Altcoin

Litecoin ETF Approved – What Crypto to Buy in a January?

Several fund managers have recently filed applications for altcoin ETFs with the Securities and Exchange Commission (SEC), including $DOGE, $TRUMP, and $MELANIA ETFs.

However, the only application to get a green light was Canary Capital’s Litecoin ETF ($LTC ETF). Unsurprisingly, the regulator has rejected all other proposed ETFs, which makes $LTC the only altcoin after $ETH to get approval.

Why $LTC? Well, $LTC has a reputation of ‘digital silver’ that compliments the ‘digital gold,’ Bitcoin ($BTC). It’s a Bitcoin fork, after all, so they share many similarities in tokenomics and technology.

Either way, this news is bullish for the entire industry, as Canary Capital sets a precedent for altcoin recognition as a serious asset class by institutional investors.

Now is the perfect time to stack up your portfolio in anticipation of the altcoin season. We hand-picked the best crypto to buy for maximum gains in 2025.

1. Solaxy ($SOLX) Addresses Solana’s Scalability Limitations

The 2021 bull run was dominated by speculative assets. This time, investors seek real-world applications that will drive the next wave of blockchain adoption.

That’s why the Solaxy ($SOLX) presale has been gaining momentum, with $16.3M raised in a little over a month.

Solaxy introduces the world’s first Layer-2 solution for Solana. By offloading a substantial part of transactions to its side chain, Solaxy could speed up processing, lower fees, and mitigate the risk of failed transactions on the mainnet.

One $SOLX now costs $0.00162, but the price will increase as the presale progresses toward its milestones. Early adopters get a first-mover advantage – 244% staking APY to increase their potential returns after the token lists on major exchanges.

2. MIND of Pepe ($MIND) Proves the Days of AI Aren’t Over

Nvidia stock and the entire AI crypto sector have dipped noticeably this week as the new Chinese AI DeepSeek rocked the market. However, that doesn’t mean the AI mania is over – on the contrary, we witness more innovation and broad interest in the industry than ever before.

This could benefit the new AI agent MIND of Pepe ($MIND), programmed to analyze data from crypto market aggregators and social media discussions to deliver exclusive insights to its token holders.

$MIND is self-sovereign and free from human bias, so its trading advice is purely data-driven and objective.

The $MIND token presale launched a few weeks ago and has already raised $4.4M in funding. With the current $MIND price of $0.0032273 and 509% staking APY, now is the best time to join the MIND of Pepe community.

3. Best Wallet Token ($BEST) Provides Entry Into the Fastest-Growing Wallet Ecosystem

What matters the most in crypto investing? Safety. A reliable, non-custodial wallet is a must if you don’t want to lose your funds to a scam or hack.

One of the most popular solutions right now is Best Wallet, a mobile-first wallet that lets you sell, buy, swap, stake, and, of course, store assets across several networks.

Besides, Best Wallet is the first and only crypto wallet that gives direct access to hot meme coin presales. Instead of buying tokens through the presale website, you can do so through the Best Wallet app, which is not only convenient but also more secure as you don’t risk falling victim to phishing or rug pull.

The ecosystem’s native token, $BEST, is now selling on presale at $0.0238. Its holders benefit from governance rights, discounted fees, and higher staking yields.

4. Toshi ($TOSHI) Explodes After Coinbase Listing

Toshi ($TOSHI) is among this week’s top gainers, with a 270% increase. The token launched in July 2023 but has only gained significant traction now, surging from $0.00013 on January 13 to $0.001455.

One of the reasons for such explosive growth is the recent Coinbase listing. Investors often see listings on Tier-1 centralized exchanges (CEXs) as a sign of legitimacy, which means the project begins to attract more risk-averse individuals.

On top of that, $TOSHI has a strong community, which could help it sustain this momentum and continue to grow in the long run.

The project’s main appeal lies in its NFT collection featuring 5K unique Toshis – cute cartoonish cats in different colors and outfits. $TOSHI token holders can also participate in project governance through the MEOW DAO.

5. Vine ($VINE) Rides the Wave of Nostalgia

Another top gainer is Vine ($VINE), and if the name seems familiar to you, that’s because it was launched by the same people who developed the short-form video platform Vine in 2012.

Funnily, Elon Musk has yet again had a hand in a crypto project’s boom. In April, he tweeted ‘Bring back Vine?’, and on January 25, the app’s founder, Rus Yusupov, announced the launch of his official token.

The token doesn’t currently have any applications and hinges merely on the nostalgic feelings of its community. Who wouldn’t want to bring back the good old ways when the world was simpler, and $BTC was trading at $6?

However, Rus might introduce some utility for $VINE along the way to ensure its long-term sustainability.

Litecoin ETF Is a Turning Point for the Market

While the SEC remains skeptical about meme coins, it evidently has changed its stance on altcoins.

This means that we might see new crypto ETFs in the future, which would drive adoption and prolong the current bull run.

However, we remind you to DYOR before investing in any cryptocurrency. Even strong fundamentals and favorable market conditions don’t guarantee returns.

Altcoin

Chainlink Price To Hit $26 If LINK Breaks Past This Crucial Level

The Chainlink price is poised for liftoff, with a bullish rebound on the horizon. As LINK has soared past its key support level, analysts and traders remain bullish about the altcoin’s potential rally new heights.

Analysts like Ali Martinez and CRYPTOWZRD have identified critical levels for LINK, invoking the community’s attention. Let’s unveil Chainlink’s potential movements through the analyses of popular analysts.

Is Chainlink Price Ready for a Rebound?

In a detailed analysis, analyst Ali Martinez spotted key support and resistance levels for Chainlink. According to Ali’s analysis, Chainlink’s support level is established at $12.28, while $14.58 acts as a significant resistance hurdle.

With the Chainlink price breaking past its support line, which now acts as a foundation, the stage is set for a potential bullish reversal, signaling an upward trend. And, if LINK breaks past the $14.58 point, which has been a significant resistance point, further upside momentum comes into view, with potential new highs on the horizon.

Chainlink’s Next Target: Is $26 Within Reach?

According to market expert CRYPTOWZRD, Chainlink daily technical outlook is uncertain, with an indecisive close. However, the analyst highlighted that LINK is currently testing the significant $12.50 level. Given LINK’s oversold condition, its price movement is likely to follow Bitcoin’s trend.

Interestingly, as pointed out by CRYPTOWZRD, LINKBTC’s daily falling wedge formation suggests potential for an impulsive upside breakout. LINK itself is forming a daily falling wedge above its lower high trend line, indicating a possible rally towards the $16 resistance target and beyond.

Significantly, the chart presented by the expert indicates that LINK could hit $26 if it passes the resistance point. However, as per CoinGape’s Chainlink Price Prediction, LINK will reach a maximum of $15.24 in 2025.

Meanwhile, LINK’s intraday chart showed a lack of clear direction, with price movements confined to a narrow range. A breakout above $13.20 could present a trade opportunity, while a decline below $11.80 would signal a test of the main support level.

LINK Market Sentiment Analysis

In an “In/Out of the Money Around Price” analysis, Ali Martinez shared insights into the market sentiment for LINK. The analyst detailed the number of traders holding Chainlink at different price points.

At press time, Chainlink is trading at $12.81, up1.46%. Despite a 0.86% surge over the past week, LINK experienced a massive decline of 30.99% over the last month.

Notably, more addresses are holding LINK at a loss than at a profit. According to the chart, 53.06% of the holdings are “out of the money,” which means that they represent 78.24 million LINK bought at a price above the current $12.68.

At the same time, 44.63% of analyzed holdings, representing 65.81 million LINK, are ‘in the money,’ having been bought by traders at a price below $12.68. This data highlights potential support and resistance levels, with significant holdings at $12.47 and $14.19.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Lorenzo Protocol (BANK) Price Rallies 150% After This Binance Announcement

Lorenzo Protocol (BANK) price has defied the broader market’s recent uncertain trend by rallying 150% this Saturday. The institutional-grade asset management platform has stolen the spotlight primarily as a top CEX, Binance, unveiled a new listing for its native token. As a result, traders and investors are extensively eyeing this crypto, speculating whether the pump could sustain amid enhanced market exposure.

Lorenzo Protocol Price Bullish As Binance Futures Adds BANKUSDT Contract

At the time of reporting, BANK price traded at $0.05237, up by a staggering 150% in just a day. The cryptocurrency’s price surged from a bottom of $0.01839 intraday, in sync with Binance’s announcement.

According to an official press release by the crypto exchange on April 18, the platform’s futures trading division is adding the BANK USD-Margined perpetual contract to its stockpile of offerings. The platform’s colossal user base remains poised to enjoy up to 50x leverage while trading the asset. The timeline for this launch was set at 18:30 UTC, the same day.

Further, the top crypto exchange set the capped funding rate at +2.00%/-2.00%. Also, the same perpetual contract will be available for ‘Futures Copy’ trading, offering users enhanced opportunities to make returns.

For context, usual market sentiments about the coin’s future price action have turned highly bullish with the new offering. Traders and investors are expecting a substantial influx of funds into the token as the new listing paves the way for more investor interaction with the asset.

Now, crypto market watchers are thoroughly monitoring the token for further gains, highly optimistic amid an ongoing rally of 150% following the listing announcement. Lorenzo Protocol is an institutional-grade asset management platform that issues yield-bearing tokens backed by diverse underlying strategies.

Besides, it’s worth mentioning that Binance revealed another crypto listing this week, CoinGape reported. The CEX has revealed plans to open trading for Balance (EPT) shortly, garnering further attention among traders and investors.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Is Solana Forming a Death Cross Against Bitcoin?

Solana (SOL) price has been under pressure recently, leading to concerns about a potential downtrend against Bitcoin (BTC). On the SOL/BTC price chart are signs that the cryptocurrency could be forming a “death cross,” a pattern that suggests a further decline in price.

This follows a period of weak performance for Solana relative to Bitcoin, sparking discussions on whether the altcoin can recover or continue to underperform.

Will Solana Form a Death Cross Against Bitcoin?

Over the past few months, Solana price has experienced a sharp decline when compared to Bitcoin. As of mid-April 2025, Solana is priced at 0.00158 BTC, down by 23% from earlier in the month. This comes after a significant 54% drop since January, showing a steady loss in value relative to Bitcoin.

The recent drop in Solana’s price has raised concerns among traders and analysts. Moving averages, which track price trends over time, have been narrowing, which is often a precursor to a potential death cross formation.

Specifically, the 23-day moving average is approaching the 200-day moving average in the weekly chart, a key level for technical analysts. If it crosses below the 200-day average, it would officially signal a death cross. This could indicate a further decline in Solana’s price against Bitcoin.

Solana’s Recent Performance and Market Trend

Nonetheless, Solana has had some strength, which can be attributed to the recent launch of Solana ETFs in Canada.

At the same time, institutional investors’ attention contributed to the altcoin’s success in surpassing the performance of numerous other cryptocurrencies, including Bitcoin. Solana delivered a 10.5% return within a week, while Bitcoin delivered a 1.8% return in the same time frame.

Nonetheless, the recent excitement about Solana appears to have subsided with the lessened market movements. Analysts like Ali Charts are now analysing whether the recent strength was just a blip in the charts or the first sign of an actual trend reversal to $65.

SOL/BTC Technical Patterns and Support Levels

Based on the current technical perspective, Solana’s price trend against Bitcoin has established the “Falling wedge” chart. This pattern is normally noticed during the consolidation phase, and the break above the upper trend line is usually interpreted as a signal for a bullish move.

The declining moving averages indicate that Solana may continue to decline against Bitcoin and possibly test lower supports despite the SOL/ETH ratio recording its highest weekly close

At present, the price is almost at the apex of the wedge pattern, meaning that it can break soon. If the price surmounts the resistance level at around 0.0018BTC, it will possibly lead to a bullish run and might even regain the value of 0.001895BTC for Sol. However, if the price cannot hold its support at 0.0014 BTC, then it may decrease even lower.

Solana’s performance against Bitcoin will be very significant over the next few weeks. The potential death cross and the support and resistance levels on the chart pinpoint that Solana might experience a difficult time moving forward. If the trend persists, the altcoin could potentially drop as low as 0.001 BTC—a price point that, when measured in dollar terms, is below $100.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin19 hours ago

Altcoin19 hours agoEthereum ETFs Record $32M Weekly Outflow; ETH Price Crash To $1.1K Imminent?

-

Market11 hours ago

Market11 hours agoPi Network Roadmap Frustrates Users Over Missing Timeline

-

Market10 hours ago

Market10 hours agoSolana (SOL) Price Rises 13% But Fails to Break $136 Resistance

-

Market23 hours ago

Market23 hours agoVietnam Partners with Bybit to Launch Legal Crypto Exchange

-

Market22 hours ago

Market22 hours ago100 Million Tokens Could Trigger Decline

-

Market19 hours ago

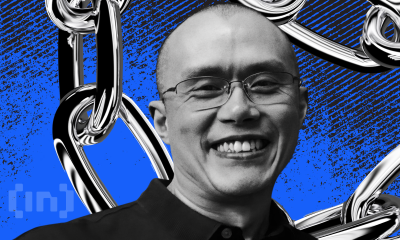

Market19 hours agoCZ’s Plan to Streamline BNB Staking Could Boost DeFi

-

Market12 hours ago

Market12 hours agoMEME Rallies 73%, BONE Follows

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Price Stalls In Tight Range – Big Price Move Incoming?

✓ Share: