Market

DEXE Price Soars to Four-Year High Amid Market Downturn

While many cryptocurrencies struggle with price declines, DEXE has bucked the trend, emerging as the market’s top gainer in the past 24 hours. The governance token has outperformed many leading assets, which have faced losses during the same period.

With steady demand for the token, it may extend its gains in the short term.

DEXE Leads Market Rally

The DeXe protocol is an open-source platform for creating and managing decentralized autonomous organizations (DAOs). The DeXe DAO, which has DEXE as its governance token, controls the protocol.

DEXE currently trades at $22.67, noting a 4% price surge over the past 24 hours, making it the market’s top gainer. This rally has pushed the token’s price to its highest level since December 2021. With strengthening demand, DEXE appears poised to maintain this uptrend.

The setup of its Super Trend indicator supports this bullish outlook. At press time, the indicator’s green line acts as dynamic support for DEXE’s price at $14.52.

This momentum indicator helps traders identify the market’s direction by placing a line above or below the price chart based on the asset’s volatility. As with DEXE, when an asset’s price trades above the green line of the Super Trend indicator, it signals a bullish trend, indicating that the market is in an uptrend and that buying pressure is dominant.

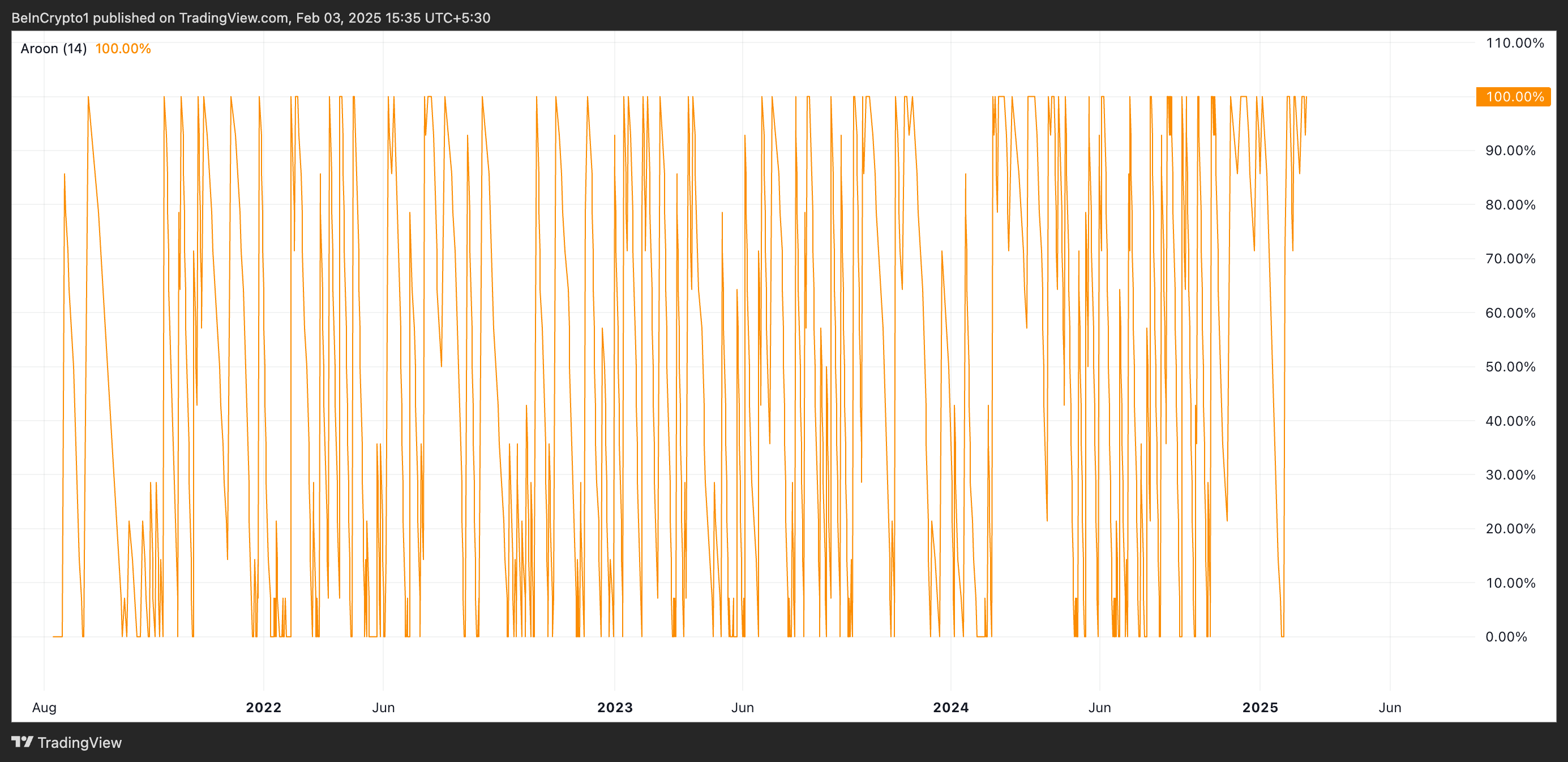

Moreover, DEXE’s Aroon Up Line at 100% indicates its current uptrend is strong. The Aroon indicator measures the strength and direction of a trend by analyzing the time since an asset’s recent highs (Aroon Up) and lows (Aroon Down).

When an asset’s Aroon Up line is at 100%, it indicates that its most recent high was reached very recently. This is true of DEXE, which currently trades at a four-year high.

DEXE Price Prediction: Is an All-Time High on the Horizon?

If this bullish pressure persists and DEXE maintains its uptrend, it could climb to its all-time high of $35.41, which it last reached in March 2021.

However, DEXE could shed its recent gains and drop toward $17.89 if profit-taking makes a comeback.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Price Drops 18% as Bearish Pressure Dominates

Cardano’s (ADA) price has dropped 30% in a month and roughly 18% in the past two weeks. Its market cap has now fallen to $27 billion, reflecting the broader weakness in altcoins.

Technical indicators, including a rising ADX and a bearish Ichimoku Cloud setup, suggest that ADA’s current downtrend is strengthening. With key support at $0.519 and a potential downside of $0.32, ADA needs a strong reversal to reclaim $0.78 and push toward the $1 mark.

Cardano ADX Shows the Current Downtrend Is Very Strong

Cardano ADX has surged to 44, up from just 11.2 three days ago, signaling a sharp increase in trend strength. Since ADX measures the strength of a trend without indicating direction, this jump confirms that ADA’s current price movement is gaining momentum.

Given that ADA is in a downtrend, this rising ADX suggests that bearish pressure is intensifying rather than weakening.

ADX values above 25 indicate a strong trend, while readings above 40 suggest an even more dominant market move.

With ADA’s ADX now at 44, the ongoing downtrend appears well-established, making a reversal less likely unless a significant shift in buying activity occurs. If selling pressure continues, ADA could face further downside, with lower support levels coming into focus.

ADA Ichimoku Cloud Shows a Bearish Scenario

Cardano Ichimoku Cloud setup confirms a strong bearish trend. The price is trading well below the cloud, which is a clear sign of downside momentum. The future cloud is also turning bearish, suggesting that selling pressure is likely to continue.

Additionally, the Tenkan-sen (blue line) remains below the Kijun-sen (red line), reinforcing the short-term bearish outlook.

For ADA to reverse this trend, it would need to break back above the cloud and establish it as support. However, with the Chikou Span (green line) trailing far below the price action and the cloud widening, the bearish momentum remains strong.

Unless buying volume increases significantly, ADA price could struggle to regain key resistance levels and may continue facing downside risk.

ADA Price Prediction: Can Cardano Reclaim $1 This Week?

Cardano price is currently facing resistance at $0.78 and support at $0.519. If the ongoing downtrend persists and ADA loses this support, the next major level to watch is $0.32, which would mark its lowest price since late November 2024.

Given the strong bearish momentum, breaking below $0.519 could accelerate the decline.

However, if the broader altcoin market starts recovering, Cardano could attempt to reclaim $0.78.

A successful breakout above this level could push it toward $0.87, and if the momentum continues, ADA could reach $1, representing a potential 40.8% gain. For this scenario to play out, buying pressure would need to increase significantly.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

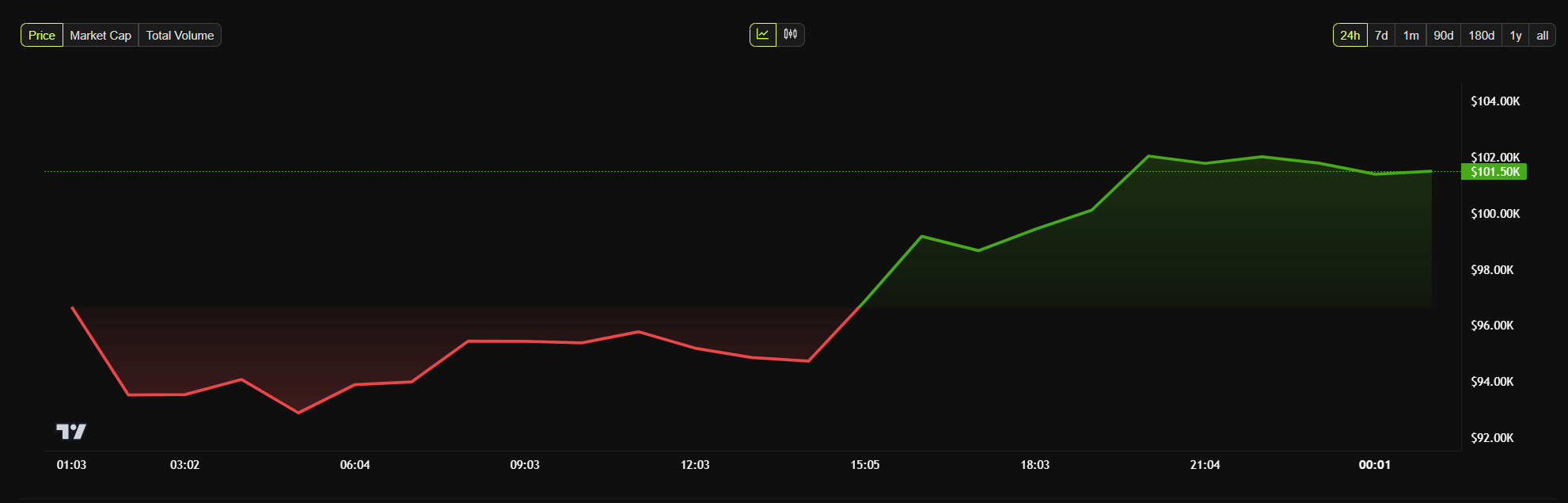

Bitcoin Rebounds to $100,000 as US-Canada Postpones Tariffs

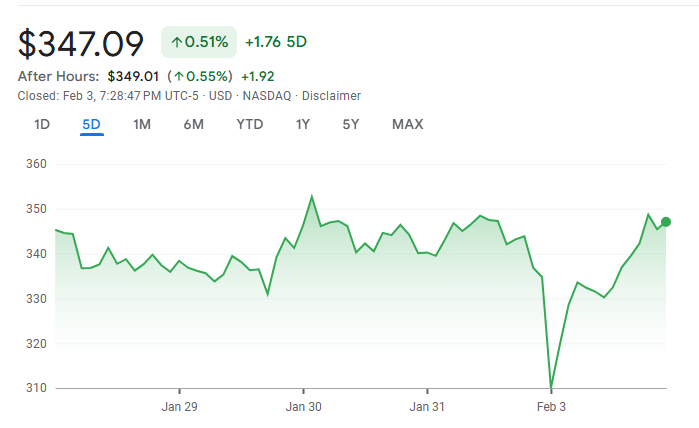

According to Prime Minister Justin Trudeau, tariffs between the US and Canada have been postponed for 30 days. Bitcoin recovered from its earlier plunge to $92,000, and MicroStrategy’s stock price rebounded 4%

The proposed trade war between the US and its closest neighbors has apparently been resolved (or delayed), but the tariffs against China still stand. This is an active and underreported component of possible future market actions.

Canada and US Halt Tariffs

The threat of US tariffs against Canada, Mexico, and China has played a chaotic role in crypto markets today. Tech stocks were already wobbling due to DeepSeek, but the implementation of tariffs caused a reported $2 billion wipeout. These reports may have underestimated the real damage, which could have gone as high as $10 billion.

Earlier on Monday morning, Bitcoin dipped to $92,000, and crypto-related stocks saw notable liquidations. Notably, MicroStrategy’s MSTR lost 8% following tariff announcements.

However, Mexican President Claudia Sheinbaum reached an agreement with Donald Trump, postponing a possible trade war. According to an announcement from Prime Minister Justin Trudeau, Canada has reached a similar agreement that will pause all tariffs for 30 days.

“I just had a good call with President Trump. Canada is implementing our $1.3 billion border plan — reinforcing the border with new choppers, technology and personnel, enhanced coordination with our American partners, and increased resources to stop the flow of fentanyl. Proposed tariffs will be paused for at least 30 days while we work together,” he said.

In other words, these tariffs have caused substantial trauma to the markets, but Canada and Mexico have already negotiated a deal. This is a particular relief because Canada is well-integrated in the crypto economy and may play an outsized role in crypto values.

Since the agreement, however, all the main “Made in USA” cryptocurrencies have bounced. Bitcoin and XRP, in particular, have mostly recovered from earlier liquidations. At the time of reporting, BTC surged back to $102,000.

Crypto Stocks Bounce Back

MicroStrategy and other Bitcoin mining stocks, such as MARA, have further substantially recovered from earlier losses following Canada’s deal on tariffs.

Earlier today, MicroStrategy surprised the market by breaking its 12-week streak on Bitcoin purchases. Michael Saylor did not directly comment on the reason for this pause, but its stock dropped substantially today.

However, this incident is far from a case of “all’s well that ends well.” Simply put, the US threatened one of its closest allies with major tariffs and severely damaged their working relationship.

That will certainly have consequences. It is unclear how this incident may impact US-Canada trade, but there are several worrying signs. Also, if the tariffs are enforced again after a month, a similar impact on the crypto market could be expected.

Additionally, while Canada and Mexico have negotiated with Trump, China has been quiet. The PRC has clearly demonstrated its recent ability to disrupt the US stock market, as illustrated by DeepSeek. Its response could be pivotal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

AI, RWA, and Meme Coins

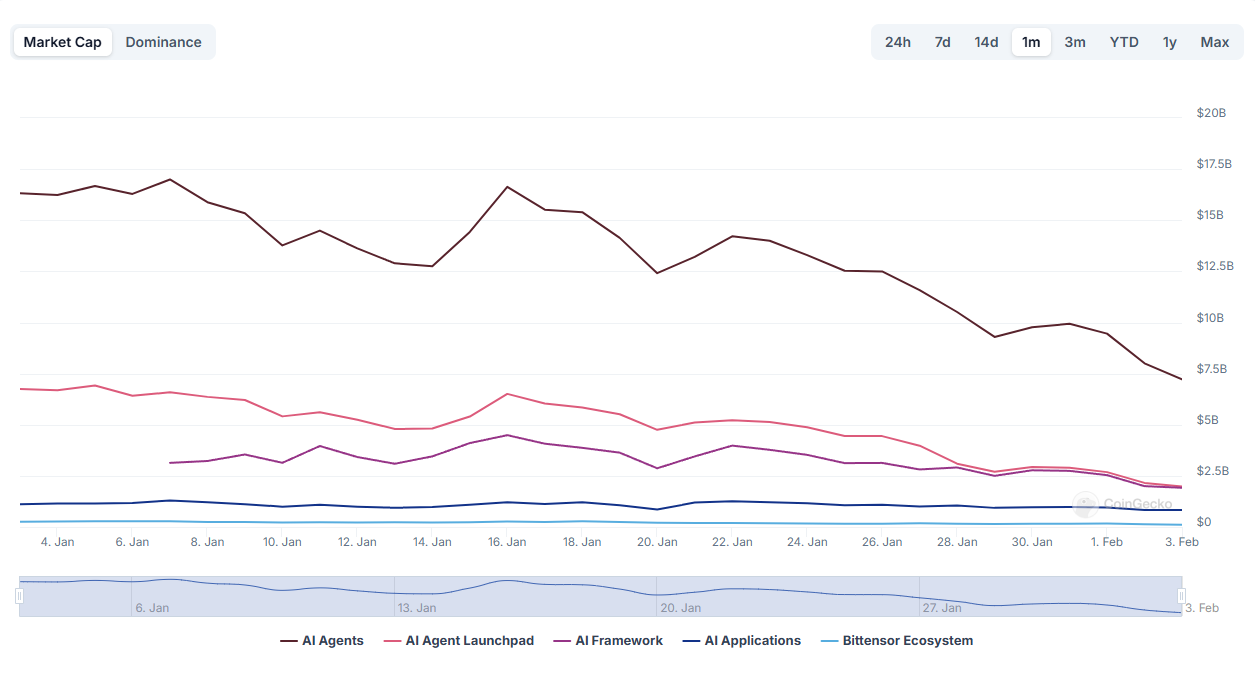

Crypto narratives are undergoing major shifts this week, with AI tokens, Real-World Assets (RWA), and meme coins all seeing significant corrections. The AI sector, once a top-performing category, has seen its market cap drop 42% in the past month, with major tokens like FET and RENDER extending their losses.

Meanwhile, the RWA sector has fallen from $72 billion to $55.5 billion in just three days, though regulatory clarity in the US could provide long-term support. Meme coins have also taken a hit, with the top 10 largest tokens all down at least 22% in the last week.

AI Tokens

The artificial intelligence sector has been one of the hardest-hit areas in the crypto market over the past month. After reaching a peak market cap of $60 billion on January 6, it has now fallen to $32.8 billion, reflecting a sharp decline.

Some of the biggest AI tokens have taken heavy losses in the past seven days, with FET down 32.2%, RENDER dropping 27.21%, and VIRTUAL losing 35%.

The correction, which began roughly two weeks ago with DeepSeek’s impact, has extended across the sector, pushing many AI tokens to multi-month lows.

With the AI crypto market cap down nearly 42% in 30 days, this week could be crucial in determining whether these assets stabilize and get ready for a rebound or face further downside.

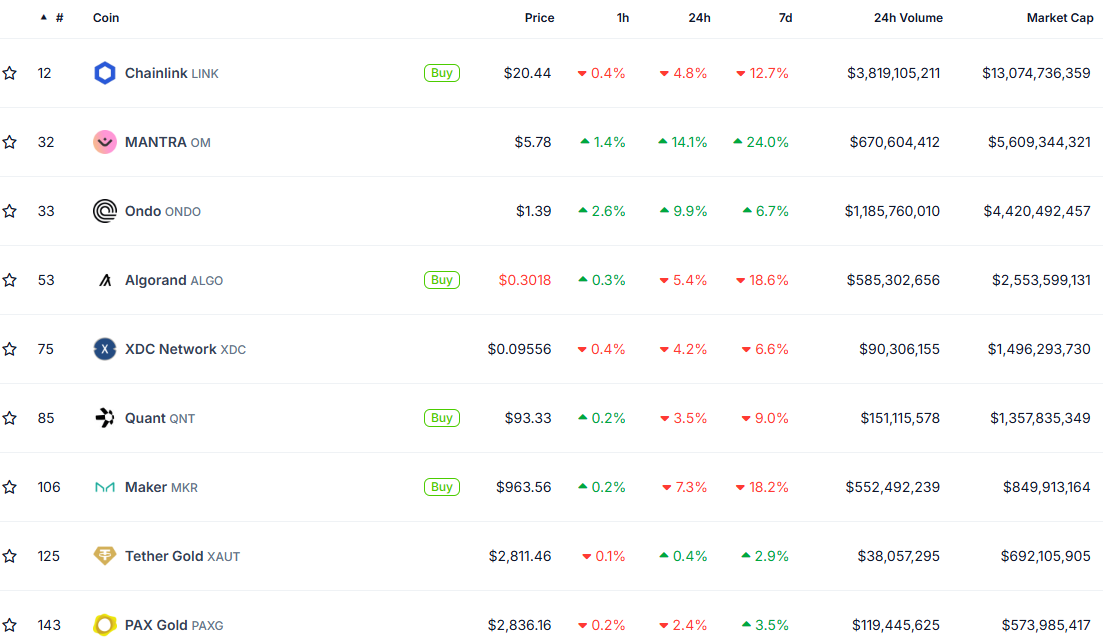

Real-World Assets (RWA)

The Real-World Assets (RWA) sector has experienced a sharp decline, with its market cap dropping from $72 billion on January 31 to $55.5 billion in just three days.

Despite this downturn, RWA remains a significant asset class within crypto, currently comprising nine projects with market caps above $1 billion. Key players such as Chainlink, Avalanche, Hedera, Mantra, and Ondo continue to drive the sector’s development.

Although the recent correction has impacted RWA valuations, the sector continues to be one of the most interesting crypto narratives. It stands to gain from potential regulatory advancements in the US, a strong promise made by Donald Trump.

A clearer and more favorable regulatory framework could unlock new opportunities for RWA applications. With institutional giants like BlackRock and Morgan Stanley showing interest, the sector is already drawing mainstream attention, further strengthening its long-term growth prospects.

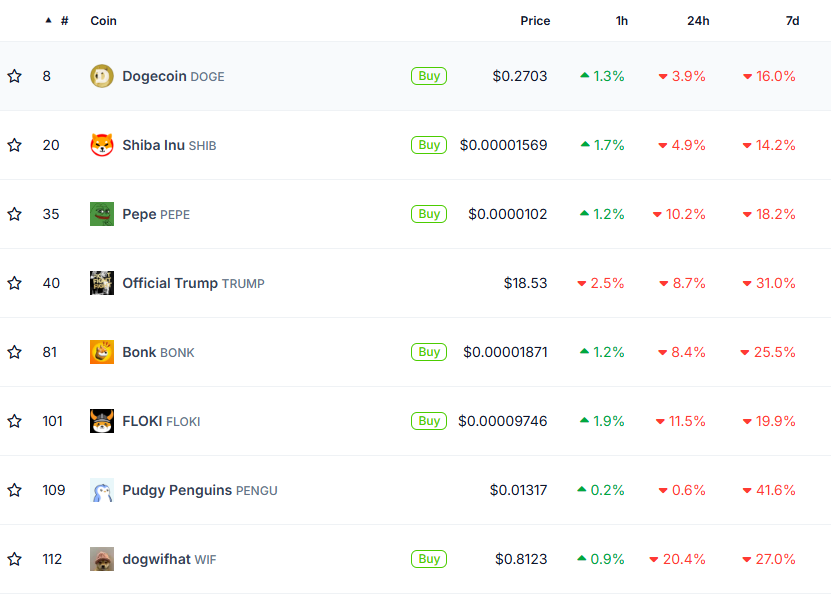

Meme Coins

The meme coin sector, one of the biggest crypto narratives in the market, has taken a major hit in today’s liquidation chaos. The top 10 largest meme coins are all down at least 22% in the past week. PENGU has led the losses, dropping 46%, while only five meme coins now maintain a market cap above $1 billion.

Over the last 30 days, the entire meme coins market has shrunk by 37%, bringing its total valuation down to $68 billion. This sharp correction highlights a shift in sentiment, with meme coins losing the momentum they had in previous months.

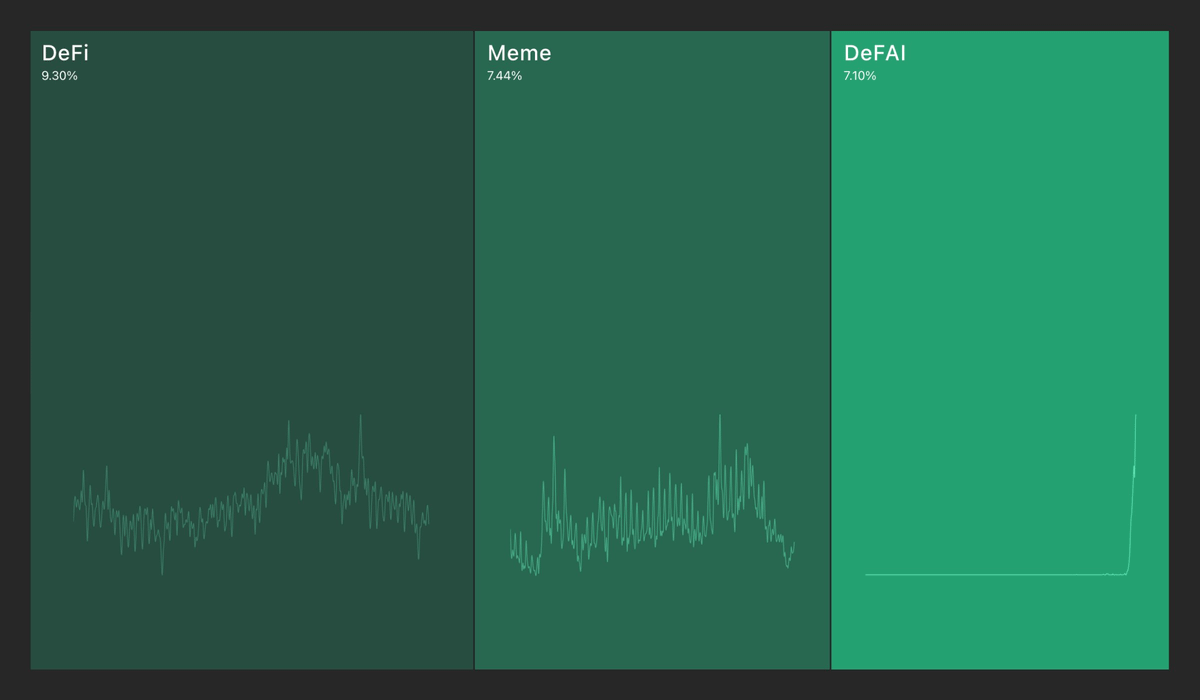

Recent data from Kaito suggests that meme coin mindshare has now fallen below that of DeFi, a trend that hasn’t occurred in months.

This shift implies that investors may be rotating funds away from meme coins and into more traditional DeFi assets or stablecoins.

With lower engagement and declining prices, meme coins are facing increased selling pressure. Unless a new catalyst emerges, their market dominance could continue to fade.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoDogecoin (DOGE) Plunges to $0.20: Is This the Bottom or More Pain Ahead?

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Says Dogecoin Is Yet To Complete 5th Wave, Here’s How High It Must Go

-

Market22 hours ago

Market22 hours agoWhat’s Next After the Major Decline?

-

Market21 hours ago

Market21 hours agoXRP Price Crashes Hard: Is There a Recovery in Sight?

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Price Bullish Ahead Of Important Date, Why Is February 4th So Important?

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin Crashes To $93K In Market Shake-Up

-

Market20 hours ago

Market20 hours agoCutting US Debt? Senator Lummis Bets on Bitcoin Reserve

-

Altcoin20 hours ago

Altcoin20 hours agoWhy Are Dogecoin and Shiba Inu Price Crashing Over 25% Today?