Ethereum

New Users See Largest Spike In 27 Months

On-chain data shows a large amount of new addresses have popped up on the Ethereum network recently, a sign that ETH adoption is occurring.

Ethereum Network Growth Registered A Sharp Spike Recently

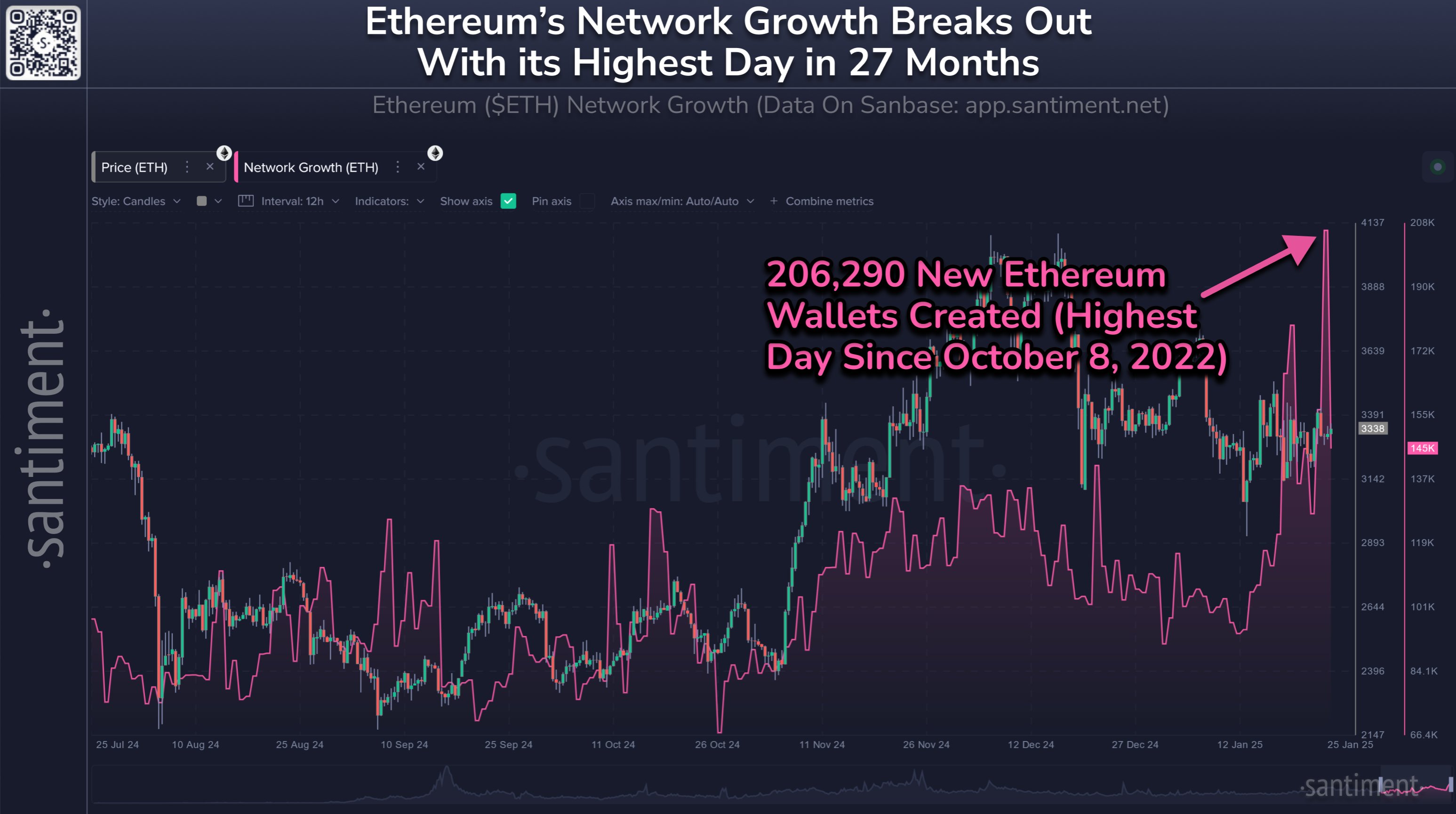

In a new post on X, the on-chain analytics firm Santiment has discussed about the latest trend in the Network Growth for Ethereum. The “Network Growth” here refers to an indicator that keeps track of the total number of addresses that are coming online on the ETH blockchain for the first time.

An address is said to be ‘online’ or active when it participates in some kind of transaction activity on the network, whether as a sender or receiver. Thus, the Network Growth measures the number of addresses making their very first transfer.

When the value of this indicator is high, it means the network is witnessing the creation of a large number of addresses. This kind of trend can arise when new users join the chain or old ones who had sold earlier return.

A spike in the Network Growth can also naturally occur when existing users create multiple wallets for a purpose like privacy. In general, all of these factors are at play to some degree whenever the indicator observes an increase, so some adoption of the cryptocurrency could be assumed to be taking place.

Now, here is the chart shared by the analytics firm that shows the trend in the Ethereum Network Growth over the past six months:

The value of the metric seems to have been quite high in recent days | Source: Santiment on X

As displayed in the above graph, the Ethereum Network Growth saw a huge spike during the weekend, implying a large number of new addresses were generated on the ETH blockchain.

In total, the users created 206,290 addresses during this spike, which is the largest value for the indicator since October 2022, more than two years ago.

As the analytics firm notes,

The 27-month high in daily wallet creation comes during a time when ETH crowd sentiment has veered particularly negative as other altcoins have outperformed it. Regardless, due to DeFi and staking options for crypto’s #2 market cap asset, Ethereum is still the entire sector’s leader in total non-empty addresses.

Historically, adoption is something that has been constructive for cryptocurrencies, as a wider userbase can provide for a stronger foundation on which future price moves can thrive.

The potential bullish effects of adoption, however, usually only become apparent in the long term. Thus, these new addresses are unlikely to have any noticeable influence on the price of Ethereum in the near future.

ETH Price

Ethereum, like the rest of the cryptocurrency sector, has crashed during the past day. After a drawdown of around 7%, ETH’s price is now trading under $3,100.

Looks like the price of the coin has plummeted over the past day | Source: ETHUSDT on TradingView

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Ethereum

Ethereum Large-Scale Transactions Show No Significant Upsurge, What’s Holding Whales Back?

Speculations about Ethereum’s potential for a major upswing to a new all-time high in the ongoing cycle swells within the community as many wonder why ETH has underperformed compared to other altcoins. Several factors have been considered to have hindered ETH’s much-awaited rally including weak whale activity.

Is Large Investors’ Interest In Ethereum Fading?

The euphoria among whale Ethereum investors sparks worries as large-scale transaction volume fails to show any significant increase in the ongoing market cycle. Verified author at the CryptoQuant on-chain platform IT Tech underlined the negative trend, suggesting a lack of strong whale activity.

The development implies that high net worth and institutional investors are still cautious as major ETH transfers remain at a low range. With large transactions fading, ETH may face significant hurdles since whale activity typically fuels price increases.

IT Tech considers Ethereum’s large transactions to be low in contrast to past cycles such as 2017 and 2021, where these transfers were rampant. This goes to say that the market is more retail-driven and organic, rather than speculative mania.

While there have been small increases in whale activity, the expert outlined that they are not at levels that would indicate a sell-off or parabolic move. In the meantime, IT Tech urges investors to look out for unexpected spikes in whale activity since they typically come before significant price changes.

According to the expert, Ethereum is experiencing a gradual upward trend. However, the next significant change in market dynamics will be determined by whale movements. Presently, the altcoin has reclaimed the $3,000 mark as prices recover after a general market pullback, bringing the next crucial resistance point at $3,500.

In order to confirm a break through the $3,500 mark, IT Tech claims there must be an increase in large transaction volume. If ETH does not see a rise in these transactions, it could witness a consolidation phase or a notable pullback.

IT Tech expects a pullback toward the $2,800 and $2,500 level if the large transaction coincides with price weakness, which might lead to whale distribution and cause ETH to drop. With this subdued movement, ETH’s sustainability is being questioned, triggering uncertainty about its next big price action.

ETH’s Uptrend Set To Face Volatility?

ETH is hovering between $3,000 and $3,200 with slight bullish momentum. Nonetheless, crypto expert and trader, Titan of Crypto has identified a trend that might strengthen Ethereum’s upward movement in the coming days.

Examining ETH’s price on the daily chart, Titan of Crypto expects an upswing following a breakout from a Falling Wedge pattern. This pattern is supported by an impending RSI bullish divergence, which could fuel more price spikes toward key resistance levels.

Even though Ethereum is demonstrating upside potential, the expert believes that volatility may unfold shortly after the recently concluded FOMC meeting.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

What Is Really Going On? Analyst Weighs In

Ethereum performance has lagged behind the broader cryptocurrency market in recent months, with the asset failing to capitalize on the bullish momentum recently seen in the market.

While Bitcoin has repeatedly reached new all-time highs, Ethereum has struggled to break past $4,000 and remains well below its 2021 peak of $4,800.

Amid this slow recovery, a crypto analyst known as ProjectW has shared insights on the potential for Ethereum’s resurgence, urging investors to consider the long-term picture.

In a detailed post on X, ProjectW outlined several factors that could drive Ethereum’s next breakout. The analyst highlighted Ethereum’s years of accumulation within a broad trading range, suggesting that such prolonged consolidation often precedes significant price expansions.

Despite the negative sentiment around Ethereum and narratives favoring other networks like Solana, ProjectW emphasized that Ethereum’s long-term upward trend remains intact.

A possible retest of the sub-$ 3,000 range could serve as a catalyst, providing the liquidity needed to push Ethereum past $4,000 and set the stage for a broader recovery.

Related Reading

ETH/BTC Performance And Outlook

A key point in ProjectW’s analysis is Ethereum’s ongoing underperformance against Bitcoin. So far, Ethereum has struggled to match Bitcoin’s gains during market rallies and has often faced steeper declines during market corrections.

This trend is reflected in the ETH/BTC trading pair, which remains in a bearish structure on higher timeframes. However, the analyst identified a potential reversal zone around $2,700 for Ethereum, which could coincide with a structural shift if ETH/BTC stabilizes at these levels.

THE BIG COMEBACK OF ETHEREUM: An Unbiased Evaluation

“Ethereum is dead. Solana stole the show.”

You’ve probably heard this take a hundred times.

The sentiment around ETH has never been worse.

And yet – if we strip away emotions and narratives – Ethereum’s long-term… pic.twitter.com/ipkXvuXbnj

— ProjectW (@fitforcrypto_) January 29, 2025

The analyst also touched on the role of market makers and institutional players in shaping Ethereum’s price trajectory. According to ProjectW, recent negative coverage of Ethereum—ranging from concerns about the Ethereum Foundation to repeated comparisons with Bitcoin—may not be coincidental.

Instead, it could represent a deliberate effort by major market participants to accumulate Ethereum at lower prices, a pattern observed in past market cycles.

The involvement of institutional players, such as Trump-affiliated World Liberty Financial reportedly acquiring significant amounts of Ethereum, adds another layer of complexity to the current market dynamics. The analyst wrote:

We know how this game works. MMs move price where they want – especially to areas with high liquidity. And how do they do it? Media narratives. Recently, we’ve seen an aggressive push of ETH FUD in major publications. – The Ethereum Foundation being questioned – ETH’s underperformance against BTC being highlighted everywhere Is this really a coincidence? Or is it the same old SM playbook? Flood the market with FUD → Retail panic sells at the bottom → Institutions accumulate.

Ethereum’s Core Strengths and Future Outlook

Despite recent underperformance, the analyst argued that Ethereum’s core fundamentals remain strong. ProjectW wrote:

Despite all the noise, Ethereum remains the most important smart contract network. – The deepest liquidity in DeFi – The highest security & decentralization – It has the strongest developer ecosystem While sentiment is at rock bottom, the actual fundamentals suggest ETH is still the backbone of the space. So where does this leave us?

Related Reading

While no rally is guaranteed, ProjectW suggested that Ethereum’s long-term conditions are aligning for potential growth. The analyst concluded with a call to closely monitor Ethereum’s progress in the coming weeks, as market participants await signs of a sustained upward trend.

Featured image created with DALL-E, Chart from TradingView

Ethereum

ETH Faces ‘Moment Of Truth’ After Crash Toward $3,000

Crypto analyst Max has revealed that the Ethereum price is at a critical junction, which could determine its trajectory going forward. The analyst remarked that ETH faces a ‘moment of truth’ and explained that the crypto could enter a bearish phase if it doesn’t complete a particular pattern.

Ethereum Price Faces Moment Of Truth After ETH’s Crash Toward $3,000

In an X post, Max stated that the Ethereum price faces a moment of truth right here following ETH’s crash to around $3,000. The crypto analyst added that if ETH doesn’t complete its famous “ultra-scary 3 drive into the lows” pattern before being miraculously saved, then it is over for a while, indicating the crypto could suffer a further downtrend.

Related Reading

Max further explained that there is nothing but air beneath the Ethereum price structure, which he highlighted in his chart. His accompanying chart showed that the next significant support level for ETH beneath $3,000 was at $2,400, indicating that the crypto could drop to as low as this level if it loses the psychological $3,000 level as support.

The crypto analyst then mentioned the worst case that could happen before giving up on the Ethereum price is if it sweeps the $2,800 wick and then the Bitcoin price drops to as low as $95,000. In such a scenario, Max remarked that ETH would need an immediate reaction, possibly because of the bearish sentiment that could spark among investors.

However, the analyst looks to still be bullish on the Ethereum price in the meantime, reaffirming that he has no intention to sell his spot holdings. Crypto whales also look to be bullish on ETH despite its underperformance, as they have been actively accumulating this past week. Bitcoinist reported that Ethereum’s large transaction volume spiked by over 200% in 24 hours, indicating an accumulation trend from these whales.

How The ETH Price Action Could Play Out

In an X post, crypto analyst Wolf predicted how the Ethereum price action could play out this year while claiming that ETH is currently being suppressed so that large players can accumulate. According to the analyst, ETH could break out to the psychological $4,000 price level by the end of February.

Related Reading

Following that, Wolf predicts that the Ethereum price will enjoy a bullish March as it rallies from $4,000 to $5,000 in days. He added that the second-largest crypto by market cap could hit $6,500 by early April. Once that is done, the analyst expects Ethereum to experience two to three weeks of price correction before it then pushes to between $9,500 and $10,000.

At the time of writing, the Ethereum price is trading around $3,100, down almost 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

-

Bitcoin22 hours ago

Bitcoin22 hours agoWho’s In Control? New Bitcoin Investors Now Hold Over 50% Of The Market

-

Market21 hours ago

Market21 hours agoBTC Price Holds Steady as Whale Activity Hits One-Year Low

-

Market7 hours ago

Market7 hours agoRipple analyst tips this sub-$1 altcoin over XRP for its huge rally potential

-

Market19 hours ago

Market19 hours agoBinance May Face Criminal Charges In Spanish Court

-

Market23 hours ago

Market23 hours agoRobinhood Offers Crypto Futures Trading With CME Partnership

-

Altcoin23 hours ago

Altcoin23 hours agoXRP Price To Flip Ethereum Price, Analyst Reveals How

-

Market22 hours ago

Market22 hours agoWill SOL Rebound Above $290 in February 2025?

-

Altcoin22 hours ago

Altcoin22 hours agoWhy Did The Dogecoin Price Crash To $0.31?