Market

Bitcoin Permanent Holders Boost Accumulation

Since the beginning of February, Bitcoin has had difficulty stabilizing above the $100,000 mark. Donald Trump’s tariff wars have triggered significant market volatility, keeping traders on edge.

However, despite these headwinds, a key group of coin holders—those with no recorded history of selling—have intensified their accumulation. This signals a strong conviction in the asset’s long-term prospects.

Bitcoin Long-Term Holders Remain Resilient

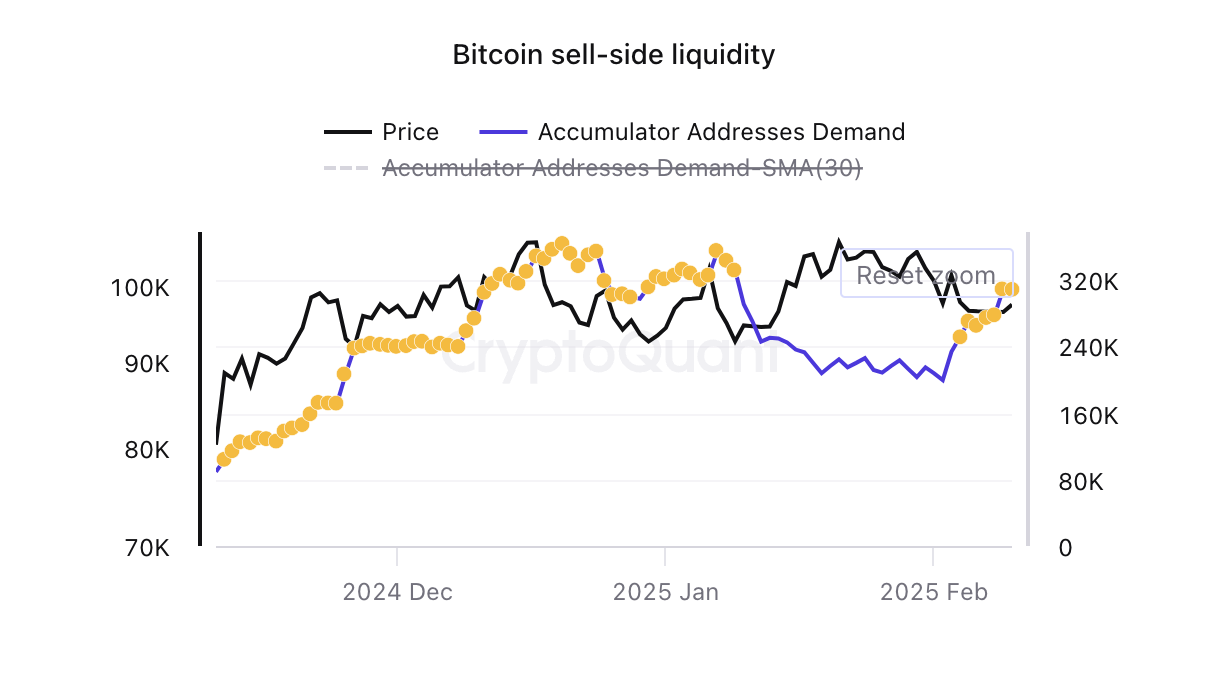

Data from the on-chain analytics platform CryptoQuant shows a spike in Bitcoin’s Permanent Holder Demand. According to the data provider, Bitcoin’s permanent holders consist of owners who primarily accumulate the coin over time and never engage in spending transactions, indicating a long-term holding strategy.

BeInCrypto’s assessment of the coin’s accumulator address demand reveals that since it hit a year-to-date low on February 2, it has soared. This reflects the surge in accumulation among these long-term investors.

Demand has rebounded even amid Bitcoin’s early February correction, signaling that long-term holders remain confident in the leading asset. Compared to previous cycles, fewer long-term holders are selling, reinforcing the bullish conviction.

Furthermore, BTC’s attempt to cross above its 20-day exponential moving average (EMA) confirms the resurgence in demand for the king coin. At press time, BTC trades at $98,022, slightly below this key moving average, which forms resistance above it at $98,995.

The 20-day EMA tracks an asset’s average price over the past 20 trading days by giving more weight to recent price data. When an asset is poised to break above this moving average, it signals growing bullish momentum, suggesting a potential shift toward an uptrend if sustained.

BTC Price Prediction: Strong Holder Demand to Push BTC Above Key Resistance?

Sustained demand for BTC among its permanent holders could trigger a rally above the resistance formed by its 20-day EMA. A successful break above this level would provide the momentum needed for the coin to reclaim its all-time high of $109,356.

However, if accumulation stalls among BTC investors, it could reverse current gains and drop to $92,325.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

iDEGEN’s value skyrockets with its listing in the horizon

The cryptocurrency market has continued to show resilience in the wake of trade tensions. Most majors have recorded some gains as investors beyond the current instabilities and onto the expected surge in cryptocurrency adoption rates.

Notably, more market participants are broadening their horizon to include fresh projects with great potential. iDEGEN, a revolutionary force within the AI crypto space is one such entity.

With about two weeks left for its presale, savvy investors are steadily amassing $IDGN tokens. Based on its potential, its current token price of $0.0236 is likely the lowest it will ever get to moving forward.

Bitcoin’s steady appeal to sustain it above months-long support zone

Even with the recent risk-off mood, bitcoin price has held steady above $90,000, a support zone that has been steady since mid-November 2024. As a cryptocurrency, it is categorized as a risky asset.

Nonetheless, it continues to attract more individual and institutional investors as its global adoption increases. Indeed, countries like the US and Czech Republic may soon join the growing number of nations and sovereign wealth funds that have included Bitcoin in their strategic reserves. It is this optimism, coupled with eased cryptocurrency regulations, that will support bitcoin in the short and medium-term.

A look at its daily chart shows Bitcoin price hovering around the 50-day EMA while still trading below the short-term 20-day EMA. At the same time, its RSI is at 47, slightly below the neutral level of 50. Notably, the RSI is facing upwards, indicating that the current rebounding may continue in the ensuing sessions.

At its current level, the range between the psychologically crucial zone of $100,000 and the support level of $96,005 remains worth watching. Further rebounding will have the bull eye the next target at $102,595. However, this bullish thesis will be invalid if the cryptocurrency pulls back below the lower support zone of $94,444.87.

iDEGEN’s positioning turns early adopters to rich crypto investors ahead of its listing

iDEGEN, an AI crypto project that has been making waves in the market since late November 2024, is set to hit the public shelves in about two weeks. Notably, the powerful trifactor that has captured the attention of investors is expected to catapult it to great heights upon listing.

To begin with, the AI crypto space has grown to a market cap of $29.2 billion as seen on CoinGecko. AI16z, one of iDEGEN’s rivals which was launched in October 2024, is valued at over $618 million. As a revolutionary force that has succeeded at curving its niche in the sector, iDEGEN also has the potential to have its value surge by 20x post-listing.

Besides, its positioning as a community-driven project with no guard rails has given it a competitive edge in the market. For instance, its previous ban on X on grounds of “violent content” attracted more investors; enabling it to raise an additional $1 million within 24 hours.

It has gone on to expand its reach with it the latest V3 upgrade allowing for video content. These upgrades, coupled with its integration of the viral DeepSeek, have yielded fresh waves of buying pressure.

So far, it has raised over $21 million with more than 1.7 million $IDGN tokens already sold. As it stands, investors only have a few more weeks left to get onto this highly profitable bandwagon. With returns of over 21,000%, the early adopters are already earning big even before the project’s listing. You can buy the iDegen token here.

Cardano price to rebound within a range amid competition from smart contract projects

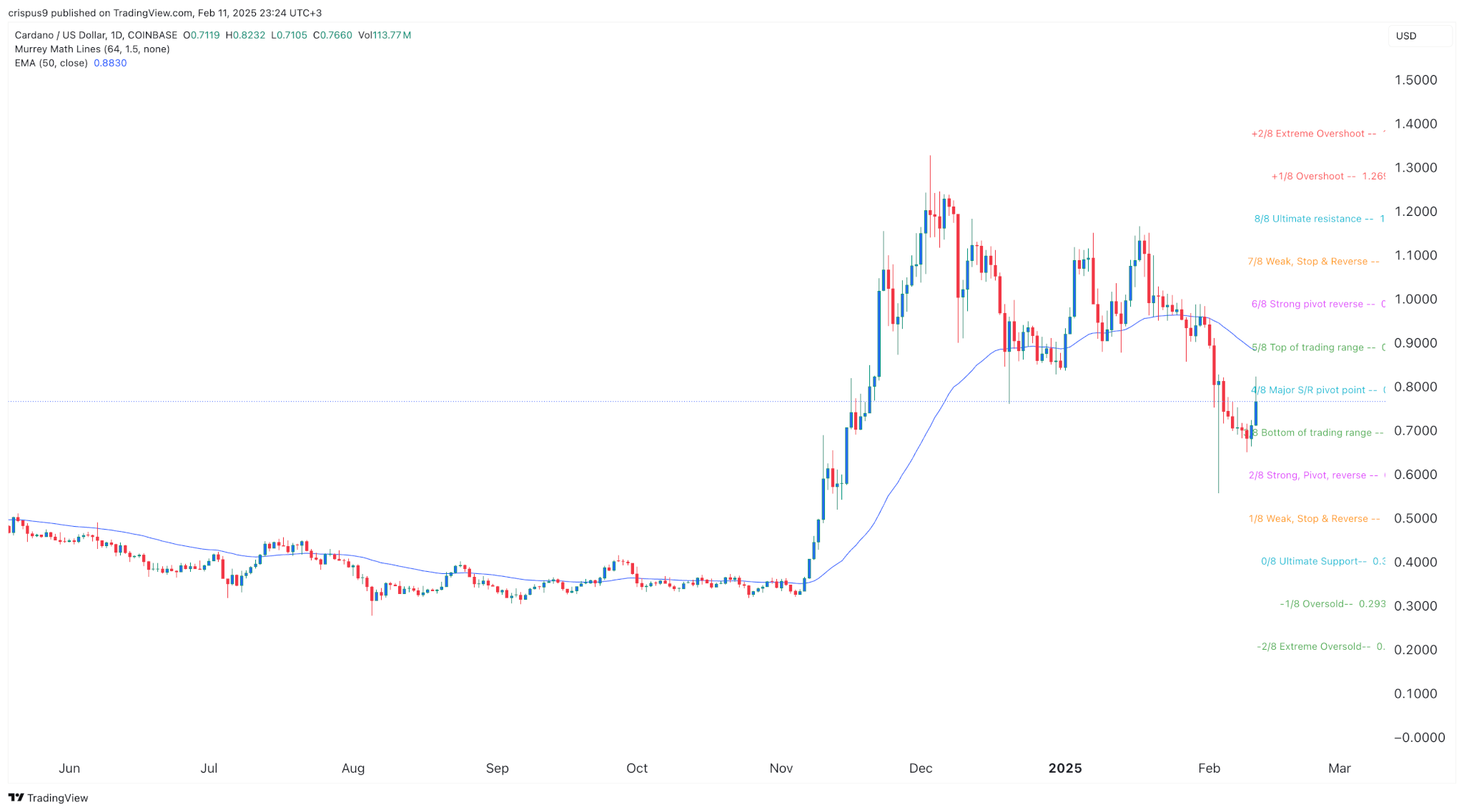

Cardano price appears set for a week of gains after being in the red over the past three weeks. On the one hand, new projects in the smart contract space have exerted pressure on Cardano. However, its healthy adoption rate and blockchain infrastructure continues to support the altcoin.

On its daily chart, cardano price remains below the 25 and 50-day EMAs. At an RSI of 39, it has some room for a rebound. However, while the rebounding will likely continue in the ensuing sessions, it may be range-bound in the short term.

At its current level, the range between the support zone of $0.7005 and the 20-day EMA at $0.8185 is worth watching. With additional bullish momentum, the bulls will be eyeing the next resistance level at $0.8875.

Market

Shiba Inu Price Down 27% in 30 Days

Shiba Inu (SHIB) price has been trading sideways over the past seven days but remains down 27% in the last 30 days, reflecting a broader period of weakness. Despite recent signs of recovery, momentum indicators like the RSI and BBTrend suggest that SHIB is still struggling to establish a clear direction.

However, a potential golden cross forming on the EMA lines could signal a bullish breakout, with SHIB eyeing key resistance levels at $0.000017 and $0.000019. On the downside, if selling pressure resumes, SHIB could retest support at $0.000014.

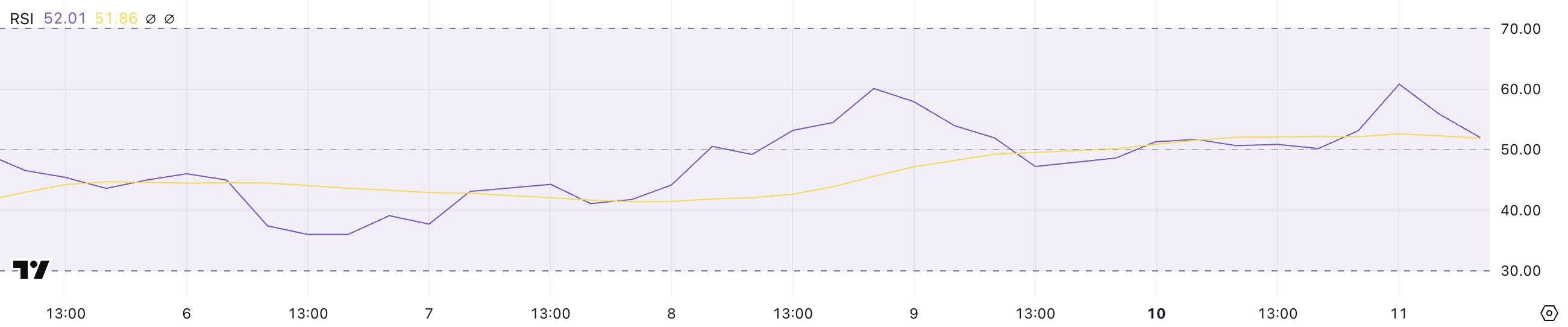

SHIB RSI Is Currently Neutral, Down From 60.8

Shiba Inu RSI is currently at 52 after a sharp move yesterday that saw it surge from 50 to 60.8. The Relative Strength Index (RSI) is a momentum indicator used to measure whether an asset is overbought or oversold on a scale of 0 to 100.

Typically, an RSI above 70 signals overbought conditions and a potential price pullback, while an RSI below 30 indicates oversold conditions and the possibility of a rebound.

When the RSI hovers around the 50 mark, it suggests a lack of strong momentum in either direction, meaning the asset is in a neutral zone without a defined trend.

With the meme coin’s RSI now sitting at 52, it indicates that the recent bullish momentum has faded slightly, but the price is not yet in a bearish state. While RSI above 50 can suggest slight bullish strength, it is not strong enough to confirm a breakout.

If SHIB can regain momentum and push RSI back above 60, it could signal increasing buying pressure and a potential continuation of the uptrend.

However, if RSI continues to decline below 50, it may indicate weakening demand, leaving SHIB vulnerable to further consolidation or even a pullback.

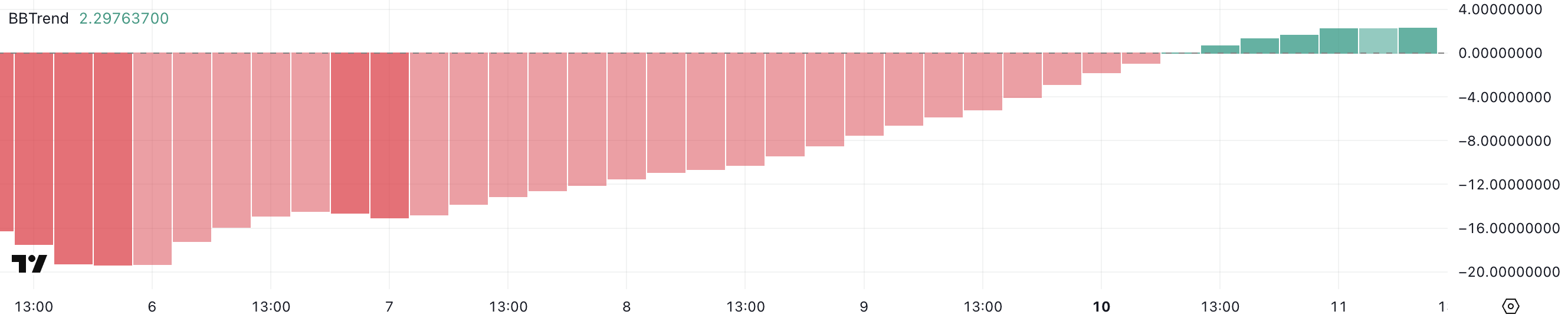

Shiba Inu BBTrend Is Now Positive, But Still Low

Shiba Inu BBTrend indicator has turned positive, currently at 2.29, after spending six consecutive days in negative territory and reaching a low of -19.3 on February 6. The BBTrend, or Bollinger Bands Trend, is a volatility-based indicator that helps determine the strength and direction of a trend.

A positive BBTrend value suggests bullish momentum, while a negative value indicates bearish pressure. The deeper the negative reading, the stronger the selling pressure, whereas higher positive values signal an increasing uptrend.

With SHIB BBTrend now at 2.29, the shift from negative territory suggests that bearish momentum has weakened, and buying pressure is starting to build. While this does not yet confirm a strong uptrend, it indicates a potential transition toward a more bullish structure.

If BBTrend continues rising, it could signal increasing volatility in favor of buyers, pushing SHIB toward further gains.

However, if the indicator struggles to move higher or turns negative again, it would suggest that the recent recovery lacks strength, leaving SHIB at risk of renewed downward pressure.

SHIB Price Prediction: A Potential 57% Surge

Shiba Inu’s EMA lines suggest that a golden cross could form soon. A golden cross is a bullish signal that occurs when a short-term moving average crosses above a long-term moving average. If this pattern materializes, SHIB price could gain momentum and first test the resistance at $0.000017.

A breakout above this level could push the price higher toward $0.000019, and if bullish momentum continues, SHIB could target $0.0000249, representing a potential 57% upside.

On the other hand, if SHIB price fails to sustain buying pressure and enters a renewed downtrend, it may test the key support at $0.000014.

A breakdown below this level would open the door for further downside, with the price potentially falling to $0.0000116, marking a 27% decline. This would indicate that the bearish momentum seen in recent weeks remains intact, increasing the likelihood of further losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Altcoins Trending Today On February 11

The crypto market has experienced a rebound today, with the uptick in trading activity signaling renewed investor interest.

As market sentiment improves, several altcoins have recorded gains as they receive attention from market participants. Among the standout altcoins today are AI16z, B3, and PinLink, each showing significant price movements.

ai16z (AI16Z)

AI Agent token AI16Z is one of the altcoins trending today. It currently trades at $0.58, having surged 35% in price in the past 24 hours.

Beyond the broader market rally, AI16Z’s price surge is driven by a notable spike in whale activity. In an X (formerly Twitter) post, an on-chain analyst highlights a recent transaction, revealing that a particular whale address executed a massive $7.5 million swap.

The transaction included the acquisition of 6.5 million AI16Z tokens at an average price of $0.5609. This large-scale accumulation signals strong investor confidence and adds to the bullish momentum surrounding the AI token.

If this momentum continues, AI16Z could break above $0.68 and target $1.21.

On the other hand, if buying activity wanes, AI16Z could fall to $0.41.

B3 (B3)

Newly launched Layer-3 coin B3 is another altcoin that has received significant attention today from traders and analysts alike. At the time of writing, the altcoin trades at $0.0063, up 34% in the past 24 hours.

On an hourly chart, B3’s Relative Strength Index (RSI) is in an upward trend, reflecting the buying activity among traders. It is currently at 56.04.

An asset’s RSI measures its oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. On the other hand, values under 30 indicate that the asset is oversold and may witness a rebound.

At 56.04 and in an uptrend, B3’s RSI suggests that buying pressure is increasing steadily, hinting at a potential continuation of its rally. In this case, the altcoin’s price could reach $0.0075.

However, if selloffs commence, B3’s price may fall to $0.0061. The lack of strong support at this level could cause its price to drop to $0.0052.

PinLink (PIN)

AI token PIN is a trending altcoin today. Its price has soared 10% over the past 24 hours, fueled by the general market uptick. However, this rally is not backed by any significant demand for the altcoin, as reflected by its falling daily trading volume.

This has totaled $2.39 million, dropping by 9% in the past 24 hours. When an asset’s price rises while its trading volume falls, a divergence occurs, suggesting that the price increase may not be supported by strong market participation.

This indicates a lack of conviction or sustainability in the upward trend. It also signals that the price rise is driven by a smaller number of traders, possibly making it more vulnerable to correction.

If PIN reverses its current trend, its value could drop to $0.75.

Conversely, a spike in the demand for the altcoin could drive its price up to $1.53.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoBitcoin Treasury Firm Metaplanet Is Japan’s Hottest Stock, Up 3,600%

-

Altcoin12 hours ago

Altcoin12 hours agoCrypto ETF Filings Fuel Rally In ADA, LTC, & Others, Altcoin Season Imminent?

-

Altcoin22 hours ago

Altcoin22 hours agoCardano Price at Critical Level as It Tests Strong Support

-

Regulation14 hours ago

Regulation14 hours agoNYSE Arca files 19b-4 for Grayscale Cardano ETF as Bitcoin Pepe’s presale goes live

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Holds Multi-Year Bullish Pattern – Expert Suggests The Next Move Will Be ‘The Real Deal’

-

Market24 hours ago

Market24 hours agoYi He Discusses Binance’s Token Listing Criteria After CZ’s Remark

-

Altcoin13 hours ago

Altcoin13 hours agoSolana Smart Whales Bag $18.5M Tokens; SOL Price To Hit $296?

-

Altcoin24 hours ago

Altcoin24 hours agoCrypto Analyst Predicts Dogecoin Price Could Hit $3.69 In Next Rally