Market

XRP Price Eyes Uptick as Network Activity Hits Monthly Low

XRP price has moved just 2% over the last seven days, struggling to sustain levels above $2.50 in recent days. Its market cap has now fallen to $140 billion, and its trading volume is up 47% in the last 24 hours, reaching $5.6 billion.

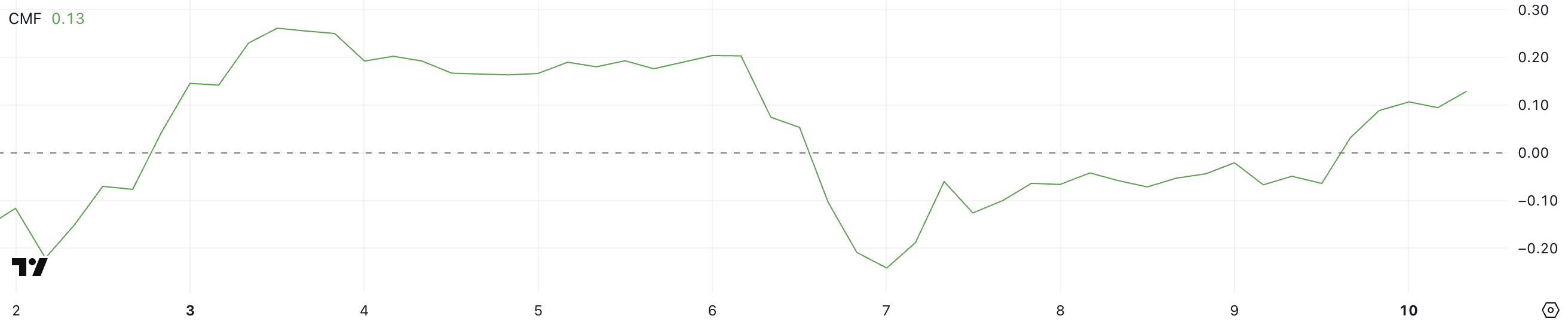

While the Chaikin Money Flow (CMF) has turned positive, signaling increased buying pressure, network activity has declined. Meanwhile, XRP’s EMA lines still indicate a bearish setup, with price trading in a key range that could determine whether it rebounds toward $3 or faces a 26% correction.

XRP CMF Is Increasing Fast

XRP Chaikin Money Flow (CMF) is currently at 0.13, a sharp rise from -0.06 just one day ago. This shift marks a return to positive territory after remaining negative for three consecutive days, indicating increased buying pressure.

A move from negative to positive suggests that more money is flowing into XRP rather than out, potentially signaling renewed interest from buyers.

The CMF measures the volume-weighted flow of money into or out of an asset, ranging from -1 to 1. Values above 0 indicate accumulation, while negative values suggest distribution.

With XRP CMF now at 0.13, buying pressure has returned, which could support further price stability or even upward movement if sustained. However, if CMF fails to hold above zero, selling pressure could resume, weakening bullish momentum.

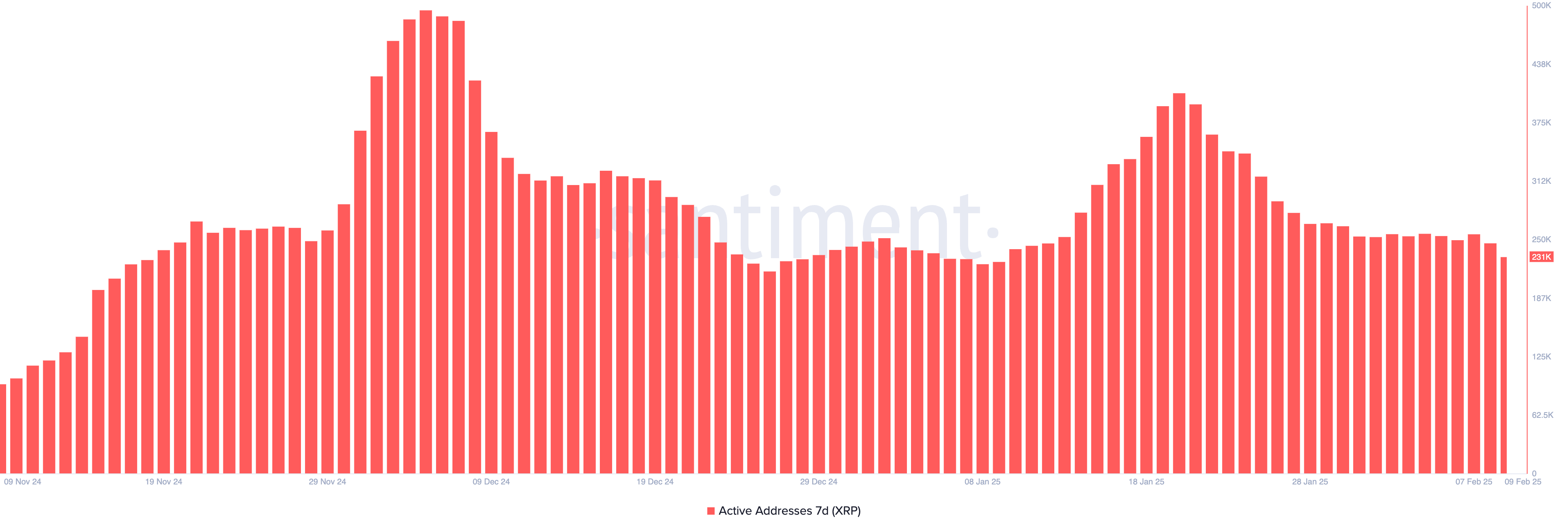

XRP Active Addresses Just Hit a Month-Low

XRP’s 7-day active addresses recently peaked at 495,000 on December 5, 2024, before declining. Another surge occurred in mid-January 2025, reaching 407,000 on January 20, but activity has steadily decreased since then.

The metric is currently at 231,000, marking its lowest point in a month. This decline suggests a slowdown in network engagement, which could have implications for price movement.

Tracking active addresses is crucial because it reflects user participation and overall demand for the asset. A sustained drop in active addresses often indicates reduced transaction activity, which can lead to lower liquidity and weaker buying pressure.

With XRP active addresses now at a monthly low, it suggests waning interest, potentially limiting price growth unless activity picks up again.

XRP Price Prediction: Will XRP Correct By 26% In February?

XRP’s EMA lines continue to show a bearish setup, with short-term moving averages positioned below long-term ones. Price is currently trading between a support level at $2.26 and a resistance at $2.54, indicating a critical range.

If bearish momentum increases and the $2.26 support fails, XRP price could see a significant drop toward $1.77, representing a potential 26% correction.

However, if buying pressure strengthens and an uptrend emerges, XRP price could push toward the $2.54 resistance. A breakout above that level could open the door for a test of $2.65. If momentum continues, XRP may even challenge $2.96.

Increased network activity would further support bullish momentum, as well as XRP ETF getting finally approved, potentially allowing XRP to break above $3 and test the next major resistance at $3.15.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

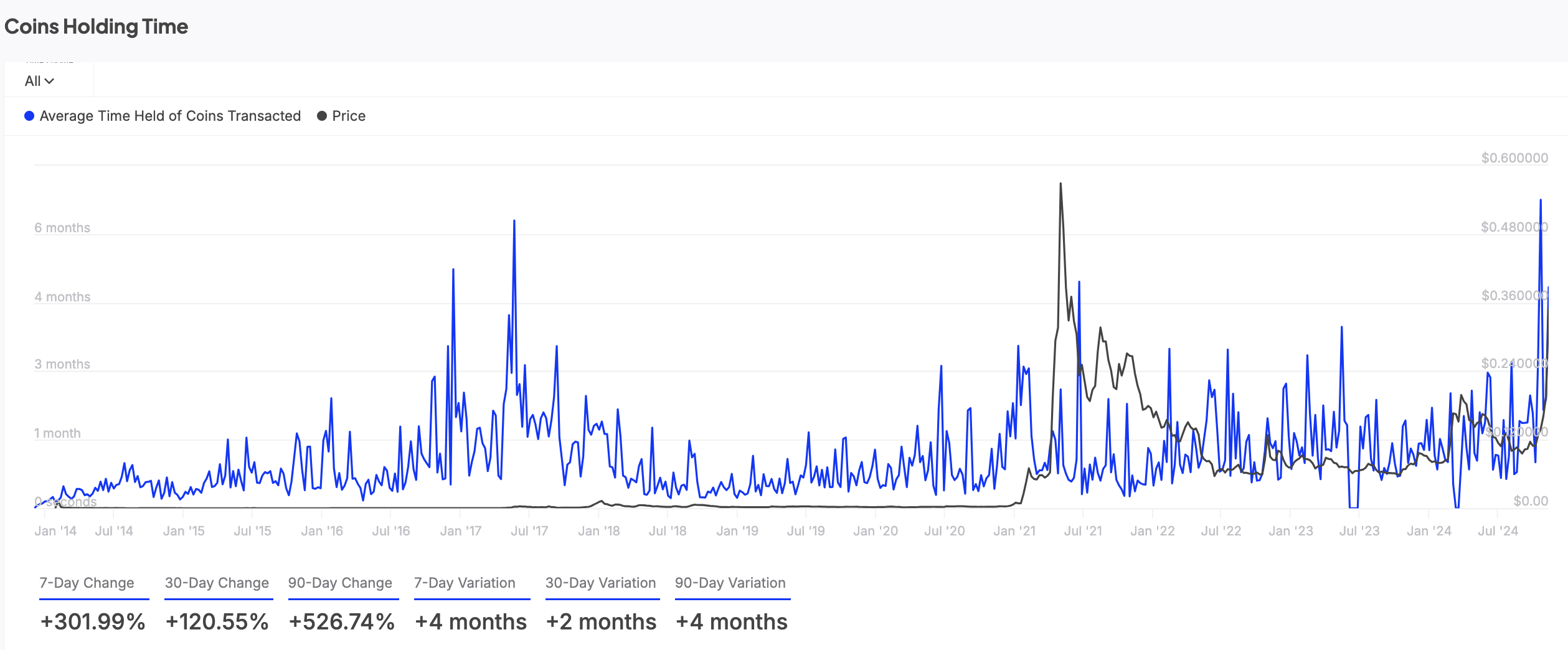

DOGE Holding Time Spikes, Signaling Strong Market Momentum

The value of leading meme coin Dogecoin (DOGE) has climbed 7% in the past 24 hours, benefiting from renewed trading activity in the broader crypto market.

The surge comes amid the significant increase in DOGE’s holding time among traders, a sign that investors choose to accumulate rather than sell.

Dogecoin Bulls Run the Market

The holding time of all DOGE coins transacted over the past seven days has significantly increased. According to IntoTheBlock, it increased by 302% during the review period.

The holding time of an asset’s transacted coins measures the average duration its tokens are held before being sold or transferred. Long holding periods reflect stronger investor conviction, as investors choose to keep their coins rather than sell. This can help reduce the selling pressure in the DOGE market, driving up its value in the near term.

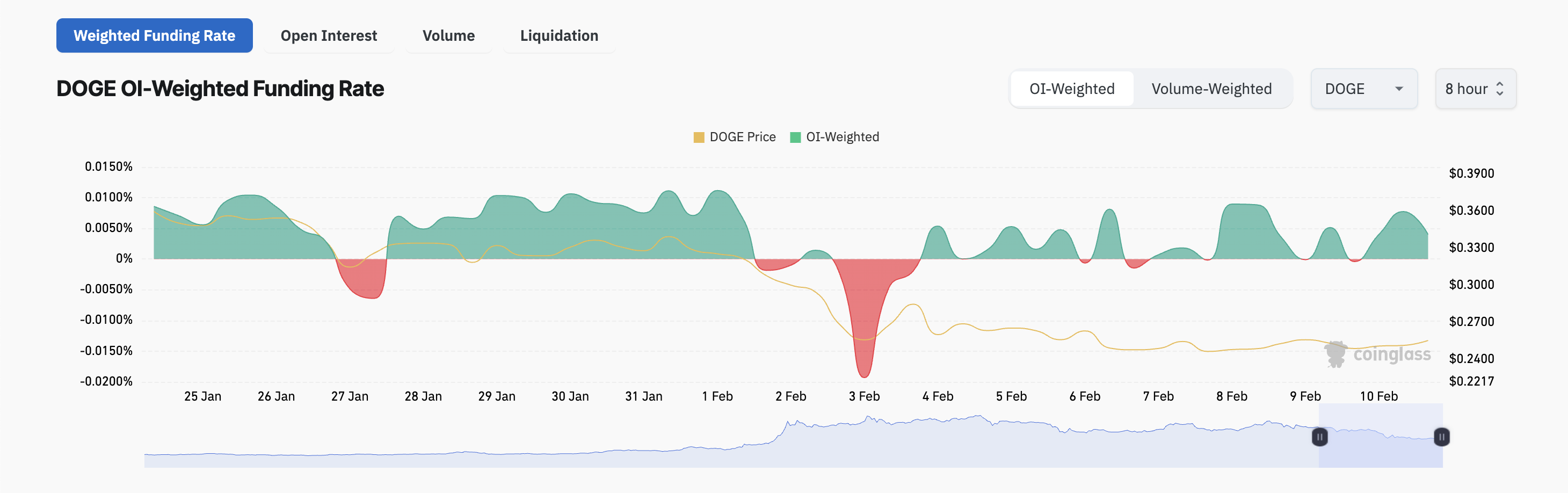

Moreover, this bullish outlook is further reinforced by DOGE’s positive funding rates, which indicate growing confidence among its futures traders. At press time, this sits at 0.0040%.

The funding rate is a fee exchanged between long and short traders on perpetual futures contracts to keep the contract’s price in line with the underlying asset’s spot price.

When an asset’s funding rate is positive, long traders (buyers) pay short traders (sellers) to keep their positions open, indicating bullish sentiment and a higher demand for long positions.

DOGE Price Prediction: $0.32 Within Reach if Bulls Prevail

On its daily chart, DOGE’s rising Chaikin Money Flow (CMF) highlights the weakening selling pressure among its holders. As of this writing, this momentum indicator lies above the zero line at 0.06.

An asset’s CMF measures money flow into and out of its market. A positive CMF value like this indicates strong buying pressure, suggesting that DOGE is being accumulated rather than sold. If buying pressure remains, it could propel the meme coin’s price to $0.32.

On the other hand, if the bears regain market control, they may cause DOGE’s value to go down to $0.24. If the bulls fail to defend this support level, the coin’s price could plunge to $0.19.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Aims For $0.8119 As Confidence Grows

Cardano is showing renewed strength as bullish momentum builds, driving ADA closer to the $0.8119 resistance level. After steady accumulation, buyers are beginning to take control, pushing the price higher and reinforcing optimism in the market. This growing confidence suggests that ADA could be on the verge of a significant breakout, provided it can overcome key resistance zones.

With technical indicators turning positive and market sentiment improving, all eyes are on whether ADA can sustain its upward momentum. A decisive move past $0.8119 may pave the way for further gains, while failure to break through might invite renewed selling pressure. As the battle between bulls and bears intensifies, the coming sessions will be crucial in determining Cardano’s next move.

Technical Analysis: Can ADA Sustain Its Upside Trajectory?

Presently, Cardano is exhibiting strong bullish momentum as it steadily climbs toward the $0.8119 resistance level, a barrier crucial for its next major move. After facing a strong rebound at the $0.6822 support mark, buying pressure has increased, pushing ADA higher as market sentiment turns optimistic. but the sustainability of this uptrend depends on key technical factors.

Related Reading

It is worth noting that ADA’s price steadily rises toward the 100-day Simple Moving Average (SMA), a critical level that often acts as a dynamic resistance. A successful break above this indicator could reinforce positive sentiment and pave the way for extended gains.

Supporting this momentum, the Relative Strength Index (RSI) has recently crossed above the 50% threshold, indicating a shift from bearish to bullish market conditions. This is a significant development, as an RSI above 50% typically suggests that buying pressure outweighs selling pressure, triggering further upside potential.

Additionally, ADA’s trading volume has surged by over 10% in the last 24 hours, indicating growing market activity and increased investor interest. This uptick in volume suggests that traders are becoming more engaged, possibly fueling price movements.

As long as the RSI remains on an upward trajectory and buying pressure continues to rise alongside volume, it might strengthen ADA’s bullish outlook, increasing the likelihood of a breakout above key resistance levels.

What’s Next For Cardano? Predictions Beyond $0.8119

As Cardano continues its upward trajectory, breaking through the $0.8119 resistance level has become a focal point. But what lies beyond this key milestone?

Related Reading

If buyers maintain control and push the price above this key barrier, ADA is likely to see an extended rally toward $0.8306 and $0.9077 in the near term. A decisive move above these levels can strengthen upward performances, opening the door for a test of $1.2630, a psychological milestone.

However, if Cardano struggles to surpass $0.8119, it may enter a consolidation phase or experience a pullback, with $0.6822 as the next closest support level. The bulls must hold this zone to prevent further bearish pressure. Furthermore, a break below this level could signal an extended correction, exposing ADA to deeper losses.

Featured image from Medium, chart from Tradingview.com

Market

Breakout Signals Potential for $1.05

Solana-based meme coin Fartcoin has been the market’s top performer over the past 24 hours, surging by 30% and outperforming major cryptocurrencies. The rally comes as the broader market posts a modest 2% rebound following the recent decline.

The meme coin has broken above a descending trendline that previously kept its price in a downtrend. This breakout signals a potential shift in momentum.

Fartcoin Breaks Above Bearish Trend Line

FARTCOIN’s double-digit price surge has pushed it above a descending trendline that previously kept its price in a downtrend. This bearish pattern emerged as traders began to take profit after the token climbed to an all-time high of $2.74 on January 19.

However, the resurgence in FARTCOIN’s demand and the resulting break above this trend line marks a bullish shift in the market trend.

When an asset breaks above a descending trendline, it signals a potential trend reversal from bearish to bullish. This indicates that the selling pressure is weakening, and buyers are gaining control. This breakout suggests that FARTCOIN may continue upward if demand remains strong.

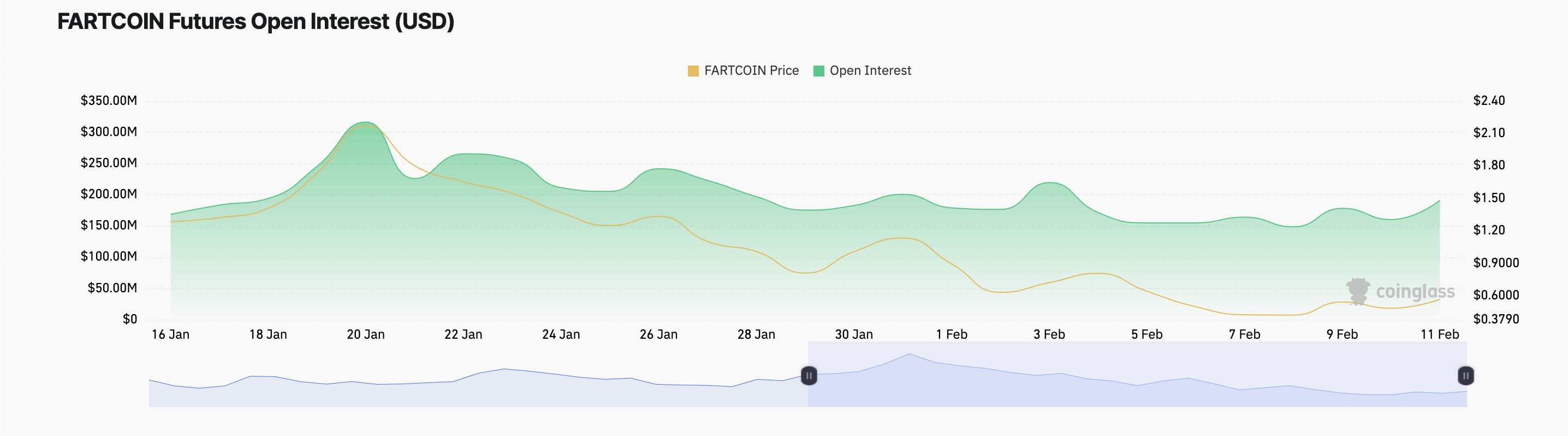

FARTCOIN’s surging open interest also suggests increasing trader confidence, reinforcing the bullish outlook. At press time, it is at $221 million, noting a 28% spike over the past 24 hours.

Open interest measures the total number of active futures or options contracts that have not been closed or settled. Spikes in open interest during a price rally like this indicate strong market participation, with new capital entering trades. It suggests a sustained momentum and hints at the potential for further price gains.

FARTCOIN Price Prediction: Will It Hit $1.05 or Fall Back to $0.40?

A sustained rally above the breakout line could propel FARTCOIN to new heights. However, the buying momentum must also be sustained for this to happen.

The meme coin could rally back above the $1 price zone to trade at $1.05 in this scenario.

However, if profit-taking commences, this bullish outlook will be invalidated. The token’s price could fall below the descending trend line to trade at $0.40 in this case

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoTrump’s Tariffs, AI Meme Coins, P2E Games

-

Altcoin14 hours ago

Altcoin14 hours agoBitcoin Treasury Firm Metaplanet Is Japan’s Hottest Stock, Up 3,600%

-

Market24 hours ago

Market24 hours agoWeekly Price Analysis: Crypto Prices Reel from Risk Off Sentiments

-

Bitcoin21 hours ago

Bitcoin21 hours agoCrypto Inflows Hit $1.3 Billion Despite Price Volatility

-

Market21 hours ago

Market21 hours agoShiba Inu (SHIB) Demand Plummets as Meme Coin Hype Fades

-

Ethereum24 hours ago

Ethereum24 hours agoAnalyst Says Prepare For Ethereum Price To Hit $17,000, Here’s Why

-

Market20 hours ago

Market20 hours agoStrategy Resumes Bitcoin Buys After Rebrand and Purchase Pause

-

Bitcoin24 hours ago

Bitcoin24 hours agoJapan’s FSA Plans Crypto Tax Reform & Bitcoin ETF Greenlight