Bitcoin

Florida Moves Toward State Crypto Investment

The American state of Florida could be one of the pioneering local governments that allows a percentage of its state funds for cryptocurrency investments, particularly Bitcoin.

Florida Senator Joe Gruters has filed a bill that would permit the US state to use 10% of its funds to buy Bitcoin. This political backing could entice other American states to build their own cryptocurrency investments.

My state of Florida introduces a Bitcoin investment bill! 💪

If passed Florida’s CFO may allocate up to 10% of public funds to invest in $BTC or other digital assets.Thank you Senator Joe Gruters 🫡 pic.twitter.com/nF0SoTbT96

— Lucidvein (@Lucidvein) February 8, 2025

Florida To Invest In Bitcoin

Gruters introduced a legislative measure that would allow Florida to invest in Bitcoin using state funds to combat inflation.

The senator said that Senate Bill 550 proposed to permit Florida’s chief financial officer to use up to 10% of its funds to buy Bitcoin and other cryptocurrencies.

“The state should have access to tools such as BTC to protect against inflation,” Gruters said.

The bill aims to incorporate Bitcoin into state financial planning in the US, a legislative action that could reshape state authorities’ investment funds strategy and lead to other states adopting crypto.

Fighting Inflation With BTC

Gruters eyes that the proposed bill would help financial planners of Florida to hedge against inflation.

“Inflation has eroded the purchasing power of assets held in state funds managed by the Chief Financial Officer, and this erosion diminishes the value of the state’s reserves, affecting the financial stability and economic security of this state, its taxpayers, and its residents,” Gruters said.

The senator explained in the bill that inflation has “eroded the purchasing power of assets” managed by the state’s chief financial officer, adding that the state is responsible for safeguarding “Florida’s financial resources” against inflation and economic uncertainties.

“Bitcoin is viewed as a hedge against inflation by sovereign nations and prominent investment advisors, including BlackRock, Fidelity, and Franklin Templeton,” he said.

Hence, the American senator explained that Florida should have access to tools like Bitcoin to protect state funds from inflation.

Impact On The State Economy

Once Gruter’s proposed legislation was enacted, it would be beneficial to the state in several ways.

Analysts said that investing in Bitcoin would diversify Florida’s state assets, adding that the state would incorporate in its portfolio an asset that historically provides high returns but with significant volatility.

Market observers added that this crypto legislation would help turn Florida into a blockchain hub that promotes cryptocurrency innovation, further establishing Florida as a crypto-friendly state.

Florida might become the model state for adopting Bitcoin in state financial planning, making BTC adoption in government finance a reality.

Crypto analysts also see that Florida’s success could encourage other states to follow its lead and start incorporating digital assets into their financial systems.

Featured image from Shutterstock, chart from TradingView

Bitcoin

China Liquidates Seized Crypto to Boost Struggling Treasury

Amid mounting economic challenges and a growing pile of confiscated cryptocurrencies, local governments in China are increasingly liquidating seized digital assets to bolster strained public finances.

The practice raises legal and regulatory questions, especially concerning China’s blanket ban on crypto trading.

China Selling Seized Crypto To Bolster Treasury

China reportedly held around 15,000 Bitcoin (BTC) worth $1.4 billion by the end of 2024. According to River, a Bitcoin investment firm, this places the country among the top 15 global holders of the asset.

However, reports suggest China’s local governments are offloading digital currencies through private firms despite the national crypto ban.

Cas Abbe, a Web3 growth manager, and Binance exchange affiliate, noted on X that the dump in crypto prices may partly stem from these offloading activities.

“Local governments in China are selling seized crypto to top up their treasury. Despite the crypto trading ban in China, local governments are using private companies to offload their holdings. This explains pretty much the dump even before tariff news hit the market,” Abbe noted.

The surge in liquidations comes as authorities grapple with inconsistent policies for handling crypto seized from criminal investigations, which spiked sharply in 2023.

Over $59 billion was tied to crypto-related crimes in China that year. Blockchain security firm SAFEIS reported that more than 3,000 people were prosecuted for offenses ranging from internet fraud to illegal gambling.

Despite Beijing’s ban, local governments have reportedly turned to private firms to offload confiscated tokens. Specifically, they are converting them into cash to fund their treasuries.

Jiafenxiang, a Shenzhen-based technology firm, has sold more than 3 billion yuan ($414 million) worth of digital assets in offshore markets since 2018. Documents reviewed by Reuters link the company to liquidation deals with local authorities in Xuzhou, Hua’an, and Taizhou.

Though practical for cash-strapped regions, the process is legal gray territory. Such practices risk undermining the country’s crypto enforcement regime without clear regulatory frameworks.

“This raises so many questions about transparency. How are they even doing this legally?” noted one analyst in a post.

Experts are now calling for urgent regulatory reforms. These include judicial recognition of crypto as assets and the creation of standardized disposal mechanisms.

Some are even floating the idea of building a centralized national crypto reserve. This mirrors Trump’s administration’s proposals to manage seized assets more strategically.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Is Bitcoin the Solution to Managing US Debt? VanEck Explains

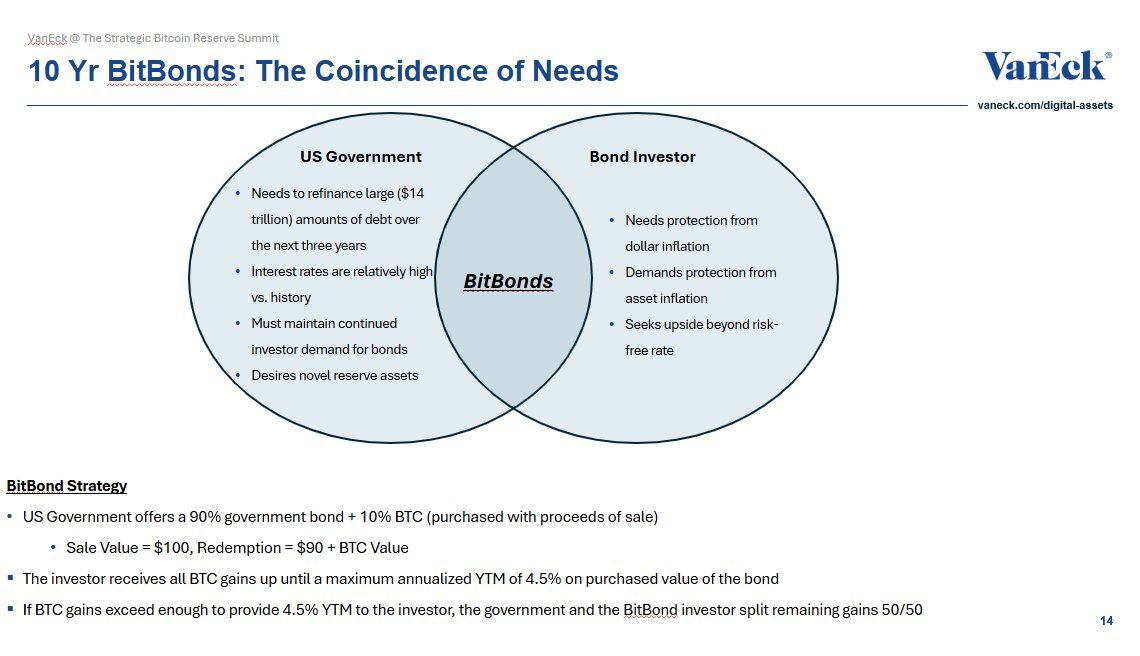

Matthew Sigel, Head of Digital Assets Research at VanEck, has proposed a new financial instrument, “BitBonds,” to help manage the US government’s looming $14 trillion refinancing debt requirement.

The 10-year financial instrument combines traditional US Treasury bonds with Bitcoin (BTC) exposure. This offers a potential solution to the nation’s fiscal concerns.

Can Bitcoin-Backed Bonds Help Solve the US Debt Crisis?

According to Sigel’s proposal, BitBonds’ investment structure allocates 90% of the funds to low-risk US Treasury securities and 10% to Bitcoin, combining stability with the potential for higher returns. Additionally, the government would purchase Bitcoin with proceeds from the bond sale.

Investors would receive all Bitcoin gains up to a maximum annualized yield-to-maturity of 4.5%. Furthermore, the investor and the government would split any additional gains equally.

“An aligned solution for mismatched incentives,” Sigel remarked.

From an investor perspective, Sigel highlighted that the bond offers a breakeven Bitcoin compound annual growth rate (CAGR) between 8% and 17%, depending on the coupon rate. Additionally, investors’ returns could skyrocket if Bitcoin grows at a 30%–50% CAGR.

“A convex bet—if you believe in Bitcoin,” he added.

However, the structure is not without risks: investors bear Bitcoin’s downside while only partially participating in its upside. Lower-coupon bonds may lose appeal if Bitcoin underperforms.

Meanwhile, the Treasury’s downside is limited. Even a complete collapse of Bitcoin’s value would still result in cost savings compared to traditional bond issuance. Yet, this is contingent on the coupon remaining below the breakeven threshold.

“BTC upside just sweetens the deal. Worst case: cheap funding. Best case: long-vol exposure to the hardest asset on Earth,” Sigel stated.

Sigel claimed that this hybrid approach aligns the interests of the government and investors over a 10-year period. The government faces high interest rates and significant debt refinancing needs. Meanwhile, investors seek protection from inflation and asset debasement.

The proposal comes amid growing concerns over the US debt crisis, exacerbated by the recent increase in the debt ceiling to $36.2 trillion, as reported by BeInCrypto. Notably, the Bitcoin Policy Institute (BPI) has also endorsed the concept.

“Building on President Donald J. Trump’s March 6, 2025, Executive Order establishing the Strategic Bitcoin Reserve, this white paper proposes that the United States adopt Bitcoin-Enhanced US Treasury Bonds (“₿ Bonds” or “BitBonds”) as an innovative fiscal tool to address multiple critical objectives,” the brief read.

In the paper, co-authors Andrew Hohns and Matthew Pines suggested that issuing $2 trillion in BitBonds at a 1% interest rate could cover 20% of the Treasury’s 2025 refinancing needs.

“Over a ten-year period, this represents nominal savings of $700 billion and a present value of $554.4 billion,” the authors wrote.

BPI estimates that if Bitcoin achieves a CAGR of 36.6%, the upside could potentially defease up to $50.8 trillion of federal debt by 2045.

These recommendations are part of broader conversations regarding Bitcoin’s potential impact on national finance. Previously, Senator Cynthia Lummis argued that a US Strategic Bitcoin Reserve could halve the national debt. In fact, VanEck’s analysis indicated that such a reserve could help reduce $21 trillion of debt by 2049.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Adoption Grows As Public Firms Raise Holdings In Q1

Public companies have added nearly 100,000 Bitcoin to their balance sheets during the first quarter of 2025, pushing total corporate Bitcoin holdings to a staggering 688,000 BTC worth $56.7 billion. According to data from crypto fund issuer Bitwise, this represents a 16% increase in total crypto holdings by publicly traded companies.

12 New Corporate Buyers Enter The Market

The Bitcoin buying spree wasn’t limited to existing crypto investors. Twelve public companies purchased Bitcoin for the first time during Q1, bringing the total number of Bitcoin-holding public firms to 79.

Hong Kong construction firm Ming Shing led new buyers, with its subsidiary Lead Benefit acquiring 833 BTC through two separate purchases – an initial 500 BTC buy in January followed by 333 BTC in February.

Video platform Rumble ranked as the second-largest new buyer, adding 188 BTC to its treasury in mid-March. In a move that stunned market watchers, Hong Kong investment firm HK Asia Holdings Limited purchased just one Bitcoin in February – a modest investment that still caused its share price to almost double in a single day of trading.

Companies are buying bitcoin, Q1 2025 edition. pic.twitter.com/qZc62N8vu5

— Bitwise (@BitwiseInvest) April 14, 2025

Japanese Firm Acquires At A Discount

While new entrants made headlines, existing Bitcoin holders also strengthened their positions. Japanese investment firm Metaplanet announced on April 14 that it had purchased an additional 319 BTC at an average price of 11.8 million yen (about $82,770) per coin.

This latest purchase brings Metaplanet’s total Bitcoin holdings to 4,525 BTC, currently valued at approximately $383.2 million. The company has spent nearly $406 million (58.145 billion yen) building its crypto stack.

Based on current holdings, Metaplanet now ranks as the 10th largest public company crypto holder worldwide, sitting behind Jack Dorsey’s Block, Inc., which holds 8,480 BTC.

BTC reclaiming the green zone in the last week. Source: Coingecko

Bitcoin Price Recovers After Brief Slump

Bitcoin trades at around $85,787 as of April 15, showing a decent performance over the past 24 hours according to CoinGecko data. The cryptocurrency has gained roughly 2.5% since the end of Q1 on March 31.

The price has bounced back from a brief drop below $75,000 on April 7. That temporary decline came after a broader market selloff triggered by a new round of global tariffs announced by US President Donald Trump.

The growing corporate interest in the top crypto comes as more companies look to diversify their treasury holdings. The combined value of public companies’ Bitcoin rose about 2.3% during the first quarter, reaching nearly $57 billion with BTC priced at $82,400 by quarter’s end.

Featured image from Crews Bank, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market23 hours ago

Market23 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Metrics Reveal Critical Support Level – Can Buyers Step In?

-

Market19 hours ago

Market19 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Market18 hours ago

Market18 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Adoption Grows As Public Firms Raise Holdings In Q1

-

Market17 hours ago

Market17 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market16 hours ago

Market16 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

-

Market15 hours ago

Market15 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline