Market

70% of Cryptocurrencies Are Down Since the US Election – Why?

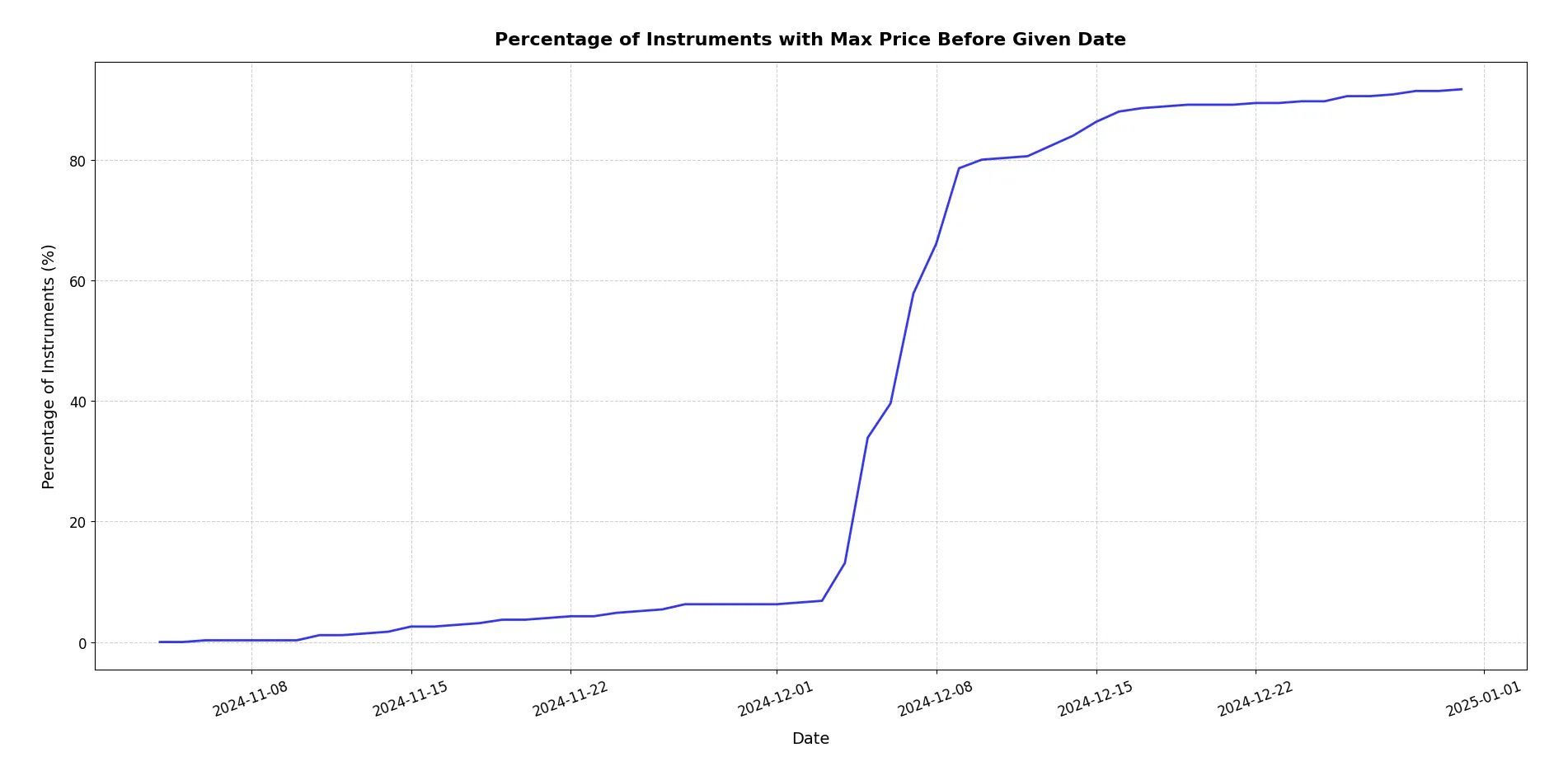

A recent analysis shows that 70% of cryptocurrencies on the crypto exchange Binance are now trading below their pre-US election prices.

This finding contrasts with the broader market sentiment, which has been largely bullish in recent months. The disparity signifies a disconnect between perceived momentum and actual price performance, raising questions about the true state of the crypto market.

Election Hype Fades as Cryptocurrencies Trade Lower

In an X post, analyst ltrd examined price movements of cryptocurrencies before and after the elections, offering a clearer picture of actual market performance.

“Nearly 70% of coins are now trading lower than they were before the elections!” the post read.

While some coins surged significantly, the majority have struggled to maintain their value. The analyst outlined Hedera (HBAR), XRP (XRP), Mantra (OM), Stellar (XLM), and VeThor (VTHO) as the top-performing assets.

In contrast, some assets experienced sharp declines. This list included Nerio (NEIRO) and THORChain (RUNE), BOOK OF MEME (BOME), ConstitutionDAO (PEOPLE), and dogwifhat (WIF).

One of the most interesting revelations from the analyst’s data was the timing of market peaks.

“It turns out the crucial period for traders was between December 3rd and December 9th—almost 80% of coins hit their peak during this short window,” he examined.

According to the analyst, this narrow window suggested that the market is highly correlated, with most tokens reaching their peak within a short timeframe. Furthermore, he also emphasized the importance of timing in trading, as market opportunities can vanish within days.

TRUMP Coin Frenzy Drains Liquidity

Meanwhile, many investors had expected that Donald Trump’s election victory would trigger a new bull run for cryptocurrencies. However, rather than boosting the market, the Official Trump (TRUMP) meme coin frenzy drained liquidity, leaving traders surprised.

Crypto analyst Otto Suwen likened the current conditions to the 2022-2023 bear market.

Suwen explained that many altcoins experienced a strong rally following Trump’s election victory. Yet, the momentum faded quickly.

Traders initially viewed the pullback as a natural retrace. Moreover, by early 2025, expectations were high for a seasonal surge, with retail investors rotating between different meme coin trends. However, the launch of the TRUMP token significantly impacted on-chain liquidity.

Traders anticipated that profits from TRUMP would be reinvested into other assets. Nonetheless, the subsequent launch of Melania Meme (MELANIA) created further turmoil.

“Alts are massacred across the board. This isn’t your traditional 50% retrace either. It’s -90% on so many popular picks. Volume is looking bleak as well. We went from alt season being imminent to down only with a flip of a switch,” Suwen described.

He added that Bitcoin (BTC) has yet to experience a major correction, raising concerns about additional volatility.

“While I don’t think we have topped yet, this has been the hardest cycle I’ve experienced in 8 years,” he concluded.

This sentiment aligns with other analysts’ concerns.

“We wanted Trump to Pump the market for us and be a Crypto legend. Instead he and his wife launched shitcoin, Dumped on all of Crypto investors, now imposed Tarrif on imports and Dumping the market further,” one user wrote on X.

President Trump recently announced a 25% tariff on imports from Mexico and Canada and a 10% tariff on goods from China. The immediate market reaction was severe.

The total market capitalization lost approximately $300 billion in value overnight. Nevertheless, the president later decided to delay some of these measures.

The combination of aggressive trade policies and volatility in the cryptocurrency market has left investors on edge, fueling concerns about the sustainability of the current bull cycle.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Aims For $0.8119 As Confidence Grows

Cardano is showing renewed strength as bullish momentum builds, driving ADA closer to the $0.8119 resistance level. After steady accumulation, buyers are beginning to take control, pushing the price higher and reinforcing optimism in the market. This growing confidence suggests that ADA could be on the verge of a significant breakout, provided it can overcome key resistance zones.

With technical indicators turning positive and market sentiment improving, all eyes are on whether ADA can sustain its upward momentum. A decisive move past $0.8119 may pave the way for further gains, while failure to break through might invite renewed selling pressure. As the battle between bulls and bears intensifies, the coming sessions will be crucial in determining Cardano’s next move.

Technical Analysis: Can ADA Sustain Its Upside Trajectory?

Presently, Cardano is exhibiting strong bullish momentum as it steadily climbs toward the $0.8119 resistance level, a barrier crucial for its next major move. After facing a strong rebound at the $0.6822 support mark, buying pressure has increased, pushing ADA higher as market sentiment turns optimistic. but the sustainability of this uptrend depends on key technical factors.

Related Reading

It is worth noting that ADA’s price steadily rises toward the 100-day Simple Moving Average (SMA), a critical level that often acts as a dynamic resistance. A successful break above this indicator could reinforce positive sentiment and pave the way for extended gains.

Supporting this momentum, the Relative Strength Index (RSI) has recently crossed above the 50% threshold, indicating a shift from bearish to bullish market conditions. This is a significant development, as an RSI above 50% typically suggests that buying pressure outweighs selling pressure, triggering further upside potential.

Additionally, ADA’s trading volume has surged by over 10% in the last 24 hours, indicating growing market activity and increased investor interest. This uptick in volume suggests that traders are becoming more engaged, possibly fueling price movements.

As long as the RSI remains on an upward trajectory and buying pressure continues to rise alongside volume, it might strengthen ADA’s bullish outlook, increasing the likelihood of a breakout above key resistance levels.

What’s Next For Cardano? Predictions Beyond $0.8119

As Cardano continues its upward trajectory, breaking through the $0.8119 resistance level has become a focal point. But what lies beyond this key milestone?

Related Reading

If buyers maintain control and push the price above this key barrier, ADA is likely to see an extended rally toward $0.8306 and $0.9077 in the near term. A decisive move above these levels can strengthen upward performances, opening the door for a test of $1.2630, a psychological milestone.

However, if Cardano struggles to surpass $0.8119, it may enter a consolidation phase or experience a pullback, with $0.6822 as the next closest support level. The bulls must hold this zone to prevent further bearish pressure. Furthermore, a break below this level could signal an extended correction, exposing ADA to deeper losses.

Featured image from Medium, chart from Tradingview.com

Market

Breakout Signals Potential for $1.05

Solana-based meme coin Fartcoin has been the market’s top performer over the past 24 hours, surging by 30% and outperforming major cryptocurrencies. The rally comes as the broader market posts a modest 2% rebound following the recent decline.

The meme coin has broken above a descending trendline that previously kept its price in a downtrend. This breakout signals a potential shift in momentum.

Fartcoin Breaks Above Bearish Trend Line

FARTCOIN’s double-digit price surge has pushed it above a descending trendline that previously kept its price in a downtrend. This bearish pattern emerged as traders began to take profit after the token climbed to an all-time high of $2.74 on January 19.

However, the resurgence in FARTCOIN’s demand and the resulting break above this trend line marks a bullish shift in the market trend.

When an asset breaks above a descending trendline, it signals a potential trend reversal from bearish to bullish. This indicates that the selling pressure is weakening, and buyers are gaining control. This breakout suggests that FARTCOIN may continue upward if demand remains strong.

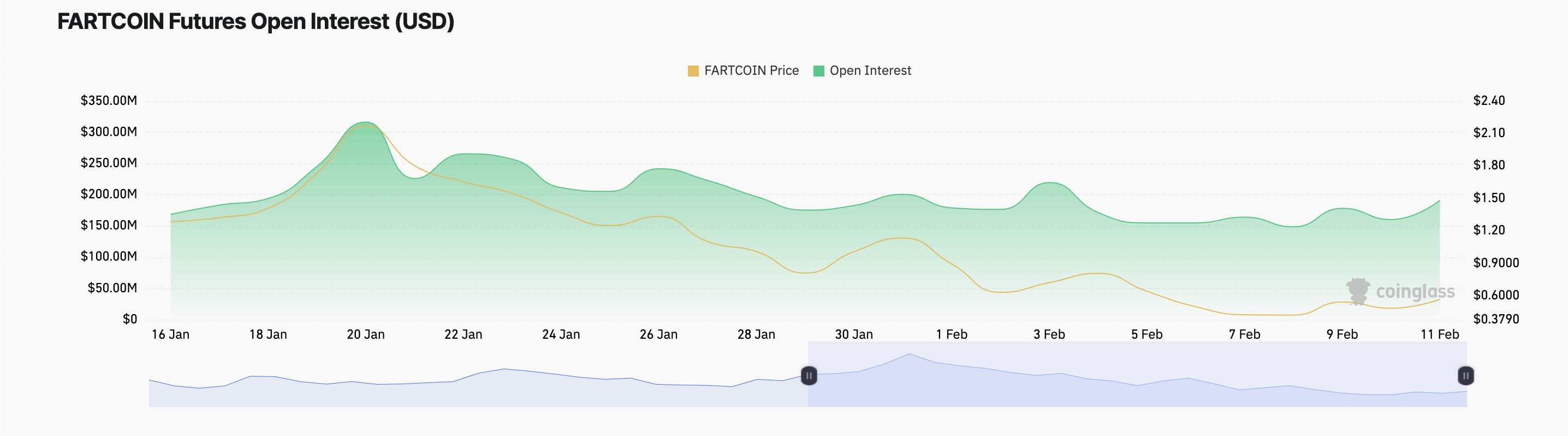

FARTCOIN’s surging open interest also suggests increasing trader confidence, reinforcing the bullish outlook. At press time, it is at $221 million, noting a 28% spike over the past 24 hours.

Open interest measures the total number of active futures or options contracts that have not been closed or settled. Spikes in open interest during a price rally like this indicate strong market participation, with new capital entering trades. It suggests a sustained momentum and hints at the potential for further price gains.

FARTCOIN Price Prediction: Will It Hit $1.05 or Fall Back to $0.40?

A sustained rally above the breakout line could propel FARTCOIN to new heights. However, the buying momentum must also be sustained for this to happen.

The meme coin could rally back above the $1 price zone to trade at $1.05 in this scenario.

However, if profit-taking commences, this bullish outlook will be invalidated. The token’s price could fall below the descending trend line to trade at $0.40 in this case

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will It Smash Resistance and Climb?

Bitcoin price is consolidating above the $96,200 support zone. BTC is showing a few positive signs and might attempt to rally above $99,000.

- Bitcoin started a decent recovery wave above the $95,000 level.

- The price is trading above $96,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $98,000 zone.

Bitcoin Price Eyes Fresh Increase

Bitcoin price failed to continue higher above the $100,500 zone. It started another decline below the $97,500 zone. BTC gained bearish momentum for a move below the $96,000 and $95,000 levels.

There was also a spike below the 61.8% Fib retracement level of the upward wave from the $91,000 swing low to the $102,500 high. The price tested the $95,000 zone and recently recovered some losses. There was a move above the $96,000 level.

Bitcoin price is now trading above $97,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $98,000 level. There is also a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $99,000 level. The next key resistance could be $100,000. A close above the $100,000 resistance might send the price further higher. In the stated case, the price could rise and test the $101,200 resistance level. Any more gains might send the price toward the $102,500 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $98,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $96,500 level. The first major support is near the $95,500 level.

The next support is now near the $93,700 zone or the 76.4% Fib retracement level of the upward wave from the $91,000 swing low to the $102,500 high. Any more losses might send the price toward the $92,000 support in the near term. The main support sits at $91,000.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $96,500, followed by $95,500.

Major Resistance Levels – $98,000 and $100,000.

-

Altcoin22 hours ago

Altcoin22 hours agoTrump’s Tariffs, AI Meme Coins, P2E Games

-

Market23 hours ago

Market23 hours agoWeekly Price Analysis: Crypto Prices Reel from Risk Off Sentiments

-

Market21 hours ago

Market21 hours agoLitecoin Whales Increase Holdings—Is a $124 Breakout Coming?

-

Altcoin21 hours ago

Altcoin21 hours agoNasdaq Files 19b-4s For CoinShares XRP & Litecoin ETFs With US SEC

-

Market20 hours ago

Market20 hours agoShiba Inu (SHIB) Demand Plummets as Meme Coin Hype Fades

-

Ethereum23 hours ago

Ethereum23 hours agoAnalyst Says Prepare For Ethereum Price To Hit $17,000, Here’s Why

-

Bitcoin23 hours ago

Bitcoin23 hours agoJapan’s FSA Plans Crypto Tax Reform & Bitcoin ETF Greenlight

-

Altcoin14 hours ago

Altcoin14 hours agoBitcoin Treasury Firm Metaplanet Is Japan’s Hottest Stock, Up 3,600%