Market

Bitcoin Price Attempts a Comeback: Can the Recovery Hold?

Bitcoin price is consolidating above the $95,500 support zone. BTC is showing a few positive signs and might attempt a recovery if it clears $100,000.

- Bitcoin started a fresh decline below the $100,000 level.

- The price is trading below $99,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $100,000 zone.

Bitcoin Price Holds Support

Bitcoin price failed to continue higher above the $102,500 zone. It started another decline below the $99,000 zone. BTC gained bearish momentum for a move below the $98,500 and $96,500 levels.

A low was formed at $95,700 and the price recently started a consolidation phase. There was a minor increase above the $97,000 level. The price surpassed the 23.6% Fib retracement level of the downward move from the $102,500 swing high to the $95,700 low.

Bitcoin price is now trading below $98,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $98,000 level. There is also a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $99,100 level or the 50% Fib retracement level of the downward move from the $102,500 swing high to the $95,700 low. The next key resistance could be $100,000. A close above the $100,000 resistance might send the price further higher.

In the stated case, the price could rise and test the $101,200 resistance level. Any more gains might send the price toward the $102,500 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $98,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $96,200 level. The first major support is near the $95,500 level.

The next support is now near the $93,200 zone. Any more losses might send the price toward the $92,200 support in the near term. The main support sits at $90,900.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $96,200, followed by $95,500.

Major Resistance Levels – $98,000 and $100,000.

Market

Japan Bans Five Crypto Exchanges After Ignored Warnings

Japan’s FSA requested Apple and Google to remove five crypto exchanges from its app stores. The FSA claims that these exchanges are unregistered and did not meet compliance despite past warnings.

The businesses in question are KuCoin, Bybit, Bitget, MEXC Global, and LBank Exchange. Several of them had been trying to reach compliance in other jurisdictions.

Japan Bans Five Exchanges

According to local reports, Japan’s Financial Services Agency (FSA) has asked Apple and Google to block downloads for five crypto exchanges.

Specifically, the FSA targeted KuCoin, Bybit, Bitget, MEXC Global, and LBank Exchange. As BeInCrypto reported earlier, the regulator previously warned these businesses about failing to comply with registration requirements. It seems these warnings went unheeded.

Despite this crackdown on unregistered exchanges, Japan has actually made several recent overtures to the crypto industry. For example, the FSA began reviewing crypto tax laws last year in an attempt to lower them.

Lawmakers have also started advocating for a Bitcoin Reserve, and some ETF issuers believe a Bitcoin ETF is nearing approval.

Despite the positive momentum, the regulator cannot ignore flagrant violations like these exchanges were committing. It seems that none of the firms in question made any attempt to reach compliance since the warning in September.

Only Bybit has released a statement, and it seems to ignore the problem outright:

“We want to clarify recent discussions about Bybit’s services to our Japanese language users. Bybit is continuing to offer services to Japanese language users. We sincerely apologize for any inconvenience this may have caused. We are committed to working closely with the authority to ensure we meet all local regulatory expectations,” it claimed.

It’s very unclear what the firm means by this. When Deribit exited Russia yesterday, the company’s statements made it clear that Russian users abroad can only access its services under very specific conditions.

Will these exchanges claim similar exceptions for users outside Japan? Whatever the new terms are, they seem poorly thought out.

The most confusing element is that most of these exchanges have sought to improve regulatory compliance in countries other than Japan. Bybit acquired a license in India yesterday, and KuCoin reached a settlement with the US last month.

Also, Bitget has a proactive strategy to fulfill EU requirements. Japan warned these companies months ago, but they seemingly did nothing.

“These platforms were low-key trading crypto in Japan without the right paperwork, and now their users are left exposed. No legal protection, no oversight—just pure chaos. Japan’s putting the crypto world on notice: follow the rules or face the consequences,” Mario Nawfal wrote on X (formerly Twitter).

Overall, it’s unclear how long these exchanges will be banned in Japan or if they’re even interested in returning. This incident will serve as one more data point in a sordid chart of fines, bans, and criminal charges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

TON Suffers Significant Dip in User Engagement

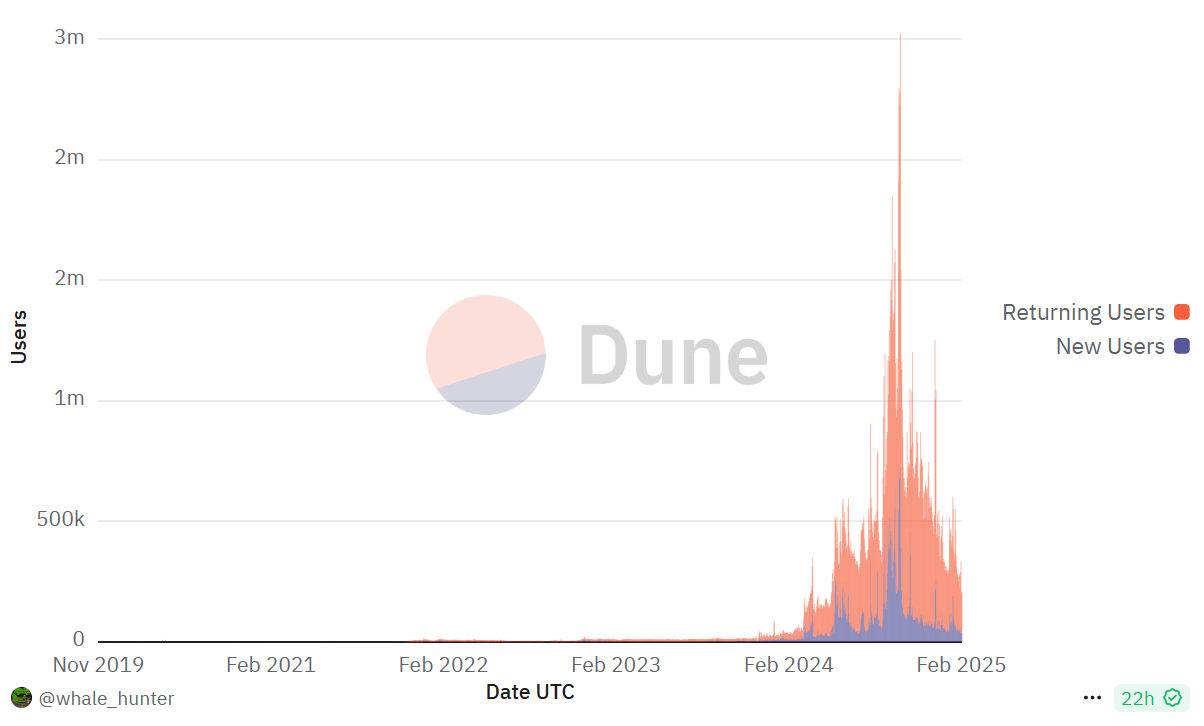

The TON ecosystem has suffered in the past week, with significant drops in user engagement and increasing selling pressure. The number of new users has dropped by a staggering 95% since the network’s July all-time high.

These negative metrics represent a decline in investor confidence and raise questions over whether the ecosystem is losing its long-term appeal.

On-Chain Data Paints a Grim Picture for TON

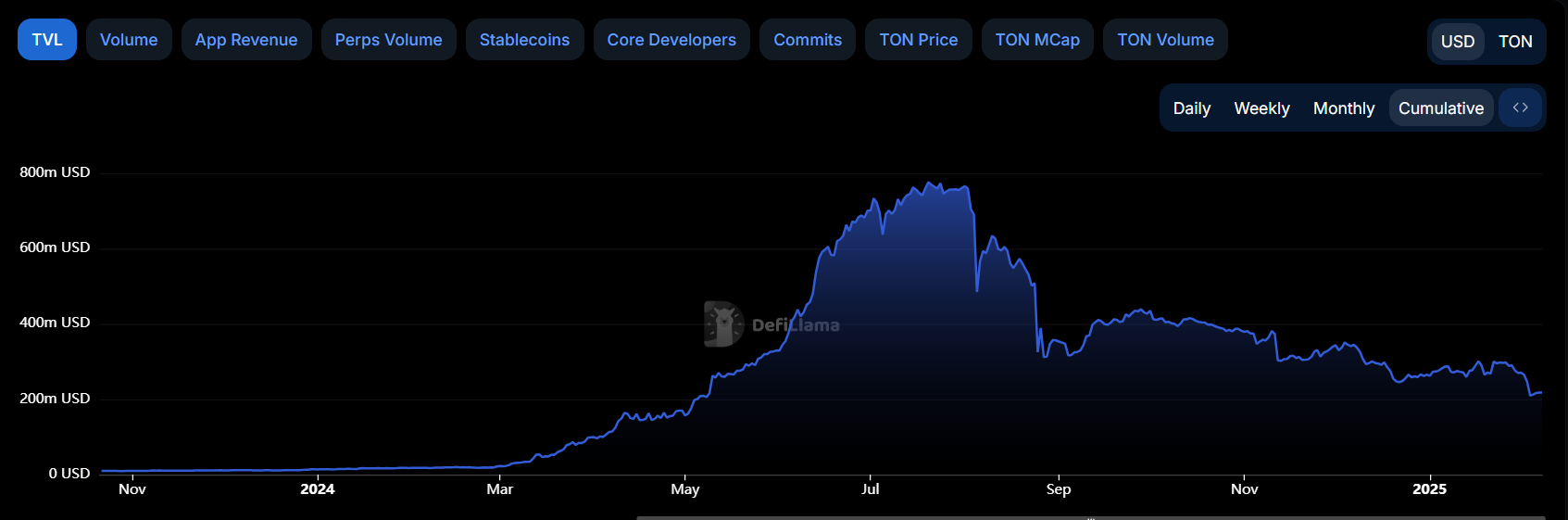

According to data from DefiLlama, The Open Network (TON) experienced a peak in Total Value Locked (TVL) in mid-July, reaching $773 million.

Since then, its value has been in constant decline. Today, the ecosystem’s TVL stands at $215 million, representing a drop of more than 72% since its all-time high.

This decline is also reflected in the alarming drop in new daily users. According to Dune data, TON reached an all-time high of 724,465 on September 30, but as of February 5, that number dropped to just 33,852.

The over 95% decrease has raised concerns about the blockchain’s current and future attractiveness.

Investors in TON projects have reported financial losses, leading to expressions of dissatisfaction on social media platforms.

“Never in my life did I ever think I would see Notcoin at $0.0033 and Toncoin at $4.2,” one user said on X.

Also, data indicates that most TON token holders, approximately 96% representing over 108 million addresses, are currently experiencing investment losses.

Conversely, only a small fraction, about 4% or a little over 4.2 million addresses, are seeing profits. This data suggests a prevailing negative sentiment among TON investors, which may contribute to increased token-selling activity.

The Roadmap Ahead

TON is a Telegram-based blockchain infrastructure that has relied on tap-to-earn and other GameFi apps to drive adoption and spur engagement.

Less than two weeks ago, the TON core team published its development roadmap for the first half of 2025. This layout outlines planned updates, including improvements to core functions and exploration of potential future revenue streams.

TON’s expansion strategy is a reaction to its falling revenue, largely due to the declining popularity and profitability of tap-to-earn games and other GameFi apps that were previously important revenue streams for the company.

Though Telegram originally severed ties with TON in 2020 over regulatory pressures, the network recently re-partnered with the messaging app under Trump’s new regulatory environment.

This decision prompted debate among TON’s users. Some questioned Telegram’s dedication to decentralized principles, while others expressed concerns about the potential impact on liquidity and market stability.

The long-term success of TON’s newly released roadmap remains to be determined, as current on-chain data suggests potential challenges in the near future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitget’s BGB Token Poised to Hit New Highs

Bitget’s native token, BGB, has been the market’s top gainer over the past 24 hours. Its value has risen by 1% during that period, outperforming leading crypto assets, which continue to record losses.

On-chain and technical indicators suggest that the price rally is fueled by rising demand for BGB. Hence, the token is poised to extend its gains in the short term.

Bitget’s Soaring Demand Pushes Price Up

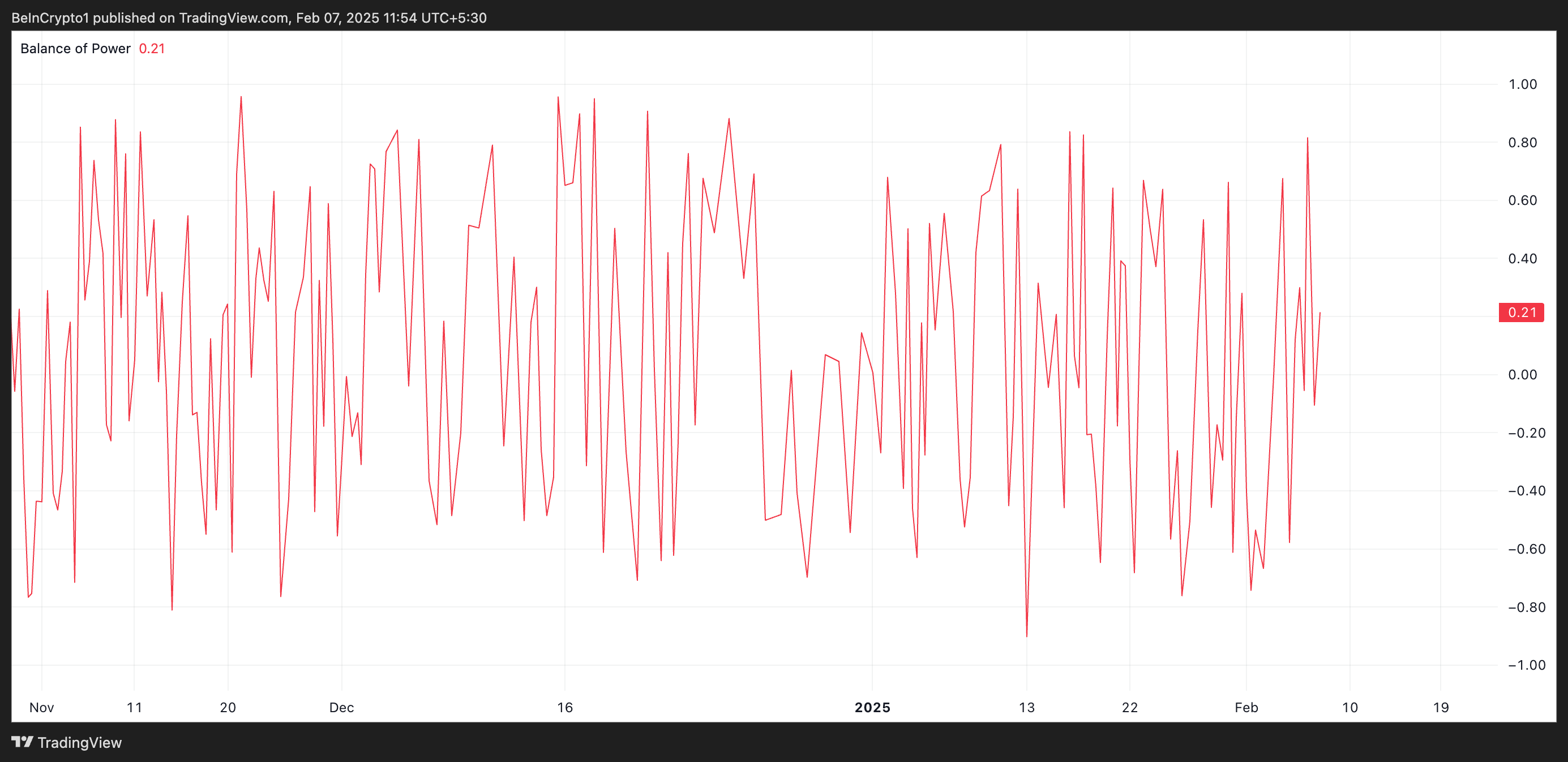

Readings from BGB’s price chart highlight the buying pressure among market participants. For example, its Balance of Power (BoP) returns a positive value of 0.21 at press time, confirming the bullish bias toward the altcoin.

An asset’s BoP measures the strength of its buyers against sellers by analyzing price movements within a given period. When the indicator’s value is positive, buyers are in control, signaling strong buying pressure and a potential continuation of the asset’s upward trend.

Notably, according to on-chain data, the steady rise in BGB’s Relative Strength Index (RSI) confirms this accumulation trend. As of this writing, the key momentum metric is at 54.38 and in an uptrend.

An asset’s RSI measures the speed and magnitude of its recent price changes to assess whether it is overbought or oversold. RSI value of 54.38 suggests that buying momentum is increasing but has not yet reached the overbought territory. This indicates room for further gains, with the potential for continued bullish movement if demand remains strong.

BGB Price Analysis: A Break Above $7.80 Could Lead to ATH

BGB currently exchanges hands at $6.73, trading below the crucial resistance formed at $7.80. Sustained demand for the altcoin could push BGB above this level and propel it toward its all-time high of $8.50.

However, if buying pressure wanes and BGB distribution resumes among traders, it will shed its recent gains. In that case, its price could drop to find support at $5.97.

BGB’s price decline could extend to $4.42 if the bulls fail to defend this level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin24 hours ago

Bitcoin24 hours agoUS Senate Panel Approves Crypto Advocate, Billionaire Howard Lutnick For Commerce Secretary

-

Altcoin21 hours ago

Altcoin21 hours agoTornado Cash Developer Alexey Pertsev Set To Be Released; TORN Price Skyrockets

-

Altcoin20 hours ago

Altcoin20 hours agoUS SEC Seeks Public Comments on Grayscale’s Litecoin ETF Proposal

-

Altcoin19 hours ago

Altcoin19 hours agoWhy Is Bitcoin, XRP, Solana & Dogecoin Price Dropping?

-

Regulation22 hours ago

Regulation22 hours agoGermany’s AfD Calls for Euro Exit and Bitcoin Deregulation Before Election

-

Market21 hours ago

Market21 hours agoSolana’s BONK Roundtrips Total Gains From 2024, Here’s Why It’s A Good Buy Now

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Trades Inside A Multi-Year Bullish Pennant – Analyst Sees A Breakout Above $4K

-

Market20 hours ago

Market20 hours agoADA Price Drops 25% in a Week