Altcoin

Is An Altcoin Season Around The Corner? Here’s What Historical Data Shows

The much-anticipated altcoin season, during which huge capital flows from Bitcoin toward alts continue to fail to manifest, as major tokens like Ethereum struggle to initiate a significant rally. With top altcoins facing a pullback, the possibility of an altseason remains low.

Altcoin Season Unfolding Out Of The Blue

Heightened volatility in the general crypto market has triggered uncertainty and disbelief about an altcoin season happening in the ongoing bull cycle. Technical expert and investor Titan of Crypto has shed light on the much-awaited season, highlighting the possibility that one could unfold in the short term.

His forecast is based on historic cycle trends, particularly after the Bitcoin Halving event. Using past cycle trends, the expert believes that the market is showing early signs of a potential altseason.

Looking at the chart, an altcoin season tends to begin at least 200 days following the Halving event as seen in the 2017 and 2021 cycles. Meanwhile, after about 273 days since the last Halving event, an altseason in this cycle seems to be on the horizon. “With consensus leaning towards no Altseason this cycle, history suggests this might be the perfect setup for one to unfold,” Titan of Crypto stated.

While Titan of Crypto anticipates an altseason in the short term, Ali Martinez, a technical and on-chain expert thinks otherwise. In fact, the on-chain expert believes that it is unlikely that there will be an altseason this cycle, citing altcoins market cap trends over the years.

According to Ali Martinz, the alt market capitalization has decreased in March for 5 out of the last 7 years. During these periods, there was either no altseason or it performed poorly.

As a result, the expert expects the alt market cap to witness a decline in March this year, which might result in the absence of an altseason this cycle. “So, if you’re 100% convinced an altseason is coming, don’t be shocked if your dreams get shattered,” he stated.

An Ideal Time To Accumulate Alts?

Presently, the key Altcoin Season Index metric has risen to its most extreme levels, which suggests an ideal time to accumulate some alts. The index in the daily time frame shows that the market has returned to the Bitcoin season zone with a percentage change period of 60. Specifically, this indicates a critical moment for altcoins, which is increasing Bitcoin’s dominance.

Furthermore, the index in the 1-hour time frame reveals a sharp drop in alt prices in the near term, which some may consider as an opportunity to accumulate. Investors are advised to be careful as only 30-40% of altcoins are in oversold territory in their daily Relative Strength Index (RSI). This suggests that many alts, particularly the ones that have increased drastically lately, might decline further.

Although acquiring a few alts might be sensible, caution must be taken because retail traders are highly exposed to leverage. In the meantime, strategies such as intelligent stop losses and Dollar-Cost Averaging (DCA) are valid methods during this period.

Featured image from iStock, chart from Tradingview.com

Altcoin

BTC Holds $97K, Altcoins Flux, FTT Up 8%

Crypto prices today mainly continued showcasing a sluggish performance, reverberating investor uncertainty globally. Bitcoin (BTC) price faced market turbulence and stood at $97K, whereas ETH managed to trade in the green territory. Besides, XRP and Solana faced hurdles, with their intraday trading session primarily in the red zone.

However, FTX Token (FTT) emerged as the leading gainer on Thursday, defying the broader market trend. Notably, the coin rises in tandem with the FTX exchange’s Bahamas creditor reimbursement plan looming for February 18.

Here’s a brief report on some of the most trending coins’ prices on Thursday.

Crypto Prices Today: BTC, XRP, & SOL Turbulent But ETH Rises

It’s worth noting that the global crypto market cap was down 0.71% from yesterday, reaching $3.19 trillion as of press time. Further, the total market volume also witnessed a 36.88% decline to $122.2 billion. When coupled with the intraday price movements, these stats indicate that traders and investors are currently cautious.

Bitcoin Price At $97K

BTC price witnessed a nearly 1% drop in value over the past 24 hours, reaching $97,409. The flagship coin’s intraday low and high were $96,174.83 and $99,113.21, respectively. Bitcoin futures OI slipped marginally by 0.2% intraday and is currently at $58.92 billion. Besides, BTC recorded liquidations worth $35.79 million in the past 24 hours, per Coinglass data.

Despite the waning movement, the coin’s long-term prospects glimmer with optimism as institutional interest in the asset continues to rise. MicroStrategy recently rebranded itself into Strategy whilst also revealing Q4 2024 earnings. This saga garnered significant attention to BTC, as the rebranded logo contains Bitcoin’s symbol. Also, the firm grew substantially in Q4 2024, completing $20 billion of its $42 billion capital plan in the wake of Bitcoin adoption.

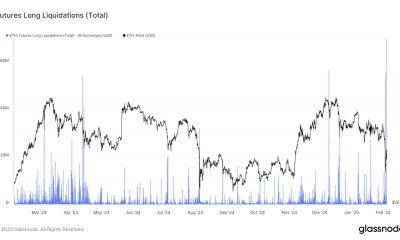

Ethereum Price Jumps 3% Defying Broader Crypto Market Trend

Meanwhile, ETH price witnessed an uptick of 3% in the past 24 hours and is currently trading at $2,808. The coin’s intraday low and high were $2,710.52 and $2,824.40, respectively. Ethereum rises despite $39.76 million worth of liquidations witnessed in the past 24 hours. CoinGape reported that ETH OI spiked notably, with the latest Coinglass data indicating a jump of nearly 4% in the futures OI over the past 24 hours, reaching $24.44 billion.

XRP Price Slips 3%

XRP price lost 3% of its value over the past day and is currently sitting at $2.42. The coin’s 24-hour low and high were $2.36 and $2.57, respectively. Notably, the Ripple Labs-backed asset’s futures OI slipped by nearly 1.5% and is at $3.62 billion.

Solana Price Follows

SOL price also tanked by 3% intraday, reaching $200. The crypto’s 24-hour bottom and peak were $195.39 and $207.59, respectively. The coin currently mirrors the broader cryptocurrency market trend, showcasing volatility.

Meme Crypto Prices Today

Dogecoin (DOGE) price fell by nearly 2% in the past 24 hours and is trading at $0.26. Shiba Inu (SHIB) price followed, waning 0.5% to $0.00001586. However, it’s worth mentioning that the TRUMP coin defied the trend and jumped nearly 5% to reach $18.57.

Top Crypto Gainer Prices Today

FTX Token (FTT)

Price: $2.13

24-Hour Gains: +8%

Monero (XMR)

Price: $232.91

24-Hour Gains: +4%

Ethereum Name Service (ENS)

Price: $27.71

24-Hour Gains: +4%

Top Crypto Loser Prices Today

Pudgy Penguins (PENGU)

Price: $0.01178

24-Hour Loss: -13%

Raydium (RAY)

Price: $5.48

24-Hour Loss: -9%

Ethena (ENA)

Price: $0.5438

24-Hour Loss: -8%

Simultaneously, in light of the current turbulent performance, renowned crypto market analyst Ali Martinez revealed that the signs of the Altcoins season commencing haven’t prevailed in the market yet. According to him, “Capital continues to flow out of BTC & ETH into stablecoins,” negtively impacting market dynamics.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Altcoin Season Paused Forever? What The Rising Bitcoin Dominance Says Will Happen

Bitcoin’s dominance over the entire market has continued to increase steadily over the past few weeks, even as many Bitcoin and many other cryptocurrencies started the week on a negative note. According to data from CoinMarketCap, Bitcoin’s dominance is now at 60.4%, its highest level since the 2021 bull market.

This increasing Bitcoin dominance has intensified talks as to whether an altcoin season is imminent or indefinitely paused. According to popular crypto analyst Benjamin Cowen, Bitcoin’s dominance might continue for now until the current trend of new meme coin launches comes to an end.

Bitcoin Dominance Signals A Long-Term Shift

According to crypto analyst Benjamin Cowen, the reality is that altcoins have been steadily losing value against Bitcoin since 2021, despite occasional short-lived rallies. His perspective, based on the OTHERS/BTC chart, suggests that investors anticipating an explosive altcoin resurgence may need to wait longer.

Bitcoin’s increasing dominance over the broader cryptocurrency market has raised questions about when the Bitcoin gains will eventually roll over into the alt market like in the previous bull cycles. Cowen highlights that the OTHERS/BTC ratio, which measures the market capitalization of all cryptocurrencies outside the top ten against Bitcoin, has been in a continuous downtrend for nearly three years.

As of now, the OTHERS/BTC ratio is at a new low this week since the 2021 bull market. This downfall reinforces the idea that alts have consistently lost ground relative to Bitcoin despite temporary spikes from time to time among a few altcoins.

Interestingly, Cowen noted this trend of temporary spikes among a few altcoins as one of the reasons why Bitcoin’s dominance is on the rise. A significant portion of the altcoin market is constantly pushed by hype cycles, with new meme coins showing up to briefly outperform Bitcoin before eventually collapsing. Cowen believes that many investors misinterpret these short-lived pumps as signs of an altcoin resurgence but ignore the broader trend of capital flowing back into Bitcoin.

Will Altcoins Recover? The Key Market Indicators To Watch

The steady decline of OTHERS/BTC shows how capital is consistently flowing away from altcoins, reinforcing Bitcoin’s strength as the dominant crypto, especially among institutional investors. However, many alt advocates continue to anticipate a resurgence.

On the other hand, Cowen noted quantitative tightening (QT) as the key historical factor that determines when the altcoin season will eventually roll into action. During the previous bull market, the end of quantitative tightening marked a turning point for alts, allowing them to regain momentum against Bitcoin. However, since QT remains in effect, he argues that the conditions necessary for an altcoin comeback have not yet materialized. As such, the alt season may be paused indefinitely.

At the time of writing, Bitcoin is trading at $97,900.

Featured image from iStock, chart from Tradingview.com

Altcoin

Will HBAR Price Skyrocket To $0.9?

Hedera Hashgraph’s Hedera (HBAR) token is currently facing downward pressure as the global crypto market is in turmoil. However, the HBAR price is poised for a notable upsurge, primarily driven by the platform’s major developments.

HBAR Price To Reach $1.9: Analyst Insights

Crypto enthusiast Merlijn The Trader shared an X post, predicting the HBAR price’s potential upswing. Positing that a higher move is imminent, the trader wrote, “HBAR is ready for liftoff.” According to his analysis, the HBAR price will reach a high of $0.3 in the near future.

Notably, Merlijn The Trader’s analysis highlighted HBAR’s robust retest of a crucial resistance level, maintaining its parabolic structure and gaining momentum for a potential upward move.

Meanwhile, another prominent figure, Solberg Invest, provided a more ambitious forecast. According to the crypto aspirant, the HBAR price could reach even the $0.9 mark.

Is History Being Repeated?

In his X post, analyst Rekt Capital, HBAR’s Relative Strength Index (RSI) showed overbought signs, similar to those seen in 2021. Thus, HBAR’s price has pulled back to a specific area, marked as an orange circle within the graph.

In 2021, when HBAR’s price stabilized around $1.5, it sparked a significant bullish rally. The rally pushed the token to a high of around $5. With HBAR currently hovering around the same level as in 2021, the analyst predicts a potential repeat of the previous rally, driving the token’s price even higher.

Meanwhile, CryptoELITES, a well-known analyst, has set an even more bold target of $75 for HBAR. As of press time, the HBAR is trading at $0.2442, marking a dip of 3.8% in a day. Over the last week and month, the token has seen massive declines of 21.4% and 22.6%, respectively. Only time will tell if the token can reach this lofty goal.

What Drives HBAR Price Surge?

“I think for this cycle, for example, a lot of people have been talking about the dinosaur altcoins, for example, that have caught a bid,” stated David Duong, head of research at Coinbase. Duong highlighted the surprising return of “dinosaur” altcoins, including HBAR, XRP, and Solana. According to him, the recent crypto crash has resulted in the rally of these tokens. Duong stated,

I think that money is going to finally go into an XRP, into a Cardano, into an HBAR. Hedera is great. It’s a great protocol, and I think anybody who goes in, especially right now, they’ll reap the benefits of it six to eight months down the line.

Similarly, Hedera has announced its first-ever HederaCon taking place on February 25, 2025, at The Arch in Denver, Colorado. These developments have significantly contributed to the HBAR price’s journey despite the current dip.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Regulation15 hours ago

Regulation15 hours agoKraken appoints former Paxos executive as its new chief legal officer

-

Regulation16 hours ago

Regulation16 hours agoIndia’s financial regulator fines Bybit $1M, compliance status unclear

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Leverage Elevated Despite Long Squeeze, Glassnode Says

-

Market22 hours ago

Market22 hours agoCan It Break Through and Turn Bullish?

-

Altcoin22 hours ago

Altcoin22 hours agoWhy Is XRP Price Down 8% Today?

-

Market21 hours ago

Market21 hours agoCronos ETF Incoming? Crypto.com Sets 2025 Target

-

Altcoin21 hours ago

Altcoin21 hours agoChainlink Whales Dump Heavily Sparking Concerns; Is LINK At Risk

-

Market18 hours ago

Market18 hours agoA Global Benchmark for Blockchain Adoption

✓ Share: