Market

5 Token Unlocks to Watch Next Week

Token unlock events release previously restricted tokens, often tied to fundraising agreements. These events are planned carefully to manage market impact and support price stability.

Here are five important token unlocks scheduled for today and the upcoming week.

XRP

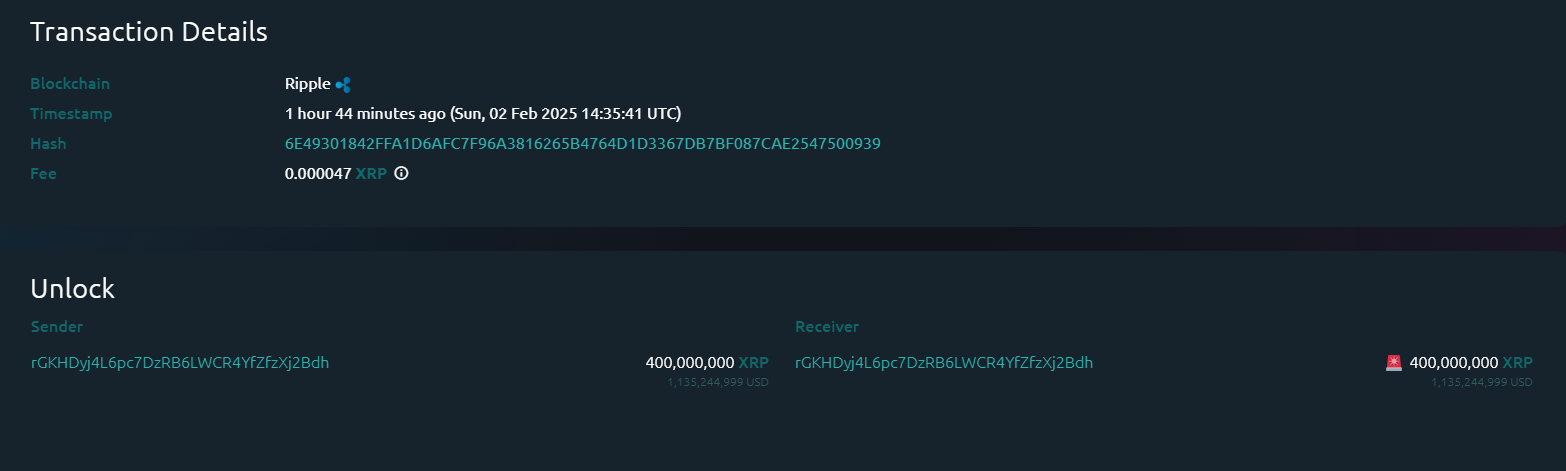

Although XRP had no scheduled vesting period today or in the common weeks, it experienced a surprising token unlock today on February 2.

Data from Whale Alert showed that 400 million XRP tokens – worth around $1.13 billion – were unlocked today by Ripple. However, the entire supply of the unlocked tokens won’t enter the market.

Ripple will only use a small portion of the tokens to select activities. The remaining tokens will be locked back into custody.

However, such a major token unlock could potentially impact the XRP price in the market.

XRP is currently the third-largest cryptocurrency in the market, with a capitalization of over $160 billion. Despite a 300% rally since Trump’s election victory in November, XRP has shown some bearish signals in recent weeks.

Jito Labs (JTO)

- Unlock Date: February 7

- Number of Tokens to be Unlocked: 11.3 Million JTO

- Current Circulating Supply: 289.4 Million JTO

Jito Labs is a leading Solana MEV (Maximum Extractable Value) infrastructure company. It develops high-performance systems to improve the Solana blockchain’s efficiency and performance.

The company offers a liquid staking solution, allowing users to stake SOL tokens and receive JitoSOL in return. The JTO token is the governance token for the Jito Network, allowing holders to participate in key decisions shaping the network’s future.

JTO has a total supply of 1 billion tokens. Currently, around 289.4 million JTO tokens are in circulation. On February 7, the network will unlock an additional 11.3 million tokens worth around $33,89 million.

According to Cryptorank data, these tokens will be distributed to the network’s core contributors and investors.

Galxe (GAL)

- Unlock Date: February 5

- Number of Tokens to be Unlocked: 5.18 Million GAL

- Current Circulating Supply: 127.7 Million GAL

Galxe is a decentralized super app and Web3’s largest on-chain distribution platform. The platform offers various applications, including Galxe Quest, Galxe Compass, Galxe Passport, and Galxe Score, which enable user engagement and credential management.

The native utility token of the Galxe ecosystem is the GAL token, which powers transactions and serves as the gas token on the Gravity chain.

Galxe has a total supply of 200 million GAL tokens, with 70.5% token, around 127.7 million currently in circulation. On February 5, the network will unlock an additional 5.18 million GAL tokens.

The newly unlocked tokens will be distributed across the ecosystem. The lion’s share of the unlocked tokens – around 3.2 million – will go to investors or growth backers. The rest of the GAL tokens will be distributed among the community members, project team, partners, and advisors.

TARS AI (TAI)

- Unlock Date: February 2

- Number of Tokens to be Unlocked: 26.7 Million TAI

- Current Circulating Supply: 586.6 Million TAI

TARS AI is an AI-driven platform on the Solana blockchain that facilitates seamless Web2 to Web3 transitions with scalable solutions.

TAI has a total supply of 1 billion tokens, with 59.4% still locked. Today, February 2, an additional 2.68%—26.7 million TAI tokens—will be unlocked. The tokens will be distributed among all major stakeholders of the platform.

The largest portion will be distributed to the platform’s ‘AI to Earn’ feature. The rest will be distributed among liquidity and market makers, project teams, community airdrops, and investors.

Neutron (NTRN)

- Unlock Date: February 3

- Number of Tokens to be Unlocked: 9.96 Million NTRN

- Current Circulating Supply: 284.8 Million NTRN

Neutron (NTRN) is a permissionless smart contract platform built using Tendermint and the Cosmos SDK. It enables inter-chain smart contract deployment and supports Inter-Blockchain Communication (IBC) protocol.

This allows developers to create cross-chain applications with enhanced security and interoperability features.

NTRN has a total supply of 1 billion tokens, with only 22% currently circulating. The upcoming token unlock will see 9.96 million NTRN tokens worth around $2.38 million enter the market. These tokens will be distributed among team members, investors, and advisors.

Next week’s token unlock will also include Tribal Token (TRIBL), NEON, and Automata Network (ATA), among others. Overall, around $70 million worth of new tokens will be unlocked.

The post 5 Token Unlocks to Watch Next Week appeared first on BeInCrypto.

Market

Asia’s First XRP Investment Fund is Here, Backed by Ripple

HashKey Capital has launched the HashKey XRP Tracker Fund, the first fund in Asia focused exclusively on tracking the performance of XRP.

The fund is now open to professional investors. Ripple is backing the initiative as an early investor.

Institutional Interest in XRP Investment Continues to Grow

According to HashKey, XRP offers a faster and more cost-effective alternative to traditional cross-border payment systems. The new tracker fund aligns with HashKey Capital’s goal of connecting conventional finance with digital asset markets.

The fund allows investors to subscribe using either cash or in-kind contributions. Investors can redeem or subscribe to shares on a monthly basis.

CF Benchmarks, known for its role in global ETF markets, will provide the fund’s benchmark.

“XRP stands out as one of the most innovative cryptocurrencies in today’s market, attracting global enterprises who use it to transact, tokenize, and store value. With the first XRP Tracker Fund available in the region, we simplify access to XRP, catering to the demand for investment opportunities in the very best digital assets,” said Vivien Wong, Partner at HashKey Capital.

Most recently, Ripple acquired prime brokerage platform Hidden Road for $1.25 billion. It was one of the largest acquisition deals in the crypto and blockchain space.

Earlier today, Hidden Road secured a broker-dealer license from the Financial Industry Regulatory Authority (FINRA).

Meanwhile, XRP continues to gain traction with institutional investors. Standard Chartered recently forecast that XRP could surpass Ethereum by 2028, citing increased demand for efficient cross-border payment solutions and growing disruption in global trade.

“XRP is uniquely positioned at the heart of one of the fastest-growing uses for digital assets – facilitation of cross-border and cross-currency payments. In this way, XRPL is similar to the main use case for stablecoins such as Tether. This stablecoin use has grown 50% annually over the past two years, and we expect stablecoin transactions to increase 10x over the next four years. We think this bodes well for XRPL’s throughput growth, given the similar use cases for stablecoins and XRPL,” Geoff Kendrick, Standard Chartered’s Head of Digital Assets Research, told BeInCrypto.

Interest in XRP ETFs is also increasing. Teucrium Investment Advisors recently received NYSE Arca approval for the Teucrium 2x Long Daily XRP ETF (XXRP), the first leveraged XRP ETF in the United States.

Also, attention is now turning to spot XRP ETFs. Grayscale and 21Shares are both awaiting decisions from the SEC on their XRP-based products.

The SEC has up to 240 days to review the Grayscale XRP Trust and the 21Shares Core XRP Trust, with final deadlines set for October 18 and 19, 2025.

XRP’s price has declined by nearly 20% over the past month, but institutional confidence remains high.

Ripple recently confirmed progress in resolving its long-standing legal battle with the SEC. A joint motion to pause court proceedings was approved, giving both parties 60 more days to finalize a settlement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

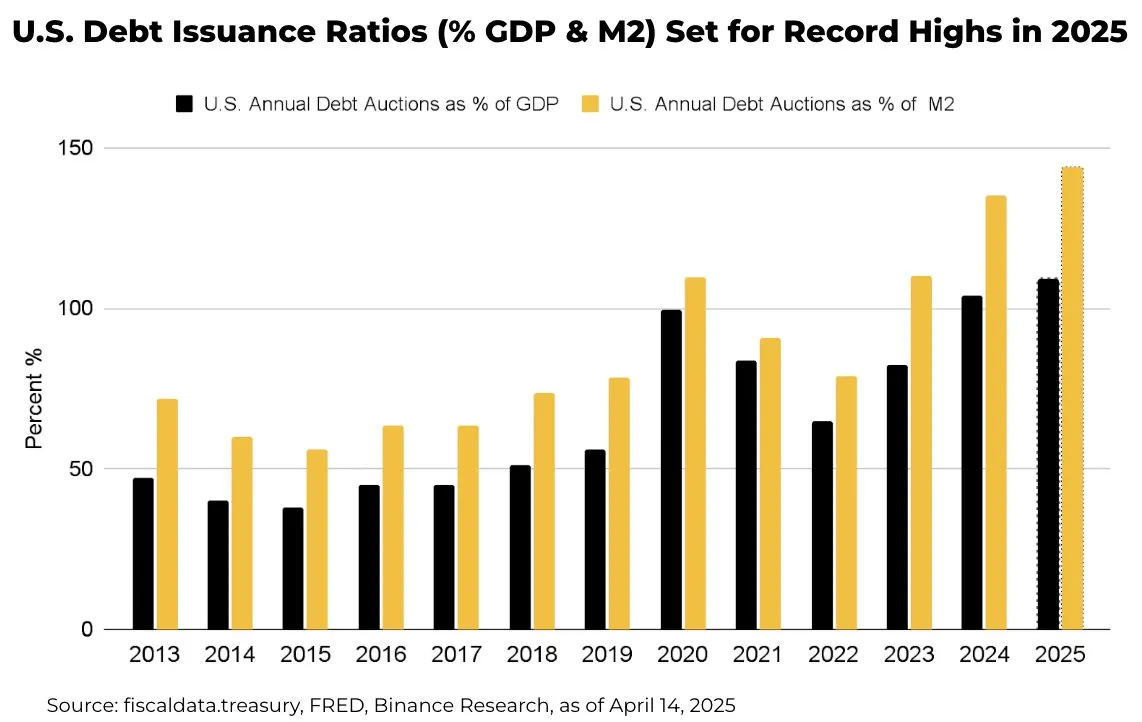

How $31 Trillion in US Bonds Could Impact Crypto Markets in 2025

US Treasury plans to issue over $31 trillion in bonds this year—around 109% of GDP and 144% of M2. This would be the highest recorded level of bond issuance in history. How will it impact the crypto market?

Heavy supply may push yields higher, as Treasury financing needs outstrip demand. Higher yields increase the opportunity cost of holding non‑yielding assets like Bitcoin and Ethereum, potentially drawing capital away from crypto.

US Bonds Might Add to the Crypto Market’s Volatility

The whole narrative potentially boils down to foreign demand for US bonds. Overseas investors hold roughly one‑third of US debt.

Any reduction in appetite—whether due to tariffs or portfolio rebalances—could force the Treasury to offer even steeper yields. Rising yields tend to tighten global liquidity, making risk assets like cryptocurrencies less attractive.

When yields climb, equities and crypto can face selling pressure. For example, during the 2022 bond sell‑off, Bitcoin fell more than 50% alongside Treasury yields spiking. A repeat scenario could test crypto’s appeal.

Meanwhile, the US dollar’s strength could compound headwinds. As yields rise, the dollar typically gains. A stronger dollar makes Bitcoin’s USD‑denominated price more expensive for overseas buyers, dampening demand.

Yet crypto offers unique attributes. In periods of extreme monetary expansion, such as post‑pandemic, investors turned to Bitcoin as an inflation hedge.

Even if higher yields curb speculative flows, crypto’s finite supply and decentralized nature may sustain a baseline of buyer interest.

Technically, Bitcoin’s correlation to yields may weaken if Treasury issuance triggers broader macro volatility. When bond markets are hit by trade or fiscal policy shocks, traders may turn to digital assets to diversify since they don’t move in step.

However, that thesis hinges on continued institutional adoption and favorable regulation.

Crypto’s liquidity profile also matters. Large bond sales often drain bank reserves—tightening funding markets.

In theory, tighter liquidity could boost demand for DeFi protocols offering higher yields than traditional money markets.

Overall, record US debt supply points to higher yields and a stronger dollar—volatility for crypto as a risk asset.

Yet crypto’s inflation‑hedge narrative and evolving technical role in diversified portfolios could temper volatility. Market participants should watch foreign demand trends and liquidity conditions as key indicators for crypto’s next moves.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Are Ethereum Whales Threatening ETH Price Stability?

Ethereum (ETH) continues to struggle below the $2,000 mark, a level it hasn’t reclaimed since March 28, as bearish momentum lingers across both technical and on-chain indicators. Despite attempts to stabilize, recent data reveals rising concentration of ETH among whale wallets, alongside persistent weakness in trend indicators like EMA lines.

At the same time, retail and mid-sized holders are gradually losing share, further skewing ownership toward large players. This combination of declining retail participation and heavy whale dominance may leave ETH increasingly vulnerable to sharp corrections if sentiment turns.

ETH Whale Holdings Hit 9-Year High, Raising Centralization Concerns

The amount of ETH held by whale addresses—wallets controlling more than 1% of the total circulating supply—has reached its highest level since 2015, sitting at 46%.

This marks a significant shift in Ethereum’s ownership data, as whales surpassed the holdings of retail investors back on March 10 and have continued to grow their share since. In comparison, investor-level addresses, which hold between 0.1% and 1% of supply, and retail wallets, which hold less than 0.1%, have both seen declines in their share of ETH.

The jump from 43% to 46% in just a few months reflects a sharp accumulation trend among the largest holders, suggesting a growing concentration of ETH in fewer hands.

Whales typically represent institutional investors, funds, or early adopters, and their behavior can significantly impact price due to the volume they control. Investor-level addresses often reflect high-net-worth individuals or smaller institutions, while retail addresses include everyday traders and holders.

While some might see the rise in whale holdings as a vote of confidence, it also increases the risk of sudden volatility if large holders begin offloading.

With retail and investor participation shrinking, the market may become more fragile and vulnerable to sharp, unexpected price movements driven by a few dominant players.

Whales Holding 1,000 to 100,000 ETH Now Control $59 Billion

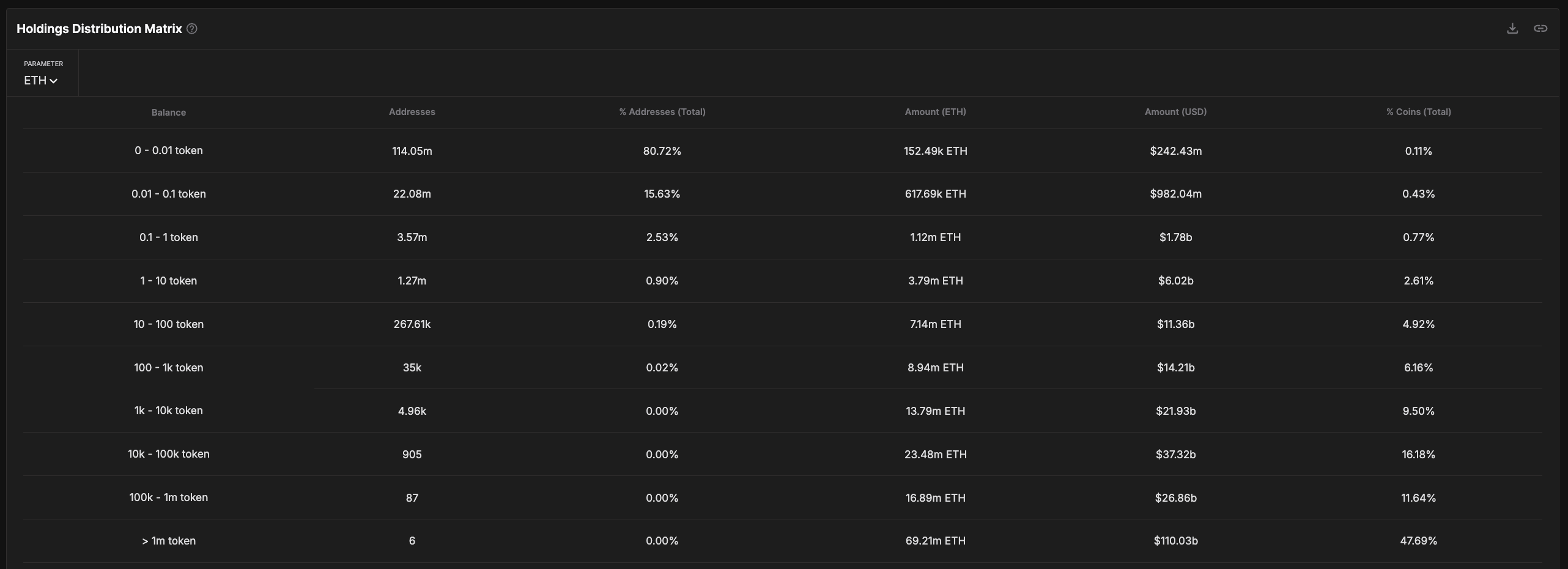

Analyzing the ETH Holdings Distribution Matrix reveals concerning signs of deepening concentration.

When excluding addresses with over 100,000 ETH—typically linked to centralized exchanges—whale addresses holding between 1,000 and 100,000 ETH now control roughly $59 billion in ETH, representing around 25.5% of the circulating supply.

This group has steadily accumulated more of the network’s supply, reinforcing a power shift toward large entities operating outside of exchanges but still commanding immense influence over the market. Recently, Galaxy Digital moved $100 million in Ethereum, raising questions about whether it was a strategic shift or a sell-off signal.

While some might interpret this trend as strategic positioning by confident holders, it also exposes Ethereum to significant downside risk.

With over a quarter of supply concentrated in the hands of these whales, any coordinated or panic-driven selling could trigger sharp price drops, especially in an environment with weakening retail participation.

Rather than a sign of long-term stability, this level of concentration may make the ETH market increasingly fragile and prone to volatility if these holders start to rotate their capital to other assets.

Bearish EMA Structure Keeps ETH Under Pressure

Ethereum’s EMA lines continue to flash bearish signals, with short-term averages still positioned below the long-term ones—indicating downward momentum remains in play.

If a new correction happens, Ethereum could first test support at $1,535. A breakdown below that level opens the door to deeper declines toward $1,412 or even $1,385.

Should these supports also fail to hold, Ethereum would edge dangerously close to the $1,000 mark, a level some analysts have flagged as a potential downside target in the event of an extended market correction.

Still, a bullish reversal is not entirely out of the question. If buying pressure returns and Ethereum reclaims short-term momentum, it could test the resistance level at $1,669.

A breakout above that would be a significant technical signal, potentially pushing Ethereum price toward $1,749 and even $1,954.

However, with EMAs still tilted to the downside, the burden remains on bulls to prove that momentum has shifted decisively in their favor.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin18 hours ago

Altcoin18 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Market23 hours ago

Market23 hours agoCrypto Casino Founder Charged With Fraud in New York

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

-

Market20 hours ago

Market20 hours agoCrypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

-

Market19 hours ago

Market19 hours agoBinance Leads One-Third of the CEX Market in Q1 2025

-

Market18 hours ago

Market18 hours agoHedera Struggles Under $0.17 Despite Strong Support

-

Altcoin17 hours ago

Altcoin17 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop