Market

XRP Price Finds Stability—Can It Turn Higher from Here?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

BNB Uptrend Gears Up: 10% Jump Brings $724 Resistance Into Play

BNB is riding a strong bullish wave, surging over 10% as bullish momentum continues to build. This impressive rally has brought the price closer to the critical $724 resistance level, a key barrier that could dictate its next major move.

Over the past few days, BNB has displayed strong buying pressure, signaling renewed investor confidence. The surge comes amid broader market optimism, with bulls aiming to capitalize on the move. However, the $724 mark has historically been a tough zone, where sellers have previously stepped in to trigger corrections.

With market sentiment shifting in favor of altcoins, BNB’s performance is being closely watched. Will it conquer $724, or will resistance prove too strong? The coming days will be crucial in determining BNB’s next chapter.

Technical Analysis: Can BNB Break Through $724?

BNB’s recent 10% surge has brought it closer to the critical and challenging $724 resistance level, and breaking through it would require substantial buying pressure. The cryptocurrency’s price is currently trading above the 100-day Simple Moving Average (SMA), indicating that bullish momentum remains intact. This technical indicator is often used to gauge the overall market trend, and trading above it suggests that buyers are in control and the uptrend could continue.

A sustained position above the 100-day SMA typically acts as a strong support level, preventing deeper pullbacks and reinforcing market confidence. If buying pressure remains steady, the price may continue its upward trajectory to key resistance levels.

However, the MACD indicator shows overbought conditions, signaling that the asset may be approaching a potential reversal or consolidation phase. When the MACD line moves significantly above the signal line and the histogram expands, it often suggests that upside pressure is losing steam, and a price correction could be on the horizon.

An overbought MACD reading does not necessarily mean an immediate downturn, but it does indicate that buyers may be exhausted and that profit-taking may increase. If the indicator starts to show a bearish crossover—where the MACD line crosses below the signal line—it would confirm a weakening trend, leading to a price retracement toward key support levels.

Market Outlook: What’s Next For The Price?

The market outlook remains cautiously bullish, with technical indicators showing strong momentum. BNB is trading above key moving averages, reinforcing the uptrend, while trading volume remains high, signaling sustained investor interest. However, challenges remain, particularly with the MACD flashing overbought signals, causing the rally to lose steam.

Should BNB break and hold above $724, it might trigger a fresh wave of buying, pushing the price toward $795 and beyond. On the other hand, a rejection at this level is likely to spark a short-term pullback, with $680 and $605 acting as key support zones.

Market

NFT Marketplace OpenSea Launches SEA Token

OpenSea has confirmed plans to release its SEA token while rolling out the OS2 open beta. The upgraded platform now supports transactions across 14 blockchains, including Flow, ApeChain, Sony’s Soneium BSL, and Berachain.

The update also enables cross-chain purchases, expanding interoperability for users.

OpenSea Finally Launches Its Token

The SEA token distribution will consider historical activity on OpenSea, rather than focusing only on recent transactions. The redemption process will be straightforward, and users in the US will also have access.

In December, OpenSea established a foundation in the Cayman Islands, a move that aligns with its broader expansion efforts.

The NFT marketplace is entering the token space later than some competitors. Magic Eden introduced its ME token in December 2024, but its value dropped nearly 90% from launch. Blur’s token, released in mid-2024, faced a similar decline.

NFT marketplace tokens have struggled with adoption and price stability. OpenSea’s entry into this space raises the question of whether it can shift market sentiment or encounter the same challenges as its predecessors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Onyxcoin (XCN) Price Recovery Plagued By Massive Outflows

Onyxcoin (XCN) had been in a three-week-long downtrend, erasing much of the gains it made in January. While the altcoin is preparing for a potential bullish breakout, it faces challenges in ensuring a strong recovery.

Continued outflows and investor sentiment are proving to be key hurdles for XCN’s recovery.

Onyxcoin Investors Are Pulling Back

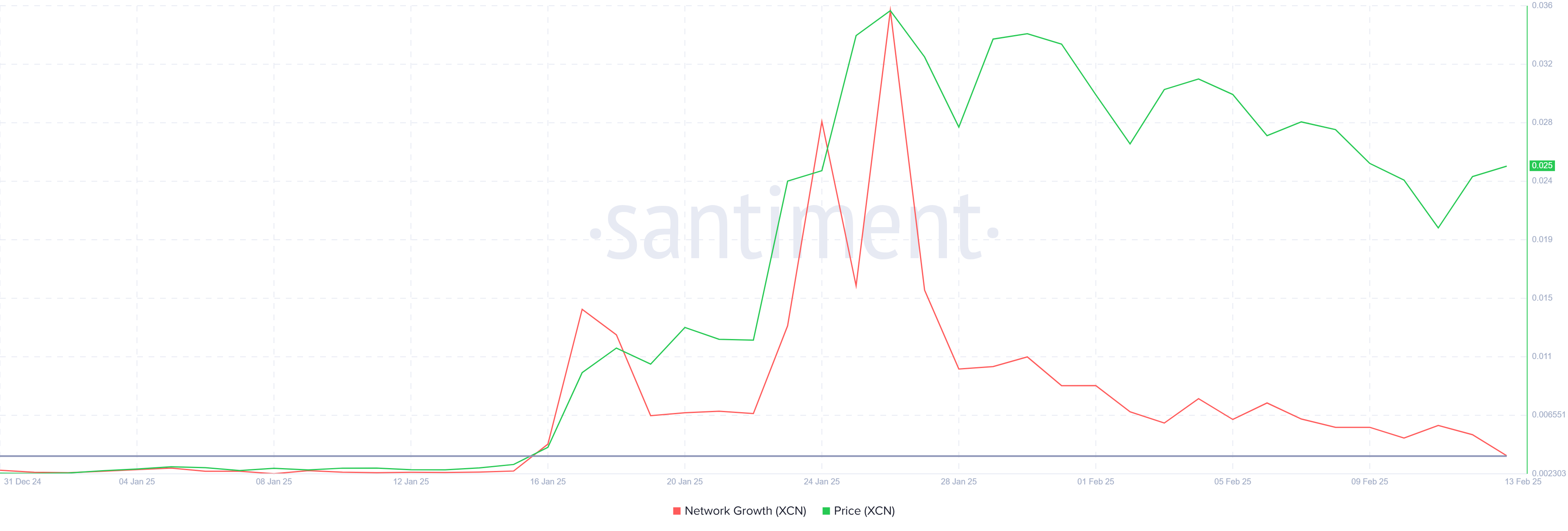

The network growth indicator for Onyxcoin has recently reached a monthly low, signaling a decrease in new addresses on the network. This metric helps gauge how well the altcoin is gaining traction among new investors. Unfortunately for XCN, the prolonged decline has resulted in a loss of interest from potential buyers.

The drop in network growth reflects waning confidence, which is impacting XCN’s ability to recover. With fewer new participants entering the market, XCN is struggling to build momentum, leaving the altcoin more vulnerable to further downside risks. For a meaningful recovery, the altcoin will need to attract fresh investor interest.

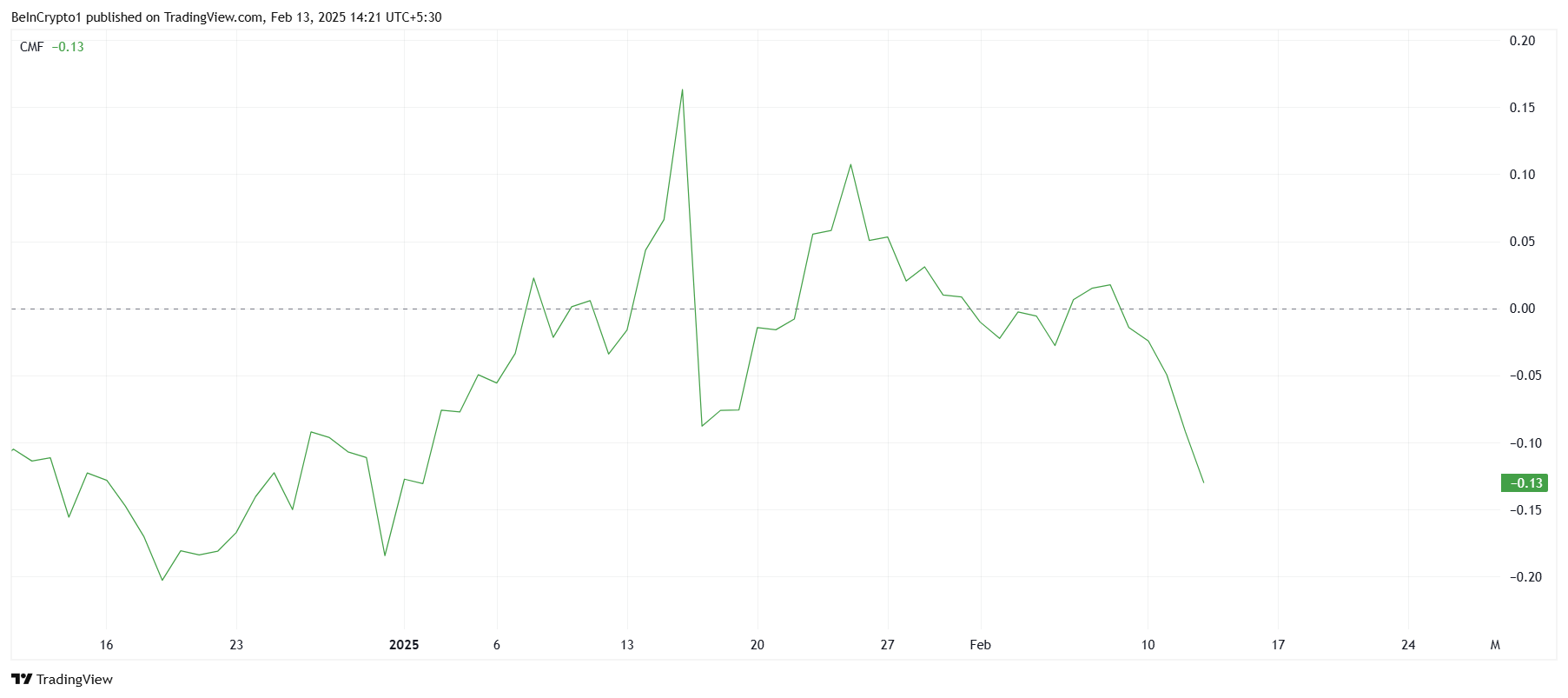

Onyxcoin’s broader momentum is showing signs of weakness, as indicated by the Chaikin Money Flow (CMF). The CMF has exhibited a sharp downtick over the last few days, suggesting that money is flowing out of the asset. This pullback could reflect growing investor frustration with the lack of price recovery.

The decline in the CMF is a sign that XCN holders are pulling their funds, possibly due to the prolonged downtrend. If this trend continues, it could delay or even prevent a full recovery, as outflows put downward pressure on the price. Without a shift in market sentiment, Onyxcoin could continue to face challenges.

XCN Price Prediction: Breakout May Not Materialize

XCN’s price is breaking out of a descending wedge pattern it had been stuck in for nearly four weeks. This bullish pattern typically signals a potential 66% rally post-breakout, with the target price set at $0.0398. However, achieving this level will depend on overcoming the challenges posed by current market conditions.

Firstly, the altcoin needs to secure $0.0237 as support. If investor behavior improves and broader market conditions become more favorable, XCN could rise toward $0.0358. However, this scenario will require stronger investor confidence and positive market cues.

A more realistic approach, based on the current market sentiment, suggests XCN might hover around the $0.0237 level. Losing this support could result in a consolidation period, with the price potentially dropping to $0.0184. This would prolong the altcoin’s downtrend and prevent any immediate recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin12 hours ago

Altcoin12 hours agoBTC Jumps To $97K, ETH Gains 6%, & CAKE Soars 59%

-

Market24 hours ago

Market24 hours agoUS Inflation Spurs Bitcoin ETF Outflows, Ethereum ETFs Persist

-

Altcoin23 hours ago

Altcoin23 hours agoGlassnode Reveals Altcoin Devaluation Amid Bitcoin Stability

-

Ethereum11 hours ago

Ethereum11 hours agoEthereum Whales Have Bought Over 600,000 ETH In The Past Week – Time For A Price Upswing?

-

Market11 hours ago

Market11 hours agoSolana (SOL) Inches Toward $200—Breakout Confirmation Needed

-

Altcoin11 hours ago

Altcoin11 hours agoAnalyst Says It’s Time To Buy Bitcoin Again After Cup And Handle Pattern, Reveals New ATH Target

-

Market13 hours ago

Market13 hours agoBitcoin Price Stuck In Consolidation—Is a Big Move Coming?

-

Market12 hours ago

Market12 hours agoONDO Price Holds 22% Gains but Struggles to Break Key Levels