Market

Fairshake Super PAC Has $116 Million for the US Midterms

Fairshake, the pro-crypto super PAC, currently has $116 million to influence elections in the 2026 US midterms. Several major donors who supported this effort during the 2024 elections have redoubled their donations.

At the moment, it doesn’t seem clear which senates will become the highest-priority targets. Since Kamala Harris endorsed crypto and lost, anti-industry sentiment has been much quieter in Congress, but a few opponents remain in power.

Fairshake Stockpiles for the Midterms

Fairshake, the pro-crypto Super PAC, is stockpiling resources for the midterms in 2026. According to a report from CNBC, the group currently has a war chest of $116 million to compete in these races.

Right after Trump won the Presidential election in November, a16z donated $25 million for this purpose, and other donations brought the total to $103 million.

However, more donations are likely. Elections can be very expensive in the current US political environment. In the 2024 cycle, Fairshake spent around $180 million to influence national races, and the midterms will be just as important.

In addition to electing President Trump, Fairshake’s political contributions also helped down-ballot candidates like Bernie Moreno.

“With the midterms on the horizon, we are poised to continue backing candidates committed to advancing innovation, growing jobs, and enacting thoughtful, responsible regulation,” Fairshake said in a statement.

Previous Fairshake donors, such as Coinbase, doubled down on their support, building new reserves for the midterms. According to CNBC, several additional big-name supporters like Ripple and Uniswap have provided new contributions for this purpose alone.

However, this does beg one question: who are they going to challenge with this money?

Crypto Industry Holds the Cards in US Elections

In the last Presidential election, Kamala Harris was more reluctant to embrace crypto than Donald Trump, but she eventually ran as a pro-crypto candidate.

Indeed, she even received high-level donor support from influential figures in the space, albeit less than Trump. If the Democrats continue their reconciliation with crypto into the midterms, who will Fairshake target?

There are some candidates that come to mind. First of all, a few outspoken crypto opponents like Senator Elizabeth Warren remain in Congress and continue to rail against Trump’s policies.

Since launching the TRUMP meme coin, several Representatives have called for a probe into possible criminal activity. Fairshake could fund races against these figures in the midterms.

However, there is another possible option. The Republicans have generally coalesced around Trump’s pro-crypto messages, but there are complications.

For example, a few elected officials have vocally supported the industry since the election despite opposing it beforehand. The threat of Fairshake spending could keep the half-hearted converts in line.

Ultimately, the midterms are nearly two years away, and Fairshake will have ample time to prepare. Regardless of which races take the highest priority, the super PAC will be ready to influence them.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Gains Traction: Can It Sustain the Climb?

Ethereum price started a fresh increase above $3,220. ETH is now consolidating and might eye more gains above the $3,270 resistance zone.

- Ethereum started a fresh increase above the $3,120 zone.

- The price is trading above $3,200 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $3,200 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start another increase if it stays above the $3,200 level.

Ethereum Price Recovers

Ethereum price started a decent increase from the $3,020 zone, like Bitcoin. ETH was able to surpass the $3,120 and $3,150 resistance levels to move into a positive zone.

There was a break above a key bearish trend line with resistance at $3,200 on the hourly chart of ETH/USD. The pair surpassed the 50% Fib retracement level of the downward move from the $3,427 wing high to the $3,020 swing low.

However, the bears are now active near the $3,270 and $3,280 resistance levels. Ethereum price is now trading above $3,200 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $3,270 level and the 61.8% Fib retracement level of the downward move from the $3,427 wing high to the $3,020 swing low. The first major resistance is near the $3,330 level. The main resistance is now forming near $3,360. A clear move above the $3,360 resistance might send the price toward the $3,450 resistance.

An upside break above the $3,450 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,550 resistance zone or even $3,650 in the near term.

Another Drop In ETH?

If Ethereum fails to clear the $3,270 resistance, it could start another decline. Initial support on the downside is near the $3,220 level. The first major support sits near the $3,200.

A clear move below the $3,200 support might push the price toward the $3,120 support. Any more losses might send the price toward the $3,050 support level in the near term. The next key support sits at $3,000.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,200

Major Resistance Level – $3,270

Market

Sam Bankman-Fried’s Parents Want Trump to Pardon Him

Sam Bankman-Fried’s parents are petitioning President Trump for a pardon. Trump recently pardoned Silk Road founder Ross Ulbricht, but Bankman-Fried may be a more difficult case.

SBF contributed millions to defeat Trump’s Presidential campaign in 2020 and was sentenced to prison less than a year ago. For these and other reasons, a pardon seems much less likely.

Could SBF Get a Pardon?

Sam Bankman-Fried (SBF), one of the most infamous criminals in crypto history, may receive a pardon from President Trump. According to a Bloomberg report, his parents, Joseph Bankman and Barbara Fried, are spearheading the effort.

Both parents are law professors, and they’ve been consulting with figures in Trump’s orbit.

Since Donald Trump re-took office, he’s been fulfilling obligations to the crypto community. He pardoned Ross Ulbricht on his second day in office, making good on a campaign promise.

Ulbricht’s mother was a key figure in petitioning for this pardon, and SBF’s parents want to use the same strategy. Indeed, due to Trump’s early string of pardons, he’s facing many requests.

“I have been hearing from people in prison, from people recently sentenced who haven’t reported to the Bureau of Prisons yet, from people who have been indicted. They are looking for somebody who knows somebody,” claimed Jeffrey Grant, who runs a legal and advisory firm in New York for white-collar defendants. He has received around 100 pardon requests.

Rumors about an SBF pardon have circulated a few times since Trump won the Presidential election, but nothing has materialized yet. Indeed, it might be much more difficult than Ulbricht’s pardon.

For example, the new US Attorney in the SDNY pledged that his office would stop a crypto crackdown, but only after defeating Bankman-Fried’s appeal.

In other words, even when the legal system wants to ease up on crypto criminals, the Bankman-Fried case is still very recent. He was sentenced less than a year ago, whereas Ulbricht spent more than a decade behind bars.

If Trump gives SBF a pardon this soon, it might directly encourage these large-scale financial crimes.

“In my opinion, SBF will be pardoned and released. There are more truths to be revealed. Nothing is what it seems and definitely not what you were told. Watch this space. The real criminals will be exposed,” wrote Martin Folb.

Additionally, before his arrest, Ulbricht was a libertarian with no strong affiliation to either political party. Bankman-Fried, on the other hand, was a major Democratic donor who directly contributed millions to defeat Donald Trump in 2020.

If SBF wishes for Trump to pardon him now, his contributions to the Republicans might not be enough to clear the bad blood. In other words, it doesn’t seem particularly likely that SBF will receive a pardon anytime soon.

Reports suggest that his parents consulted a lawyer who helped several clients receive clemency in Trump’s first term. They were told that “Trump is busy doing other things” and should contact him again in a month.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

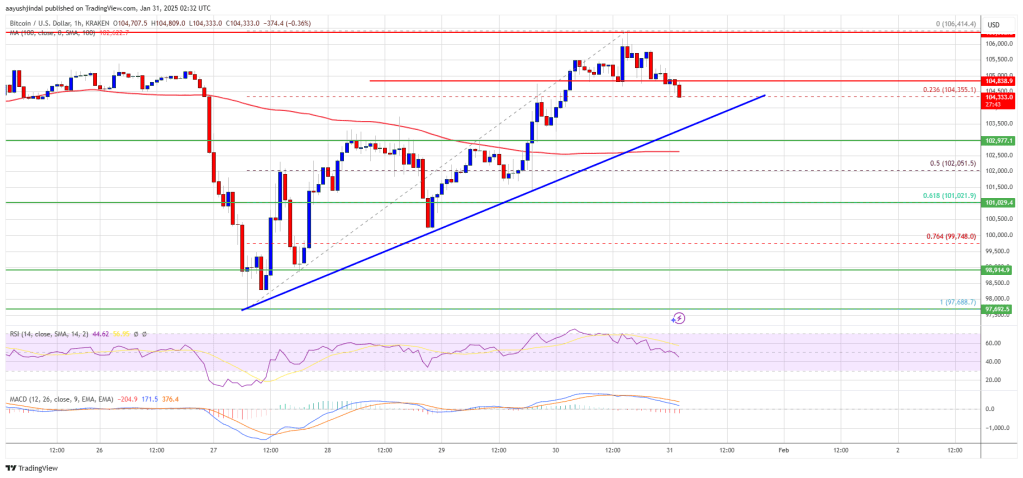

Bitcoin Price Comeback Meets Resistance: Breakout or Rejection?

Bitcoin price started a fresh upward move above $103,200. BTC is now correcting gains and might revisit the $102,000 support zone.

- Bitcoin started a decent upward move above the $103,200 zone.

- The price is trading above $103,000 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $103,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $102,000 zone.

Bitcoin Price Recovers Above $102,000

Bitcoin price started a decent increase above the $101,500 resistance zone. BTC was able to surpass the $102,200 and $103,200 resistance levels to move into a positive zone.

It even cleared the $104,500 resistance zone. The pair settled in a positive zone and now faces hurdles near the $106,500 zone. A high was formed at $106,414 and the price is now correcting gains. There was a move below the $105,000 level.

It is now testing the 23.6% Fib retracement level of the upward move from the $97,688 swing low to the $106,414 high. Bitcoin price is now trading above $103,000 and the 100 hourly Simple moving average.

There is also a key bullish trend line forming with support at $103,500 on the hourly chart of the BTC/USD pair. On the upside, immediate resistance is near the $105,500 level. The first key resistance is near the $106,500 level. The next key resistance could be $107,000.

A close above the $107,000 resistance might send the price further higher. In the stated case, the price could rise and test the $108,800 resistance level. Any more gains might send the price toward the $110,000 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $105,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $103,500 level. The first major support is near the $102,500 level and the 50% Fib retracement level of the upward move from the $97,688 swing low to the $106,414 high.

The next support is now near the $102,000 zone. Any more losses might send the price toward the $100,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $103,500, followed by $102,500.

Major Resistance Levels – $105,500 and $106,500.

-

Market20 hours ago

Market20 hours agoRipple analyst tips this sub-$1 altcoin over XRP for its huge rally potential

-

Market19 hours ago

Market19 hours agoEthereum Price Struggles Against Resistance: A Tough Road Ahead

-

Blockchain10 hours ago

Blockchain10 hours agoSecuritize launches tokenized Apollo fund on major blockchains

-

Market24 hours ago

Market24 hours agoGemini Halts MIT Hiring Due to Gary Gensler’s Academic Ties

-

Altcoin20 hours ago

Altcoin20 hours agoLitecoin ETF Approved – What Crypto to Buy in a January?

-

Altcoin15 hours ago

Altcoin15 hours agoBONK Price Drops 17%—Is This Newcomer the Next Big Profit Maker?

-

Ethereum15 hours ago

Ethereum15 hours agoEthereum Large-Scale Transactions Show No Significant Upsurge, What’s Holding Whales Back?

-

Altcoin19 hours ago

Altcoin19 hours agoExpert Clears About XRP Lawsuit Removal and Case Deadline Date