Market

Satoshi’s Bitcoin Could be Hacked With Quantum Computing

Tether CEO Paolo Ardoino has dismissed concerns that quantum computing poses an immediate risk to Bitcoin’s security.

His remarks follow reports that Google anticipates commercial quantum computing applications could emerge within the next five years.

Quantum Computing Might Allow Lost BTC to Reenter Circulation

In a February 8 post on X, Ardoino reassured the community that Bitcoin’s cryptographic security remains intact. He stated that quantum computing is still far from posing a meaningful threat and that Bitcoin would adopt quantum-resistant solutions before the technology becomes a serious concern.

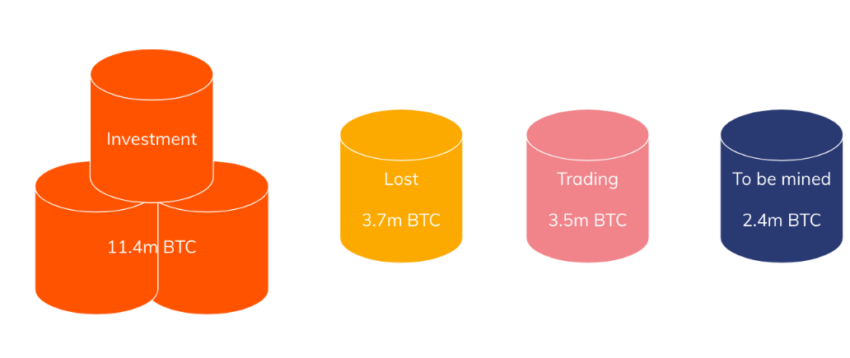

However, he pointed out that if quantum technology advances significantly, inactive Bitcoin wallets—particularly those belonging to lost keys or deceased owners—could face exposure.

This includes wallets believed to contain the estimated 1.2 million BTC linked to Bitcoin’s pseudonymous creator, Satoshi Nakamoto.

“Any Bitcoin in lost wallets, including Satoshi (if not alive), will be hacked and put back in circulation,” the Tether CEO said.

Despite this, Ardoino dismissed concerns that quantum computing could disrupt Bitcoin’s fundamental monetary structure. He emphasized that Bitcoin’s supply cap of 21 million will remain unchanged, irrespective of technological advances.

“Only 21 million Bitcoin anyway. Nothing can change that. Not even quantum computing. That’s the real key important message,” Ardoino added.

Ardoino’s stance aligns with that of Emin Gün Sirer, co-founder of Ava Labs. Sirer previously pointed out that early Bitcoin transactions used a now-outdated Pay-to-Public-Key (P2PK) format.

This method exposes public keys, making them potentially vulnerable to quantum attacks.

Sirer suggested that a precautionary approach could help mitigate future risks. This includes freezing old P2PK-based holdings or setting a deadline for their usability.

“Satoshi’s early minded coins used the very old Pay-To-Public-Key (P2PK) format, which reveals the public key and gives the attacker time to grind, for the mother of all cryptography bounties…as QC gets threatening, the Bitcoin community might want to look into freezing Satoshi’s coins, or more generally, provide a sunset date and freeze all coins at P2PK utxos,” Sirer noted.

The Quantum Computing Race and Its Implications

Quantum computing leverages the principles of quantum mechanics to process information at speeds far beyond conventional computers.

This breakthrough has raised concerns about its ability to weaken modern encryption, including the cryptographic safeguards securing blockchain networks.

Google recently unveiled its latest quantum processor, Willow, sparking fresh discussions about how soon these advancements could impact cybersecurity.

While many experts had estimated that practical quantum threats were at least a decade away, Google’s Quantum AI chief, Hartmut Neven, suggested that commercial applications might arrive within five years.

“We’re optimistic that within five years we’ll see real-world applications that are possible only on quantum computers,” Neven reportedly said.

A sufficiently advanced quantum computer could theoretically break cryptographic keys, manipulate blockchain transactions, and take control of mining operations.

This could lead to risks such as unauthorized access, double spending, and network manipulation. As a result, the crypto community is closely watching these developments for their potential impact on digital security.

Notably, the blockchain industry is already developing countermeasures. Blockchain networks like Solana are actively working on quantum-resistant cryptography, ensuring that the technology evolves alongside emerging threats.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PEPE Price Enters Oversold Levels On Daily Timeframe, Here’s What Happened The Last Two Times

The recent downturn that has swept across the entire crypto market has pushed meme coin PEPE into oversold territory, according to the Relative Strength Index indicator. Notably, this is only the third time PEPE has reached the oversold levels in its history, particularly on the daily candlestick timeframe.

Historical data shows that in the previous two instances, PEPE’s price movement followed a specific pattern, leading to a strong recovery after a period of consolidation. As such, the recent PEPE price crash might be the first step before an incoming bull price action.

PEPE Oversold Condition Is A Rare Market Event: What Happened The Last Two Times?

PEPE hasn’t had much history to go by, as it is one of the youngest meme coins with a large market cap. However, over the past year and a half since its launch, PEPE has rarely dipped into oversold territory on the Relative Strength Index (RSI). This makes its current oversold status a significant event in technical analysis, as it has only happened twice before. An oversold condition is when the selling pressure on a crypto becomes too much in a short period, which causes the RSI indicator to fall below 30.

Related Reading

In both previous instances where PEPE became oversold, the price entered a consolidation phase lasting approximately one month before rebounding with a strong uptrend. This pattern is evident in a PEPE daily candlestick chart shared on social media platform X by crypto analyst Obi (@obi_eths), which illustrated the meme coin’s historical response to oversold conditions.

As shown by the chart below, the first time the meme coin became oversold was in September 2023, four months after its launch. Notably, the oversold condition was followed by 31 days of consolidation before PEPE eventually shot up to new all-time highs in the weeks after.

A similar trend occurred in August 2024, when PEPE entered into an oversold condition for the second time. This was followed by another 31 days of consolidation up until September 6, when another uptrend began.

Accumulation Phase? What To Expect Next

With PEPE now entering another oversold condition, historical patterns suggest that the meme coin could remain in a consolidation phase for at least the next month. If past trends repeat, this period could serve as an accumulation window for investors who are willing to exercise patience and position themselves ahead of a potential rally.

Related Reading

The timeline for this anticipated surge should begin on March 10, which is exactly 31 days after PEPE entered the recent oversold condition. From here, the meme coin could attempt to mirror its past rebounds by staging an extended move that could push its price beyond its current all-time high of $0.00002803, which was recorded on December 9, 2024.

At the time of writing, PEPE is trading at $0.000009544, 65.8% below this all-time high.

Featured image from Shutterstock, chart from Tradingview.com

Market

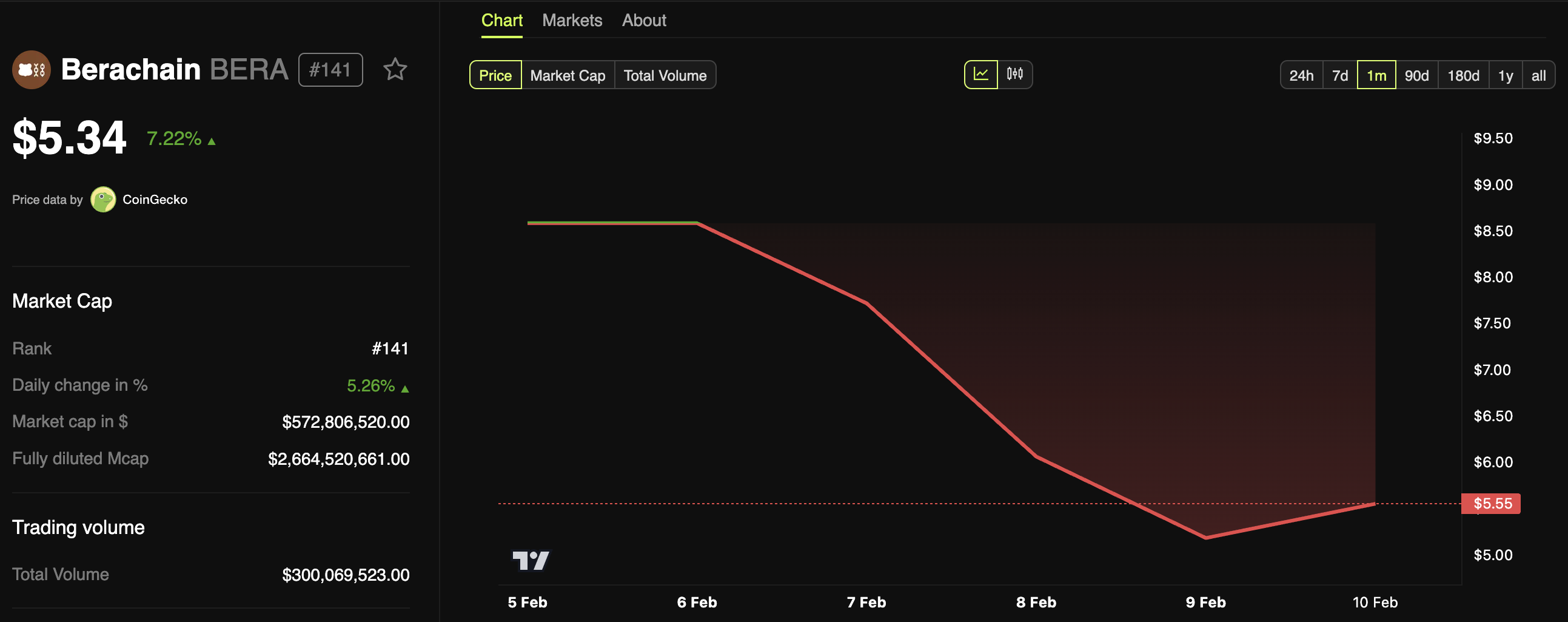

Berachain Controversy as Co-Founder Sells BERA Tokens

Just days after its mainnet launch and airdrop, the Berachain community is concerned about the project’s visible favoritism toward private investors. There are also allegations about the network’s lead developer swapping large amounts of airdropped BERA tokens.

Despite this, however, Berachain does have a chance to rebuild public trust. If its Proof of Liquidity system gets implemented and becomes operational, it would be a truly novel project.

Questionable Decisions from Berachain Developers

Berachain, the new layer-1 blockchain network, has created notable engagement in the crypto space due to its airdrop and mainnet launch last week. Although the firm has a clear vision to become a novel network with its unique ‘Proof of Liquidity’ mechanism, its marketing and hype are evocative of meme coin culture.

Its pre-launch liquidity platform attracted $2.3 billion in deposits. Berachain also started one of the biggest airdrops this year with its mainnet launch on February 6. Its BERA token also received Binance listing immediately after TGE, along with other major exchanges.

However, trouble has been brewing. When the airdrop happened, users complained that testnet farmers got minuscule BERA token rewards.

Berachain’s blockchain is designed as a self-contained system of three tokens: BERA, BGT, and HONEY, which serve different functions. However, by staking and burning different tokens, users can exploit the system.

“Wait, so all the huge insiders of Berachain, with locked BERA tokens, can stake the BERA, receive BGT, burn the BGT for BERA and then dump? Please tell me this isn’t true. It’s almost criminal,” one user wrote after the BERA tokenomics were revealed last week.

Ericonomic, an observer of Berachain’s blockchain ecosystem, compiled a thread of pressing concerns. Essentially, more than 35% of the BERA token supply went to private investors, and its inflation is much higher than most projects.

Also, private investors can stake BERA to earn liquid rewards that they can easily dump. There are also concerns about one potential core developer dumping his BERA tokens.

“A cofounder [DevBear] is selling tokens from one of his doxxed addresses. He got around 200,000 BERA from the airdrop (this is a really bad thing since he, or the core, designed the airdrop) and then he swapped some of those tokens for WBTC, ETH, BYUSD, etc,” Ericonomic claimed.

Berachain developers didn’t reveal the nature of their blockchain’s staking scheme until recently. Additionally, although they claim that Berachain’s core product will be Proof of Liquidity, this hasn’t materialized yet.

So, all of these factors do make BERA’s long-term sustainability questionable. It might end up being as extremely volatile as non-utility meme coins.

“I’ve always seen Berachain as a breath of fresh air in a place full of scams, something with its own culture and good morals, and I’m not gonna lie—seeing this ‘bad’ launch and the ‘shady’ stuff makes me feel kinda sad. But the end, if the builders keep working as they have for the last few years, Berachain will succeed and become the best place to yield by far,” Ericonomic wrote.

BERA Token Continues to Struggle

As soon as the airdrop took place, BERA’s price began dropping like a rock. It fell over 50% from its intra-day peak post-airdrop, and it continued to struggle the next day.

Ostensibly, Berachain is attempting a novel type of blockchain project, but community confidence has been shaken, and that crisis has been reflected in its valuation.

Still, even despite these alarming trends, community members are not totally bearish in their predictions. There is still a lot of optimism around the Proof of Liquidity (PoL) mechanism. The network has significant developer support.

So, if PoL is implemented and the dev community remains committed to leveraging the novel architecture, Berachain could likely overcome these challenges in the long-term.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Price Struggles as Bearish Indicators Persist

Cardano (ADA) price remains in a consolidation phase after dropping more than 25% over the last 30 days as it struggles to reclaim the $25 billion market cap threshold. Despite signs of stabilization, indicators still reflect lingering bearish pressure.

The Ichimoku Cloud setup also suggests ADA is struggling to build momentum, with price trading near key levels but failing to break decisively higher. However, if bullish momentum returns, ADA could test resistance at $0.82, with a breakout potentially leading to a recovery toward $1.16, representing a 67% upside.

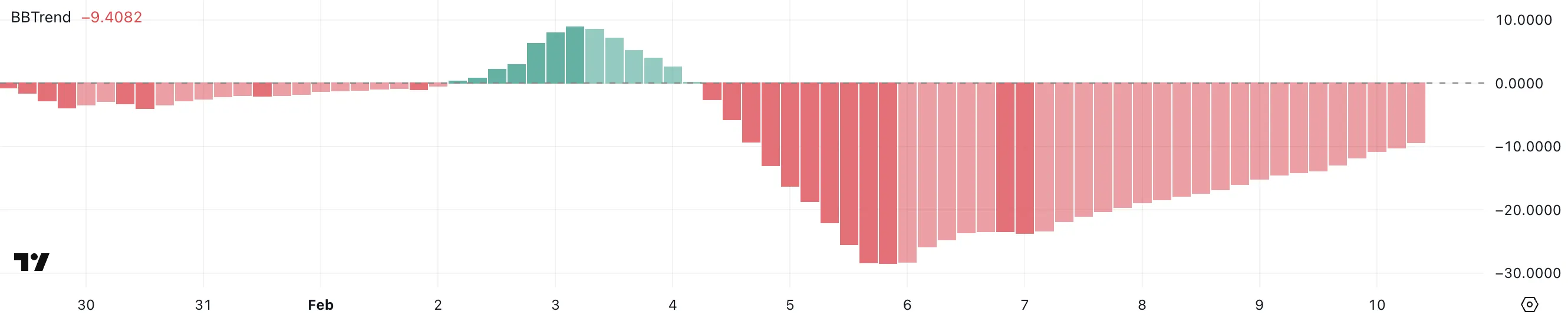

Cardano BBTrend Is Recovering From Recent Lows, But It’s Still Very Negative

Cardano BBTrend indicator is currently at -9.4, showing a steady recovery from its recent low of -28 just five days ago. Despite this rebound, the indicator remains in negative territory and has now been negative for six consecutive days.

This suggests that while bearish pressure is easing, ADA has yet to establish a clear shift in momentum. Without stronger bullish signals, the recovery could stall, keeping price action under pressure.

BBTrend, or Bollinger Band Trend, measures the strength and direction of a trend using Bollinger Bands. Values below zero indicate bearish conditions, while positive values suggest bullish momentum.

With ADA BBTrend still at -9.4, the market remains in a downtrend despite recent improvements. If the indicator continues rising, it could signal a trend reversal, but as long as it stays negative, ADA price may struggle to build sustained upward momentum.

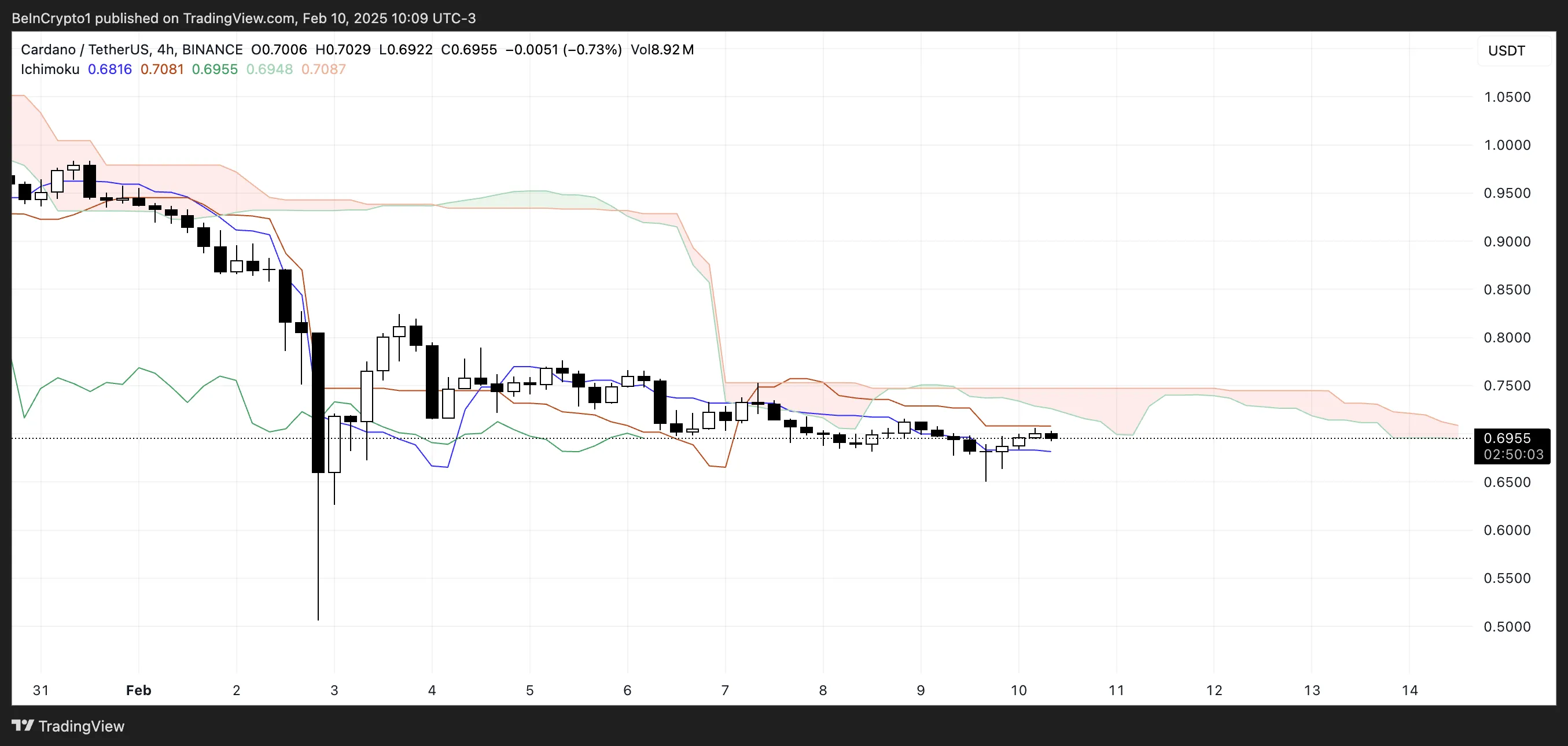

Ichimoku Cloud Shows ADA Is Struggling To Build Momentum

Cardano Ichimoku Cloud setup reflects a market struggling to gain momentum, with price trading near the baseline (red line) and conversion line (blue line).

The lagging span (green line) remains below the price, reinforcing that ADA has yet to show any strong bullish signs. Price has remained mostly below the cloud, signaling ongoing weakness, with no clear break above key levels.

The future cloud (Kumo) remains thin and bearish, with the leading span A (green cloud boundary) below the leading span B (red cloud boundary).

A thin cloud suggests weak trend strength, meaning ADA price could continue in a choppy, indecisive pattern. Until price can break above the cloud and hold, upside potential remains limited, and bearish momentum could persist.

ADA Price Prediction: Will Cardano Recover December 2024 Strong Uptrend?

Cardano (ADA) EMA lines continue to signal a downtrend, with short-term moving averages positioned below long-term ones. This bearish setup suggests that unless momentum shifts, Cardano price could extend its decline toward $0.50.

The persistent weakness in EMA alignment indicates that sellers still have control, and a failure to stabilize could accelerate losses.

However, BBTrend suggests that the downtrend may be easing, opening the possibility of a trend reversal. If ADA can regain bullish momentum, it could push toward the $0.82 resistance level, with a breakout paving the way for a move to $0.98.

If ADA can recover the good momentum from December 2024, it could reclaim levels around $1.16, representing a potential 67% upside.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoRetail Investors Rush To Buy Bitcoin As Whales Offload; What Does This Mean For Bitcoin?

-

Market20 hours ago

Market20 hours agoXRP Price Uptrend Hits a Snag—Is a Fresh Increase Still Possible?

-

Market21 hours ago

Market21 hours agoBitcoin Price Gradually Slips: Can Bulls Hold Key Support?

-

Altcoin21 hours ago

Altcoin21 hours agoBTC & Altcoins Turbulent, LTC Jumps 5%

-

Market19 hours ago

Market19 hours agoEthereum Price Declines Again: Will the Downtrend Continue?

-

Bitcoin18 hours ago

Bitcoin18 hours agoUS Economic Data to Watch This Week for Crypto Investors

-

Bitcoin12 hours ago

Bitcoin12 hours agoJapan’s FSA Plans Crypto Tax Reform & Bitcoin ETF Greenlight

-

Market17 hours ago

Market17 hours agoTRUMP Price Hits An All-Time Low As Traders Turn Bearish