Market

SEC Recognizes Grayscale’s Solana and Litecoin ETF Filings

The US Securities and Exchange Commission (SEC) has officially recognized the 19b-4 filings submitted by the New York Stock Exchange (NYSE) to list and trade the Grayscale Solana and Litecoin exchange-traded fund (ETF).

On February 6, the regulatory body called for public feedback on both filings. Comments must be submitted within 21 days following their publication in the Federal Register.

First SEC Acknowledgment for Solana ETFs

The SEC’s acknowledgment marks a first for Solana (SOL) ETFs, making it a significant development.

“This is actually newsworthy because the SEC had refused to do this in recent filing attempts for SOL,” Bloomberg ETF analyst James Seyffart wrote on X.

He further suggested that this decision could indicate a positive shift for exchanges or firms facing SEC lawsuits that label Solana as a security. Fox Business journalist Eleanor Terrett echoed this sentiment, calling the move “very noteworthy.”

“The same SEC asked the CBOE to withdraw issuers’ Solana filings just a few weeks ago when Gensler was still at the helm,” Terrett explained.

Bloomberg’s senior ETF analyst Eric Balchunas also agreed. He emphasized the significance of the SEC’s recognition of a product tied to a digital asset previously labeled a “security.”

“So we are now in new territory, albeit just a baby step, but seemingly the direct result of leadership change,” Balchunas remarked.

The SEC’s move comes after the Chicago Board Options Exchange (Cboe) refiled 19b-4 applications for Solana ETFs on behalf of Bitwise, VanEck, 21Shares, and Canary Capital.

Meanwhile, Gary Gensler’s departure has triggered a surge in ETF filings. This is because many anticipate a more favorable stance toward crypto-related products.

Seyffart estimated that the final deadline for a decision on the Solana ETF application would likely be around October 11.

Grayscale Litecoin ETF Gets Initial Nod

In addition to the Solana ETF, the SEC has acknowledged the NYSE’s 19b-4 filing to list and trade shares of the Grayscale Litecoin Trust. This marks the second acknowledgment of a Litecoin (LTC) ETF.

According to Seyffart, spot Litecoin ETF could be the next to gain regulatory approval.

“Sticking to my call/view that Litecoin will be the next digital asset to be approved by the SEC for a spot ETF wrapper,” Seyffart posted.

Meanwhile, on the same day, the SEC acknowledged Nasdaq’s 19b-4 filing to allow in-kind creations and redemptions on the iShares Bitcoin Trust ETF (IBIT). Nate Geraci, president of The ETF Store, noted that while this was a step forward, it was long overdue.

“Ridiculous we’re still doing cash creates & redeems,” Geraci stated.

The SEC’s acknowledgment of the Grayscale Solana ETF and Litecoin Trust filings is a positive step forward. Nonetheless, regulatory approval is still far off. Whether the new SEC under President Trump would accelerate the approval of altcoin ETFs remains to be seen.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Attempts a Comeback: Can the Recovery Hold?

Bitcoin price is consolidating above the $95,500 support zone. BTC is showing a few positive signs and might attempt a recovery if it clears $100,000.

- Bitcoin started a fresh decline below the $100,000 level.

- The price is trading below $99,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $100,000 zone.

Bitcoin Price Holds Support

Bitcoin price failed to continue higher above the $102,500 zone. It started another decline below the $99,000 zone. BTC gained bearish momentum for a move below the $98,500 and $96,500 levels.

A low was formed at $95,700 and the price recently started a consolidation phase. There was a minor increase above the $97,000 level. The price surpassed the 23.6% Fib retracement level of the downward move from the $102,500 swing high to the $95,700 low.

Bitcoin price is now trading below $98,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $98,000 level. There is also a connecting bearish trend line forming with resistance at $98,000 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $99,100 level or the 50% Fib retracement level of the downward move from the $102,500 swing high to the $95,700 low. The next key resistance could be $100,000. A close above the $100,000 resistance might send the price further higher.

In the stated case, the price could rise and test the $101,200 resistance level. Any more gains might send the price toward the $102,500 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $98,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $96,200 level. The first major support is near the $95,500 level.

The next support is now near the $93,200 zone. Any more losses might send the price toward the $92,200 support in the near term. The main support sits at $90,900.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $96,200, followed by $95,500.

Major Resistance Levels – $98,000 and $100,000.

Market

Meme Coins to Altcoins with Real-World Value

Crypto analysts have observed a significant shift in investor sentiment over the past several weeks, suggesting a more knowledgeable investor base, even among the retail holders.

Previously dominated by speculative meme coins, the market is now increasingly focused on high-tech altcoin projects with real-world utility and novel blockchain solutions.

Investor Interest Shifts to RWA and DeFi

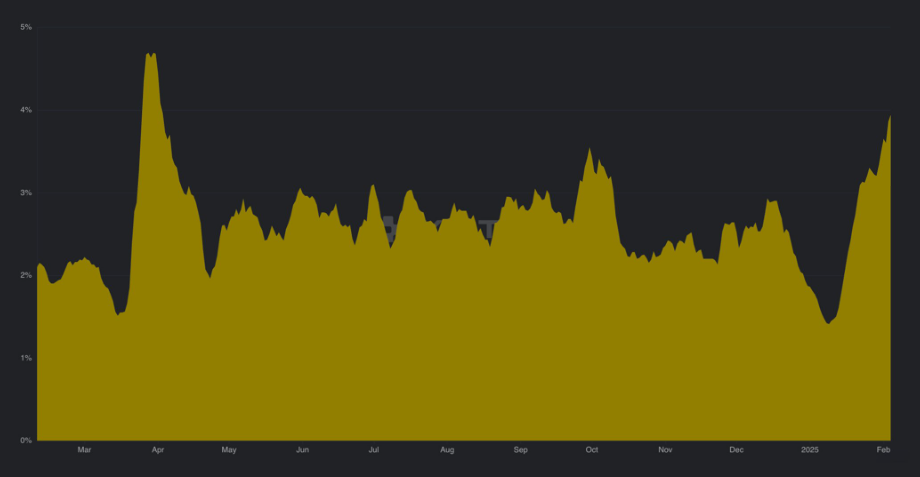

Web3 information platform Kaito AI and insights from crypto analysts suggest that investor mindshare is increasingly shifting toward Real-World Assets (RWAs), decentralized finance (DeFi), and advanced blockchain protocols.

According to Kaito AI, RWA mindshare has surged after reaching a 12-month low in January. This resurgence signals renewed interest in tokenizing real-world financial assets, which has attracted institutional players.

Similarly, DeFi has regained prominence, overtaking AI tokens in market interest. The resurgence of DeFi suggests a shift towards more sustainable financial mechanisms, in contrast to the speculative nature of meme coins.

Several blockchain projects have emerged as major beneficiaries of this sentiment shift. Berachain (BERA) and MegaETH (WETH) have gained traction. Kaito AI’s analysis highlights these as top mindshare gainers.

However, for Berachain, social dominance or consumer awareness is likely ascribed to its recent airdrop and the subsequent listing on Binance and Bitrue. In a statement shared with BeInCrypto, Bitrue committed to supporting the developers on Berachain, a blockchain that introduces a unique Proof-of-Liquidity (PoL) consensus mechanism, believed to be superior to Proof-of-Stake (PoS).

“To celebrate this milestone, Bitrue is rolling out two special events for the exchange’s users. First, Power Piggy Listing: BERA will be available in Power Piggy, Bitrue’s flexible investment product, at 10% APR starting February 6th at 14:00 UTC. Secondly, Deposit Contest: Users who deposit BERA on Bitrue can win rewards based on their deposit amounts,” Bitrue told BeInCrypto.

However, despite the excitement, Berachain’s token price has seen downward pressure due to post-airdrop selling, demonstrating that speculative dynamics are still at play.

Beyond Berachain, MegaETH, Initia, and Monad have captured the market’s attention. These projects focus on technical advancements in scalability, DeFi, and blockchain efficiency. DeFi expert Ignas said this renewed enthusiasm mirrors the early 2020/21 cycle. Then, projects with substantial technical innovation garnered significant hype.

“Technically innovative launches are getting hype again…It’s not just your Degen monkey brain blindly aping into meme coins or simping for a new Celeb Coin – your analytical & research skills can be put to action again,” Ignas wrote.

Investors are now diving deeper into protocol mechanisms, farming strategies, and long-term sustainability rather than unquestioningly speculating on short-lived trends.

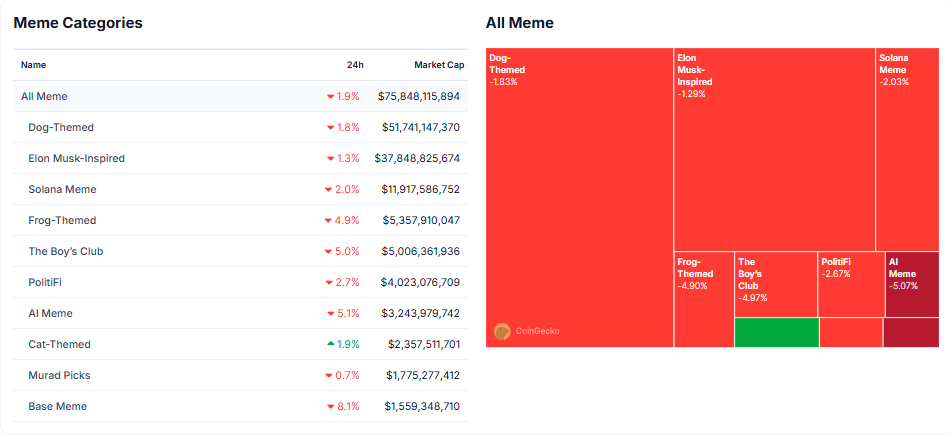

Meme Coins Lose Ground as Investors Seek Fundamentals

Amid investors’ shifting focus, the meme coin market cap is declining, with attention shifting towards projects with technical value. Previously, the speculative fervor around meme coins would drive short-term rallies. Now, their lack of fundamental innovation has resulted in diminishing investor confidence.

Crypto executive Tarun Gupta acknowledges the cultural shift. He cites real growth and innovation in protocols like Fluid, Balancer V3, Uniswap, and Ondo Finance.

This maturation of the crypto market indicates that investors are beginning to prioritize real-world applications and financial sustainability over short-term speculative trading. It aligns with recent insights from Glassnode, suggesting that this shift is not accidental but rather a reflection of a more sophisticated investor base.

Retail holders today exhibit a greater understanding of blockchain technology and market changes than in previous market cycles. Rather than chasing meme coins for quick profits, investors are conducting in-depth research on emerging protocols. They also engage with projects through governance and community-building initiatives.

Moreover, industry observers like Ignas highlight that projects rewarding community engagement—such as MegaETH and Berachain—are gaining traction. On the other hand, meme coin traders are often excluded from such incentives.

“Is it just me? We have always learned a few lessons on how to reward the community: Both Bera and MegaETH rewarded value-adding community members. It pays to support projects at an early stage via testnet or simply yapping on X. Notice how Meme coin traders didn’t make it into the whitelist/airdrop for either? I also feel that those who burnt badly with altcoins are either already sold what’s left to stablecoins or consolidating in coins they truly believe in,” Ignas added.

Despite these positive developments, the shift toward technically novel altcoins does not guarantee sustained market stability. While many investors are moving toward high-tech projects, the crypto market remains volatile and sentiment-driven. The market could pivot back to meme coin speculation at any moment, particularly if broader macroeconomic conditions turn unfavorable.

Additionally, while DeFi and RWA tokenization are gaining traction, challenges remain regarding regulation, security, and scalability. Investors must conduct their research.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Eyes 40% Gains, Analyst Reveals The ‘Best Level’ To Buy And Hold

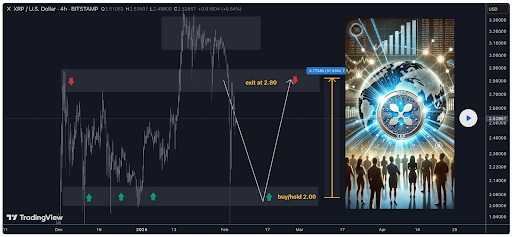

Crypto analyst ProjectSyndicate has made a bullish case for the XRP price, which he predicts could record 40% gains soon enough. The analyst also revealed the price level, which he believes is ideal for market participants to buy and hold XRP.

XRP Price Eyes 40% Gains As Analyst Reveals Key Level

In a TradingView post, ProjectSyndicate predicted that the XRP price could witness a 40% move to the upside soon enough. This came following his analysis of XRP’s 4-hour chart. He noted that the outlook remains bullish despite the current pullback in progress. The analyst added that buying low is still a perfect trade setup with low risk.

Related Reading

Project Syndicate remarked that the price is currently in correction mode after the retest of the all-time high. He added that there is limited upside at the current market price of $2.50. In line with this, he asserted that the pullback isn’t complete and predicted that XRP could still drop to as low as $2 before it records the 40% gains that he predicted.

Based on his strategy of buying low, he recommended that market participants should look to buy and hold the crypto when its price drops to $2. He also advised that they should take profit when XRP records the 40% gains as it rebounds to $2.80.

The XRP price has suffered one of the worst pullbacks among the major caps amid the current bearish sentiment in the crypto market. As a result, XRP has also lost its spot as the third-largest crypto by market cap, dropping to number four behind USDT.

However, amid this pullback, crypto analyst ColdBloodedCharter has also stated that now is a great opportunity to accumulate XRP. He highlighted $2.50, between $2.25 and $2.30, and between $1.90 and $2 as buy-the-dip levels that “make sense.”

This Pullback Could Be The Final Low Before Liftoff

In an X post, crypto analyst CasiTrades raised the possibility of this pullback being the final low before a price liftoff. She asserted that there has been no change to the overall bullish setup on XRP, although the crypto is now targetting Wave 3 down extensions at $2.16, $1.87, and $1.57 for the next major support.

Related Reading

The crypto analyst opined that the XRP price is in the fifth wave of C within an ABC pattern for a large Wave 2. She added that the sell-off massively extended the asset past C targets, but the pattern still needs to be completed. With this development, CasiTrades stated that this means that XRP could be at the final low before a massive Wave 3 up begins. She added that this would send the altcoin past previous all-time highs (ATHs) with minimal resistance.

At the time of writing, the XRP price is trading at around $2.45, down almost 3% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Medium, chart from Tradingview.com

-

Altcoin23 hours ago

Altcoin23 hours agoWhat It Means for the Crypto Market?

-

Altcoin19 hours ago

Altcoin19 hours agoWill It Boost SUI Price?

-

Bitcoin19 hours ago

Bitcoin19 hours agoUS Senate Panel Approves Crypto Advocate, Billionaire Howard Lutnick For Commerce Secretary

-

Altcoin16 hours ago

Altcoin16 hours agoTornado Cash Developer Alexey Pertsev Set To Be Released; TORN Price Skyrockets

-

Market21 hours ago

Market21 hours agoBinance’s CZ Sparks TST Meme Coin Frenzy, Traders Reap Huge

-

Market20 hours ago

Market20 hours agoXRP Holders On The Path To Millionaire Status

-

Market19 hours ago

Market19 hours agoBybit Returns to India After Paying $1 Million Fine

-

Altcoin15 hours ago

Altcoin15 hours agoUS SEC Seeks Public Comments on Grayscale’s Litecoin ETF Proposal