Ethereum

Ethereum Set For Significant Changes In Mid-March

Despite facing considerable price challenges, Ethereum (ETH) remains resilient, with vital developments continuing to unfold within its ecosystem. Among the most anticipated advancements is the upcoming Pectra Upgrade, expected to roll out in mid-March.

This upgrade is being hailed as the largest in Ethereum’s history, marked by the introduction of numerous Ethereum Improvement Proposals (EIPs) that promise to transform the network’s functionality and user experience.

How Ethereum Validators Could Earn Even Higher Rewards

Anthony Sassano, an independent Ethereum educator and angel investor, has been vocal about the potential impact of the Pectra Upgrade, emphasizing that this upgrade will significantly enhance Ethereum’s user transaction flow through account abstraction, primarily driven by EIP-7702.

Instead of navigating the cumbersome approve-then-swap process, users will be able to execute these actions in a single transaction, substantially simplifying the user experience.

Related Reading

Another notable proposal, EIP-7251, is set to increase the maximum effective balance that validators can earn rewards on from 32 ETH to an impressive 2048 ETH per validator.

This change means that validators will no longer need to wait to accumulate 32 ETH before they can start earning staking rewards. The upgrade will also allow for the consolidation of validators managed by a single node operator, thereby alleviating some of the network’s operational burden.

Key EIPs To Optimize Network Performance

EIP-7691 addresses scalability concerns by increasing blob throughput. Blobs have been near capacity for months, which has constrained the scalability of rollups and layer 2 solutions while driving up transaction fees for users.

With the forthcoming increase from 3/6 to 6/9 blobs, the network is expected to accommodate more transactions, leading to lower fees and improved performance for users.

The Pectra Upgrade also introduces EIP-7623, which raises the cost of using calldata for rollups. This measure encourages rollups to utilize blobs exclusively, optimizing resource allocation on the network.

In addition, EIP-7002 will introduce a new mechanism that facilitates validator withdrawals at the execution layer. This innovation aims to create fully trustless staking pools, minimizing reliance on intermediaries for processing withdrawals and reward distributions.

Related Reading

EIP-7685 enhances communication between the execution and consensus layers of Ethereum, allowing smart contracts to interact directly with the staking layer. This development could reduce the need for intermediaries, such as trusted oracles, thereby improving efficiency.

Furthermore, EIP-2537 will make cryptographic processes on the network more efficient, particularly benefiting zero-knowledge (zk) operations that are crucial for scalability and privacy.

In addition to these prominent proposals, the Pectra Upgrade includes four more EIPs designed to streamline network operations. These encompass improvements such as serving historical block hashes from state and supporting validator deposits on-chain, which will further optimize Ethereum’s infrastructure.

Despite these expected upgrades, the Ethereum price continues to hover around $3,200 and $3,300, showing a notable lack of catalysts that could boost the altcoin’s price.

Featured image from DALL-E, chart from TradingView.com

Ethereum

13 Mega Whales Holding Over 10,000 Ethereum Join The Network In 24 Hours – Major Accumulation Signal?

Ethereum (ETH) has had a turbulent week, with the price dipping to tag the critical $3,000 support level before recovering to current levels around $3,200. This sharp drop sparked fear among investors, as doubts about Ethereum’s performance for this cycle intensified. Many began questioning whether ETH could regain its momentum amid the broader market’s volatility.

However, key on-chain metrics suggest that not all investors share this skepticism. Data reveals that major players are still accumulating ETH despite recent price action. In the past 24 hours alone, 13 new mega whales—wallets holding over 10,000 ETH each—have joined the network. This signals strong confidence among high-net-worth investors and institutional players, who appear to see the current price levels as an opportunity.

This significant accumulation activity suggests that big players are positioning themselves for a potential breakout. While smaller retail investors may be hesitant, the moves of these whales could indicate optimism for Ethereum’s long-term prospects. As ETH stabilizes around the $3,200 level, the market will be closely watching whether this accumulation trend leads to renewed bullish momentum and a stronger recovery in the weeks ahead. The coming days could be pivotal for Ethereum’s trajectory in this market cycle.

Ethereum Enters A Recovery Phase

Ethereum has faced significant selling pressure since late December, shedding over 25% in value during this period. The prolonged downturn has tested investor confidence, yet recent price action suggests that the bearish phase may be nearing its conclusion. Analysts are now optimistic about a reversal and potential recovery, with Ethereum showing signs of regaining its footing.

Top crypto analyst Ali Martinez has highlighted compelling data supporting this bullish outlook. According to his analysis shared on X, 13 mega whales—wallets holding over 10,000 ETH each—have joined the Ethereum network in the last 24 hours.

This surge in large-scale accumulation suggests that big players are taking advantage of current price levels, positioning themselves for an anticipated recovery. Significant whale activity often serves as a strong indicator of confidence among institutional and high-net-worth investors, who typically operate with a long-term perspective.

At its current levels, Ethereum appears to be building a strong base of support. This accumulation by mega whales aligns with the broader market sentiment that ETH is poised for a bullish phase once the selling pressure subsides. If ETH can hold its ground and reclaim key resistance levels, the next upward move could mark the beginning of a strong recovery and sustained bullish momentum in the months ahead.

ETH Testing Crucial Liquidity

Ethereum is trading at $3,190 after finding strong support at the $3,000 mark, which aligns with the 200-day moving average. This key level has acted as a critical long-term indicator of strength, and ETH’s ability to hold above it suggests the potential for a trend reversal. After weeks of downward pressure, the current price action indicates that ETH might finally be ready to shift from its bearish trajectory.

For a complete confirmation of a bullish reversal, Ethereum must break above and hold the $3,500 level, a significant resistance zone that has capped its upward movement in recent weeks. Reclaiming this level would likely restore investor confidence and signal the start of a new uptrend. However, market conditions remain volatile, driven by speculation and broader macroeconomic uncertainties, which may delay ETH’s breakout.

Despite the challenges, Ethereum’s recovery above the 200-day moving average is a positive sign for the long-term outlook. Investors are cautiously optimistic as ETH stabilizes at current levels. Patience may be required, but the recent price action suggests ETH is setting the stage for a potential rally once it overcomes key resistance and the broader market finds direction.

Featured image from Dall-E, chart from TradingView

Ethereum

Ethereum Reserves Hit Multi-Year Lows—Are We On The Verge Of A Bull Run?

Ethereum is experiencing a gradual recovery as its price climbs above $3,100. This marks a 2.3% increase over the past day. However, the asset remains in a state of overall decline, down 3.3% over the week.

While this modest rebound offers some relief, Ethereum is still grappling with the effects of an overall bearish trend. The ongoing price movement has prompted some analysts to revisit Ethereum’s underlying on-chain metrics to understand what may lie ahead for the cryptocurrency.

One key area of focus is Ethereum’s spot exchange reserves. According to a recent analysis by Cryptoavails, a contributor to the CryptoQuant QuickTake platform, the total reserves of Ethereum held on spot exchanges have been steadily declining. This long-term trend points to a shift in how market participants are managing their holdings.

Ethereum Spot Exchange Reserves Trend

According to Cryptoavails, Ethereum reserves on spot exchanges have gone through significant changes over the years. During the 2017-2018 bull market, reserves reached their peak, driven by a surge in investor interest.

The 2020-2021 period saw another substantial increase, fueled by the rise of the DeFi ecosystem and Ethereum-based projects. However, starting in late 2021, reserves began a sharp decline as large withdrawals from exchanges became more common.

By 2023, reserve levels hit a low point, and by 2024, these reduced levels persisted, signaling a potential supply shortage. This reduction in reserves often indicates that holders are withdrawing Ethereum from exchanges for long-term storage, rather than leaving it available for immediate trading.

As a result, the diminished supply on exchanges can create upward pressure on prices. Cryptoavails noted that from 2022 onward, as reserves decreased, Ethereum’s price started to stabilize at higher levels. This pattern suggests that low reserve levels could support further price increases, potentially triggering a new upward trend.

Technical Analysis Of ETH

From a technical standpoint, Ethereum has shown patterns that analysts interpret as bullish. Several prominent figures in the crypto community have shared their insights.

One renowned analyst known as Crypto Ceaser recently highlighted a bounce in Ethereum’s price as a significant opportunity, expressing a view that the cryptocurrency is undervalued and may be poised to reach new all-time highs.

$ETH – #Ethereum bounced as expected. This was a huge opportunity. Send it.

In my opinion Ethereum is heavily undervalued. I think we will see new ATH’s soon. pic.twitter.com/ljMa1lEpJO

— Crypto Caesar (@CryptoCaesarTA) January 28, 2025

However, not all analyses paint a uniformly optimistic picture. Anup Dhungana, another crypto analyst, pointed out a divergence between Bitcoin and Ethereum’s market behavior.

While Bitcoin has maintained a steady uptrend, Ethereum’s performance against Bitcoin has been less robust, with the ETH/BTC pair forming lower lows. This divergence reflects reduced investor interest in Ethereum relative to other assets.

According to Dhungana, the next technical support level for ETH/BTC may lie between 0.028 and 0.026. A rebound from this level could potentially revive broader interest in Ethereum and altcoins, paving the way for another phase of growth.

Featured image created with DALL-E, Chart from TradingView

Ethereum

New Users See Largest Spike In 27 Months

On-chain data shows a large amount of new addresses have popped up on the Ethereum network recently, a sign that ETH adoption is occurring.

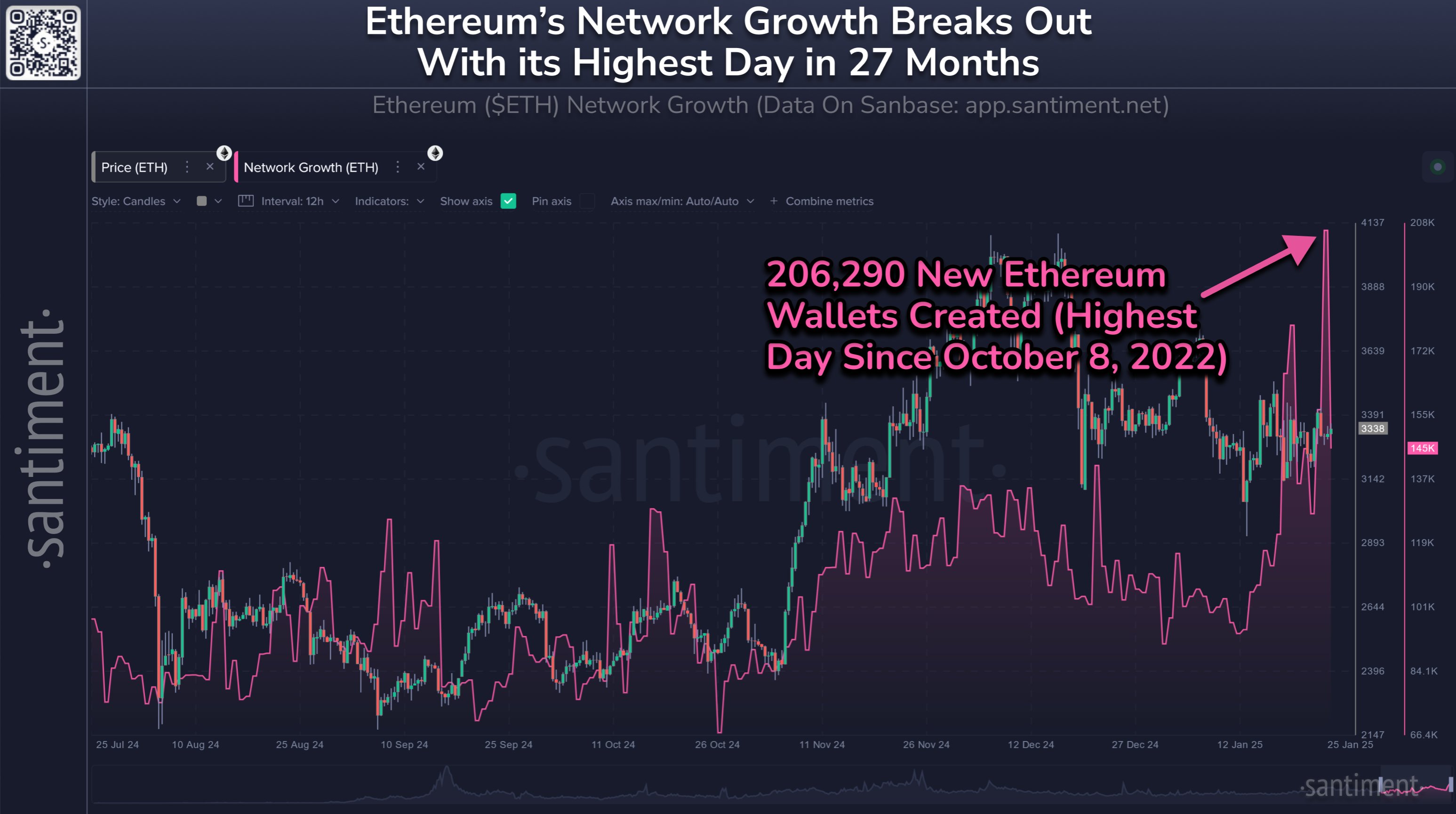

Ethereum Network Growth Registered A Sharp Spike Recently

In a new post on X, the on-chain analytics firm Santiment has discussed about the latest trend in the Network Growth for Ethereum. The “Network Growth” here refers to an indicator that keeps track of the total number of addresses that are coming online on the ETH blockchain for the first time.

An address is said to be ‘online’ or active when it participates in some kind of transaction activity on the network, whether as a sender or receiver. Thus, the Network Growth measures the number of addresses making their very first transfer.

When the value of this indicator is high, it means the network is witnessing the creation of a large number of addresses. This kind of trend can arise when new users join the chain or old ones who had sold earlier return.

A spike in the Network Growth can also naturally occur when existing users create multiple wallets for a purpose like privacy. In general, all of these factors are at play to some degree whenever the indicator observes an increase, so some adoption of the cryptocurrency could be assumed to be taking place.

Now, here is the chart shared by the analytics firm that shows the trend in the Ethereum Network Growth over the past six months:

The value of the metric seems to have been quite high in recent days | Source: Santiment on X

As displayed in the above graph, the Ethereum Network Growth saw a huge spike during the weekend, implying a large number of new addresses were generated on the ETH blockchain.

In total, the users created 206,290 addresses during this spike, which is the largest value for the indicator since October 2022, more than two years ago.

As the analytics firm notes,

The 27-month high in daily wallet creation comes during a time when ETH crowd sentiment has veered particularly negative as other altcoins have outperformed it. Regardless, due to DeFi and staking options for crypto’s #2 market cap asset, Ethereum is still the entire sector’s leader in total non-empty addresses.

Historically, adoption is something that has been constructive for cryptocurrencies, as a wider userbase can provide for a stronger foundation on which future price moves can thrive.

The potential bullish effects of adoption, however, usually only become apparent in the long term. Thus, these new addresses are unlikely to have any noticeable influence on the price of Ethereum in the near future.

ETH Price

Ethereum, like the rest of the cryptocurrency sector, has crashed during the past day. After a drawdown of around 7%, ETH’s price is now trading under $3,100.

Looks like the price of the coin has plummeted over the past day | Source: ETHUSDT on TradingView

Featured image from Dall-E, Santiment.net, chart from TradingView.com

-

Regulation10 hours ago

Regulation10 hours agoFrance probing Binance over fraud, money laundering: report

-

Altcoin23 hours ago

Altcoin23 hours agoBTC At $102K, Altcoins Mixed, JUP Up 15% Ahead of FOMC

-

Market12 hours ago

Market12 hours agoMEXC Leads Q4 2024 Meme Trading Wave: 140% QoQ Volume Growth & 240 New Projects Added

-

Market15 hours ago

Market15 hours agoShiba Inu price predicted to hit $0.01, XRP price targets $5, but WallitIQ (WLTQ) could surge to $10 event faster – Here’s how

-

Bitcoin13 hours ago

Bitcoin13 hours agoMetaplanet Reveals Record Funding for Bitcoin-Focussed Strategy

-

Regulation9 hours ago

Regulation9 hours agoLegal Expert Confirms Ripple SEC Case Still Active Despite Website Changes

-

Market13 hours ago

Market13 hours agoOndo Finance Expands Institutional Reach with XRPL Integration

-

Bitcoin8 hours ago

Bitcoin8 hours agoRipple CTO Spills The Beans