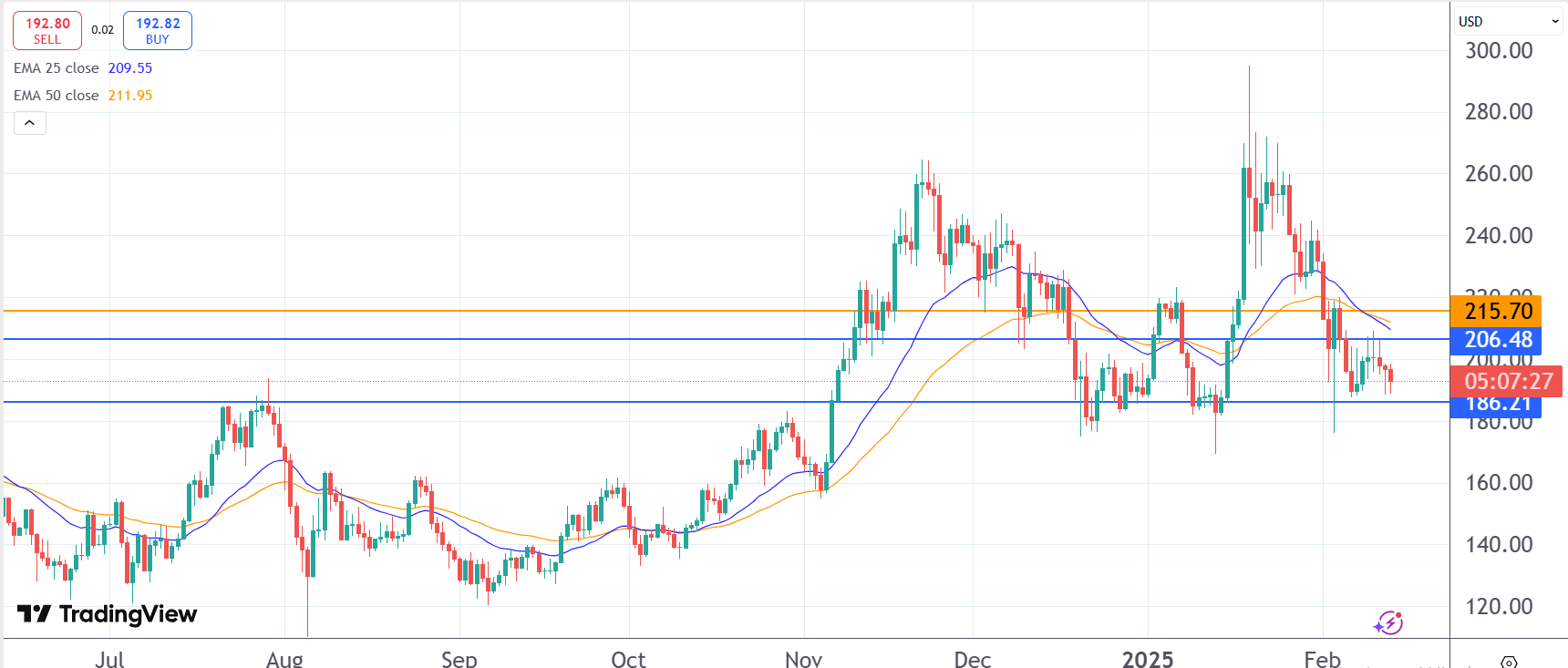

In the meantime, the bulls are keen on defending the support at $186.21. On the upside, additional momentum may have it break the resistance at $206.48. However, a rebound past $215.70 to rubberstamp a trend reversal.

Market

Will Tether Have To Sell Bitcoin to Comply with US Regulations?

According to a report from JPMorgan, Tether may need to sell Bitcoin and other commodities to reach compliance with proposed US stablecoin rules. CEO Paolo Ardoino disputed this on social media but didn’t address the core concerns.

The US is pushing strongly for new stablecoin regulations, which would include strict accounting and secured reserves. Tether didn’t comply with similar regulations in Europe, but it can’t afford to lose the US market.

Will Tether Have to Sell its Bitcoin?

Tether, the world’s leading stablecoin issuer, achieved a succesful financial year in 2024 despite regulatory challenges. Last quarter, the firm reported record-high profits, and it’s opening new market opportunities with a relocation to El Salvador.

However, a JPMorgan report claims that Tether may have to sell a lot of its Bitcoin, and its CEO fought back immediately:

“JPMorgan analysts are salty because they don’t own Bitcoin. Tether analysts say that JPMorgan does not have enough Bitcoin!” Tether CEO Paolo Ardoino said via social media.

The analysts identified that the new US stablecoin regulations will compel Tether to offload its Bitcoin reserves. Several stablecoin bills are currently proposed to the Senate, and most of them advocate for issuers to hold their asset reserves in the US.

The most likely bill be passed is Tennessee Senator Bill Hagerty’s ‘the GENIUS Act’. The bill’s standards show that only 83% of Tether’s reserves are in compliance, and other proposed bills are more aggressive.

Putting aside the question of Tether’s Bitcoin holdings, it seems clear that US stablecoin regulation is coming. These efforts have bipartisan support, and Federal Reserve Chair Jerome Powell strongly supports them, too. If both Congressional factions and the regulatory apparatus want this, some version of it will likely come to pass.

Why would these proposed regulations compel Tether to sell its Bitcoin? Essentially, they would entirely change the way the company handles its reserves. The company would need to store a significant portion of its total cash reserves in US Treasury bonds or other insured institutions.

In short, this framework doesn’t entirely support the decentralization of stablecoin issuers.

Last December, it was largely kicked out of Europe because it could not meet similar requirements under the new MiCA framework. Tether could handle losing the EU, especially because it prepared, but US crypto exchanges are also ready to drop the company if required.

In short, Ardoino’s social media outburst attracted some attention, but it’s practically an impractical response to the impending crisis. Tether may need to sell a lot of its Bitcoin, and even that might be enough.

Analysts have pointed out that the firm has fervently resisted close scrutiny of its reserves. New transparency requirements could reveal some ugly secrets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Chainlink Struggles to Break $19 Barrier Amid Market Uncertainty

Chainlink (LINK) has struggled to maintain momentum after a failed attempt to breach the $26 resistance level towards the end of January. This setback triggered a decline, causing LINK to fall below the $20 mark.

For a meaningful recovery, Chainlink now relies on the actions of its investors to make the right moves.

Chainlink Investors Have An Opportunity

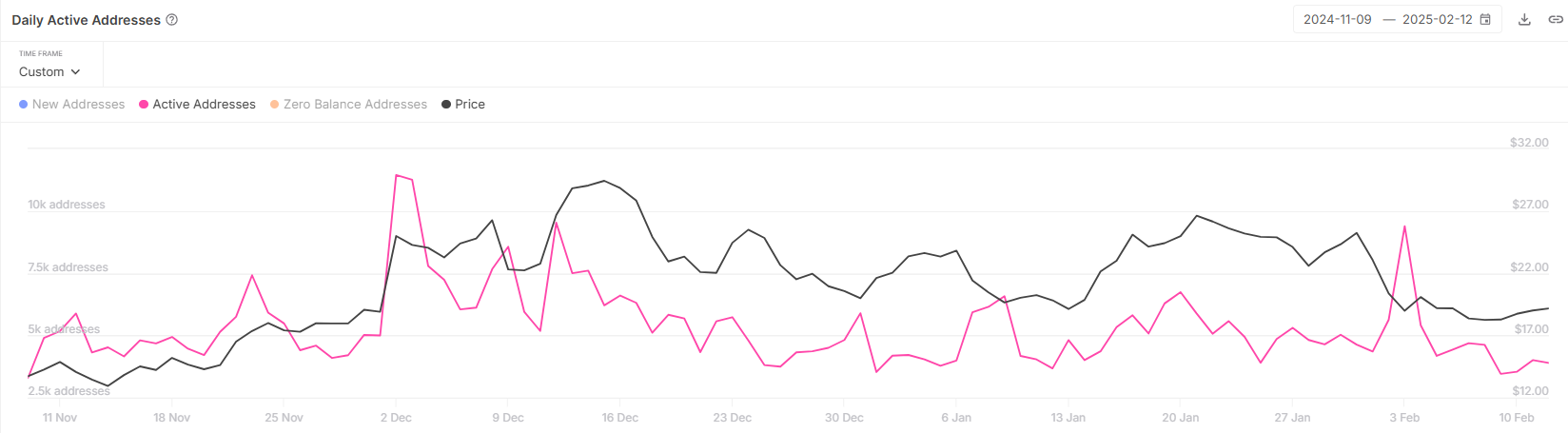

Currently, Chainlink’s active addresses have dropped to a two-month low of 3,400, a figure not seen since November 2024. This decline in active users indicates a waning interest from investors, as fewer participants are conducting transactions on the network. This suggests that the sentiment among LINK holders is largely skeptical.

The reduction in active addresses signals that many investors are adopting a wait-and-see approach, likely due to the recent price struggles. This lack of engagement and hesitance could further weigh on Chainlink’s price, as diminished transaction activity tends to correlate with limited upward momentum in the market.

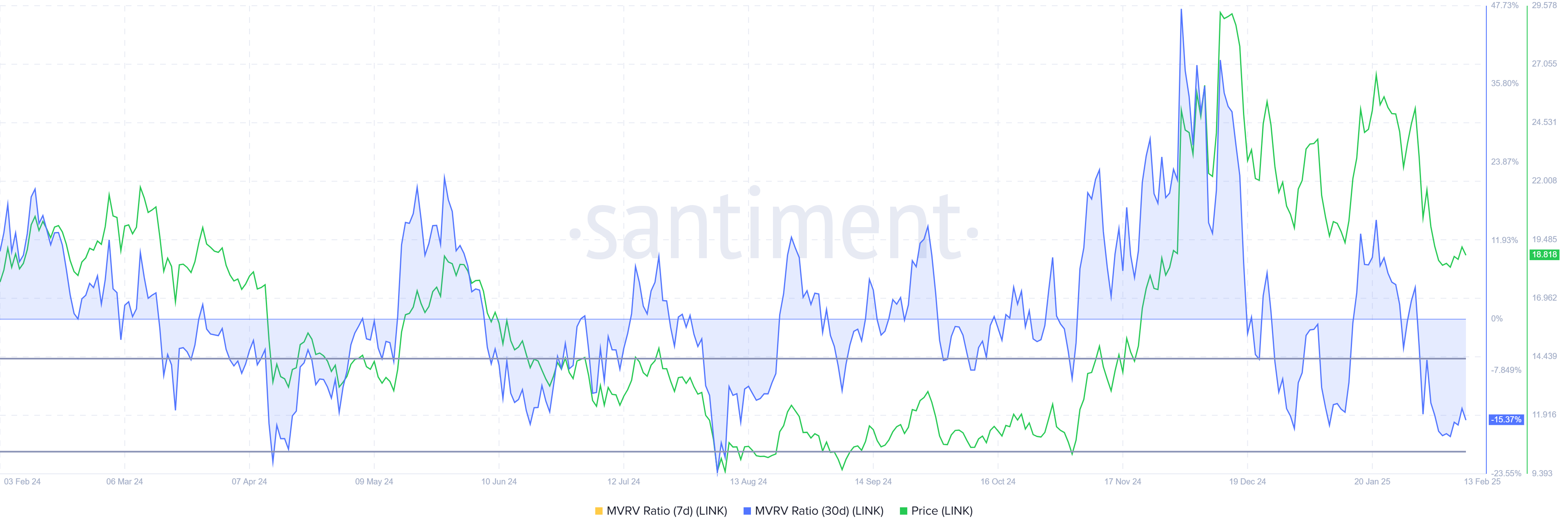

Chainlink’s broader momentum is also under pressure, as reflected by the Market Value to Realized Value (MVRV) ratio, which is currently at -15%. This means that those who bought LINK in the last month are facing losses of 15% on average. The MVRV ratio is now in the opportunity zone, between -8% and -19%, signaling potential for a reversal.

Historically, when the MVRV ratio dips into this range, it suggests that investors are halting sales and instead choosing to accumulate at lower prices. If this pattern continues, it could mark a turning point for Chainlink’s price, as long-term holders may step in to provide support and drive price recovery.

LINK Price Prediction: Bouncing Back

Chainlink’s price has fallen by 25% since the beginning of the month, currently trading at $18.84. The altcoin has been struggling to break above the resistance at $19.23 for the past week, which indicates a crucial level that must be breached for a potential recovery.

If investors begin to accumulate LINK at these lower prices, there is a strong possibility that the $19.23 resistance will be flipped into support. This could push Chainlink toward the next barrier at $22.03, providing the momentum needed for further price gains.

However, if the breach of $19.23 fails, Chainlink could fall through its downtrend support line, hitting $17.31. A drop below this level would invalidate the current bullish outlook, signaling a continued bearish trend for LINK and possibly triggering further declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin14 hours ago

Altcoin14 hours agoBTC Jumps To $97K, ETH Gains 6%, & CAKE Soars 59%

-

Ethereum14 hours ago

Ethereum14 hours agoEthereum Whales Have Bought Over 600,000 ETH In The Past Week – Time For A Price Upswing?

-

Market13 hours ago

Market13 hours agoSolana (SOL) Inches Toward $200—Breakout Confirmation Needed

-

Altcoin13 hours ago

Altcoin13 hours agoAnalyst Says It’s Time To Buy Bitcoin Again After Cup And Handle Pattern, Reveals New ATH Target

-

Market12 hours ago

Market12 hours agoBNB Soars to New Heights – Outpaces Solana in Market Cap

-

Altcoin24 hours ago

Altcoin24 hours agoJapanese Gaming Powerhouse Gumi Snaps Up 1 Billion Yen In BTC

-

Altcoin19 hours ago

Altcoin19 hours agoUS CPI Rises To 3% Sparking Crypto Market Crash Speculations

-

Ethereum12 hours ago

Ethereum12 hours agoIs Ethereum Undervalued? A Close Look at Realized Price and Institutional Activity