Ethereum

Ethereum Whales Have Bought Over 600,000 ETH In The Past Week – Time For A Price Upswing?

Ethereum has been struggling to regain momentum, trading below the critical $2,800 mark since last Thursday. Bulls are in trouble as the price remains trapped under key supply levels, leaving investors concerned about Ethereum’s short-term future. Many who expected a bullish year for the second-largest cryptocurrency are now questioning their outlook after last week’s massive selling pressure took ETH from $3,150 to $2,150 in less than two days.

Related Reading

The recent price action has amplified fear and uncertainty among retail investors, with many continuing to sell amid the market turbulence. However, on-chain metrics tell a different story, signaling growing confidence from larger players. Key data shared by top crypto analyst Ali Martinez reveals that whales have accumulated over 600,000 Ethereum in the past week, even as retail investors remain cautious. This divergence highlights a critical trend in the market—retail investors appear scared and reactive, while big players are quietly buying up ETH at discounted prices.

As the market grapples with indecision and volatility, this accumulation by whales could set the stage for a significant shift in momentum. If bulls manage to reclaim the $2,800 and $3,000 levels, Ethereum may begin a recovery rally. For now, all eyes are on whether the divergence will lead to a turning point in ETH’s price action.

Ethereum Investors Are Divided: Retail Fears Vs. Whales Trust

Ethereum remains in a challenging position after last week’s dramatic sell-off, which saw the price drop from $3,150 to $2,150 in less than 48 hours. Despite a strong recovery back into the $2,700 range, ETH has struggled to reclaim key supply levels, leaving many investors cautious. The price remains trapped below crucial resistance at $2,800, with bulls needing to push above the $3,000 mark to shift the bearish trend and regain market confidence.

Key metrics shared by crypto analyst Ali Martinez reveal a promising trend amidst the uncertainty. Whales have accumulated over 600,000 Ethereum in the past week, signaling strong buying activity from big players.

This accumulation trend is a stark contrast to the cautious behavior of retail investors, many of whom continue to sell amid fear and uncertainty. The divergence between whale accumulation and retail selling suggests that large investors remain optimistic about Ethereum’s long-term prospects, even as short-term price action remains shaky.

Related Reading

This whale activity gives hope to investors who believe Ethereum still has the potential to surge this year. A breakout above $3,000, which aligns with the 200-day moving average, could mark a significant turning point for ETH, sparking a rally toward higher price levels. Until then, ETH remains in a critical phase as it navigates between bearish pressure and the potential for recovery.

ETH Price Action: Key Levels To Reclaim

Ethereum is currently trading at $2,620, attempting to reclaim the $2,700 mark as it battles against key supply levels. Bulls are under pressure to break through resistance at $2,800 and $3,000, as reclaiming these levels would signify a reversal of the daily downtrend that has persisted since late December. The $3,000 mark holds particular significance, as it aligns with the 200-day moving average, a widely watched indicator that signals long-term strength when prices hold above it.

A successful push above the $3,000 level could ignite a strong rally, with Ethereum targeting higher price levels quickly. Such a move would restore confidence in the market and signal a potential bullish trend for ETH, which has struggled to regain its footing following last week’s dramatic sell-off.

Related Reading

However, if Ethereum fails to hold above the $2,600 mark, the outlook becomes bearish. A breakdown below this level could open the door to further declines, with ETH potentially testing lower demand zones in the coming days. The market remains at a critical juncture, and Ethereum’s ability to reclaim and hold key levels will determine its short-term direction as investors closely monitor the next moves.

Featured image from Dall-E, chart from TradingView

Ethereum

Is Ethereum Undervalued? A Close Look at Realized Price and Institutional Activity

Ethereum price action amid the broader crypto market bearish sentiment over recent weeks hasn’t been any different from the performance recorded in the past months. Over this period, Ethereum’s price has struggled to gain significant upward momentum, remaining in a prolonged consolidation phase.

Amid this, a recent analysis by CryptoQuant contributor MAC_D has shed light on Ethereum’s current state and factors that may influence its future price trajectory. The analysis notes that Ethereum’s “ultrasound money” narrative—an idea tied to its post-Merge deflationary tokenomics—has faced challenges.

Total supply has reached record highs, and the staking ratio has decreased by 1% since November. However, despite these supply-side hurdles, several demand-side factors suggest Ethereum might be positioned for long-term growth.

Related Reading

Undervaluation, Holder Behavior, and Institutional Interest

One other key insight from the analysis is that Ethereum appears undervalued based on its realized price. The realized price reflects the average acquisition cost of ETH holdings across all wallets, currently sitting at approximately $2,200.

With the current market price around $2,600, the analyst calculates a market value to realized value (MVRV) ratio slightly above 1, indicating that ETH remains undervalued relative to historical norms. This level could act as a strong support base, potentially limiting further downside.

Another factor supporting Ethereum’s potential upside is the behavior of long-term holders. The analysis highlights an increasing number of addresses that accumulate Ethereum without selling, akin to Bitcoin’s “permanent holders.”

Although some larger investors have sold during recent downturns, their positions have been absorbed by these long-term holders, helping stabilize the market. This trend suggests that Ethereum’s investor base is maturing, with a growing segment committed to holding the asset through market volatility.

Ethereum: A Major Rebound On The Horizon?

Furthermore, the analyst points out that selling pressure in the futures market has eased. Data shows a notable reduction in market price trading volume on the sell side since Ethereum’s price near $4,000 in November last year.

This decline in selling activity, even as prices fell, signals a relative influx of buying power, which could set the stage for a recovery if market conditions improve.

Institutional participation is another encouraging factor. Major players, including BlackRock, Cumberland, and other prominent firms, have reportedly accumulated substantial amounts of ETH during the recent downturn.

For example, BlackRock is said to have purchased over 100,000 ETH, valued at more than $270 million. Such significant institutional inflows not only boost demand but also lend credibility to Ethereum’s long-term investment thesis.

Despite these positive indicators, the analysis acknowledges lingering challenges. The increase in total supply and the slight dip in the staking ratio could weigh on sentiment, particularly if macroeconomic conditions remain uncertain.

Related Reading

Moreover, Ethereum’s price movement may remain constrained in the short term as the broader market digests ongoing economic shifts. However, the combination of undervaluation, strong long-term holder participation, reduced selling pressure, and institutional accumulation paints a more optimistic medium- to long-term outlook.

While Ethereum may continue to trade sideways in the near term, the factors outlined in the analysis suggest that it could be well-positioned for growth once broader market conditions stabilize.

Featured image created with DALL-E, Chart from TradingView

Ethereum

Exchange Outflows Hit Highest In 2 Years

Data shows Ethereum has recently observed its highest exchange net outflows in around two years, something that can be bullish for the ETH price.

Ethereum Exchange Flow Balance Has Seen A Deep Red Spike Recently

According to data from the on-chain analytics firm Santiment, investors have been withdrawing ETH from exchanges recently. The indicator of relevance here is the “Exchange Flow Balance,” which keeps track of the net amount of Ethereum that’s entering into or exiting out of the wallets associated with all centralized exchanges.

When the value of the metric is positive, it means the exchange inflows are outweighing the outflows. As one of the main reasons why investors may deposit their coins to these platforms is for selling-related purposes, this kind of trend can lead to a bearish outcome for ETH.

On the other hand, the indicator being under the zero mark suggests the holders are making net withdrawals from the exchanges. This kind of trend can be a sign that the investors are looking to hold into the long term, which can naturally be bullish for the asset’s price.

Now, here is a chart that shows the trend in the Ethereum Exchange Flow Balance over the last few months:

The value of the metric appears to have been red in recent days | Source: Santiment on X

As is visible in the above graph, the Ethereum Exchange Flow Balance has seen a couple of large negative spikes recently, which means that a large amount of ETH has left the exchanges.

During this outflow spree, the asset saw a 24-hour period with some historically high withdrawals. As Santiment explains,

There was a historic milestone of ~224,410 ETH moving away from exchanges in the 24 hours between February 8th and 9th. This was the most amount of net coins moving off of known exchange wallets in a single day in 23 months.

At the current exchange rate of the cryptocurrency, this 224,410 ETH amount converts to around $596 million. In the same chart, the analytics firm has also attached the data of another indicator known as the Supply on Exchanges, which measures the total amount of ETH sitting on exchanges. These large outflows have meant that this metric has witnessed a sharp plummet to 9.63 million ETH, which is the lowest level since August of last year.

The Ethereum price has been struggling recently, but the fact that the large investors of the market have been making net withdrawals could be a positive sign for things to come. That said, Santiment also cautions, “just be mindful of the fact that Ethereum’s performance in 2025 will still largely be dictated by Bitcoin’s own ability to stay afloat and try to rebound back to ATH levels.”

ETH Price

Ethereum has been unable to make any notable recovery from its crash earlier in the month as its price is still floating around the $2,600 mark.

Looks like the price of the coin has been trading sideways recently | Source: ETHUSDT on TradingView

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Ethereum

Ethereum Whales Holding Over 10,000 ETH Grow Since February 1st – Accumulation Signal?

Ethereum has been struggling below the $2,800 mark since last Thursday, leaving bulls in trouble as the price continues to trade beneath key supply levels. This bearish price action has shaken investor confidence, especially among those who anticipated 2025 would be a bullish year for Ethereum. Last week’s massive selling pressure further compounded fears, with ETH struggling to reclaim lost ground.

The current market sentiment toward ETH reflects growing uncertainty, as the second-largest cryptocurrency fails to show signs of a strong recovery. Investors are worried that ETH’s underwhelming performance could persist, especially as it lags behind Bitcoin and other altcoins that have shown relative strength in recent weeks. Many now question whether Ethereum can regain the bullish momentum it has been known for in previous cycles.

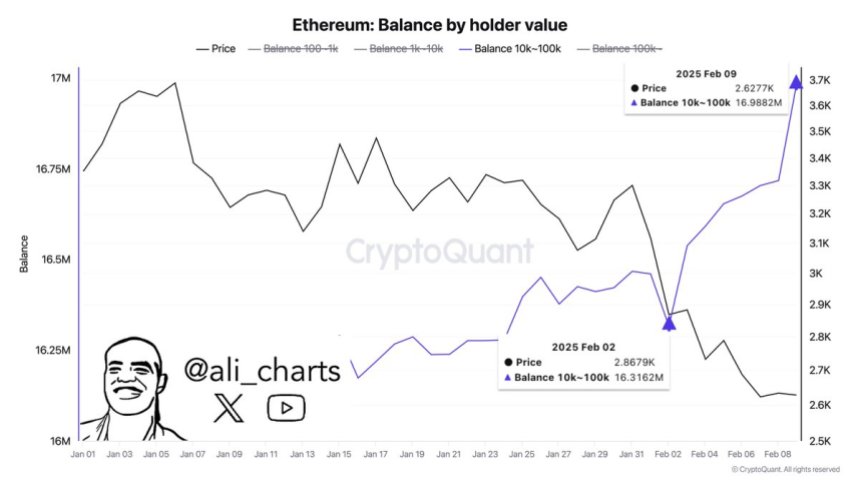

Despite these challenges, there are glimmers of optimism. Key on-chain metrics shared by crypto analyst Ali Martinez reveal an interesting trend: the number of Ethereum whales holding over 10,000 ETH has risen by 2.30% since February 1.

This suggests that large holders accumulate Ethereum during this consolidation phase, potentially signaling confidence in its long-term prospects. Whether this accumulation will translate into price recovery remains to be seen, but it adds a layer of intrigue to Ethereum’s current market dynamics.

Ethereum Accumulation Taking Place

After last week’s dramatic sell-off, which saw Ethereum plummet from $3,150 to $2,150 in less than two days, the price has struggled to reclaim key supply levels. While ETH managed a strong recovery from its lows, pushing back to the $2,700 mark, it still faces significant resistance and remains in a bearish trend. Bulls are under pressure, with the $3,000 level emerging as the critical threshold to regain control and shift the narrative toward a bullish recovery.

Despite the challenging price action, there are signs of optimism for Ethereum’s long-term outlook. Key metrics shared by top analyst Ali Martinez reveal that the number of Ethereum whales—wallets holding over 10,000 ETH—has risen by 2.30% since February 1.

This growing accumulation suggests that large-scale investors remain confident in Ethereum’s potential, even as the broader market struggles with volatility and uncertainty. Historically, whale accumulation during bearish phases has often preceded strong rallies as these players anticipate future price increases.

This trend provides a glimmer of hope for Ethereum investors who still believe in a bullish year ahead. If ETH can reclaim the $3,000 mark and hold it as support, a recovery into higher supply levels could trigger a broader rally. For now, however, the coming days will be crucial as Ethereum consolidates and bulls attempt to regain control. With growing whale activity signaling confidence, the question remains: can Ethereum overcome its current struggles and set the stage for another upward surge?

ETH Price Action: Key Levels To Reclaim

Ethereum (ETH) is trading at $2,680 as it attempts to reclaim the $2,700 mark and push above key supply levels. Bulls are under pressure to regain control after weeks of bearish price action. Reclaiming the $2,800 and $3,000 levels is crucial for Ethereum to reverse the daily downtrend it has experienced since late December. Breaking above these levels would signal a shift in momentum, giving bulls a chance to regain strength.

The $3,000 mark is particularly significant, as it aligns with the 200-day moving average, a critical indicator of long-term trend strength. Historically, breaking and holding above this moving average has triggered bullish rallies, and a similar move now could send ETH into higher price levels quickly. A push above $3,000 would likely attract increased investor interest, setting the stage for a sustained recovery.

On the downside, losing the $2,600 support level would put Ethereum at risk of further declines. Such a move could take ETH into lower demand zones, potentially revisiting levels last seen during its dramatic sell-off earlier this month. For now, the $2,700 mark remains the immediate battleground, as bulls and bears fight for short-term dominance in an uncertain market.

Featured image from Dall-E, chart from TradingView

-

Blockchain23 hours ago

Blockchain23 hours agoPEPE & Dogecoin investors buy into 1FUEL as analysts hint that this wallet exchange could see astronomical gains

-

Market23 hours ago

Market23 hours agoSolana Price Fails To Breach Critical Barrier, Stuck Under $200

-

Altcoin23 hours ago

Altcoin23 hours agoArbitrum Helps Tether Overcome Challenges – Next Big Crypto Coins, New Horizons

-

Bitcoin23 hours ago

Bitcoin23 hours agoCrypto Market Trends: What to Expect in February 2025

-

Market22 hours ago

Market22 hours agoB3’s Surge, LAYER’s Dip, and BERA’s Struggles

-

Altcoin12 hours ago

Altcoin12 hours agoUS CPI Rises To 3% Sparking Crypto Market Crash Speculations

-

Altcoin22 hours ago

Altcoin22 hours agoFranklin Templeton Launches Tokenized Fund On Solana

-

Market11 hours ago

Market11 hours agoB3 Price Soars, Becoming a Top Coin on the Base Chain