Market

Ethereum ETFs See Record Volume Despite Market Chaos

US Ethereum ETFs hit record volume Monday as investors bought the dip despite market downturns. The nine ETFs saw $1.5 billion in total trading volume, with a $84 million inflow from new investors.

Although the ETFs are performing quite well, trouble remains on the horizon. Their trade volumes are becoming increasingly uncoupled from Ethereum itself as the community faces leadership crises and shaken public confidence.

Ethereum ETFs See Record Trading Volumes

Ethereum has been in a challenging spot lately, but its ETFs are pulling huge numbers. Ethereum was already struggling with declining user counts and falling prices, but Trump’s tariff threats brought huge shocks to the whole crypto market.

However, even while the altcoin was struggling, ETF investors bought the dip in huge amounts, leading to $1.5 billion in trading volume.

Essentially, the broader market shocks triggered huge levels of panic-selling, stop-loss triggers, and forced liquidations. As a key asset for the DeFi space, ETH is vulnerable to swings from overall leveraged trading.

These outflows pumped up the ETFs’ trading volume, and Ethereum delivered net inflows, including $84 million from new investors.

After these complicated actions, Ethereum’s price somewhat recovered from Monday’s early market crash.

However, the leading altcoin has been struggling for a few different reasons. Leadership restructuring at Ethereum has shaken public confidence in the firm, feeding price concerns.

Meanwhile, Ethereum ETFs also have a few bullish factors under their belt. They set a new record for inflows in December, attracting more than $2 billion in institutional interest despite a flagging price.

This trend continued throughout January, with heightened ETF trade despite widening cracks in the Ethereum Foundation.

Additionally, a few outside factors helped juice this rally. Donald Trump’s son, Eric Trump, encouraged his followers to invest in Ethereum via social media.

“In my opinion, it’s a great time to add ETH,” Eric Trump posted.

Open interest in ETH futures contracts on the CME also climbed around 6%, signaling institutional interest. Together, these revenue streams helped guarantee big gains.

Ultimately, Ethereum ETFs are doing well, but the underlying asset’s broader future is still uncertain. Community turmoil is causing serious cracks in the asset’s support base.

This is especially concerning because ETH enjoys prestige and reputation due to its long history in the space. Ultimately, these ETF trades may only paper over broader concerns.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Relying on TVL Could Mislead Your DeFi Strategy

Total value locked (TVL) is a widely used metric to track the popularity, adoption, and overall health of decentralized finance (DeFi) projects. However, is it the most accurate reflection of a chain’s true value? David Silverman, SVP of Strategic Product Initiatives at Polygon Labs, believes TVL is useful for grabbing headlines but doesn’t provide the full picture.

In an exclusive interview with BeInCrypto, Silverman explained why TVL has its limitations. He also revealed how the Chain-Aligned TVL (CAT) could provide a more meaningful measure for the crypto ecosystem.

Why TVL Falls Short as a Key DeFi Metric

Silverman acknowledged that TVL provides a general overview of the assets held within a protocol or chain. Yet, he argued that its importance and accuracy remain debatable.

“TVL mainly serves as a tool for crafting headlines and providing a general overview of the value held on a DeFi platform or a chain, and most people don’t really know what exactly this metric entails in particular. Saying that Ethereum has a TVL of $44.38 billion doesn’t really mean much until you dig deeper into the specifics,” Silverman told BeInCrypto.

According to DefiLlama data, in April 2025, Ethereum (ETH) ranks the highest among all chains in terms of TVL, dominating more than half of the market. Meanwhile, Polygon’s (POL) TVL stands at $760.9 million, making it the 13th largest chain.

Although there have been advancements in tracking the TVL over time, Silverman believes several issues persist. Thus, he advocated for what he calls a Chain-Aligned TVL.

According to Silverman, the name itself clearly differentiates it from traditional TVL. This metric focuses on the active use of assets rather than their mere presence on the chain.

“Knowing how much USDC or USDT is on a chain can make for good headlines, but if those tokens are just collecting dust in a wallet and don’t contribute to anything, do they really add any value to the ecosystem?” he questioned.

To illustrate his point, he emphasized that holding $1 million worth of USDT in Morpho is arguably far more beneficial for the chain, its users, and the ecosystem. Why? Because on the platform, it earns a yield and helps grow the chain’s TVL by extending credit.

“This is the main idea of Chain-Aligned TVL, which is the total value of assets that directly support and strengthen their underlying chain, whether held natively or within aligned protocols,” Silverman disclosed to BeInCrypto.

Furthermore, he said, the goal is to associate CAT with projects that truly add value to their communities.

Maximizing DeFi Potential: How Chain-Aligned TVL Benefits Users

The Polygon executive also outlined the benefits Chain-Aligned TVL brings to users. He explained that CAT’s nuanced way of gauging a chain’s value can help users find better yield opportunities.

“Chains will naturally want to promote projects that benefit them and their ecosystems, so they are more likely to promote projects with higher chain-aligned TVLs, making it easier for users to locate high-yielding opportunities,” he noted.

Silverman stressed that focusing on CAT can drive the development of more effective and user-friendly applications. The underlying chain will prioritize well-integrated projects beneficial to its ecosystem.

“Benefits to users include things like easier/cheaper/faster transitions and better DeFi opportunities,” he claimed.

Additionally, CAT-driven projects may offer better interest rates and provide more engaging experiences in areas like games and non-fungible tokens (NFTs), as developers are incentivized to enhance ecosystem engagement.

The benefits aren’t limited to users only. Rather, it can also have positive implications for entire blockchains.

“CAT is a metric that all chains can leverage and benefit from to get a better understanding of where their development efforts should be focused,” Silverman revealed to BeInCrypto.

He pointed out that transaction fees alone are not always a sustainable business model for chains. According to Silverman, the focus on CAT helps bring long-term value to a chain and its ecosystem beyond just short-term transaction revenue.

Meanwhile, to showcase Chain-Aligned TVL in action, Silverman cited Agora’s AUSD deployment on Polygon as an example.

“While other stables may have large amounts of idle TVL, the issuer and the issuer alone benefits from this not the chain and not the users. With AUSD, a portion of the yield generated from reserves is emitted on the chain as incentives helping grow protocols, rewarding active users and growing the chain’s economy even when the assets remain idle,” he highlighted.

While Silverman presents a strong case for Chain-Aligned TVL, widespread adoption of this metric remains a challenge. TVL has dominated the DeFi space for years, becoming the standard by which projects are measured.

Shifting to a more nuanced metric like CAT will require industry-wide education and a change in how both developers and users evaluate blockchain value.

However, as the ecosystem matures and the need for more accurate assessments of chain health grows, metrics like CAT could gradually gain traction, offering a more sustainable and meaningful way to measure a chain’s true impact.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

China’s M2 Surge Could Send Bitcoin to $90,000

Welcome to the US Morning Crypto News Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see what experts say about Bitcoin’s (BTC) price, with $90,000 in sight. Global and regional liquidity is expanding, a trend that has historically proven bullish for risk assets like crypto.

Will Bitcoin Follow As China’s M2 Money Supply Rises?

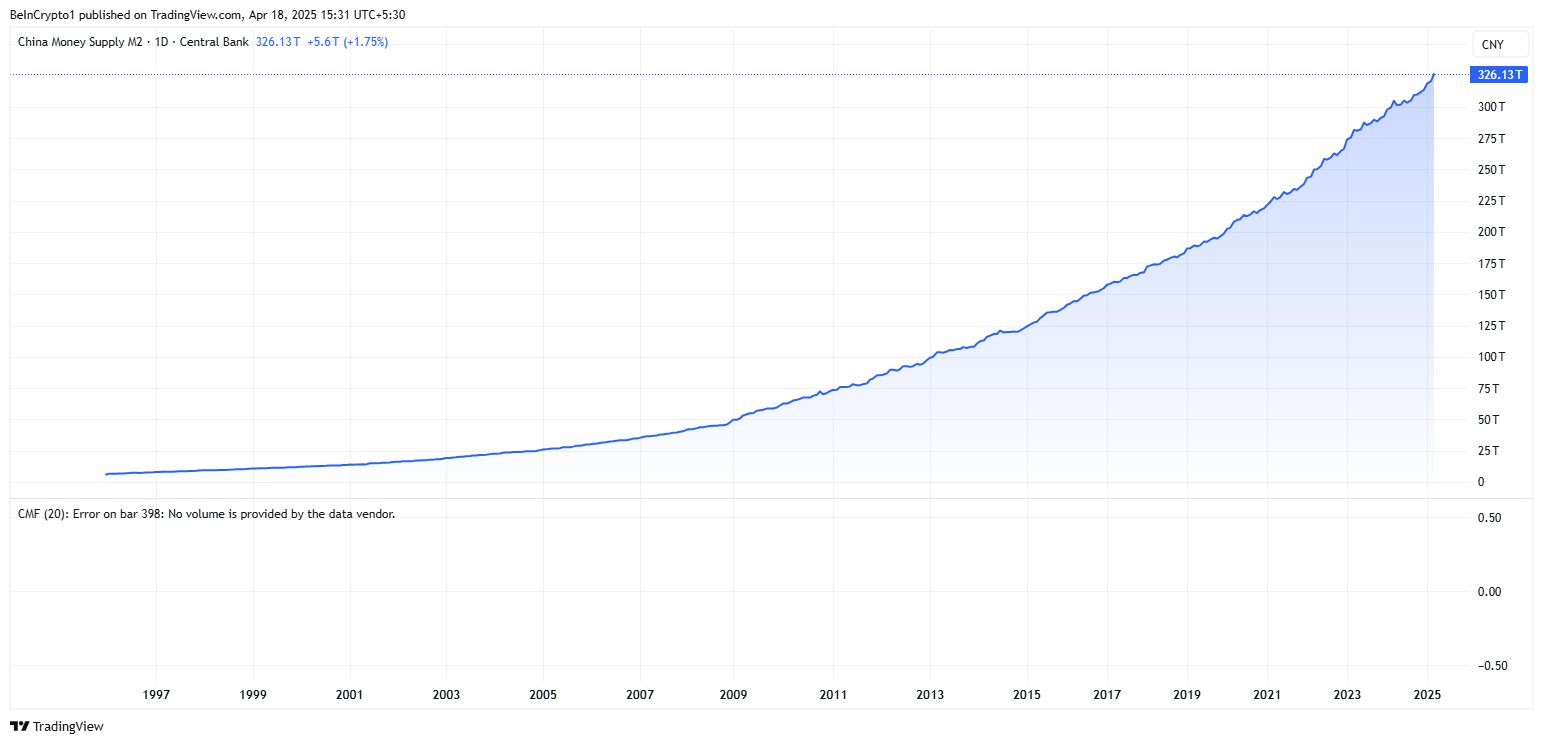

According to data on TradingView, China’s M2 money supply has reached a record $326.13 trillion, steadily surging to new record highs.

A rise in M2 signals greater liquidity in the financial system, suggesting more money is often seeking returns in riskier assets like Bitcoin and altcoins or others, such as equities and real estate.

“China’s M2 money supply just hit 326 trillion. The money printers are back on. Risk assets are about to go parabolic.,” analyst Kong Trading remarked.

Data on BGeometrics show that the global M2 is rising, a trend similar to that seen in China’s M2 money supply. Recent spikes have taken both metrics to their respective peaks.

Against this backdrop, analysts suggest a strong upside may be imminent for Bitcoin and altcoins. BeInCrypto contacted Brickken market analyst Enmanuel Cardozo D’Armas, who said Bitcoin could retest $90,000 soon.

“If China’s M2 keeps growing, it could give Bitcoin a push upwards, based on what we’ve seen before. Right now, Bitcoin’s at $85,000, and if M2 keeps increasing, we could potentially see a retest of $90,000,” Enmanuel Cardozo D’Armas told BeInCrypto.

This target aligns with yesterday’s US crypto news, where Blockhead Research Network (BRN) analyst Valentin Fournier highlighted the $90,000 target for Bitcoin price.

Meanwhile, Cardozo D’Armas articulated that China’s M2 money supply is projected to hit record levels by the end of 2025. In his opinion, more money floating around in China could mean more people willing to invest their cash into riskier assets like crypto, especially now that China’s stance is shifting positively.

According to the analyst, the $90,000 threshold is an important resistance level, necessary to conquer before a run-up to the $100,000 milestone. However, whether this is attainable by mid-year remains debatable amid macroeconomic jitters.

“But it’s not a sure bet, as there are a lot of things that could affect the markets at the moment. If the Fed cuts rates in May or June, as some expect, that could add more fuel. On the flip side, if trade tensions with China or crypto regulations tighten again, we might not see those targets hit,” the Brickken market analyst added.

Indeed, there remain concerns about Trump’s tariff chaos and China’s retaliatory stance. Amidst these uncertainties, investors may delay allocating capital to high-volatility assets until trade tensions stabilize.

The macro context also includes a hawkish Federal Reserve (Fed) stance from Jerome Powell, which ruled out any imminent rate cuts.

Reports also indicate that China is liquidating seized cryptocurrencies through private firms to support local government finances amid economic struggles.

Cognizant of these factors, Cardozo D’Armas explained that while China’s M2 can contribute to Bitcoin’s upward momentum, especially in bullish times, it is not the only thing crypto market participants should pay attention to.

Despite the bullish prediction, traders and investors should brace for macroeconomic headwinds, among other elements, which could temper any near-term gains.

Charts of the Day

This chart suggests Bitcoin may follow China’s M2 trend toward a price surge.

This chart shows a historical correlation where rising M2 often precedes altcoin price surges.

“Altcoins don’t run until liquidity breaks out. It’s time,” crypto analyst TechDev quipped.

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of April 17 | Pre-Market Overview |

| Strategy (MSTR) | $317.20 | $316.25 (-0.30%) |

| Coinbase Global (COIN) | $175.03 | $175.02 (-0.009%) |

| Galaxy Digital Holdings (GLXY.TO) | $15.36 | $15.12 (-1.51%) |

| MARA Holdings (MARA) | $12.66 | $12.68 (+0.16%) |

| Riot Platforms (RIOT) | $6.46 | $6.46 (+0.009%) |

| Core Scientific (CORZ) | $6.63 | $6.65 (+0.29%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

100 Million Tokens Could Trigger Decline

One hundred million Pi Network (PI) tokens, valued at approximately $60 million, is about to be unlocked through the remainder of April.

This may intensify the already bearish momentum that has plagued the token in recent weeks, raising concerns of a further slide toward its all-time low.

PI Struggles Under Bearish Sentiment

According to PiScan, 9.5 million tokens worth $5.76 million at current market prices are due to be released into circulation today. This is part of a broader schedule that will see over 1.56 billion PI tokens released over the next 12 months.

With recent broader market headwinds, this month’s tranche of tokens to be unlocked could trigger heightened selling activity, especially given the current lack of strong demand for the altcoin.

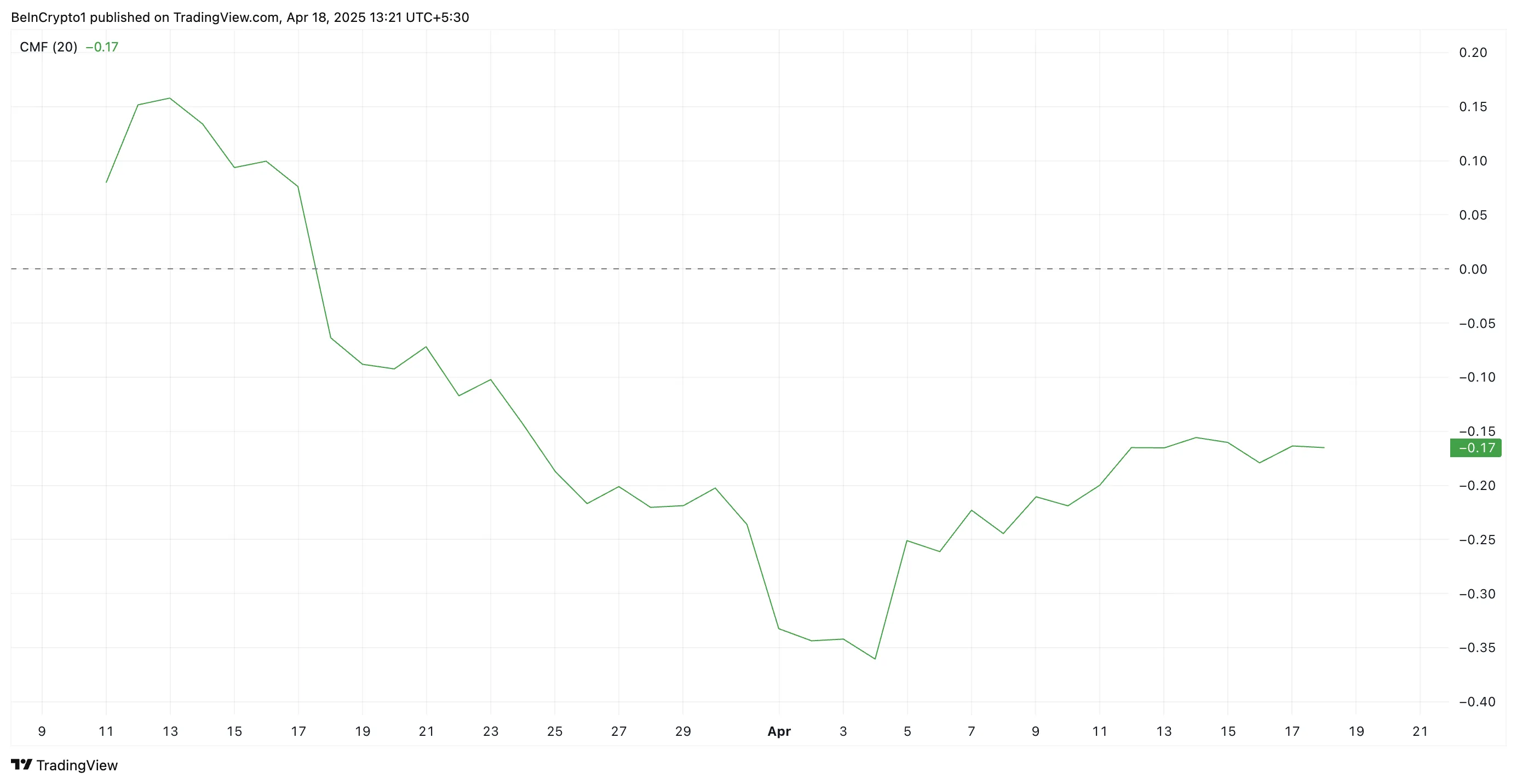

Meanwhile, technical indicators suggest weakening support. For example, PI’s Balance of Power (BoP) is declining at press time, and it is currently below zero at 0.75.

This indicator measures an asset’s buying and selling pressures. When it falls like this, it indicates that sellers are currently in control, exerting more influence over price action than buyers. This confirms the bearish trend in the PI spot markets and signals continued downward pressure on its price.

Moreover, PI’s Chaikin Money Flow (CMF) remains firmly below the center line, and has been so positioned since its price decline began on February 26. This momentum indicator currently stands at -0.17.

PI’s negative CMF indicates more selling pressure than buying pressure, meaning money flows out of the asset. This also confirms the bearish sentiment and points to potential further price declines.

PI Could Fall to All-Time Low

PI currently trades below its 20-day Exponential Moving Average, which forms dynamic resistance above its price at $0.70.

The 20-day EMA measures PI’s average price over the past 20 trading days, giving more weight to recent prices. With PI currently trading below this key moving average, it indicates bearish short-term momentum.

It suggests that sellers dominate, and the asset could face continued downward pressure. If the decline persists, PI could revisit its all-time low of $0.40.

Conversely, a resurgence in demand for the altcoin could invalidate this bearish thesis. PI could break above its 20-day EMA and rally toward $0.95 in this scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoOver $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

-

Altcoin20 hours ago

Altcoin20 hours agoCZ Honors Nearly $1 Billion Token Burn Promise

-

Market24 hours ago

Market24 hours agoWhy XRP Could Beat Dogecoin, Solana In ETF Race And Trigger A Price Surge

-

Market21 hours ago

Market21 hours agoXRP Price Finds Stability Above $2 As Opposing Forces Collide

-

Altcoin21 hours ago

Altcoin21 hours agoCoinbase Reveals Efforts To Make Its Solana Infrastructure Faster, Here’s All

-

Market23 hours ago

Market23 hours agoBitcoin Price Poised for $90,000 Surge

-

Altcoin23 hours ago

Altcoin23 hours agoXRP Continues To Outpace ETH For 5 Months; What Lies Ahead?

-

Altcoin14 hours ago

Altcoin14 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high