Market

Japan Bans Five Crypto Exchanges After Ignored Warnings

Japan’s FSA requested Apple and Google to remove five crypto exchanges from its app stores. The FSA claims that these exchanges are unregistered and did not meet compliance despite past warnings.

The businesses in question are KuCoin, Bybit, Bitget, MEXC Global, and LBank Exchange. Several of them had been trying to reach compliance in other jurisdictions.

Japan Bans Five Exchanges

According to local reports, Japan’s Financial Services Agency (FSA) has asked Apple and Google to block downloads for five crypto exchanges.

Specifically, the FSA targeted KuCoin, Bybit, Bitget, MEXC Global, and LBank Exchange. As BeInCrypto reported earlier, the regulator previously warned these businesses about failing to comply with registration requirements. It seems these warnings went unheeded.

Despite this crackdown on unregistered exchanges, Japan has actually made several recent overtures to the crypto industry. For example, the FSA began reviewing crypto tax laws last year in an attempt to lower them.

Lawmakers have also started advocating for a Bitcoin Reserve, and some ETF issuers believe a Bitcoin ETF is nearing approval.

Despite the positive momentum, the regulator cannot ignore flagrant violations like these exchanges were committing. It seems that none of the firms in question made any attempt to reach compliance since the warning in September.

Only Bybit has released a statement, and it seems to ignore the problem outright:

“We want to clarify recent discussions about Bybit’s services to our Japanese language users. Bybit is continuing to offer services to Japanese language users. We sincerely apologize for any inconvenience this may have caused. We are committed to working closely with the authority to ensure we meet all local regulatory expectations,” it claimed.

It’s very unclear what the firm means by this. When Deribit exited Russia yesterday, the company’s statements made it clear that Russian users abroad can only access its services under very specific conditions.

Will these exchanges claim similar exceptions for users outside Japan? Whatever the new terms are, they seem poorly thought out.

The most confusing element is that most of these exchanges have sought to improve regulatory compliance in countries other than Japan. Bybit acquired a license in India yesterday, and KuCoin reached a settlement with the US last month.

Also, Bitget has a proactive strategy to fulfill EU requirements. Japan warned these companies months ago, but they seemingly did nothing.

“These platforms were low-key trading crypto in Japan without the right paperwork, and now their users are left exposed. No legal protection, no oversight—just pure chaos. Japan’s putting the crypto world on notice: follow the rules or face the consequences,” Mario Nawfal wrote on X (formerly Twitter).

Overall, it’s unclear how long these exchanges will be banned in Japan or if they’re even interested in returning. This incident will serve as one more data point in a sordid chart of fines, bans, and criminal charges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ETH Price Stuck Below $3,000 as Bearish Pressure Persists

Ethereum (ETH) price is struggling to reclaim the $3,000 level as bearish momentum continues to weigh on its recovery. The RSI remains neutral, failing to break above 50 since February 1, indicating that buying pressure has yet to strengthen significantly.

Meanwhile, the Directional Movement Index (DMI) shows that ETH is still in a downtrend, though selling pressure has started to ease slightly. With short-term EMAs still below long-term ones, ETH remains at risk of further declines unless momentum shifts in favor of the bulls.

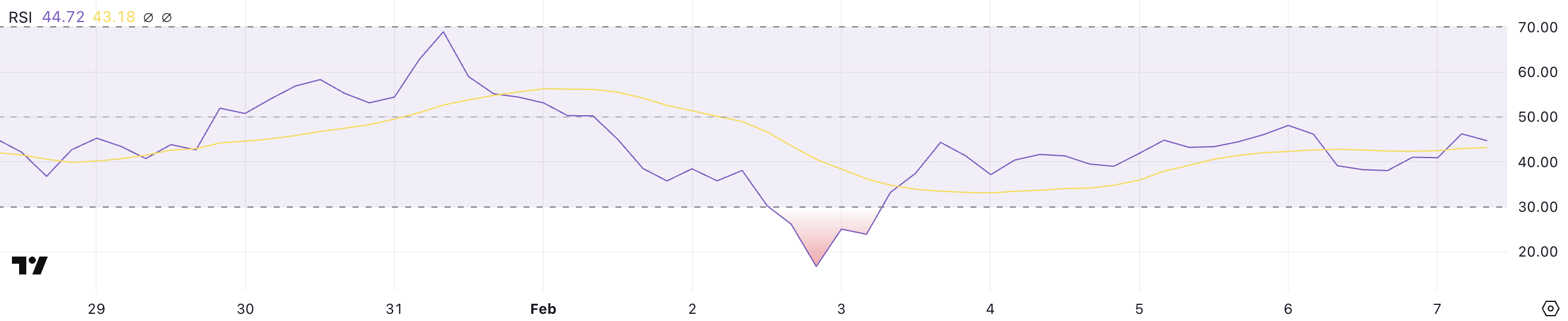

ETH RSI Failed to Break Above 50 Since February 1

Ethereum’s Relative Strength Index (RSI) is currently at 44.7, maintaining a neutral stance since February 3 after briefly plunging to 16.7 on February 2. The RSI is a momentum oscillator that measures the strength and speed of price movements on a scale from 0 to 100.

Typically, an RSI above 70 signals overbought conditions, suggesting a potential price correction, while an RSI below 30 indicates oversold levels, often associated with buying opportunities.

A reading between 30 and 70 is considered neutral, meaning the market lacks a clear bullish or bearish trend.

With ETH RSI at 44.7, it remains in neutral territory but continues to struggle to break above 50, a level it has failed to reach since February 1. This suggests that while bearish pressure has eased since the extreme oversold conditions of early February, buying momentum remains weak.

If ETH can push its RSI above 50, it would indicate a shift toward bullish control, potentially leading to a stronger price recovery.

However, failure to do so may signal prolonged consolidation or even renewed selling pressure, keeping ETH in a choppy trading range until stronger demand emerges.

Ethereum DMI Shows The Current Trend Is Still Bearish

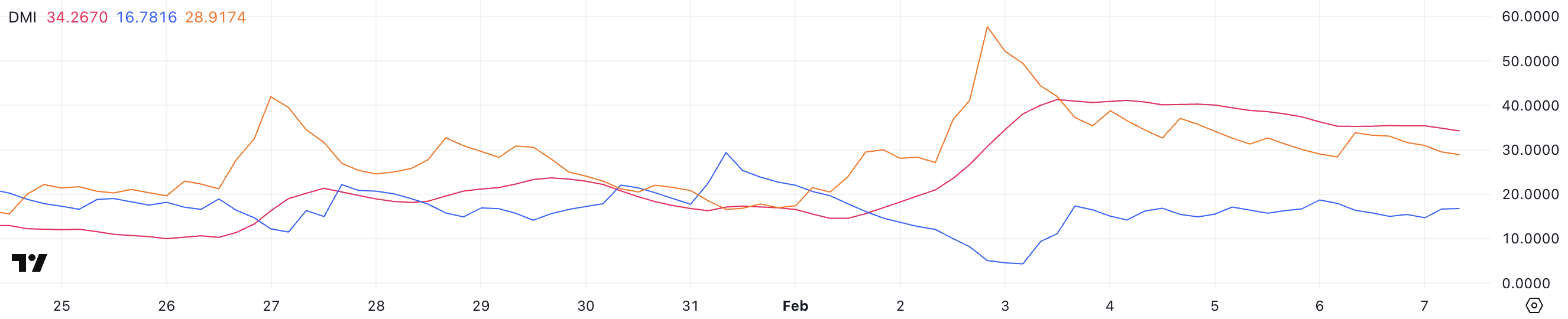

Ethereum’s Directional Movement Index (DMI) chart shows that its Average Directional Index (ADX) is currently at 34.2, down from 40 just two days ago. The ADX measures trend strength, with values above 25 generally indicating a strong trend and values below 20 suggesting weak or range-bound price action.

A reading of 34.2 confirms that ETH price is still in a well-defined trend, though the slight decline in ADX suggests that trend strength is weakening.

ETH’s +DI is currently at 16.7 and has been fluctuating between 14 and 18 over the past four days. That indicates a weak bullish momentum. Meanwhile, the -DI has dropped from 33.8 yesterday to 28.9, suggesting that selling pressure could be easing.

Despite this, Ethereum remains in a downtrend, as the -DI is still significantly higher than the +DI. If the +DI begins to rise while the -DI continues to decline, it could suggest an early shift in momentum toward a potential trend reversal.

However, as long as the -DI remains dominant and ADX holds above 25, ETH could continue facing downside risks before any significant recovery materializes.

ETH Price Prediction: Will Ethereum Return To $3,000 In The Next Days?

Ethereum Exponential Moving Average (EMA) lines continue to indicate a bearish trend, with short-term EMAs still positioned below long-term ones. This alignment suggests that downward pressure remains dominant, keeping ETH at risk of further declines.

If this bearish momentum persists, Ethereum price could test the support level at $2,356, and a failure to hold this zone could lead to a deeper drop toward $2,163.

The current EMA structure reflects a market where sellers remain in control, and a clear shift in trend would be required to reverse the ongoing decline.

However, if ETH can regain positive momentum, it could make a move back toward the $3,000 level. A breakout above this psychological resistance could signal renewed bullish strength, potentially pushing ETH to $3,300.

If buying pressure remains strong beyond this point, ETH price could even rally to $3,744, marking its highest price since January 6.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Bought These Altcoins This Week

The cryptocurrency market has been plunged into a decline this week, with global crypto market capitalization dropping by 11% in the past seven days.

As the market continues to face volatility, crypto whales have been acquiring specific altcoins to navigate the downturn. Some of the tokens that are attracting attention from major investors during the first week of February are Dogecoin (DOGE), Pepe (PEPE), and Cardano (ADA).

Dogecoin (DOGE)

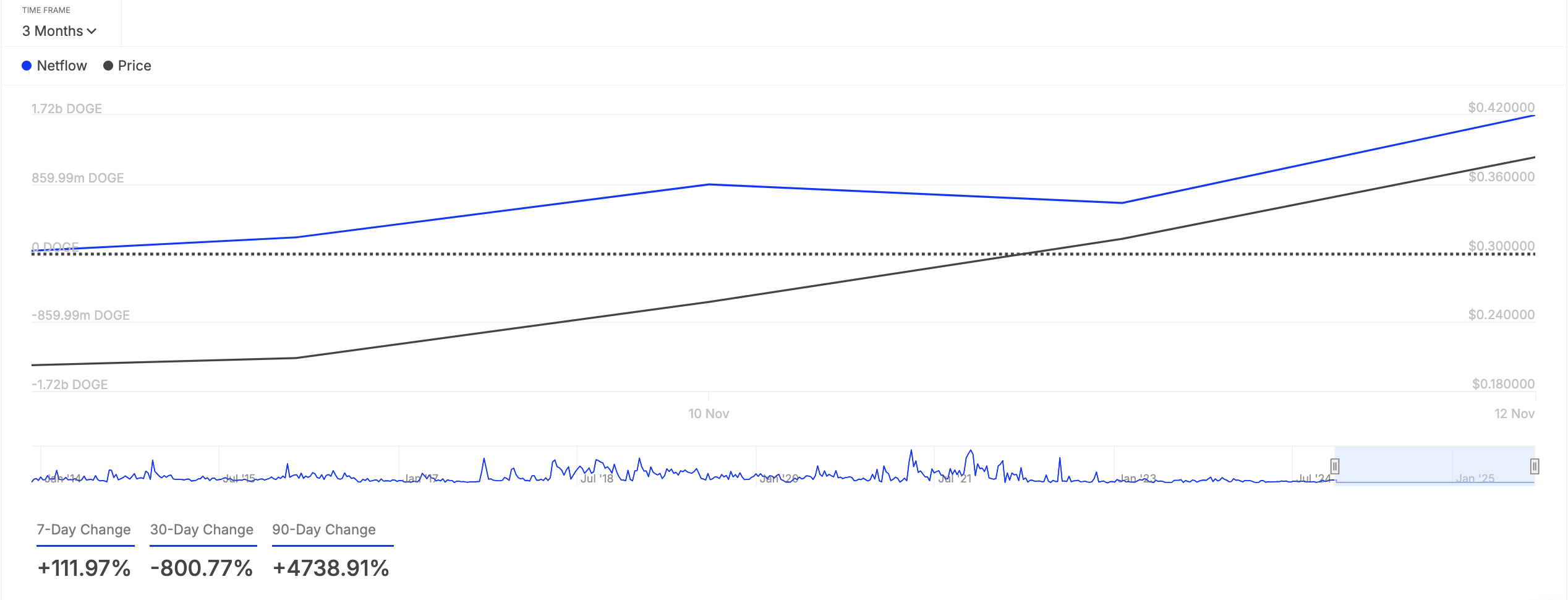

Leading meme coin DOGE has enjoyed significant whale attention this week. The triple-digit surge in its large holders’ netflow, which has spiked by 112% in the past seven days, reflects the whale activity.

Large holders refer to whale addresses that own more than 0.1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and sell over a set period.

When their netflow spikes, it indicates that these large investors are purchasing more coins. This is a bullish signal that could prompt retail traders to increase their buying activity as well.

If DOGE whales continue to buy the altcoin, it may resume its uptrend and climb toward $0.32.

Pepe (PEPE)

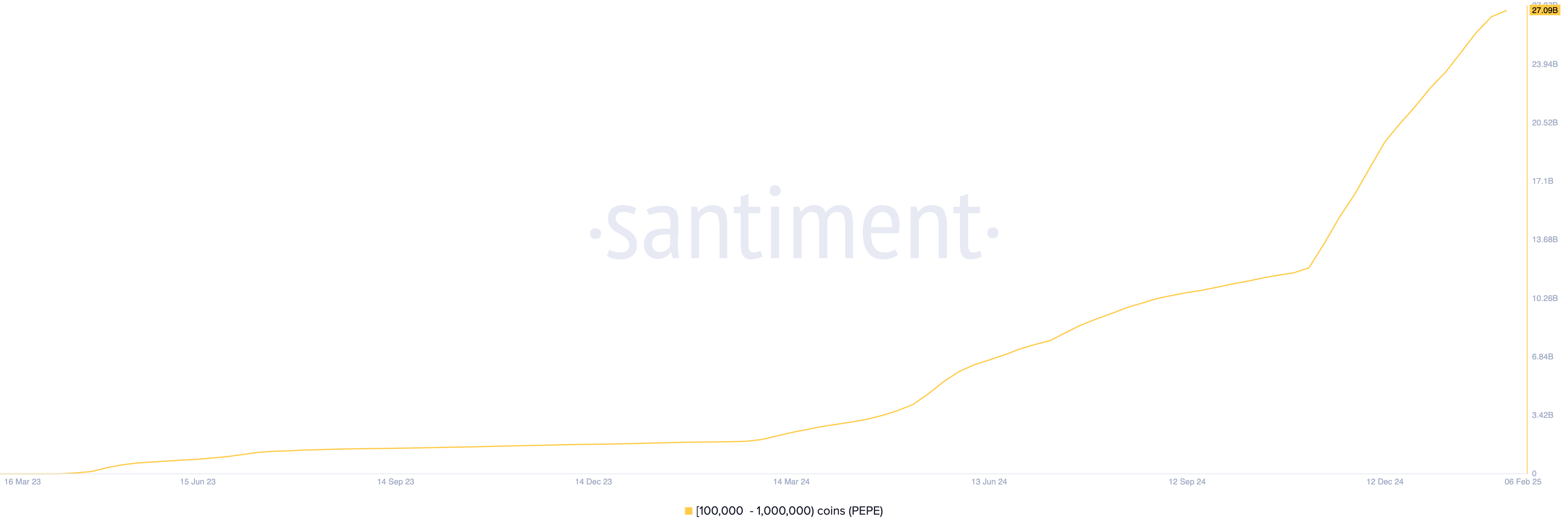

Ethereum-based meme coin PEPE is another altcoin the whales bought this week. BeInCrypto’s assessment of its supply distribution shows that whale addresses holding between 100,000 and 1,000,000 tokens have bought 870 million PEPE in the past seven days.

This has pushed the group’s PEPE holdings to an all-time high of 27.09 billion.

If whale accumulation persists, the meme coin’s value could rise to $0.000010.

Cardano (ADA)

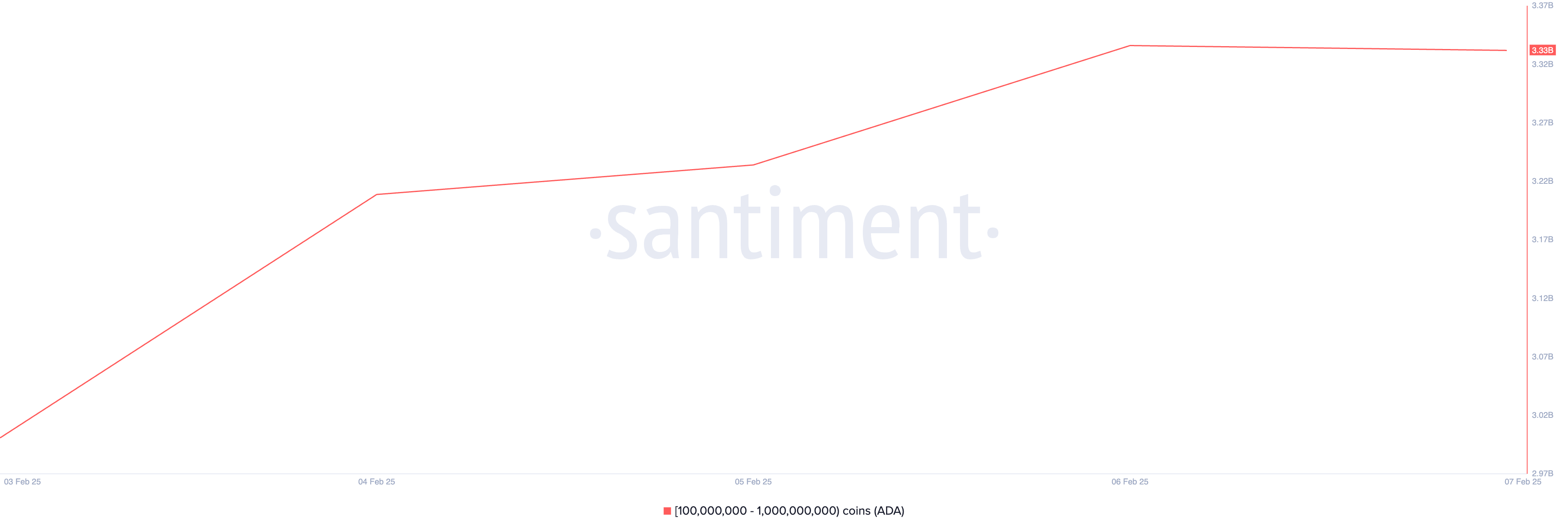

This week, layer-1 (L1) coin ADA is also a top pick among crypto whales. Per Santiment, ADA large investors holding between 100 million and 1 billion coins have accumulated 330 million ADA worth above $230 million over the past seven days.

Moreover, if accumulation persists, the L1 coin could see its value rocket above $0.80.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PEPE Price Crashes 50%; Death Cross and an Opportunity next

PEPE has suffered a sharp downturn, dropping nearly 50% over the past month and reaching its lowest price in three months. Investors have faced significant losses as bearish sentiment grips the meme coin market.

While the possibility of further correction remains, an emerging technical pattern could also signal a buying opportunity for long-term holders.

PEPE Is Facing a Bearish Cycle

The exponential moving averages (EMAs) indicate growing bearish pressure, with the 200-day EMA approaching a crossover above the 50-day EMA. This event, known as a Death Cross, is typically a strong bearish signal.

If the crossover occurs, selling momentum could intensify, further dragging PEPE’s price lower.

Currently, the 200-day EMA is just 8% away from completing the Death Cross formation. If bearish conditions persist, PEPE could struggle to recover in the short term. This technical pattern often leads to extended downtrends across various assets.

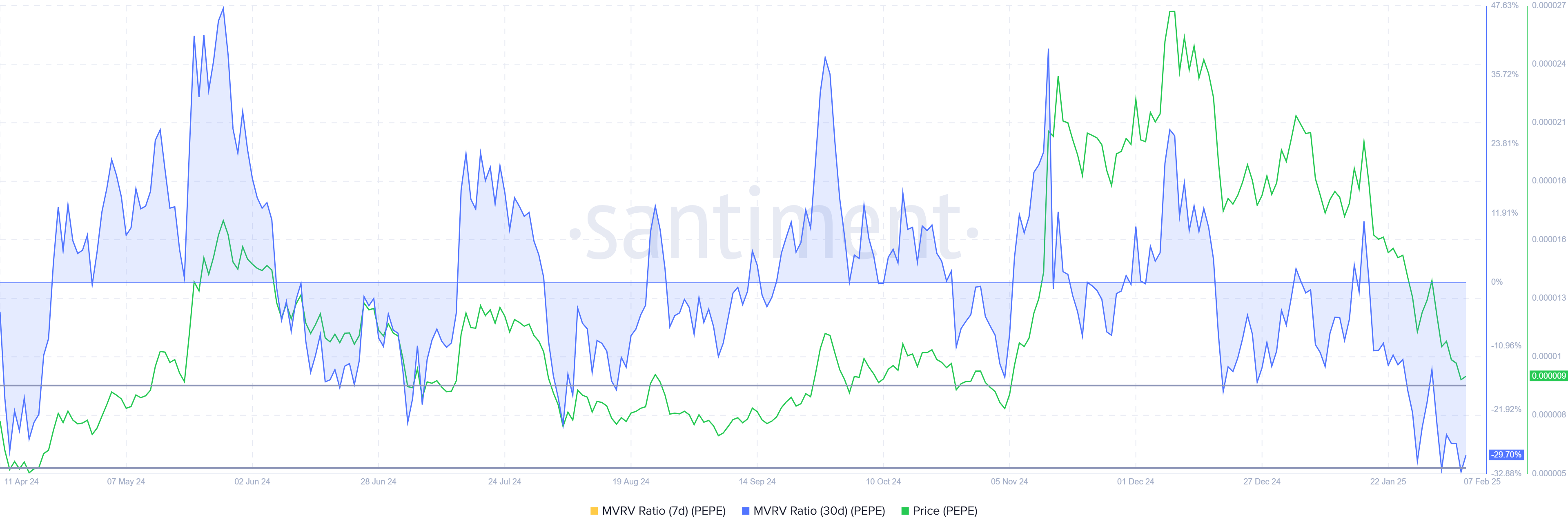

Despite bearish signals, PEPE’s Market Value to Realized Value (MVRV) ratio suggests a possible shift in momentum. The MVRV ratio has reached -29%, placing PEPE within the “Opportunity Zone.”

Historically, when this metric drops between -17% and -30%, it indicates that selling pressure is nearing exhaustion.

A negative MVRV ratio suggests investors are holding unrealized losses, making them less likely to sell further. This can create an accumulation period where long-term holders start buying at discounted prices.

If this trend follows previous patterns, PEPE price could be setting up for a potential recovery.

PEPE Price Prediction: Recovering The Losses

PEPE is currently trading at $0.00000941, slipping below the critical support level of $0.00001000. This marks a three-month low for the meme coin, making it one of the worst-performing assets of the month. The sustained selling pressure has made it difficult for PEPE to regain upward momentum.

The looming Death Cross raises concerns about further declines, potentially pushing PEPE below the $0.00000839 support level. A drop below this threshold would likely trigger additional selling, worsening investor losses.

If bearish momentum remains dominant, PEPE could see prolonged consolidation at lower price levels.

However, a reversal remains possible if PEPE can reclaim $0.00001000 as support. If the meme coin flips $0.00001146 into support, it would invalidate the bearish outlook and shift momentum toward recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market17 hours ago

Market17 hours agoXRP Price Weakens Gradually: Can It Find Support?

-

Altcoin13 hours ago

Altcoin13 hours agoBerachain (BERA) Price Rockets 630% Amid Major Binance Support, What’s Next?

-

Market12 hours ago

Market12 hours agoMeme Coins to Altcoins with Real-World Value

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Could Crash To $1,700 If This Support Fails, Analyst Says

-

Altcoin17 hours ago

Altcoin17 hours agoWhen Will Altcoins Selling Stop? Is This Final Dump Before Pump?

-

Bitcoin16 hours ago

Bitcoin16 hours agoUtah Pushes Digital Asset Reserve Bill to Senate Approval

-

Market16 hours ago

Market16 hours agoSEC Recognizes Grayscale’s Solana and Litecoin ETF Filings

-

Market15 hours ago

Market15 hours agoBNB Price Poised to Rally—If It Can Overcome This Hurdle