Market

How the Fed’s latest decision could affect crypto markets in 2025

Bitcoin may have kicked off 2025 with a rebound back to $100,000, but since the release of the U.S. Federal Reserve’s December 2024 Federal Open Market Committee meeting on Jan. 8, the BTC/USD exchange rate dropped to as low as $91,220.84.

Bitcoin has stabilized at around $95,000 since then, but concerns run high whether further news about the future direction of interest rates and monetary policy will result in an additional negative impact to the performance of Bitcoin and other cryptocurrencies.

As cryptocurrencies have entered the financial mainstream, they have become increasingly sensitive to policy changes from the Federal Reserve. With this in mind, let’s take a closer look at the latest news from the Fed, and see what it could mean for the performance of both Bitcoins and altcoins in the months ahead.

Why Cryptos Fell on The Latest Fed News

As revealed in the aforementioned Fed meeting minutes, the central bank once again cut interest rates by 0.25%, or 25 basis points. This was in line with expectations. However, while the latest rate cuts arrived as expected, other takeaways from the meeting minutes caught investors off-guard.

Namely, the Fed’s signaling of its plans to reduce the number of 25-basis point rate cuts in 2025. Before the meeting minutes hit the street, the market was still expecting four such cuts throughout the year. The latest remarks from Fed officials regarding quantitative tightening also suggested that the “Fed pivot” this year will not be as rapid of a shift from hawkish to dovish as previously anticipated.

Taking this into account, it’s not completely surprising that Bitcoin has once again encountered negative volatility. Nor is it surprising that more volatile altcoins, like Ethereum, Solana, and Dogecoin, have all experienced double-digit declines over the past week. As “risk-on” assets, cryptocurrencies, especially altcoins, perform better during times of accommodative fiscal policy.

Yet while the Fed may be not turning as dovish as previously expected, and is in fact continuing to engage in monetary tightening, the impact of these policy decisions on cryptocurrency prices in 2025 may not be as dire as it seems at first glance.

What This Means for Bitcoin and Altcoin Prices in 2025

Although the cryptocurrency market reacted negatively to the Fed’s current policy gameplan, said plans could still result in further upside for Bitcoin and other cryptocurrencies. For one, the planned implementation of fewer 25 basis-point rates still means a further loosening of monetary policy, helping to justify additional upside for this “risk-on” asset class.

Second, with regards to Bitcoin, other positive factors are at play that could drive further upside for the largest cryptocurrency by market capitalization. These include increased institutional and retail investor allocation, as well as the specter of a more favorable crypto regulatory environment from the incoming Trump administration.

Binance CEO Richard Teng commented on what we can expect in the crypto industry in 2025, “We expect to see development across all aspects. Crypto regulation saw great growth across the world in 2024 and we expect to see more in 2025. Given the recent U.S. presidential election and expected crypto regulation from its new government, we expect to see other countries follow the lead from the U.S. and enact more legislation across the world.”

Teng continues, “In terms of institutional interest, financial giants like BlackRock and Fidelity entered the crypto business in 2024, and we expect to see more new players next year. More companies are learning about crypto and integrating crypto features like tokenization into their business. This is a trend that has grown for years and we expect to see more development in.”

Admittedly, the recently-announced changes to the Fed’s rate cut plans could still negatively impact the performance of altcoins in the short-term. Altcoins are much more sensitive to changes in fiscal policy. Nevertheless, if a bull market continues in Bitcoin, chances are it will spill over into the altcoin space as well. Investors profiting from a continued run up in the price of Bitcoin could cycle their gains into Ethereum, XRP, Solana, and other major and emerging altcoins.

The Bottom Line

Over a longer timeframe, the Fed’s decision to more cautiously lower interest rates and loosen fiscal policy may do little to threaten the long-term bull case for cryptocurrencies. Due to a variety of trends, including the proliferation of exchange-traded cryptocurrency investment products, institutional and retail capital inflows into cryptocurrencies are poised to continue.

Of course, nothing’s for certain. For instance, following the latest jobs report, there is growing doubt whether the Fed will further walk back its 2025 rate cut plans. Even if the Fed sticks to its current plan, this asset class is likely to stay highly volatile. Caution and patience remain key.

Nevertheless, taking into account not just the Fed news,but the other positive trends at play as well, the opportunity for long-term price appreciation with Bitcoin and other cryptocurrencies is still on the table.

Market

Biggest Altcoin Gainers Of The Fourth Week of January 2025

The crypto market experienced significant volatility this week as Bitcoin surged to $107,000. This movement caused some altcoins to face drawdowns while others emerged as top performers, delivering impressive profits to investors.

BeInCrypto has identified three standout altcoins that ranked among the week’s biggest gainers and explores what investors can anticipate next.

GateToken (GT)

GT has seen a 23% rise this week, reaching a new all-time high of $25.96 during the latest intra-day session. This consistent upward momentum has captured investor attention, positioning the altcoin as one of the top-performing altcoins in the current market.

Despite occasional bearish market cues, GT has yet to experience a sharp correction. This resilience reflects strong investor confidence and a bullish sentiment surrounding the token. If this momentum continues, GT could extend its rally and achieve further milestones in the coming days.

However, significant profit-taking could lead to a decline, with the altcoin testing critical support at $19.89. A drop below this level could invalidate the bullish outlook and signal increased bearish pressure.

KuCoin Token (KCS)

KCS experienced a 16% rise this week, with most of the gains occurring in the last 72 hours. The altcoin is currently trading at $13.12, reflecting growing investor interest and strong upward momentum as it seeks to sustain its recent rally.

The altcoin recently breached the $13.74 resistance level after establishing solid support at $12.47. If the bullish momentum persists, KCS could close above this barrier, paving the way for further gains.

However, a drop from the current price below $12.47 could trigger a decline to $11.52. Such a move would invalidate the bullish outlook, erasing recent gains and signaling potential bearish sentiment.

OFFICIAL TRUMP (TRUMP)

TRUMP has solidified its position as one of the week’s top-performing and most trending tokens, recording an impressive 112% rise. This surge reflects strong investor interest, bolstered by market sentiment and the token’s recent developments, keeping it in the spotlight among meme coins.

Despite its overall growth, TRUMP has experienced some volatility and is currently attempting to regain the $30 support level. Flipping $34 into support could help the token recover recent losses and maintain its bullish trajectory. This move would signal renewed momentum, encouraging further investment in the token.

However, trading at $27.46, TRUMP faces risks of falling further. If it loses the critical support at $26.09, the token could drop to $21.04. Such a decline would invalidate the bullish outlook, raising concerns about sustained bearish momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Potential Grayscale Litecoin ETF Sparks 25% Rally In LTC Price

Litecoin’s price surged by 25% this week following news that Grayscale filed for a spot Litecoin ETF, sparking demand from institutional investors.

The move validated the efforts of long-term holders (LTHs), whose support has anchored LTC through market fluctuations. This development has positioned Litecoin as a standout performer in the cryptocurrency market.

Litecoin Has Its Investor’s Support

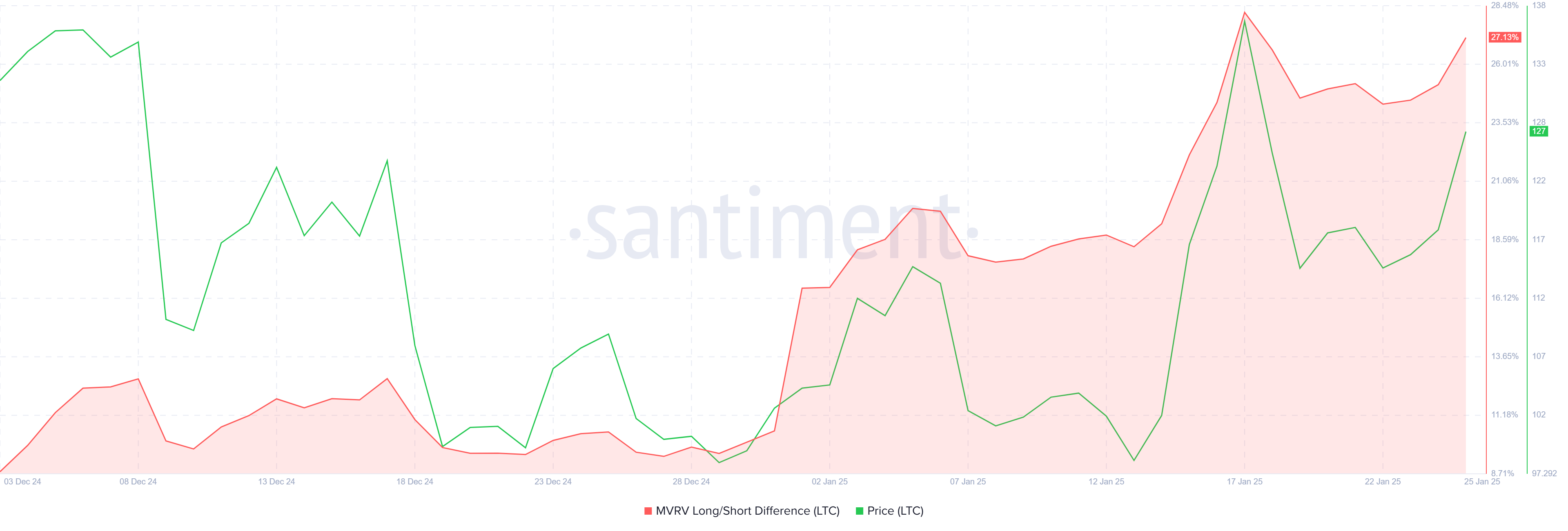

Long-term holders have played a critical role in stabilizing Litecoin. The MVRV Long/Short Difference indicator remains highly positive, signaling that LTHs are in profit. These investors, known for their tendency to HODL rather than sell, provide essential support, reducing the likelihood of sharp corrections.

This behavior has created a strong foundation for Litecoin, enabling it to sustain rallies even during periods of market volatility. By holding onto their assets, LTHs act as the backbone of Litecoin, ensuring that the cryptocurrency maintains momentum and garners investor confidence.

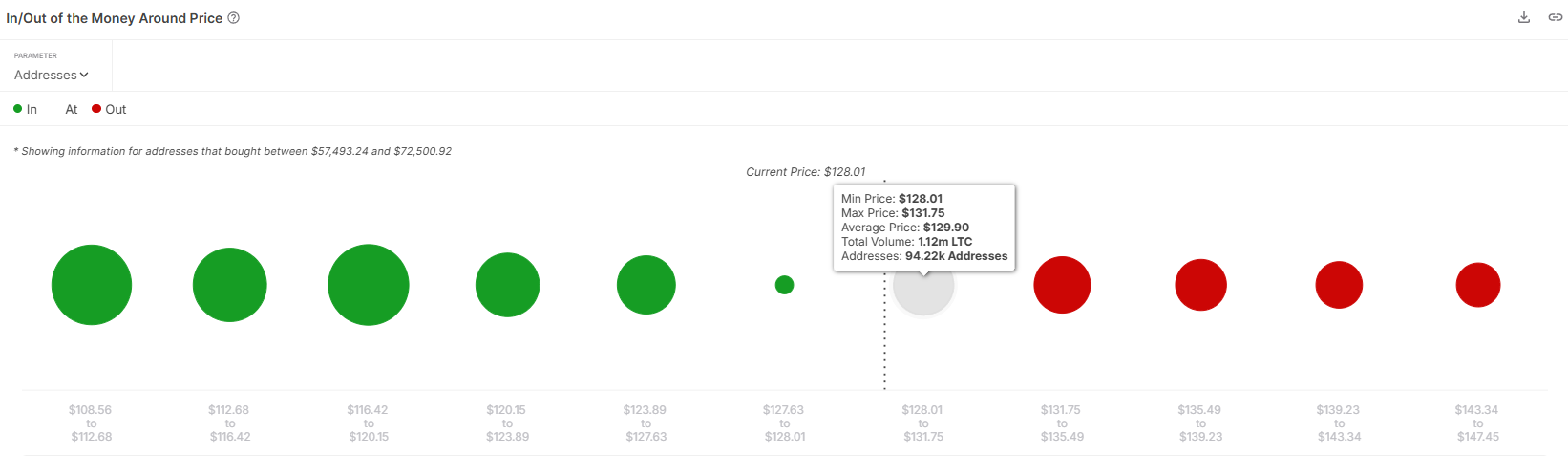

The macro momentum for Litecoin remains bullish, supported by the IOMAP metric. Data reveals that investors bought over 2 million LTC, valued at more than $256 million, within the $128 to $135 range. This supply becomes fully profitable once Litecoin flips $136 into support, reinforcing positive sentiment.

This concentration of profitable investors is likely to keep sentiment optimistic. Anticipation of breaking the $136 resistance level has fueled bullish momentum, as investors remain confident that LTC can sustain its upward trajectory. The substantial backing at these levels further solidifies the asset’s potential for continued growth.

LTC Price Prediction: Flipping Key Barrier Into Support

Litecoin has risen by 25% in the past 24 hours, currently trading at $128. The altcoin now faces resistance at $136, which will be critical for maintaining its bullish momentum and enabling further gains.

If Litecoin breaches and flips $136 into support, it could unlock the $256 million in profits tied to this level. Such a move would likely propel LTC to $147, marking a significant step in its ongoing rally and validating investor confidence.

However, Litecoin price’s failure to break above $136 could result in a decline to $117 or even $105. This would erase a significant portion of recent gains, invalidate the bullish outlook, and delay the realization of anticipated profits.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Virtuals Protocol Targets Solana for AI-Driven Innovation

Virtuals Protocol, a decentralized platform for launching AI agents, has announced its expansion to the Solana blockchain.

This move aims to foster multichain availability while empowering builders and driving innovation within the ecosystem.

Virtuals’ Multichain Ambition

On January 25, Virtuals Protocol confirmed its expansion from Base to Solana. The protocol highlighted that this step marks the beginning of a new chapter, enabling it to grow its community and create more value for developers.

Virtuals aim to unlock new growth opportunities by leveraging Solana’s advanced scalability and active developer community,

“We are beyond excited to announce Virtuals’ expansion to Solana, marking a significant step in our journey to empower builders and drive innovation across multiple ecosystems. Solana, known for its speed, scalability, and vibrant community, is the perfect place for us to grow and bring our vision to life,” Virtuals said.

EtherMage, the protocol’s pseudonymous lead developer, described this expansion as the first of many steps toward building a diverse and robust multichain ecosystem. According to him, the move would help to realize their vision of an interconnected and autonomous digital society.

He noted that dedicated teams are already in place to collaborate with Solana and other blockchain communities. These teams will focus on funding, mentorship, and visibility for projects building within the Virtuals ecosystem.

“Going multi-chain is important for our vision of an agentic society. Diversity of agents is a critical component for autonomous businesses, autonomous societies. Solana is the first step. We are building support across several other chains as well,” EtherMage wrote on X.

Virtuals’ Plan for the Solana Ecosystem

Virtuals Protocol has outlined several initiatives tailored to Solana. Among these is the Meteora Pool, a platform feature designed to create fresh opportunities for trading and engagement.

Additionally, 1% of the trading fees generated will be converted to SOL and allocated to the Strategic SOL Reserve (SSR) to reward contributors and enhance Solana’s ecosystem.

The protocol has also introduced a grant program to boost development across both Base and Solana ecosystems. Under this program, projects on these chains can access 42,000 $VIRTUAL tokens to support early-stage growth.

Looking ahead, Virtuals is set to host an AI Hackathon in March in partnership with the Solana Foundation. This event aims to offer technical mentorship and support to developers, further reinforcing the protocol’s commitment to fostering innovation.

Virtual protocol has emerged as a top-performing platform in the crypto space, benefiting from the growing demand for AI-driven solutions. Its multichain expansion to Solana signals its dedication to shaping the future of decentralized AI and supporting a thriving developer ecosystem.

“Virtuals joining the Solana ecosystem is not just an expansion — it’s the beginning of a new chapter. We’re here to create value, empower builders, and grow the Virtuals Nation to new heights,” the team concluded.

Despite news of the expansion, Virtuals’ native VIRTUAL token is down more than 4% in the last 24 hours to $2.54 as of press time, according to BeInCrypto data.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoBTC Price Holds $105,000 as Whale Activity Hits One-Year Low

-

Bitcoin20 hours ago

Bitcoin20 hours agoBlackRock IBIT Bitcoin ETF Set for Potential In-Kind Upgrade

-

Market19 hours ago

Market19 hours agoCardano Investors Anchor for ADA Price at $1 By HODLing

-

Altcoin19 hours ago

Altcoin19 hours agoJUP Price Soars 8% As Solana DEX Jupiter Acquires Majority Stake In Moonshot

-

Market24 hours ago

Market24 hours agoECB Pushes Digital Euro as US Expands Crypto Regulations

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Says This Is Your Last Chance To Sell XRP Above $3, Here’s Why

-

Regulation21 hours ago

Regulation21 hours agoMicroStrategy May Face Tax Issues Over $19 Billion Unrealized Bitcoin Gains: Report

-

Altcoin23 hours ago

Altcoin23 hours agoWhat’s Next For Altcoins As Top Expert Refutes Altseason Possibilities?