Market

Berachain Airdrop Details Announced Ahead of Mainnet Launch

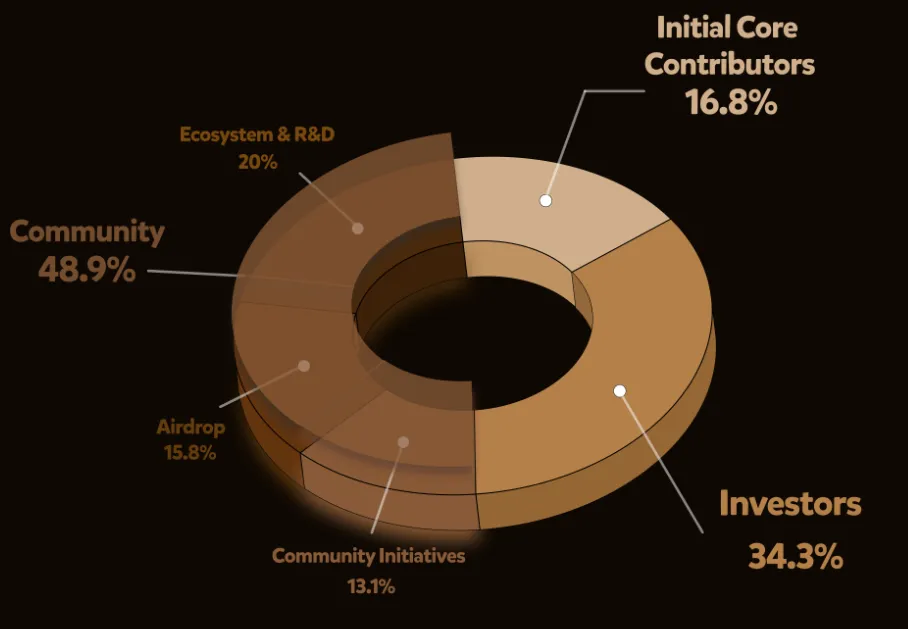

Berachain announces airdrop details ahead of its mainnet launch on February 6. The network will airdrop 15.8% of its total 500 million BERA tokens to eligible users after the token generation event (TGE) on the mainnet.

Berachain’s mainnet launch has gained notable engagement among the crypto community, largely due to its unique Proof-of-Liquidity (PoL) consensus mechanism. The project previously raised $142 million worth of funding in two rounds.

Berachain Airdrop Details

After the mainnet launch announcement yesterday, Berachain today revealed detailed tokenomics of the BERA token and airdrop details.

The distribution targets a wide range of participants. This includes testnet users, NFT holders, community builders, social media supporters, and ecosystem dApps.

The largest share of the BERA airdrop will go to holders of Bong Bears NFTs and related rebases—such as Bond, Boo, Baby, Band, and Bit Bears. This will include users who bridge their NFTs to Berachain.

Additionally, over 8.2 million BERA tokens will be airdropped to users who participated in Berachain’s public testnets.

The network previously launched two testnets, Artio and bArtio. These testnets were used to evaluate the network’s infrastructure and dApp performance.

The Berachain Foundation has set aside 1.25 million BERA tokens for community members active on social platforms, excluding dApp accounts and Berachain team members.

Also, in collaboration with Binance, Berachain will distribute 10 million BERA tokens to BNB holders. Those who subscribed to Binance’s ‘BNB to Simple Earn’ program between January 22 and 26 will qualify for this airdrop as part of Binance’s HODLer Airdrops campaign.

Berachain’s approach aims to reward early supporters and active participants within its growing ecosystem. This airdrop sets up the stage for the mainnet launch.

Users can check BERA airdrop eligibility using their wallet addresses. After the TGE and mainnet launch, BERA will be listed on Binance and MEXC.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MicroStrategy Rebrands to Strategy, Reveals 74% Bitcoin Yield

Michael Saylor just announced that MicroStrategy has rebranded to Strategy. As part of the rebrand, it incorporated the Bitcoin symbol into its official logo.

The firm also released its Q4 2024 Financial Results, claiming that it spent over $20 billion on BTC acquisitions during this period. This rebrand clearly defines Strategy’s overwhelming focus on Bitcoin into the future.

Michael Saylor Reveals His Strategy

Michael Saylor first teased this rebrand on social media before announcing that the company will be known as “Strategy.” The company’s leadership is expected to discuss this rebrand at an Earnings Call on Wednesday afternoon.

“Strategy is one of the most powerful and positive words in the human language. It also represents a simplification of our company name to its most important, strategic core. After 35 years, our new brand perfectly represents our pursuit of perfection,” Saylor claimed.

Earlier this week, the firm stopped its 12-week streak of Bitcoin purchases. These BTC acquisitions had been continuing since October and were regaining momentum in January.

However, the firm was also involved in a billion-dollar tax dilemma, and Bitcoin’s price has been fluctuating. Nonetheless, Strategy’s new logo makes its Bitcoin commitment extremely clear.

According to the firm’s latest financial results, Q4 2024 was its largest-ever Bitcoin acquisition quarter, with over $20 billion worth of BTC purchased. Under the new brand ‘Strategy’, the company aims to achieve an annual BTC gain of $10 billion in 2025.

Despite a $74.3% BTC yield in 2024, MicroStrategy’s total revenue declined 3% year-over-year. This was due to a massive 693.2% increase in business expenses.

Still, the firm will maintain its focus on Bitcoin. Saylor personally bet on Bitcoin to an immense degree and has advocated for pro-crypto political reforms like a US Bitcoin Reserve.

However, the asset has seen some corrections in the past week, which had a disproportionate impact on his company’s stock price. The rebrand could help its image.

Overall, MSTR stock price has declined 11% in the past month, but it remains up by 580% in a year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Drops After Outage and 50% Activity Decline

XRP price remains under pressure, trading within a key range as technical indicators signal potential downside risks. The recent 64-minute outage, which briefly halted transactions, has now been resolved, but it did little to boost investor confidence.

Meanwhile, XRP’s CMF remains positive but has weakened. Also, the network’s active addresses have dropped nearly 50% from its December peak. With a possible death cross forming on its EMA lines, XRP could test lower support levels unless renewed hype and buying pressure push it back above key resistance zones.

XRP CMF Is Still Very Positive, But Consolidating

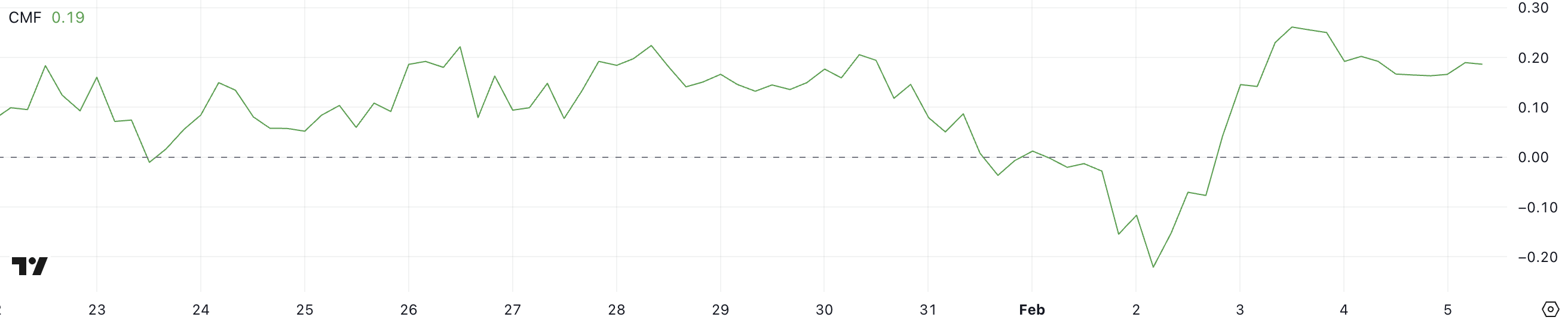

XRP Chaikin Money Flow (CMF) is currently at 0.19, down from 0.26 two days ago, after briefly dipping to -0.22 three days ago. This decline suggests that buying pressure has weakened, but the indicator has now stabilized around 0.19 and 0.20.

The previous drop into negative territory signaled strong selling, but the quick recovery above zero shows that buyers have stepped in to support the price. However, with CMF lower than its recent high, XRP’s bullish momentum has softened.

The CMF is a volume-weighted indicator that tracks the flow of money into or out of an asset. A positive CMF indicates buying dominance, while a negative reading suggests selling pressure. With XRP’s CMF stabilizing around 0.19 after dropping from 0.26, capital inflows remain positive but have slowed.

If it stays in this range, XRP price could consolidate, but a move below 0.15 may indicate increasing weakness, while a recovery above 0.25 could signal renewed buying strength.

XRP Active Addresses Are Still High, But Down 50% From Its Peak In December

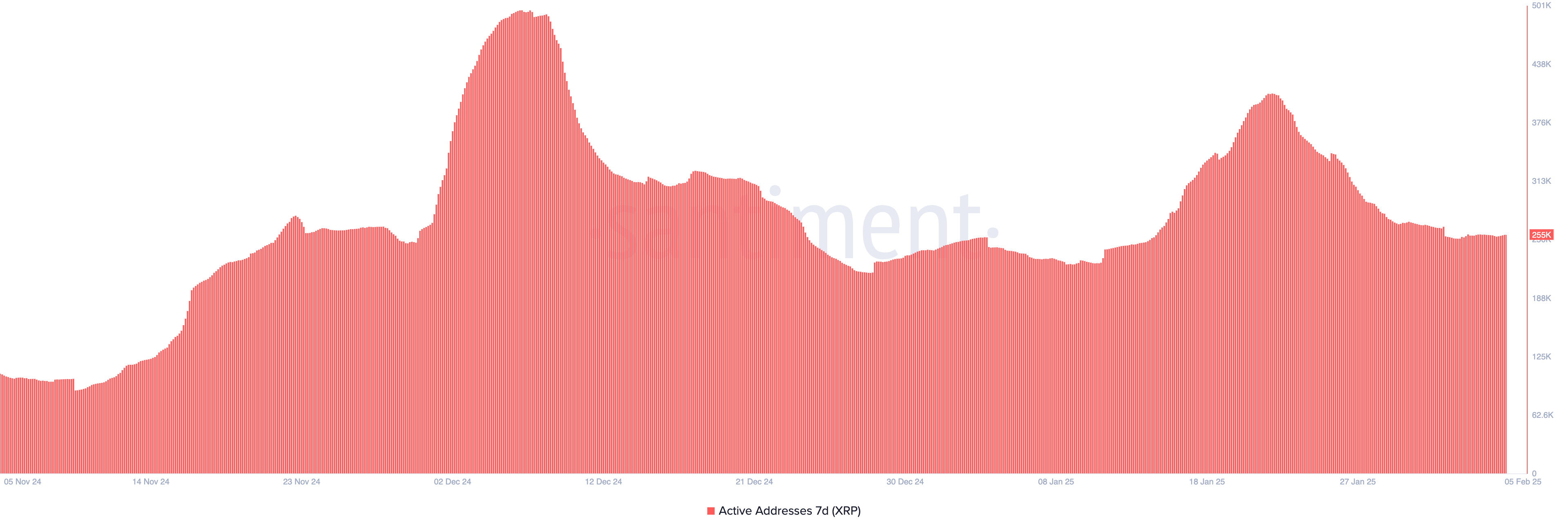

The number of 7-day XRP active addresses is currently around 256,000, down from 407,000 nearly two weeks ago, marking a 37% decline. While this remains a relatively high value compared to most of 2024, it is still nearly 50% lower than the peak reached in early December.

This drop suggests a slowdown in network activity, which could indicate reduced demand or lower transaction volumes. If active addresses continue to decline, it may reflect waning interest or participation in XRP transactions.

Tracking active addresses is important because it measures real user engagement and transaction activity on the network. A higher number of active addresses often signals strong adoption and demand, while a decline may indicate reduced network usage.

Although XRP current count remains elevated compared to most of last year, the sharp decrease from December and January suggests fading momentum.

If this trend persists, it could signal weaker market participation, but a rebound in active addresses might indicate renewed investor and user interest.

XRP Price Prediction: Can XRP Drop Below $2 Soon?

XRP’s EMA lines indicate that a new death cross could form soon, with a short-term line crossing below its longest-term line. If this bearish signal plays out, XRP price may test the support at $2.32, and if that level is lost, it could drop further to $2.20.

A continued decline in active addresses and a weakening CMF could push XRP below $2, with the next key support at $1.99. This would confirm a deeper bearish trend, making recovery more difficult, especially if new outages occur.

On the other hand, if the hype around XRP returns to levels seen in recent months, it could break the $2.60 resistance. A strong breakout above this level could lead to a test of $2.82, and if momentum builds, XRP could push above $3.

A further rally could see it test $3.15 and even $3.40, reinforcing a bullish breakout and increasing the chances of the XRP price reaching $4 in February. For this scenario to play out, buying pressure and network activity would need to improve significantly.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Analyst Says It’s A Good Buy At These Levels

The XRP price has entered a Golden Pocket—a key Fibonacci retracement level that often acts as strong support. According to a crypto analyst, this new development could present an attractive buying opportunity for investors, especially as the market consolidates.

XRP Price Golden Support Could Trigger Rebound

A crypto analyst, known as “ColdBloodedCharter’ on TradingView, has presented a detailed technical chart analysis of XRP, discussing its current position, potential future trends, and key buying levels. The analyst disclosed that XRP is currently inside a Golden Pocket, supported by a 50-day Moving Average (MA) directly below it.

Related Reading

The analyst noted that his previous analysis from the day before was playing out exactly as planned, with the new Golden Pocket acting as a resistance level when approached from below. On a short-term outlook, the TradingView crypto expert expects no immediate breakout for the XRP price. This bleak forecast is attributed to the possible selling pressure fueled by the recent 500 million XRP escrow unlocks initiated by Ripple Labs earlier this week.

The analyst also cited XRP’s current consolidation phase, which started 19 days after hitting a cycle high, as a barrier to an immediate bullish price breakout. The last consolidation phase lasted as long as 39 days after XRP had reached $2.91 on December 3, 2024.

Looking at the analyst’s price chart, XRP formed a Bullish Pennant pattern, which led to an earlier breakout in 2024 before its consolidation phase. Based on this past trend, the TradingView analyst predicts that XRP could experience another two to three weeks of choppy price action before initiating its next big move. The triangle pattern on the XRP price chart suggests a strong rebound towards a bullish price target at $3.43 if the cryptocurrency can hold its Golden Pocket support.

Key Buy Levels To Watch

While ColdBloodedCharter projects a rally to $3.43 for the XRP price, the TradingView analyst has also outlined key buy-the-dip levels investors can watch out for in preparation for this potential surge. The $2.50 level will be a primary support area for XRP, offering investors a 6-7% discount from current low prices.

Related Reading

If XRP plunges further, the analyst expects it to reach the support levels between $2.25 and $2.30. He reveals that this price level is a much safer entry point and accumulation zone for investors, especially if Bitcoin (BTC) remains above $95,000.

The analyst has also highlighted a steeper support zone between $1.9 and $2.00. This support presents a significant dip-buy opportunity and is expected to occur if Bitcoin experiences a sharp pullback to new lows around $91,000.

While further market declines will serve as a buying opportunity for many investors, they also pose a risk to those who purchased XRP during price highs. The TradingView analyst has revealed that XRP’s Relative Strength Index (RSI) is cooling down, suggesting weakening market momentum. However, he remains optimistic, predicting a strong reversal soon.

Featured image from Medium, chart from Tradingview.com

-

Regulation10 hours ago

Regulation10 hours agoKraken appoints former Paxos executive as its new chief legal officer

-

Regulation11 hours ago

Regulation11 hours agoIndia’s financial regulator fines Bybit $1M, compliance status unclear

-

Market23 hours ago

Market23 hours agoSUI Trading Volume Hits $615 Million, Overtakes Avalanche

-

Altcoin23 hours ago

Altcoin23 hours agoDogecoin Price Prediction: ‘Channel Down’ Formation Shows Why A Bounce Above $0.3 Is Expected

-

Altcoin21 hours ago

Altcoin21 hours agoShiba Inu Whales Move 15 Trillion SHIB Amid Market Crash, Are They Preparing For A Surge?

-

Ethereum17 hours ago

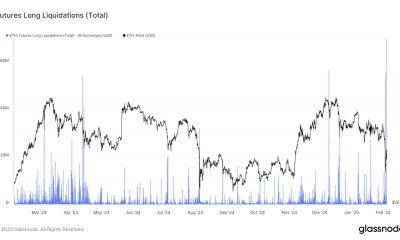

Ethereum17 hours agoEthereum Leverage Elevated Despite Long Squeeze, Glassnode Says

-

Market17 hours ago

Market17 hours agoCan It Break Through and Turn Bullish?

-

Altcoin17 hours ago

Altcoin17 hours agoWhy Is XRP Price Down 8% Today?