Bitcoin

University of Austin Raises $5 Million for Pioneering Bitcoin Fund

The University of Austin is making major moves in institutional Bitcoin adoption, planning to launch a dedicated Bitcoin investment fund.

This initiative reflects the increasing interest among US institutions to adopt Bitcoin and other digital assets.

University Endowment Funds Increasingly Embrace Crypto

Latest reports reveal that the University of Austin, established just a year ago, is raising a $5 million Bitcoin fund as part of its $200 million endowment. This move positions it as the first institution in the US to introduce a dedicated crypto endowment fund.

Chad Thevenot, the university’s senior vice president for advancement, stated that the Bitcoin holdings will remain untouched for at least five years. He likened Bitcoin’s long-term value to traditional investment assets such as real estate and equities.

“We think there is long-term value there, just the same way that we might think there is long-term value in stocks or real estate,” Thevenot explained.

While this marks a significant step in institutional crypto adoption, Austin is not alone. Last year, Emory University invested over $15 million in Bitcoin through Grayscale’s spot Bitcoin exchange-traded fund (ETF). It was the first endowment to gain direct exposure to the leading cryptocurrency.

Historically, endowments have maintained a conservative stance on cryptocurrencies, largely avoiding them. However, shifting regulatory landscapes and increasing acceptance of digital assets are encouraging a change in strategy.

Why Are Endowment Funds Turning to Bitcoin?

The growing pro-crypto stance of the US government has played a role in accelerating institutional interest. A recent executive order focused on strengthening leadership in digital finance is paving the way for broader blockchain adoption. This initiative promotes responsible growth in the digital asset sector.

A key part of this policy is the President’s Working Group on Digital Asset Markets, led by newly appointed crypto and AI czar David Sacks. The group is tasked with developing a regulatory framework for digital assets, including stablecoins, while also exploring the creation of a national digital asset reserve.

As a result, endowment funds are trooping into the emerging sector. For context, the Rockefeller Foundation, managing $4.8 billion in assets, has hinted at increasing its exposure to cryptocurrencies.

The foundation has previously invested in crypto-focused venture funds but is now considering deeper involvement, especially as broader market adoption gains momentum.

Chun Lai, the foundation’s chief investment officer, acknowledged the uncertainties surrounding Bitcoin’s long-term trajectory. However, he emphasized the risk of missing out on substantial opportunities if the foundation does not take action.

“We don’t have a crystal ball on how cryptocurrencies will become in 10 years. We don’t want to be left behind when their potential materialises dramatically,” Lai said.

Market observers noted that the increasing integration of Bitcoin into institutional portfolios highlights its growing appeal as an alternative asset.

So, as regulatory frameworks become clearer, more institutional investors will recognize digital assets as viable components for their traditional financial portfolios, which would further cement Bitcoin’s role in mainstream finance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Florida Moves Toward State Crypto Investment

The American state of Florida could be one of the pioneering local governments that allows a percentage of its state funds for cryptocurrency investments, particularly Bitcoin.

Florida Senator Joe Gruters has filed a bill that would permit the US state to use 10% of its funds to buy Bitcoin. This political backing could entice other American states to build their own cryptocurrency investments.

My state of Florida introduces a Bitcoin investment bill! 💪

If passed Florida’s CFO may allocate up to 10% of public funds to invest in $BTC or other digital assets.Thank you Senator Joe Gruters 🫡 pic.twitter.com/nF0SoTbT96

— Lucidvein (@Lucidvein) February 8, 2025

Florida To Invest In Bitcoin

Gruters introduced a legislative measure that would allow Florida to invest in Bitcoin using state funds to combat inflation.

The senator said that Senate Bill 550 proposed to permit Florida’s chief financial officer to use up to 10% of its funds to buy Bitcoin and other cryptocurrencies.

“The state should have access to tools such as BTC to protect against inflation,” Gruters said.

The bill aims to incorporate Bitcoin into state financial planning in the US, a legislative action that could reshape state authorities’ investment funds strategy and lead to other states adopting crypto.

Fighting Inflation With BTC

Gruters eyes that the proposed bill would help financial planners of Florida to hedge against inflation.

“Inflation has eroded the purchasing power of assets held in state funds managed by the Chief Financial Officer, and this erosion diminishes the value of the state’s reserves, affecting the financial stability and economic security of this state, its taxpayers, and its residents,” Gruters said.

The senator explained in the bill that inflation has “eroded the purchasing power of assets” managed by the state’s chief financial officer, adding that the state is responsible for safeguarding “Florida’s financial resources” against inflation and economic uncertainties.

“Bitcoin is viewed as a hedge against inflation by sovereign nations and prominent investment advisors, including BlackRock, Fidelity, and Franklin Templeton,” he said.

Hence, the American senator explained that Florida should have access to tools like Bitcoin to protect state funds from inflation.

Impact On The State Economy

Once Gruter’s proposed legislation was enacted, it would be beneficial to the state in several ways.

Analysts said that investing in Bitcoin would diversify Florida’s state assets, adding that the state would incorporate in its portfolio an asset that historically provides high returns but with significant volatility.

Market observers added that this crypto legislation would help turn Florida into a blockchain hub that promotes cryptocurrency innovation, further establishing Florida as a crypto-friendly state.

Florida might become the model state for adopting Bitcoin in state financial planning, making BTC adoption in government finance a reality.

Crypto analysts also see that Florida’s success could encourage other states to follow its lead and start incorporating digital assets into their financial systems.

Featured image from Shutterstock, chart from TradingView

Bitcoin

Privacy and Staking in Bitcoin’s Growth 2025

Core DAO and Element Wallet are collaborating to expand Bitcoin’s utility for holders, offering new avenues for interaction beyond simple storage. This partnership emphasizes user privacy while aiming to maximize the security of decentralized finance (DeFi) mechanisms like Bitcoin staking.

BeInCrypto discussed with representatives from both platforms to explore how user privacy and enhanced functionality in staking can create new opportunities for Bitcoin-oriented DeFi participation.

Expanding Bitcoin Use Cases

For 2025, the CORE team aims to develop new use cases for Bitcoin holders who wish to use their BTC rather than keep it perpetually stored. Core achieves this by enabling Bitcoin users to interact easily with DeFi.

“A lot of people have been holding Bitcoin over the years and are totally happy with that. I get it, myself included, but there are also a lot of people who want to actually do something with their BTC and not just hold it. They want to actually put it to work, bring it into DeFi, take out a loan on it, or lend it out and earn some yield. Core basically allows for whatever you want to do with your Bitcoin,” explained Dylan Dennis, Contributor at Core DAO.

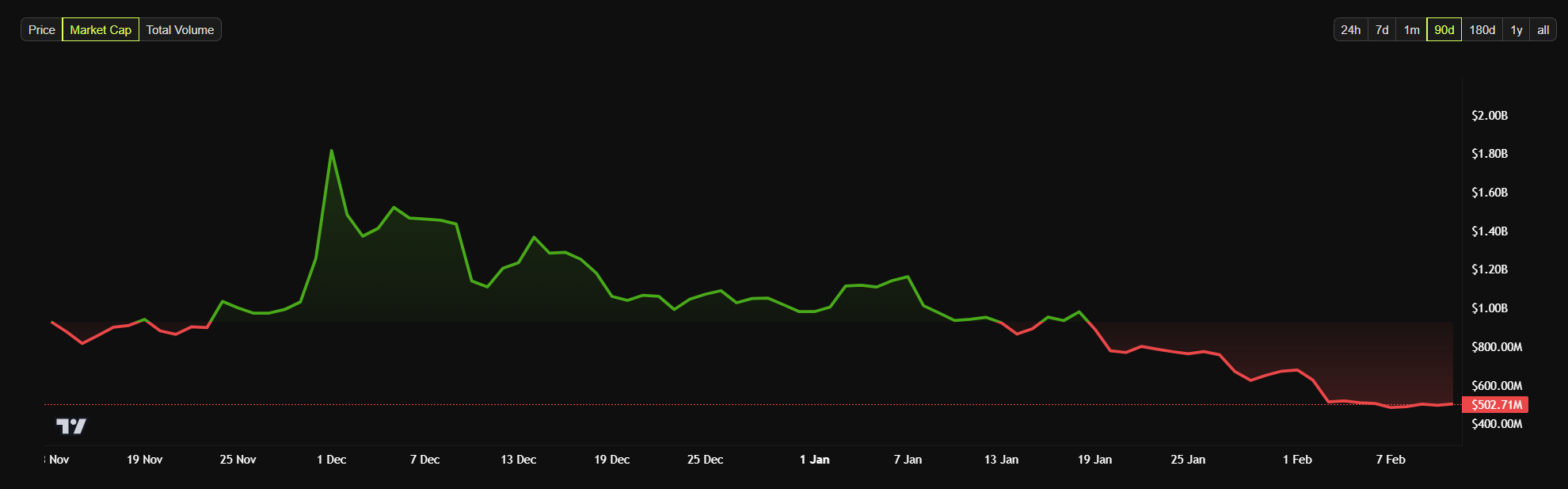

Designed to enhance Bitcoin’s utility while preserving its decentralization and security, Core is a layer-1 blockchain that integrates with Bitcoin and offers EVM compatibility. Launched in January 2023, it has achieved a market capitalization of over $497 million.

The Core DAO, a decentralized autonomous organization, supports and develops the Core blockchain, pursuing security, scalability, and decentralization through community-driven collaboration.

Members of the Core DAO used the term BTCfi to describe decentralized financial services and applications built on a Bitcoin-based blockchain. This initiative combines Bitcoin’s security and reliability with innovative financial services found in DeFi platforms.

BTCfi enhances Bitcoin’s value by expanding protection and increasing utility via on-chain yield and a comprehensive dApp ecosystem.

Meanwhile, Core’s EVM compatibility enables developers to use familiar Ethereum tools for interoperable dApps. These dApps increase Bitcoin’s versatility and cater to diverse user needs, from simple BTC staking to complex DeFi activities.

“Basically, Core was created by Bitcoiners. The whole point of Core is to scale Bitcoin and unlock new use cases for every kind of Bitcoiner, whether you’re someone who wants to take no new risk, and just keep your BTC in your wallet. Then on the other side, there’s this whole Bitcoin DeFi ecosystem, with 100+ Dapps, all BTC-based. Whatever you want to do with your BTC you could do it with Core,” Dennis said.

While exposing Core users to DeFi, Core also uses a three-in-one strategy to secure its high-throughput blockchain.

The Satoshi Plus Consensus for Ensured Decentralization

To stay true to Bitcoin’s core principles of decentralization and security, Core employs a mechanism defined as the Satoshi Plus Consensus. This method involves active collaboration from Bitcoin miners, CORE stakers, and Bitcoin Stakers.

Bitcoin miners contribute to the security of the blockchain by delegating their Proof-of-Work (PoW) mechanisms to a Core validator. This non-destructive delegation of PoW allows miners to leverage their existing work without choosing between securing Bitcoin and Core.

Core’s security is also enhanced through a delegated Proof-of-Stake (dPoS) mechanism, which allows holders of Core’s native CORE tokens to participate in network security by delegating their tokens to validators.

Finally, Core’s Satoshi Plus consensus mechanism incorporates non-custodial Bitcoin staking.

“With the non custodial staking, you can stake Bitcoin in your own wallet by putting a time lock on it. It’s called a time lock contract and it’s a Bitcoin native feature. You lock it in that transaction, you include the validator you want to delegate to, and for helping to decentralize and secure the core network, you get paid out in Core tokens for doing so without any new trust assumptions. So, something that helps to secure Core also helps with the whole mission, which is to unlock new use cases,” Dennis added.

Though Core emphasizes Bitcoin functionality for its holders, the Element Wallet is in charge of user privacy and the secure management of digital assets.

Addressing User Privacy and Asset Security

While the nature of the Core blockchain remains decentralized and transparent, the same does not apply to user details.

Privacy is a crucial aspect for Bitcoin users and the crypto ecosystem in general, explained Bruna Brambatti, Marketing Manager at Element Wallet.

“You’re going to see a lot of people that have random handles. They’re not using their profile picture. They are using an NFT. People like to be private and want to keep their money private. Even though we have this open space with the blockchain, we’re never going to know who the owner of that money in that wallet is,” she said.

Element Wallet is a multi-chain crypto wallet for seamless asset management and DeFi access. Though it’s compatible with different crypto assets like Bitcoin and TRON, it was initially built for Core participants and acts as the first and primary interface for the Core blockchain.

To address user privacy concerns, Element Wallet uses various mechanisms to protect identity and financial information. Element’s messaging uses end-to-end encryption for user privacy. Only the recipient can decrypt messages, protecting content from third parties.

While Element does not store these messages’ content, it maintains a record of communication between users, excluding the actual message content. The messages themselves are stored locally on the users’ devices.

Element also integrates in-chat peer-to-peer (P2P) transfers. Users can send payments or payment requests within these chats, enhancing security and clarity by communicating directly with the recipient. This functionality provides added security and convenience, enabling direct trading within the application.

“We never, ever have access to anyone’s funds or to their seed phrases. We do believe that the owners should have the power in their hands, so they can do what they think is best with their assets and trust that they are theirs,” Brambatti added.

To ensure that users can easily navigate the Core blockchain, Element Wallet incorporates user-friendly design strategies to simplify interaction.

Breaking Down Web3 Complexities

Core and Element representatives emphasized that community was at the heart of the blockchain’s success. To further cultivate user engagements, Core DAO focuses on breaking down onboarding barriers and facilitating user experience.

“We’re really focused on simplifying the kind of Web3 complexities that are often found in the space today. As we work closely with the Core DAO and the core team, and as the space evolves, we just find more opportunities to really simplify it and make UX be at the forefront of this,” explained Sean Schireson, Head of Product at Element Wallet.

Element Wallet simplifies Core chain-related activities by providing a unique and comprehensive wallet that meets all user needs.

“The Element Wallet really enhances the user experience on Core chain, since it was built for the Core ecosystem. If you want to buy crypto, swap, non custodially stake your Bitcoin, you could do it all. If you want to chat with people, you could do it on there. So just trying to get the whole community onboarded, so that we could all be on this one Element Wallet and all transact together and just make the experience better for everybody,” explained Dennis.

The Core team created Sparks, a dynamic system for measuring contributions to the Core community’s growth to encourage user participation. Sparks track user activity and engagement within the Core Chain ecosystem. Based on their interactions and involvement, they are awarded to users and their teams.

Daily Spark allocations are distributed based on activity level, with more active users receiving larger amounts. Users can also receive sparks by engaging with the Element Wallet.

“What we want to do is make that entry point feel like a consumer app that you’ve used and loved before. And that’s really our gold element. We’re not trying to necessarily reinvent the wheel, but we’re definitely trying to have a new spin on an otherwise kind of saturated UX market. And so that’s where we’re really focused on there,” concluded Schireson.

This focus on user experience and community engagement aims to facilitate broader adoption and participation in the developing BTCfi sector.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

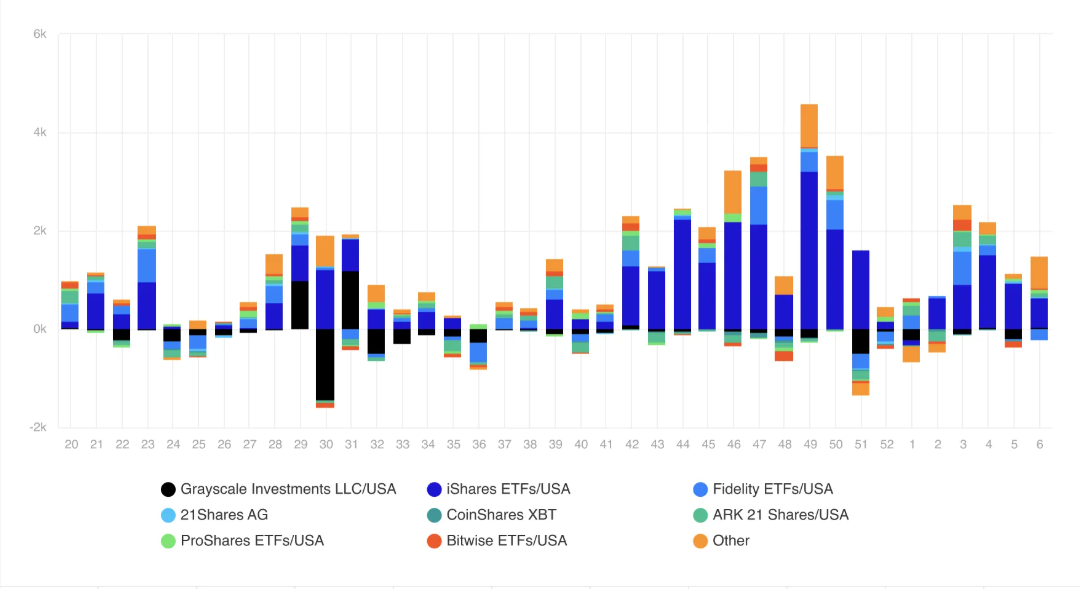

Crypto Inflows Hit $1.3 Billion Despite Price Volatility

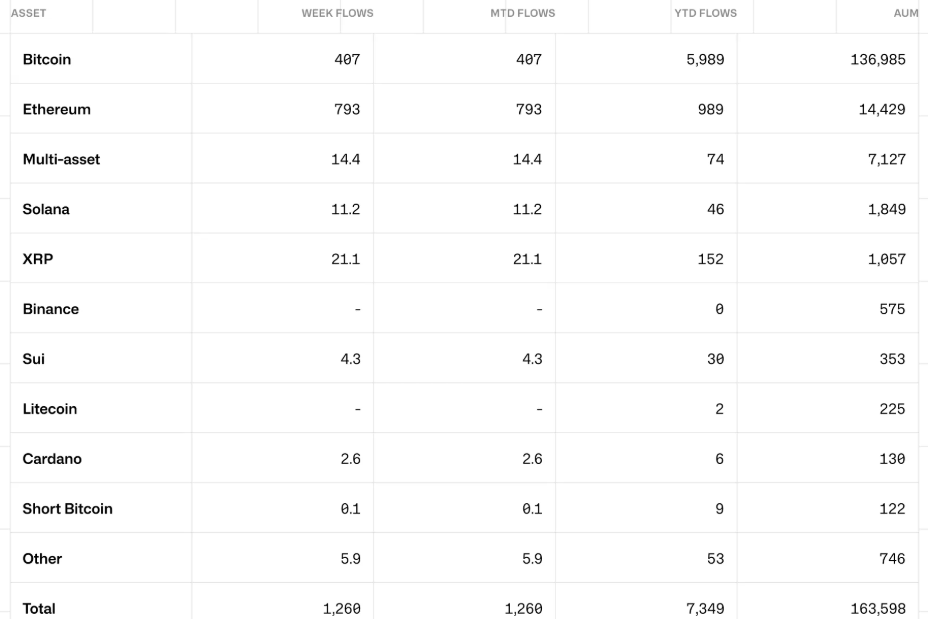

Despite recent price declines, crypto inflows soared to $1.3 billion last week. It marks the fifth consecutive week of positive inflows, demonstrating sustained investor confidence in the cryptocurrency market.

Interestingly, Ethereum inflows almost doubled the positive flows into Bitcoin, marking a notable paradigm shift.

Crypto Inflows Reached $1.3 Billion Last Week

The latest CoinShares report indicates that crypto inflows reached $1.3 billion last week. Specifically, Bitcoin saw inflows of $407 million, while Ethereum saw significant ‘buying the dip’ after its price dropped to $2,500, leading to inflows of $793 million.

Analysts attribute Ethereum’s inflows to the hype around the upcoming Pectra upgrade.

“Ethereum is still holding its uptrend support since May 2023. Last week, Ethereum ETFs had over $400 million in inflows. ETH big upgrades are coming next month. Trump is still buying and holding ETH. Mark my words; Once Ethereum goes above $4,000, it’ll pump like crazy,” one analyst observed.

This surge in crypto inflows follows a week where crypto investments saw $527 million in inflows amid the DeepSeek AI frenzy and Donald Trump’s tariffs on several countries. The continued interest highlights how institutional and retail investors capitalize on market dips to accumulate digital assets.

However, the market corrections over the five trading sessions saw the AUM (asset under management) of ETPs drop to $163 billion. This represents a drop of around 10% from the all-time high of $181 billion established in late January.

Notwithstanding, global ETPs remain the largest Bitcoin holder compared to any other entity.

“With ETPs globally now representing 7.1% of the current market capitalization, making them the largest holder relative to any other entity,” an excerpt in the report stated.

Trading volumes remained steady at $20 billion for the week, suggesting active repositioning among traders and investors amid recent price fluctuations. US President Donald Trump’s tariffs were a key trigger for the corrections, leading to a historic liquidation event in the crypto market.

More Altcoin ETFs on the Horizon

In a related development, Nasdaq has formally filed 19b-4 forms with the US SEC (Securities and Exchange Commission) to list and trade two ETPs from CoinShares. First, the CoinShares XRP ETF and second, the Litecoin ETF, with the proposed funds expected to provide investors exposure to XRP and LTC, respectively.

CoinShares is not alone—other firms such as Grayscale, WisdomTree, Bitwise, and Canary Capital have also submitted filings for an XRP ETF, as reported in recent filings with the SEC.

Ripple CEO Brad Garlinghouse recently stated that an XRP ETF is inevitable, emphasizing the growing demand for structured investment vehicles that provide regulated exposure to the asset.

Similarly, Litecoin ETFs are gaining traction, with Canary Capital and Grayscale applying for their respective funds. Nasdaq has also filed to list a Litecoin ETF, further reflecting the expanding market for crypto investment products.

This surge in ETF filings aligns with broader industry trends, where institutional players seek regulated investment vehicles for alternative digital assets.

As speculation around a Litecoin ETF builds, on-chain data reveals that whales are increasing their LTC holdings, anticipating potential regulatory approval.

Such accumulation trends have historically been early indicators of strong institutional and retail demand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoRetail Investors Rush To Buy Bitcoin As Whales Offload; What Does This Mean For Bitcoin?

-

Market21 hours ago

Market21 hours agoBitcoin Price Gradually Slips: Can Bulls Hold Key Support?

-

Altcoin21 hours ago

Altcoin21 hours agoBTC & Altcoins Turbulent, LTC Jumps 5%

-

Market20 hours ago

Market20 hours agoXRP Price Uptrend Hits a Snag—Is a Fresh Increase Still Possible?

-

Market19 hours ago

Market19 hours agoEthereum Price Declines Again: Will the Downtrend Continue?

-

Bitcoin18 hours ago

Bitcoin18 hours agoUS Economic Data to Watch This Week for Crypto Investors

-

Bitcoin12 hours ago

Bitcoin12 hours agoJapan’s FSA Plans Crypto Tax Reform & Bitcoin ETF Greenlight

-

Market17 hours ago

Market17 hours agoTRUMP Price Hits An All-Time Low As Traders Turn Bearish