Market

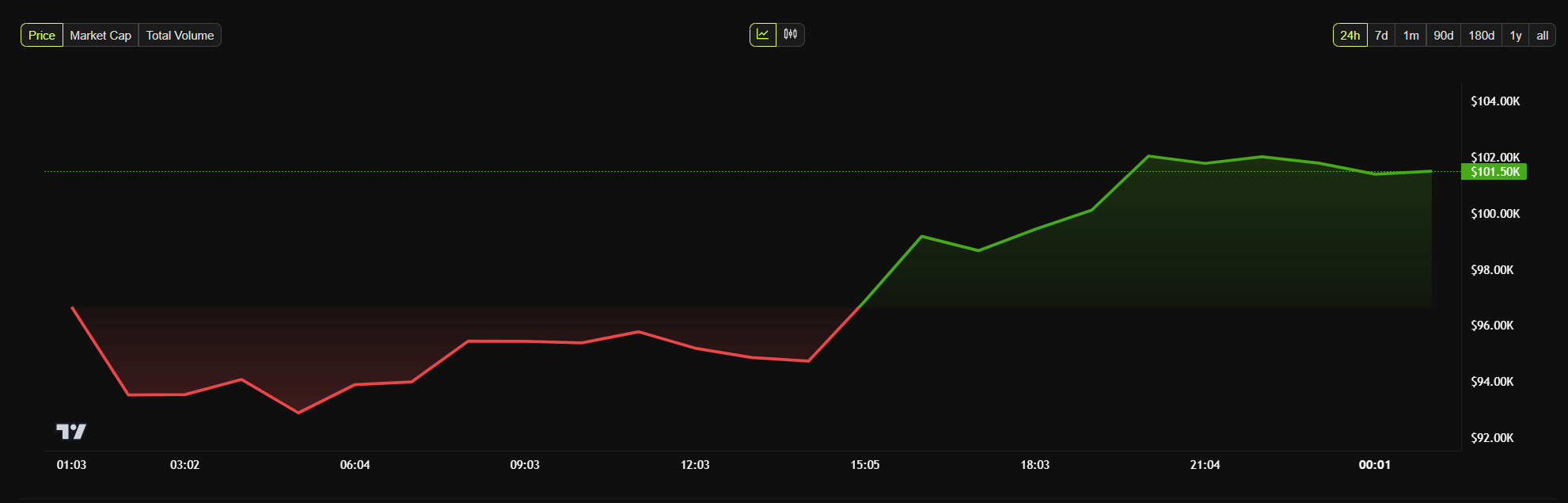

Bitcoin Rebounds to $100,000 as US-Canada Postpones Tariffs

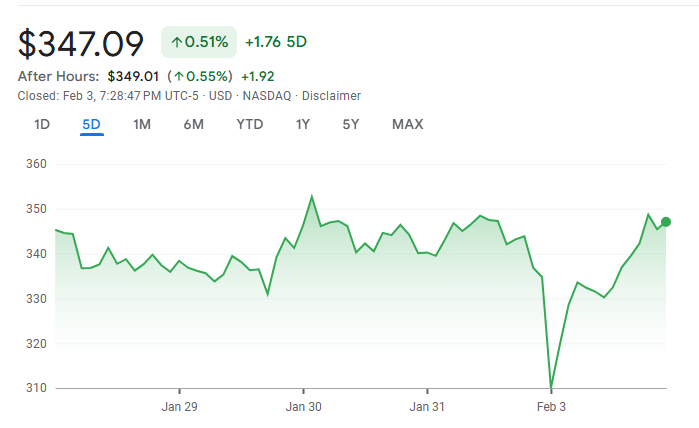

According to Prime Minister Justin Trudeau, tariffs between the US and Canada have been postponed for 30 days. Bitcoin recovered from its earlier plunge to $92,000, and MicroStrategy’s stock price rebounded 4%

The proposed trade war between the US and its closest neighbors has apparently been resolved (or delayed), but the tariffs against China still stand. This is an active and underreported component of possible future market actions.

Canada and US Halt Tariffs

The threat of US tariffs against Canada, Mexico, and China has played a chaotic role in crypto markets today. Tech stocks were already wobbling due to DeepSeek, but the implementation of tariffs caused a reported $2 billion wipeout. These reports may have underestimated the real damage, which could have gone as high as $10 billion.

Earlier on Monday morning, Bitcoin dipped to $92,000, and crypto-related stocks saw notable liquidations. Notably, MicroStrategy’s MSTR lost 8% following tariff announcements.

However, Mexican President Claudia Sheinbaum reached an agreement with Donald Trump, postponing a possible trade war. According to an announcement from Prime Minister Justin Trudeau, Canada has reached a similar agreement that will pause all tariffs for 30 days.

“I just had a good call with President Trump. Canada is implementing our $1.3 billion border plan — reinforcing the border with new choppers, technology and personnel, enhanced coordination with our American partners, and increased resources to stop the flow of fentanyl. Proposed tariffs will be paused for at least 30 days while we work together,” he said.

In other words, these tariffs have caused substantial trauma to the markets, but Canada and Mexico have already negotiated a deal. This is a particular relief because Canada is well-integrated in the crypto economy and may play an outsized role in crypto values.

Since the agreement, however, all the main “Made in USA” cryptocurrencies have bounced. Bitcoin and XRP, in particular, have mostly recovered from earlier liquidations. At the time of reporting, BTC surged back to $102,000.

Crypto Stocks Bounce Back

MicroStrategy and other Bitcoin mining stocks, such as MARA, have further substantially recovered from earlier losses following Canada’s deal on tariffs.

Earlier today, MicroStrategy surprised the market by breaking its 12-week streak on Bitcoin purchases. Michael Saylor did not directly comment on the reason for this pause, but its stock dropped substantially today.

However, this incident is far from a case of “all’s well that ends well.” Simply put, the US threatened one of its closest allies with major tariffs and severely damaged their working relationship.

That will certainly have consequences. It is unclear how this incident may impact US-Canada trade, but there are several worrying signs. Also, if the tariffs are enforced again after a month, a similar impact on the crypto market could be expected.

Additionally, while Canada and Mexico have negotiated with Trump, China has been quiet. The PRC has clearly demonstrated its recent ability to disrupt the US stock market, as illustrated by DeepSeek. Its response could be pivotal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Gears Up for Next Leg Higher—Upside Potential Builds

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price is slowly moving higher above the $83,500 zone. BTC must clear the $85,200 resistance zone to continue higher in the near term.

- Bitcoin found support at $83,200 and started a recovery wave.

- The price is trading above $84,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $84,650 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,200 zone.

Bitcoin Price Eyes Fresh Upside

Bitcoin price started a fresh decline below the $86,200 and $85,500 levels. BTC even declined below the $84,00 level before the bulls appeared.

The price tested the $83,200 support. A low was formed at $83,171 and the price recently started a recovery wave. The price climbed above the $84,500 resistance zone. There was a break above the 50% Fib retracement level of the downward move from the $86,400 swing high to the $83,171 low.

Besides, there was a break above a connecting bearish trend line with resistance at $84,650 on the hourly chart of the BTC/USD pair. Bitcoin price is now trading above $84,500 and the 100 hourly Simple moving average.

On the upside, immediate resistance is near the $85,200 level. It is near the 61.8% Fib retracement level of the downward move from the $86,400 swing high to the $83,171 low. The first key resistance is near the $85,500 level. The next key resistance could be $86,500.

A close above the $86,500 resistance might send the price further higher. In the stated case, the price could rise and test the $87,200 resistance level. Any more gains might send the price toward the $88,800 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,200 resistance zone, it could start another decline. Immediate support on the downside is near the $84,500 level. The first major support is near the $84,000 level.

The next support is now near the $83,200 zone. Any more losses might send the price toward the $82,500 support in the near term. The main support sits at $81,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $83,200.

Major Resistance Levels – $85,200 and $85,500.

Market

Circle Introduces On-Chain Refund Protocol to Strengthen USDC Payments

Circle, the issuer behind the USDC stablecoin, has officially introduced the Refund Protocol—an advanced smart contract framework developed by Circle Research.

This innovation marks a turning point for decentralized stablecoin payments by directly embedding on-chain dispute resolution mechanisms into the blockchain, ensuring digital commerce transparency, security, and trust.

Role of Refund Protocol in the Circle Ecosystem

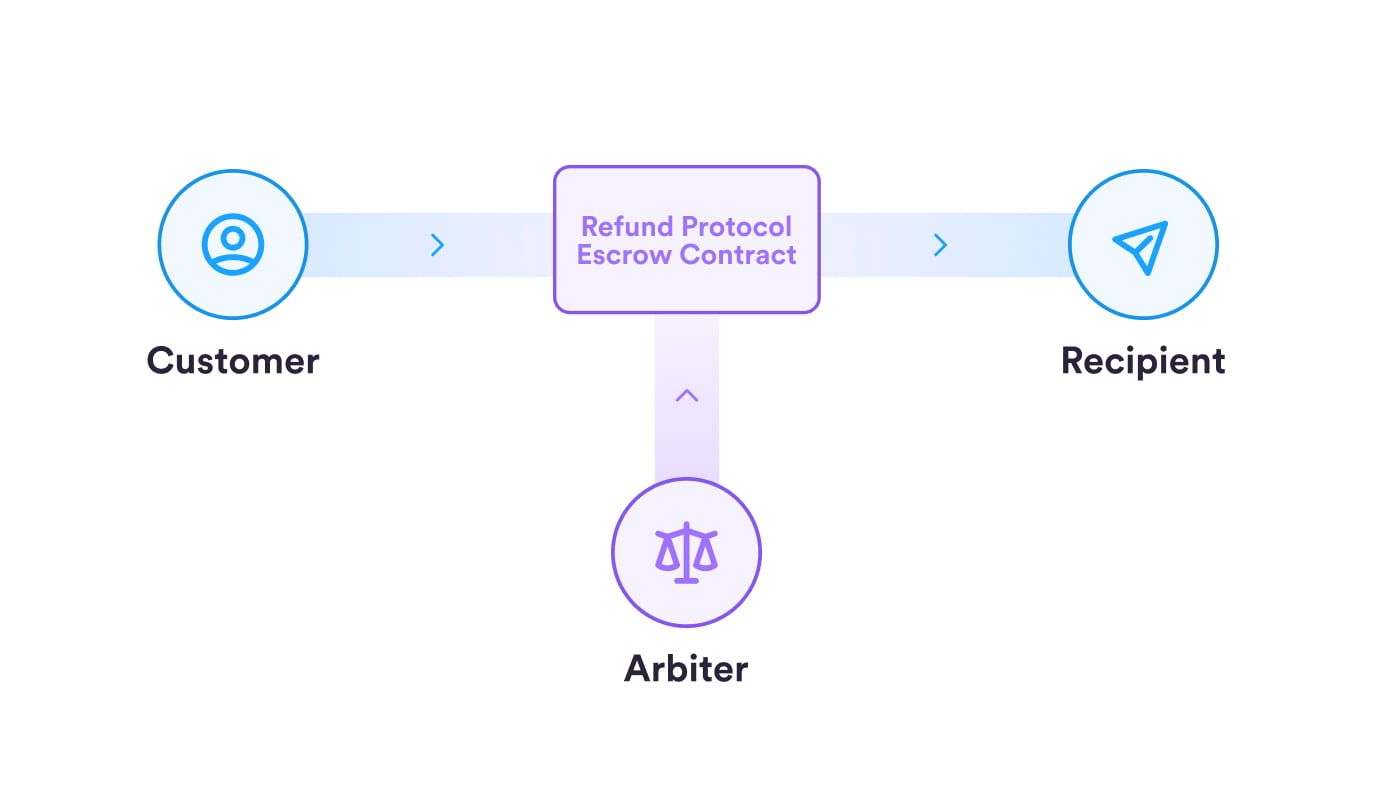

Traditional stablecoin payment models often lack on-chain refund or dispute resolution mechanisms. Typically, the sender’s stablecoins are held in escrow for a period before being released to the recipient.

An external party, known as an arbiter, oversees this escrow account. However, resolution usually happens off-chain when disputes arise, leading to two major concerns: centralized control by the arbiter and lack of transparency in the dispute process.

To solve this, Circle has designed the Refund Protocol to enhance the overall stablecoin payment experience, especially for USDC. The protocol acts as a smart contract, enabling non-custodial escrow and on-chain dispute resolution.

“Today, Circle’s R&D team released a new Refund Protocol for stablecoin payments. This builds on our earlier open source releases for confidential payments as well as reversible payments. Progress in mainstreaming stablecoin payments,” said Circle CEO Jeremy Allaire.

Rather than controlling the escrow account, the Refund Protocol can only do two things: release funds to the recipient or refund them to the customer. This removes reliance on third-party intermediaries, increases transparency, and boosts efficiency and user trust.

Refund Protocol to Help USDC Gain Market Share?

According to data from DefiLlama, USDT from Tether currently dominates the stablecoin market with over 61% market share. Although USDC holds the second position, its market capitalization is still less than half that of USDT.

The launch of Refund Protocol provides Circle with a strategic edge. By offering developers and businesses an easy way to integrate USDC payments into e-commerce platforms, NFT marketplaces, and DeFi applications, the protocol strengthens USDC’s position as a flexible and reliable medium of exchange.

Additionally, Refund Protocol gives Circle an advantage by providing a decentralized, low-cost, and transparent solution. This will help USDC stand out in real-world applications.

Refund Protocol may face regulatory hurdles despite its innovation, especially in jurisdictions with strict blockchain laws. The legal recognition of on-chain dispute resolution remains uncertain in many regions, potentially posing one of the biggest obstacles to widespread adoption.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Under Pressure—Bearish Setup Could Trigger Sell-Off

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Bitcoin24 hours ago

Bitcoin24 hours agoGary Gensler Explains Why Bitcoin Will Outlast Altcoins

-

Market23 hours ago

Market23 hours agoBitcoin Whales Withdraw $280 Million: Bullish Signal?

-

Market16 hours ago

Market16 hours agoOver $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

-

Altcoin16 hours ago

Altcoin16 hours agoCZ Honors Nearly $1 Billion Token Burn Promise

-

Altcoin23 hours ago

Altcoin23 hours agoHow Crypto Traders Made $666K from $4.5K in One Trade?

-

Market22 hours ago

Market22 hours agoBitcoin Price Range-Bound—But a Move Higher May Be Brewing?

-

Market21 hours ago

Market21 hours agoExpanding Blockspace and Enhancing Privacy

-

Market20 hours ago

Market20 hours agoWhy XRP Could Beat Dogecoin, Solana In ETF Race And Trigger A Price Surge