Market

Dogecoin Price Suffers 25% Crash, But Here’s How It Can Recover

Dogecoin has suffered a significant downturn, dropping nearly 25% in the past week and reaching a two-month low. The recent price decline has weakened investor confidence, leaving DOGE vulnerable to further corrections.

While bearish sentiment dominates, there is possible scope for recovery if key market conditions align in favor of buyers.

Dogecoin Investors Have A Shot

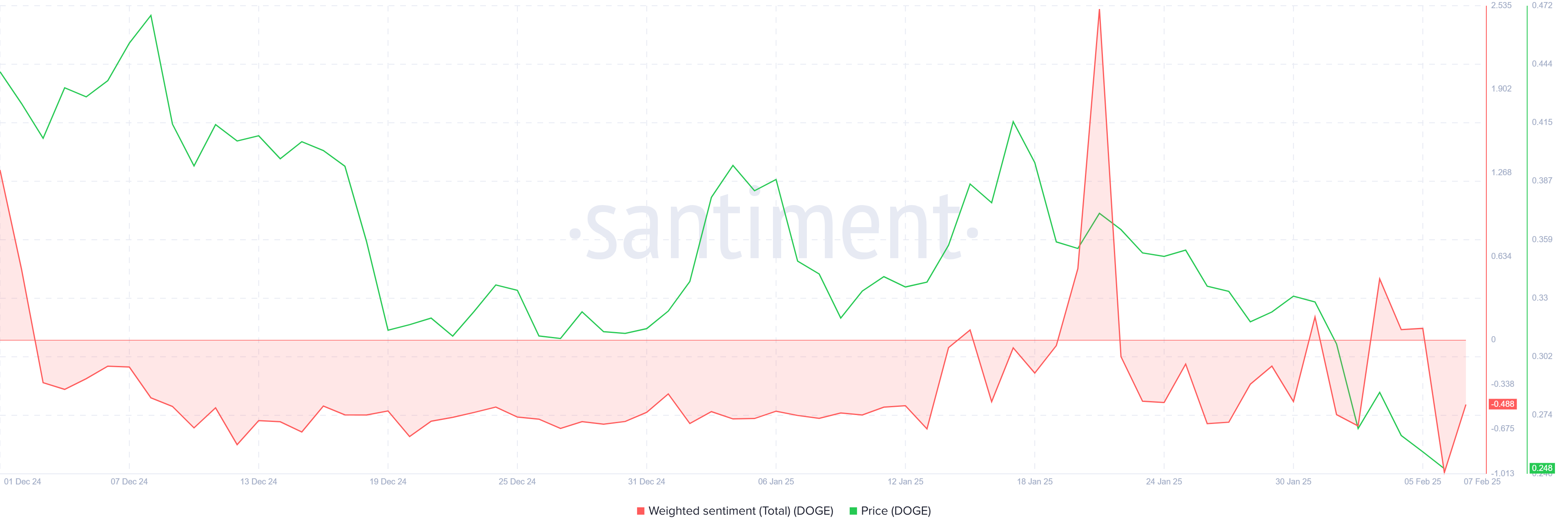

The weighted sentiment for Dogecoin has entered negative territory as skepticism grows among investors. The ongoing decline and lack of a meaningful recovery have contributed to bearish outlooks.

Without a strong upward push, DOGE holders may continue exiting their positions, further increasing selling pressure and slowing any potential rebound.

As uncertainty rises, liquidity and active addresses could decline, making it difficult for DOGE to sustain buying momentum. Historically, prolonged periods of negative sentiment have resulted in lower network participation.

If this trend persists, Dogecoin may struggle to recover in the short term, keeping price action constrained under key resistance levels.

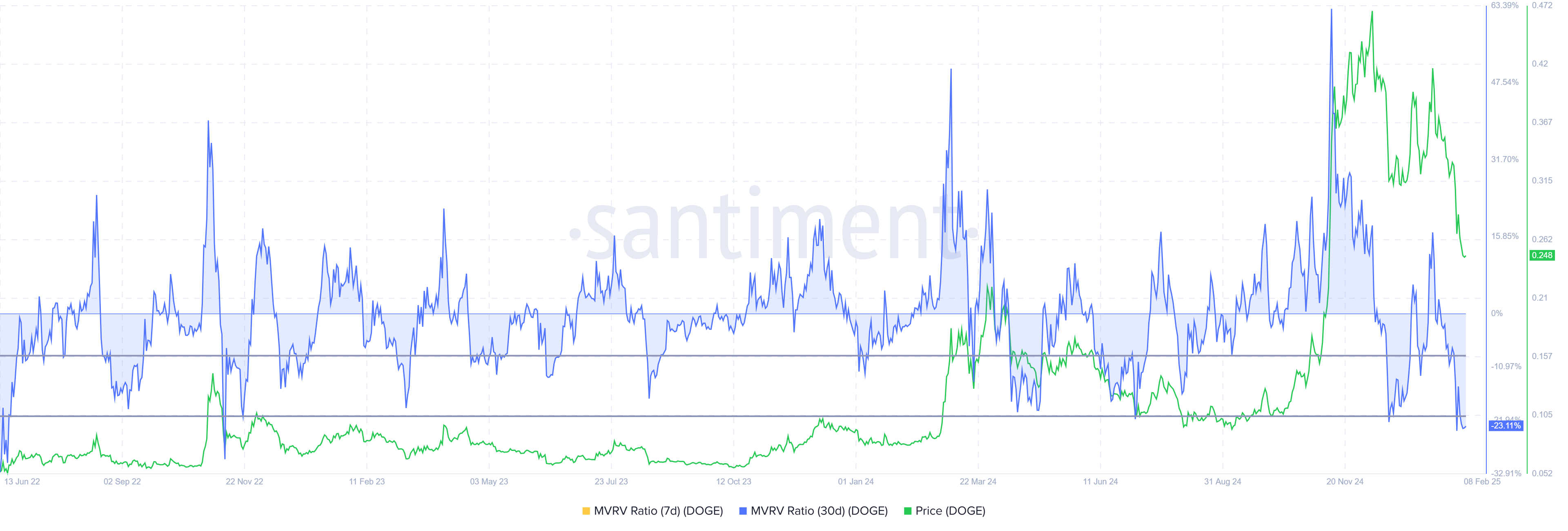

The broader market outlook for Dogecoin suggests a potential buying opportunity, as indicated by the Market Value to Realized Value (MVRV) ratio. Currently sitting at -23%, the metric is below the historical opportunity zone, which ranges between -9% and -21%. In past cycles, DOGE has rebounded from these levels.

Investors seeking to accumulate at lower prices could take advantage of current conditions, potentially driving DOGE’s price higher. If accumulation increases, the meme coin may experience a gradual recovery.

DOGE Price Prediction: Breaching Barriers

Dogecoin is trading at $0.248, marking a 25% crash over the past week. If the bearish pressure continues, the price could drop further toward $0.220, extending recent losses.

The ability to maintain support at this level will be crucial in determining whether DOGE can stabilize.

The current market signals remain mixed, suggesting that DOGE may consolidate between $0.220 and $0.268. Without a breakout, price movement could remain stagnant within this range.

For Dogecoin to regain lost ground, it must breach the $0.268 resistance level. Successfully flipping this barrier into support would open the door for a rally toward $0.311.

If achieved, this move would invalidate the bearish outlook and help DOGE recover a portion of its recent losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Kanye West Says No to $2 Million Crypto Scam Proposal

American rapper Kanye West has revealed that scammers offered him $2 million to promote a fraudulent meme coin bearing his name.

The revelation comes amid speculation that he is exploring the crypto industry and seeking connections with Coinbase CEO Brian Armstrong.

Kanye West’s Crypto Revelation Raises Questions on Celebrity Endorsements

West stated that an unknown party approached him with a lucrative offer to mislead his audience.

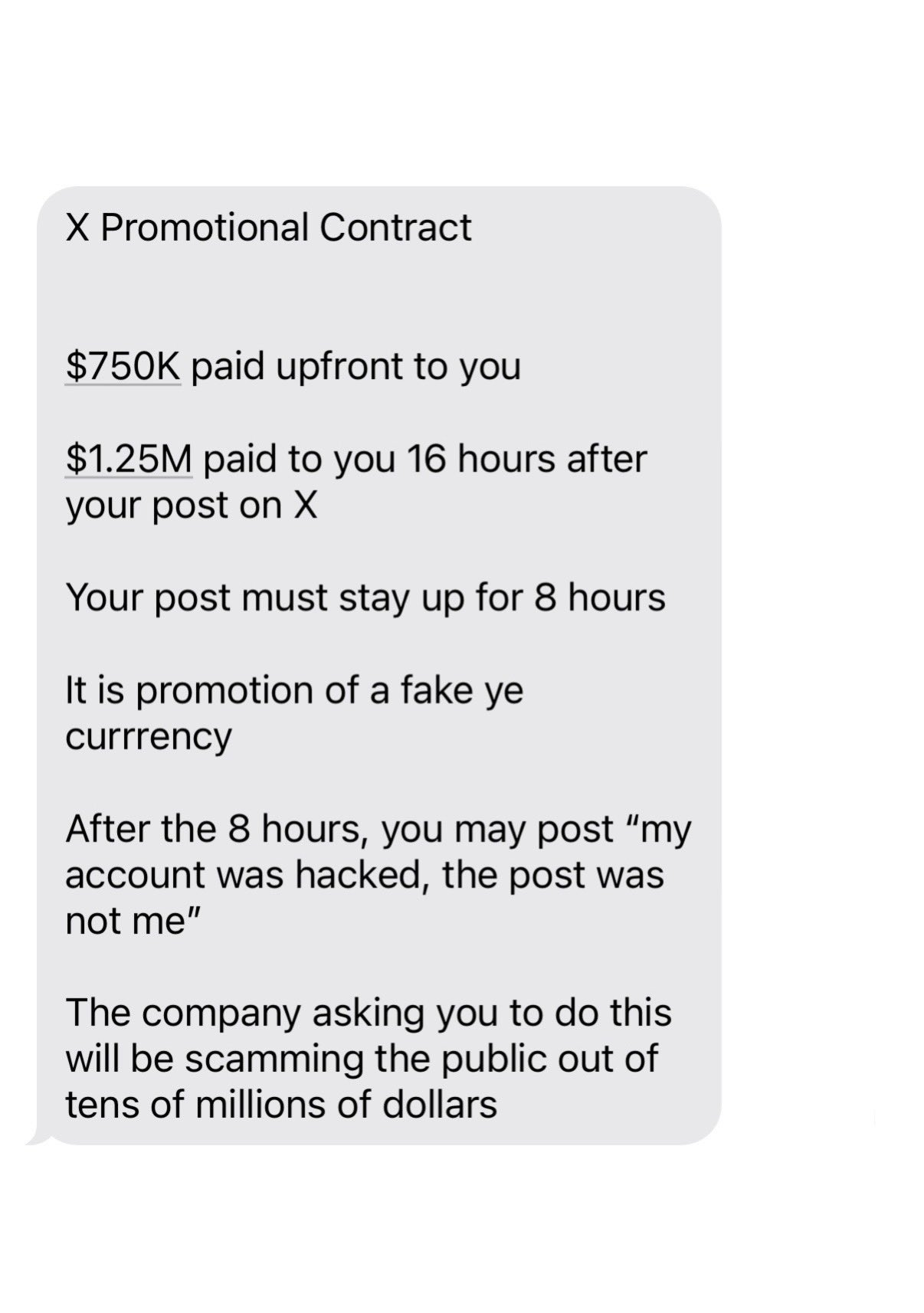

According to his post, the proposed deal included an initial payment of $750,000, with the remaining $1.25 million scheduled for release 16 hours after he promoted the token.

The agreement also required the promotional post to stay live for at least eight hours before he could delete it. To cover up the endorsement, the scammers suggested he later claim his account had been hacked.

The fraudsters’ final message bluntly admitted that their plan was to steal “tens of millions of dollars” from the public.

However, West rejected the deal because he had no interest in deceiving his followers. The rapper also added that his net worth is back to $2.77 billion, and he achieved that without endorsing any cryptocurrency.

“I was proposed 2 million dollars to scam my community-those left of it. I said no and stopped working with their person who proposed it,” West stated.

Following his public rejection of the scam, West shared another screenshot of a private conversation where he sought guidance from a reliable figure in the crypto industry. One suggestion pointed him toward Coinbase CEO Brian Armstrong.

Celebrity Endorsements Have Lost Credibility

Meanwhile, West’s revelation has raised concerns about similar incidents involving high-profile accounts on X. Over the years, multiple celebrities and influencers have reported hacks that led to the promotion of questionable crypto projects.

Some believe these so-called hacks may not always be genuine, suggesting certain influencers may willingly participate in these schemes.

“Are you telling me all the big accounts getting ‘hacked’ and posting a memecoin over the last several months are fake?” Crypto influencer NotEezzy questioned.

Meanwhile, blockchain security expert Yu Xian, founder of SlowMist, confirmed that these types of scams are widespread. He noted that while compromised accounts are often used for fraudulent promotions, scammers also directly approach influencers with financial incentives.

“I believe this kind of scam exists. The scammers get a big [influencer] to act in the scheme, post a CA, and 8 hours later, the big [influencer] tweets that they got hacked. But with a prepayment of $750,000, is it that intense?” Xian wrote.

Overall, celebrity-endorsed meme coins are highly questionable in the current market. The ease of stealing millions with a simple rug pull might be too lucrative for some celebrities to ignore.

Users must remain cautious and not take any celebrity endorsement as a seal of trust or credibility.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Fails To Hold $100,000: What’s Next for Investors?

Bitcoin has experienced significant price swings in the past 24 hours, briefly surpassing the $100,000 mark before retracing. The sudden drop reflects the ongoing market uncertainty, with traders reacting to short-term volatility.

However, long-term stability appears to be taking shape, largely supported by mature investors holding onto their positions.

Bitcoin has Taken A Different Approach

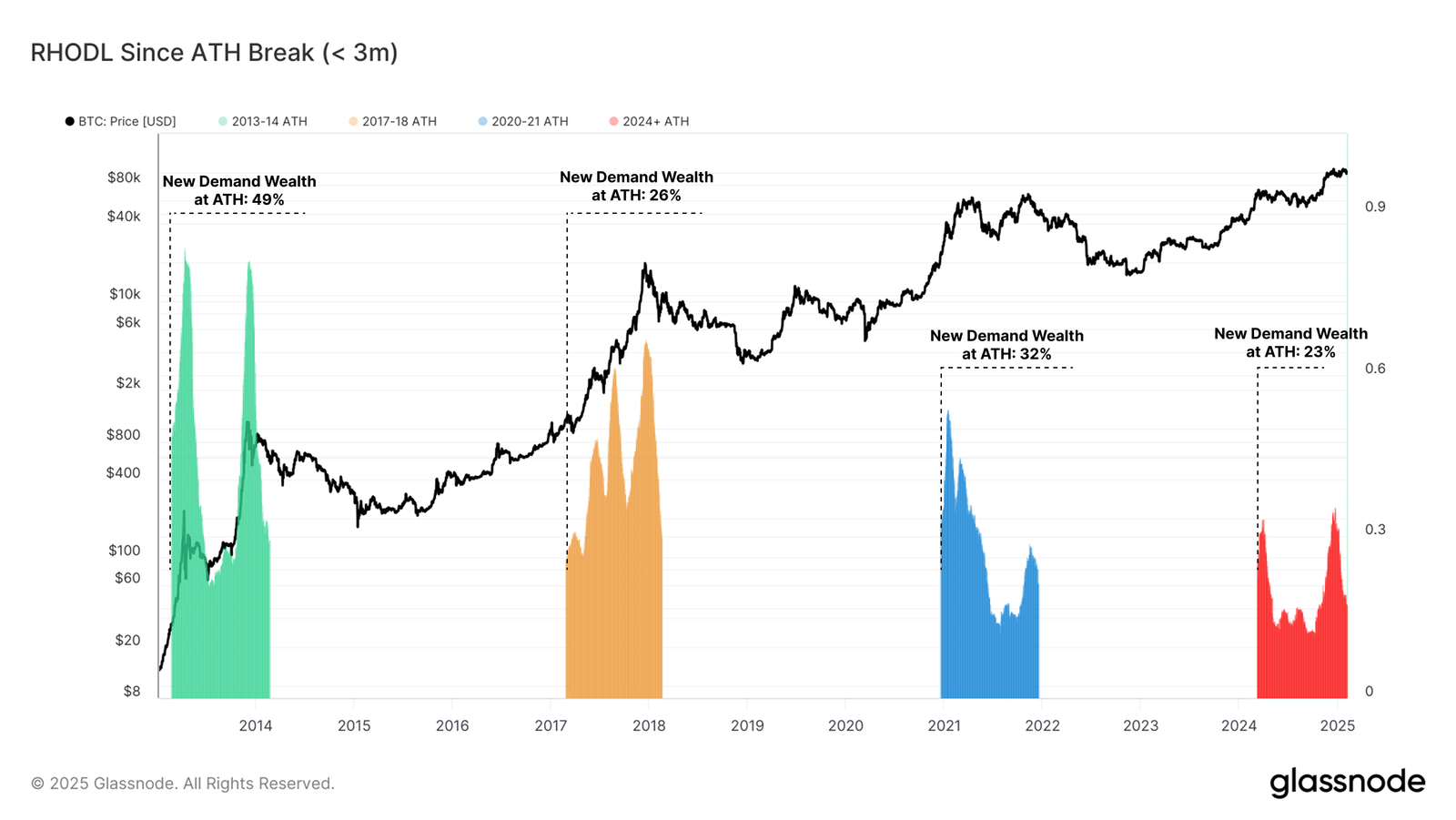

The RHODL (Realized HODL) ratio since Bitcoin’s recent all-time high (ATH) sits at 23%. While new demand remains significant in this cycle, the wealth held in coins older than three months is much lower than in previous cycles. This suggests that new demand inflows have been occurring in bursts rather than in a sustained pattern.

Unlike previous market cycles, which typically concluded one year after the first ATH break, the current cycle has taken an atypical trajectory. Bitcoin first reached a new ATH in March 2024, yet demand has yet to match the levels seen in past rallies. This deviation raises questions about how the rest of the cycle will unfold.

Realized volatility on a three-month rolling window remains below 50% in this cycle. In contrast, past bull runs saw volatility levels exceeding 80% to 100%. This reduction in volatility suggests that Bitcoin’s price action is more structured, with mature investors contributing to a more stable market environment.

The 2023-25 cycle has followed a stair-stepping pattern, with price rallies followed by consolidation periods. Unlike previous cycles characterized by extreme swings, Bitcoin’s current trajectory exhibits signs of gradual price increases. This trend supports a more controlled bull market, reducing the risk of extreme crashes.

BTC Price Prediction: Holding Above A Crucial Support

Although Bitcoin’s long-term outlook remains uncertain due to rising short-term volatility, the immediate forecast suggests vulnerability to correction. The cryptocurrency is trading close to key support levels, and further declines could lead to a deeper retracement.

If Bitcoin loses the $95,869 support level, it may drop toward $93,625. While BTC holders have refrained from significant profit-taking, further losses could trigger a wave of selling. This scenario would put additional pressure on the price, extending Bitcoin’s correction.

On the other hand, a bounce off $95,869 could enable Bitcoin to reclaim the $100,000 level. Successfully breaching this psychological barrier would invalidate the bearish outlook, potentially setting the stage for a renewed uptrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Biggest Altcoin Losers in the First Week of February 2025

The volatile market led to significant drawdowns for many altcoins this week, as Bitcoin and Ethereum also faced corrections. While a few assets managed to stay in the green, most cryptocurrencies hit multi-week or multi-month lows.

BeInCrypto analyzed three altcoins that recorded the steepest declines, emerging as the worst performers of the week.

Dogwifhat (WIF)

WIF price plummeted by nearly 38% this week, hitting an 11-month low of $0.704. The steep decline followed the loss of the crucial $0.829 support level earlier this week. This downturn has intensified bearish sentiment, raising concerns about further losses as the altcoin struggles to find stability in the current market.

The meme coin’s decline was aggravated by reports that it made false claims about a partnership with the Las Vegas Sphere. The drawdown also caused WIF to slip below the psychological $1.000 mark.

Currently holding above $0.674, the meme coin remains vulnerable to further declines. If this support fails, selling pressure could drive WIF below $0.600, with a potential drop to $0.500, further extending losses for investors.

A possible reversal remains if WIF can bounce off the $0.674 support. A successful recovery could see the token reclaim $0.829 as a support level. If WIF pushes back above $1.000, it would invalidate the bearish outlook, signaling a shift toward a potential recovery.

Virtuals Protocol (VIRTUAL)

VIRTUAL has suffered a significant 40% decline, making it the worst-performing cryptocurrency of the week. The token is currently trading at $1.19 after losing its crucial $1.30 support. This sharp drop has intensified selling pressure, and without a reversal, VIRTUAL could face further downside in the short term.

The AI agent token has reached a two-month low, with traders closely watching the $1.00 level. Holding above this support is critical, as any further decline could push VIRTUAL toward $0.90.

A drop to this level would extend investor losses and reinforce bearish momentum, delaying any potential recovery.

However, reclaiming $1.30 as support could shift sentiment in favor of buyers. A breakout above this level would invalidate the bearish outlook and position VIRTUAL for a rally toward $1.99.

This move would erase recent losses and restore confidence in the altcoin’s long-term potential.

Celestia (TIA)

TIA is experiencing a sharp 31% decline this week and is currently trading at $2.88. The altcoin is attempting to hold above the crucial support level of $2.67.

If the downtrend continues, this support will play a key role in determining whether TIA can stabilize or extend its losses in the coming days.

Although investor selling has not significantly increased, TIA remains vulnerable to profit-taking. If selling pressure rises, the altcoin could slip below the $2.67 support.

A drop to $2.50 or lower would extend losses and reinforce the bearish momentum, making recovery more challenging for the asset in the short term.

A potential reversal is possible if TIA reclaims $3.28 as a support level. Flipping this barrier could invalidate the bearish outlook and restore buying confidence.

If momentum strengthens, the altcoin could push toward $3.88, marking a significant recovery from recent losses and shifting sentiment back to bullish territory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Investors’ Risk Appetite Declines Sharply Amid Growing Market Uncertainty

-

Market23 hours ago

Market23 hours agoCoinbase Puts PENGU, POPCAT, and MORPHO On Roadmap

-

Market22 hours ago

Market22 hours agoPEPE Price Crashes 50%; Death Cross and an Opportunity next

-

Market21 hours ago

Market21 hours agoCrypto Whales Bought These Altcoins This Week

-

Market18 hours ago

Market18 hours agoTornado Cash Co-Founder Alexey Pertsev Released From Prison

-

Market17 hours ago

Market17 hours agoSOL Price Drops 17% in a Week, Struggles Near $200

-

Market16 hours ago

Market16 hours agoTop AI Coins To Watch In February: SNAI, VVV, VIRTUAL

-

Altcoin16 hours ago

Altcoin16 hours agoCrypto Analyst Says Dogecoin Price Could Reach $20 This Cycle With Over 306x Surge