Altcoin

Don’t Try to Time the Market Top

Bitcoin (BTC) has recorded massive volatility over the last several weeks, rising past the $100,000 milestone only to retrace to the $90,000 range. This has sparked debate over whether the crypto market has topped, drawing opinions from various analysts and traders.

Despite market fluctuations, many remain optimistic about the future trajectory of Bitcoin and altcoins, while others caution against unchecked bullish sentiment.

Optimism for Q1 and Bitcoin’s Bullish Trend

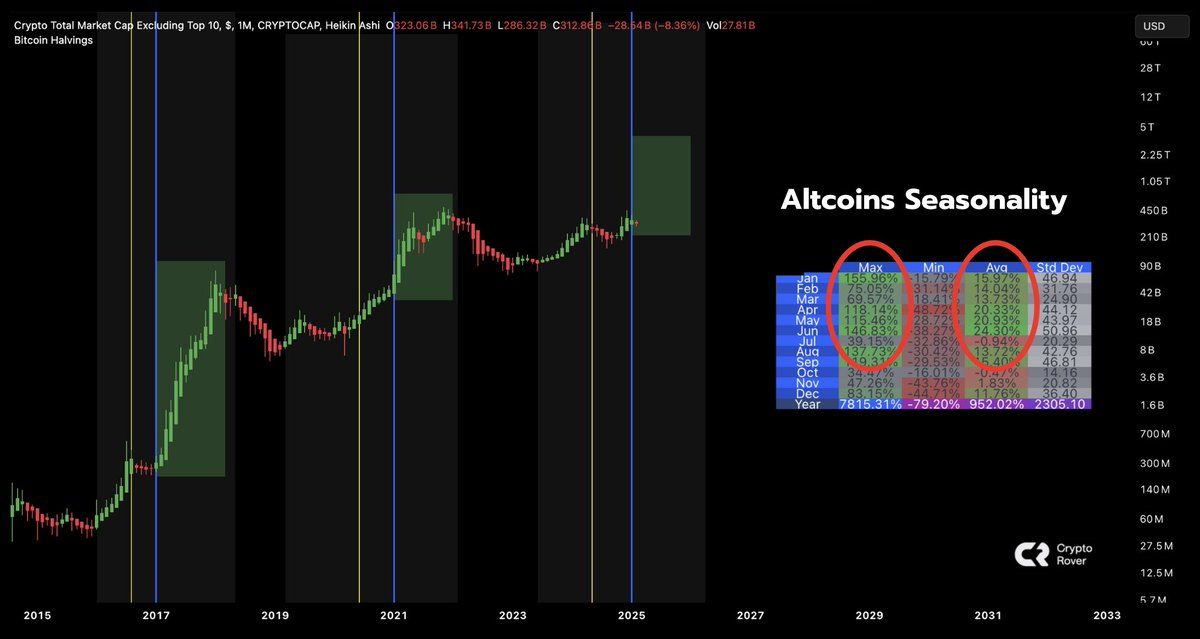

Crypto Rover remains confident that history will repeat itself, maintaining that Bitcoin’s price target remains steadfast at $175,000. According to the renowned analyst, a bullish breakout is imminent.

“Q1 is always bullish for altcoins. This time will not be any different. I trust history,” Rover remarked.

Meanwhile, some analysts urge investors to shift their focus away from short-term market tops. Instead, they should concentrate on identifying strong communities with longevity, citing a “war of attrition” in the crypto space.

HODL Protocol reinforces that momentum should guide decision-making rather than an obsession with whether the market has peaked. Their advice is to stay adaptable and focus on long-term gains.

In the same tone, Crypto Nova, a seasoned investor, cautions against attempting to time market tops. Instead, she recommends taking profits gradually, regardless of whether the market continues to rise. This strategy, she argues, will ultimately outperform most traders.

“Hear it from someone that has been here for quite a while: Don’t ever try to time to the top on anything. Not on Bitcoin, not on your favorite alts, not on anything. Eventually, the goal is to take profits before the top of the market happens. Regardless if it keeps running or not. Do that and you’ll outperform almost anyone in this entire space,” the analyst quipped.

Trump’s Influence on Bitcoin and the Crypto Market

Elsewhere, analyst Crypthoem presents an intriguing theory regarding the Trump family’s influence on the crypto market. He suggests that strategic announcements regarding tariffs and liquidity events have been used to depress altcoin prices, making Ethereum (ETH) an attractive buy for major investors.

“Release TRUMP Sucks liquidity out of all alts, allows world liberty fi to buy cheap ETH. Release MELANIA Dumps all alts, allows world liberty fi to buy cheap ETH. Announcing tariffs causes a liquidation cascade in an already weak altcoin market, allowing the world liberty fi to buy cheap ETH. Calls of tariffs bags have been filled,” Hoem wrote.

This theory implies that these events create shakeouts that ultimately benefit well-positioned players.

Nachi, a top trader on Binance, sees a pattern in Trump’s market influence. He suggests the recent tariff news was a deliberate political maneuver to create a crisis, shake out traders, and allow major investors to accumulate Ethereum at lower prices. He believes this cycle will repeat with China, leading to further shakeouts before another major price rally.

Ran Neuner, founder of Crypto Banter, reiterates this allusion, referencing Eric Trump’s tweet suggesting, “It’s a great time to add ETH.” The tweet was later edited, leading analysts like Duo Nine to speculate about potential insider knowledge.

“The Trumps are the ultimate KOL,” Neuner remarked.

However, The DeFi Investor counters this view, arguing that Trump’s DeFi project had already purchased over $100 million worth of Ethereum before Trump’s tariff announcement. This means their holdings also suffered.

Caution Amid Market Uncertainty

Despite the optimism, some analysts are urging caution. Andrew Kang believes the recent rally was a massive mechanical bounce and advises traders to take profits while they can.

“Massive mechanical bounce today. If you made good profits, IMO it is a good spot to secure them. Easy mode is over for alts. Mean reversion buyers turn into mean reversion sellers. There will be more great buying opportunities in February/March,” Kang advised.

In the same tone, Binaso advises traders to cash out profits into their bank accounts instead of stablecoins or other crypto assets. The analyst encourages a disciplined approach to securing gains. Others add to the skepticism, highlighting excessive leverage in the market as traders have been front-running Bitcoin’s rise since $15,000. Nevertheless, with open interest still at extreme levels, chances of a correction remain high.

Sachin Sharma, a market analyst, refutes the notion of an imminent crash. He points out that true market tops are typically marked by excessive speculation and unsustainable valuations, which, in his view, have not yet materialized. He also argues that AI-driven innovations are more likely to fuel growth than cause a downturn.

“Market tops near when IPO and speculative growth tech is going up with no revenue to back. As a sector, tech financial metrics are still within 1-sigma to mean. And BTW the whole AI saga which is leading the market to dip today comes with a promise that you can use AI to improve productivity, products, cash cycle, lower costs, and higher revenues,” the analyst challenged.

However, Evanss6 takes a firm stance, estimating a 90-95% chance the cycle has topped.

As the debate over whether the crypto market has topped remains highly contentious, traders must navigate the market cautiously. Balancing optimism with risk management strategies to maximize gains ultimately, but investors must also conduct their own research.

BeInCrypto data shows BTC was trading for $98,900 as of this writing, up by over 5% since Tuesday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Cardano Price To Hit $4 If This Happens, Analyst Says Despite 180M ADA Dump

A renowned crypto market analyst predicted that Cardano price could hit $4 ahead despite the current broader market uncertainty. ‘ALLINCRYPTO’ has forecasted a highly bullish outlook for the crypto recently, primarily against the backdrop of historical data. However, traders and investors are left scratching their heads as the market also saw massive ADA whale dumps, with 180 million coins offloaded.

Cardano Price Eyes $4, Analyst Predicts Citing Historical Data

According to ALLINCRYPTO’s X post on April 18, Cardano price is eyeing $4 as the analyst believes history is set to repeat itself. A major bull run lies ahead as the price is completing its final cycle, per the analyst.

For context, the ALLINCRYPTO’s chart spotlights how ADA had a massive bull run as of 2020 and continued till mid-2021. Citing this past performance, the analyst revealed that a $4 price target lies ahead.

Crypto market traders and investors are left speculating if such a feat is even possible amid broader market trends. It’s also noteworthy that historical performances don’t always guarantee future performances, given the dynamic nature of digital assets.

However, another renowned analyst has joined the fray by projecting a bullish outlook for Cardano price. Analyst Ali Martinez revealed in an X post on April 18 that the crypto is consolidating within a triangle, setting the stage for a potential 30% price move. This bullish prediction has slightly tilted the scales towards the optimistic side.

ADA coin’s price currently rests at $0.6298, up nearly 2.5% over the past day. The coin’s intraday bottom and peak were recorded as $0.612 and $0.6341, respectively.

Massive Whale Dumps Usher Caution

Besides, recent whale metrics have conversely stirred up some caution among investors, underscoring rising selling pressure on the asset. According to another X post by Ali Martinez, whales took advantage of the recent ADA price upswing to offload 180 million coins in the past 5 days.

This massive selling has also hinted at declining market confidence surrounding the cryptocurrency. As a result, market watchers are slightly apprehensive regarding the bullish predictions shared by the analysts.

Besides, a Cardano price prediction by CoinGape also revealed that bears remain in control of the asset at the moment, as per the 3-month bias indicator. In turn, broader market sentiments surrounding the coin’s long-term prospects remain shrouded in an enigma.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Chainlink Price To Hit $26 If LINK Breaks Past This Crucial Level

The Chainlink price is poised for liftoff, with a bullish rebound on the horizon. As LINK has soared past its key support level, analysts and traders remain bullish about the altcoin’s potential rally new heights.

Analysts like Ali Martinez and CRYPTOWZRD have identified critical levels for LINK, invoking the community’s attention. Let’s unveil Chainlink’s potential movements through the analyses of popular analysts.

Is Chainlink Price Ready for a Rebound?

In a detailed analysis, analyst Ali Martinez spotted key support and resistance levels for Chainlink. According to Ali’s analysis, Chainlink’s support level is established at $12.28, while $14.58 acts as a significant resistance hurdle.

With the Chainlink price breaking past its support line, which now acts as a foundation, the stage is set for a potential bullish reversal, signaling an upward trend. And, if LINK breaks past the $14.58 point, which has been a significant resistance point, further upside momentum comes into view, with potential new highs on the horizon.

Chainlink’s Next Target: Is $26 Within Reach?

According to market expert CRYPTOWZRD, Chainlink daily technical outlook is uncertain, with an indecisive close. However, the analyst highlighted that LINK is currently testing the significant $12.50 level. Given LINK’s oversold condition, its price movement is likely to follow Bitcoin’s trend.

Interestingly, as pointed out by CRYPTOWZRD, LINKBTC’s daily falling wedge formation suggests potential for an impulsive upside breakout. LINK itself is forming a daily falling wedge above its lower high trend line, indicating a possible rally towards the $16 resistance target and beyond.

Significantly, the chart presented by the expert indicates that LINK could hit $26 if it passes the resistance point. However, as per CoinGape’s Chainlink Price Prediction, LINK will reach a maximum of $15.24 in 2025.

Meanwhile, LINK’s intraday chart showed a lack of clear direction, with price movements confined to a narrow range. A breakout above $13.20 could present a trade opportunity, while a decline below $11.80 would signal a test of the main support level.

LINK Market Sentiment Analysis

In an “In/Out of the Money Around Price” analysis, Ali Martinez shared insights into the market sentiment for LINK. The analyst detailed the number of traders holding Chainlink at different price points.

At press time, Chainlink is trading at $12.81, up1.46%. Despite a 0.86% surge over the past week, LINK experienced a massive decline of 30.99% over the last month.

Notably, more addresses are holding LINK at a loss than at a profit. According to the chart, 53.06% of the holdings are “out of the money,” which means that they represent 78.24 million LINK bought at a price above the current $12.68.

At the same time, 44.63% of analyzed holdings, representing 65.81 million LINK, are ‘in the money,’ having been bought by traders at a price below $12.68. This data highlights potential support and resistance levels, with significant holdings at $12.47 and $14.19.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Lorenzo Protocol (BANK) Price Rallies 150% After This Binance Announcement

Lorenzo Protocol (BANK) price has defied the broader market’s recent uncertain trend by rallying 150% this Saturday. The institutional-grade asset management platform has stolen the spotlight primarily as a top CEX, Binance, unveiled a new listing for its native token. As a result, traders and investors are extensively eyeing this crypto, speculating whether the pump could sustain amid enhanced market exposure.

Lorenzo Protocol Price Bullish As Binance Futures Adds BANKUSDT Contract

At the time of reporting, BANK price traded at $0.05237, up by a staggering 150% in just a day. The cryptocurrency’s price surged from a bottom of $0.01839 intraday, in sync with Binance’s announcement.

According to an official press release by the crypto exchange on April 18, the platform’s futures trading division is adding the BANK USD-Margined perpetual contract to its stockpile of offerings. The platform’s colossal user base remains poised to enjoy up to 50x leverage while trading the asset. The timeline for this launch was set at 18:30 UTC, the same day.

Further, the top crypto exchange set the capped funding rate at +2.00%/-2.00%. Also, the same perpetual contract will be available for ‘Futures Copy’ trading, offering users enhanced opportunities to make returns.

For context, usual market sentiments about the coin’s future price action have turned highly bullish with the new offering. Traders and investors are expecting a substantial influx of funds into the token as the new listing paves the way for more investor interaction with the asset.

Now, crypto market watchers are thoroughly monitoring the token for further gains, highly optimistic amid an ongoing rally of 150% following the listing announcement. Lorenzo Protocol is an institutional-grade asset management platform that issues yield-bearing tokens backed by diverse underlying strategies.

Besides, it’s worth mentioning that Binance revealed another crypto listing this week, CoinGape reported. The CEX has revealed plans to open trading for Balance (EPT) shortly, garnering further attention among traders and investors.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin20 hours ago

Altcoin20 hours agoEthereum ETFs Record $32M Weekly Outflow; ETH Price Crash To $1.1K Imminent?

-

Market13 hours ago

Market13 hours agoMEME Rallies 73%, BONE Follows

-

Market23 hours ago

Market23 hours ago100 Million Tokens Could Trigger Decline

-

Market21 hours ago

Market21 hours agoWhy Relying on TVL Could Mislead Your DeFi Strategy

-

Market12 hours ago

Market12 hours agoPi Network Roadmap Frustrates Users Over Missing Timeline

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Price Stalls In Tight Range – Big Price Move Incoming?

-

Market11 hours ago

Market11 hours agoSolana (SOL) Price Rises 13% But Fails to Break $136 Resistance

-

Market18 hours ago

Market18 hours agoHow $31 Trillion in US Bonds Could Impact Crypto Markets in 2025

✓ Share: