Bitcoin

USDT Joins Bitcoin’s Lightning Network for Faster Transactions

Tether, the world’s leading stablecoin issuer, has announced the integration of USDT into Bitcoin’s ecosystem, including its base layer and the Lightning Network.

By leveraging Bitcoin’s unmatched security with Lightning’s efficiency, Tether aims to redefine how stablecoins function within the cryptocurrency ecosystem.

Tether Enhances Bitcoin’s Financial Ecosystem

The move is expected to revolutionize stablecoin usage within the Bitcoin ecosystem, enabling seamless, high-speed, and low-cost transactions. With over 350 million users worldwide, USDT’s adoption of the Lightning Network will provide developers and users with the reliability of Bitcoin. It will also deliver the efficiency of Lightning-enabled payments.

“Bringing USDT to Bitcoin combines the security and decentralization of Bitcoin with the speed and scalability of Lightning. Millions of people will now be able to use the most open, secure blockchain to send dollars globally. It all comes back to Bitcoin,” said Elizabeth Stark, CEO of Lightning Labs, in a statement shared with BeInCrypto.

It comes amid the growing demand for Bitcoin among institutional and retail investors. The integration of USDT further cements the pioneer crypto’s role in global financial systems.

The integration is powered by the Taproot Assets protocol, developed by Lightning Labs. This protocol leverages Bitcoin’s security and decentralization while enhancing transaction speed and scalability.

As the Taproot Assets protocol expands Bitcoin’s functionality, tokenized assets such as USDT can operate without compromising the blockchain’s decentralized nature. The integration will unlock new financial applications, including micro-transactions, remittances, and efficient cross-border settlements.

“Tether is committed to driving innovation in the Bitcoin ecosystem. By enabling USDT on the Lightning Network, we are reinforcing Bitcoin’s foundational principles of decentralization and security while offering practical solutions for remittances and payments that demand speed and reliability,” the statement added, citing Tether CEO Paolo Ardoino.

Tether Extends Reach Despite Regulatory Challenges

It comes barely a week after Tether revealed plans to launch a blockchain academy in Vietnam. Two weeks ago, Tether also facilitated upgrading and handing the Bridged USDT on Arbitrum to the USDT0 standard. BeInCrypto reported that this upgrade ensures seamless interoperability while maintaining a 1:1 backing on Ethereum.

According to USDT0, Arbitrum currently leads all Layer-2 networks in stablecoin adoption. Over 1.3 billion USDT was minted under the new standard.

“With over 1.3 billion USDT minted, Arbitrum leads all L2s in stablecoin adoption. Starting today, USDT on Arbitrum is upgraded to the USDT0 standard,” USDT0 shared on X.

Despite these technological advancements, Tether faces regulatory hurdles. In Europe, the MiCA (Markets in Crypto-Assets) framework is particularly set to impose stricter controls on stablecoins. In anticipation of MiCA’s rollout, several EU-based exchanges have already delisted USDT, causing liquidity and market stability concerns.

However, some experts believe MiCA’s impact on Tether will be minimal. This stance is based on the fact that the majority of USDT’s trading volume originates from Asia.

“…80% of USDT’s trading volume comes from Asia, so the EU delisting won’t have any severe impact. This is evident from USDT’s market cap, which is down by only 1.2%,” claimed Axel Bitblaze.

Regarding regulations, Tether has secured a major license in El Salvador, leading to its relocation to the country. This move aligns with El Salvador’s pro-Bitcoin stance and further strengthens Tether’s position in a jurisdiction that embraces digital assets.

Meanwhile, regulatory uncertainty continues to loom over Tether in the United States. Brian Armstrong, CEO of Coinbase, has stated that if new legislation requires it, the exchange would consider delisting USDT. This reflects the broader regulatory pressures that stablecoin issuers face, particularly in the US market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Elliott Warns Crypto Bubble Could Burst Amid Political Backing

Hedge fund giant Elliott Management has warned that the White House’s pro-crypto stance fuels an unsustainable market bubble that could cause severe financial disruption when it collapses.

The concern comes amid Donald Trump’s pro-crypto stance, which contributed heavily to his re-election as US President.

Elliott Says Crypto is “Ground Zero” for Speculative Frenzy

The Financial Times reported the hedge funds’ warning, citing a letter to investors. Per the report, Elliott cautioned that the speculative mania surrounding digital assets, as amplified by political support, represents a looming financial risk with unpredictable consequences.

The $70 billion hedge fund, founded by billionaire Paul Singer, criticized the US government’s increasing alignment with cryptocurrencies. Specifically, Elliot argued that such assets lack fundamental value yet have surged due to perceived proximity to the White House.

Against this backdrop, the firm warned that embracing digital assets that could marginalize the US dollar. In their opinion, the global reserve currency is a dangerous policy direction.

According to the investor letter, Elliott has “never seen a market like this.” The firm pointed to the AI-driven stock rally and soaring cryptocurrency prices as evidence that investors are behaving irrationally. It singled out crypto as the epicenter of the speculative surge, describing it as assets with “no substance.”

The hedge fund believes that the crypto industry has grown to dangerous levels due to White House endorsement.

“Crypto is ground zero…could wreak havoc in ways we cannot yet anticipate,” the report stated, citing Elliot.

Elliott’s criticism is notable given Singer’s political connections. Despite being a longtime Republican donor and contributing $56 million to conservative candidates in the 2024 election cycle, Singer has frequently voiced skepticism about cryptocurrencies.

His hedge fund now argues that political support for digital assets, particularly under the Trump administration, has exacerbated reckless speculation.

Beyond policymaking, Trump’s personal and business dealings have deepened his ties to the crypto sector. Alongside his sons and business associates, Trump backed World Liberty Financial (WLFI), a cryptocurrency platform launched last year.

He and the First Lady have also introduced meme coins, TRUMP and MELANIA, respectively, presenting a speculative class of cryptocurrencies with no inherent value. Similarly, Trump Media, where the former president holds a majority stake, also announced plans to invest up to $250 million in crypto. These actions, Elliott warns, have further legitimized speculative behavior in the market.

Additionally, pro-crypto lobbying has surged, with the Fairshake PAC spending $173 million in the 2023-2024 election cycle to support crypto-friendly candidates. The advocacy group has a $116 million war chest for the 2026 midterms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Over $10 Billion in Crypto Options Expiring Today: What It Means for Bitcoin and Ethereum

The crypto market will witness $10.31 billion in Bitcoin and Ethereum options contracts expire today. This massive expiration could impact short-term price action, especially as both assets have recently declined.

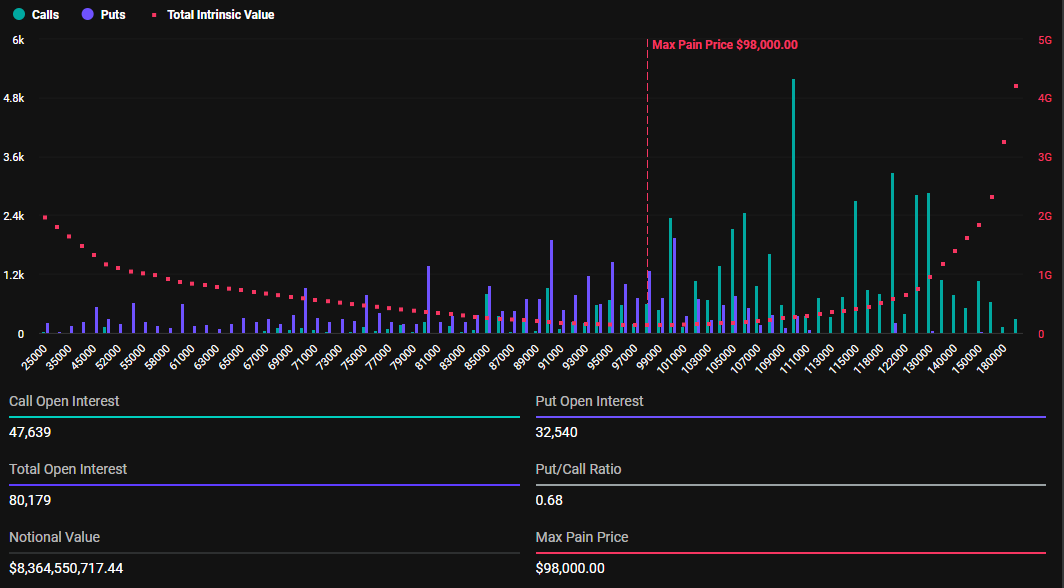

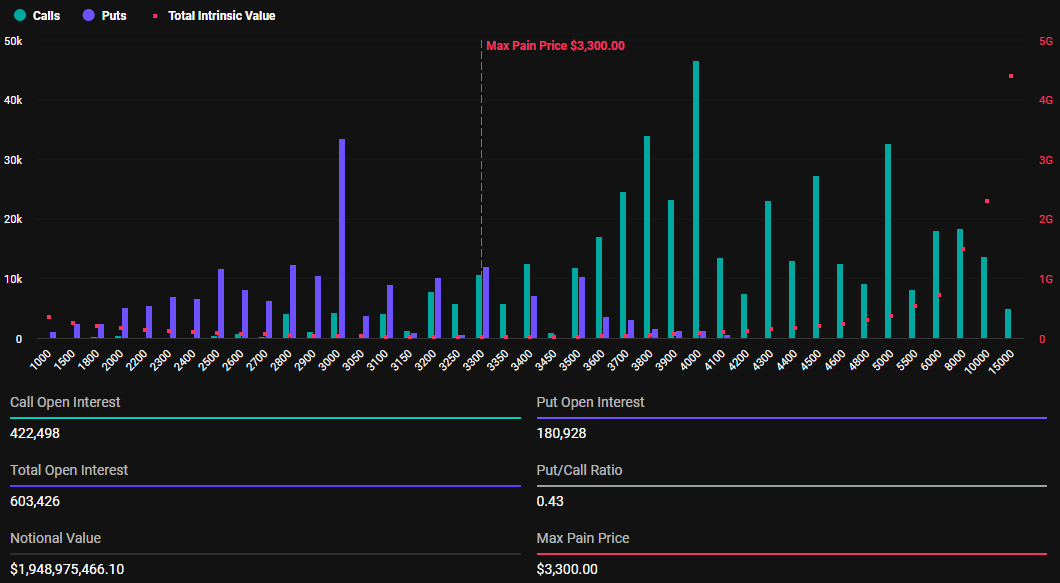

With Bitcoin options valued at $8.36 billion and Ethereum at $1.94 billion, traders are bracing for potential volatility.

High-Stakes Crypto Options Expirations: What Traders Should Watch Today

Today’s expiring options mark a significant increase from last week, as it expires at the end of the month. According to Deribit data, Bitcoin options expiration involves 80,179 contracts, compared to 30,645 contracts last week. Similarly, Ethereum’s expiring options total 603,426 contracts, up from 173,830 contracts the previous week.

These expiring Bitcoin options have a maximum pain price of $98,000 and a put-to-call ratio 0.68. This indicates a generally bullish sentiment despite the asset’s recent pullback. In comparison, their Ethereum counterparts have a maximum pain price of $3,300 and a put-to-call ratio of 0.43, reflecting a similar market outlook.

Put-to-call ratios below 1 for Bitcoin and Ethereum suggest optimism in the market, with more traders betting on price increases. Nevertheless, analysts call for caution due to the tendency of options expiration to cause market volatility.

“This could bring significant market volatility as traders reposition ahead of expiry, expect sharp price movements and potential liquidations,” Crypto Dad, a popular user on X, warned.

The warning comes as options expirations often cause short-term price fluctuations, creating market uncertainty. Meanwhile, BeInCrypto data shows Bitcoin’s trading value has dropped by 0.64% to $104,299. On the other hand, Ethereum’s price is up by a modest 1.04%, now trading at $3,226.

Implications of Options Expiry on BTC and ETH

With their current prices, Bitcoin stands well above its maximum pain level of $98,000, while Ethereum is below the strike price of $3,300. The maximum pain point or strike price is a crucial metric that guides market behavior. It represents the price level at which most options expire worthless.

Based on the Max Pain theory, BTC and ETH prices will likely approach their respective strike prices, hence expected volatility. Here, the largest number of options (both calls and puts) would expire worthless as these options contracts near expiration.

Option buyers who lose the entire value of their options would feel the “pain.” On the other hand, option sellers would benefit as the contracts expire out-of-the-money, and they keep the credit received from selling the options.

This happens because the maximum pain theory operates on the assumption that option writers are typically large institutions or professional traders, otherwise termed smart money. Therefore, they have the resources and market influence to drive the stock’s closing price toward the maximum pain point on expiration day.

“Traders often monitor this level as it can influence price movements as expiration approaches,” one analyst on X wrote.

Based on this assumption, these market makers will hedge their positions to maintain a delta-neutral portfolio. As their positions near expiration, they offset their short option positions by selling or buying the contract, influencing the price toward the maximum pain point.

Of note, however, is that markets usually stabilize soon after as traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing crypto market trends into the weekend.

The post Over $10 Billion in Crypto Options Expiring Today: What It Means for Bitcoin and Ethereum appeared first on BeInCrypto.

Bitcoin

Bitcoin In Texas’ Future? Gov. Dan Patrick Unveils Reserve Plan

Texas is poised to be at the forefront of cryptocurrency adoptions through its ambitious legislative proposal. Lieutenant Governor Dan Patrick has an ambitious plan to set up a Bitcoin reserve for the state as part of his legislative priorities in 2025. This is a new shift at the state level in terms of cryptocurrency policy and adoption, which can transform the financial landscape of Texas.

States Race To Embrace Bitcoin Reserves

Momentum for state-level Bitcoin reserves is growing across America. A recent committee approval of a Strategic Bitcoin Reserve bill has energized the movement in Utah, following in the footsteps of Arizona, which helped to pioneer this approach. Now several other states follow close behind with similar proposals.

An AI image rendition of a bitcoin reserve vault in Texas. Image created by: Gemini Imagen 3.

Texas Builds On Crypto-Friendly Foundation

With Texas’s latest Bitcoin project, the state advances even more as a cryptocurrency hub. The state had rules in place earlier that support blockchain technology development and Bitcoin mining activities. This new reserve will be strictly guided by the state. This way, it can ensure compliance with regulations while extracting maximum benefits.

🇺🇸 TEXAS LT GOVERNOR DAN PATRICK SAYS ESTABLISHING TEXAS #BITCOIN RESERVE IS A TOP PRIORITY‼️ pic.twitter.com/G4y1ZzagI2

— The Bitcoin Conference (@TheBitcoinConf) January 29, 2025

Senate Bill 21, the BTC reserve proposal, is one of Dan Patrick’s top 40 legislative priorities. Its presence on such a renowned list indicates how digital assets are becoming essential to state financial strategy. The project may influence how other states integrate cryptocurrency.

Federal Discussions Signal Broader Changes

States are continuing their efforts, and the federal government is contemplating cryptocurrency reserves. Senator Cynthia Lummis is an important figure on the national reserve. Her plan has sparked lively arguments in Washington. The debate focuses on how cryptocurrencies are becoming more commonly accepted as a viable asset class.

Total crypto market cap at $3.5 trillion on the daily chart: TradingView.com

State-Level Innovation Drives National Policy

Joining the states seeking to draft legislation for a crypto reserve are Oklahoma and Massachusetts, with both bringing their distinct approach to the incorporation of digital assets. Divergent views at the state level could assist in establishing standards and best practices when implemented later on.

Evolution in state-level policies on cryptocurrency signifies a major shift in American mindset about finance. Traditional reserve approaches are being reappraised through digital alternatives. The Texas model, with Lieutenant Governor Dan Patrick at the helm, could be adopted by other states. Its roll-out would make it a highly watched policy within the United States.

Setting up state Bitcoin reserves is an important step in the growth of the alpha crypto as a valuable asset. States are shifting from basic rules to actively getting involved in digital assets. This change shows that people are becoming more confident in the future of cryptocurrency.

Featured image from Gemini Imagen 3, chart from TradingView

-

Blockchain17 hours ago

Blockchain17 hours agoSecuritize launches tokenized Apollo fund on major blockchains

-

Altcoin23 hours ago

Altcoin23 hours agoBONK Price Drops 17%—Is This Newcomer the Next Big Profit Maker?

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Large-Scale Transactions Show No Significant Upsurge, What’s Holding Whales Back?

-

Market22 hours ago

Market22 hours agoMeme Coin Frenzy Highlights Solana dApp Limitations

-

Altcoin22 hours ago

Altcoin22 hours agoIs Solaxy Meme Coin the Solution?

-

Market16 hours ago

Market16 hours agoGrayscale Files for XRP ETF

-

Market21 hours ago

Market21 hours agoBitcoin price prediction 2025 – Will institutional inflow drive growth?

-

Market20 hours ago

Market20 hours agoLitecoin Price Aims At 2-Month High As SEC Reviews ETF Filing