Market

US Inflation Spurs Bitcoin ETF Outflows, Ethereum ETFs Persist

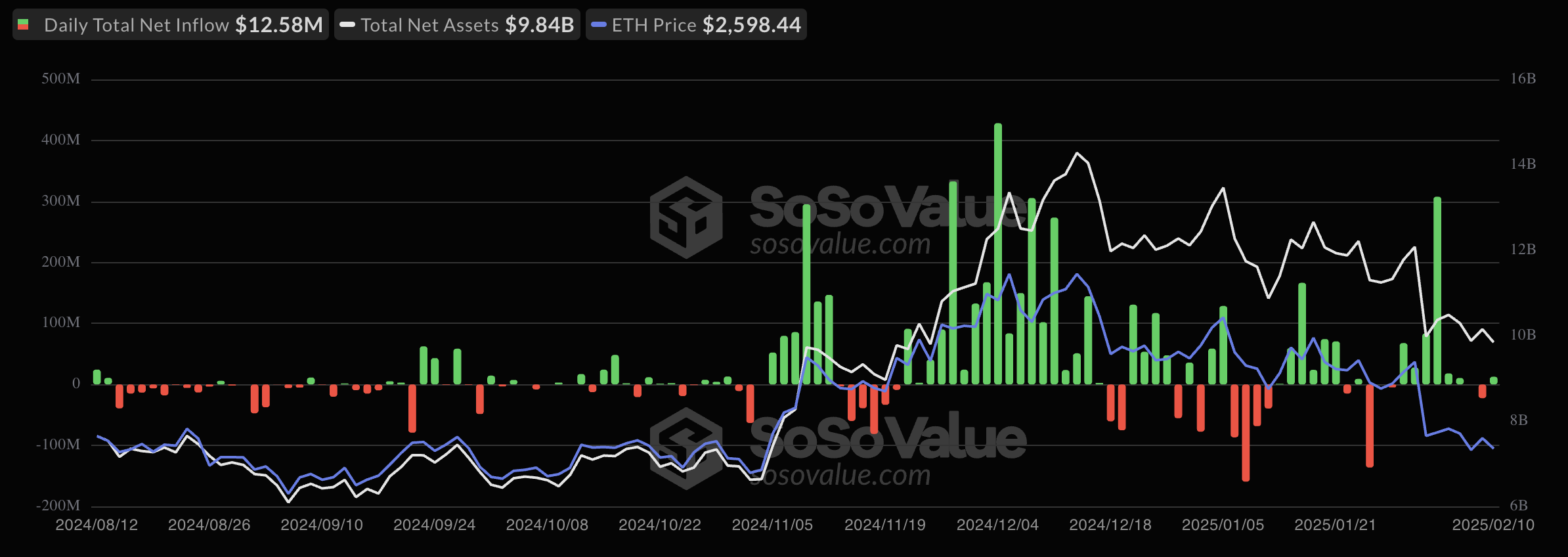

Bitcoin ETF outflows continue as Powell’s rejection of rate cuts and high inflation trigger a pullback from institutional investors. However, the Ethereum ETF market performed well, showing strong confidence and investor appetite for buying the dip.

It may be alluring to suggest that high inflation will decrease investment across the entire crypto market, but other factors can overcome this bearish headwind.

Bitcoin ETFs Feel the Inflation

Since the SEC first approved Bitcoin ETFs in 2024, they’ve heralded a wave of integration between the crypto industry and traditional finance. In some ways, crypto has benefitted greatly, with BlackRock’s IBIT counting as one of the most successful ETFs ever. This market entanglement, however, can sometimes have a negative impact, as shown by recent outflows:

Yesterday, the Bitcoin ETF market saw $56.76 million in outflows, with $243 million in total outflows this week. This may seem surprising at first, considering that these funds were headed toward a dramatic recovery less than a month ago.

However, the BTC ETFs saw their first week of net outflows in 2025 last week, and outflows have since continued.

A few factors in the broader market help explain this phenomenon. Top-level analysts have predicted that US inflation and economic policies will have an outsized role on the crypto market, and that prediction is coming true. Yesterday, Jerome Powell rejected President Trump’s plan to use rate cuts to reduce inflation.

Powell’s decision does have a few positive factors for crypto, but in the short term, it’s making investors very skittish. US inflation climbed to 3% YoY this morning, causing capital to pull back from Bitcoin and its ETF market.

However, these factors have not halted the momentum of Ethereum ETFs, as they saw inflows of $12.58 million yesterday.

Perversely, this ETF category is actually gaining from its asset’s underlying woes, in contrast with Bitcoin. Last week, these products saw a huge rush in trading volume as investors sought to buy the dip. Since then, Ethereum has stayed low, pushing ETF inflows to a two-month high.

In short, inflation and other broad market factors have triggered a brief pullback for Bitcoin ETFs, but they aren’t the only factors in play. For Ethereum, there seems to be a strong short-term confidence.

The upcoming Pectra upgrade in March and recent purchases from Donald Trump-backed World Liberty Financial have driven institutional interest in the largest altcoin. So, the US spot Ethereum ETF market might continue to see net inflows as long as ETH is below $3,000.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin (BTC) Stays Flat as Whales Reduce Market Exposure

Bitcoin (BTC) has been trading in a tight range between $83,000 and $86,000 over the past five days, showing signs of indecision in both price action and momentum indicators.

While the number of whale wallets has started to decline, on-chain data still reflects elevated interest from large holders. Technically, BTC remains in a consolidation phase, with weak EMA signals and mixed Ichimoku readings.

Bitcoin Whales Pull Back: Early Sign of Fading Confidence?

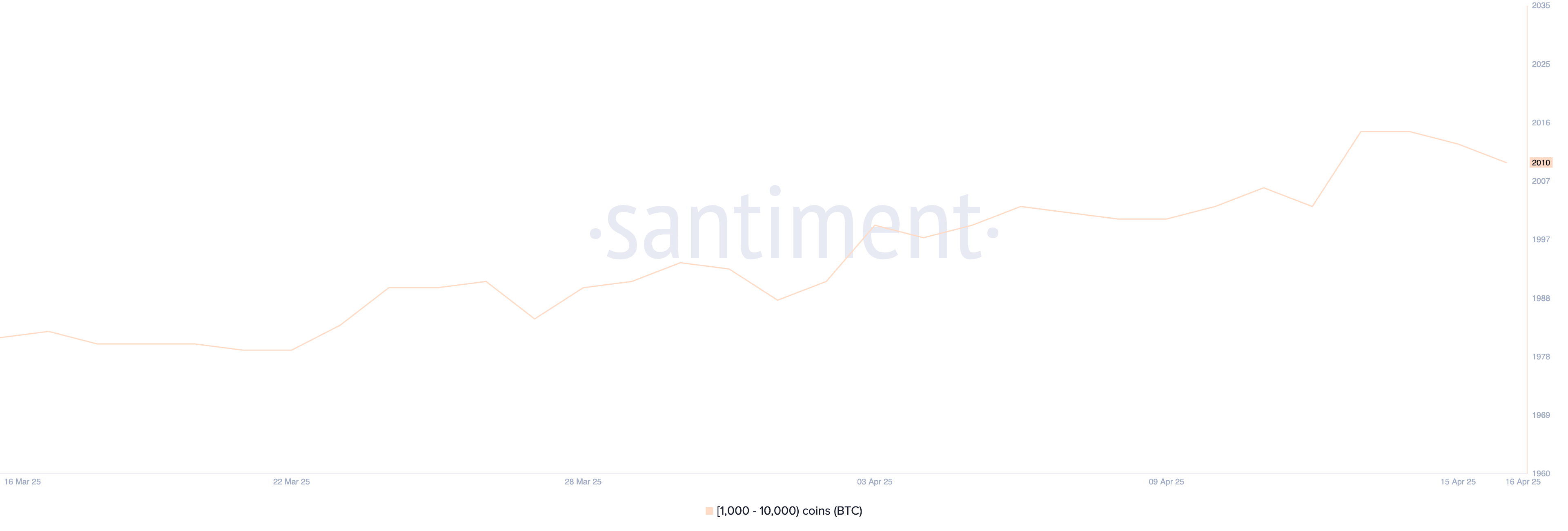

The number of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—has declined slightly in recent days, dropping from 2,015 on April 14 to 2,010 by April 16.

This pullback comes just after the metric hit its highest level since May 2024, suggesting a potential shift in sentiment among large holders.

While the drop may seem small, movements in whale behavior often precede broader market trends, making even slight changes worth watching.

Whale activity is a key on-chain signal because these large holders can significantly influence market liquidity and price direction.

An increase in whale wallets often reflects accumulation and long-term confidence, while a decline may suggest strategic profit-taking or risk-off behavior.

The recent dip from the local peak could indicate that some whales are trimming exposure as market uncertainty rises. If the number continues to fall, it may signal weakening institutional conviction, potentially putting short-term pressure on Bitcoin’s price.

Bitcoin Stalls Near Ichimoku Pivot as Momentum Fades

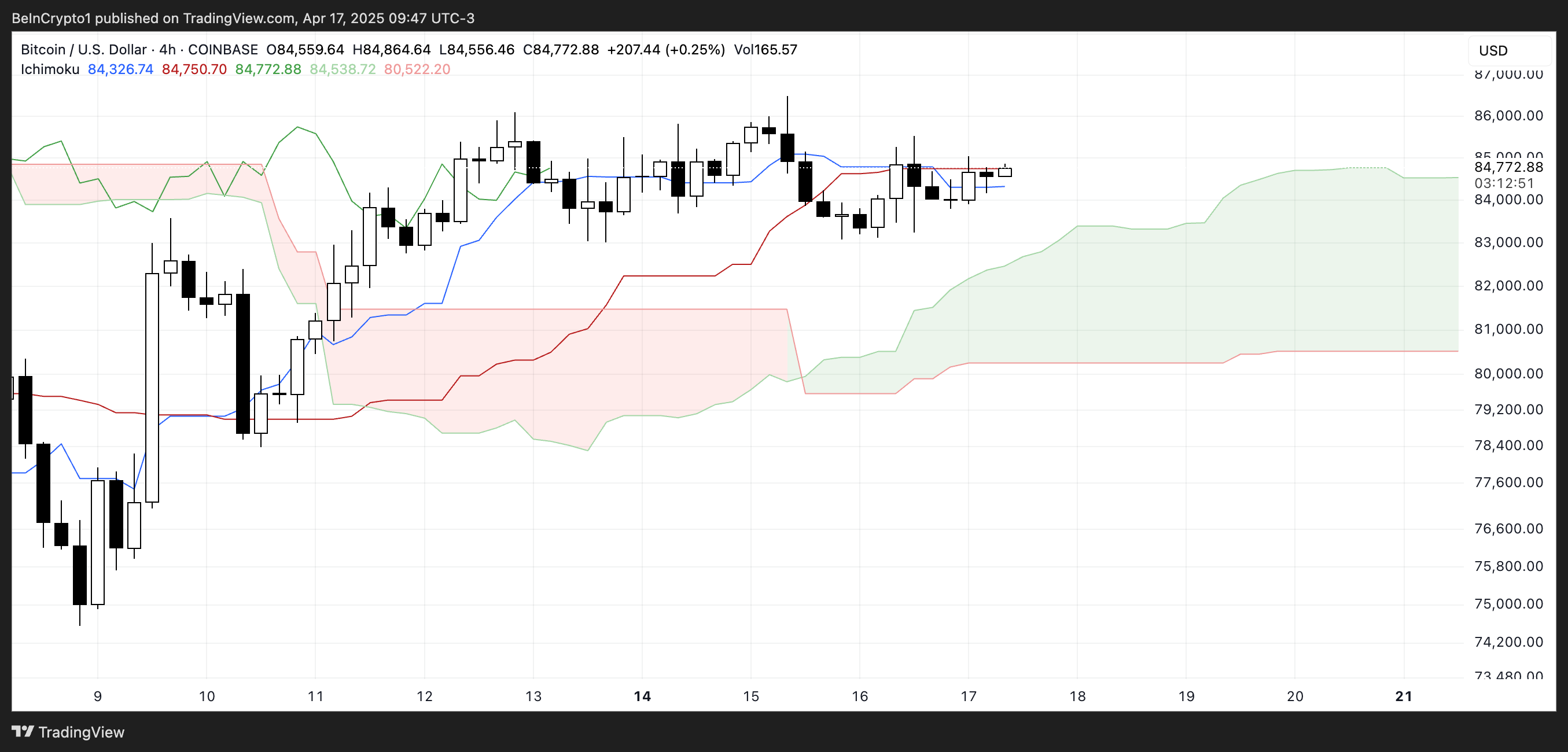

The Ichimoku Cloud chart for Bitcoin shows a period of consolidation, with the price currently trading near the flat Tenkan-sen (blue line) and Kijun-sen (red line).

This alignment suggests a lack of short-term momentum, as both lines are moving sideways, indicating equilibrium between buyers and sellers.

The Kumo (cloud) ahead is bullish, with the Senkou Span A (green cloud boundary) above the Senkou Span B (red cloud boundary), but the distance between them is relatively narrow.

This hints at weak bullish momentum for now. The price is sitting just above the cloud, which is a positive sign, but without a clear breakout above the Tenkan-sen and recent highs, the trend remains indecisive.

Chikou Span (lagging line) is overlapping with recent candles, reinforcing the sideways movement.

Overall, Bitcoin is hovering in a neutral-to-slightly-bullish zone, but it needs a stronger push to confirm a clear trend direction.

Bitcoin Struggles for Direction as Key Levels Loom

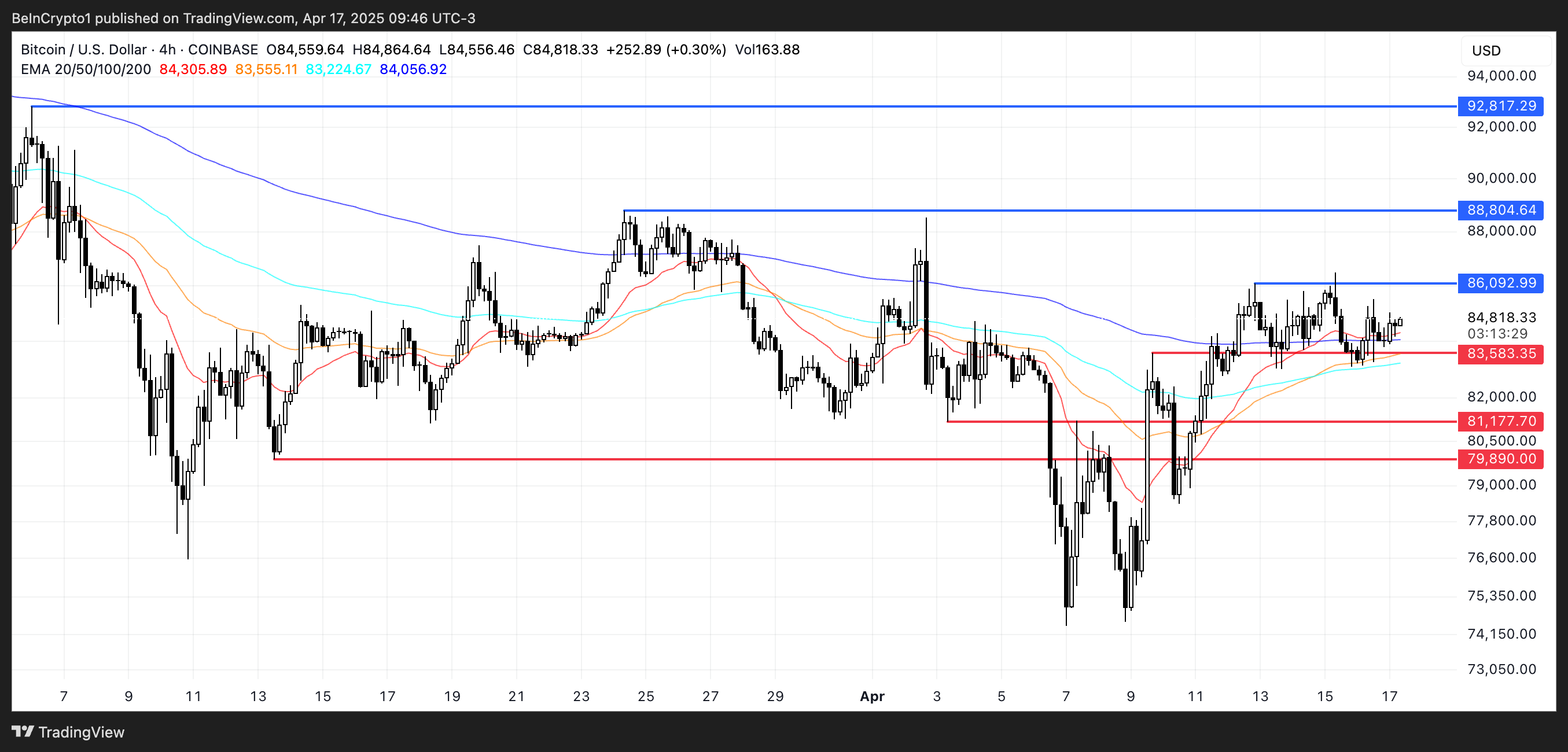

Bitcoin’s EMA lines are currently flat, indicating a weak and uncertain trend. The price action shows hesitation, with bulls and bears lacking conviction.

If the support level at $83,583 is tested and fails to hold, the market could enter a sharper correction, targeting the next support at $81,177.

A break below that could push Bitcoin price under the psychological $80,000 level once again, with $79,890 as the next possible downside target.

However, if bulls manage to regain control, Bitcoin could shift toward recovery. The first key resistance lies at $86,092—breaking this level would suggest renewed upward momentum.

From there, the next upside targets would be $88,804 and, if the trend strengthens further, $92,817.

Reaching this level would mean breaking above the $90,000 mark for the first time since March 7, potentially sparking renewed interest from both retail and institutional investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Casino Founder Charged With Fraud in New York

Richard Kim, founder of Zero Edge, a defunct “crypto casino,” was arrested and subsequently released on bail in a federal securities fraud case. After an arrest on Tuesday, Kim posted a $250,000 bond using $100,000 in cash as collateral.

Before Zero Edge, Kim had an esteemed career at major institutes like JP Morgan and Goldman Sachs. The Southern District of New York (SDNY) is hearing this case.

How Richard Kim’s Crypto Casino Collapsed

Before everything fell apart, Richard Kim was ostensibly a successful crypto entrepreneur. A former executive at Galaxy Digital, an attorney, and an elite trader, he left in March 2024 to found Zero Edge.

This “crypto casino” would bring classical gambling onto the blockchain, according to a recent court document:

“In particular, Kim represented to prospective investors that Zero Edge would ‘develop a number of onchain games,’ beginning with craps, and operate both a ‘free to play / social casino version of the game’ in which players could win virtual currency, as well as a real money version of the game. KIM wrote that he would serve as the ‘chief architect’ of the company,” it read.

Kim leveraged his former connections, including those at Galaxy, to raise over $7 million in seed funding. However, Kim’s casino never opened.

According to his public statements, Kim initially lost $80,000 to a phishing scam and blew through $3.8 million by chasing losses in “high-risk leveraged crypto trades.” This happened within a week of his initial funding round.

From there, he misled investors for months before finally coming clean last June, describing himself as a gambling addict. Several of the casino’s investors, including Galaxy, filed complaints that progressed to federal charges this week.

The FBI arrested Kim on charges of wire fraud and securities fraud, and he is being tried in the Southern District of New York (SDNY).

In the grand scheme of things, Kim’s aborted attempt to open a digital casino is on the smaller end of crypto crimes. Nonetheless, it’s important that the federal government actually seeks to prosecute him.

For example, the Department of Justice recently shut down its Crypto Enforcement Team and stopped investigating tumblers and exchanges. “Crime is legal now” is a growing refrain in the community, as regulators are halting all enforcement.

Even the SDNY, which is handling Kim’s casino case, claimed it would end crypto prosecutions.

This may be a small win for justice, but fresh crypto cases are being tried. Kim is currently out on bail, but he still faces repercussions for his failed casino. Whatever happens, its results will be an important data point for US crypto enforcement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Over $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP is making headlines this month as whale activity surges across the network. In a surprising twist, reports indicate that XRP whales have dumped more than $700 million worth of tokens just this April. This sudden shift in whale behavior raises the question of what these big players are really up to.

XRP Whales Offload 370 Million Tokens In April

On April 15, prominent crypto analyst Ali Martínez reported on X (formerly Twitter) that XRP whales have begun dumping the popular cryptocurrency in large volumes. Following a period of substantial token accumulation, these large-scale investors have sold over 370 million XRP since the beginning of April.

Related Reading

Notably, this massive whale sell-off amounts to over $700 million, triggering a wave of speculation about the intentions behind this move. More interestingly, the XRP dumps appear to align with recent price fluctuations, as whales tend to heavily influence market dynamics, especially during a downturn.

The Santiment chart provided by Martinez reveals a clear trend, from April 3 to 14, 2025, that XRP wallets holding between 100 million to 1 billion tokens have drastically reduced their holdings. As this large-scale whale dumping progressed, the XRP price dropped to new lows around April 8 and then began a steady climb, reaching $2.1 at the time of writing.

While the reason behind such large-scale exits is unclear, a few plausible explanations exist. Whales might be capitalizing on earlier price gains to lock in profits while the market conditions for XRP remain relatively stable. These investors could also be responding to heightened market volatility, pushing them to shift their holdings into alternative assets to hedge risks and safeguard against losses.

Another possibility is that these big players are selling tokens between wallets or transferring them to exchanges in anticipation of a significant event — perhaps the final legal decision between Ripple and the United States Securities and Exchange Commission (SEC). In less optimistic scenarios, such coordinated whale activity, which tends to influence prices, may be indicative of market manipulation, often aimed at achieving strategic gains.

Although it’s uncertain whether the above motives are driving recent whale dumps, one thing is clear: large-scale XRP movements always warrant close attention. With XRP now hovering around $2, the market waits to see just how these sell-offs will influence the future price of the cryptocurrency.

Update On Latest XRP Price Action

According to crypto analyst Andrew Griffiths, the current XRP price analysis indicates a notably bullish trend. This momentum emerged after the cryptocurrency surpassed two key resistance levels and established a solid support level, signaling a potential upward movement.

Related Reading

As a result, the analyst predicts that XRP could record a massive gain of over 20% in the coming weeks. With the token currently trading at $2.10, a 20% increase would bring it to approximately $2.589. Based on the upward trajectory within the Ascending Channel seen on the price chart, the analyst predicts that XRP could climb as high as $3.3.

Featured image from Pixabay, chart from Tradingview.com

-

Market20 hours ago

Market20 hours agoCrypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

-

Market23 hours ago

Market23 hours agoBitcoin and Ethereum Now Accepted by Panama City Government

-

Ethereum23 hours ago

Ethereum23 hours agoOver 1.9M Ethereum Positioned Between $1,457 And $1,598 – Can Bulls Hold Support?

-

Bitcoin22 hours ago

Bitcoin22 hours agoETF Issuers Bring Stability to Bitcoin Despite Tariff Chaos

-

Market21 hours ago

Market21 hours agoBase Meme Coin Wipes $15 Million After Official Promotion

-

Market19 hours ago

Market19 hours agoPEPE Price To Bounce 796% To New All-Time Highs In 2025? Here’s What The Chart Says

-

Market16 hours ago

Market16 hours agoNo Rate Cut Soon, Crypto Banking Rules to Ease

-

Market15 hours ago

Market15 hours agoEthereum Price Struggles to Rebound—Key Hurdles In The Way