Market

Fed Governor Waller Backs Stablecoins for Dollar Growth

Federal Reserve Governor Christopher Waller has emphasized that stablecoins have the potential to “maintain and extend” the US dollar’s international role.

He joins a growing list of crypto executives who have expressed optimism about stablecoin’s potential to drive a financial market boom.

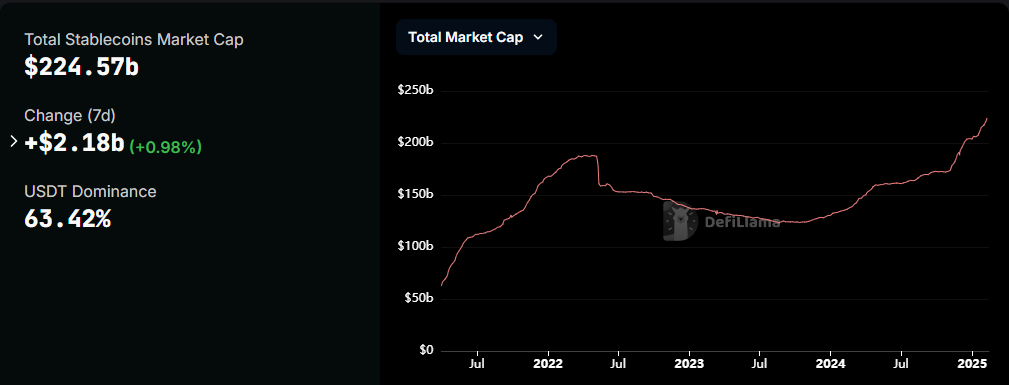

Stablecoins’ Rising Market Capitalization

At a conference in San Francisco, Waller highlighted the need for a comprehensive US regulatory framework. Specifically, he wants risks associated with stablecoins addressed while ensuring they remain a strong part of the financial system.

“The stablecoin market would benefit from a US regulatory and supervisory framework that addresses stablecoin risks directly, fully, and narrowly,” Bloomberg reported, citing Waller.

He added that the framework should allow banks and non-banks to issue regulated stablecoins, with clear guidelines on compliance and reserve requirements.

The stablecoin market has been upward, reaching a new high of $224.5 billion in February. This growth reflects stablecoins’ increasing significance in the digital economy and highlights their role in expanding the reach of the US dollar beyond traditional financial (TradFi) institutions.

However, Waller noted that stablecoins are still vulnerable to liquidity and run risks, highlighting the importance of stringent oversight.

Stablecoins are digital assets designed to maintain a steady value, often pegged to a specific currency such as the US dollar. Their issuers typically hold reserves in liquid assets like cash or US Treasury bills to back the tokens, ensuring stability.

While their use cases have expanded significantly, Waller cautioned that fragmented regulations at the state and international levels could hinder their global scalability.

“The emergence of different global stablecoin regulatory regimes creates the potential for conflicting regulation domestically and internationally. This regulatory fragmentation could make it difficult for US dollar stablecoin issuers to operate at a global scale,” Waller noted.

Calls for Stablecoin Regulation Gain Momentum

State regulators have also played an essential role in shaping stablecoin policies, with several states already implementing or finalizing new laws. Senator Bill Hagerty recently introduced the GENIUS Act. As BeInCrypto reported, the bill created a regulatory framework for payment stablecoins and enhanced US dollar dominance.

“My legislation establishes a safe and pro-growth regulatory framework that will unleash innovation and advance the President’s mission to make America the world capital of crypto,” he stated.

The proposed bill includes provisions requiring stablecoin issuers to maintain one-to-one reserves and comply with anti-money laundering laws. The House Financial Services Committee has also released a discussion draft of a bill aiming to provide more regulatory clarity.

However, conflicting state regulations could limit the widespread use of certain stablecoins across different jurisdictions.

As regulatory discussions continue at the state level, key figures in the crypto industry have weighed in on the role of stablecoins in the broader financial space. Trump’s crypto Czar, David Sacks, recently hosted a press conference where stablecoins were a focal point. He emphasized their potential to revolutionize global payments and financial inclusion.

“Stablecoins could potentially generate trillions of dollars’ worth of demands for US treasuries, which could lower long-term interest rates,” Sacks said.

Meanwhile, Circle’s Chief Business Officer Kash Razzaghi highlighted the transformative impact of stablecoins on high-inflation economies. Speaking to BeInCrypto, Razzaghi said stablecoins provide a reliable alternative for individuals and businesses in countries where traditional fiat currencies suffer from volatility and depreciation.

The growing relevance of stablecoins has also caught the attention of major crypto industry leaders. Binance CEO Richard Teng recently predicted a major crypto boom in 2025, with stablecoins playing a pivotal role in driving adoption and liquidity within the sector.

Similarly, Hashed CEO Simon Kim echoed these sentiments, stating that stablecoins will drive crypto growth in the coming years.

“Stablecoins represent a significant opportunity for US dollar dominance. While the US dollar accounts for a limited share of global currency reserves, it dominates nearly 99% of the stablecoin market. This essentially expands USD territory in the digital space. From the US perspective, there’s no reason to resist this trend — private companies are effectively expanding dollar dominance in digital spaces without government intervention,” Kim told BeInCrypto.

With increasing institutional interest and mounting regulatory discussions, the future of stablecoins appears poised for expansion. However, their potential to extend the international role of the US dollar largely depends on implementing a balanced and effective regulatory framework.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will Tether Have To Sell Bitcoin to Comply with US Regulations?

According to a report from JPMorgan, Tether may need to sell Bitcoin and other commodities to reach compliance with proposed US stablecoin rules. CEO Paolo Ardoino disputed this on social media but didn’t address the core concerns.

The US is pushing strongly for new stablecoin regulations, which would include strict accounting and secured reserves. Tether didn’t comply with similar regulations in Europe, but it can’t afford to lose the US market.

Will Tether Have to Sell its Bitcoin?

Tether, the world’s leading stablecoin issuer, achieved a succesful financial year in 2024 despite regulatory challenges. Last quarter, the firm reported record-high profits, and it’s opening new market opportunities with a relocation to El Salvador.

However, a JPMorgan report claims that Tether may have to sell a lot of its Bitcoin, and its CEO fought back immediately:

“JPMorgan analysts are salty because they don’t own Bitcoin. Tether analysts say that JPMorgan does not have enough Bitcoin!” Tether CEO Paolo Ardoino said via social media.

The analysts identified that the new US stablecoin regulations will compel Tether to offload its Bitcoin reserves. Several stablecoin bills are currently proposed to the Senate, and most of them advocate for issuers to hold their asset reserves in the US.

The most likely bill be passed is Tennessee Senator Bill Hagerty’s ‘the GENIUS Act’. The bill’s standards show that only 83% of Tether’s reserves are in compliance, and other proposed bills are more aggressive.

Putting aside the question of Tether’s Bitcoin holdings, it seems clear that US stablecoin regulation is coming. These efforts have bipartisan support, and Federal Reserve Chair Jerome Powell strongly supports them, too. If both Congressional factions and the regulatory apparatus want this, some version of it will likely come to pass.

Why would these proposed regulations compel Tether to sell its Bitcoin? Essentially, they would entirely change the way the company handles its reserves. The company would need to store a significant portion of its total cash reserves in US Treasury bonds or other insured institutions.

In short, this framework doesn’t entirely support the decentralization of stablecoin issuers.

Last December, it was largely kicked out of Europe because it could not meet similar requirements under the new MiCA framework. Tether could handle losing the EU, especially because it prepared, but US crypto exchanges are also ready to drop the company if required.

In short, Ardoino’s social media outburst attracted some attention, but it’s practically an impractical response to the impending crisis. Tether may need to sell a lot of its Bitcoin, and even that might be enough.

Analysts have pointed out that the firm has fervently resisted close scrutiny of its reserves. New transparency requirements could reveal some ugly secrets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Chainlink Struggles to Break $19 Barrier Amid Market Uncertainty

Chainlink (LINK) has struggled to maintain momentum after a failed attempt to breach the $26 resistance level towards the end of January. This setback triggered a decline, causing LINK to fall below the $20 mark.

For a meaningful recovery, Chainlink now relies on the actions of its investors to make the right moves.

Chainlink Investors Have An Opportunity

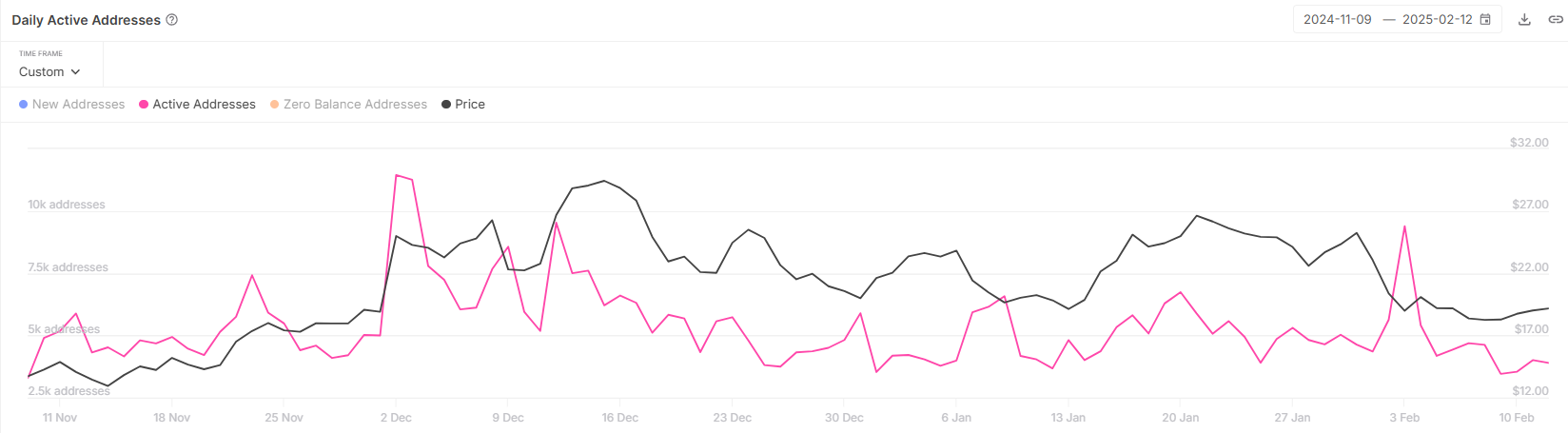

Currently, Chainlink’s active addresses have dropped to a two-month low of 3,400, a figure not seen since November 2024. This decline in active users indicates a waning interest from investors, as fewer participants are conducting transactions on the network. This suggests that the sentiment among LINK holders is largely skeptical.

The reduction in active addresses signals that many investors are adopting a wait-and-see approach, likely due to the recent price struggles. This lack of engagement and hesitance could further weigh on Chainlink’s price, as diminished transaction activity tends to correlate with limited upward momentum in the market.

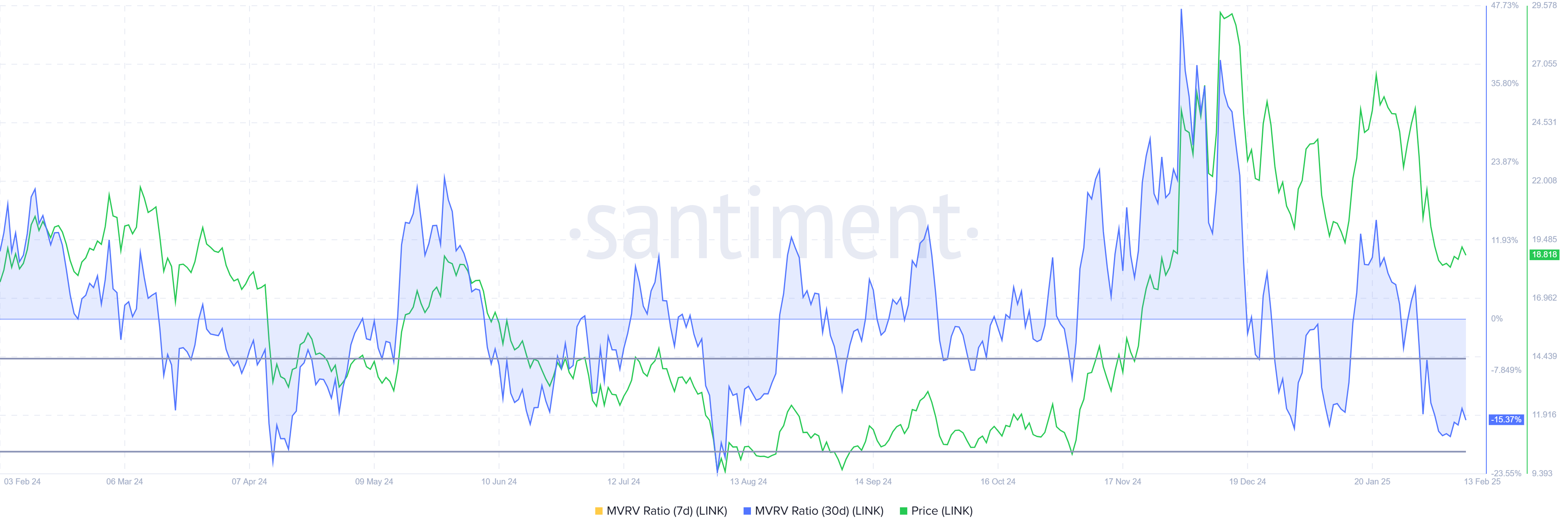

Chainlink’s broader momentum is also under pressure, as reflected by the Market Value to Realized Value (MVRV) ratio, which is currently at -15%. This means that those who bought LINK in the last month are facing losses of 15% on average. The MVRV ratio is now in the opportunity zone, between -8% and -19%, signaling potential for a reversal.

Historically, when the MVRV ratio dips into this range, it suggests that investors are halting sales and instead choosing to accumulate at lower prices. If this pattern continues, it could mark a turning point for Chainlink’s price, as long-term holders may step in to provide support and drive price recovery.

LINK Price Prediction: Bouncing Back

Chainlink’s price has fallen by 25% since the beginning of the month, currently trading at $18.84. The altcoin has been struggling to break above the resistance at $19.23 for the past week, which indicates a crucial level that must be breached for a potential recovery.

If investors begin to accumulate LINK at these lower prices, there is a strong possibility that the $19.23 resistance will be flipped into support. This could push Chainlink toward the next barrier at $22.03, providing the momentum needed for further price gains.

However, if the breach of $19.23 fails, Chainlink could fall through its downtrend support line, hitting $17.31. A drop below this level would invalidate the current bullish outlook, signaling a continued bearish trend for LINK and possibly triggering further declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Uptrend Gears Up: 10% Jump Brings $724 Resistance Into Play

BNB is riding a strong bullish wave, surging over 10% as bullish momentum continues to build. This impressive rally has brought the price closer to the critical $724 resistance level, a key barrier that could dictate its next major move.

Over the past few days, BNB has displayed strong buying pressure, signaling renewed investor confidence. The surge comes amid broader market optimism, with bulls aiming to capitalize on the move. However, the $724 mark has historically been a tough zone, where sellers have previously stepped in to trigger corrections.

With market sentiment shifting in favor of altcoins, BNB’s performance is being closely watched. Will it conquer $724, or will resistance prove too strong? The coming days will be crucial in determining BNB’s next chapter.

Technical Analysis: Can BNB Break Through $724?

BNB’s recent 10% surge has brought it closer to the critical and challenging $724 resistance level, and breaking through it would require substantial buying pressure. The cryptocurrency’s price is currently trading above the 100-day Simple Moving Average (SMA), indicating that bullish momentum remains intact. This technical indicator is often used to gauge the overall market trend, and trading above it suggests that buyers are in control and the uptrend could continue.

A sustained position above the 100-day SMA typically acts as a strong support level, preventing deeper pullbacks and reinforcing market confidence. If buying pressure remains steady, the price may continue its upward trajectory to key resistance levels.

However, the MACD indicator shows overbought conditions, signaling that the asset may be approaching a potential reversal or consolidation phase. When the MACD line moves significantly above the signal line and the histogram expands, it often suggests that upside pressure is losing steam, and a price correction could be on the horizon.

An overbought MACD reading does not necessarily mean an immediate downturn, but it does indicate that buyers may be exhausted and that profit-taking may increase. If the indicator starts to show a bearish crossover—where the MACD line crosses below the signal line—it would confirm a weakening trend, leading to a price retracement toward key support levels.

Market Outlook: What’s Next For The Price?

The market outlook remains cautiously bullish, with technical indicators showing strong momentum. BNB is trading above key moving averages, reinforcing the uptrend, while trading volume remains high, signaling sustained investor interest. However, challenges remain, particularly with the MACD flashing overbought signals, causing the rally to lose steam.

Should BNB break and hold above $724, it might trigger a fresh wave of buying, pushing the price toward $795 and beyond. On the other hand, a rejection at this level is likely to spark a short-term pullback, with $680 and $605 acting as key support zones.

-

Altcoin14 hours ago

Altcoin14 hours agoBTC Jumps To $97K, ETH Gains 6%, & CAKE Soars 59%

-

Ethereum13 hours ago

Ethereum13 hours agoEthereum Whales Have Bought Over 600,000 ETH In The Past Week – Time For A Price Upswing?

-

Market13 hours ago

Market13 hours agoSolana (SOL) Inches Toward $200—Breakout Confirmation Needed

-

Altcoin13 hours ago

Altcoin13 hours agoAnalyst Says It’s Time To Buy Bitcoin Again After Cup And Handle Pattern, Reveals New ATH Target

-

Ethereum11 hours ago

Ethereum11 hours agoIs Ethereum Undervalued? A Close Look at Realized Price and Institutional Activity

-

Market22 hours ago

Market22 hours agoTrump Trades BTC-e Founder Alexander Vinnik to Russia

-

Market17 hours ago

Market17 hours agoB3 Price Soars, Becoming a Top Coin on the Base Chain

-

Market11 hours ago

Market11 hours agoXRP Price Finds Stability—Can It Turn Higher from Here?