Market

Breakout Signals Potential for $1.05

Solana-based meme coin Fartcoin has been the market’s top performer over the past 24 hours, surging by 30% and outperforming major cryptocurrencies. The rally comes as the broader market posts a modest 2% rebound following the recent decline.

The meme coin has broken above a descending trendline that previously kept its price in a downtrend. This breakout signals a potential shift in momentum.

Fartcoin Breaks Above Bearish Trend Line

FARTCOIN’s double-digit price surge has pushed it above a descending trendline that previously kept its price in a downtrend. This bearish pattern emerged as traders began to take profit after the token climbed to an all-time high of $2.74 on January 19.

However, the resurgence in FARTCOIN’s demand and the resulting break above this trend line marks a bullish shift in the market trend.

When an asset breaks above a descending trendline, it signals a potential trend reversal from bearish to bullish. This indicates that the selling pressure is weakening, and buyers are gaining control. This breakout suggests that FARTCOIN may continue upward if demand remains strong.

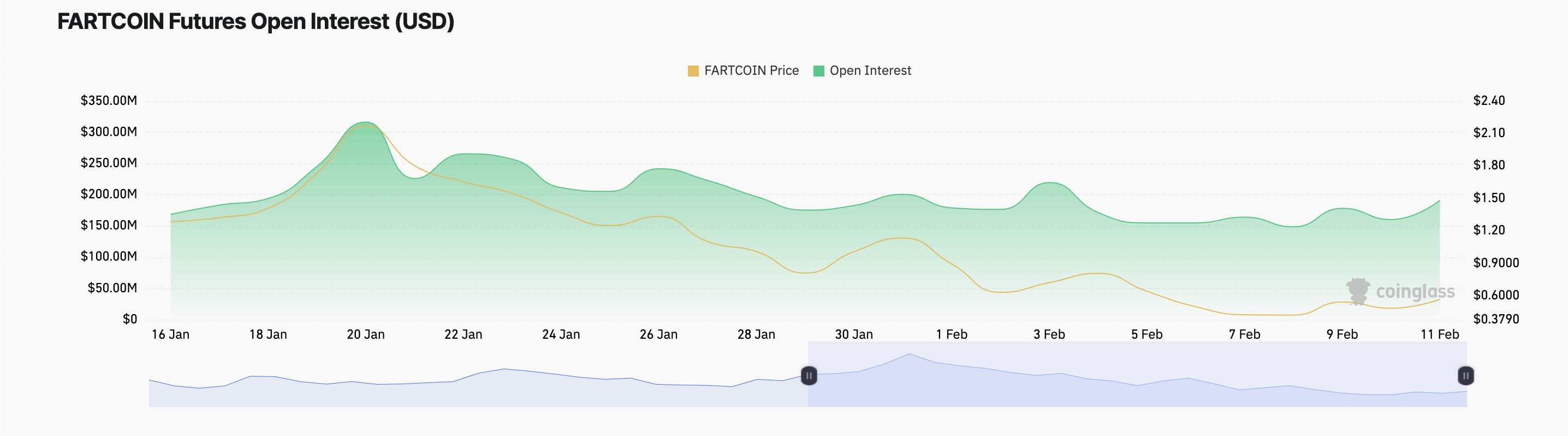

FARTCOIN’s surging open interest also suggests increasing trader confidence, reinforcing the bullish outlook. At press time, it is at $221 million, noting a 28% spike over the past 24 hours.

Open interest measures the total number of active futures or options contracts that have not been closed or settled. Spikes in open interest during a price rally like this indicate strong market participation, with new capital entering trades. It suggests a sustained momentum and hints at the potential for further price gains.

FARTCOIN Price Prediction: Will It Hit $1.05 or Fall Back to $0.40?

A sustained rally above the breakout line could propel FARTCOIN to new heights. However, the buying momentum must also be sustained for this to happen.

The meme coin could rally back above the $1 price zone to trade at $1.05 in this scenario.

However, if profit-taking commences, this bullish outlook will be invalidated. The token’s price could fall below the descending trend line to trade at $0.40 in this case

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Altcoins Trending Today On February 11

The crypto market has experienced a rebound today, with the uptick in trading activity signaling renewed investor interest.

As market sentiment improves, several altcoins have recorded gains as they receive attention from market participants. Among the standout altcoins today are AI16z, B3, and PinLink, each showing significant price movements.

ai16z (AI16Z)

AI Agent token AI16Z is one of the altcoins trending today. It currently trades at $0.58, having surged 35% in price in the past 24 hours.

Beyond the broader market rally, AI16Z’s price surge is driven by a notable spike in whale activity. In an X (formerly Twitter) post, an on-chain analyst highlights a recent transaction, revealing that a particular whale address executed a massive $7.5 million swap.

The transaction included the acquisition of 6.5 million AI16Z tokens at an average price of $0.5609. This large-scale accumulation signals strong investor confidence and adds to the bullish momentum surrounding the AI token.

If this momentum continues, AI16Z could break above $0.68 and target $1.21.

On the other hand, if buying activity wanes, AI16Z could fall to $0.41.

B3 (B3)

Newly launched Layer-3 coin B3 is another altcoin that has received significant attention today from traders and analysts alike. At the time of writing, the altcoin trades at $0.0063, up 34% in the past 24 hours.

On an hourly chart, B3’s Relative Strength Index (RSI) is in an upward trend, reflecting the buying activity among traders. It is currently at 56.04.

An asset’s RSI measures its oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. On the other hand, values under 30 indicate that the asset is oversold and may witness a rebound.

At 56.04 and in an uptrend, B3’s RSI suggests that buying pressure is increasing steadily, hinting at a potential continuation of its rally. In this case, the altcoin’s price could reach $0.0075.

However, if selloffs commence, B3’s price may fall to $0.0061. The lack of strong support at this level could cause its price to drop to $0.0052.

PinLink (PIN)

AI token PIN is a trending altcoin today. Its price has soared 10% over the past 24 hours, fueled by the general market uptick. However, this rally is not backed by any significant demand for the altcoin, as reflected by its falling daily trading volume.

This has totaled $2.39 million, dropping by 9% in the past 24 hours. When an asset’s price rises while its trading volume falls, a divergence occurs, suggesting that the price increase may not be supported by strong market participation.

This indicates a lack of conviction or sustainability in the upward trend. It also signals that the price rise is driven by a smaller number of traders, possibly making it more vulnerable to correction.

If PIN reverses its current trend, its value could drop to $0.75.

Conversely, a spike in the demand for the altcoin could drive its price up to $1.53.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This is Why Bitcoin Could Face a Supply Shock Soon

Bitcoin may face a major supply shock as exchange reserves hit the lowest point in years. CryptoQuant data shows reserves at the lowest level since it began recording this data in 2022.

Additionally, demand for Bitcoin is spiking from long-term holders despite price turmoils. This supply shock could become a major bullish signal for the coming months.

Is Bitcoin Headed for a Supply Shock?

Since Bitcoin has reached a new era of market integration and institutional acceptance, corporate and individual whales are acquiring as much as they can.

Last month, ETF issuers were buying it 20x faster than miners could produce it, and they collectively hold more than Satoshi Nakamoto. However, due to these trends, Bitcoin’s supply is in jeopardy.

As CryptoQuant data shows, around 2.5 million BTC is currently held in exchange reserves. This is the lowest reserve balance in nearly 3 years.

Additionally, the US Bitcoin ETF issuers and other corporate whales are very flashy buyers, but 69% of the supply is held by individuals. In fact, ETFs recently had their first weekly outflow of 2025, showing that the problem goes beyond them.

In other words, the supply crisis in Bitcoin is very real right now. Additionally, the vast majority of it has been mined already, with only 5.7% remaining. On top of that, unknown quantities are lost. A slight increase in demand could kick off a fresh, bullish cycle.

This demand may be materializing despite Bitcoin’s recent price declines. This week, the market has witnessed a sharp spike in Permanent Holder Demand, signaling strong confidence from individual users. These holders are also selling BTC less frequently. These factors could combine to create a Bitcoin supply shock.

“Soon every billionaire will buy a billion dollars of Bitcoin and the supply shock will be so great that we’ll stop measuring BTC in terms of fiat,” said Michael Saylor in a recent interview.

There’s also the consideration of a Bitcoin reserve in the US and many other countries. In the US, 20 states have currently proposed bills to establish a strategic Bitcoin reserve. If such strategies are approved, state and national governments will purchase BTC, and the supply will further decline.

So, at the current level, a Bitcoin supply chain is very much imminent. However, macroeconomic factors, such as interest rates and global tariffs, will also play a critical role.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HARRYBOLZ Price Soars 3,000% After Elon Musk’s Name Swap

Elon Musk’s recent name change on social media platform X (Twitter) inspired a parabolic surge for the HARRYBOLZ token.

It marks the second time Musk has inadvertently inspired a rally for a crypto token by changing his name on the popular social media platform.

Elon Musk Changes X (Twitter) Name To Harry Bōlz

While his X handle remains @elonmusk, the platform’s CEO has changed his account name to Harry Bōlz. In the immediate aftermath of this name change, the price of HARRYBOLZ rallied by over 3,000% before profit booking commenced.

Notably, this is not the first time Musk has used Harry Bōlz as his name on X. In April 2023, he pulled a similar move, leaving his followers baffled. At the time, followers speculated that the tech mogul was plotting his next major project. Meanwhile, others ascribed the move to his occasional acts playing with fans, saying it was nothing more than wordplay.

Moreover, in January 2023, Musk changed his name to Mr.Tweet and again to ‘Naughtius Maximus’ before reverting back to his original name. More recently, Elon Musk changed his name on X to Kekius Maximus, inspiring a 500% surge for the KEKIUS meme coin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin21 hours ago

Altcoin21 hours agoBitcoin Treasury Firm Metaplanet Is Japan’s Hottest Stock, Up 3,600%

-

Altcoin11 hours ago

Altcoin11 hours agoCrypto ETF Filings Fuel Rally In ADA, LTC, & Others, Altcoin Season Imminent?

-

Altcoin23 hours ago

Altcoin23 hours agoCrypto Analyst Says Dogecoin Price Is Ready For Rally Toward $0.5, But It’s Not All Good News

-

Regulation22 hours ago

Regulation22 hours agoBloomberg Analysts Reveal Prediction For Solana, XRP, Dogecoin, & Litecoin ETFs

-

Market21 hours ago

Market21 hours agoADA Price Struggles as Bearish Indicators Persist

-

Altcoin20 hours ago

Altcoin20 hours agoCardano Price at Critical Level as It Tests Strong Support

-

Regulation13 hours ago

Regulation13 hours agoNYSE Arca files 19b-4 for Grayscale Cardano ETF as Bitcoin Pepe’s presale goes live

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Holds Multi-Year Bullish Pattern – Expert Suggests The Next Move Will Be ‘The Real Deal’