Market

Trump Tariffs, XRP ETF, and More

This week, the crypto market recorded several important developments, from US trade policies and token listings to blockchain and regulatory advancements. The highlights display how the global cryptocurrency ecosystem continues to advance.

The following is a roundup of crucial developments that happened this week but will continue shaping the sector.

Trump’s Tariffs Shake Global Markets

US President Donald Trump stirred the global trade market earlier this week, proposing tariffs against Canada, Mexico, and China. This new round of trade restrictions was aimed at protecting domestic industries.

Following the initial announcement, Canada and Mexico pushed back, leading to temporary delays in some tariff applications. Mexico, in particular, secured a short-term reprieve as both nations entered new negotiations with the US government.

“We had a good conversation with President Trump with great respect for our relationship and sovereignty; we reached a series of agreements. Our teams will begin working today on two fronts: security and trade. Tariffs will be paused for one month from now,” Mexican President Claudia Sheinbaum shared on X (Twitter).

Against this backdrop, analysts observed Bitcoin’s Coinbase Premium Index hitting a 2025 high, indicating increased demand in North America. Investors appear to be shifting toward Bitcoin as a hedge against possible economic instability caused by these trade policies.

Meanwhile, China retaliated, imposing a 10% tariff on US crude oil and agricultural machinery on its exports to the US. While this reignited fears of another prolonged trade war, some analysts argue that China’s latest tariffs may not have as severe an impact as initially feared.

UAE Taps Shiba Inu

BeInCrypto also reported the United Arab Emirates (UAE) is advancing its aggressive push toward becoming a global leader in Web3 adoption. This week, Shiba Inu (SHIB) was selected to integrate blockchain into various government services. The partnership will facilitate blockchain-based solutions across sectors, improving efficiency and security.

“By embracing emerging technologies, we aim to set a global benchmark for innovation, delivering transformative solutions that benefit both our citizens and the wider community,” His Excellency Eng Sharif Al Olama, Undersecretary for Energy and Petroleum Affairs at UAE’s Ministry of Energy and Infrastructure, stated.

Beyond this collaboration, the UAE remains one of the most crypto-friendly jurisdictions, reinforced by its tax exemption policy for digital asset firms. With no corporate tax levied on crypto businesses, the country attracts global blockchain firms and talent, positioning itself as a pivotal player in the digital economy.

The price of Shiba Inu briefly surged after the announcement. At press time, the meme coin was trading at $0.00001563.

Coinbase Mulls Two Altcoins for Listing

Coinbase, the largest US-based crypto exchange, added two new altcoins—Ether.fi (ETHFI) and Bittensor (TAO)—to its listing roadmap. Following the announcement, the tokens’ values surged by nearly 40%, reflecting the typical price action seen when assets gain visibility on major exchanges.

Historically, tokens listed on Coinbase or Binance exchange tend to witness significant price appreciation due to increased accessibility and liquidity. For example, Binance’s recent addition of AI-powered altcoins led to price spikes across the sector. Similarly, the TOSHI token soared upon the Coinbase listing announcement.

Cognizant of such turnouts, investors often monitor these listing announcements in a calculated attempt to capitalize on expected gains.

SEC Litigator Reassignment

The US Securities and Exchange Commission (SEC) recently reassigned one of its lead litigators to the agency’s IT department. What was surprising, however, was that litigator Jorge Tenreiro was pivotal in the high-profile Ripple (XRP) case.

Ripple has been in a legal battle with the SEC over classifying XRP as a security. The reassignment suggests a possible shift in regulatory focus. Specifically, it fueled speculation that the SEC might be stepping back from its aggressive approach toward XRP. It also meant a possible imminent end to the longstanding case.

Indeed, the commission has given several hints that it will drop the Ripple case. Most recently, the SEC completely removed the lawsuit from its website. Reassigning Tenreiro to a non-crypto-related role further suggests that the lawsuit might be coming to an end.

These changes follow the recent resignation of former SEC chair Gary Gensler. In his place, SEC commissioner Mark Uyeda stepped in as interim chair, potentially laying the groundwork for Paul Atkins.

UBS Brings Gold Trading to Blockchain

Adding to the list of interesting things that happened in crypto this week, UBS unveiled a new initiative. BeInCrypto reported that the Swiss banking giant integrated gold trading with blockchain technology.

The bank is leveraging Ethereum’s zkSync layer to facilitate secure and transparent gold transactions on the blockchain. This marks another significant step in traditional finance (TradFi) adopting decentralized ledger technology.

The move by UBS could enhance efficiency in gold markets. Specifically, it could provide a more accessible and verifiable means of trading the precious metal.

As more financial institutions explore blockchain for asset tokenization, Ethereum continues establishing itself as a preferred platform for institutional adoption.

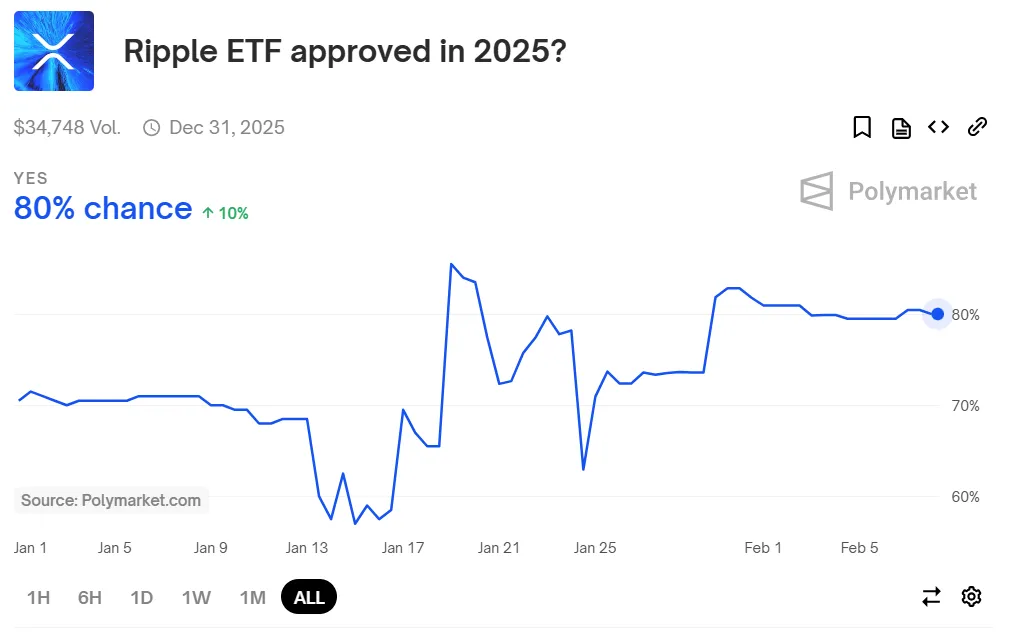

XRP ETF Eyes SEC Approval

In another major development for XRP, Cboe Global Markets filed a 19b-4 application with the SEC—the options exchange plans to launch an XRP-based exchange-traded fund (XRP ETF). If approved, this would mark a significant milestone for institutional adoption of XRP.

XRP ETF approval would provide investors with a regulated and convenient way to gain exposure to the asset, which could increase liquidity and price stability for the XRP token.

Given the ongoing legal battle between Ripple and the SEC, the approval process is expected to face scrutiny. Nevertheless, market participants remain optimistic about a favorable outcome following Gensler’s ouster.

On the prediction platform Polymarket, the likelihood of an XRP ETF receiving approval in 2025 has been strikingly high. The odds stood at a notable 80% at the time of this report.

MicroStrategy Rebrands to Strategy

MicroStrategy, one of the largest corporate holders of Bitcoin, rebranded itself this week, taking the moniker “Strategy.” The move aligns with its commitment to Bitcoin accumulation and adoption of blockchain technology.

“Strategy is one of the most powerful and positive words in the human language. It also represents a simplification of our company name to its most important, strategic core. After 35 years, our new brand perfectly represents our pursuit of perfection,” The firm’s executive chair, Michael Saylor, explained.

Under Michael Saylor’s leadership, the company has consistently increased its Bitcoin holdings, viewing it as a long-term asset. The rebranding reinforces its dedication to leveraging Bitcoin for corporate treasury management and institutional investment strategies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MEME Rallies 73%, BONE Follows

The meme coin market is experiencing a surge in investor interest, helping certain tokens recover from their all-time lows (ATLs). Memecoin (MEME) is one such token that has avoided a new ATL and also posted a significant 73% rise.

BeInCrypto has analyzed two other meme coins that have performed well over the past day, making them important tokens to watch.

Memecoin (MEME)

- Launch Date – November 2023

- Total Circulating Supply – 43.11 Billion MEME

- Maximum Supply – 69 Billion MEME

- Fully Diluted Valuation (FDV) – $135.37 Million

MEME had a rough week, hitting a new all-time low at $0.00137. However, the altcoin rebounded sharply, rising by 38% in the last 24 hours to trade at $0.00196. This surge marks a significant recovery, driven by renewed interest in meme coins.

The recent surge in MEME’s price was fueled by a sudden spike in interest for joke tokens, driving a 73% intraday high. To maintain its gains, MEME must successfully breach and flip the $0.00228 resistance into support, a critical level for sustaining its upward momentum.

If MEME experiences profit-taking from investors, it could reverse course and drop back down to the all-time low of $0.00137. A decline through this level would invalidate the bullish outlook and signal further challenges for the meme coin.

Bone ShibaSwap (BONE)

- Launch Date – July 2021

- Total Circulating Supply – 249.89 Million BONE

- Maximum Supply – 250 Million BONE

- Fully Diluted Valuation (FDV) – $71.67 Million

BONE posted an impressive 18.5% rise over the last 24 hours, trading at $0.285. The altcoin is currently under the key resistance of $0.295. Given the recent momentum, it seems poised to breach this level, signaling a potential upward trajectory for the token in the near future.

Flipping the $0.295 resistance into support would open the door for BONE to target its next major resistance at $0.348. A sustained push above this level could drive further bullish sentiment, propelling the token toward even higher price levels.

However, if BONE fails to breach $0.295, the bullish momentum could fade. A decline from this point could send the meme coin back towards $0.232, invalidating the optimistic outlook. Such a reversal would likely create caution among investors, delaying potential upward movement.

- Launch Date – April 2024

- Total Circulating Supply – 999.96 Million BAN

- Maximum Supply – 1 Billion BAN

- Fully Diluted Valuation (FDV) – $40.54 Million

BAN, a small-cap token, has caught the attention of investors, rising nearly 25% in the last 24 hours to trade at $0.040. This surge highlights the growing interest in the meme coin market, with BAN standing out despite its smaller market capitalization.

Inspired by the infamous banana taped to a wall, BAN gained significant fame after being purchased by Tron’s founder, Justin Sun, for $6.2 million last year. If the token continues its upward momentum, it could breach the $0.045 barrier and potentially flip it into support, securing its gains.

However, failing to break through the $0.045 resistance could lead to a drop back to $0.032. If this occurs, it would invalidate the bullish outlook and erase the recent gains, putting investors on alert for further price declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

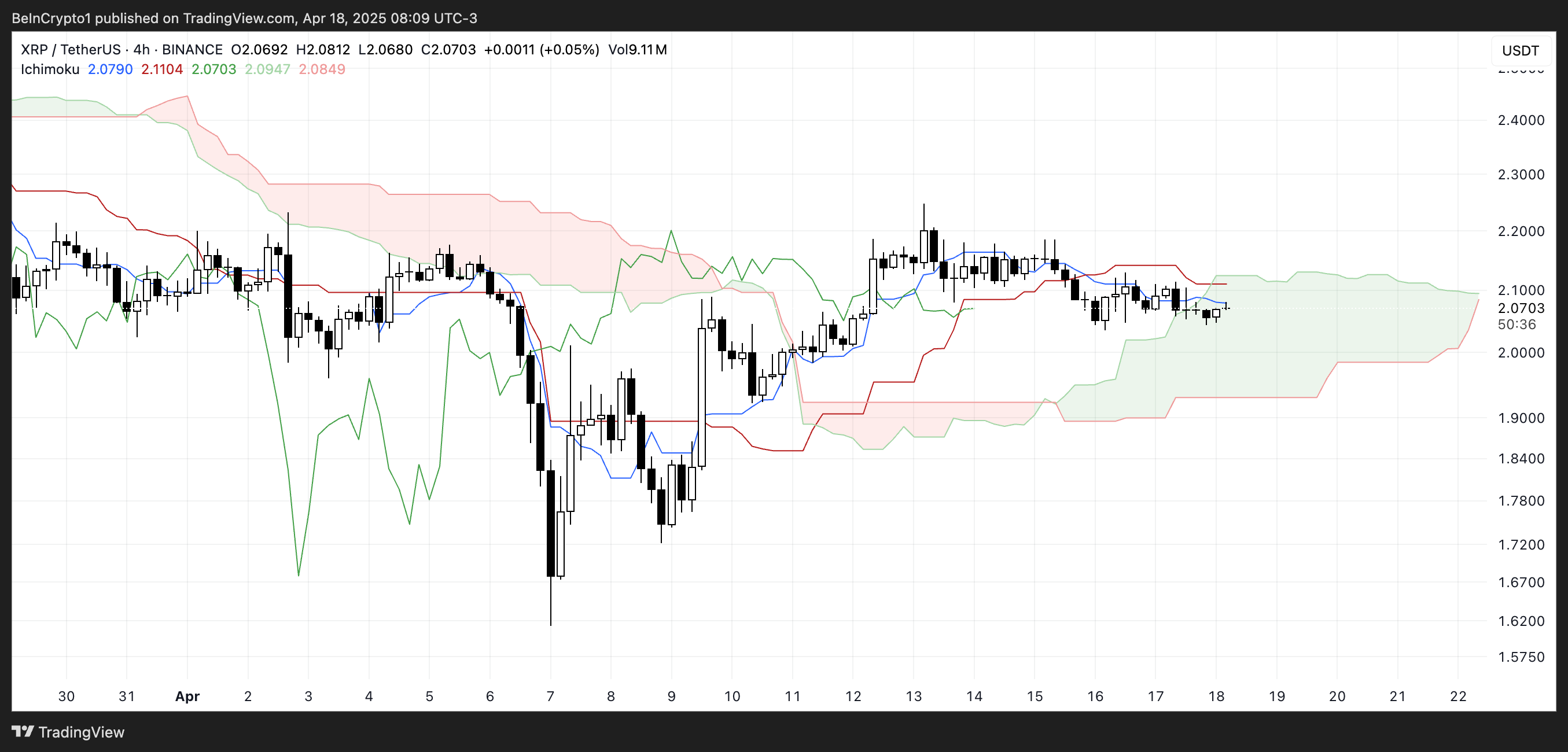

XRP Volume Plunges 20% Amid Market Uncertainty

XRP is currently showing signs of indecision, trading sideways with limited momentum as traders await a clearer signal. Over the past 24 hours, XRP’s trading volume has dropped by 20.37%, now sitting at $2.4 billion—a decline that reflects cooling interest in the short term.

Technical indicators like the RSI and Ichimoku Cloud suggest a neutral trend, with no strong bullish or bearish dominance in play. Price action remains confined between key support and resistance levels, leaving the next breakout direction still uncertain.

Neutral RSI Reading Suggests Caution for XRP Traders

XRP’s Relative Strength Index (RSI) is currently sitting at 46.82, signaling neutral momentum in the market. This neutral zone has persisted since April 7, with no significant shifts into either overbought or oversold territory.

Notably, the RSI was at 57.30 just three days ago, indicating that XRP has experienced a recent decline in buying pressure.

The drop suggests cooling interest or a possible shift in sentiment among traders, as the asset now hovers closer to the midpoint of the RSI scale.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes, typically on a scale from 0 to 100.

Readings above 70 often suggest an asset is overbought and could be due for a pullback, while readings below 30 indicate it may be oversold and potentially poised for a bounce. With XRP now at 46.82, the asset is neither overbought nor oversold, implying indecision in the market.

This level, combined with the recent dip from 57.30, may signal growing caution or weakening bullish momentum. It could potentially point to a consolidation phase or slight downward pressure in the short term unless buyers re-enter with conviction.

Ichimoku Indicators Show Indecision in XRP’s Price Action

XRP is currently trading inside the Ichimoku Cloud, reflecting a state of indecision or consolidation.

The Tenkan-sen (blue line) and Kijun-sen (red line) are flat and closely aligned, suggesting weak momentum and a lack of short-term trend direction.

The Senkou Span A and B (the cloud boundaries) are relatively flat as well, which typically indicates that the market is in equilibrium without strong pressure from either buyers or sellers.

The Ichimoku Cloud, or Kumo, helps visualize support, resistance, and trend direction at a glance. When the price is above the cloud, the trend is considered bullish; below it, bearish.

Inside the cloud, as XRP currently is, the trend is neutral, and volatility often contracts. The flatness of the cloud’s leading edges implies a consolidation phase, and the fact that price is not breaking clearly above or below the cloud reinforces the idea of market uncertainty.

For now, the lack of a decisive breakout suggests XRP could remain range-bound until a stronger trend develops.

$2.03 Support and $2.09 Resistance Hold the Key to XRP’s Next Move

XRP price is currently trading within a narrow consolidation range, with key support at $2.03 and resistance at $2.09.

The price action has been relatively muted, but the EMA lines are starting to show signs of potential weakness, as a death cross—where the short-term EMA crosses below the long-term EMA—appears to be forming.

If this bearish crossover confirms and XRP breaks below the $2.03 support, a move down to $1.96 becomes increasingly likely.

A strong continuation of the downtrend could trigger a steeper drop. It could potentially drive the price as low as $1.61 if selling pressure accelerates.

However, there’s still a bullish scenario on the table. If buyers manage to push XRP above the $2.09 resistance, it could open the door for a retest of the $2.17 and $2.35 levels.

This would indicate renewed strength and a shift in momentum in favor of the bulls. Should the rally gain traction beyond these levels, XRP could make a run toward $2.50, marking a significant recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BONK Symmetrical Triangle Squeeze: Is A Mega Breakout Imminent?

Bonk (BONK), one of the more energetic players in the meme coin space, is showing signs of a potentially explosive move as it coils tighter within a symmetrical triangle pattern. This classic chart formation, characterized by converging trendlines of lower highs and higher lows, often acts as a pressure booster for price action — the longer the squeeze, the more powerful the breakout tends to be.

The symmetrical triangle squeeze is a technical signal that often precedes sharp breakouts, and in BONK’s case, it couldn’t come at a more pivotal moment. With the broader meme coin market showing signs of strength and sentiment slowly shifting, a decisive move from this setup could define the next chapter for BONK. A breakout above the upper trendline might ignite fresh bullish momentum and open the door to new highs, while a break below support could trigger a sell-off toward lower key levels.

Bonk’s Recent Price Action: The Setup For A Big Move

According to a recent post by Whales_Crypto_Trading on X (formerly Twitter), Bonk is currently forming a symmetrical triangle pattern on the 1-hour chart. The price has just rebounded from the lower support trendline of the triangle, suggesting that buyers are stepping in to defend the structure and potentially build momentum for an upward breakout.

What makes this pattern particularly noteworthy is the potential upside. Whales_Crypto_Trading highlighted a profit target range of 70–80%, should BONK successfully break above the upper resistance trendline. With volatility tightening and volume starting to show signs of recovery, such a breakout could offer a substantial short-term trading opportunity.

However, traders are advised to keep a close eye on volume confirmation and key breakout levels to avoid possible fakeouts, as symmetrical triangles can break in either direction.

Will The Meme Coin Explode Or Fizzle Out?

Bonk’s symmetrical triangle pattern has reached a critical stage, raising speculations about whether the meme coin will break free with force or lose steam under pressure. The recent bounce off the support trendline suggests bullish interest is still alive, and if momentum continues to build, BONK could be gearing up for a powerful breakout, potentially delivering gains in the 70–80% range as projected by traders.

However, it’s important to remain cautious. Symmetrical triangles are neutral by nature, meaning a breakdown is still on the table if buyers fail to push through resistance. The next few candles on the 1-hour chart could provide key confirmation of BONK’s direction.

In the end, BONK is approaching a defining moment. Whether it explodes into a bullish run or fizzles out into another rejection will largely depend on volume, sentiment, and the strength of the breakout. Traders should stay alert, as a big move may be closer than it seems.

-

Market24 hours ago

Market24 hours agoCrypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

-

Altcoin18 hours ago

Altcoin18 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market23 hours ago

Market23 hours agoBinance Leads One-Third of the CEX Market in Q1 2025

-

Market16 hours ago

Market16 hours agoIs XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

-

Altcoin22 hours ago

Altcoin22 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Ethereum14 hours ago

Ethereum14 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Altcoin21 hours ago

Altcoin21 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop