Market

Ethereum Price Stuck in Slow Gear: Will a Breakout Come Soon?

Ethereum price started a recovery wave above the $2,650 zone. ETH is now struggling to clear the $2,880 and $2,920 resistance levels.

- Ethereum started a decent upward move above the $2,620 zone.

- The price is trading below $2,750 and the 100-hourly Simple Moving Average.

- There was a break below a key bullish trend line with support at $2,800 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh decline if it stays below the $2,800 level.

Ethereum Price Recovery Could Soon Fade

Ethereum price started a recovery wave above the $2,550 level, like Bitcoin. ETH was able to surpass the $2,600 and $2,620 resistance levels to move into a short-term positive zone.

The price was able to surpass the 50% Fib retracement level of the downward wave from the $3,400 swing high to the $2,120 swing low. However, the bears seem to be active below the $2,880 and $2,920 resistance levels. The price is again moving lower.

There was a break below a key bullish trend line with support at $2,800 on the hourly chart of ETH/USD. Ethereum price is now trading below $2,800 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $2,770 level and the 100-hourly Simple Moving Average. The first major resistance is near the $2,800 level. The main resistance is now forming near $2,920 or the 61.8% Fib retracement level of the downward wave from the $3,400 swing high to the $2,120 swing low. A clear move above the $2,920 resistance might send the price toward the $3,000 resistance.

An upside break above the $3,000 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,050 resistance zone or even $3,120 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $2,800 resistance, it could start another decline. Initial support on the downside is near the $2,630 level. The first major support sits near the $2,600 zone.

A clear move below the $2,600 support might push the price toward the $2,500 support. Any more losses might send the price toward the $2,420 support level in the near term. The next key support sits at $2,350.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $2,630

Major Resistance Level – $2,800

Market

DOGE Spot Outflows Exceed $120 Million in April

Dogecoin holders have been withdrawing their funds from spot markets in April, with the leading meme coin facing mounting selling pressure.

The lack of new capital flowing into DOGE reflects a decline in investor confidence and adds downward pressure on the altcoin.

Sell-Off Worsens for DOGE as Outflows Outpace Inflows

Since the beginning of April, DOGE has seen a consistent stream of net outflows from its spot market, totaling over $120 million. Net inflows during the same period have been negligible, amounting to less than $5 million per Coinglass.

When an asset records spot outflows, more of its coins or tokens are being sold or withdrawn from the spot market than are being bought or deposited.

This indicates that DOGE investors are losing confidence and opting to liquidate their holdings due to increasingly bearish market conditions.

The persistent outflows from the meme coin over the past two weeks reflect the lack of new demand for the altcoin. If this trend continues, DOGE’s price could remain range-bound or face another decline cycle.

On the technical front, DOGE’s Relative Strength Index (RSI) has continued to trend downward on the daily chart, further confirming the bearish outlook.

At press time, this key momentum indicator, which measures an asset’s oversold and overbought market conditions, is below the 50-neutral line at 47.61.

When an asset’s RSI falls below the center line, bearish momentum strengthens. This suggests that DOGE selling pressure is beginning to outweigh buying interest, signaling a potential dip in the asset’s price.

DOGE Risks Retesting Yearly Lows

With the crypto market’s volatility heightened by Donald Trump’s ongoing trade wars and DOGE’s current struggles to attract fresh investment, the meme coin may test new lows in the near term. If selling pressure strengthens, DOGE could revisit its year-to-date low of $0.12.

Conversely, a resurgence in new demand for the meme coin will invalidate this bearish outlook. In that scenario, DOGE’s price could break above $0.17 and climb to $0.20.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PI Coin Recovers 80% From All-time Low — Will It Retake $1?

PI has staged a remarkable comeback after plunging to an all-time low of $0.40 on April 5. Amid a broader market recovery over the past week, the altcoin has seen a resurgence in demand, driving its price up 84% from its recent bottom.

With the bulls attempting to strengthen market control, PI could extend its gains in the short term.

PI Recovers From Crash With Strong Bullish Setup

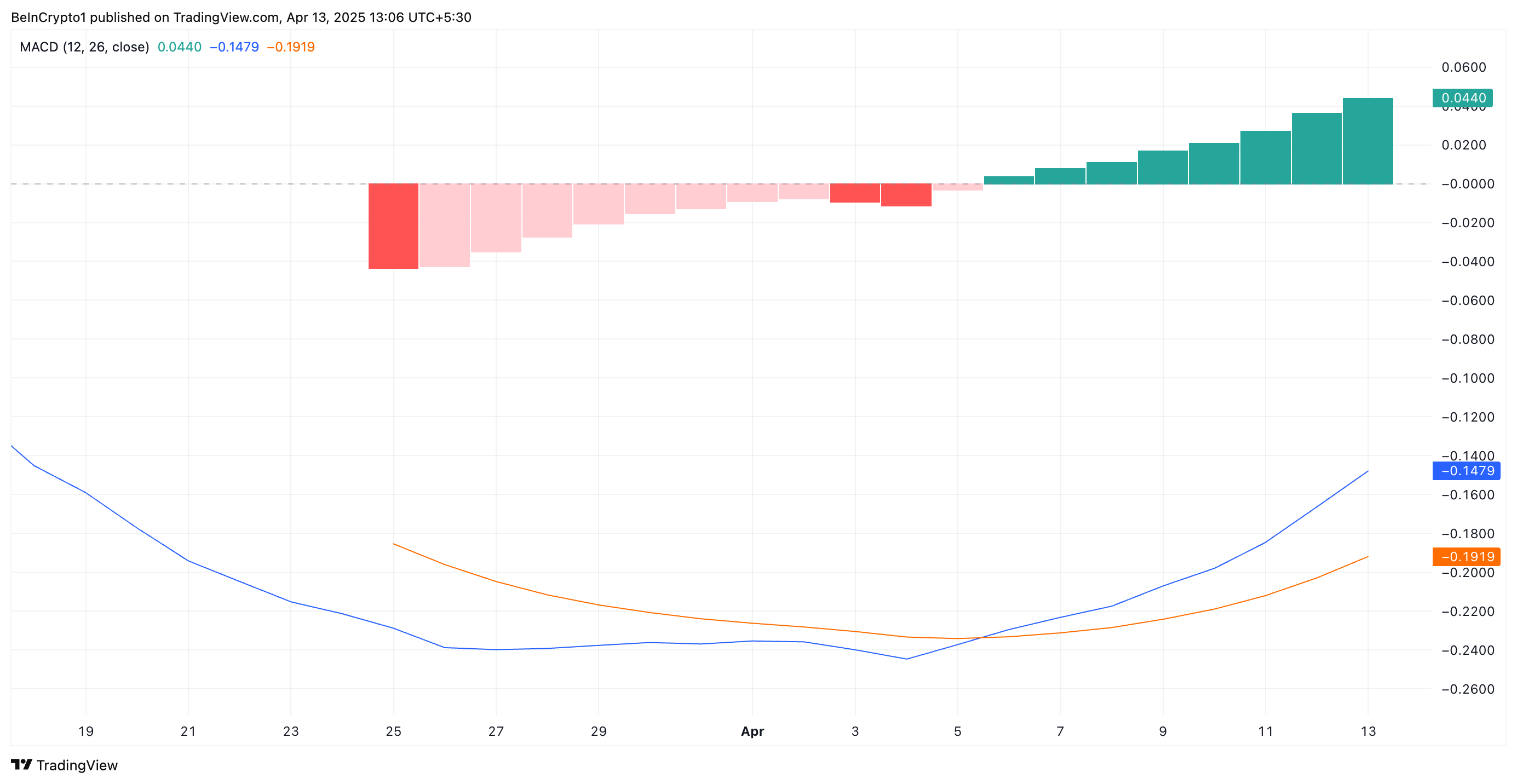

PI’s Moving Average Convergence Divergence (MACD) indicator has flashed a bullish signal. On the daily chart, the MACD line (blue) crossed above the signal line (orange) on April 5, indicating a positive shift in momentum right after it bottomed at $0.40.

Additionally, the histogram bars, which reflect the strength of that momentum, have gradually increased in size over the past few days, highlighting the growing demand for the altcoin.

When an asset’s MACD is set up this way, upward momentum is building, and buyers are gaining control. PI’s MACD crossover is a bullish signal, suggesting the potential for continued price gains as buying pressure increases.

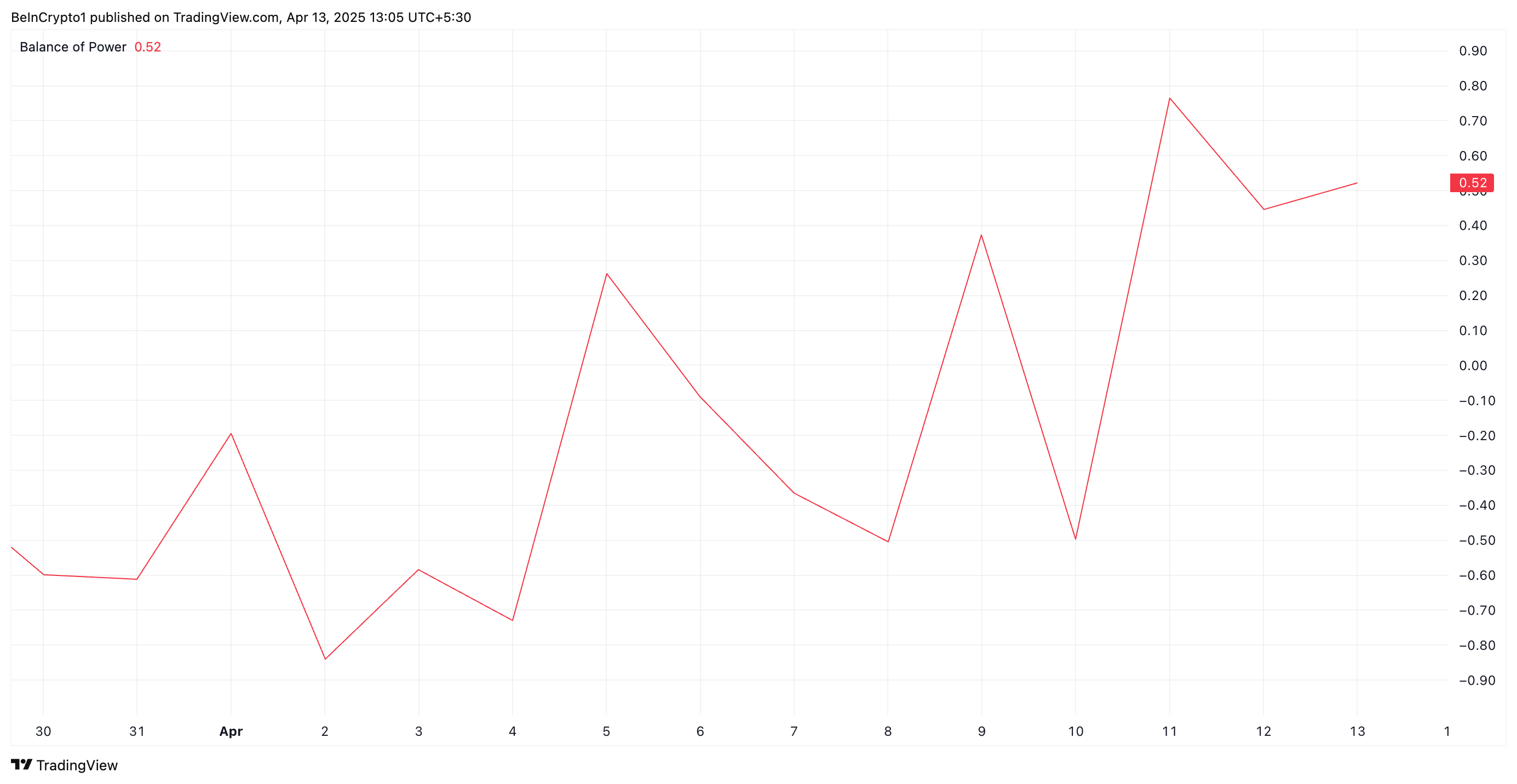

In addition, PI’s positive Balance of Power (BoP) reflects the growing demand for the altcoin. As of this writing, the indicator is at 0.52.

The BoP indicator measures the strength of buyers versus sellers in the market, helping to identify momentum shifts. When its value is positive, buyers are dominating the market over sellers and driving newer price gains.

Is $1 Within Reach?

PI’s ongoing rally has caused its price to trend within an ascending parallel channel. This bullish pattern is formed when an asset’s price consistently moves between two upward-sloping, parallel trendlines.

It signals a sustained uptrend, with PI buyers gradually gaining control while allowing short-term pullbacks. If the rally continues, PI could exchange hands at $0.95.

However, if the altcoin reverses its current trend and sheds recent gains, its value could fall to $0.40.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Golden Cross Creates Bullish Momentum: Is $2.50 Next?

Since plunging to its year-to-date low of $1.61 on April 7, XRP holders have taken full advantage of the dip, ramping up accumulation efforts. This buying pressure has steadily increased the asset’s value over the past week.

At press time, XRP trades at a seven-day high of $2.19 and technical indicators show that it’s positioned to extend the gains.

XRP Golden Cross Drives Bullish Momentum

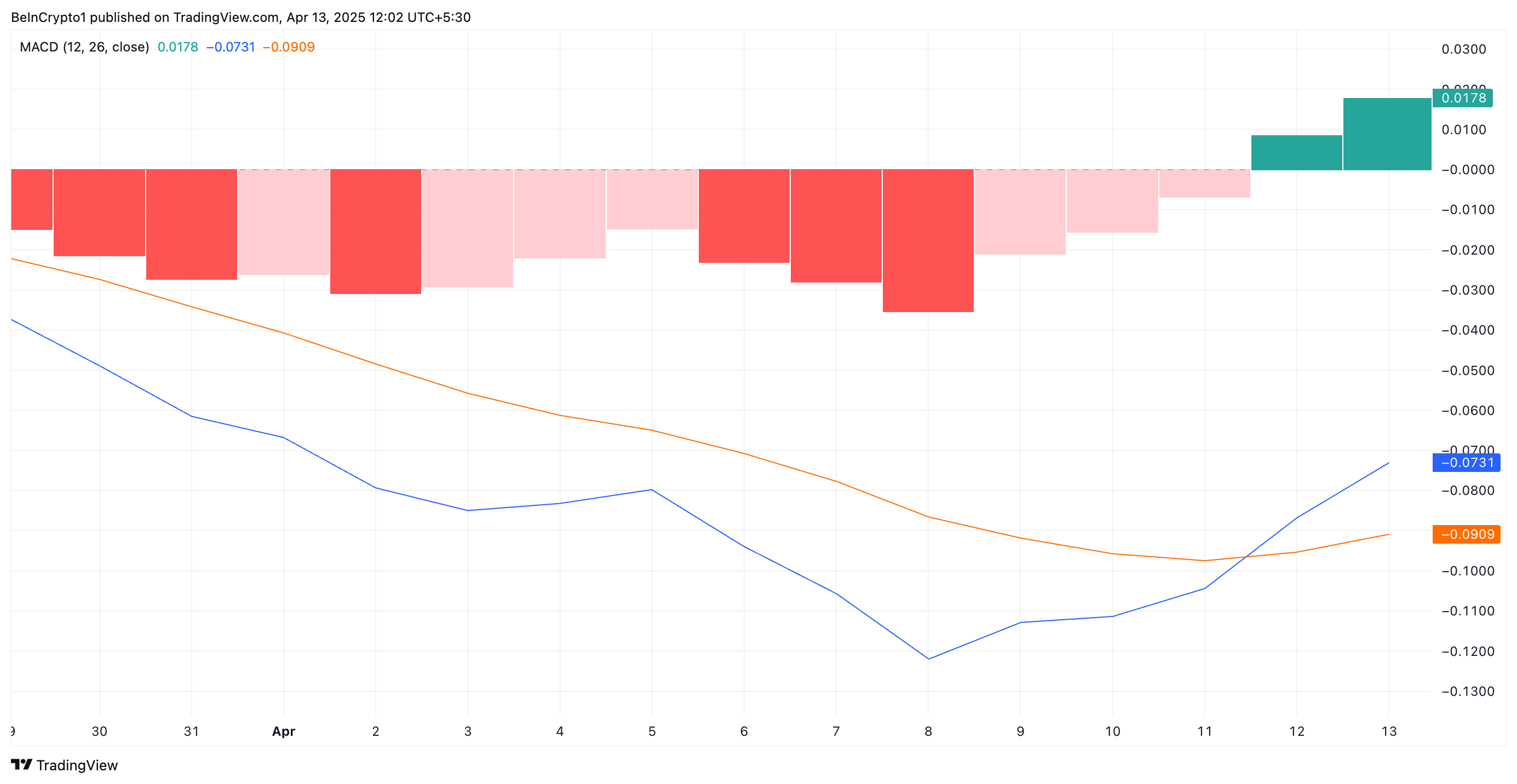

On the daily chart, a golden cross has formed on XRP’s Moving Average Convergence Divergence (MACD) indicator, which is often viewed as a key signal of a shift toward long-term upside.

The MACD indicator measures an asset’s price trends and momentum, and identifies reversal points. It forms a golden cross when its MACD line (blue) crosses above its signal line (orange).

When a golden cross emerges like this, it signals a positive shift in investor sentiment. Traders interpret it as a cue that buying pressure outpaces selling activity, which can attract even more inflows and drive the price higher.

For XRP, this golden cross occurred on April 11, reinforcing the growing bullish sentiment surrounding the asset. This pattern confirms that the altcoin’s recent price rebound is not just a short-lived reaction but may mark the beginning of a more sustained uptrend.

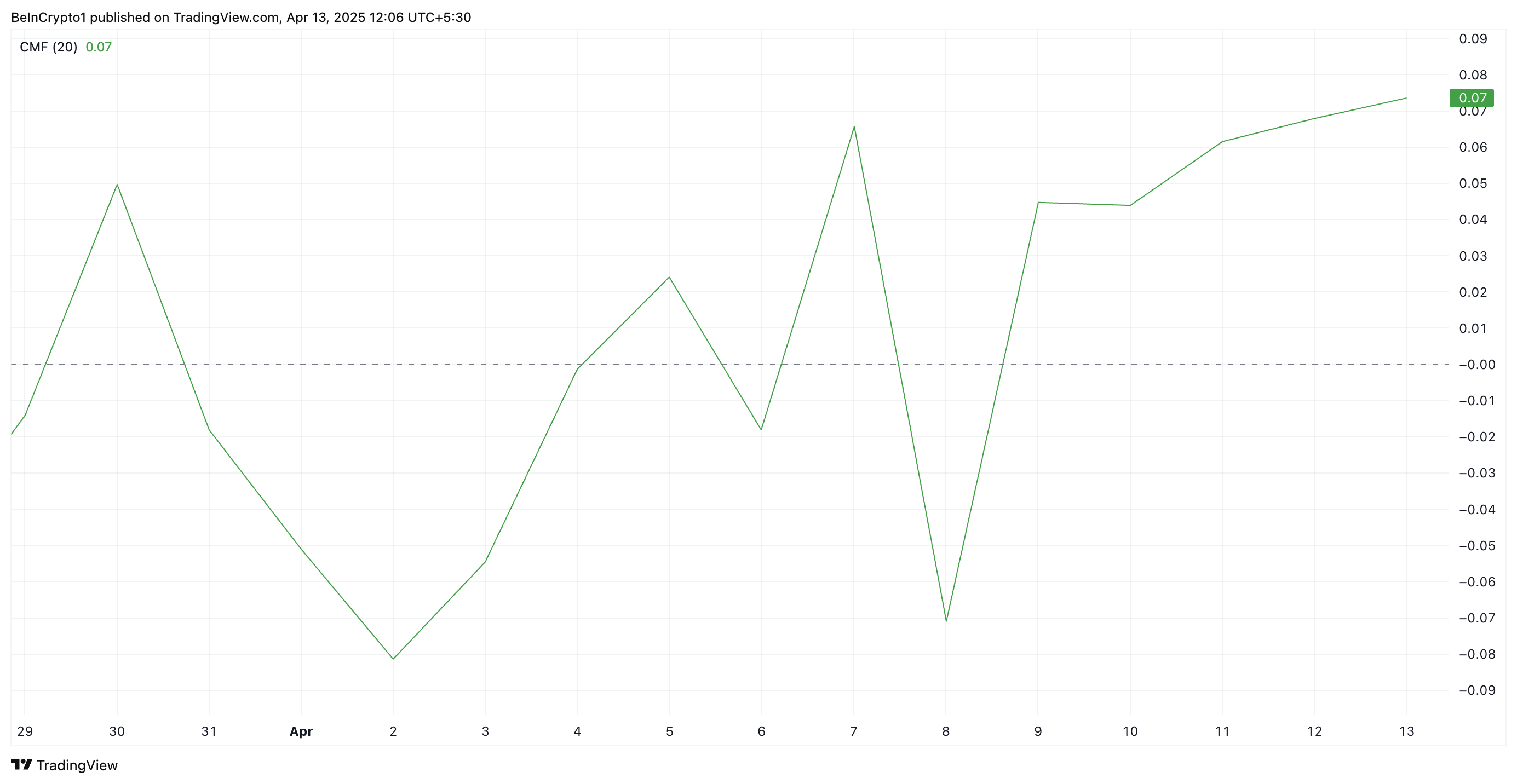

Further, the token’s positive Chaikin Money Flow (CMF) supports this bullish outlook. At press time, it rests above the center line and in an uptrend at 0.07.

The CMF indicator measures how money flows into and out of an asset. A positive CMF reading, as with XRP, means buying pressure is stronger than selling pressure over a given period. It suggests capital is flowing into the token, signaling accumulation and potential price growth.

XRP Maintains Uptrend—Next Stop: $2.50 or Back to $1.99?

Since its rally began on April 7, XRP has traded above an ascending trend line. This bullish pattern emerges when an asset forms higher lows over time, creating an upward-sloping support line.

It signals sustained buying interest in XRP and suggests that momentum is building in favor of the bulls as the token’s price continues to climb.

If demand soars, XRP could extend its gains and climb to $2.29. A successful flip of this resistance into a support floor could propel XRP to $2.50.

However, if profit-taking resumes and selling pressure rises, XRP could reverse its uptrend and fall to $1.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoEthereum ETFs See Seventh Consecutive Week of Net Outflows

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin’s Impact Alarming, Says NY Atty. General—Congress Needs To Act

-

Market21 hours ago

Market21 hours agoRipple May Settle SEC’s $50 Million Fine Using XRP

-

Market23 hours ago

Market23 hours agoSEC Signals Readiness to Rethink Crypto Trading Oversight

-

Altcoin20 hours ago

Altcoin20 hours agoBankless Cofounder David Hoffman Reveals Strategy To Improve Ethereum Price Performance

-

Market20 hours ago

Market20 hours agoSolana Bulls Lead 17% Recovery, Targeting $138

-

Market17 hours ago

Market17 hours agoXRP Price To Hit $45? Here’s What Happens If It Mimics 2017 And 2021 Rallies

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum (ETH) Consolidates Within Tight Range As Key Support Level Forms