Market

Cardano (ADA) Under Pressure, Rebound Risks Liquidations

Cardano’s price has failed to sustain any meaningful recovery, invalidating the previously anticipated bullish pattern. Despite oversold conditions suggesting a potential reversal, ADA remains under pressure.

Market conditions indicate that an immediate rebound is uncertain, with sellers maintaining control. Investors remain cautious as Cardano struggles to reclaim key resistance levels.

Cardano Traders Are Prone To Losses

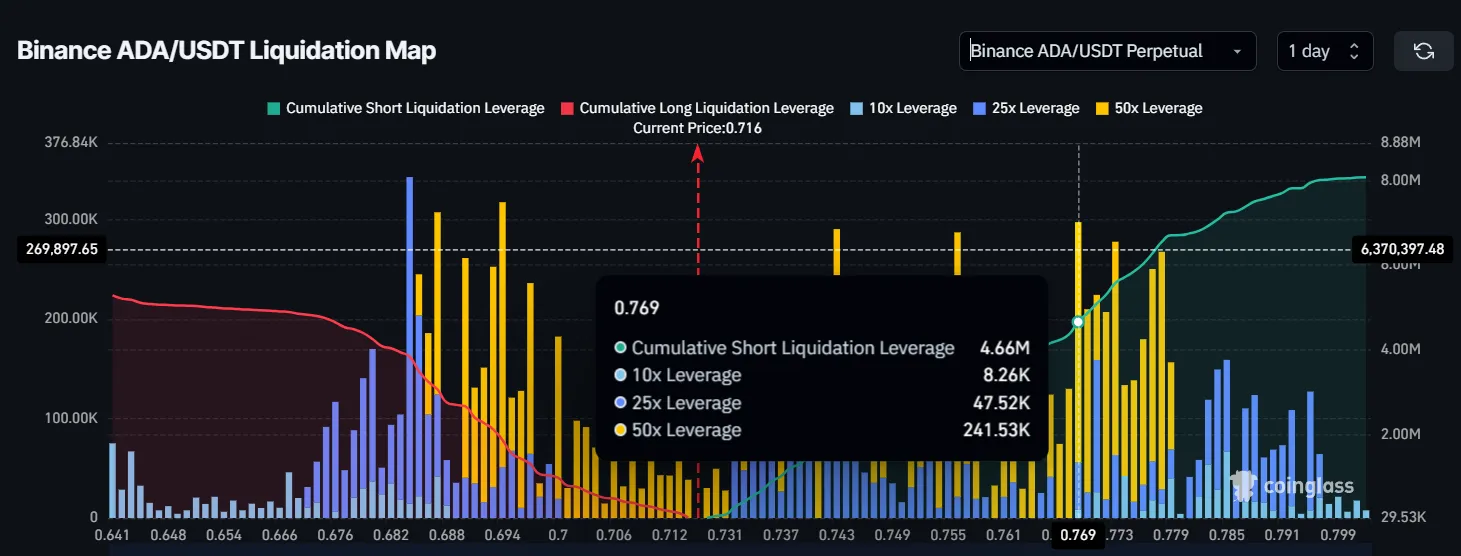

Cardano’s liquidation map highlights over $4.66 million worth of ADA at risk of liquidation if the price rebounds toward the $0.77 resistance. This suggests that bearish traders have aggressively bet on further declines. Their dominance has driven the funding rate negative, indicating strong short interest and hesitation among bullish investors.

However, the broader market sentiment does not entirely align with this bearish outlook. While shorts currently hold the upper hand, any unexpected shift in buying momentum could trigger a wave of short liquidations.

Technical indicators suggest Cardano is experiencing extreme selling pressure, with the Relative Strength Index (RSI) now in the oversold zone. This marks the first instance in six months where ADA has reached this level, typically signaling that bearish momentum is nearing exhaustion. Historically, such conditions have led to minor recoveries.

However, Cardano has repeatedly demonstrated that an oversold RSI does not necessarily translate into significant price rallies. While some assets bounce back sharply after hitting oversold territory, ADA has struggled to capitalize on these moments. As a result, expecting a rapid recovery remains speculative unless broader market conditions improve substantially.

ADA Price Prediction: Recovery Is Likely

Cardano’s price has dropped by 25% over the past week, now trading at $0.71. The asset found support at $0.70, preventing further downside for now. However, the absence of strong bullish momentum raises concerns about ADA’s ability to recover in the near term.

With the previously established bullish falling wedge pattern now invalidated, ADA may struggle to post any significant gains. Given current market conditions, the price is likely to remain range-bound between $0.70 and $0.77. Until a breakout occurs, traders should expect continued consolidation within this zone.

A decisive move above $0.77 could shift momentum in favor of buyers. If ADA flips this resistance into support, a short squeeze may follow, triggering liquidations and fueling a potential rally to $0.85 breaching, which is crucial for ADA to reach $1.00.

However, a rally to $1.00 is far away since, without this breakout, upside potential remains limited, and Cardano could stay trapped in a tight range.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Berachain (BERA) Price Falls 50% Post Launch to New Lows

Berachain’s native token, BERA, has had an underwhelming start, struggling to gain traction amid weak market conditions. The token’s launch followed the debut of Berachain’s Layer 1 proof-of-liquidity blockchain on Thursday.

Along with it came an airdrop of 55.75 million BERA, which peaked at a valuation of $1 billion before experiencing a sharp decline.

Berachain Is Losing Traction

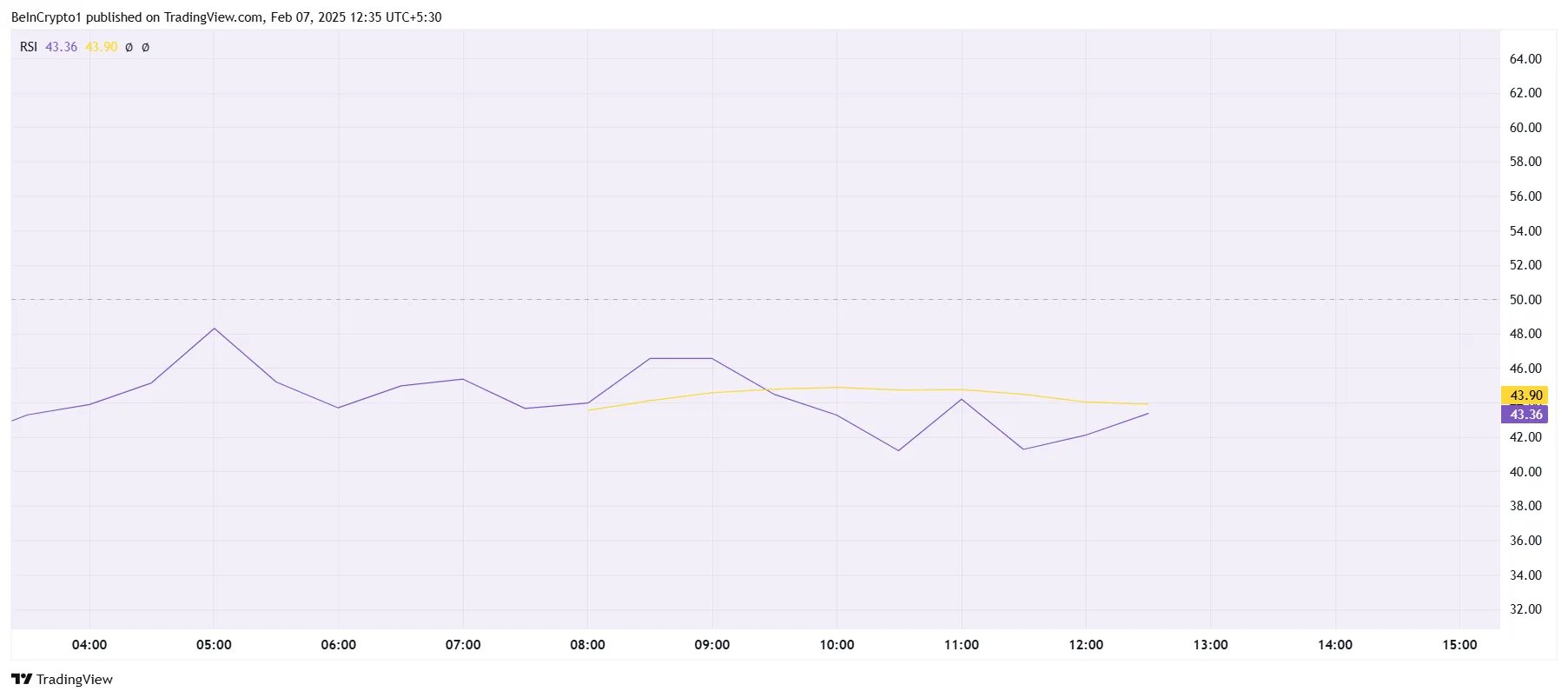

The Relative Strength Index (RSI indicates that bearish momentum is currently in control, with the indicator struggling below the neutral 50.0 mark. This suggests that selling pressure outweighs buying interest, limiting any immediate recovery potential. Traders remain cautious, further contributing to BERA’s sluggish performance in the early trading phase.

Given the lack of strong bullish momentum, short-term price growth appears uncertain. If RSI remains below the neutral level, BERA could continue to face resistance in establishing a meaningful uptrend. Without a shift in market sentiment, the token may remain under pressure, extending its current consolidation phase.

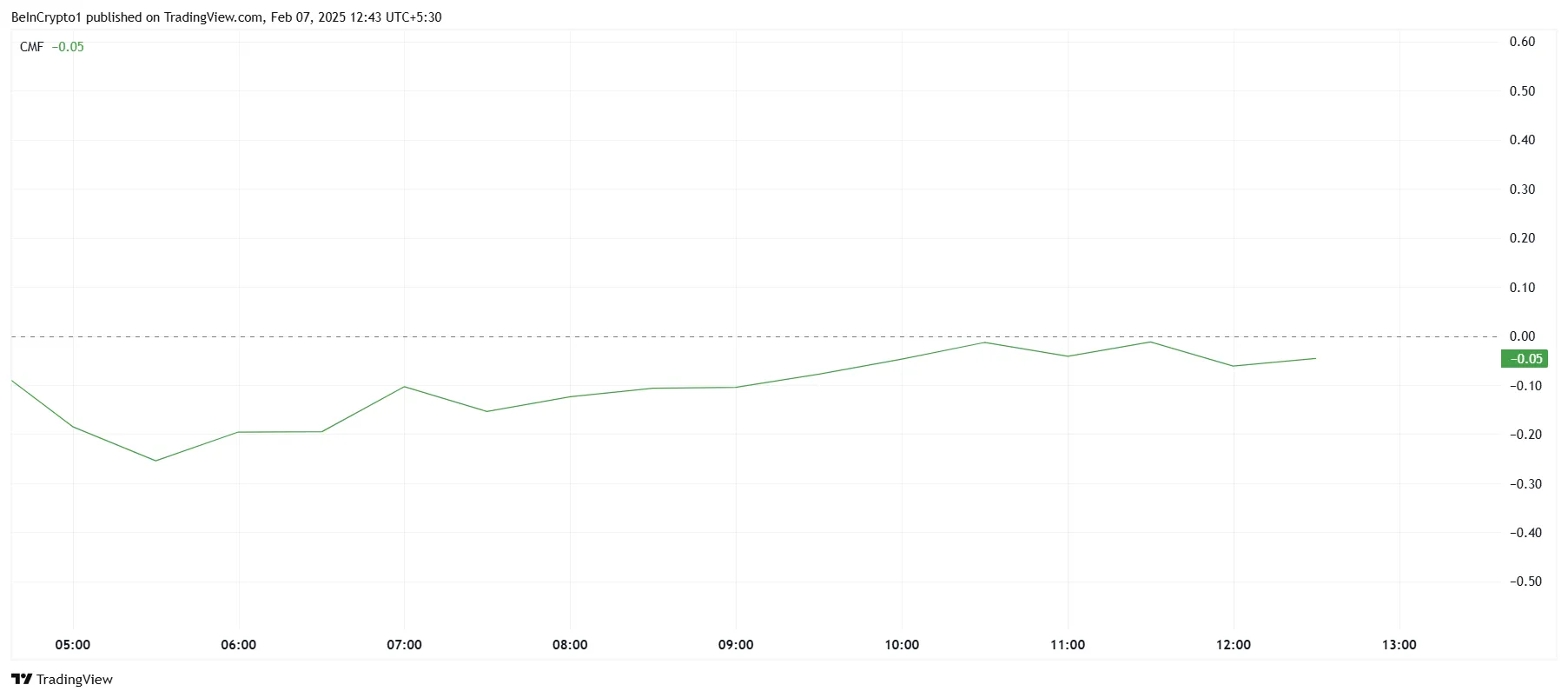

The broader market outlook for BERA remains uncertain, as reflected in the Chaikin Money Flow (CMF) indicator, which is currently below the zero line. This signals weak capital inflows into the token, suggesting investors are hesitant to commit funds. The uncertainty surrounding Berachain’s long-term viability may be a contributing factor.

Skepticism regarding newly launched projects often results in cautious trading behavior, as seen with BERA. If investor confidence does not improve, the token may struggle to attract significant inflows. Without an increase in buying pressure, the price could remain subdued, further limiting its ability to recover from the initial decline.

BERA Price Prediction: Breaking Out

BERA is currently trading at $7.61, consolidating between $8.72 and $7.07 over the past 12 hours. The limited movement within this range highlights the impact of bearish sentiment and weak investor interest. Until a breakout occurs, price action is likely to remain subdued.

The altcoin has already experienced a sharp 50% decline during its intra-day low and its current all-time low and is now down by 45% from its peak. Such a steep drop on the first day raises concerns about its immediate outlook. If selling pressure continues, BERA could extend its losses, potentially testing the $5.00 support level.

However, a potential turnaround remains possible if the altcoin can reclaim $8.72 as a support level. A successful flip of this resistance could spark renewed interest, leading to a rally toward $9.85. This move would invalidate the bearish outlook and set the stage for further recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Attempts a Comeback: Can the Recovery Hold?

Bitcoin price is consolidating above the $95,500 support zone. BTC is showing a few positive signs and might attempt a recovery if it clears $100,000.

- Bitcoin started a fresh decline below the $100,000 level.

- The price is trading below $99,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $100,000 zone.

Bitcoin Price Holds Support

Bitcoin price failed to continue higher above the $102,500 zone. It started another decline below the $99,000 zone. BTC gained bearish momentum for a move below the $98,500 and $96,500 levels.

A low was formed at $95,700 and the price recently started a consolidation phase. There was a minor increase above the $97,000 level. The price surpassed the 23.6% Fib retracement level of the downward move from the $102,500 swing high to the $95,700 low.

Bitcoin price is now trading below $98,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $98,000 level. There is also a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $99,100 level or the 50% Fib retracement level of the downward move from the $102,500 swing high to the $95,700 low. The next key resistance could be $100,000. A close above the $100,000 resistance might send the price further higher.

In the stated case, the price could rise and test the $101,200 resistance level. Any more gains might send the price toward the $102,500 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $98,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $96,200 level. The first major support is near the $95,500 level.

The next support is now near the $93,200 zone. Any more losses might send the price toward the $92,200 support in the near term. The main support sits at $90,900.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $96,200, followed by $95,500.

Major Resistance Levels – $98,000 and $100,000.

Market

Meme Coins to Altcoins with Real-World Value

Crypto analysts have observed a significant shift in investor sentiment over the past several weeks, suggesting a more knowledgeable investor base, even among the retail holders.

Previously dominated by speculative meme coins, the market is now increasingly focused on high-tech altcoin projects with real-world utility and novel blockchain solutions.

Investor Interest Shifts to RWA and DeFi

Web3 information platform Kaito AI and insights from crypto analysts suggest that investor mindshare is increasingly shifting toward Real-World Assets (RWAs), decentralized finance (DeFi), and advanced blockchain protocols.

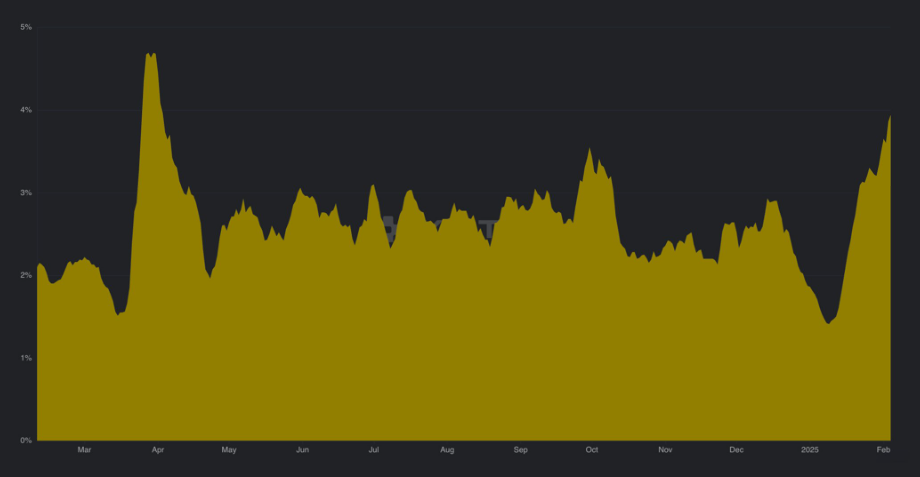

According to Kaito AI, RWA mindshare has surged after reaching a 12-month low in January. This resurgence signals renewed interest in tokenizing real-world financial assets, which has attracted institutional players.

Similarly, DeFi has regained prominence, overtaking AI tokens in market interest. The resurgence of DeFi suggests a shift towards more sustainable financial mechanisms, in contrast to the speculative nature of meme coins.

Several blockchain projects have emerged as major beneficiaries of this sentiment shift. Berachain (BERA) and MegaETH (WETH) have gained traction. Kaito AI’s analysis highlights these as top mindshare gainers.

However, for Berachain, social dominance or consumer awareness is likely ascribed to its recent airdrop and the subsequent listing on Binance and Bitrue. In a statement shared with BeInCrypto, Bitrue committed to supporting the developers on Berachain, a blockchain that introduces a unique Proof-of-Liquidity (PoL) consensus mechanism, believed to be superior to Proof-of-Stake (PoS).

“To celebrate this milestone, Bitrue is rolling out two special events for the exchange’s users. First, Power Piggy Listing: BERA will be available in Power Piggy, Bitrue’s flexible investment product, at 10% APR starting February 6th at 14:00 UTC. Secondly, Deposit Contest: Users who deposit BERA on Bitrue can win rewards based on their deposit amounts,” Bitrue told BeInCrypto.

However, despite the excitement, Berachain’s token price has seen downward pressure due to post-airdrop selling, demonstrating that speculative dynamics are still at play.

Beyond Berachain, MegaETH, Initia, and Monad have captured the market’s attention. These projects focus on technical advancements in scalability, DeFi, and blockchain efficiency. DeFi expert Ignas said this renewed enthusiasm mirrors the early 2020/21 cycle. Then, projects with substantial technical innovation garnered significant hype.

“Technically innovative launches are getting hype again…It’s not just your Degen monkey brain blindly aping into meme coins or simping for a new Celeb Coin – your analytical & research skills can be put to action again,” Ignas wrote.

Investors are now diving deeper into protocol mechanisms, farming strategies, and long-term sustainability rather than unquestioningly speculating on short-lived trends.

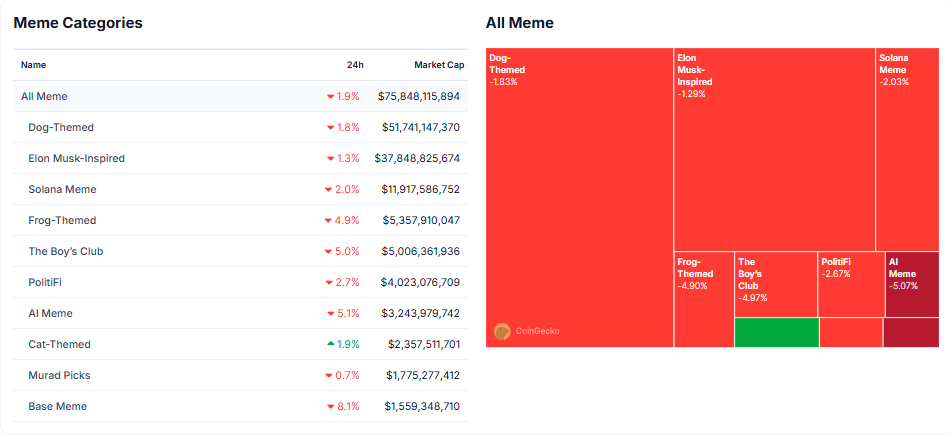

Meme Coins Lose Ground as Investors Seek Fundamentals

Amid investors’ shifting focus, the meme coin market cap is declining, with attention shifting towards projects with technical value. Previously, the speculative fervor around meme coins would drive short-term rallies. Now, their lack of fundamental innovation has resulted in diminishing investor confidence.

Crypto executive Tarun Gupta acknowledges the cultural shift. He cites real growth and innovation in protocols like Fluid, Balancer V3, Uniswap, and Ondo Finance.

This maturation of the crypto market indicates that investors are beginning to prioritize real-world applications and financial sustainability over short-term speculative trading. It aligns with recent insights from Glassnode, suggesting that this shift is not accidental but rather a reflection of a more sophisticated investor base.

Retail holders today exhibit a greater understanding of blockchain technology and market changes than in previous market cycles. Rather than chasing meme coins for quick profits, investors are conducting in-depth research on emerging protocols. They also engage with projects through governance and community-building initiatives.

Moreover, industry observers like Ignas highlight that projects rewarding community engagement—such as MegaETH and Berachain—are gaining traction. On the other hand, meme coin traders are often excluded from such incentives.

“Is it just me? We have always learned a few lessons on how to reward the community: Both Bera and MegaETH rewarded value-adding community members. It pays to support projects at an early stage via testnet or simply yapping on X. Notice how Meme coin traders didn’t make it into the whitelist/airdrop for either? I also feel that those who burnt badly with altcoins are either already sold what’s left to stablecoins or consolidating in coins they truly believe in,” Ignas added.

Despite these positive developments, the shift toward technically novel altcoins does not guarantee sustained market stability. While many investors are moving toward high-tech projects, the crypto market remains volatile and sentiment-driven. The market could pivot back to meme coin speculation at any moment, particularly if broader macroeconomic conditions turn unfavorable.

Additionally, while DeFi and RWA tokenization are gaining traction, challenges remain regarding regulation, security, and scalability. Investors must conduct their research.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoWill It Boost SUI Price?

-

Bitcoin20 hours ago

Bitcoin20 hours agoUS Senate Panel Approves Crypto Advocate, Billionaire Howard Lutnick For Commerce Secretary

-

Altcoin17 hours ago

Altcoin17 hours agoTornado Cash Developer Alexey Pertsev Set To Be Released; TORN Price Skyrockets

-

Market22 hours ago

Market22 hours agoBinance’s CZ Sparks TST Meme Coin Frenzy, Traders Reap Huge

-

Market21 hours ago

Market21 hours agoXRP Holders On The Path To Millionaire Status

-

Market20 hours ago

Market20 hours agoBybit Returns to India After Paying $1 Million Fine

-

Altcoin16 hours ago

Altcoin16 hours agoUS SEC Seeks Public Comments on Grayscale’s Litecoin ETF Proposal

-

Altcoin15 hours ago

Altcoin15 hours agoWhy Is Bitcoin, XRP, Solana & Dogecoin Price Dropping?