Market

Grayscale Seeks SEC Approval for Spot Cardano ETF

Grayscale, through NYSE Arca, has submitted a filing under the Securities and Exchange Act of 1934 to introduce a spot Cardano exchange-traded fund (ETF).

This filing stands out from previous ones, representing a direct ETF launch rather than a conversion. Grayscale has not yet offered a standalone investment product for ADA, marking a new chapter in its investment offerings.

Grayscale Files For Cardano ETF

The exchange submitted the 19b-4 filing to the SEC on February 10. The proposed ETF aims to offer investors regulated exposure to Cardano. Moreover, if approved, the shares will be listed under the ticker symbol “GADA.”

“While an investment in the Shares is not a direct investment in ADA, the Shares are designed to provide investors with a cost-effective and convenient way to gain investment exposure to ADA,” the filing stated.

Grayscale’s proposed fund would mark the debut of a US spot ETF for Cardano. This filing comes after Tuttle Capital Management submitted a request for ten leveraged crypto ETFs featuring an ADA fund.

“First one in US and ballpark 60th crypto ETF filed this year so far,” Bloomberg’s senior ETF analyst, Eric Balchunas, posted on X (formerly Twitter).

In addition to Cardano, Grayscale has also filed to convert other existing trusts into spot ETFs, including those for Solana (SOL), XRP (XRP), and Dogecoin (DOGE). Nonetheless, the application faces regulatory challenges.

The SEC previously categorized Cardano as a security in its lawsuits against Binance and Coinbase, alongside XRP and Solana. These legal obstacles could delay approval, as seen with other altcoin-based ETFs.

That said, recent developments suggest a potential shift in the regulatory stance. Last week, the SEC officially acknowledged the 19b-4 filing for the Grayscale Solana ETF. This move has led analysts to speculate that it could set a positive precedent for other altcoin ETFs, including those for XRP and ADA.

The filing comes after Bloomberg analysts James Seyffart and Balchunas outlined the odds for altcoin ETF approvals. According to their analysis, Litecoin (LTC) has a 90% chance of securing an ETF approval. Furthermore, DOGE stands at 75%, SOL is at 70%, and XRP is at 65%. Yet, how things will fare for ADA remains to be seen.

Meanwhile, after the news broke, ADA surged by 9.3% on the 24-hour chart. In daily gains, it even outperformed Bitcoin (BTC), Ethereum (ETH), and XRP.

Notably, this rise followed a period of losses. Over the past week, it was down by 4.7%. Furthermore, the last month was also bearish for the altcoin as it dipped by 26.3%. At the time of writing, ADA was trading at $0.75.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HARRYBOLZ Price Soars 3,000% After Elon Musk’s Name Swap

Elon Musk’s recent name change on social media platform X (Twitter) inspired a parabolic surge for the HARRYBOLZ token.

It marks the second time Musk has inadvertently inspired a rally for a crypto token by changing his name on the popular social media platform.

Elon Musk Changes X (Twitter) Name To Harry Bōlz

While his X handle remains @elonmusk, the platform’s CEO has changed his account name to Harry Bōlz. In the immediate aftermath of this name change, the price of HARRYBOLZ rallied by over 3,000% before profit booking commenced.

Notably, this is not the first time Musk has used Harry Bōlz as his name on X. In April 2023, he pulled a similar move, leaving his followers baffled. At the time, followers speculated that the tech mogul was plotting his next major project. Meanwhile, others ascribed the move to his occasional acts playing with fans, saying it was nothing more than wordplay.

Moreover, in January 2023, Musk changed his name to Mr.Tweet and again to ‘Naughtius Maximus’ before reverting back to his original name. More recently, Elon Musk changed his name on X to Kekius Maximus, inspiring a 500% surge for the KEKIUS meme coin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano Price Rises 18%; Investors Month Long Losses Fade

Cardano’s price has recently bounced back, rising by 18% over the last 24 hours. This recovery follows a notable correction, signaling that the bullish pattern ADA has been forming remains intact.

After struggling for several weeks, the altcoin’s ability to regain momentum offers hope for continued positive price action.

Cardano Traders Are Confused

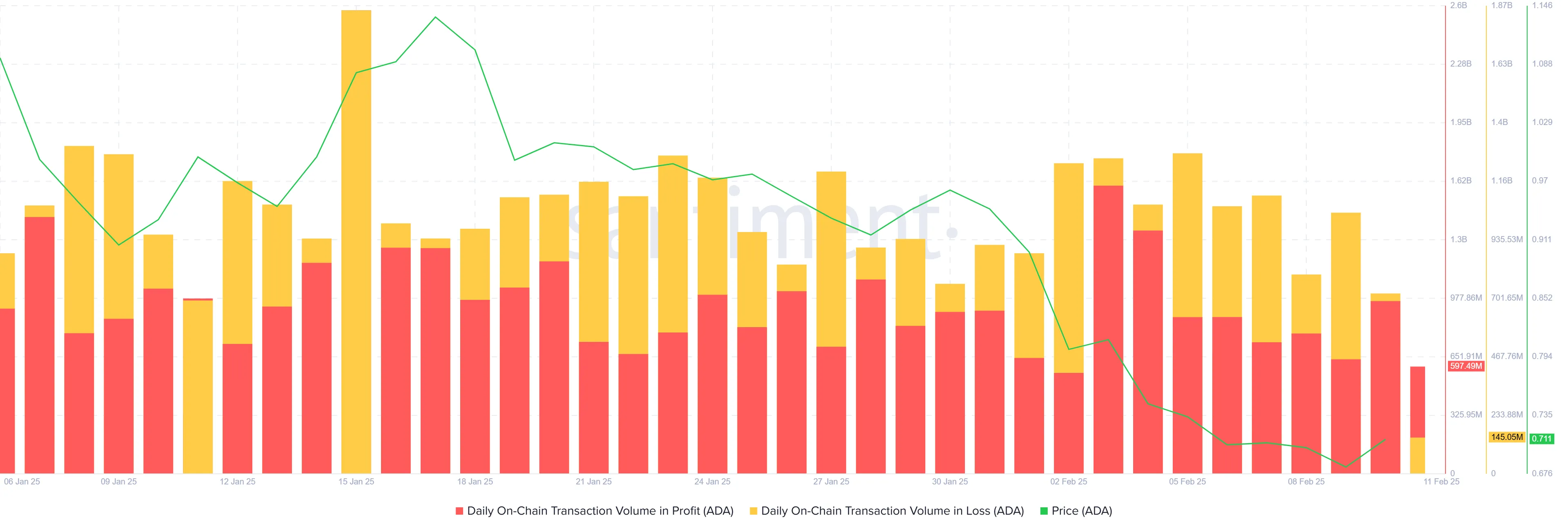

Over the past month, Cardano investors have faced significant losses as the price of ADA continues to follow a downward trend. Most transactions were showing losses, with the market unable to sustain any meaningful rallies.

The recent shift toward transactions showing profits is a positive sign, indicating a potential change in market sentiment.

As ADA’s price rose above recent lows, the volume of profitable transactions increased, signaling that investors are starting to recover from prior losses. This shift in transaction volume, with profits now edging out losses. It suggests that the altcoin is finding a stable support level, which could lead to further price appreciation.

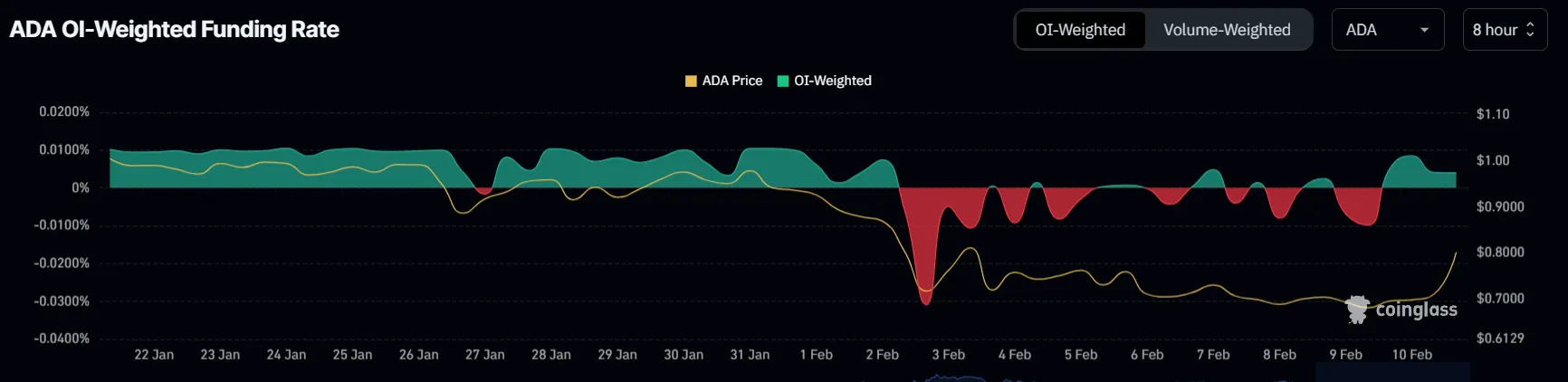

The macro momentum of Cardano has also shown signs of improvement. The funding rate, which fluctuated for the past two weeks, had been a sign of uncertainty among traders.

The lack of upward price momentum caused traders to shift from a positive to a negative stance in February, opting to capitalize on price declines instead.

However, the funding rate has turned positive again, signaling a potential shift in trader sentiment. If Cardano continues its price uptick, traders could maintain a more bullish outlook. A sustained positive funding rate would further support this shift, reinforcing the possibility of ADA’s continued upward momentum in the near term.

Cardano Price Prediction: Can ADA Secure Support at $0.85?

Cardano’s price rose 18% in the last 24 hours. It is currently trading at $0.80, having successfully breached the $0.77 resistance. The altcoin now aims to flip the $0.85 resistance into support.

A successful breach of this level could allow ADA to continue rising, attracting further investor interest. At the same time, this rise would keep the bullish descending wedge pattern intact.

Securing $0.77 as support is essential for ADA’s continued bullish movement. If this level holds, and $0.85 is flipped into support, Cardano could push towards $0.99, potentially even $1.00. Such a move would signify sustained momentum and potentially mark the start of a longer-term uptrend.

However, if ADA fails to breach the $0.85 resistance, it could fall back to $0.77 or dip lower to $0.70. A decline to these levels would invalidate the current bullish thesis. This would also erase the recent gains and potentially lead to renewed selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Maxine Waters Pushes for Stablecoin Regulation With New Bill

On February 10, Maxine Waters, the representative for California’s 43rd Congressional District, introduced an initial discussion draft. The unnamed bill seeks to establish a regulatory framework for stablecoin issuers in the US.

It follows extensive bipartisan negotiations and technical guidance from the Treasury Department and the Federal Reserve.

Maxine Waters Pushes For Stablecoin Regulation

The proposed bill outlines a licensing and regulatory framework for payment stablecoin issuers. It details the criteria for both nonbank and bank issuers. A central feature is the Federal Reserve’s role in supervising stablecoin issuers. This ensures strict compliance with the proposed regulations.

The bill mandates that stablecoin issuers back their coins one-to-one with reserves. This includes US currency, insured deposits, short-term Treasury bills, or repurchase agreements backed by Treasury securities.

It also prohibits any unauthorized individual or entity from issuing a payment stablecoin in the US. Violators would face significant penalties.

“Be fined not more than $1,000,000 for each such violation; (ii) imprisoned for not more than 5 years; or (iii) be fined as described in clause (i) and imprisoned as described in clause (ii),” the bill read.

In addition to regulatory oversight, the bill includes provisions designed to strengthen consumer protection. It prevents non-financial companies from owning stablecoin issuers, ensuring the separation of banking and commerce.

The proposal also mandates strict compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) laws. Therefore, it subjects issuers to US sanctions laws.

Additionally, it bans individuals convicted of certain crimes, such as Sam Bankman-Fried, from holding executive positions or significant shares in stablecoin issuers.

The Federal Reserve would be granted enforcement authority. At the same time, existing regulators, including the Treasury Department, the Consumer Financial Protection Bureau (CFPB), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC), would maintain oversight over activities related to stablecoins, wallet providers, exchanges, and intermediaries.

This bill is crafted with input from both Republican and Democratic congressional staff. Moreover, it is seen as a bipartisan effort to create a balanced, effective framework for stablecoin regulation.

“This draft bill fosters innovation, while properly addressing and prioritizing concerns I have long held about safeguarding our nation’s consumers from scams that have plagued the crypto industry,” said Congresswoman Waters.

Waters’ announcement followed a release by Republicans French Hill and Bryan Steil. The representatives introduced their version of a payment stablecoin bill just days earlier. The proposed bill is titled STABLE Act of 2025.

Meanwhile, efforts to regulate stablecoins are also underway in the Senate. On February 4, Senator Bill Hagerty introduced the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act.

Besides the bills, on February 7, CFTC Acting Chair Caroline Pham announced a CEO Forum with a key focus on stablecoin regulations. The forum will bring together major crypto companies to discuss and propose new policies for stablecoins and tokenized non-cash collateral.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin18 hours ago

Altcoin18 hours agoBitcoin Treasury Firm Metaplanet Is Japan’s Hottest Stock, Up 3,600%

-

Market24 hours ago

Market24 hours agoStrategy Resumes Bitcoin Buys After Rebrand and Purchase Pause

-

Altcoin8 hours ago

Altcoin8 hours agoCrypto ETF Filings Fuel Rally In ADA, LTC, & Others, Altcoin Season Imminent?

-

Altcoin23 hours ago

Altcoin23 hours agoDogecoin’s Parallel Channel Formation Hints At A Path To New All-Time High

-

Altcoin17 hours ago

Altcoin17 hours agoCardano Price at Critical Level as It Tests Strong Support

-

Regulation10 hours ago

Regulation10 hours agoNYSE Arca files 19b-4 for Grayscale Cardano ETF as Bitcoin Pepe’s presale goes live

-

Altcoin20 hours ago

Altcoin20 hours agoCrypto Analyst Says Dogecoin Price Is Ready For Rally Toward $0.5, But It’s Not All Good News

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Holds Multi-Year Bullish Pattern – Expert Suggests The Next Move Will Be ‘The Real Deal’