Market

Reshaping the EU Crypto Market

Since its enaction two months ago, the Markets in Crypto-Assets (MiCA) regulation has created a cohesive framework and clear standards for digital asset issuers across the European Union (EU). The model aims to balance innovation and consumer protection, creating greater pathways for crypto adoption.

BeInCrypto spoke with Monerium, Moonpay, OKX, and Yellow Network experts to further understand what this unprecedented regulation means for EU-based crypto users and the challenges that remain for firms looking to set up shop in the region.

The EU Sets a Global Precedent

On December 30, 2024, the European Union made history by becoming the first region in the world to enact a widespread crypto regulation.

Crypto companies wanting to operate in the EU can obtain a single MiCA license to offer services across all member states, avoiding the hassle of getting separate permits for each country.

“MiCA sets a global benchmark as the most extensive regulatory framework for crypto assets to date, positioning the EU as a leader in shaping the future of digital finance and providing a blueprint for other jurisdictions to follow,” Erald Ghoos, CEO OF OKX Europe, told BeInCrypto.

Several regional crypto firms have already applied for MiCA and received licenses. Less than two weeks ago, Crypto.com became the first global crypto platform to receive full approval under the EU’s regulatory framework.

At the beginning of January, MoonPay, BitStaete, ZBD, and Hidden Road secured the MiCA license from the Dutch Authority for the Financial Markets (AFM). Standard Chartered closely followed suit when it gained its license in Luxembourg. Meanwhile, Boerse Stuttgart Digital Custody became Germany’s first crypto asset service provider to receive a full license.

MiCA Unified Licensing Regime

The crypto market has expanded considerably since Bitcoin’s launch over 15 years ago. Despite this growth, a consistent and comprehensive regulatory structure is still lacking in many parts of the world. This absence of clear rules can expose investors to risks and create vulnerabilities in consumer protection and market integrity.

The EU’s MiCA framework is designed to address these challenges while simultaneously promoting responsible growth within the cryptocurrency industry.

“Clear rules create a more predictable environment where serious players can thrive. MiCA is essentially giving the green light for the next chapter of crypto in Europe,” explained Alexis Sirkia, Co-Founder of Yellow Network.

MiCA’s standardized licensing process across the EU simplifies regulatory requirements and makes it easier for companies to operate within the European Economic Area. This framework also provides official recognition for the cryptocurrency industry.

“One of the biggest advantages of MiCA is its role in legitimizing the crypto asset industry, for both consumers and other companies, given its requirements and regulatory standards. This should consequently help build confidence in MiCA-regulated firms,” Matt Sullivan, Deputy General Counsel and Head of Ireland at MoonPay, told BeInCrypto.

The legislation also specifically works toward safeguarding the interests of consumers by keeping associated risks at bay and enhancing trust.

“MiCA enhances consumer protection through robust transparency requirements, stringent compliance measures, and oversight of stablecoin issuers. It also strengthens anti-money laundering (AML) and Know Your Customer (KYC) protocols, creating a safer, more secure, and trustworthy environment for market participants. This comprehensive framework paves the way for broader adoption and sustainable growth of the crypto ecosystem across Europe,” added Ghoos.

Despite its long list of advantages, MiCA’s framework also raises some considerations, particularly for smaller players.

A Rigorous Process

Compared to frameworks developed by other jurisdictions, MiCA’s legislation is particularly thorough.

“MiCA is definitely one of the most detailed and stringent frameworks out there. While places like Singapore and Hong Kong focus on fostering innovation with lighter-touch regulations, MiCA is all about building trust and security. It’s a different approach and less about speed and more about laying down a solid foundation,” said Sirkia.

Securing a MiCA license involves a step-by-step procedure. Crypto firms must first assess their eligibility and prepare all relevant documentation. Once submitted, the application undergoes a compliance review by the applicable regulatory authority.

“It will become more difficult for the classic example of two individuals with a novel idea to simply launch their crypto service or token to the public,” Sullivan said.

It might also create certain barriers to entry.

Obstacles for Smaller Players

This process can be particularly burdensome for small players or newer crypto firms seeking services in the European Union.

“While MiCA brings much-needed regulation, it also introduces higher compliance costs and operational burdens, particularly for smaller crypto businesses. Companies will have to navigate complex reporting requirements, stringent capital reserves for stablecoin issuers, and strict disclosure obligations,” Ghoos explained.

The framework also requires companies to have a base of operations in the EU.

“For smaller players, the requirements, such as maintaining a physical presence in the EU and holding significant capital reserves, can feel like a high hurdle. It risks shutting out startups that could bring fresh ideas to the table,” said Sirkia.

Some critics have said that this sort of regulation favors established crypto firms, creating barriers to entry for newer players. Larger companies with sufficient resources to overcome these obstacles do so anyway, given the significant opportunities of operating across such a large region.

“Those who manage to navigate the regulations will find themselves in a more secure and stable environment, with access to a massive market of 450 million people. It’s a challenge, yes, but it could also be a badge of legitimacy,” Sirkia said.

Beyond this, the MiCA regulation has also presented concerns regarding user privacy.

KYC Requirements Generate Privacy Concerns

MiCA implements AML and KYC protocols to create a safer, more secure, and trustworthy environment for market participants. However, it also raises some security concerns for users.

“On the user side, there’s concern about privacy. The stricter KYC rules, while aimed at security, could make some people uneasy about how their data is handled,” Sirkia said.

The extensive data collection and storage required by Know Your Customer (KYC) regulations conflict with individual privacy rights, raising concerns about data security, potential misuse, and unauthorized access.

“MiCA’s KYC rules are designed to prevent fraud and boost security, but they do raise eyebrows when it comes to privacy. Collecting and storing so much personal data creates risks. What happens if that data is hacked or misused? Users who value their privacy might turn to less regulated platforms, which is exactly what MiCA is trying to avoid. It’s a fine line to walk, and how the EU handles these concerns will be critical in building user trust,” Sirkia added.

Looking past these concerns, the most debated aspect of MiCA has been its regulation of stablecoins.

Stablecoin Issuers Face Significant Hurdles

Stablecoins are cryptocurrencies designed to maintain a stable value, typically by being pegged to another asset like gold or fiat currency. This makes them popular with investors seeking to engage with digital assets while mitigating price volatility.

The stringent nature of MiCA’s stablecoin regulations has been a key point of contention.

“MiCA will require all stablecoin issuers to maintain more than 1:1 backing with liquid reserves and obtain proper authorization as electronic money institutions. This will particularly impact unauthorized stablecoin issuers who have been operating in Europe without the appropriate e-money licenses, as they’ll need to either comply with these stricter requirements or cease operations in the EU,” Jón Helgi Egilsson, Co-Founder of Monerium and former Chairman of the Central Bank of Iceland, told BeInCrypto.

To that point, Sirkia added:

“Stablecoins are going to feel the MiCA effect in a big way. Issuers will need to step up their game with more transparency and stronger reserves. For USDC, which already operates under a pretty robust framework, the transition might be smoother. But for others, like USDT, it could mean more scrutiny and possibly some big adjustments.”

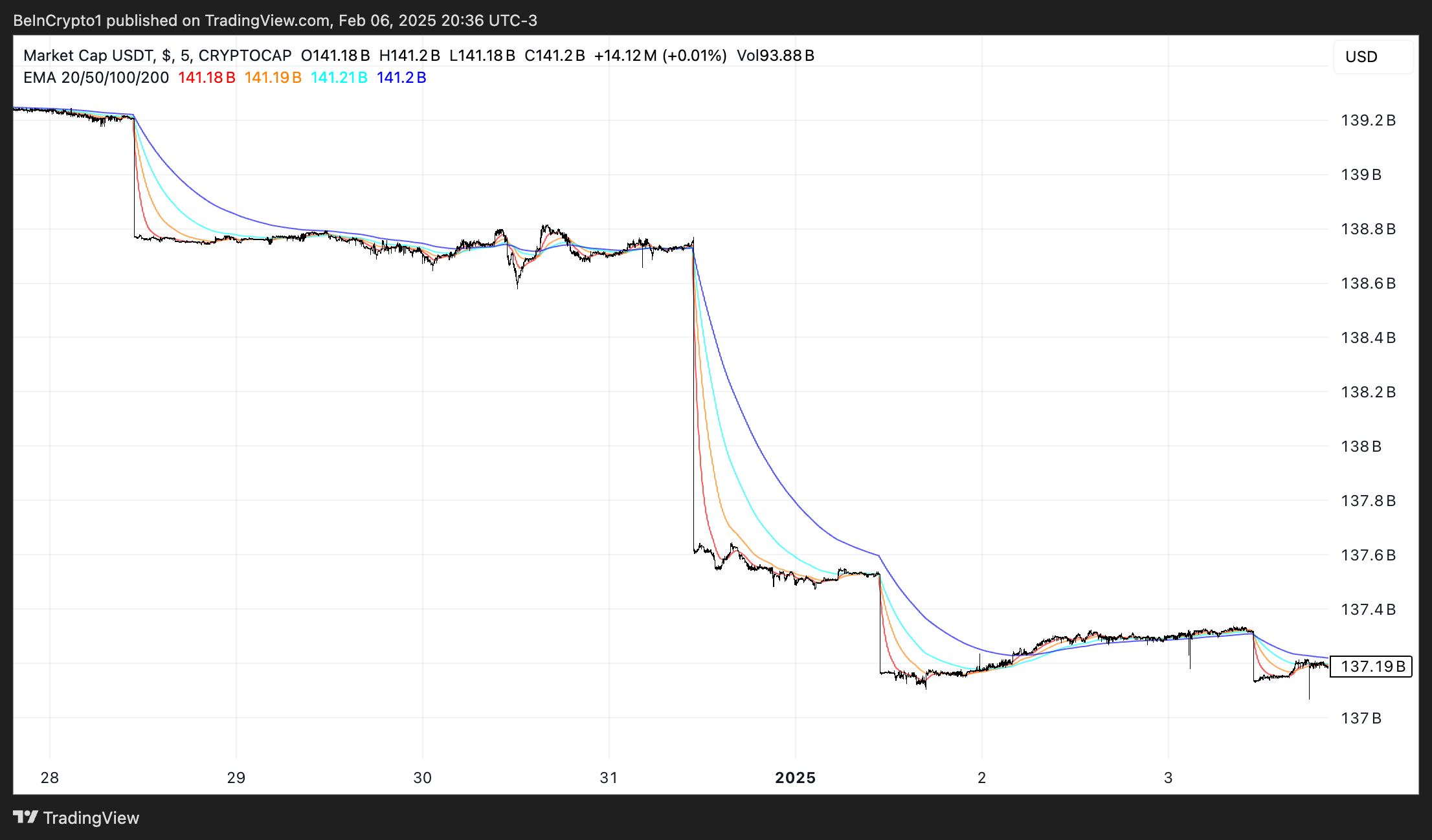

As soon as MiCA took effect, Tether’s USDT experienced a $2 billion drop in market capitalization– the biggest since the FTX collapse. Even before MiCA’s enactment, centralized exchanges like Coinbase began restricting USDT, while EU exchanges were directly ordered to delist the stablecoin en masse.

While USDT hasn’t yet met MiCA’s stablecoin regulation, its criteria have sparked debate. Some critics argue that they give traditional financial institutions a considerable advantage.

Three days before MiCA’s launch, Tether CEO Paolo took to social media to call out the framework’s requirements for stablecoin issuers.

“MiCA is nothing but a massive gift to the traditional banking system. Forcing stablecoin issuers to hold >30% of their liquidity in banks only ensures more profits for the legacy players. Its regulation designed to benefit the old system, not innovation,” read Diomede’s X post.

Egilsson explained that this policy significantly influences banks over their competitors’ operations and licensing.

“In extreme cases stablecoin issuers will have to safeguard up to 60% of funds with up to 12 commercial banks. Placing banks as intermediaries is like handing them the keys as gatekeepers to monitor their competitors and determine if their competitors will get a license to operate since a business relationship with multiple banks is now a requirement by EU law under MiCA,” he said.

Using traditional banks as intermediaries between stablecoin providers and consumers directly also opposes the idea of decentralization, according to Egilsson.

“It is simply absurd and a misuse of public EU legislation power in order to try to preserve the status quo for EU banks. To demand banks to be intermediaries doesn’t align with either the ethos of web3 or is it a fair playing field that would facilitate innovation,” he told BeInCrypto.

Egilsson also pointed out that USDT continues to operate within the European Union despite MiCA being in effect.

“Before MiCA, stablecoins fell under EU law as e-money, but EU legislators did not enforce it. The promise made by EU legislators was that enforcement will now follow. Yet, the legislation has taken effect, but unauthorized stablecoins continue to be offered. Regulation is one thing, enforcement is another. If enforcement remains as lax as it was before MiCA, one might ask: why bother regulating at all?” he said.

Regardless, Tether’s lack of full MiCA compliance creates risks, such as potential penalties, fines, or even an EU-based ban on USDT.

MiCA and the Future of Crypto Regulation

Despite certain pain points, most industry experts believe MiCA is a groundbreaking piece of legislation that could inspire similar regulations in other jurisdictions.

Given that the framework has only been in effect for a little over two months, the likelihood that it will be revised in the future is high– especially considering that the crypto industry is under a constant state of transformation.

“All regulations evolve, and MiCA will likely be no different. This evolution could be driven by increased crypto adoption, but it could also be driven by other factors such as technological progress. To use payment regulation as an example of natural regulatory progression, the EU is currently preparing the third Payment Services Directive (PSD3), a natural evolution of the earlier payment directives, PSD and PSD2,” Sullivan noted.

As Web3 evolves and new technologies emerge, MiCA must be updated to address them.

“The crypto space moves fast, and the framework will need to keep up. As adoption grows and new technologies like DeFi and NFTs become more mainstream, we’ll likely see updates to address these areas. The EU has set the bar high with MiCA, but staying relevant in a constantly evolving industry will require ongoing dialogue with the crypto community and flexibility in the regulatory approach,” said Sirkia.

If other countries adopt similar regulations, the EU may revise MiCA to remain competitive.

“As other jurisdictions develop their own crypto laws, the EU may refine MiCA to remain competitive and aligned with global standards, ensuring that Europe continues to be a leader in crypto regulation,” Ghoos explained.

In the future, a collaboration between industry players and regulators will be crucial in ensuring that these frameworks continue to protect consumers while developing an environment that fosters innovation.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MiCA vs Trump’s Crypto Policy: Battle for Crypto Dominance

Since the implementation of MiCA in the EU and the shift in US policy under President Trump, both jurisdictions have progressed in crypto legislation, albeit with distinct approaches. Europe got a head start by becoming the first to establish a comprehensive and unified regulatory framework for crypto-assets. Meanwhile, the US is catching up, with more capital to offer and a larger user base.

Manouk Termaaten, CEO of Vertical Studio AI, and Erwin Voloder, Head of Policy at the European Blockchain Association, shared their perspectives with BeInCrypto on the areas where the EU and the US are demonstrating leadership in the high-stakes development of crypto legislation and who will ultimately set the pace for global crypto regulation.

EU’s MiCA and Early Regulatory Certainty

By implementing the Markets in Crypto-Assets (MiCA) regulation on December 30, 2024, the European Union made history as the first jurisdiction to create a complete regulatory structure for crypto-assets that applies to all its member nations.

Since then, leading companies like Standard Chartered, MoonPay, BitStaete, Crypto.com, and OKX, to name a few, have secured their licenses.

The United States, in turn, was slower to act. Instead of lobbying for comprehensive crypto legislation, industry leaders have concentrated on getting approval from the US Securities and Exchange Commission (SEC). Under the Biden administration, that turned out to be a particularly hard feat.

“The EU definitely had a first-mover advantage in getting regulatory certainty out the gate with MiCA. Especially since at the time, the US was retreating from leadership in the digital asset space and the industry was facing what amounted to persecution back home in many cases,” Voloder told BeInCrypto.

Former SEC Chair Gary Gensler became known within the walls of the crypto industry as being particularly hostile toward the technology, taking a controversial regulation-by-enforcement policy stance. Crackdowns became common, and many innovators packed their bags and moved abroad, seeking opportunities in friendlier jurisdictions.

“The US relied on existing agencies like the SEC instead of building a unified crypto law. Remember, Gary Gensler almost cracked down on the market and caused massive fear but never managed to get anything through. This does not mean regulation will never come and creates legal uncertainty that’s driven many projects overseas,” Termaaten said.

Now, under Trump, things have taken quite a turn.

How Does the US Approach Crypto Innovation?

The Trump administration aims to foster a predictable environment for US crypto innovation and expansion through clear regulatory frameworks. It strongly emphasizes keeping that innovation within the United States to establish its global leadership.

In pursuit of this goal, the administration has created working groups and task forces to develop detailed regulatory frameworks, including stablecoins and crypto asset classification guidelines.

“What we’ve seen under the Trump administration so far has been a complete roll-back of Biden-era regulations and weaponization of the agencies against crypto in favour of a light- touch, pro-innovation stance. He’s dismantling the DOJ’s Crypto Enforcement Team, the SEC’s new Crypto-Asset Task Force has a new mandate, under new leadership in Commissioner Pierce, and there’s ongoing investigations in the House against the systematic de-banking of digital assets businesses, and banks with revelations coming to light almost weekly,” Voloder explained.

As part of this new chapter in crypto regulation, the United States intends to forge its path, developing distinct crypto regulations rather than adopting the EU’s MiCA framework. Its intent diverges significantly from the European approach.

MiCA’s Regulatory Framework in the EU

MiCA provides the EU with a comprehensive and unified regulatory framework for crypto assets, extending bank-like rules focused on financial stability and consumer protection.

The regulation mandates licensing for crypto service providers and stablecoin issuers, aligning them with traditional finance and supporting the creation of a Central Bank Digital Currency (CBDC) as a digital euro to safeguard monetary sovereignty.

“The EU treats crypto as part of its traditional financial system– it’s cautious, centralized, and prioritizes regulation through MiCA and the upcoming digital euro (CBDC),” Termaaten told BeInCrypto.

The US, however, operates with a contrasting attitude.

US Focus on Private Innovation and Opposition to CBDCs

Trump has clearly stated that he intends to eliminate any regulations that promote CBDCs, citing concerns about government overreach and the erosion of financial freedom.

The United States now charts a policy course that champions blockchain technology through private innovation while firmly opposing CBDCs. This stance is underscored by a recent executive order in which the White House argues that CBDCs “threaten the stability of the financial system, individual privacy, and the sovereignty of the United States.”

Trump has also clarified that stablecoins are the priority for innovation, as they can help reinforce US dollar dominance.

Meanwhile, a notably fragmented approach has characterized the advancement of crypto legislation in the US. The absence of nationwide regulations has allowed certain states to establish an early lead, but others continue to lag in pursuing crypto innovation.

“The US, especially under Trump’s recent shift, is leaning harder into private-sector innovation, explicitly opposing a CBDC and focusing on blockchain as a new tech frontier, which the USA will be the capital from. The EU’s approach is about control and stability; the US’s is about flexibility and economic leadership through innovation. Both aim to protect consumers, but through very different methods,” Termaaten said.

These fundamentally different philosophies also allow for the analysis of which regulations yield the most favorable outcomes.

What are the Financial Burdens of MiCA Compliance?

The significant investment companies must make to obtain a MiCA operating license has drawn scrutiny. Though member states set varying fees, these are generally steep.

“[There are] high costs that are not in proportion compared to the gain for a business. It also just adds a layer of legal complexity most projects dont want to bring into their project. At Vertical AI, we decided it’s strategic to proceed with becoming compliant, but others could just geo-block EU users to avoid the burden,” Termaaten told of his personal experience.

MiCA mandates minimum capital requirements based on the crypto services offered. These range from €50,000 for advisory and order-related services to €125,000 for exchange and trading platforms and up to €150,000 for custody services. Businesses must maintain this capital as a financial safeguard.

Beyond minimum capital requirements, companies must factor in government and legal fees, local presence costs, bank setups, and ongoing operational costs.

“MiCA is an expensive regulation. Compliance in Europe can be an exorbitant expense and I think the main challenge going forward at least for start-ups is justifying the high up-front costs of advisory, licensing, auditing etc., when many of these companies have a fixed burn they need to manage. The last thing you want to be doing as a start-up is piling all of your capital into compliance when that money could have been put to better use developing/refining your product and your GTM,” Voloder told BeInCrypto.

In contrast, the US allows crypto companies greater leeway to innovate.

Flexible Regulatory Stance and Private Sector Innovation in the US

While the European Union’s MiCA regulation establishes a comprehensive and structured regulatory environment, the United States has opted for a more flexible regulatory stance.

This approach prioritizes the growth of private blockchain innovation, aiming to encourage rapid development and technological advancement within the crypto industry by providing a less restrictive regulatory environment.

“The US favors letting the private sector innovate, especially with USD-backed stablecoins, which it believes can expand dollar dominance globally. This approach avoids centralization while still enabling digital payments innovation. It’s very much a “let the market lead” philosophy. In my opinion, the way to go with crypto,” Termaaten told BeInCrypto.

Should the US continue developing crypto-friendly legislation, it will quickly position itself to outpace Europe in this regulatory race.

“The EU still leads in terms of finalized law (MiCA), but the US is regaining ground by openly backing the crypto industry and promising regulatory clarity. If that clarity turns into actual, friendly regulation, the US will become more attractive than the EU– especially for developers and fintech firms who value speed and scale + access to more venture capital,” Termaaten said, adding that, “While the EU is a large crypto market, the US still dominates in capital, user base, and market liquidity.”

This contrasting approach, favoring a more agile and less burdensome regulatory environment, illustrates the fundamental differences in how each jurisdiction envisions the future of digital finance.

Will the US or EU Ultimately Secure Global Leadership?

While the European Union secured an early advantage in the global crypto regulatory landscape through the comprehensive and unified framework of MiCA, its thoroughness and the significant financial investment required for licensing have inadvertently created barriers to rapid innovation.

This situation has opened a window of opportunity for the United States, particularly with the shift in administration under Trump. By adopting a more permissive and innovation-centric approach, dismantling perceived regulatory obstacles, and prioritizing private blockchain development, the US is quickly emerging as the preferred jurisdiction for crypto innovation.

Despite Europe’s regulatory clarity, the US’s focus on flexibility, coupled with its robust capital markets and extensive user base, positions it to potentially eclipse the EU as the true leader in fostering the next wave of crypto advancements, provided it can deliver on its promise of clear and supportive legislation.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Canary Capital Aims to Launch TRON-Focused ETF

Canary Capital has filed a Form S-1 registration with the US Securities and Exchange Commission (SEC) to launch a spot exchange-traded fund (ETF) focused on Tron (TRX).

The proposal, submitted on April 18, is the first of its kind to offer investors exposure to TRX’s market performance while also providing staking rewards. This sets the fund apart from previous spot crypto ETF proposals.

Canary Capital’s TRX ETF Could Test SEC Stance on Staking Assets

The filing designates BitGo Trust Company as the custodian for TRX holdings and appoints Canary Capital as the fund’s sponsor.

Justin Sun, the founder of Tron, weighed in on the development, encouraging US investors to act promptly. He emphasized TRX’s potential for long-term growth and suggested institutional interest would likely surge if the ETF is approved.

“US VCs should start buying TRX — and fast. Don’t wait until it’s too late. TRX is a price that only moves one way: up,” Sun said on X.

According to BeInCrypto data, TRX is currently the ninth-largest crypto by market capitalization, valued at approximately $22.94 billion.

Moreover, Tron’s blockchain has gained strong traction in stablecoin settlements, ranking second only to Ethereum. Its efficiency in processing fast and low-cost transactions has made it a preferred choice for Tether’s USDT, based on data from DeFiLlama.

While the proposal has created a buzz in the market, questions remain over its chances of gaining regulatory approval. The inclusion of staking within the ETF is a bold move, but the SEC has historically opposed similar features in other crypto funds.

The SEC has flagged staking services within investment products as potential unregistered securities, leading to increased scrutiny.

Due to this, past Ethereum ETF proposals were forced to remove staking components to align with regulatory expectations.

Nonetheless, several firms, including Grayscale, continue to push for altcoin ETFs that incorporate staking or offer broader asset exposure.

Still, regulatory uncertainty clouds the Canary TRX ETF proposal, especially in light of past controversies involving Justin Sun. The network has also faced allegations of being used by illicit actors, claims it has publicly denied.

If approved, Canary Capital’s ETF would mark a historic milestone by combining exposure to TRX with staking rewards. This structure could attract both retail and institutional investors seeking yield alongside market performance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Consolidation About To Reach A Bottom, Wave 5 Says $5.85 Is Coming

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP is still in consolidation mode after hitting a new seven-year high in January 2025. This consolidation has seen the price drop slowly, but steadily, losing around 40% of its value since then. Currently, bulls seem to have created support for the altcoin at $2, as this level continues to hold even through crashes. Thus, it has created the expectation that the bottom could be close for the XRP price, and this could serve as a bounce-off point.

XRP Price Consolidation Could Be Over Soon

Taking to X (formerly Twitter), crypto analyst Dark Defender revealed that the consolidation that the XRP Price has been stuck in for months now is coming to an end. The analyst used the monthly chart for the analysis, calling out an end and a bottom for the XRP price. According to him, this is actually the “Final Consolidation” for XRP, suggesting that this is where a breakout would start from.

Related Reading

With the consolidation expected to come to an end soon, the crypto analyst highlights what could be next for the altcoin using the 5-Wave analysis. Now, in total, these five waves are still very bullish for the price and could end up marking a new all-time high.

For the first wave, Dark Defender calls it the Impulsive Wave 1, which is expected to begin the uptrend. This first wave is expected to push the price back to $3 before the second wave starts, and this second wave is bearish.

The second wave would trigger a crash from $3 back toward $2.2, providing the setup for the third wave. Once the third wave begins, this is where the crypto analyst expects the XRP price to hit a new all-time high. The target for Wave 3 puts the XRP price as high as $5, clearing the 2017 all-time high of $3.8.

Next in line is the fourth wave, which is another bearish wave. This wave will cause at least a 30% crash, according to the chart shared by the crypto analyst, taking it back toward the $3 territory once again. However, just like the second bearish wave, the fourth bearish wave is expected to set up the price for a final and more explosive Wave 5.

Related Reading

Once the fifth wave is in action, a brand-new all-time high is expected to happen, with the price rising over 100% from the bottom of the fourth wave. The target for this, as shown in the chart, is over $6.

As for the crypto analyst, the major targets highlighted during this wave action are $3.75 and $58.85. Then, for major supports and resistances, supports are $1.88 and $1.63, while resistances lie at $2.22 and $2.30.

Featured image from Dall.E, chart from TradingView.com

-

Altcoin22 hours ago

Altcoin22 hours agoEthereum ETFs Record $32M Weekly Outflow; ETH Price Crash To $1.1K Imminent?

-

Market14 hours ago

Market14 hours agoPi Network Roadmap Frustrates Users Over Missing Timeline

-

Market15 hours ago

Market15 hours agoMEME Rallies 73%, BONE Follows

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Price Stalls In Tight Range – Big Price Move Incoming?

-

Market21 hours ago

Market21 hours agoAre Ethereum Whales Threatening ETH Price Stability?

-

Market13 hours ago

Market13 hours agoSolana (SOL) Price Rises 13% But Fails to Break $136 Resistance

-

Market20 hours ago

Market20 hours agoHow $31 Trillion in US Bonds Could Impact Crypto Markets in 2025

-

Altcoin18 hours ago

Altcoin18 hours agoXRP Price History Signals July As The Next Bullish Month