Market

AI, RWA, and Meme Coins

Crypto narratives are undergoing major shifts this week, with AI tokens, Real-World Assets (RWA), and meme coins all seeing significant corrections. The AI sector, once a top-performing category, has seen its market cap drop 42% in the past month, with major tokens like FET and RENDER extending their losses.

Meanwhile, the RWA sector has fallen from $72 billion to $55.5 billion in just three days, though regulatory clarity in the US could provide long-term support. Meme coins have also taken a hit, with the top 10 largest tokens all down at least 22% in the last week.

AI Tokens

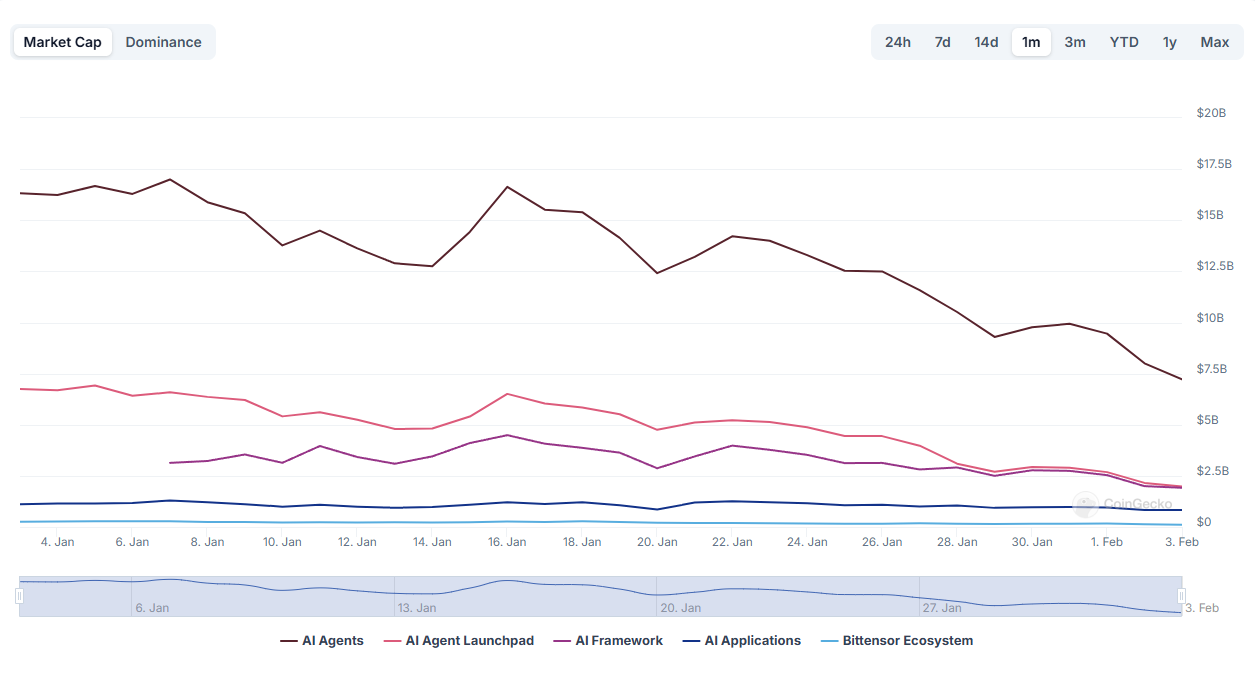

The artificial intelligence sector has been one of the hardest-hit areas in the crypto market over the past month. After reaching a peak market cap of $60 billion on January 6, it has now fallen to $32.8 billion, reflecting a sharp decline.

Some of the biggest AI tokens have taken heavy losses in the past seven days, with FET down 32.2%, RENDER dropping 27.21%, and VIRTUAL losing 35%.

The correction, which began roughly two weeks ago with DeepSeek’s impact, has extended across the sector, pushing many AI tokens to multi-month lows.

With the AI crypto market cap down nearly 42% in 30 days, this week could be crucial in determining whether these assets stabilize and get ready for a rebound or face further downside.

Real-World Assets (RWA)

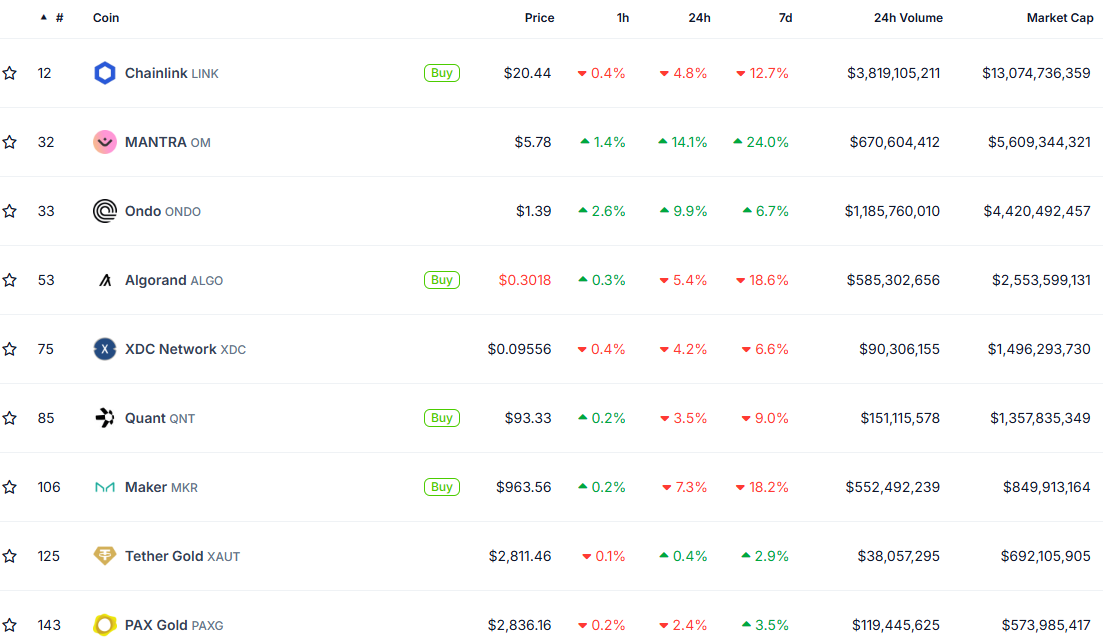

The Real-World Assets (RWA) sector has experienced a sharp decline, with its market cap dropping from $72 billion on January 31 to $55.5 billion in just three days.

Despite this downturn, RWA remains a significant asset class within crypto, currently comprising nine projects with market caps above $1 billion. Key players such as Chainlink, Avalanche, Hedera, Mantra, and Ondo continue to drive the sector’s development.

Although the recent correction has impacted RWA valuations, the sector continues to be one of the most interesting crypto narratives. It stands to gain from potential regulatory advancements in the US, a strong promise made by Donald Trump.

A clearer and more favorable regulatory framework could unlock new opportunities for RWA applications. With institutional giants like BlackRock and Morgan Stanley showing interest, the sector is already drawing mainstream attention, further strengthening its long-term growth prospects.

Meme Coins

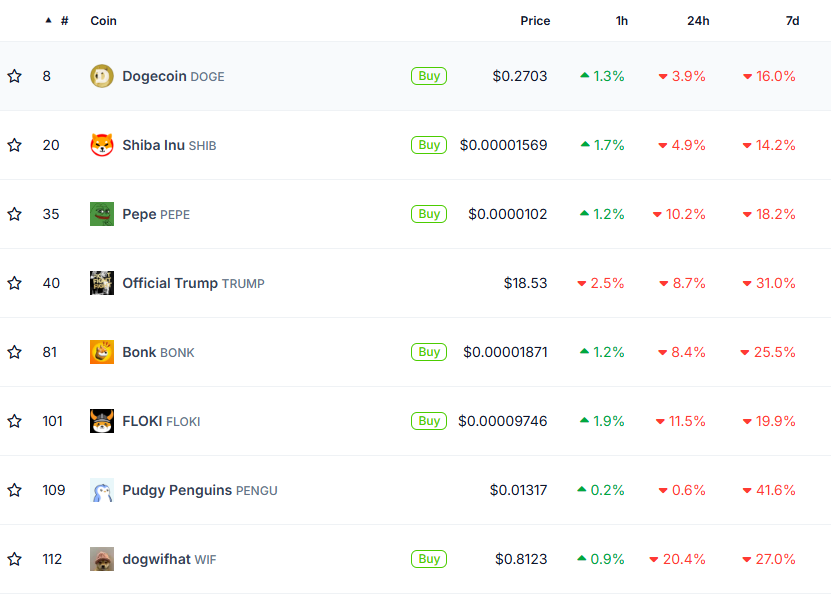

The meme coin sector, one of the biggest crypto narratives in the market, has taken a major hit in today’s liquidation chaos. The top 10 largest meme coins are all down at least 22% in the past week. PENGU has led the losses, dropping 46%, while only five meme coins now maintain a market cap above $1 billion.

Over the last 30 days, the entire meme coins market has shrunk by 37%, bringing its total valuation down to $68 billion. This sharp correction highlights a shift in sentiment, with meme coins losing the momentum they had in previous months.

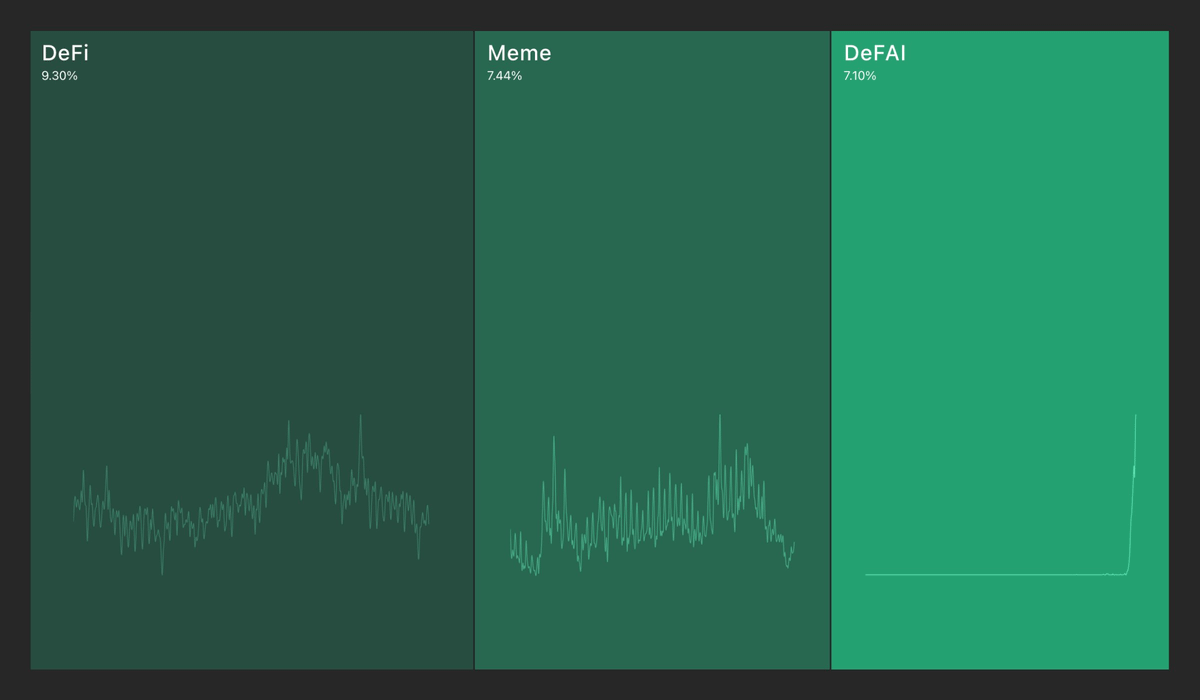

Recent data from Kaito suggests that meme coin mindshare has now fallen below that of DeFi, a trend that hasn’t occurred in months.

This shift implies that investors may be rotating funds away from meme coins and into more traditional DeFi assets or stablecoins.

With lower engagement and declining prices, meme coins are facing increased selling pressure. Unless a new catalyst emerges, their market dominance could continue to fade.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Consolidation About To Reach A Bottom, Wave 5 Says $5.85 Is Coming

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP is still in consolidation mode after hitting a new seven-year high in January 2025. This consolidation has seen the price drop slowly, but steadily, losing around 40% of its value since then. Currently, bulls seem to have created support for the altcoin at $2, as this level continues to hold even through crashes. Thus, it has created the expectation that the bottom could be close for the XRP price, and this could serve as a bounce-off point.

XRP Price Consolidation Could Be Over Soon

Taking to X (formerly Twitter), crypto analyst Dark Defender revealed that the consolidation that the XRP Price has been stuck in for months now is coming to an end. The analyst used the monthly chart for the analysis, calling out an end and a bottom for the XRP price. According to him, this is actually the “Final Consolidation” for XRP, suggesting that this is where a breakout would start from.

Related Reading

With the consolidation expected to come to an end soon, the crypto analyst highlights what could be next for the altcoin using the 5-Wave analysis. Now, in total, these five waves are still very bullish for the price and could end up marking a new all-time high.

For the first wave, Dark Defender calls it the Impulsive Wave 1, which is expected to begin the uptrend. This first wave is expected to push the price back to $3 before the second wave starts, and this second wave is bearish.

The second wave would trigger a crash from $3 back toward $2.2, providing the setup for the third wave. Once the third wave begins, this is where the crypto analyst expects the XRP price to hit a new all-time high. The target for Wave 3 puts the XRP price as high as $5, clearing the 2017 all-time high of $3.8.

Next in line is the fourth wave, which is another bearish wave. This wave will cause at least a 30% crash, according to the chart shared by the crypto analyst, taking it back toward the $3 territory once again. However, just like the second bearish wave, the fourth bearish wave is expected to set up the price for a final and more explosive Wave 5.

Related Reading

Once the fifth wave is in action, a brand-new all-time high is expected to happen, with the price rising over 100% from the bottom of the fourth wave. The target for this, as shown in the chart, is over $6.

As for the crypto analyst, the major targets highlighted during this wave action are $3.75 and $58.85. Then, for major supports and resistances, supports are $1.88 and $1.63, while resistances lie at $2.22 and $2.30.

Featured image from Dall.E, chart from TradingView.com

Market

Despite an 18% Drop, XRP’s Exchange Supply Hits Lows—Bullish Setup Ahead?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has been trading under pressure in recent weeks, losing much of the momentum it built during its late 2024 to early 2025 rally. After reaching highs above $3.40, the asset has experienced an 18.3% decline over the past month, reflecting broader market softness.

At the time of writing, XRP trades significantly below its peak at a price of $2.06, with subdued investor activity and falling market participation across both spot and derivatives markets.

Related Reading

XRP On-Chain Activity Slows, But Price Remains Relatively Stable

Amid XRP’s decline, a CryptoQuant analyst known as EgyHash has recently shared his analysis on the altcoin in a post titled, “XRP’s Market Paradox: With Ledger Activity Dipping 80%, Is a Rebound on the Horizon?”

According to EgyHash, XRP’s on-chain and futures market data presents a mixed picture—declining activity but resilience in price. EgyHash noted that XRP Ledger activity has fallen sharply since December, with the percentage of active addresses down by 80%.

Similar declines have been observed in the futures market, where open interest has dropped roughly 70% from its highs, and funding rates have occasionally turned negative.

He added that the Estimated Leverage Ratio, which gauges average user leverage by comparing open interest to coin reserves, has also dropped significantly.

Despite these indicators pointing to weakening momentum, the altcoin’s price has only declined about 35% from its peak. This is a milder correction compared to other assets such as Ethereum, which has fallen roughly 60% over the same period.

Additionally, the altcoin’s Exchange Reserve has continued to decline, reaching levels last observed in July 2023. Lower reserves typically suggest that fewer tokens are available for immediate sale, a factor that can help support prices during market downturns.

According to EgyHash, this trend, along with relatively stable pricing, could indicate growing long-term confidence in the asset.

Institutional Developments Could Strengthen Market Sentiment

While on-chain metrics remain a focus, institutional developments may also play a role in shaping XRP’s future trajectory. Hong Kong-based investment firm HashKey Capital recently announced the launch of the HashKey XRP Tracker Fund—the first XRP-focused investment vehicle in Asia.

Backed by Ripple as the anchor investor, the fund is expected to transition into an exchange-traded fund (ETF) in the future. The initiative is designed to attract more institutional capital into the XRP ecosystem.

HashKey Capital is launching Asia’s first XRP Tracker Fund—with @Ripple as an early investor.

This marks a major step in expanding institutional access to XRP, the third-largest token by market cap. 🧵👇

— HashKey Capital (@HashKey_Capital) April 18, 2025

HashKey Capital has also indicated that this collaboration with Ripple could lead to further projects, including tokenized investment products and decentralized finance (DeFi) solutions.

Related Reading

Vivien Wong, a partner at HashKey, emphasized the strategic value of integrating Ripple’s network with regulated investment infrastructure across Asia.

Although the altcoin faces near-term pressure, long-term developments, including decreasing exchange reserves and rising institutional interest, may support its recovery as the broader market stabilizes.

Featured image created with DALL-E, Chart from TradingView

Market

Matchain’s Petrix Barbosa Talks the Future of Digital Identity

In an engaging session during Paris Blockchain Week, BeInCrypto caught up with Petrix Barbosa, the innovative mind behind Matchain, a blockchain venture that’s reshaping how digital identity and data sovereignty are approached.

Barbosa, who transitioned from a successful career as a venture capitalist, where he managed investments across 250 projects, brings a wealth of experience and a unique perspective to the blockchain landscape. Petrix Barbosa’s insights reveal a compelling vision for the future of blockchain, focusing on user empowerment and innovative use of technology to solve enduring problems in digital identity and data management.

Petrix Barbosa Discusses Matchain and its Mission

Matchain is a layer 2 blockchain platform that primarily addresses the challenges of identity and data sovereignty. Our mission is to empower users by giving them control over their digital identities and data, thus ensuring that they’re the primary beneficiaries of their online presence.

Barbosa on His Pivot from Venture Capital

In my time as an investor, I witnessed many great ideas fail to reach their potential due to the lack of a substantial user base or poor market timing. This inspired me to transition from funding projects to creating a platform that not only serves my vision but also provides tangible solutions to widespread issues in the blockchain community—primarily, user engagement and application.

Matchain’s Innovations in the Area of Identity Sovereignty

Matchain introduces a novel approach to managing digital identity. Unlike traditional models where user data is siloed across various platforms, Matchain allows users to have a single digital identity that spans across both Web2 and Web3. This is crucial for enabling a seamless transition and interaction between these two worlds.

How Matchain Integrates Existing Web2 Infrastructure

Our platform acts as a bridge between the decentralized ecosystem of Web3 and the more traditional Web2 infrastructure. By allowing users to manage their digital identities across both platforms, we facilitate a smoother interaction that enhances user experience while maintaining high security and trust.

Future Developments From Matchain

Looking ahead, we aim to expand our user base significantly. Currently, we are backed by strategic partnerships, like the one with Paris Saint-Germain, which not only broadens our exposure but also integrates our technology into mainstream applications.

In the next two years, we plan to onboard millions of users, leveraging our innovative solutions to enhance their digital interactions.

Barbosa on Unique Challenges in Developing Matchain

The biggest challenge was shifting the focus from simply creating a blockchain solution to ensuring it was user-centric and capable of addressing real-world problems. This involved integrating AI to manage and analyze data effectively, ensuring that our platform could deliver personalized and contextually relevant experiences to users.

Matchain Over the Next Five Years

In five years, I envision Matchain at the forefront of blockchain technology, leading the charge in digital identity management and data sovereignty. Our platform will likely become a critical tool for users and companies looking to navigate the complexities of the digital age securely and efficiently.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market13 hours ago

Market13 hours agoMEME Rallies 73%, BONE Follows

-

Market23 hours ago

Market23 hours ago100 Million Tokens Could Trigger Decline

-

Market21 hours ago

Market21 hours agoWhy Relying on TVL Could Mislead Your DeFi Strategy

-

Altcoin20 hours ago

Altcoin20 hours agoEthereum ETFs Record $32M Weekly Outflow; ETH Price Crash To $1.1K Imminent?

-

Market12 hours ago

Market12 hours agoPi Network Roadmap Frustrates Users Over Missing Timeline

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Price Stalls In Tight Range – Big Price Move Incoming?

-

Market11 hours ago

Market11 hours agoSolana (SOL) Price Rises 13% But Fails to Break $136 Resistance

-

Market18 hours ago

Market18 hours agoHow $31 Trillion in US Bonds Could Impact Crypto Markets in 2025