Market

FARTCOIN Price Soars 30% as Market Cap Reaches $1.2 Billion

FARTCOIN’s price has risen more than 30% in the last 24 hours, bringing its market cap back to $1.2 billion and trading volume to $435 million. Despite this strong surge, technical indicators show mixed signals about the trend’s sustainability.

The ADX remains low, suggesting weak momentum, while the Ichimoku Cloud indicates potential resistance ahead. Whether FARTCOIN continues rising toward $1.99 or faces a pullback depends on whether buying pressure remains strong enough to sustain the current move.

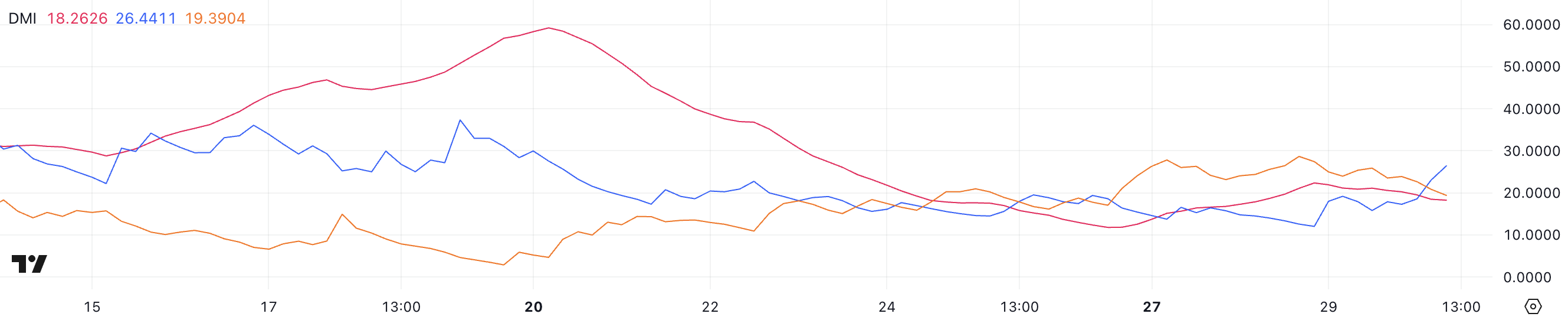

FARTCOIN DMI Signals Trend Weakness

FARTCOIN DMI chart shows its ADX at 18.2, which has remained at that level over the past few days. The ADX (Average Directional Index) measures trend strength, with values below 20 indicating weak momentum, while readings above 25 suggest a stronger trend forming.

When ADX surpasses 40, it signals a strong trend in either direction. Since ADX is still under 20, it suggests that while an uptrend is forming, the overall momentum is not yet fully confirmed.

However, the +DI has risen sharply to 26.4 from 12 in just two days, while the -DI has dropped from 28.6 to 19.3, signaling a clear shift toward bullish control. This suggests that buyers are gaining strength while selling pressure is weakening, aligning with FARTCOIN 30% price increase in the last 24 hours. However, ADX is still below 25, signaling the current trend could not last that long.

If ADX starts rising above 25, it would confirm a stronger trend, reinforcing further bullish momentum. For now, price action suggests an uptrend, but sustained buying pressure will be key to maintaining the move.

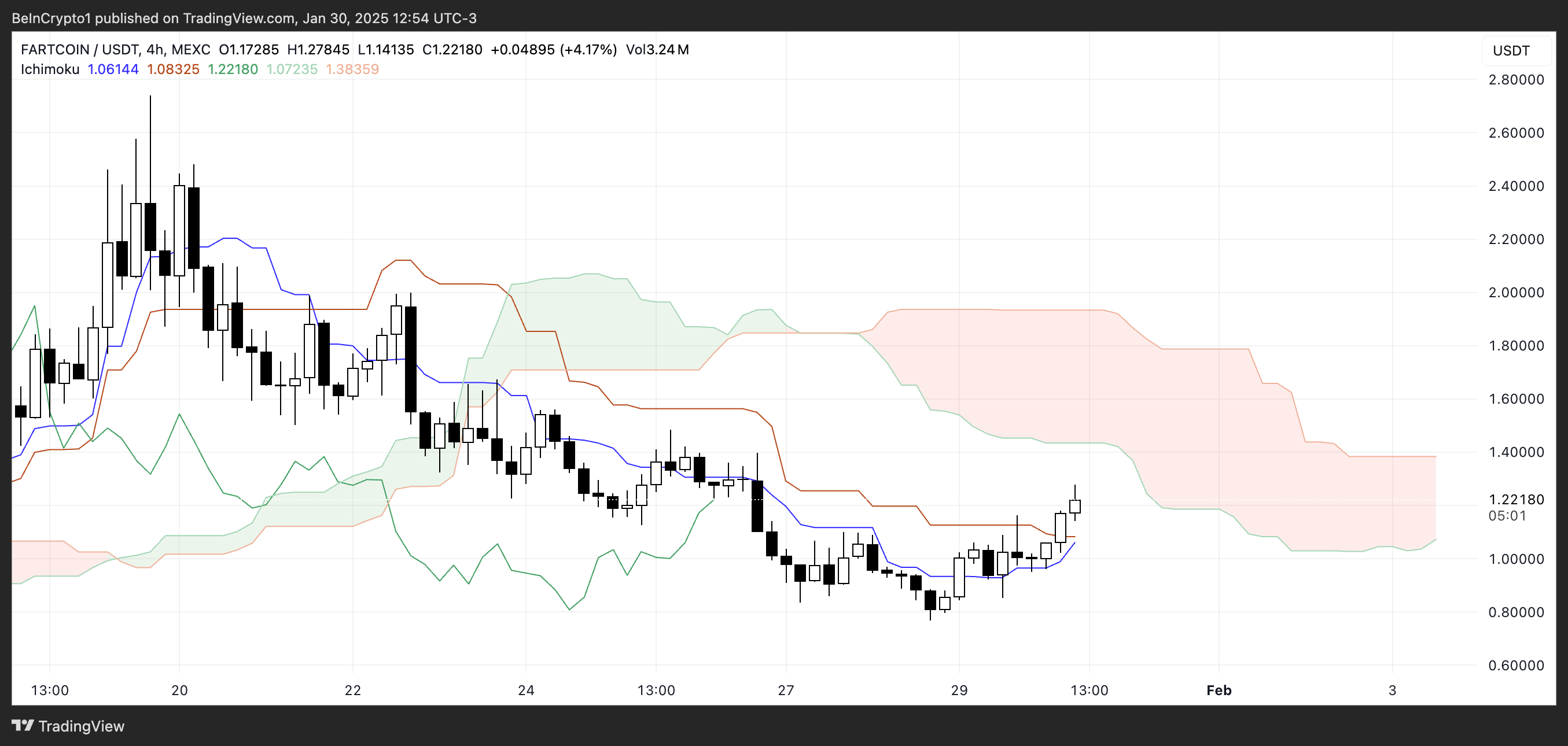

FARTCOIN Ichimoku Cloud Shows Challenges Ahead

FARTCOIN, now the third biggest meme coin on Solana, has an Ichimoku Cloud chart showing a transition phase. The price is currently trading just below the red Kumo. The cloud ahead is bearish, indicating potential resistance in the near term, while the Tenkan-sen (blue) and Kijun-sen (red) lines are beginning to slope upwards.

This suggests that short-term momentum is picking up, but the price still needs to break fully above the cloud to confirm a trend shift. Meanwhile, the Chikou Span (green) is approaching past price action, signaling that the market remains in a recovery phase rather than a confirmed bullish breakout.

The cloud is thickening in the upcoming sessions, which could indicate stronger resistance as the price moves toward it. However, if FARTCOIN price continues to hold above the Tenkan-sen and Kijun-sen, it may sustain this upward momentum. The relationship between these two lines will be key – if the Tenkan-sen crosses above the Kijun-sen, it could indicate a strengthening bullish sentiment.

On the other hand, if the price fails to stay above them and the cloud expands downward, it would suggest that bearish pressure remains dominant, keeping FARTCOIN in a consolidation phase.

FARTCOIN Price Prediction: Will the Current Surge Continue?

FARTCOIN price is currently trading between support at $1.13 and resistance at $1.3, with its uptrend still in play. If the price successfully breaks above $1.3, the next key level to watch is $1.61. This would make FARTCOIN surpass SPX6900 and BONK in terms of market cap and become the 5th biggest meme coin in the market.

A breakout above that could push FARTCOIN toward $1.99, marking a potential 60% increase from current levels. Given the recent momentum, the price action in the coming sessions will be crucial in determining whether this rally can sustain itself.

However, the Ichimoku Cloud and ADX suggest that the current surge may not be strong enough to continue for long. If momentum weakens and the meme coin fails to hold its position, a drop back to the $1.13 support could follow.

Losing this level would shift the trend downward, with the next key support at $0.74. Whether FARTCOIN continues its upward push or reverses will depend on how it reacts to these critical price levels in the short term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Arkansas Rejects Crypto Mining Restrictions

The Arkansas Senate has rejected Senate Bill 60, which would have prohibited crypto mining facilities within a 30-mile radius of any military facility in the state.

The bill required digital asset mining operations within this zone to cease operations unless they had obtained permits before December 31, 2024.

Arkansas Lawmakers Say No to Crypto Mining Restrictions

Senate Bill 60, titled “To Prohibit a Digital Asset Mining Business from Being Located Within a Thirty-Mile Radius of a Military Facility,” was rejected on Thursday in a 6-1 vote, according to the Arkansas Democrat-Gazette.

Senator Ricky Hill and Representative Brian S. Evans introduced the bill. They argued that while digital asset mining—commonly known as crypto mining—presents economic opportunities, it also carries risks.

“Risks posed by digital asset mining include without limitation threats to national security and the security of the State of Arkansas,” the bill read.

The bill added that these crypto mining risks are heightened when such facilities operate within a thirty-mile radius of military bases in Arkansas.

“This act is immediately necessary in order to ensure the health and safety of the State of Arkansas and its citizens,” the bill asserted.

Had it passed, the legislation would have required digital asset mining businesses within the designated radius to shut down. This would have applied unless they had obtained permits from the Oil and Gas Commission before December 31, 2024.

Additionally, ongoing construction of mining facilities within these zones would have been required to cease. The bill also granted the Attorney General the authority to investigate potential violations. This included the power to issue subpoenas and collect sworn statements to enforce compliance.

Despite these provisions, the bill failed to gain sufficient support, leaving digital asset mining businesses free to operate without the proposed restrictions.

This development follows Arkansas’ April 2023 “Right to Mine” law. The law protected Bitcoin mining activities in the state by loosening restrictions on commercial crypto mining. Nonetheless, it faced substantial opposition, with critics citing environmental and energy consumption concerns.

Meanwhile, lawmakers in North Dakota have introduced legislation to safeguard the rights of cryptocurrency users and miners. Representative Nathan Toman has put forward a bill designed to protect fundamental Bitcoin-related rights.

Dennis Porter, CEO of the Satoshi Action Fund, confirmed the bill’s introduction via social media platform X (formerly Twitter).

“This bill will protect the: Right-to-Mine – Right Self-Custody – Right to Peer-2-peer Transactions – Right to Run a Node,” Porter stated.

These developments come as interest in crypto grows at the national level. President Donald Trump, now serving his second term, has voiced strong support for the domestic Bitcoin mining industry. He has publicly advocated for all future Bitcoin mining to take place within the US, reinforcing his administration’s pro-crypto stance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) at Risk: Breakdown Signal Suggests Further Decline

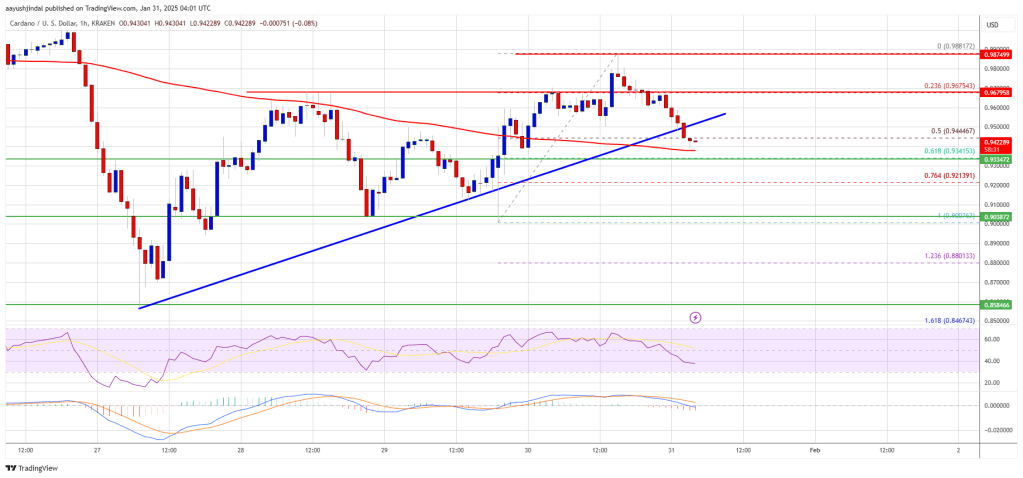

Cardano price started a fresh decline from the $1.00 zone. ADA is consolidating and might continue to move down below the $0.9350 support.

- ADA price started a fresh decline from the $1.00 zone.

- The price is trading below $0.950 and the 100-hourly simple moving average.

- There was a break below a key bullish trend line with support at $0.950 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another decline if it trades below the $0.9350 support zone.

Cardano Price Turns Red

After struggling to stay above the $1.00 level, Cardano started a fresh decline unlike Bitcoin and Ethereum. ADA declined below the $0.9650 and $0.950 support levels.

There was a clear move below the $0.950 support zone. Besides, there was a break below a key bullish trend line with support at $0.950 on the hourly chart of the ADA/USD pair. The pair even traded below the 50% Fib retracement level of the upward move from the $0.9007 swing low to the $0.9881 high.

Cardano price is now trading below $0.950 and the 100-hourly simple moving average. On the upside, the price might face resistance near the $0.950 zone. The first resistance is near $0.9650.

The next key resistance might be $0.9880. If there is a close above the $0.9880 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $1.00 region. Any more gains might call for a move toward $1.050 in the near term.

Another Decline in ADA?

If Cardano’s price fails to climb above the $0.950 resistance level, it could start another decline. Immediate support on the downside is near the $0.940 level and the 100-hourly simple moving average.

The next major support is near the $0.9350 level or the 61.8% Fib retracement level of the upward move from the $0.9007 swing low to the $0.9881 high. A downside break below the $0.9350 level could open the doors for a test of $0.9040. The next major support is near the $0.8550 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is gaining momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.9400 and $0.9350.

Major Resistance Levels – $0.9500 and $0.9880.

Market

Bitwise’s Bitcoin and Ethereum ETF Gets SEC’s Green Light

The US Securities and Exchange Commission (SEC) has given initial approval for Bitwise’s spot Bitcoin (BTC) and Ethereum (ETH) Exchange-Traded Fund (ETF).

The SEC confirmed that the filing received accelerated approval. This came after the regulator approved similar ETFs last month.

SEC Approves Bitwise’s Bitcoin and Ethereum ETF

On January 30, the SEC approved NYSE Arca’s 19b-4 filing. The filing allows Bitwise’s combined Bitcoin and Ethereum ETF to be listed and traded.

According to the filing, the fund’s asset allocation will closely reflect the relative market capitalizations of Bitcoin and Ethereum. Furthermore, its holdings would be limited to these two cryptocurrencies and cash reserves.

Notably, according to the SEC, the filing received accelerated approval. The agency determined that the filing was substantially similar to other approved spot crypto ETFs, which allowed for an expedited approval process.

“The Commission finds good cause to approve the Proposal prior to the 30th day after the date of publication of notice of Amendment No. 126 in the Federal Register,” the SEC stated.

The development follows the SEC’s approval of the first-ever combined Bitcoin and Ethereum ETFs from Hashdex and Franklin Templeton in December 2024.

“Because hashdex and Franklin were already approved it made sense that this would also be approved in short order,” Bloomberg ETF analyst James Seyffart pointed out on X.

Bloomberg Senior ETF Analyst Eric Balchunas also commented on the decision on social media platform X. He said that the decision was “news but expected.”

“Even Gensler’s SEC would approve these,” Balchunas wrote.

Balchunas also highlighted the speed of the SEC’s decision. He noted that the approval process took only 45 days instead of the standard 240-day review period.

“I really want to interpret this as a sign the new SEC will be faster but no way to know really. Litecoin on deck, know more soon,” he added.

NYSE Arca filed the 19b-4 on November 26, 2024. After a public comment period and a revision to the filing on January 21, 2025, the SEC decided to fast-track its approval. The approval adds to Bitwise’s growing footprint in the crypto ETF space.

The investment manager has also submitted applications for Solana (SOL), XRP (XRP), and Dogecoin (DOGE) ETFs. Nonetheless, given its higher volatility and speculative nature, whether the SEC will approve a meme coin ETF remains to be seen.

Meanwhile, the Bitwise 10 Crypto Index Fund also remains under review. This fund is designed to track the performance of the top cryptocurrencies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoRipple analyst tips this sub-$1 altcoin over XRP for its huge rally potential

-

Market22 hours ago

Market22 hours agoEthereum Price Struggles Against Resistance: A Tough Road Ahead

-

Blockchain12 hours ago

Blockchain12 hours agoSecuritize launches tokenized Apollo fund on major blockchains

-

Altcoin23 hours ago

Altcoin23 hours agoLitecoin ETF Approved – What Crypto to Buy in a January?

-

Altcoin17 hours ago

Altcoin17 hours agoBONK Price Drops 17%—Is This Newcomer the Next Big Profit Maker?

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Large-Scale Transactions Show No Significant Upsurge, What’s Holding Whales Back?

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Clears About XRP Lawsuit Removal and Case Deadline Date

-

Market16 hours ago

Market16 hours agoMeme Coin Frenzy Highlights Solana dApp Limitations