Market

XRP Bull Targets $2.80 Breakout — Here Are The Key Levels To Consider

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency.

Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems.

In two years of active crypto writing, Semilore has covered multiple aspects of the digital asset space including blockchains, decentralized finance (DeFi), staking, non-fungible tokens (NFT), regulations and network upgrades among others.

In his early years, Semilore honed his skills as a content writer, curating educational articles that catered to a wide audience. His pieces were particularly valuable for individuals new to the crypto space, offering insightful explanations that demystified the world of digital currencies.

Semilore also curated pieces for veteran crypto users ensuring they were up to date with the latest blockchains, decentralized applications and network updates. This foundation in educational writing has continued to inform his work, ensuring that his current work remains accessible, accurate and informative.

Currently at NewsBTC, Semilore is dedicated to reporting the latest news on cryptocurrency price action, on-chain developments and whale activity. He also covers the latest token analysis and price predictions by top market experts thus providing readers with potentially insightful and actionable information.

Through his meticulous research and engaging writing style, Semilore strives to establish himself as a trusted source in the crypto journalism field to inform and educate his audience on the latest trends and developments in the rapidly evolving world of digital assets.

Outside his work, Semilore possesses other passions like all individuals. He is a big music fan with an interest in almost every genre. He can be described as a “music nomad” always ready to listen to new artists and explore new trends.

Semilore Faleti is also a strong advocate for social justice, preaching fairness, inclusivity, and equity. He actively promotes the engagement of issues centred around systemic inequalities and all forms of discrimination.

He also promotes political participation by all persons at all levels. He believes active contribution to governmental systems and policies is the fastest and most effective way to bring about permanent positive change in any society.

In conclusion, Semilore Faleti exemplifies the convergence of expertise, passion, and advocacy in the world of crypto journalism. He is a rare individual whose work in documenting the evolution of cryptocurrency will remain relevant for years to come.

His dedication to demystifying digital assets and advocating for their adoption, combined with his commitment to social justice and political engagement, positions him as a dynamic and influential voice in the industry.

Whether through his meticulous reporting at NewsBTC or his fervent promotion of fairness and equity, Semilore continues to inform, educate, and inspire his audience, striving for a more transparent and inclusive financial future.

Market

Dogecoin and Litecoin Lead the ETF Race as XRP is Less Likely

Analysts James Seyffart and Eric Balchunas assessed the likelihood of the SEC approving various ETF products. They claimed that a Litecoin ETF is most likely but gave a few unexpected predictions.

Specifically, they believe that Dogecoin is more likely to win approval than Solana or XRP because the SEC will view the meme coin as a commodity. Either way, they expect more clarity and SEC actions soon.

Security Vs Commodity Debate Will Impact XRP ETFs

Since former Chair Gary Gensler left the SEC, there has been a surge of new ETF applications. Several new firms are intensifying their efforts to win some popular ETFs, but there are newcomers.

For example, Bitwise filed one for Dogecoin, attempting to create the first meme coin ETF. Analysts James Seyffart and Eric Balchunas tried to list ETF approval odds.

Previously, Seyffart and Balchunas predicted that a Litecoin ETF is most likely, and their case was strengthened when the SEC acknowledged a relevant 19b-4 filing. Their decision to rank it at the lead is not surprising. Litecoin is already likely to be considered a commodity due to the network being a Bitcoin fork.

So, Litecoin has regulatory clarity making its odds stronger. More surprisingly, although most of the community considers Solana ETF as a strong contender, the analyst pair ranked Dogecoin higher. Seyffart explained:

“Big implications/expectations in these odds are that: 1. Filings will be acknowledged. Likely this week for XRP & Dogecoin. 2. The SEC & Commissioner Peirce’s Crypto task force will untangle some of the security vs commodity implications from lawsuits by the end of 2025,” Seyffart claimed.

Specifically, Hester Peirce’s new Crypto Task Force is set to classify more cryptoassets as commodities. This would significantly loosen regulatory scrutiny and likely put them under the CFTC’s jurisdiction.

This will help Litecoin and Dogecoin but not Solana. Additionally, Seyffart the SEC still has a legal fight with Ripple, hurting the odds of an XRP ETF. The whole lawsuit is based on whether XRP is a security or a commodity.

So, until it’s officially dropped, XRP ETFs might be less likely.

Still, whatever happens, Seyffart and Balchunas believe that the SEC will start acknowledging more ETF applications soon. Grayscale created a Dogecoin Trust quite recently and just filed for the first-ever Cardano ETF.

The industry is eagerly waiting for new altcoin ETF approvals, and the Commission will need to address this growing concern. Presently, it’s looking bullish.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PEPE Price Enters Oversold Levels On Daily Timeframe, Here’s What Happened The Last Two Times

The recent downturn that has swept across the entire crypto market has pushed meme coin PEPE into oversold territory, according to the Relative Strength Index indicator. Notably, this is only the third time PEPE has reached the oversold levels in its history, particularly on the daily candlestick timeframe.

Historical data shows that in the previous two instances, PEPE’s price movement followed a specific pattern, leading to a strong recovery after a period of consolidation. As such, the recent PEPE price crash might be the first step before an incoming bull price action.

PEPE Oversold Condition Is A Rare Market Event: What Happened The Last Two Times?

PEPE hasn’t had much history to go by, as it is one of the youngest meme coins with a large market cap. However, over the past year and a half since its launch, PEPE has rarely dipped into oversold territory on the Relative Strength Index (RSI). This makes its current oversold status a significant event in technical analysis, as it has only happened twice before. An oversold condition is when the selling pressure on a crypto becomes too much in a short period, which causes the RSI indicator to fall below 30.

Related Reading

In both previous instances where PEPE became oversold, the price entered a consolidation phase lasting approximately one month before rebounding with a strong uptrend. This pattern is evident in a PEPE daily candlestick chart shared on social media platform X by crypto analyst Obi (@obi_eths), which illustrated the meme coin’s historical response to oversold conditions.

As shown by the chart below, the first time the meme coin became oversold was in September 2023, four months after its launch. Notably, the oversold condition was followed by 31 days of consolidation before PEPE eventually shot up to new all-time highs in the weeks after.

A similar trend occurred in August 2024, when PEPE entered into an oversold condition for the second time. This was followed by another 31 days of consolidation up until September 6, when another uptrend began.

Accumulation Phase? What To Expect Next

With PEPE now entering another oversold condition, historical patterns suggest that the meme coin could remain in a consolidation phase for at least the next month. If past trends repeat, this period could serve as an accumulation window for investors who are willing to exercise patience and position themselves ahead of a potential rally.

Related Reading

The timeline for this anticipated surge should begin on March 10, which is exactly 31 days after PEPE entered the recent oversold condition. From here, the meme coin could attempt to mirror its past rebounds by staging an extended move that could push its price beyond its current all-time high of $0.00002803, which was recorded on December 9, 2024.

At the time of writing, PEPE is trading at $0.000009544, 65.8% below this all-time high.

Featured image from Shutterstock, chart from Tradingview.com

Market

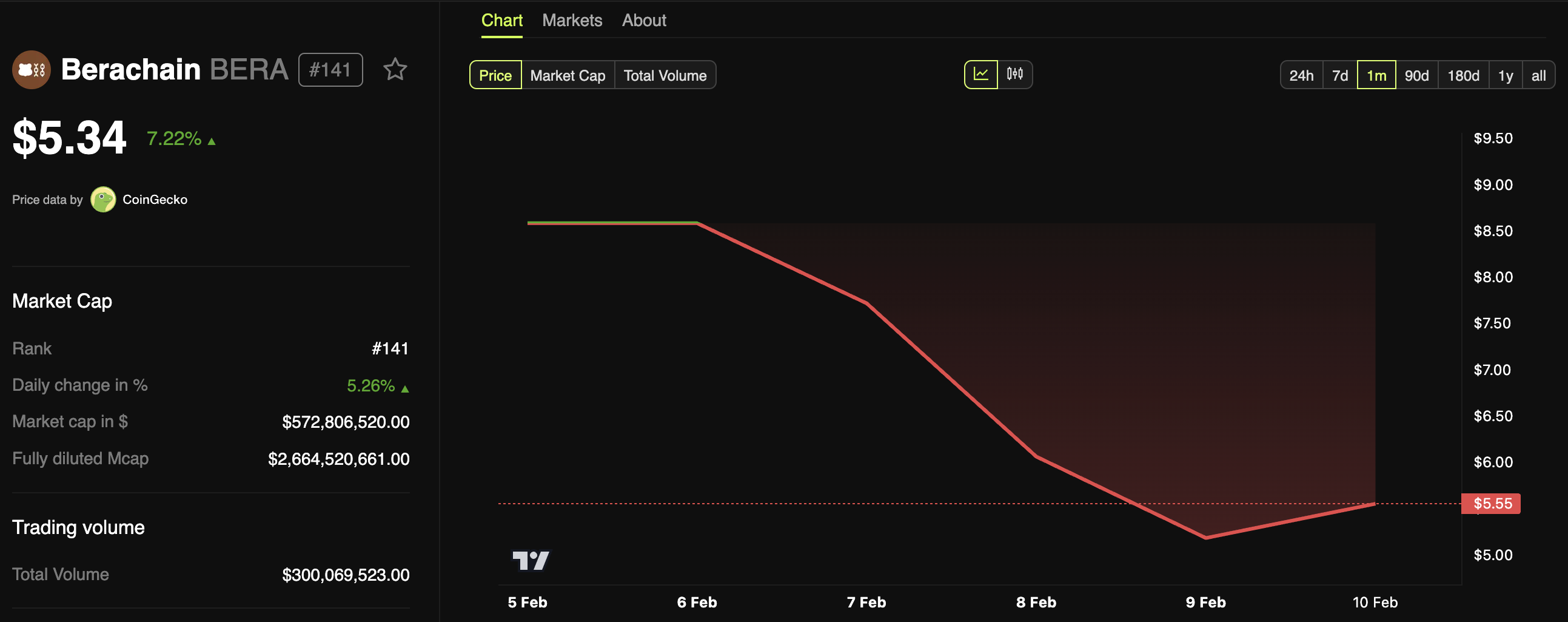

Berachain Controversy as Co-Founder Sells BERA Tokens

Just days after its mainnet launch and airdrop, the Berachain community is concerned about the project’s visible favoritism toward private investors. There are also allegations about the network’s lead developer swapping large amounts of airdropped BERA tokens.

Despite this, however, Berachain does have a chance to rebuild public trust. If its Proof of Liquidity system gets implemented and becomes operational, it would be a truly novel project.

Questionable Decisions from Berachain Developers

Berachain, the new layer-1 blockchain network, has created notable engagement in the crypto space due to its airdrop and mainnet launch last week. Although the firm has a clear vision to become a novel network with its unique ‘Proof of Liquidity’ mechanism, its marketing and hype are evocative of meme coin culture.

Its pre-launch liquidity platform attracted $2.3 billion in deposits. Berachain also started one of the biggest airdrops this year with its mainnet launch on February 6. Its BERA token also received Binance listing immediately after TGE, along with other major exchanges.

However, trouble has been brewing. When the airdrop happened, users complained that testnet farmers got minuscule BERA token rewards.

Berachain’s blockchain is designed as a self-contained system of three tokens: BERA, BGT, and HONEY, which serve different functions. However, by staking and burning different tokens, users can exploit the system.

“Wait, so all the huge insiders of Berachain, with locked BERA tokens, can stake the BERA, receive BGT, burn the BGT for BERA and then dump? Please tell me this isn’t true. It’s almost criminal,” one user wrote after the BERA tokenomics were revealed last week.

Ericonomic, an observer of Berachain’s blockchain ecosystem, compiled a thread of pressing concerns. Essentially, more than 35% of the BERA token supply went to private investors, and its inflation is much higher than most projects.

Also, private investors can stake BERA to earn liquid rewards that they can easily dump. There are also concerns about one potential core developer dumping his BERA tokens.

“A cofounder [DevBear] is selling tokens from one of his doxxed addresses. He got around 200,000 BERA from the airdrop (this is a really bad thing since he, or the core, designed the airdrop) and then he swapped some of those tokens for WBTC, ETH, BYUSD, etc,” Ericonomic claimed.

Berachain developers didn’t reveal the nature of their blockchain’s staking scheme until recently. Additionally, although they claim that Berachain’s core product will be Proof of Liquidity, this hasn’t materialized yet.

So, all of these factors do make BERA’s long-term sustainability questionable. It might end up being as extremely volatile as non-utility meme coins.

“I’ve always seen Berachain as a breath of fresh air in a place full of scams, something with its own culture and good morals, and I’m not gonna lie—seeing this ‘bad’ launch and the ‘shady’ stuff makes me feel kinda sad. But the end, if the builders keep working as they have for the last few years, Berachain will succeed and become the best place to yield by far,” Ericonomic wrote.

BERA Token Continues to Struggle

As soon as the airdrop took place, BERA’s price began dropping like a rock. It fell over 50% from its intra-day peak post-airdrop, and it continued to struggle the next day.

Ostensibly, Berachain is attempting a novel type of blockchain project, but community confidence has been shaken, and that crisis has been reflected in its valuation.

Still, even despite these alarming trends, community members are not totally bearish in their predictions. There is still a lot of optimism around the Proof of Liquidity (PoL) mechanism. The network has significant developer support.

So, if PoL is implemented and the dev community remains committed to leveraging the novel architecture, Berachain could likely overcome these challenges in the long-term.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoRetail Investors Rush To Buy Bitcoin As Whales Offload; What Does This Mean For Bitcoin?

-

Market22 hours ago

Market22 hours agoBitcoin Price Gradually Slips: Can Bulls Hold Key Support?

-

Altcoin21 hours ago

Altcoin21 hours agoBTC & Altcoins Turbulent, LTC Jumps 5%

-

Market20 hours ago

Market20 hours agoXRP Price Uptrend Hits a Snag—Is a Fresh Increase Still Possible?

-

Market19 hours ago

Market19 hours agoEthereum Price Declines Again: Will the Downtrend Continue?

-

Bitcoin19 hours ago

Bitcoin19 hours agoUS Economic Data to Watch This Week for Crypto Investors

-

Bitcoin12 hours ago

Bitcoin12 hours agoJapan’s FSA Plans Crypto Tax Reform & Bitcoin ETF Greenlight

-

Market17 hours ago

Market17 hours agoTRUMP Price Hits An All-Time Low As Traders Turn Bearish