Market

AVAX Faces Downward Trend as Whales Pull Out $272 Million

Avalanche (AVAX) price has been in a downtrend for the last two months, currently trading at $27. The altcoin has lost key support floors, which has caused whale investors to lose patience.

Despite the ongoing pressure, there may still be hope for AVAX to recover and bounce back in the near future.

Avalanche Is Under Pressure

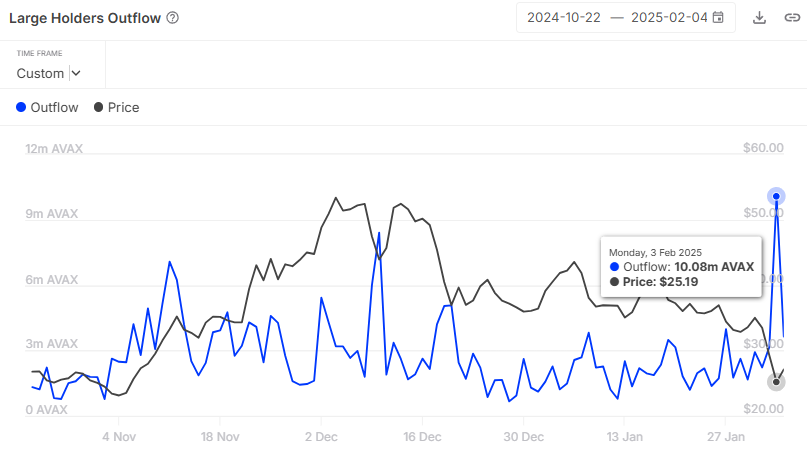

The current market sentiment for AVAX is under pressure as whale outflows reach a three-month high. As the price dropped by 23% this week, large holders have moved to sell off their holdings.

About 10.08 million AVAX over $272 million were sold in a single day 48 hours ago. This shift in investor behavior suggests a lack of confidence in a short-term recovery, with whales opting to minimize their losses rather than hold onto their positions.

This trend highlights the growing skepticism among influential investors. The whale sell-off has been a strong indicator of the bearish outlook, which is affecting AVAX’s price action. Large wallet holders are likely to focus on protecting their capital as the market remains volatile, reflecting caution among the broader investor base.

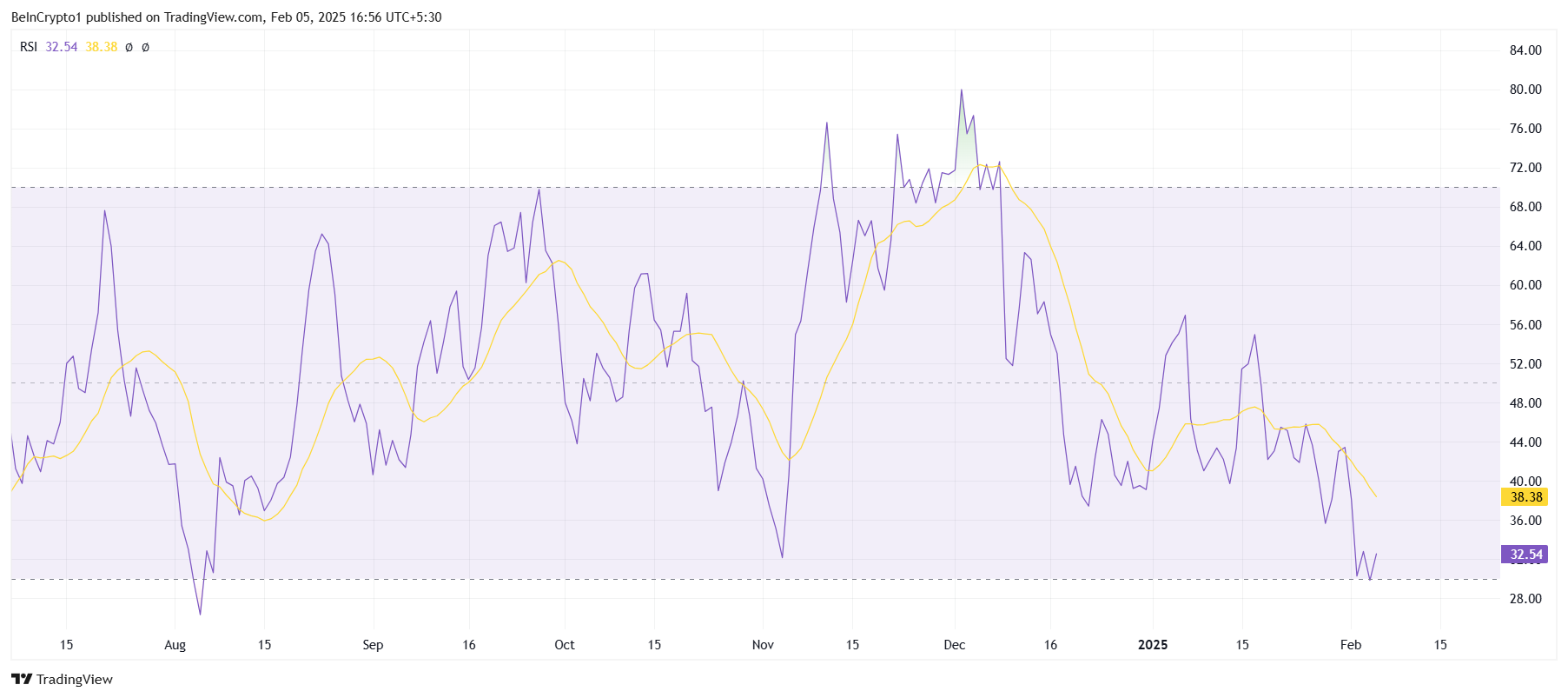

The overall momentum for AVAX is showing signs of nearing a saturation point in its bearish trend. The Relative Strength Index (RSI), a key technical indicator, is hovering dangerously close to dipping below 30.0, signaling that AVAX is inching into the oversold zone. Historically, once an asset hits the oversold region, it has often led to a price reversal as bearish momentum starts to exhaust itself.

This close proximity to the oversold zone could be an opportunity for a potential rebound. As more investors are likely to enter the market at low prices, AVAX may begin to see some support from bargain hunters, contributing to a possible recovery. However, this remains uncertain, and the market conditions will need to stabilize for a meaningful turnaround.

AVAX Price Prediction: Taking A Few Steps Back

AVAX’s price is currently sitting at $27 after losing the support level of $31 last weekend. The altcoin has struggled with a downtrend for the past two months, and a lack of buying momentum has only added to the bearish pressure. However, the current price is holding above the critical $27 support, which may present an opportunity for recovery.

While a continued drawdown is unlikely, given the saturated bearish momentum, AVAX is still at risk of falling to $22 if investor sentiment worsens and further sell-offs occur. The bearish pressure could persist in the short term, making it crucial for the altcoin to reclaim key support levels to avoid further losses.

On the other hand, reclaiming the $27 support could give AVAX a chance to recover towards $31. A break above this level would invalidate the bearish outlook, signaling that a reversal could be underway. If AVAX can breach the $31 barrier, it could recover some of its recent losses and set the stage for a more significant rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

TRUMP Price Jumps 10% as Market Cap Nears $4 Billion

TRUMP price is up roughly 10% in the last 24 hours, bringing its market cap back close to $4 billion. Despite this rebound, TRUMP has lost its third-place ranking among the largest meme coins to PEPE.

While RSI has recovered from oversold levels and price action is improving, BBTrend remains in deeply negative territory, signaling lingering bearish pressure. The meme coin now faces a critical test—if the current uptrend continues, it could reclaim key resistance levels, but rebound selling pressure could influence a move back toward lower supports.

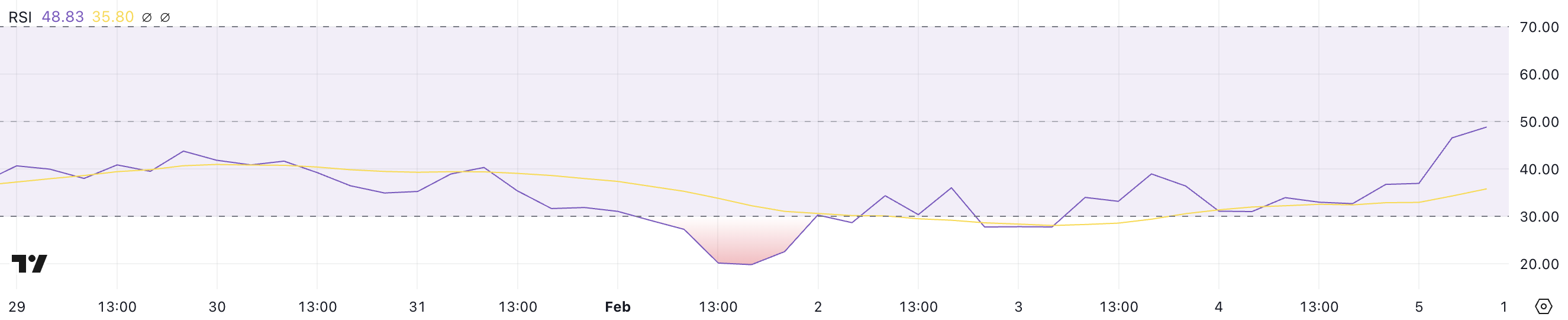

TRUMP RSI Is Recovering From Oversold Levels, But It’s Still Neutral

TRUMP Relative Strength Index (RSI) is currently at 48.5, rising from 27.8 just two days ago after hitting a low of 19.8 four days ago. This sharp recovery indicates that buying pressure has returned after TRUMP was in deeply oversold conditions.

An RSI below 30 suggests that an asset is oversold and could be due for a rebound, which aligns with the recent price action. Now at 48.5, TRUMP’s RSI is at its highest level in weeks, showing that momentum is shifting toward a more neutral stance, though it has not yet entered bullish territory.

RSI is a momentum indicator that measures the speed and magnitude of price movements on a scale from 0 to 100. Readings above 70 suggest overbought conditions and a potential pullback, while readings below 30 indicate oversold conditions and a possible recovery.

With TRUMP RSI now at 48.5, it is nearing the 50 level, which often signals a balance between buying and selling pressure. If RSI continues rising and crosses 50, it could indicate growing bullish momentum.

However, if the RSI struggles to break higher, TRUMP may remain in a consolidation phase before making its next move.

TRUMP BBTrend Is Still Very Low

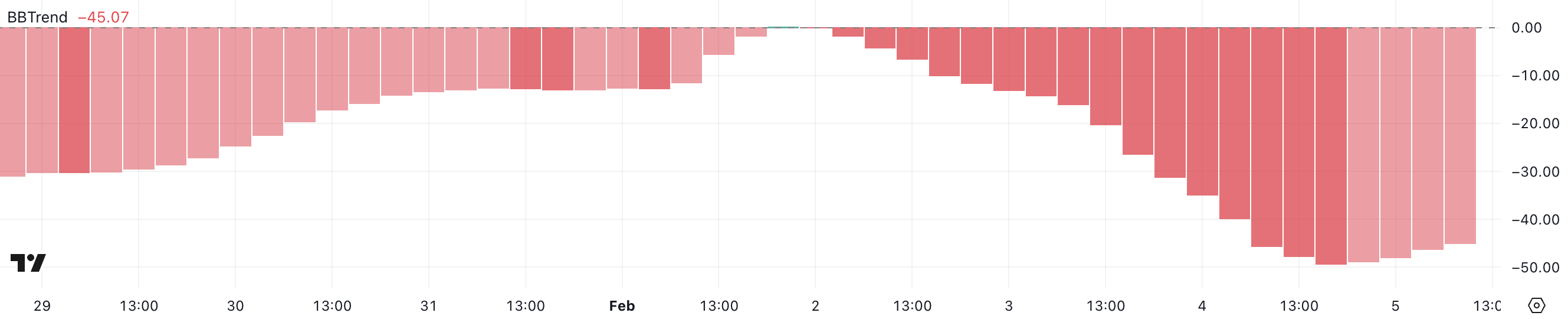

TRUMP BBTrend is currently at -45.07, marking its ninth consecutive day in negative territory. While it briefly turned positive on February 1, reaching 0.16, it quickly reversed and continued its downward trend.

Yesterday, the BBTrend was at -49.29, meaning there has been a slight improvement, but it remains deeply negative. This prolonged period of weakness suggests that TRUMP is still in a bearish phase, struggling to regain strong momentum.

BBTrend (Bollinger Band Trend) measures the strength and direction of a trend based on Bollinger Bands. A positive BBTrend indicates bullish momentum, while a negative reading signals bearish conditions.

With TRUMP’s BBTrend now at -45.07 but slightly improving from -49.29, the bearish pressure is still dominant, though selling momentum may be slowing.

If the BBTrend continues rising toward zero, it could suggest that TRUMP is stabilizing. If it remains negative, the downtrend could persist.

TRUMP Price Prediction: Can the Meme Coin Reclaim $30 In February?

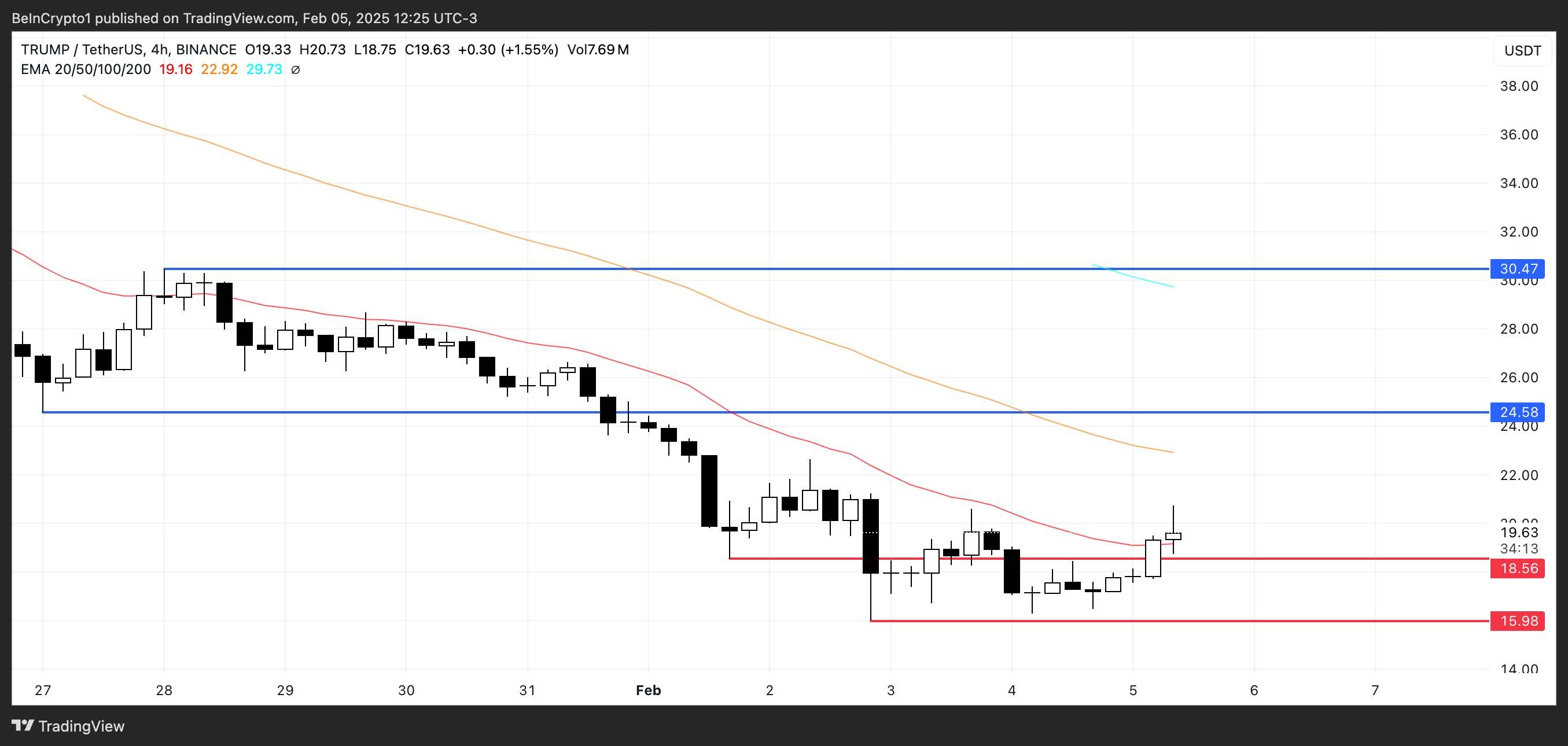

If the current uptrend holds, TRUMP price could continue its recovery and test the resistance at $24.58. A breakout above this level could push the price higher, with the next major target around $30.47.

That would possibly make TRUMP reclaim the third spot among the biggest meme coins, surpassing PEPE.

Given the recent improvement in RSI, bullish momentum is building, but TRUMP still needs to clear key resistance levels to confirm a sustained uptrend.

On the other hand, BBTrend remains negative, suggesting that recent gains could be short-lived. If bearish pressure returns, TRUMP price may test the support at $18.56, and if that level breaks, it could drop further to $15.98, marking new lows.

The market is at a critical point where a rejection at resistance could lead to a deeper correction. For the meme coin to maintain its uptrend, it needs to hold above key support levels and break through resistance with strong momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ex Malaysian PM’s Account Hacked to Promote Fake Meme Coin

Anonymous hackers took over the X account of the former Malaysian Prime Minister Mahathir Mohamad to promote a fake meme coin. Hackers are leveraging the hype around US President Donald Trump’s meme coin for wider rug pulls.

This incident is one of several meme coin scams using a political veneer. The former President of Brazil was targeted in a similar attack last month, but these hackers are probably affiliated with the infamous Russian Evil Corp.

MALAYSIA: The Latest Fake Meme Coin

Social media scams are growing in the crypto space, and it’s hard to tell how to prevent them. In a particularly egregious example, hackers used a former Malaysian prime Minister to shill a meme coin.

Mahathir Mohamad was the country’s longest-serving Prime Minister, and his social media accounts began endorsing MALAYSIA:

“Malaysia’s Official Cryptocurrency MALAYSIA is Now Live on Solana! This marks a significant milestone in showcasing the strength of our people and out nation’s presence in the digital economy. It is an honor for us to demonstrate Malaysia’s power on the global crypto network,” the fraudulent social media post claimed.

The post was removed within an hour, but the damage was done. Analysis shows that these hackers were probably related to the infamous Evil Corp, and that they managed to steal $1.7 million in this rug pull.

According to data from GeckoTreminal, the token’s market cap jumped to $1.7 million in just 15 minutes after the fake tweet and quickly collapsed. The hackers were able to liquidate this amount in less than an hour.

This MALAYSIA scam is just one component of a rising trend of fake political meme coins. Since scammers used the TRUMP token to steal $857 million, it’s been open season.

A former Brazilian President was hacked to shill one fake token, and another claimed to represent the US Treasury. Ethereum founder Vitalik Buterin officially raised the alarm about this trend.

However, these scams aren’t just limited to political topics. Crypto sleuth ZachXBT claimed that Coinbase users lost at least $150 million to scammers, and Scam Sniffer reported a 2000% increase in Telegram-based phishing attacks since November.

Ultimately, it doesn’t look like these scams are going anywhere anytime soon. Analysts have speculated that the rise of meme coins has destroyed altcoin season by redirecting capital investment and community interest to this sector.

If meme coins have this much power, fake tokens will continue receiving speculative investments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MicroStrategy Rebrands to Strategy, Reveals 74% Bitcoin Yield

Michael Saylor just announced that MicroStrategy has rebranded to Strategy. As part of the rebrand, it incorporated the Bitcoin symbol into its official logo.

The firm also released its Q4 2024 Financial Results, claiming that it spent over $20 billion on BTC acquisitions during this period. This rebrand clearly defines Strategy’s overwhelming focus on Bitcoin into the future.

Michael Saylor Reveals His Strategy

Michael Saylor first teased this rebrand on social media before announcing that the company will be known as “Strategy.” The company’s leadership is expected to discuss this rebrand at an Earnings Call on Wednesday afternoon.

“Strategy is one of the most powerful and positive words in the human language. It also represents a simplification of our company name to its most important, strategic core. After 35 years, our new brand perfectly represents our pursuit of perfection,” Saylor claimed.

Earlier this week, the firm stopped its 12-week streak of Bitcoin purchases. These BTC acquisitions had been continuing since October and were regaining momentum in January.

However, the firm was also involved in a billion-dollar tax dilemma, and Bitcoin’s price has been fluctuating. Nonetheless, Strategy’s new logo makes its Bitcoin commitment extremely clear.

According to the firm’s latest financial results, Q4 2024 was its largest-ever Bitcoin acquisition quarter, with over $20 billion worth of BTC purchased. Under the new brand ‘Strategy’, the company aims to achieve an annual BTC gain of $10 billion in 2025.

Despite a $74.3% BTC yield in 2024, MicroStrategy’s total revenue declined 3% year-over-year. This was due to a massive 693.2% increase in business expenses.

Still, the firm will maintain its focus on Bitcoin. Saylor personally bet on Bitcoin to an immense degree and has advocated for pro-crypto political reforms like a US Bitcoin Reserve.

However, the asset has seen some corrections in the past week, which had a disproportionate impact on his company’s stock price. The rebrand could help its image.

Overall, MSTR stock price has declined 11% in the past month, but it remains up by 580% in a year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation12 hours ago

Regulation12 hours agoKraken appoints former Paxos executive as its new chief legal officer

-

Regulation13 hours ago

Regulation13 hours agoIndia’s financial regulator fines Bybit $1M, compliance status unclear

-

Market18 hours ago

Market18 hours agoCronos ETF Incoming? Crypto.com Sets 2025 Target

-

Altcoin18 hours ago

Altcoin18 hours agoChainlink Whales Dump Heavily Sparking Concerns; Is LINK At Risk

-

Altcoin23 hours ago

Altcoin23 hours agoShiba Inu Whales Move 15 Trillion SHIB Amid Market Crash, Are They Preparing For A Surge?

-

Ethereum19 hours ago

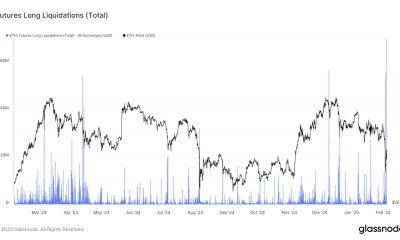

Ethereum19 hours agoEthereum Leverage Elevated Despite Long Squeeze, Glassnode Says

-

Market19 hours ago

Market19 hours agoCan It Break Through and Turn Bullish?

-

Altcoin19 hours ago

Altcoin19 hours agoWhy Is XRP Price Down 8% Today?