Ethereum

Ethereum Recovers To $2,800 As Exchange Outflows Near $1 Billion

Ethereum has made a recovery to $2,800 during the past day as on-chain data shows the whales have been making massive withdrawals from exchanges.

Ethereum Exchange Outflows Spiked After Price Crash

According to data from the market intelligence platform IntoTheBlock, investors reacted to the latest crash in the Ethereum price by making outflows from exchanges.

The on-chain indicator of relevance here is the “Exchange Netflow,” which keeps track of the net amount of the cryptocurrency that’s entering into or exiting the wallets associated with all centralized exchanges.

When the value of this metric is positive, it means the holders are depositing a net number of coins into these platforms. As one of the main reasons why investors transfer to the exchanges is for selling-related purposes, this kind of trend can be a bearish sign for the asset’s price.

On the other hand, the indicator being negative suggests the outflows outweigh the inflows and a net number of tokens is moving out of the exchanges. Such a trend can indicate that the investors are accumulating, which is something that can naturally be bullish for ETH.

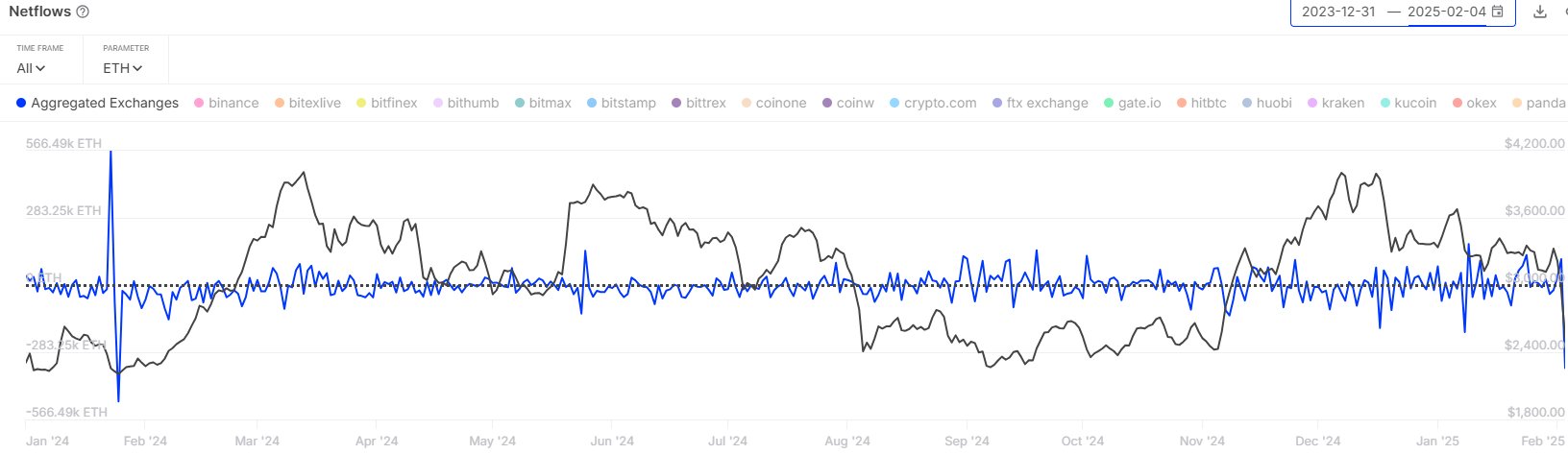

Now, here is a chart that shows the trend in the Ethereum Exchange Netflow over the past year:

As is visible in the above graph, the Ethereum Exchange Netflow observed a massive negative spike yesterday after the crash in the asset’s price took place.

In total, the investors withdrew 350,000 ETH (worth around $982 million at the current exchange rate of the token) from the exchanges in this outflow spree. “This is the highest amount of net exchange withdrawals since January 2024!” notes the analytics firm.

Given the timing of the outflows, it would appear likely that they were made by whales looking to buy Ethereum at cheap post-crash prices. The accumulation from the investors has in turn helped the cryptocurrency reach a bottom and make some recovery.

The Exchange Netflow could now be to keep an eye on in the coming days, as the upcoming trend in it might also influence the ETH price. Naturally, a continuation of the outflows would be a positive sign, while an increase in inflows could spell a bearish outcome.

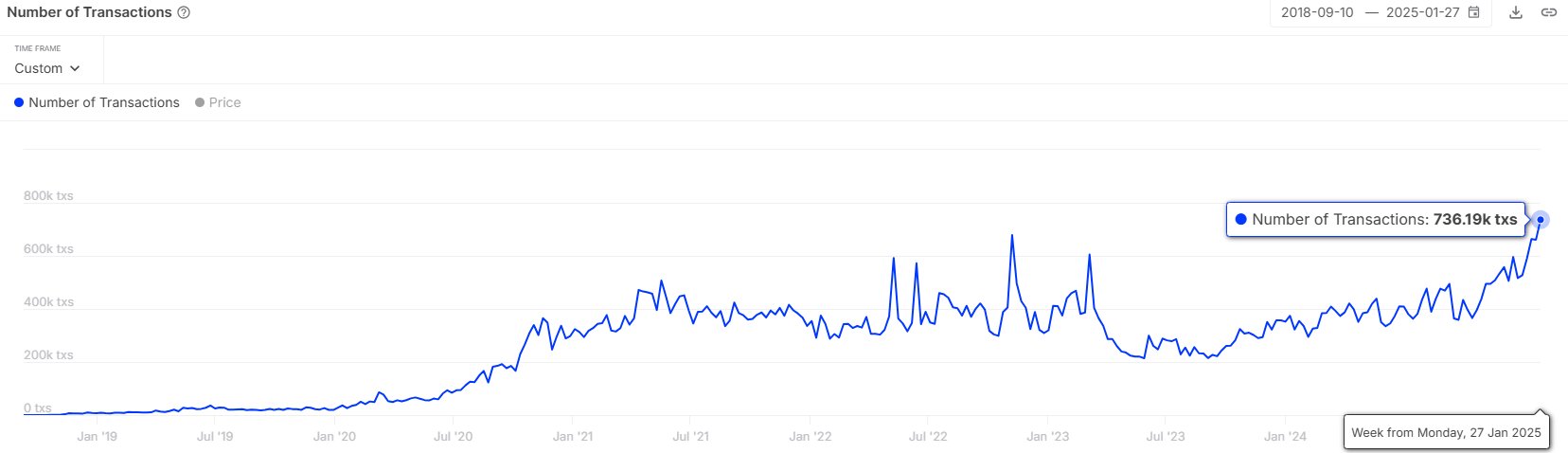

In some other news, the number two stablecoin by market cap, USDC, has seen its transaction count shoot up recently, as IntoTheBlock has pointed out in another X post.

“USDC is becoming increasingly popular, with the number of daily transactions increasing by over 119% in the last year!” says the analytics firm. Stablecoins can end up acting as fuel for volatile assets like Ethereum, so increased activity related to them can be a good sign for the market.

ETH Price

At the time of writing, Ethereum is floating around $2,800, down more than 11% over the last seven days.

Ethereum

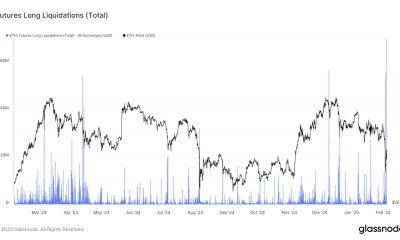

Ethereum Leverage Elevated Despite Long Squeeze, Glassnode Says

The on-chain analytics firm Glassnode has revealed how the Ethereum futures market is still overheated despite the long squeeze that just occurred.

Ethereum Open Interest Still Notably Above The Yearly Average

In a new post on X, Glassnode has discussed about how the Ethereum futures market has changed during the past day. ETH, like other digital assets, has witnessed significant volatility inside this window. Sharp price action usually means chaos for the derivatives side of the sector and indeed, a large amount of liquidations have piled up on the various exchanges.

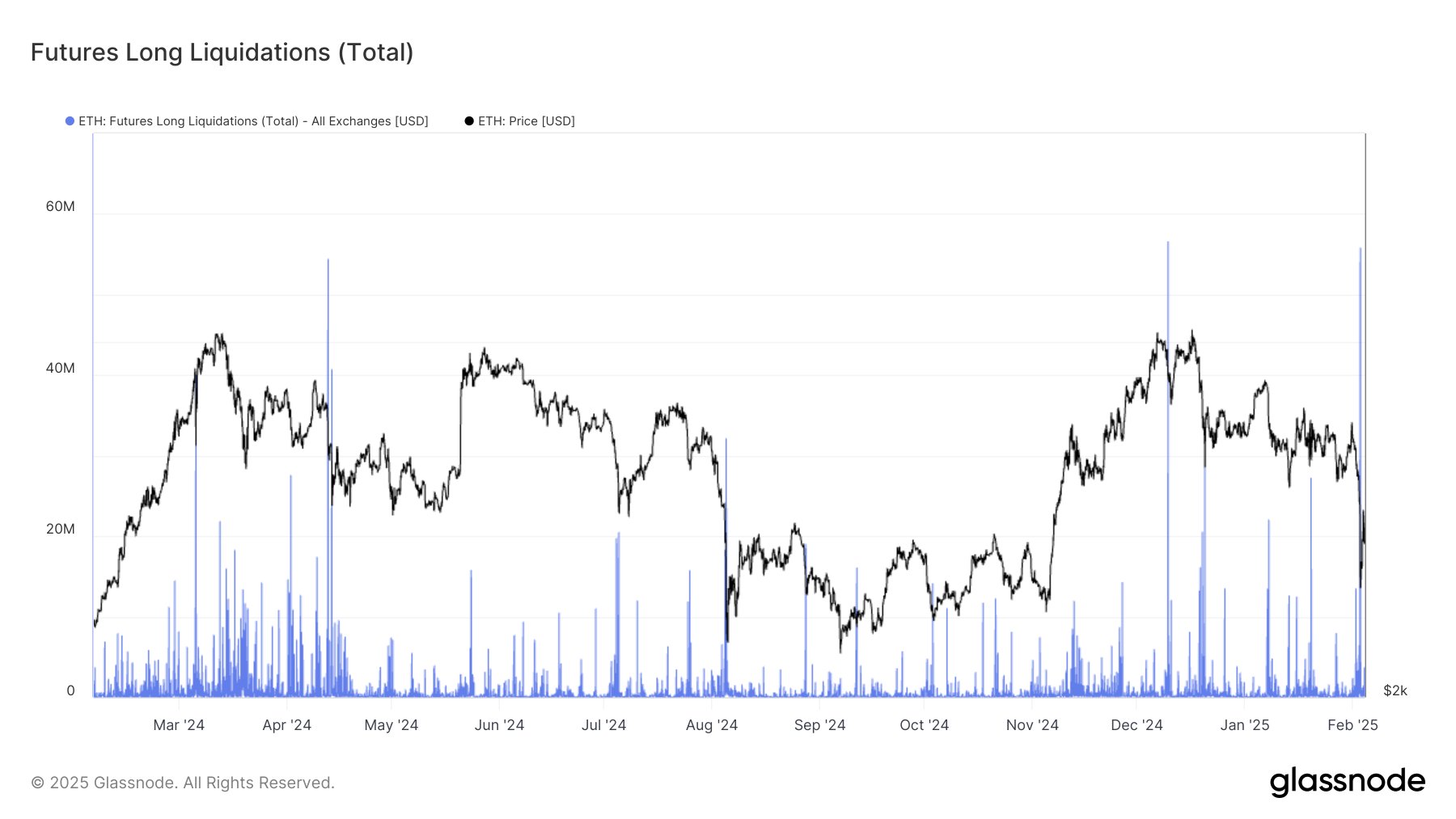

Given that the price action has been majorly towards the downside for Ethereum, the long investors would be the most heavily affected. Below is the chart shared by the analytics firm that shows the trend in the long liquidations related to ETH over the past year.

From the graph, it’s visible that the Ethereum futures market has just witnessed a massive amount of long liquidations. “Yesterday, $76.4M in ETH long liquidations hit the market, with $55.8M wiped out in a single hour – the second-largest spike in a year, just behind Dec 9’s $56M,” notes Glassnode.

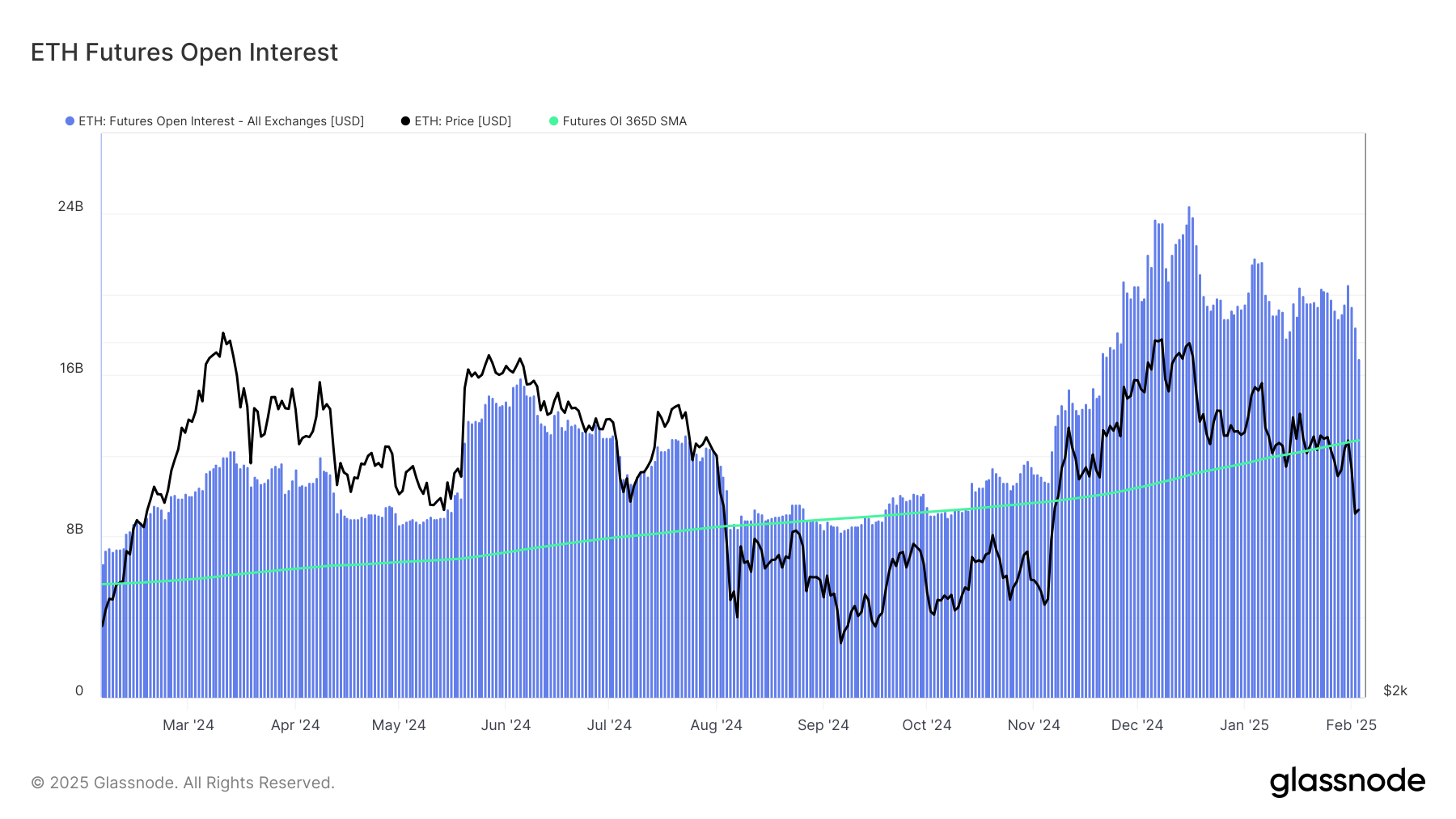

These liquidations have meant that a notable ETH leverage flush-out has occurred on the derivatives platforms. Here is another chart, this time for the Open Interest, which showcases the market deleveraging:

The “Open Interest” is an indicator that keeps track of the total amount of Ethereum-related futures positions that are open on all centralized derivatives exchanges. At the start of the month, this metric was sitting around $20.5 billion, but after the mass liquidation event, its value has come down to $15.9 billion.

This suggests $4.6 billion in positions have been wiped out from the market. While this represents a large decrease, it has actually not been enough to cause a sufficient cooldown in the Open Interest.

As displayed in the above chart, the 365-day moving average (MA) of the Ethereum Open Interest is currently situated at $13 billion. Thus, the metric’s daily value is around 22% higher than the average for the past year.

This could be a potential indication that the leverage in the sector is still at elevated levels, despite the massive amount of liquidations that the long investors have suffered.

Historically, an overheated futures market has generally unwound with volatility for the coin’s price, so it’s possible that more sharp action could follow for ETH in the near future.

ETH Price

Ethereum saw a crash towards the $2,100 mark yesterday, but it would appear the cryptocurrency has seen a rebound as its price is now trading around $2,800.

Ethereum

Whales Are Manipulating ETH Price

Major fluctuations in the Ethereum (ETH) market yesterday triggered a wave of reactions across social media, with one Ethereum co-founder claiming that certain large holders—or “whales”—were deliberately pushing the asset’s price downward.

The activity reached a fever pitch on Monday, February 4, when the ETH price swung from around $2,900 to as low as $2,120 before bouncing back sharply. Despite the intraday plunge, Ether ultimately closed the day sporting a 26% green wick—an uncommon price rebound in such a short window.

Ethereum Price Manipulated By Whales?

Analysts attributed the dramatic movement to external macroeconomic forces, most notably the US trade war under President Donald Trump. After imposing tariffs on Mexico and Canada early in the day, the president later struck an arrangement that spurred a rapid recovery across global markets, including cryptocurrency.

Related Reading

The turbulence led one observer, identified simply as “intern” (@intern), the director of growth at Monad, to post a stark sentiment on X: “ETH is dying right in front of us. honestly never thought this would happen.”

In response, Ethereum co-founder and ConsenSys CEO Joseph Lubin offered a composed outlook, underscoring that these types of price swings are not unusual for the digital asset: “It happens regularly. Then it surges. What we are seeing is whales taking advantage of economic turmoil and negative sentiment to shake out weak hands, run stops, and then buy back when they can run that same playbook in reverse.”

Lubin’s statement presents a cyclical understanding of crypto volatility, implying that larger players capitalize on market anxiety—often exacerbated by macro developments—to pressure less resilient investors into selling.

Several prominent crypto traders also commented on the events, specifically on accusations of whale-led manipulation.

One well-known figure, Hsaka (@HsakaTrades), advised newcomers not to assume ETH’s decline was driven purely by organic market sentiment: “Dear noobs, Ethereum is NOT naturally going down. It is being pushed down via whales placing spoofy sell orders on exchanges to make noobs and risk managers sell to ‘buy back lower’. They are stealing your bags and will make you buy back at a higher price.”

Related Reading

The notion of a concerted “spoofing” strategy—where large sell orders are placed and then canceled or only partially filled—has long circulated within crypto communities. The tactic reportedly aims to trigger panic sells, thereby letting so-called whales accumulate positions at more favorable price levels.

Prominent trader Pentoshi (@Pentosh1) offered a brief but pointed reaction, highlighting how ETH has underperformed relative to Bitcoin (BTC) over the past three years: “3 year shake out so far. Hope you’re right.”

The question of why whales would single out Ether in particular was raised by community member EVMaverick392.eth (@EVMaverick392): “Maybe I’ll sound naive, but why do whales perform this maneuver exclusively on ether?”

Lubin responded by drawing a parallel to conventional bank robberies and suggesting that the recent wave of unease surrounding the Ethereum ecosystem has made the asset a prime target: “Why do bank robbers rob banks— or used to? The (unjustified) FUD toward the Ethereum ecosystem is currently most pronounced.”

At press time, ETH traded at $2,704.

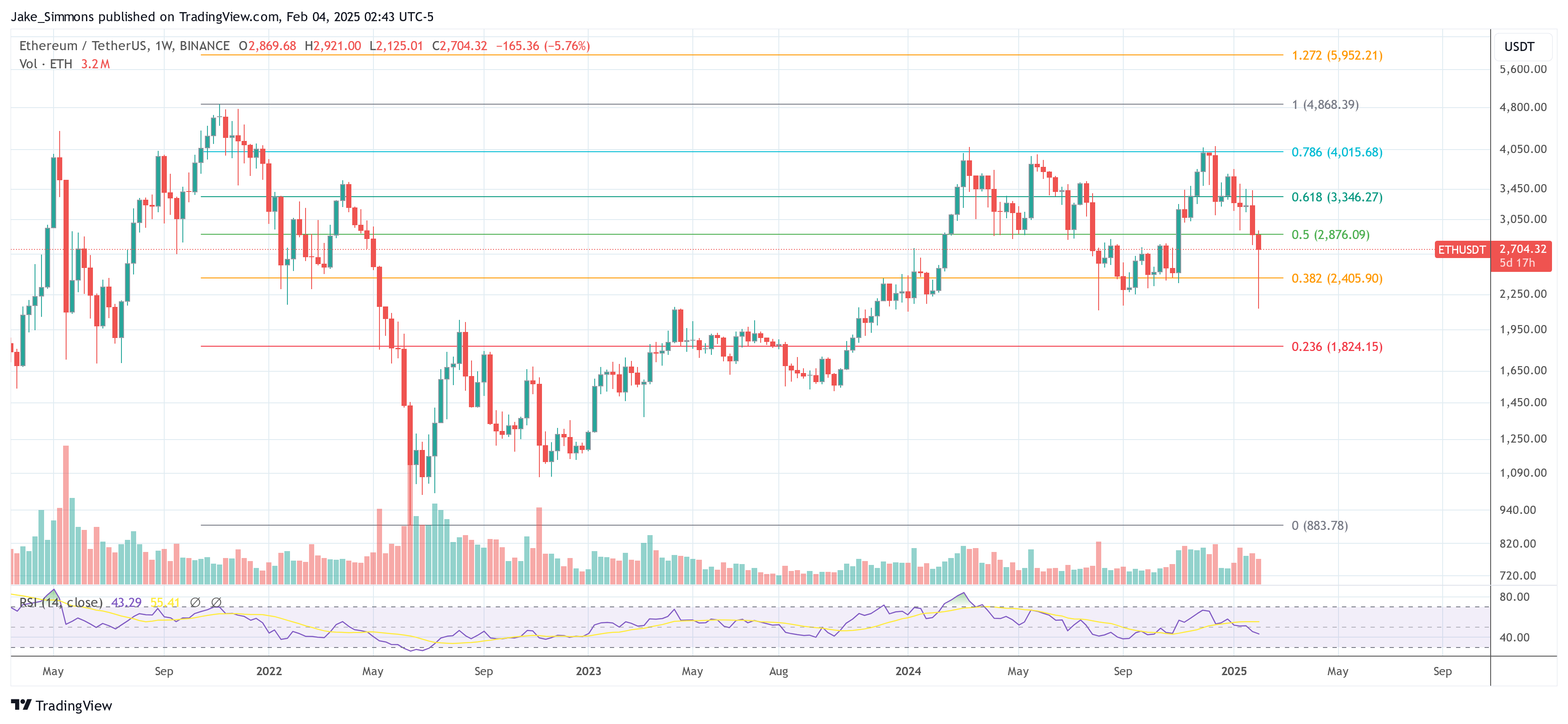

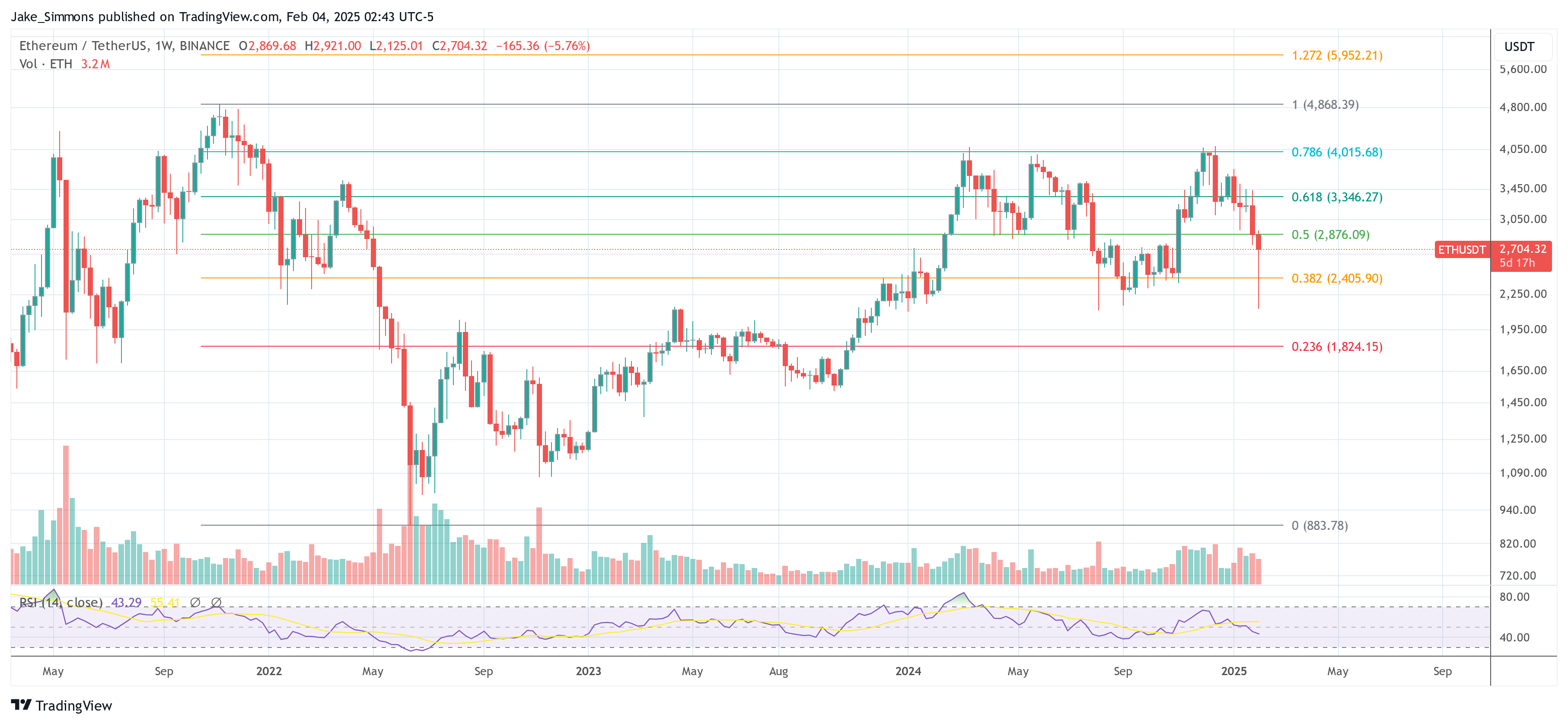

Featured image created with DALL.E, chart from TradingView.com

Ethereum

Ethereum Long-Term Bullish Structure At Risk – $2,700 Support Is Key for a $7K Target

Ethereum faced a brutal capitulation event on Sunday, plummeting over 30% in less than 24 hours as market-wide panic took hold. The dramatic sell-off was fueled by growing fears of a U.S. trade war, sending shockwaves across the crypto space and causing Bitcoin and major altcoins to drop significantly. ETH, which had been struggling to reclaim key levels, saw a sharp decline, shaking investor confidence and raising concerns about its long-term trend.

Related Reading

Top analyst Ali Martinez shared a technical analysis, revealing that Ethereum is forming a long-term head-and-shoulders pattern. According to Martinez, ETH must hold above the crucial $2,700 level to maintain its bullish structure and prevent a deeper correction. A breakdown below this level could trigger an extended bearish phase, further delaying ETH’s potential rally toward new highs.

With volatility at extreme levels and uncertainty dominating the market, Ethereum’s next move will be critical. If bulls manage to defend key support, ETH could stage a strong recovery, but failure to hold could lead to even more downside. As investors assess the damage from this weekend’s crash, all eyes remain on whether ETH can stabilize and reclaim momentum in the coming days.

Ethereum Faces A Key Challenge

Yesterday, the crypto market witnessed the largest liquidation event in its history, with over $2 billion wiped out in just a few hours. Fear has taken over, and investors are bracing for extreme volatility this week as the U.S. market reacts to escalating trade war tensions. With uncertainty dominating the landscape, Ethereum has been one of the most impacted assets, shedding a significant portion of its value as panic selling intensified.

Ethereum’s price plummeted over 37% since last Friday, marking one of its sharpest declines in recent years. The dramatic downturn has led analysts to question whether ETH can maintain its long-term bullish structure or if a deeper correction is imminent.

Top crypto expert Ali Martinez shared a technical analysis on X, revealing that Ethereum appears to be forming a long-term head-and-shoulders pattern. If this pattern is confirmed, ETH must hold above the critical $2,700 mark to keep its bullish structure intact. Losing this level could trigger a deeper selloff, potentially pushing prices toward lower demand zones before any recovery takes place.

However, if bulls successfully defend this crucial support, Ethereum could still have a shot at reclaiming lost ground and targeting its long-term goal of $7,000. The coming days will be pivotal in determining ETH’s trajectory as traders assess whether this is a temporary shakeout or the beginning of a prolonged downtrend.

Related Reading

As macroeconomic fears and trade war tensions continue to influence market conditions, Ethereum’s price action will be a key indicator of broader investor sentiment. This week will likely set the tone for ETH’s movement in the coming months, making it a defining moment for the second-largest cryptocurrency.

Price Action Details: Key Levels To Watch

Ethereum (ETH) is currently trading at $2,595 after an extremely volatile Sunday that saw its price plummet to as low as $2,150. The drastic drop has left bulls in a precarious position, as ETH has lost all major support levels and is now searching for demand to stabilize.

With the market shaken and fear-dominant sentiment, ETH must hold above the $2,600 mark in the coming days to have a chance at recovery. However, after such a massive liquidation event, regaining bullish momentum may take time, and the likelihood of further downside remains high. Traders and investors are watching key levels closely as Ethereum struggles to find its footing.

Related Reading

If ETH manages to reclaim the $2,800 level and push above $3,000, confidence could return to the market, signaling the first steps of a recovery. Until then, uncertainty remains the dominant force, and the potential for another leg down cannot be ruled out. The next few days will be crucial in determining whether Ethereum can bounce back or if it will continue its decline toward lower support levels.

Featured image from Dall-E, chart from TradingView

-

Regulation9 hours ago

Regulation9 hours agoKraken appoints former Paxos executive as its new chief legal officer

-

Regulation10 hours ago

Regulation10 hours agoIndia’s financial regulator fines Bybit $1M, compliance status unclear

-

Market22 hours ago

Market22 hours agoSUI Trading Volume Hits $615 Million, Overtakes Avalanche

-

Altcoin22 hours ago

Altcoin22 hours agoDogecoin Price Prediction: ‘Channel Down’ Formation Shows Why A Bounce Above $0.3 Is Expected

-

Altcoin20 hours ago

Altcoin20 hours agoShiba Inu Whales Move 15 Trillion SHIB Amid Market Crash, Are They Preparing For A Surge?

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Leverage Elevated Despite Long Squeeze, Glassnode Says

-

Market24 hours ago

Market24 hours agoWhat Are Crypto Whales Buying After the Market Crash?

-

Market16 hours ago

Market16 hours agoCan It Break Through and Turn Bullish?