Bitcoin

Crypto Inflows Hit $1.3 Billion Despite Price Volatility

Despite recent price declines, crypto inflows soared to $1.3 billion last week. It marks the fifth consecutive week of positive inflows, demonstrating sustained investor confidence in the cryptocurrency market.

Interestingly, Ethereum inflows almost doubled the positive flows into Bitcoin, marking a notable paradigm shift.

Crypto Inflows Reached $1.3 Billion Last Week

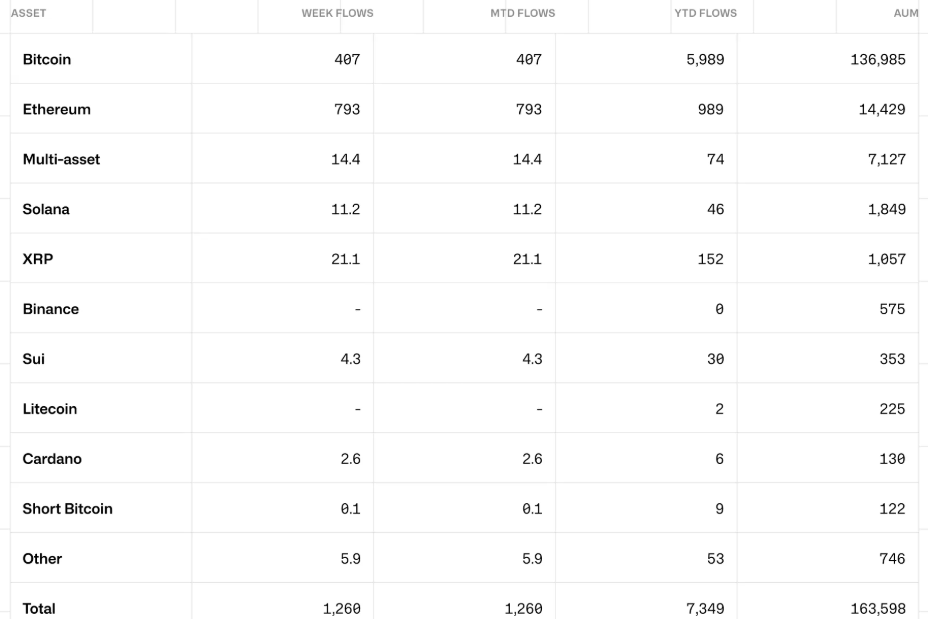

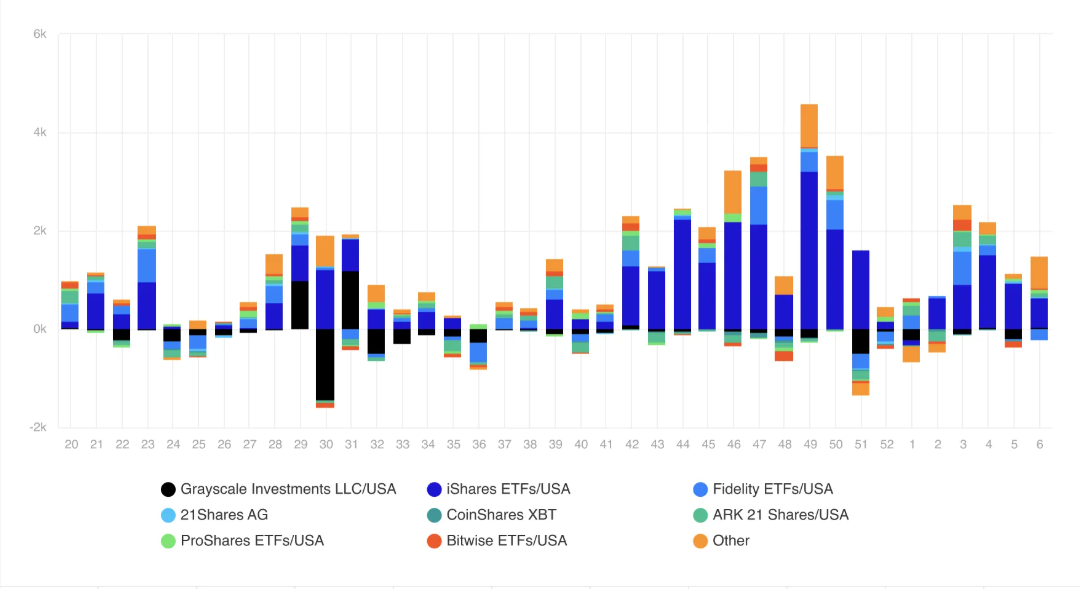

The latest CoinShares report indicates that crypto inflows reached $1.3 billion last week. Specifically, Bitcoin saw inflows of $407 million, while Ethereum saw significant ‘buying the dip’ after its price dropped to $2,500, leading to inflows of $793 million.

Analysts attribute Ethereum’s inflows to the hype around the upcoming Pectra upgrade.

“Ethereum is still holding its uptrend support since May 2023. Last week, Ethereum ETFs had over $400 million in inflows. ETH big upgrades are coming next month. Trump is still buying and holding ETH. Mark my words; Once Ethereum goes above $4,000, it’ll pump like crazy,” one analyst observed.

This surge in crypto inflows follows a week where crypto investments saw $527 million in inflows amid the DeepSeek AI frenzy and Donald Trump’s tariffs on several countries. The continued interest highlights how institutional and retail investors capitalize on market dips to accumulate digital assets.

However, the market corrections over the five trading sessions saw the AUM (asset under management) of ETPs drop to $163 billion. This represents a drop of around 10% from the all-time high of $181 billion established in late January.

Notwithstanding, global ETPs remain the largest Bitcoin holder compared to any other entity.

“With ETPs globally now representing 7.1% of the current market capitalization, making them the largest holder relative to any other entity,” an excerpt in the report stated.

Trading volumes remained steady at $20 billion for the week, suggesting active repositioning among traders and investors amid recent price fluctuations. US President Donald Trump’s tariffs were a key trigger for the corrections, leading to a historic liquidation event in the crypto market.

More Altcoin ETFs on the Horizon

In a related development, Nasdaq has formally filed 19b-4 forms with the US SEC (Securities and Exchange Commission) to list and trade two ETPs from CoinShares. First, the CoinShares XRP ETF and second, the Litecoin ETF, with the proposed funds expected to provide investors exposure to XRP and LTC, respectively.

CoinShares is not alone—other firms such as Grayscale, WisdomTree, Bitwise, and Canary Capital have also submitted filings for an XRP ETF, as reported in recent filings with the SEC.

Ripple CEO Brad Garlinghouse recently stated that an XRP ETF is inevitable, emphasizing the growing demand for structured investment vehicles that provide regulated exposure to the asset.

Similarly, Litecoin ETFs are gaining traction, with Canary Capital and Grayscale applying for their respective funds. Nasdaq has also filed to list a Litecoin ETF, further reflecting the expanding market for crypto investment products.

This surge in ETF filings aligns with broader industry trends, where institutional players seek regulated investment vehicles for alternative digital assets.

As speculation around a Litecoin ETF builds, on-chain data reveals that whales are increasing their LTC holdings, anticipating potential regulatory approval.

Such accumulation trends have historically been early indicators of strong institutional and retail demand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

North Carolina Introduces Bill to Invest in Bitcoin and Digital Assets

The state of North Carolina has become the latest to introduce a bill allowing the investment of public funds in digital assets like Bitcoin (BTC).

House Bill 92, also known as the “Digital Assets Investments Act,” was introduced on Monday. The bill is sponsored by Representative Destin Hall, along with Representatives Mark Brody and Steve Ross.

North Carolina Pushes Bitcoin Bill

The bill grants North Carolina’s State Treasurer the authority to allocate state funds to digital assets while adhering to strict security, management, and oversight criteria.

“Investing in digital assets like Bitcoin not only has the potential to generate positive yields for our state investment fund but also positions North Carolina as a leader in technological adoption & innovation,” Hall said in a statement.

The legislation defines “digital assets” as virtual currencies, cryptocurrencies, stablecoins, nonfungible tokens (NFTs), or any other digital assets that confer economic, proprietary, or access rights.

“The average market capitalization of the digital assets over the preceding 12 months is at least seven hundred fifty billion dollars ($750,000,000,000), as determined by the State Treasurer using a commercially reasonable method,” the bill specifies.

Bitcoin is the only cryptocurrency meeting the bill’s $750 billion market capitalization threshold. As per BeInCrypto, Bitcoin’s market cap stands at $1.95 trillion. In contrast, Ethereum (ETH), the second-largest cryptocurrency, falls short at $327.57 billion.

Beyond direct investments, the bill permits the State Treasurer to invest in digital asset exchange-traded products (ETPs). These must be listed or authorized for listing on reputable exchanges such as the New York Stock Exchange (NYSE) or NASDAQ and comply with rigorous security standards.

The bill also places limits on investment exposure. The total amount allocated to digital assets cannot exceed 10% of the fund’s balance at the time of investment.

Furthermore, the State Treasurer is authorized to invest in over 30 special funds, including retirement systems, health plans, and other designated funds, ensuring investments align with each fund’s specific purposes and needs.

“NC has ~$9.6 billion in Reserve funds, and has $127 billion in its retirement systems. This translates to an investible amount of ~$13.7 billion,” Bitcoin Laws revealed on X (formerly Twitter).

North Carolina is not alone in exploring Bitcoin investments. Florida has also introduced its second bill, House Bill 487, to allocate 10% of public funds to Bitcoin.

Meanwhile, more than 20 states are actively working on similar Strategic Bitcoin Reserve legislation. Among these, Utah stands out as the most advanced. The bill has passed the state house and is now under consideration in the state senate. Arizona follows closely, with its bill having passed the committee.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Institutions in a Tight Spot

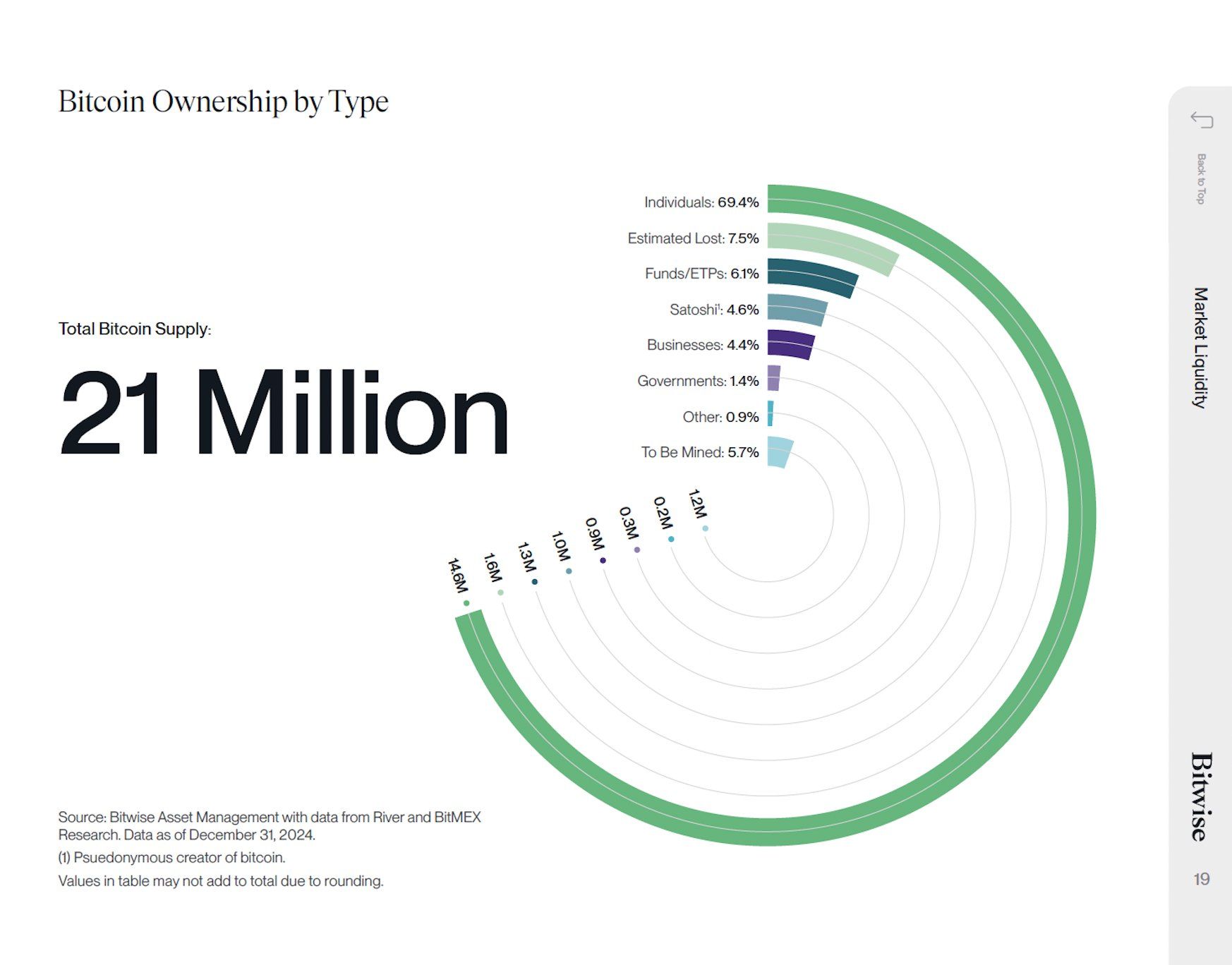

According to Bitwise Asset Management, individual holders control most of Bitcoin’s (BTC) total supply. 69.4% of the 21 million BTC in circulation belong to private investors.

Given this concentration of ownership among individuals, large institutions and governments seeking to acquire Bitcoin may face challenges.

Institutions Face Scarcity as Bitcoin Supply Declines

In a recent X post, Bitwise outlined Bitcoin’s total supply distribution. Apart from individual holders, approximately 7.5% of Bitcoin is considered lost. Funds and exchange-traded products (ETPs) control 6.1%.

The wallet associated with Satoshi Nakamoto, Bitcoin’s pseudonymous creator, holds 4.6%. Moreover, governments and businesses collectively own just 5.8% of Bitcoin.

The asset manager highlighted that if companies and governments wish to acquire Bitcoin, they will primarily need to purchase it from individuals willing to sell.

“That market dynamic between buyers and sellers could get very interesting,” the post read.

Hunter Horsley, CEO of Bitwise, also pointed out that despite consistent buying from corporates and ETFs, Bitcoin’s price has still faced downward pressure. He also stressed that the bulk of Bitcoin’s value remains in the hands of individual holders.

“Every new buyer must find a seller. Obvious but important as ever,” Horsley added.

Is a Bitcoin Supply Shock Coming?

Meanwhile, only 5.7% of Bitcoin remains to be mined. In addition, OTC (Over-the-Counter) markets are running low on Bitcoin. A crypto analyst highlighted that just 140,000 BTC remains in the OTC market.

“There’s almost no Bitcoin left even for institutions,” he claimed.

The analyst explained ETFs collectively purchased 50,000 BTC last month. Yet, price movements remained subdued. This suggested that institutions source Bitcoin from OTC markets rather than exchanges to avoid triggering price surges.

Nonetheless, this strategy may no longer be viable with OTC supply depleting.

“Every billion dollars worth of money going into BTC raises its price by 3-5%. Thats why OTC drying up is so insane,” the analyst remarked.

He added that if MicroStrategy (now Strategy) continues its aggressive acquisitions or ETFs maintain their January-level accumulation, OTC Bitcoin could be depleted. A similar scenario would unfold if the US and the states began buying Bitcoin as part of their reserves.

Strategy has maintained a consistent Bitcoin acquisition plan. On February 10, the firm purchased 7,633 BTC for approximately $742.4 million. This marked its fifth Bitcoin purchase in 2025 alone. According to Saylor Tracker, the firm now holds 478,740 BTC, valued at $47.12 billion.

Institutions such as BlackRock are also adding pressure to supply. The asset manager reportedly acquired $1 billion worth of BTC in January. In fact, it bought 227 BTC today, according to Arkham Intelligence.

Nevertheless, as supply tightens, institutions may soon be forced to buy directly from exchanges, potentially driving Bitcoin’s price significantly higher.

This supply shock threat looms as Bitcoin adoption accelerates. In a previous report, BlackRock noted that cryptocurrency reached 300 million users faster than the internet and mobile phones.

Brian Armstrong, CEO of Coinbase, also weighed in on the adoption timeline comparison.

“Bitcoin adoption should get to several billion people by 2030 at current rates,” Armstrong predicted.

He added that the comparison depends on how one defines the official starting points for Bitcoin, the internet, and mobile phones. However, Armstrong acknowledged that the overall trend is still accurate despite these variables.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin STH MVRV Signals Overheating Is Over — What Comes Next?

Market analyst Axel Adler Jr has shared some valuable insights on the Bitcoin market in relation to recent short-term holders’ activity. This commentary comes as the premier cryptocurrency is currently stuck in a consolidation phase following a flash crash in early February.

Bitcoin STHs Take Profit From Overheated Market – Analyst

In an X post on February 8, Axel Adler Jr explains that Bitcoin Short-Term Holders (STH) i.e. holders of Bitcoin between 1-3 months have been realizing their profits. This development is based on a fall in the STH MVRV – a trading metric that measures market value to the realized value of all Bitcoin held by short-term holders thus helping to determine their profit/loss status.

Generally, an STH MVRV around 1.30-1.35 suggests an overheated market as short-term holders have high unrealized profits indicating potential for a sell-off and price falls. According to Adler Jr., the STH MVRV has recently dropped from 1.35 to average levels meaning a significant portion of STH have closed their positions, helping to cool the market.

Historically, the end of an overheated phase usually translates into a period of price consolidation provided that market demand remains strong. Axel Adler Jr draws a reference to January 2024, when a similar fall in STH MVRV was even strong enough to eventually initiate a price rally.

However, the crypto analyst cautions that US President Donald Trump’s decisions are largely influencing the current market landscape. This was clearly illustrated last week when the US move to impose new tariffs on China, Mexico, and Canada attracted retaliatory measures causing investors to move funds out of risky assets amidst fears of a brewing trade war.

Axler Adler Jr states that barring any more negative triggers from Donald Trump’s political actions, Bitcoin may break out of its current FOMO-driven consolidation into an uptrend. However, in the case of eventualities, Bitcoin appears to have formed a strong support zone around $90,000 capable of preventing deeper corrections.

BTC Price Overview

At the time of writing, Bitcoin trades at $96,998 following a 0.98% gain in the last 24 hours. Meanwhile, its trading volume stands at $22.53 billion having crashed by 59.04% in the past day. For the market bulls, relevant resistance levels lie at $102,000 and $106,000. A failure to break above the initial resistance will force Bitcoin to remain in consolidation for the foreseeable future.

Featured image from iStock, chart from Tradingview

-

Altcoin22 hours ago

Altcoin22 hours agoTrump’s Tariffs, AI Meme Coins, P2E Games

-

Market23 hours ago

Market23 hours agoWeekly Price Analysis: Crypto Prices Reel from Risk Off Sentiments

-

Altcoin23 hours ago

Altcoin23 hours agoBerachain Price Drops 14%, Arthur Hayes Breaks Down the Crash

-

Market22 hours ago

Market22 hours ago3 Altcoins to Watch in the Second Week of February 2025

-

Market21 hours ago

Market21 hours agoLitecoin Whales Increase Holdings—Is a $124 Breakout Coming?

-

Altcoin21 hours ago

Altcoin21 hours agoNasdaq Files 19b-4s For CoinShares XRP & Litecoin ETFs With US SEC

-

Market20 hours ago

Market20 hours agoShiba Inu (SHIB) Demand Plummets as Meme Coin Hype Fades

-

Ethereum23 hours ago

Ethereum23 hours agoAnalyst Says Prepare For Ethereum Price To Hit $17,000, Here’s Why