Market

TON Suffers Significant Dip in User Engagement

The TON ecosystem has suffered in the past week, with significant drops in user engagement and increasing selling pressure. The number of new users has dropped by a staggering 95% since the network’s July all-time high.

These negative metrics represent a decline in investor confidence and raise questions over whether the ecosystem is losing its long-term appeal.

On-Chain Data Paints a Grim Picture for TON

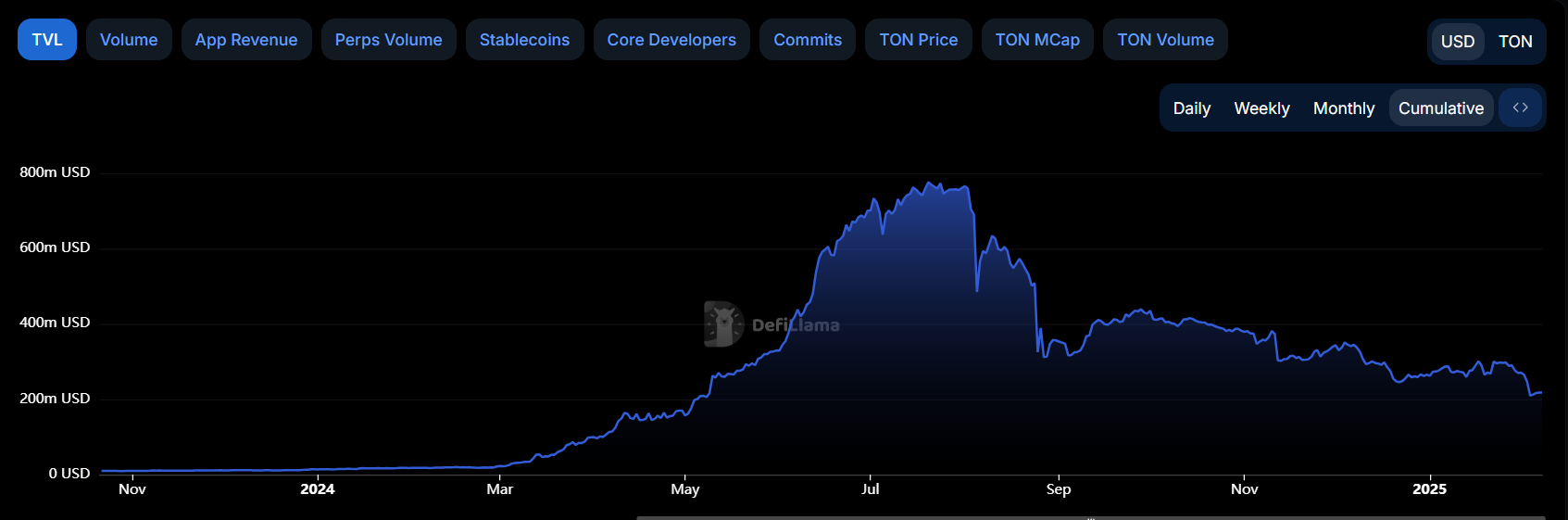

According to data from DefiLlama, The Open Network (TON) experienced a peak in Total Value Locked (TVL) in mid-July, reaching $773 million.

Since then, its value has been in constant decline. Today, the ecosystem’s TVL stands at $215 million, representing a drop of more than 72% since its all-time high.

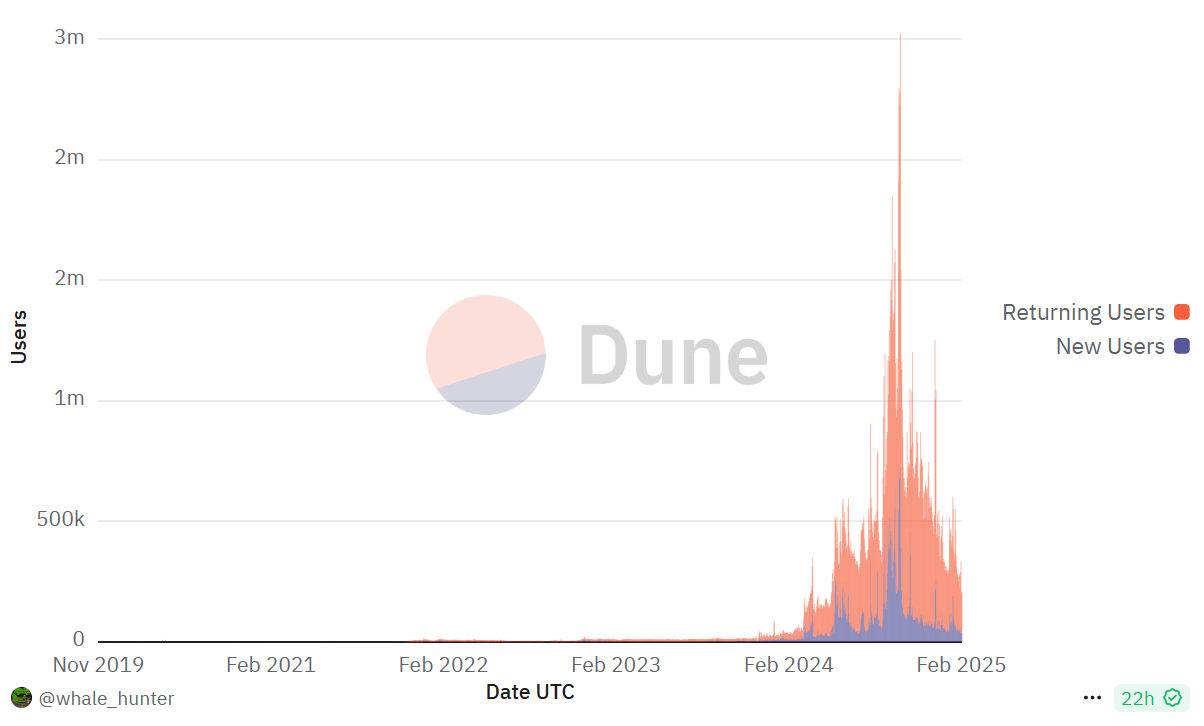

This decline is also reflected in the alarming drop in new daily users. According to Dune data, TON reached an all-time high of 724,465 on September 30, but as of February 5, that number dropped to just 33,852.

The over 95% decrease has raised concerns about the blockchain’s current and future attractiveness.

Investors in TON projects have reported financial losses, leading to expressions of dissatisfaction on social media platforms.

“Never in my life did I ever think I would see Notcoin at $0.0033 and Toncoin at $4.2,” one user said on X.

Also, data indicates that most TON token holders, approximately 96% representing over 108 million addresses, are currently experiencing investment losses.

Conversely, only a small fraction, about 4% or a little over 4.2 million addresses, are seeing profits. This data suggests a prevailing negative sentiment among TON investors, which may contribute to increased token-selling activity.

The Roadmap Ahead

TON is a Telegram-based blockchain infrastructure that has relied on tap-to-earn and other GameFi apps to drive adoption and spur engagement.

Less than two weeks ago, the TON core team published its development roadmap for the first half of 2025. This layout outlines planned updates, including improvements to core functions and exploration of potential future revenue streams.

TON’s expansion strategy is a reaction to its falling revenue, largely due to the declining popularity and profitability of tap-to-earn games and other GameFi apps that were previously important revenue streams for the company.

Though Telegram originally severed ties with TON in 2020 over regulatory pressures, the network recently re-partnered with the messaging app under Trump’s new regulatory environment.

This decision prompted debate among TON’s users. Some questioned Telegram’s dedication to decentralized principles, while others expressed concerns about the potential impact on liquidity and market stability.

The long-term success of TON’s newly released roadmap remains to be determined, as current on-chain data suggests potential challenges in the near future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Bought These Altcoins This Week

The cryptocurrency market has been plunged into a decline this week, with global crypto market capitalization dropping by 11% in the past seven days.

As the market continues to face volatility, crypto whales have been acquiring specific altcoins to navigate the downturn. Some of the tokens that are attracting attention from major investors during the first week of February are Dogecoin (DOGE), Pepe (PEPE), and Cardano (ADA).

Dogecoin (DOGE)

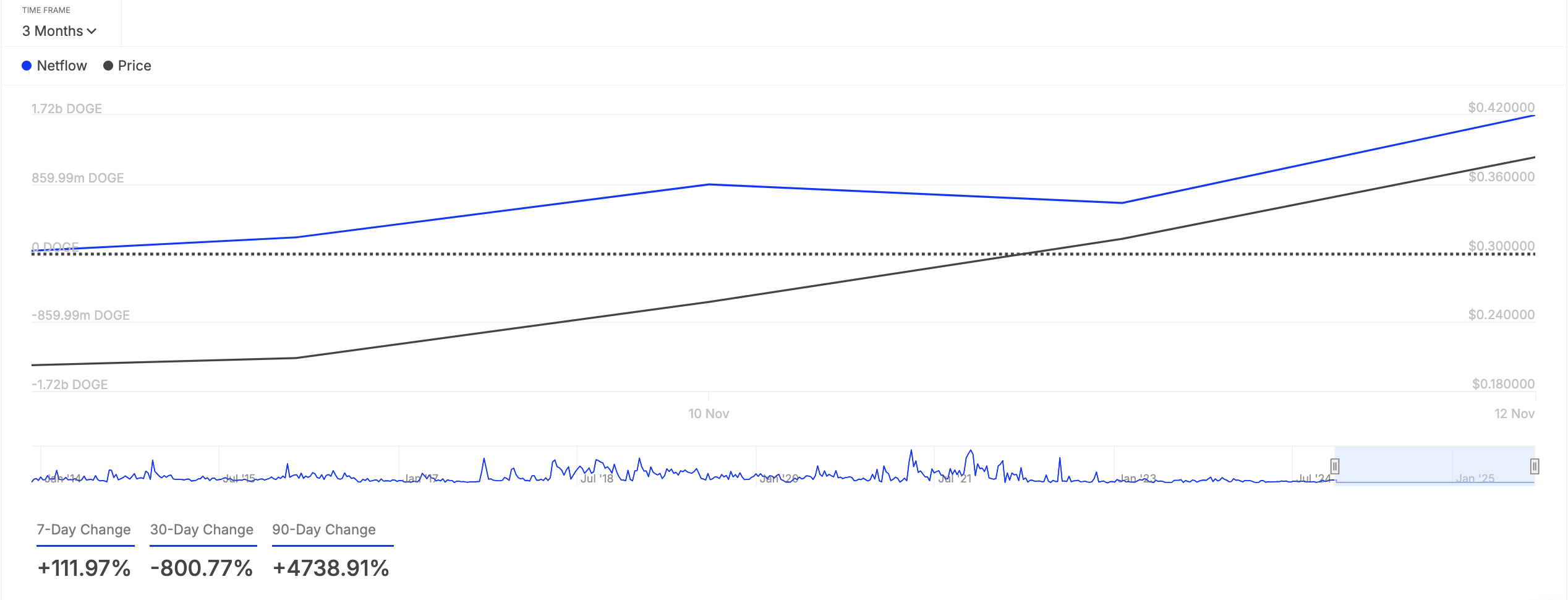

Leading meme coin DOGE has enjoyed significant whale attention this week. The triple-digit surge in its large holders’ netflow, which has spiked by 112% in the past seven days, reflects the whale activity.

Large holders refer to whale addresses that own more than 0.1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and sell over a set period.

When their netflow spikes, it indicates that these large investors are purchasing more coins. This is a bullish signal that could prompt retail traders to increase their buying activity as well.

If DOGE whales continue to buy the altcoin, it may resume its uptrend and climb toward $0.32.

Pepe (PEPE)

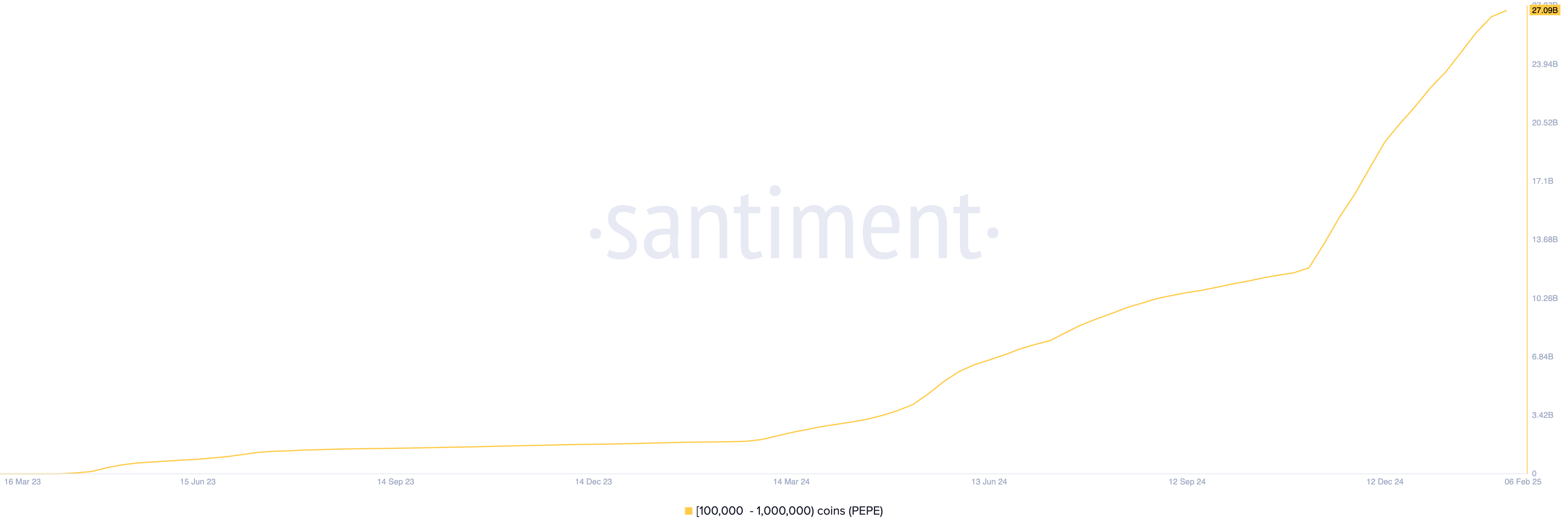

Ethereum-based meme coin PEPE is another altcoin the whales bought this week. BeInCrypto’s assessment of its supply distribution shows that whale addresses holding between 100,000 and 1,000,000 tokens have bought 870 million PEPE in the past seven days.

This has pushed the group’s PEPE holdings to an all-time high of 27.09 billion.

If whale accumulation persists, the meme coin’s value could rise to $0.000010.

Cardano (ADA)

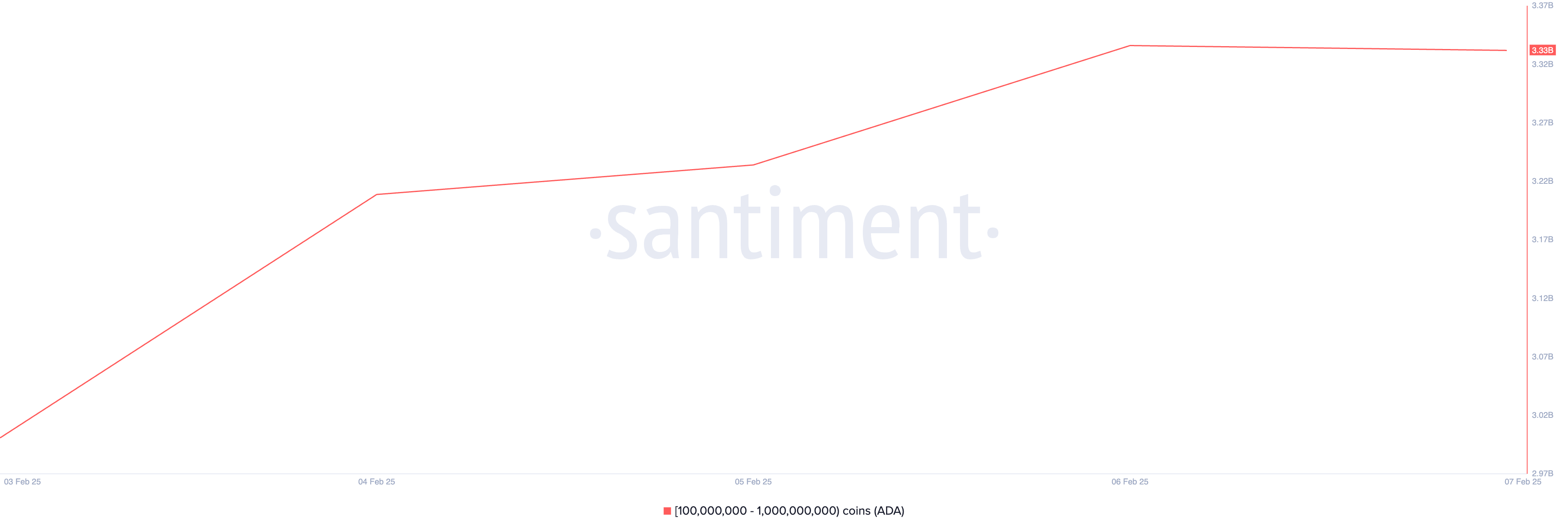

This week, layer-1 (L1) coin ADA is also a top pick among crypto whales. Per Santiment, ADA large investors holding between 100 million and 1 billion coins have accumulated 330 million ADA worth above $230 million over the past seven days.

Moreover, if accumulation persists, the L1 coin could see its value rocket above $0.80.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PEPE Price Crashes 50%; Death Cross and an Opportunity next

PEPE has suffered a sharp downturn, dropping nearly 50% over the past month and reaching its lowest price in three months. Investors have faced significant losses as bearish sentiment grips the meme coin market.

While the possibility of further correction remains, an emerging technical pattern could also signal a buying opportunity for long-term holders.

PEPE Is Facing a Bearish Cycle

The exponential moving averages (EMAs) indicate growing bearish pressure, with the 200-day EMA approaching a crossover above the 50-day EMA. This event, known as a Death Cross, is typically a strong bearish signal.

If the crossover occurs, selling momentum could intensify, further dragging PEPE’s price lower.

Currently, the 200-day EMA is just 8% away from completing the Death Cross formation. If bearish conditions persist, PEPE could struggle to recover in the short term. This technical pattern often leads to extended downtrends across various assets.

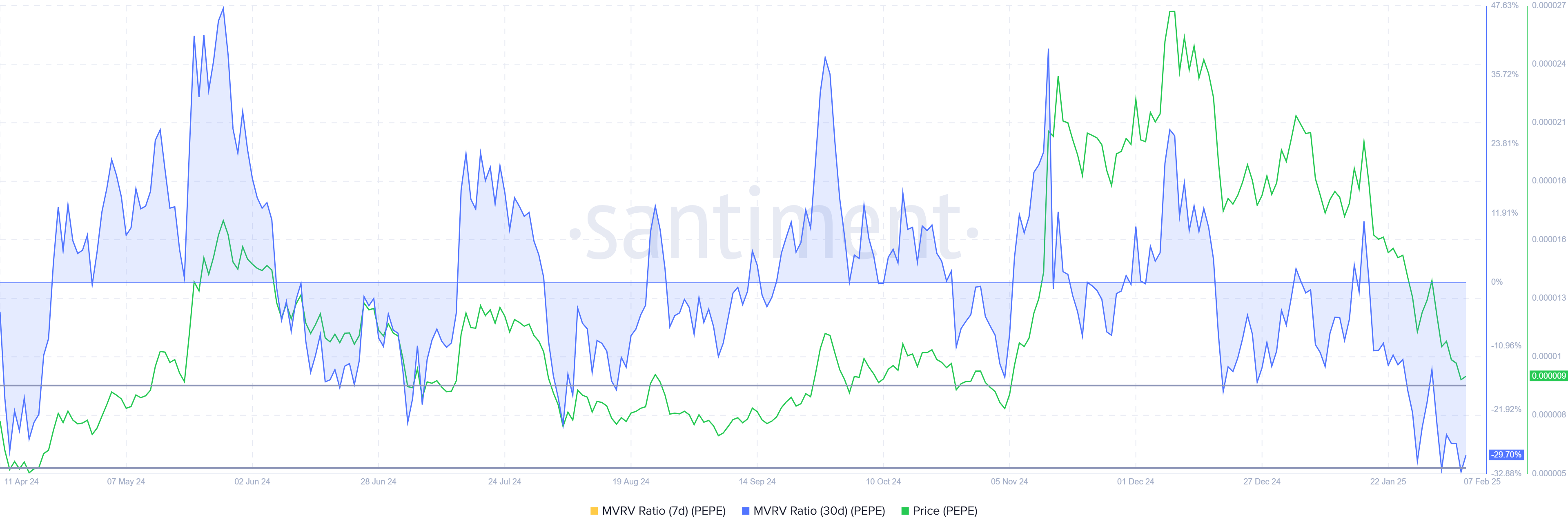

Despite bearish signals, PEPE’s Market Value to Realized Value (MVRV) ratio suggests a possible shift in momentum. The MVRV ratio has reached -29%, placing PEPE within the “Opportunity Zone.”

Historically, when this metric drops between -17% and -30%, it indicates that selling pressure is nearing exhaustion.

A negative MVRV ratio suggests investors are holding unrealized losses, making them less likely to sell further. This can create an accumulation period where long-term holders start buying at discounted prices.

If this trend follows previous patterns, PEPE price could be setting up for a potential recovery.

PEPE Price Prediction: Recovering The Losses

PEPE is currently trading at $0.00000941, slipping below the critical support level of $0.00001000. This marks a three-month low for the meme coin, making it one of the worst-performing assets of the month. The sustained selling pressure has made it difficult for PEPE to regain upward momentum.

The looming Death Cross raises concerns about further declines, potentially pushing PEPE below the $0.00000839 support level. A drop below this threshold would likely trigger additional selling, worsening investor losses.

If bearish momentum remains dominant, PEPE could see prolonged consolidation at lower price levels.

However, a reversal remains possible if PEPE can reclaim $0.00001000 as support. If the meme coin flips $0.00001146 into support, it would invalidate the bearish outlook and shift momentum toward recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Puts PENGU, POPCAT, and MORPHO On Roadmap

Coinbase put three new assets on its listing roadmap: PENGU, POPCAT, and MORPHO. This announcement only caused momentary price gains for all three tokens, possibly suggesting that the market is less interested.

The two meme coins have both endured recent volatility, but MORPHO currently has substantial momentum. Nonetheless, this pattern repeated across all three listings.

Is Coinbase’s Roadmap Losing Relevance?

Coinbase, one of the world’s leading crypto exchanges, just added three new assets to its listing roadmap: PENGU, POPCAT, and MORPHO.

Typically, these additions cause huge spikes in an asset’s price, but that has not happened today. All three of these coins experienced a brief price jump, but these gains quickly evaporated.

It’s presently unclear why these gains have proved so ephemeral. Two of the new assets on Coinbase’s roadmap, POPCAT and PENGU, are noteworthy meme coins. Both, however, have seen recent price troubles.

PENGU, for one, reached its lowest price in late January and shows little signs of recovery. POPCAT’s decline was in December, but it has also remained low.

MORPHO, on the other hand, stands out from the other offerings on Coinbase’s roadmap. It’s not a meme coin but a legitimate DeFi project creating infrastructure for on-chain lows.

It was a high performer in January and even entered a partnership with Coinbase. That may explain why it’s on the roadmap but not why it has also underperformed.

Perhaps it’s too early to determine what impact a future listing will have on these assets. At the time of writing, Coinbase put them on its roadmap only a few hours ago, and more dramatic changes may happen throughout the week.

However, the meme coin space is extremely fast-paced, making this seem unlikely. Instead, another explanation is possible.

The last two additions to Coinbase’s roadmap before this bear remarkable similarities. When it listed MOG in December, the asset’s price continued to struggle.

Last month, when it listed TOSHI, the immediate price spike was quickly slashed by new profit-taking. The asset still grew that day, but these gains proved ephemeral.

MORPHO’s inclusion also proves that these trends are not related to recent market performance. Perhaps these Coinbase announcements are losing their ability to move traders.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoUS SEC Seeks Public Comments on Grayscale’s Litecoin ETF Proposal

-

Altcoin23 hours ago

Altcoin23 hours agoWhy Is Bitcoin, XRP, Solana & Dogecoin Price Dropping?

-

Market16 hours ago

Market16 hours agoXRP Price Weakens Gradually: Can It Find Support?

-

Market14 hours ago

Market14 hours agoBNB Price Poised to Rally—If It Can Overcome This Hurdle

-

Altcoin14 hours ago

Altcoin14 hours agoCan Fartcoin Price Rally To $1.4 Or A Crash To $0.35 Looms? Here’s All

-

Altcoin12 hours ago

Altcoin12 hours agoBerachain (BERA) Price Rockets 630% Amid Major Binance Support, What’s Next?

-

Market23 hours ago

Market23 hours agoHBAR Price Struggles Under $0.25 as Bears Dominate

-

Market11 hours ago

Market11 hours agoMeme Coins to Altcoins with Real-World Value