Market

A Threat To $46 Billion Strategy?

MicroStrategy, the software company turned Bitcoin juggernaut, is grappling with an unexpected tax conundrum. Its $47 billion Bitcoin (BTC) holdings — comprising $18 billion in unrealized gains — place it squarely in the crosshairs of the US corporate alternative minimum tax (CAMT).

Enacted under the 2022 Inflation Reduction Act, this tax could force the company to pay federal income taxes on paper gains, even without selling a single Bitcoin.

MicroStrategy Suffers a Tax System Not Built for Crypto

Traditionally, investment gains are not taxed until the assets are sold. However, the CAMT, designed to prevent companies from aggressively recognizing earnings while minimizing taxable income, applies a 15% tax rate to adjusted financial statement earnings.

MicroStrategy disclosed in January that it could owe billions starting in 2026 if Bitcoin’s price remains stable. While the IRS has exempted companies like Berkshire Hathaway from paying taxes on unrealized gains from stocks, it has yet to extend similar leniency to cryptocurrency holdings.

Tax analyst Robert Willens suggests there is no technical reason why cryptocurrencies cannot receive the same treatment, but political dynamics could play a role.

“If the Biden administration had stayed in power, exemptions could not materialize,” the Wall Street Journal reported, citing Willens.

MicroStrategy’s business model centers on aggressive Bitcoin accumulation, which has earned the company a $92 billion market valuation. However, this strategy has left it vulnerable to market fluctuations and regulatory hurdles. If forced to pay taxes on unrealized gains, MicroStrategy might need to sell portions of its Bitcoin stash, undermining its core strategy.

Such a scenario would make MicroStrategy one of the least tax-efficient ways for investors to gain Bitcoin exposure. The company is already dealing with speculation about pausing Bitcoin purchases amid blackout rumors, despite planning a $2 billion stock offering to bolster its Bitcoin reserves.

Accounting Changes Add Complexity

New rules from the Financial Accounting Standards Board (FASB) compound the issue. Starting this year, companies must report the fair value of cryptocurrencies on their balance sheets. MicroStrategy disclosed that this change would add up to $12.8 billion to its retained earnings and potentially $4 billion to its deferred tax liabilities.

This shift means MicroStrategy’s Bitcoin holdings will directly affect its financial statements. Such an outcome would make the company more susceptible to regulatory scrutiny and market volatility.

MicroStrategy’s Bitcoin strategy has been both a blessing and a curse. On one hand, it propelled the company into the Nasdaq-100, cementing its reputation as a trailblazer in corporate cryptocurrency investment. On the other hand, it exposed the company to unprecedented risks, including the possibility of a tax bill that could wipe out profits or necessitate asset liquidation.

The tax dilemma is not MicroStrategy’s only concern. The IRS is set to begin tracking cryptocurrency transactions on centralized exchanges in 2025, signaling a broader regulatory crackdown.

MicroStrategy’s relentless Bitcoin acquisition spree — spending over $1.1 billion in recent purchases and planning more through stock offerings — has sparked criticism. Some view it as reckless, while others see it as a long-term bet on Bitcoin’s dominance. The company’s recent $243 million Bitcoin purchase in January, its second this year, reflects its commitment to its strategy, even as risks mount.

As the IRS drafts CAMT implementation rules, MicroStrategy is lobbying for exemptions for crypto holdings. Should the IRS grant such relief, the company could avoid the crippling tax bill. However, if Bitcoin’s value declines or regulatory relief fails to materialize, the consequences could be severe.

In a market where Bitcoin’s trajectory is uncertain, MicroStrategy’s bold $46 billion bet stands as a high-stakes gamble. It could redefine the intersection of corporate strategy, cryptocurrency, and taxation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Artificial Intelligence Coins Trending: BUZZ, BOTIFY, FREYA

Hive AI (BUZZ), BOTIFY, and Freya (FREYA) are among the top-performing artificial intelligence (AI) coins this week. BUZZ is up 58% in the last seven days, with its market cap reaching $145 million, as it powers a network of crypto AI agents.

BOTIFY, based on the Solana blockchain, has surged 74%, aiming to be “the Shopify of crypto” with its AI agent marketplace. FREYA, built on the Virtuals Protocol, has risen 47%, despite a recent 40% correction, showing strong interest in AI-driven blockchain projects.

Hive AI (BUZZ)

BUZZ, the token of Hive AI, supports a project focused on building a modular network of crypto AI agents. It aims to create artificial intelligence tools for tasks like portfolio management, risk analysis, trading, and sentiment analysis. Hive AI is also developing a “ChatGPT, but for Crypto,” as posted on its X account.

BUZZ has increased 58% in the last seven days, reaching a market cap of $145 million. Earlier this week, it hit an all-time high above $0.18, briefly pushing its market cap to $187 million.

If the bullish momentum continues, BUZZ could retest levels above $0.18. However, if the momentum weakens, the coin may test supports at $0.124 and $0.111, with a deeper retracement possible to $0.057 if those levels fail.

BOTIFY

BOTIFY aims to become “the Shopify of crypto,” streamlining and simplifying crypto automation through a certified, all-in-one artificial intelligence Agent Marketplace. Users can create AI agents and tokens while commercializing their agents through an integrated marketplace, offering a seamless platform for crypto automation and monetization.

Based on the Solana blockchain, BOTIFY has surged over 74% in the past seven days, with its market cap reaching $40 million and a daily trading volume of $5 million.

If the uptrend continues, BOTIFY’s price could surpass $0.050 and potentially test $0.060. However, a break below the $0.031 support level could trigger a significant correction in the short term.

Freya by Virtuals (FREYA)

FREYA, launched two months ago on the Base chain, operates on the Virtuals Protocol, one of the largest platforms for crypto AI agents.

Over the past seven days, FREYA’s price has risen by 47%, pushing its market cap to $21.5 million. However, the token is currently correcting, with a 40% drop in the last two days, and its daily trading volume remains below $1 million.

If FREYA regains its bullish momentum, it could revisit levels near $0.05. Conversely, a stronger correction might lead the price to test support at $0.025, with a potential drop to $0.0135 if that level fails.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Shiba Inu price prediction: Analysts predict 10x for SHIB, but this AI competitor could see much bigger returns as whale activity spikes

The Shiba Inu price has recently been making headlines with news of an incoming uptrend. Amid much speculation, analysts have revealed that a 10x surge is the most realistic expectation for the Shiba Inu price. On the other hand, an AI competitor has been raging with extreme whale activity, and some of the most bullish analysts are predicting that for this one, investors just might see up to 1000x gains. This AI competitor is WallitIQ (WLTQ), a fast-rising force in the crypto world.

Analysts Say The Shiba Inu Price May Surge 10x Its Current Price

The Shiba Inu price has dipped by about 6% over the past week. It’s now trading around $0.000019, representing a 7% drop over the month. There were a couple of predictions of a Shiba Inu price surge this season; therefore, this downtrend has disappointed traders.

Analysts explain, though, that the Shiba Inu community recently burnt tokens to reduce its large circulating supply and increase demand. This move is expected to boost the Shiba Inu price, potentially raising it 10x to $0.00019. While that sounds great, investors are not ready to settle for less. Therefore, whale support has shifted from the Shiba Inu price to an AI competitor token, WallitIQ (WLTQ).

This AI competitor brings hope of a 1000x rally and has received massive whale support in recent months. WallitIQ’s (WLTQ) potential is mouth-watering, including the ability to raise about $5m in monthly revenue. Analysts predict this AI competitor will take the $700 billion crypto wallet and AI market by storm, bringing life-changing gains for investors who key in now.

WallitIQ (WLTQ) Could Be The AI Competitor That Changes The Crypto World

A major reason why WallitIQ (WLTQ) is receiving such massive whale attention is because of its irresistible AI features. Especially since it launched the first version of its crypto wallet management app, this AI competitor has rapidly garnered whale support.

WallitIQ (WLTQ) offers users the chance to view real-time market data. With its CoinGecko API integration, investors can track the prices of various cryptocurrencies live. This interactive feature lets users tap on each currency to view its price trend over different timeframes.

Additionally, WallitIQ (WLTQ) currently supports simulated transactions, meaning users can test out crypto transfers without worrying about mistakes or unintended consequences. This AI competitor platform supports virtual transfers for common purchases such as food delivery and movie subscriptions.

WallitIQ (WLTQ) assures users of security with a complete smart contract audit with SolidProof. The platform soon plans to integrate customizable price alerts, allowing users to select which assets they want to get regular updates about. Analysts say this and many other upcoming features will spike whale interest even further.

A favorite feature that has accelerated whale investment is the platform’s modern and user-friendly interface. While many crypto management platforms are complex, WallitIQ (WLTQ) uses visually attractive design components to improve user experience. The platform is easy to use and responsive.

For now, the altcoin has raised over $6 million in concluded presales as crypto whales bought more than 350 million tokens. The ongoing presale, selling for $0.0420, has raised about $400,000 in just a few days. At this rate, analysts say the WallitIQ (WLTQ) presale will end soon, and investors have limited time to join if they want to enjoy game-changing returns.

Conclusion

As analysts predict a 10x gain for the Shiba Inu price, they also project a 1000x rise for WallitIQ (WLTQ), the AI competitor. The best choice is glaring, and many crypto whales have made a smart choice by joining the WallitIQ (WLTQ) presale.

It’s up to each investor: a 10x reward from a meme coin that has danced around the same mark for months, or the possibility of a 1000x surge from a new player with lots of untapped opportunities? Make the smartest crypto move today by joining the WallitIQ (WLTQ) presale for $0.0420 only.

Join the WallitIQ (WLTQ) presale and community:

Market

SOL Price Gains 21% as Market Cap Outpaces Sony

Solana (SOL) price is up 8% in the last 24 hours and 21% over the past week, with its market cap nearing $130 billion — larger than companies like Sony, Dior, and ADP. Trading volume has surged nearly 19% in the last 24 hours, now standing at $10 billion, reflecting strong market activity.

Technical indicators such as the Ichimoku Cloud and BBTrend suggest a bullish setup, though signs of consolidation hint at a potential pause in momentum. If SOL regains strength, it could test resistance at $292 and potentially rise to $300 for the first time, while a reversal may bring key supports at $229 and $211 into play.

SOL Ichimoku Cloud Shows a Bullish Setup

Solana Ichimoku Cloud indicates a bullish sentiment, with the price currently trading above the cloud, signaling strength. The Tenkan-sen (blue line) is above the Kijun-sen (red line), suggesting short-term momentum supports the bullish case.

The leading green cloud (Senkou Span A above Senkou Span B) provides additional confirmation of a favorable trend.

The lack of steep upward angles on the Tenkan-sen and Kijun-sen suggests the trend could be consolidating rather than accelerating. A move above $270 could confirm continued bullishness, with the potential to test higher resistance levels.

However, a dip back into the cloud could indicate indecision or weakening momentum, with the lower boundary of the cloud providing a critical support zone.

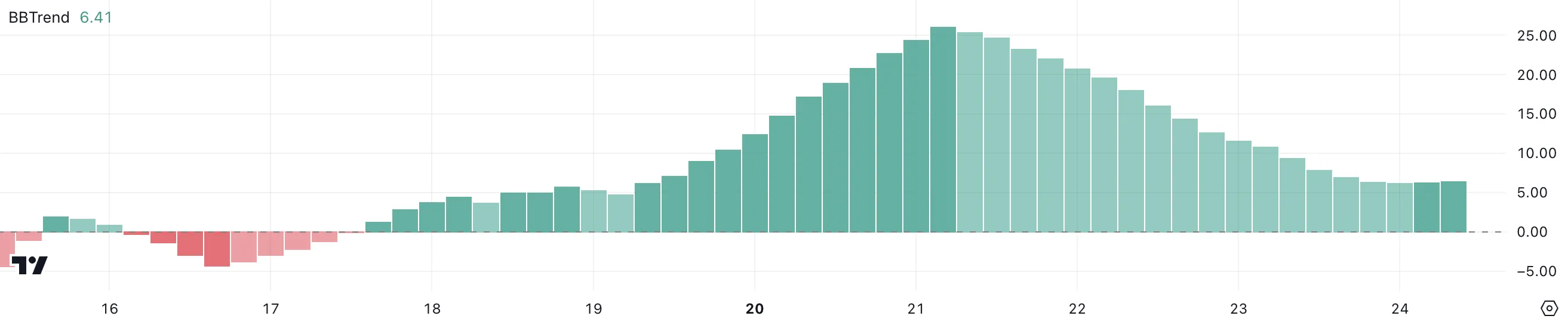

Solana BBTrend Is Stable and Positive

SOL BBTrend is currently at 6.41, down from its recent peak of 26 just three days ago, though it has remained positive for an entire week. BBTrend, or Bollinger Band Trend, is a technical indicator that measures the strength and direction of a trend based on the interaction of price with Bollinger Bands.

Positive values indicate upward momentum, while negative values suggest a downtrend. The higher the value, the stronger the trend in its respective direction.

Although Solana BBTrend has dropped significantly from its recent peak, its stabilization at 6.41 suggests the decline in momentum has paused. This could mean the price is consolidating, potentially building a base for another upward move if buying pressure returns.

On the other hand, the current level also indicates the trend is not as strong as it was recently, which might signal caution for traders awaiting clearer confirmation of the next directional move.

SOL Price Prediction: Will Solana Reach $300 for the First Time?

If Solana price can regain strong momentum, it could test its previous all-time high of $292 and potentially rise further to $295. Breaking above these levels could push SOL price to $300 for the first time ever, marking a significant milestone and attracting additional bullish interest.

These levels highlight key resistance points for traders to watch as Solana attempts to continue its upward trajectory.

Conversely, if momentum cools and the trend reverses, SOL price may test the support level at $229. A breakdown below this point could lead to further declines, with the next support at $211 and a deeper retracement to around $192 if that level is also lost.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market16 hours ago

Market16 hours agoXRP Price Faces 13% Correction As Investors Pull Back

-

Bitcoin16 hours ago

Bitcoin16 hours agoBOJ Rate Hike Impact:1929 Stock Market Crash Due for Bitcoin?

-

Market15 hours ago

Market15 hours agoMorgan Stanley Explores Crypto Services Amid Regulatory Talks

-

Market14 hours ago

Market14 hours agoAvoid Fake IVANKA Meme Coins

-

Bitcoin17 hours ago

Bitcoin17 hours agoRipple Challenges Strategic Bitcoin Reserve Plans

-

Market17 hours ago

Market17 hours agoWhat the Signs Say About Its Next Move

-

Altcoin17 hours ago

Altcoin17 hours agoDogecoin Price Prepares For Monster Rally In Q1, Here’s The ATH Target

-

Altcoin16 hours ago

Altcoin16 hours agoVine Coin Price Surges 60% Amid This Binance Announcement, What’s Next?