Market

Senator Hagerty Introduces GENIUS Act for Stablecoin Oversight

US Senator Bill Hagerty has introduced the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act to the Senate.

This follows the release of a discussion draft in October, marking a significant step toward creating a regulatory framework for stablecoins payment.

Senator Hagerty Pushes the Stablecoin Bill in the Senate

The GENIUS Act defines a payment stablecoin as a digital asset used for payments or settlements, pegged to a fixed monetary value. Under the legislation, stablecoin payments must be backed by US currency, demand deposits at insured institutions, Treasury bills, and other assets.

Furthermore, it mandates Federal Reserve oversight on stablecoin issuers with a market value exceeding $10 billion, following bank regulations. In contrast, the Office of the Comptroller of the Currency regulates nonbank issuers.

Issuers with a market value below $10 billion are subject to state regulation. However, those above the threshold may apply for state-regulation exemption.

For now, Tether (USDT) and USD Coin (USDC) are the only stablecoins exceeding the $10 billion market capitalization threshold.

The Act also requires monthly audited reports on stablecoin reserves, with penalties for false reporting. It outlines clear procedures for institutions seeking licenses to issue stablecoins.

Moreover, it establishes reserve requirements, tailored regulatory standards, and supervisory, examination, and enforcement mechanisms with defined limitations.

In the latest statement, Senator Hagerty emphasized the potential benefits of stablecoin innovation, highlighting how it could enhance transaction efficiency and drive demand for US Treasuries. He noted that the advantages of strong stablecoin development are vast and far-reaching.

“My legislation establishes a safe and pro-growth regulatory framework that will unleash innovation and advance the President’s mission to make America the world capital of crypto,” he stated.

Notably, the bill is co-sponsored by Senators Kirsten Gillibrand, Tim Scott, and Cynthia Lummis.

In a social media post, Lummis stressed that 2025 is a pivotal year for digital assets. She warned that the US must take action and not allow other countries to lead in establishing regulations for stablecoins.

“Creating a bipartisan regulatory framework for stablecoins is critical to maintaining the U.S.’s dollar dominance and promoting responsible financial innovation,” Lummis added.

Meanwhile, Fox Business reporter Eleanor Terrett reported that there are expectations for the bill to advance swiftly.

“Senate staffers tell me they expect the bill to move quickly through committees in Congress,” Terrett wrote on X.

This comes after a press conference on February 4, where David Sacks, the White House’s AI and crypto czar, voiced his support for stablecoin legislation in the near future. Sacks, along with other House leaders, stated that stablecoin regulation will be a top priority.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

A Global Benchmark for Blockchain Adoption

The Shiba Inu (SHIB) ecosystem announced a strategic partnership with the United Arab Emirates (UAE), suggesting blockchain integration at a federal level.

This partnership marks a milestone in global crypto adoption, making the UAE the first nation to fully embrace blockchain nationally.

Shiba Inu Secures Government Blockchain Integration

Based on the announcement, UAE’s Ministry of Energy and Infrastructure (MoEI) officially selected Shiba Inu as a key partner in advancing Web3 solutions across energy, infrastructure, and public services. The collaboration will unify Shiba Inu’s Operating System (ShibOS) across all Emirates, streamlining government services through decentralized solutions.

His Excellency Eng Sharif Al Olama, Undersecretary for Energy and Petroleum Affairs at MoEI, articulated the partnership’s significance. He cited the UAE’s focus on novel digital services to transform government deliverables.

“By embracing emerging technologies, we aim to set a global benchmark for innovation, delivering transformative solutions that benefit both our citizens and the wider community,” the Undersecretary stated.

Shiba Inu’s lead developer, Shytoshi Kusama, reiterated the partnership’s potential to transform government services. According to Kusama, the integration would redefine how governments, businesses, and citizens collaborate in a transparent, eco-friendly digital framework.

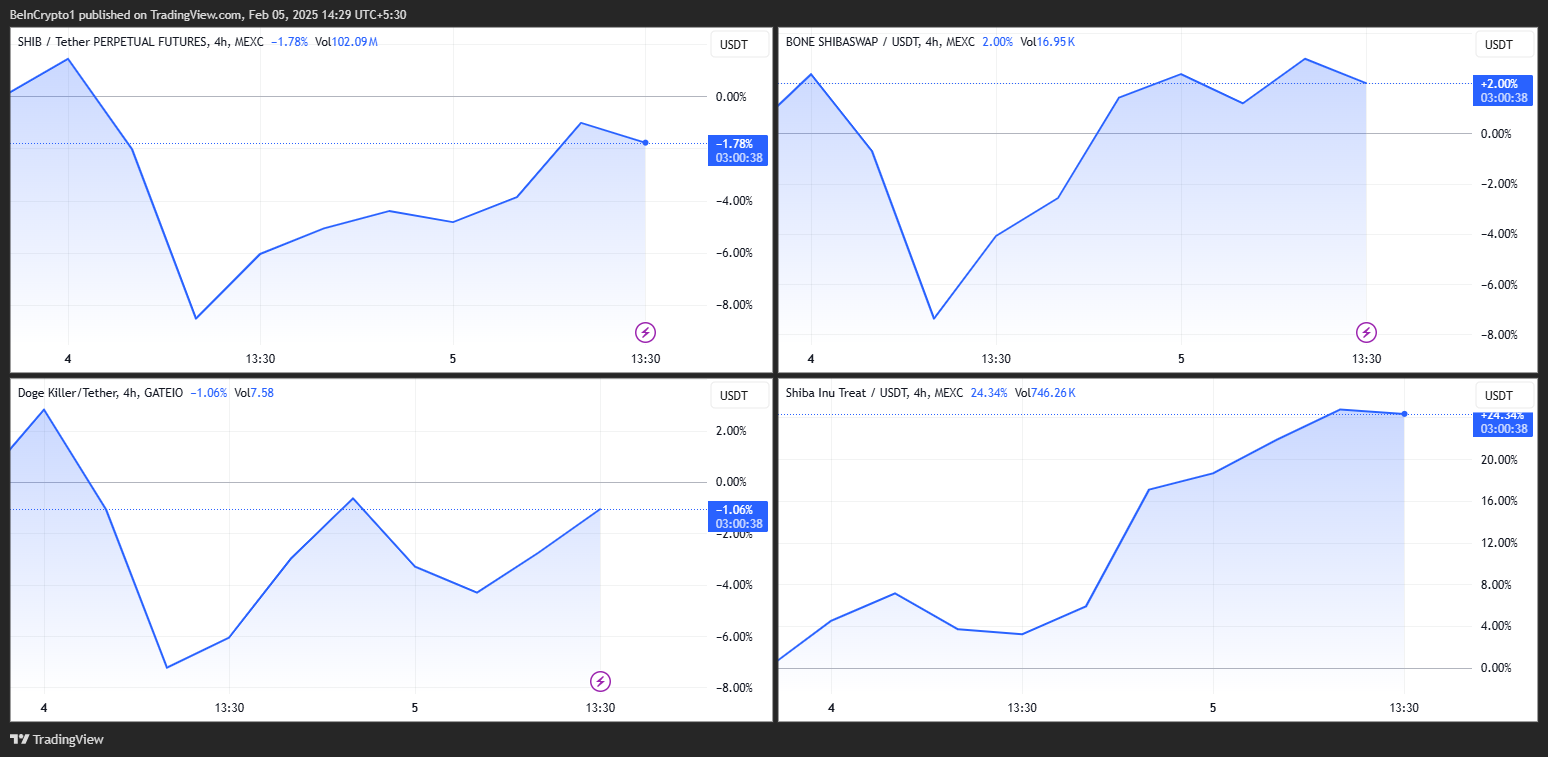

He also explained the partnership’s role in unlocking Shiba Inu’s strong Web3 technologies, from AI to Fully Homomorphic Encryption (FHE). Notably, this includes Shiba Inu token (SHIB), Bone ShibaSwap (BONE), Doge Killer (LEASH), and Shiba Inu Treat (TREAT).

While the four tokens surged following the report, the impact was subdued as token holders cashed in on the gains.

Meanwhile, this landmark agreement adds to initiatives the Shiba Inu network is taking to expand its ecosystem. The project introduced WHY Combinator three weeks ago, an incubator designed to accelerate Web3 innovation and boost BONE utility.

On the other hand, the UAE has solidified itself as a leading jurisdiction for crypto and blockchain adoption. Beyond its partnership with Shiba Inu, the region has embraced AI-driven policymaking, paperless government services, and digital transformation at an unparalleled scale.

Four months ago, the UAE further set the stage for a crypto boom by introducing a new tax exemption policy, attracting blockchain enterprises and investment into the region. Among them is the Aptos Foundation, which recently expanded its blockchain presence in Abu Dhabi.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What Caused the Block Production Stop?

The XRP Ledger (XRPL) temporarily halted block production for approximately an hour on February 4 before spontaneously recovering.

While the network is now fully operational, Ripple’s technical team is still investigating the root cause of the disruption.

XRP Ledger Halted Block Production

According to XRPL’s explorer page, network activity stalled at block height 93,927,174 for 64 minutes before resuming operations.

The blockchain’s self-custody Xaman Wallet confirmed that XRPL was back online.

“The XRP ledger is now fully operational after the recent halt, and transactions can resume as normal,” the post read.

Ripple’s Chief Technology Officer (CTO) David Schwartz addressed the issue in an X (formerly Twitter) post, explaining that while the network had recovered, the exact cause remained unknown.

“Super-preliminary observation: It looked like consensus was running, but validations were not being published, causing the network to drift apart,” Schwartz stated.

He elaborated that validator operators manually intervened to select a reliable starting point from the last fully validated ledger and resumed publishing validations. While this intervention helped realign the network, Schwartz noted that it was unclear whether this manual action directly resolved the problem or if the network self-healed.

“It looks like, as far as we can tell, only one validator operator manually intervened. It’s still not entirely clear if that solved the problem or the network self-healed,” the CTO updated.

Schwartz reassured users that the incident did not result in any asset losses. He explained that the issue only caused ledgers to be temporarily untrusted for about an hour.

This happened because the servers detected the network’s malfunction and withheld validation during the incident. Ledgers that received the majority of validation were not affected.

RippleX also reaffirmed that user funds remained secure throughout the event.

“Your funds were always safe!” RippleX posted.

This is not the first time the XRP Ledger has faced technical issues. In November 2024, the network temporarily halted transaction processing for about 10 minutes due to a node crash.

Earlier, in September 2024, full history nodes on XRPL experienced failures caused by an SQLite database page size limitation, which led to inefficiencies in handling large transaction data.

Despite these setbacks, XRPL has continued to grow. According to Ripple’s recently released Q4 2024 market report, the XRPL saw increased activity across key on-chain metrics.

On-chain decentralized exchange (DEX) trading volume reached $1 billion. Furthermore, wallet creation surged to 709,000. New token issuance on the XRPL also increased during this period.

Meanwhile, following the network disruption, XRP’s (XRP) price briefly declined.

However, in the past 24 hours, the price has mostly remained stable, to trade at $2.51 by press time. Yet, in the past seven days, XRP has declined by nearly 20%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Tests Critical Barrier: Will Bulls Lose Steam?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Market23 hours ago

Market23 hours agoOM Price Rises 70% To Form Third New All-Time High in 10 Days

-

Market22 hours ago

Market22 hours agoFET Price Crash Triggers Historic Losses, Yet Whales Accumulate

-

Market21 hours ago

Market21 hours agoADA Bullish Momentum Fades As Bears Reclaim Control At $0.8119

-

Market18 hours ago

Market18 hours agoWill It Lose Dominance in 2025?

-

Altcoin18 hours ago

Altcoin18 hours agoCan Ethereum Price Touch $4,000 In 30 Days After ETH ETF Boom?

-

Market17 hours ago

Market17 hours agoEthereum ETFs See Record Volume Despite Market Chaos

-

Bitcoin24 hours ago

Bitcoin24 hours agoTrump’s Sovereign Wealth Fund – Could Bitcoin Be in Play?

-

Market16 hours ago

Market16 hours agoSOL Price Jumps 10% as Whales Boost Accumulation