Bitcoin

This is Why US States’ Bitcoin Reserves Could Spike BTC Price

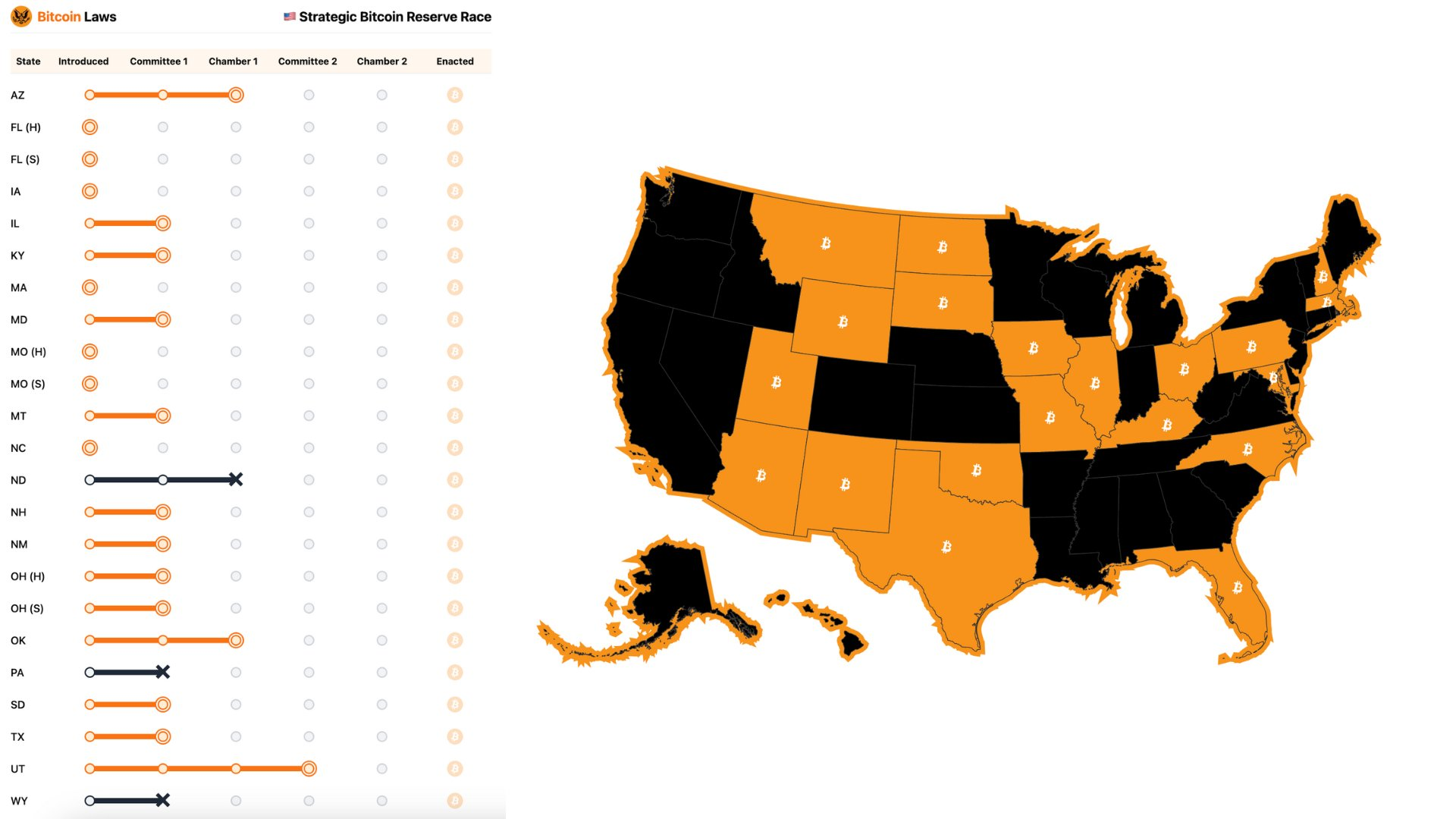

Currently, 20 US states have active proposals to create their own Bitcoin Reserve, several of which are advancing. These bills contain legal obligations to purchase $23 billion in Bitcoin, which would fuel huge demand.

These bills may also encourage some US states to invest their pension funds in Bitcoin, adding further demand. BTC is on the cusp of a supply shock, so even a few successful bills could have a dramatic impact.

US States Want Bitcoin Reserves

Since President Trump first vowed to create a US Bitcoin Reserve, several states have attempted to develop their own BTC stockpiles. Matthew Sigel, Head of Digital Assets Research at VanEck, assessed these proposals, looking for specific purchasing obligations contained within.

He found many and determined that they could have a real impact on Bitcoin’s price.

“We analyzed 20 state-level Bitcoin reserve bills. If enacted, they could drive $23 billion in buying, or 247,000 BTC. This sum is independent of any pension fund allocations, likely to rise if legislators move forward,” Sigel claimed.

Although President Trump created a US crypto stockpile by executive order, this doesn’t quite fulfill his campaign promise. Still, several states are trying to pass their own Bitcoin Reserves, and a few proposals have advanced quite far.

Utah’s Bitcoin Reserve bill made it through the first committee, and both Oklahoma and Arizona also reached this threshold. This afternoon, North Carolina sent its bill from the introduction stage to the Committee for Commerce and Economic Development.

If all these Bitcoin Reserve proposals are passed into law, it will have a huge impact on the price of Bitcoin. These initial proposals will demand that the relevant states purchase BTC worth $23 billion.

That doesn’t account for other assets like state pension funds, which would become entangled with these reserves in at least a few cases.

More to the point, however, this analysis only looks at the bills in isolation. If over a dozen US states are legally required to put Bitcoin in their new Reserves, it could spur demand from ordinary consumers.

Bitcoin is already on the cusp of a supply shock, which may happen before any of these bills become law. Still, they could be an atomic bomb on top of the current demand.

In short, the whole situation has explosive potential. The current supply of Bitcoin is unable to meet growing consumer demand, and up to 20 state-level Reserves could pile on.

It’s difficult to assess how many of these bills may succeed or fail, but even a few successes could be big. Most importantly, a federal Bitcoin Reserve could change the equation altogether.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Crypto Market Trends: What to Expect in February 2025

The cryptocurrency market started 2025 with a surge, reaching a $3.76 trillion market cap on January 7, driven by pro-crypto U.S. policies

However, sentiment shifted sharply later in January following DeepSeek’s AI breakthrough, which triggered concerns about overvalued U.S. tech stocks and led to a broader sell-off across traditional and crypto markets, according to Crypto Street.

Despite the turbulence, the crypto market still grew by 4.3% in January, with notable gains for XRP (+47.8%), Solana (+24.7%), and Bitcoin (+11.7%). Meanwhile, Ethereum (-8.2%) and Avalanche (-9.3%) saw declines as liquidity shifted to other assets.

Key Narratives to Watch in February 2025

Regulatory and Macroeconomic Developments

- U.S. Trade Policies: Potential new tariffs could impact investor risk appetite and influence crypto prices.

- Federal Reserve Rate Decisions: With only two rate cuts expected for 2025, cautious monetary policy could slow capital inflows into speculative assets.

- Stablecoin Regulations: U.S. lawmakers are discussing compliance measures for stablecoin issuers, which could shape institutional adoption.

Crypto ETF Expansion

The U.S. now has 47 active crypto ETF filings, marking a shift beyond Bitcoin and Ethereum ETFs. Upcoming approvals for altcoin and memecoin ETFs could drive new liquidity into the market.

Solana’s Continued DeFi and DEX Growth

Solana has outperformed Ethereum in DEX trading volume for four consecutive months, fueled by:

- Memecoin speculation ($TRUMP, $MELANIA)

- Low fees and high transaction speeds

- Increased validator adoption and liquidity incentives

With January’s Solana-to-Ethereum DEX ratio reaching an all-time high, the key question remains: Can Solana sustain its dominance, or will Ethereum regain market share?

AI and DeFi-AI Integration

Artificial Intelligence remains the dominant crypto narrative, accounting for 44% of market discussions, surpassing memecoins (10%) and DeFi (9.7%).

While AI-related tokens saw a correction in late January, interest in AI-powered DeFi applications and on-chain trading agents is expected to grow, according to Binance’s February 2025 report.

A Volatile but Opportunity-Rich Market

As February unfolds, the crypto market faces both regulatory uncertainty and growth potential. Key factors to monitor include:

- Crypto ETF approvals

- U.S. economic policies

- DeFi activity on Solana and Ethereum

- AI’s expanding role in crypto innovation

With institutional adoption rising and new market trends emerging, traders and investors should stay alert to shifting narratives and liquidity movements in the weeks ahead.

Bitcoin

Bitcoin On The Fed’s Radar? Journalist Notes Growing Acceptance

Historically dubious of cryptocurrencies, the US Federal Reserve could be starting to show early signs of becoming more receptive to Bitcoin and digital assets.

Recent remarks from key Fed officials point to a change in tone that would indicate a more open attitude regarding crypto inclusion, claims FOX Business writer Eleanor Terrett.

Fed Governors Recognize Growing Part Played By Crypto

Terrett highlighted comments given at the Wisconsin Bankers Association Bank Executive Conference on February 7 by Federal Reserve Governors Michelle Bowman and Christopher Waller.

Both officials talked about the increasing importance of digital assets, a clear divergence from the usually wary attitude of the central bank.

Waller, who has previously been skeptical of cryptocurrencies, noted their growing importance in the financial sector. Bowman reflected similar ideas, implying that financial institutions ought to get ready for blockchain technology to develop.

Although neither totally supports Bitcoin, their eagerness to participate in the dialogue signals a change from earlier dismissals of cryptocurrencies.

🚨NEW: The narrative around #crypto is changing at the @federalreserve. In a pair of speeches on Friday, Republican Fed Governors Michelle Bowman and Christopher Waller both signaled a more open stance toward digital assets and their future in the financial system.

Their words…

— Eleanor Terrett (@EleanorTerrett) February 11, 2025

Journalist Notes Potential Policy Development

Terrett pointed out that although these remarks don’t prove a complete policy change, they show the Fed’s growing consciousness of the influence of cryptocurrencies.

Long given top priority by the US central bank is financial stability; worries about digital assets upsetting the economy have resulted in a cautious legislative response.

But as Bitcoin adoption rises—among institutional as well as retail investors—the Fed might be changing its posture. The fact that top authorities are now candidly talking about the asset class implies that central banking circles are giving bitcoin more importance.

Political Influence And Trump’s Crypto-Friendly Stance

Terrett also talked about how current events in politics might be affecting this shift in opinion. US President Donald Trump has openly backed an America that is friendly to crypto by announcing policies that encourage innovation in the industry.

Still, the Fed hasn’t said what laws will change about Bitcoin or financial instruments that use cryptography. The shift remains one of sentiment rather than action—for now.

What’s Next For Bitcoin And The Fed?

Terrett’s analysis indicates that crypto is no longer being overlooked at the highest echelons of financial policy, even when the Federal Reserve isn’t rushing to embrace Bitcoin. Should digital assets keep their increasing trend, the Fed might have little option except to adjust.

Right now, fans of Bitcoin can consider this as a small yet significant advancement. Though it’s yet unknown whether it results in specific legislative changes, crypto’s increasing presence in economic discussions is indisputable.

Featured image from DALL-E, chart from TradingView

Bitcoin

Bitcoin Sentiment Hits New High—Will Prices Follow?

An analytics firm suggested that Bitcoin might be heading to another bull market as the hype around meme coins starts to fade and the crypto community regains its interest in the flagship crypto and other top Layer-1 protocols.

Santiment acknowledged that the crypto community’s shift to Bitcoin could indicate market maturity, creating renewed optimism in the broader digital assets market.

Shifting Attention To Bitcoin

Data giant Santiment observed that the cryptocurrency sector has once again turned its attention to Bitcoin in the last few weeks as the meme coin frenzies waned.

“The crypto community has largely shifted their attention to Bitcoin and other Layer 1 assets like Ethereum, Solana, Toncoin, and Cardano,” Santiment said in a post.

The analytics firms noted that social discussions on Bitcoin and other Layer-1 protocols are on the rise, overtaking discussions on meme coins, which have been the talk of the crypto space for some time.

😀 The crypto community has largely shifted their attention to Bitcoin and other Layer 1 assets like Ethereum, Solana, Toncoin, and Cardano. Collectively, the top Layer 1 assets are getting 44.2% of discussions among specific coins. Meanwhile, top meme coins like Dogecoin, Shiba… pic.twitter.com/PpBjD9vSi4

— Santiment (@santimentfeed) February 10, 2025

“Collectively, the top Layer 1 assets are getting 44% of discussions among specific coins. Meanwhile, top meme coins like Dogecoin, Shiba Inu, and Pepe are being discussed less and less across social media,” Santiment said.

The data giant attributed this shift to the “recent volatility, and speculative altcoin price dominance falling behind.”

More Stable, Sustainable Market

Santiment explained that investors’ shift of attention from meme coins to Bitcoin and Layer 1 only indicates “a more stable and sustainable market environment.”

“Meme coins tend to attract speculative enthusiasm, often driven by hype, viral trends, and a gambling mindset rather than fundamental value. When these assets dominate discussions, it typically signals a phase of excess greed, where traders chase rapid, short-term gains without considering long-term viability,” the analytics firm said.

Sanitment called Bitcoin and other Layer-1 protocols the “foundational infrastructure of the crypto space,” believing that the crypto community’s increased attention to these assets often reflects a “more mature and informed approach” by the crypto community.

The data giant added that it also means that the community wants to prioritize “security, innovation, and real-world adoption.”

“Layer 1 blockchains support smart contracts, decentralized applications, and network scalability—key drivers of long-term growth in the industry,” the analytics firm said.

Healthier Market Cycle

The analytics firms suggested that the investors’ regained attention towards Bitcoin and away from meme coin proves that the crypto community is more inclined to sustainability.

“When traders pivot back to assets with strong utility and established market positions, it suggests a healthier market cycle. This shift encourages a more balanced ecosystem, reducing the risk of unsustainable price surges and crashes fueled purely by speculative mania,” Santiment said.

As of this writing, Bitcoin is being traded at $97,825 per coin, up 0.2% in the last 24 hours. Its total market capitalization is nearly $2 trillion.

Featured image from Avira, chart from TradingView

-

Market21 hours ago

Market21 hours agoBTC eyes $97k from soft U.S. CPI, iDEGEN’s presale hits $21m

-

Altcoin21 hours ago

Altcoin21 hours agoWhy Could BERA, SEI, AVAX, and 5 Other Crypto See High Volatility?

-

Market20 hours ago

Market20 hours agoEthereum Price Consolidates at Support—Will It Fuel the Next Move?

-

Blockchain17 hours ago

Blockchain17 hours agoPEPE & Dogecoin investors buy into 1FUEL as analysts hint that this wallet exchange could see astronomical gains

-

Market23 hours ago

Market23 hours agoCardano (ADA) Struggles to Sustain Gains—Is the Uptrend in Trouble?

-

Bitcoin17 hours ago

Bitcoin17 hours agoCrypto Market Trends: What to Expect in February 2025

-

Market22 hours ago

Market22 hours agoBitGo Eyes IPO in 2025 Amid Crypto Market Revival

-

Market17 hours ago

Market17 hours agoB3’s Surge, LAYER’s Dip, and BERA’s Struggles